- Home

- »

- Next Generation Technologies

- »

-

Post-Quantum Cryptography Market, Industry Report, 2030GVR Report cover

![Post-Quantum Cryptography Market Size, Share & Trends Report]()

Post-Quantum Cryptography Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Lattice-Based Cryptography, Code-Based Cryptography), By Solution, By Services, By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-575-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Post-Quantum Cryptography Market Trends

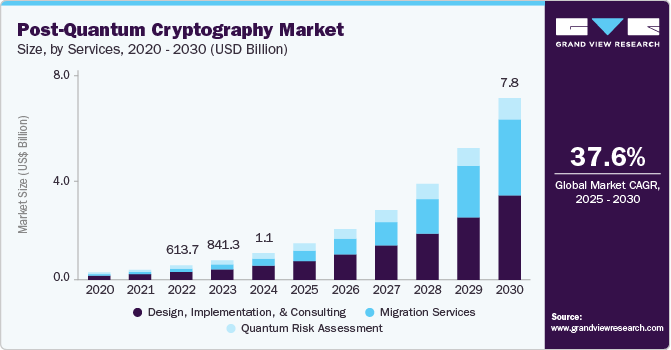

The global post-quantum cryptography market size was estimated at USD 1.15 billion in 2024 and is expected to grow at a CAGR of 37.6% from 2025 to 2030. The post-quantum cryptography (PQC) market is influenced primarily by the growing awareness of the vulnerabilities in existing cryptographic systems posed by the advancement of quantum computing.

Key Market Highlights:

- North America dominated the post-quantum cryptography vertical in 2024, accounting for a revenue share of over 37%

- The post-quantum cryptography market in the U.S. is anticipated to exhibit a significant CAGR over the forecast period.

- In terms of type segment, the lattice-based cryptography segment led the market in 2024, accounting for over 48% of global revenue

- In terms of solution segment, the quantum-resistant algorithms led the market in 2024

- In terms of services segment, the design, implementation, and consulting segment led the market in 2024

Organizations across sectors such as finance, healthcare, government, and telecommunications recognize the urgent need to protect sensitive data from quantum-enabled cyber threats. This heightened concern drives demand for quantum-resistant encryption methods, supported by ongoing research, development, and collaborations among technology providers and standards bodies such as NIST. Moreover, increasing cyberattack incidents and data breaches compel organizations to adopt stronger security measures to resist future quantum threats. Regulatory initiatives and government investments play a significant role by promoting standardization and mandating the use of quantum-safe cryptography in critical sectors such as defense, finance, and public safety.

The rising volume of sensitive data generated by IoT, 5G, and cloud computing also necessitates scalable and resilient encryption solutions, making PQC an essential component of modern cybersecurity infrastructure. In addition, integrating PQC with emerging technologies such as edge computing and network slicing is vital to maintaining low latency and high security in next-generation networks. Furthermore, continuous technological advancements and strategic industry efforts are leading to market expansion, enhancing the practicality and performance of PQC solutions.

Innovations in quantum-resistant algorithms and hybrid cryptographic models enhance the practicality and performance of these solutions. Collaborations between private companies, governments, and research institutions accelerate the development and deployment of these technologies. For instance, in February 2024, the Linux Foundation launched the Post-Quantum Cryptography Alliance (PQCA), an open collaborative initiative to promote and advance the adoption of PQC. The alliance unites researchers, developers, and industry leaders to address the security challenges caused by quantum computing. As organizations prepare for the eventual impact of quantum computing on data security, integrating PQC into existing systems becomes critical, driving sustained investment and adoption across multiple industries worldwide.

Services Insights

The design, implementation, and consulting segment led the market in 2024 due to the complexity of integrating post-quantum cryptography into existing systems. Organizations require expert guidance to develop strategies that ensure seamless migration and compliance. Customized solutions and risk assessments are essential for effective deployment. The growing need for tailored approaches across diverse industries sustains demand for these services.

The migration services segment is expected to grow significantly during the forecast period. Migration services facilitate the transition from classical to quantum-resistant cryptography, addressing compatibility and operational challenges. Organizations seek to minimize disruption while upgrading security infrastructure. Increasing awareness of quantum threats motivates investment in migration solutions. These services ensure continuity and compliance during cryptographic upgrades.

Type Insights

The lattice-based cryptography segment led the market in 2024, accounting for over 48% of global revenue due to its strong security against quantum attacks and efficient performance in encryption and digital signatures. Its inclusion in NIST’s standardized algorithms, such as CRYSTALS-Kyber and CRYSTALS-Dilithium, promotes widespread adoption. The algorithm’s flexibility supports various applications, from secure communications to digital identity verification. In addition, its resistance to known quantum attacks makes it a preferred choice for organizations preparing for future threats. Increasing investments in post-quantum cryptography research further strengthen its position in the market.

The hash-based cryptography segment is anticipated to grow at the highest CAGR during the forecast period due to its proven security in digital signature schemes and suitability for environments with limited computational resources. Stateless hash-based signatures such as SPHINCS+ offer long-term security without reliance on complex mathematical assumptions. Their simplicity and resistance to quantum attacks make them well-suited for data integrity applications. Increasing demand for secure authentication and signature verification fuels their rapid growth. Advances in lightweight cryptographic implementations enhance their adoption in IoT and embedded systems.

Solution Insights

The quantum-resistant algorithms led the market in 2024 as organizations actively replace vulnerable classical cryptography with encryption methods designed to withstand quantum computing threats. The availability of standardized algorithms provides confidence for deployment across industries. Growing cybersecurity concerns and regulatory pressures accelerate the adoption of these algorithms. Their ability to secure sensitive data against emerging quantum risks underpins their market dominance. Moreover, collaboration between governments and the private sector further drives the integration of these solutions globally.

The quantum-safe authentication solutions segment is anticipated to grow at the highest CAGR during the forecast period as it addresses the critical need to protect identity verification from quantum-enabled cyber threats. Authentication forms the foundation of secure access and communication, making quantum resistance essential. Increasing incidents of identity theft and cyberattacks drive demand for enhanced authentication methods. Integration of quantum-resistant algorithms into authentication protocols strengthens security frameworks.

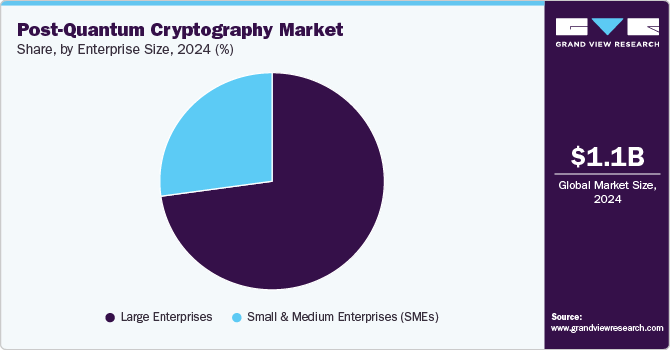

Enterprise Size Insights

The large enterprises segment led the market in 2024 due to their extensive digital assets, complex IT infrastructures, and stringent regulatory requirements. Their ability to allocate substantial resources enables investment in research, development, and deployment of advanced PQC solutions. Protecting customer data, intellectual property, and operational continuity remains a top priority, especially in finance, healthcare, and telecommunications sectors. Large organizations also face increasing pressure to comply with evolving cybersecurity regulations emphasizing quantum-safe cryptography.

Small & medium enterprises (SMEs) is expected to grow at the highest CAGR during the forecast period, as awareness of quantum computing risks spreads beyond large corporations. The availability of cloud-based PQC solutions and managed security services reduces barriers to entry for smaller organizations. Regulatory frameworks increasingly require data protection measures that include quantum-resistant algorithms, impacting SMEs as well. In addition, SMEs seek to maintain customer trust and competitive advantage by enhancing their cybersecurity posture. Market education, vendor support, and scalable solutions contribute to the rapid expansion of PQC adoption within this segment.

Vertical Insights

The government and defense segment held the largest revenue share in 2024 due to their critical need to protect national security assets and sensitive information. These sectors prioritize early adoption of PQC to safeguard communication networks, intelligence data, and defense systems from future quantum threats. Significant government funding and strategic initiatives support research, development, and deployment of quantum-resistant cryptographic technologies. Regulatory mandates and security policies further drive investment in PQC solutions.

The IT & ITES segment is estimated to grow at the highest CAGR during the forecast period, driven by its reliance on secure data exchange, cloud computing, and digital services. Increasing cyberattacks targeting intellectual property, customer information, and service continuity necessitate advanced security measures. Adopting emerging technologies such as 5G, IoT, and edge computing expands the attack surface, intensifying demand for quantum-resistant cryptography. Service providers integrate PQC to ensure compliance with data protection regulations and maintain client confidence.

Regional Insights

North America dominated the post-quantum cryptography vertical in 2024, accounting for a revenue share of over 37%, owing to its advanced technological infrastructure, substantial cybersecurity investments, and early adoption of emerging cryptographic standards. The presence of major technology companies and government agencies accelerates research, development, and deployment of PQC solutions. Regulatory frameworks such as the U.S. National Quantum Initiative promote proactive security measures against quantum threats.

U.S. Post-Quantum Cryptography Market Trends

The post-quantum cryptography market in the U.S. is anticipated to exhibit a significant CAGR over the forecast period. Heightened focus on national security and data privacy encourages organizations to adopt quantum-resistant cryptography proactively. Regulatory mandates and cybersecurity frameworks drive investments in upgrading cryptographic systems. Public-private partnerships facilitate research, development, and commercialization of PQC technologies.

Europe Post-Quantum Cryptography Market Trends

The post-quantum cryptography industry in Europe is expected to witness significant growth over the forecast period, driven by stringent data protection regulations such as GDPR and coordinated government initiatives supporting quantum research. Investments in cybersecurity infrastructure and digital sovereignty motivate the adoption of quantum-safe cryptographic solutions. Collaborative projects involving industry, academia, and regulators facilitate innovation, standardization, and knowledge sharing. Emphasis on privacy, compliance, and secure digital transformation encourages organizations to integrate PQC.

Asia Pacific Post-Quantum Cryptography Market Trends

The post-quantum cryptography market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. The region’s rapid digital transformation and expanding IT infrastructure accelerate PQC adoption, and increasing government funding and strategic initiatives in quantum technology research support market growth. Rising cybersecurity awareness and growing cyber threats motivate enterprises and public-sector organizations to implement quantum-resistant solutions. Emerging economies prioritize secure communication networks and data protection to support economic development.

Key Post-Quantum Cryptography Company Insights

Some key companies in the post-quantum cryptography vertical are NXP Semiconductor, Thales, Palo Alto Networks, and IBM Corporation.

-

NXP Semiconductor provides secure connectivity solutions, advancing PQC to protect devices against emerging quantum threats. Their innovative i.MX 94 family integrates PQC capabilities within a secure enclave, enabling devices to boot and update securely using classical and quantum-resistant cryptography. NXP Semiconductor collaborates with standards organizations like NIST to develop future-proof security solutions across automotive, industrial, IoT, and communication sectors.

-

Thales provides cybersecurity and digital identity solutions, incorporating post-quantum cryptography algorithms such as Falcon digital signature. Their crypto-agile products support hybrid cryptography to address threats from quantum computing. The company engages in global standardization efforts and offers quantum-resistant solutions for applications, including 5G SIM cards and secure communications, assisting governments and enterprises in transitioning to quantum-safe security frameworks.

Key Post-Quantum Cryptography Companies:

The following are the leading companies in the post-quantum cryptography market. These companies collectively hold the largest market share and dictate industry trends.

- NXP Semiconductor

- Thales

- IDEMIA

- Palo Alto Networks

- DigiCert

- Kloch Technologies, LLC

- PQ Solutions Limited

- PQShield Ltd

- Entrust Corporation

- IBM Corporation

Recent Developments

-

In April 2025, PQShield launched PQPlatform-TrustSys, a quantum-safe Root of Trust solution designed to enable ASICs and FPGAs to comply with emerging PQC standards such as the NSA’s CNSA 2.0. Built around a PQC-first architecture, PQPlatform-TrustSys facilitates secure boot, secure update, and lifecycle key management with minimal integration effort, while providing strong key origin and permission tracking to maintain security even if the host system is compromised.

-

In April 2025, NetApp embedded post-quantum cryptography into its storage portfolio for file and block workloads, leveraging NIST-standardized encryption algorithms to protect data against emerging quantum threats. This integration enhances cyber resiliency by securing data at rest and in transit, enabling customers to adopt a proactive security approach at the storage layer.

-

In March 2025, NIST selected the HQC algorithm as a backup post-quantum encryption standard to complement ML-KEM, the primary algorithm for general encryption. HQC is based on error-correcting codes, a mathematical foundation different from ML-KEM’s structured lattices, providing an alternative defense should vulnerabilities be found in ML-KEM. NIST plans to release a draft standard for HQC within a year, with finalization by 2027, ensuring a strong and diversified approach to securing data against future quantum threats.

Post-Quantum Cryptography Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.58 billion

Revenue forecast in 2030

USD 7.82 billion

Growth rate

CAGR of 37.6% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, solution, services, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

NXP Semiconductor; Thales; IDEMIA; Palo Alto Networks; DigiCert; Kloch Technologies, LLC; PQ Solutions Limited; PQShield Ltd; Entrust Corporation; IBM Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Post-Quantum Cryptography Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global post-quantum cryptography market report based on the type, solution, services, enterprise size, vertical, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Lattice-Based Cryptography

-

Code-Based Cryptography

-

Multivariate Cryptography

-

Hash-Based Cryptography

-

Others

-

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Quantum-Resistant Algorithms

-

Quantum-Safe Cryptographic Libraries

-

Quantum-Safe Authentication Solutions

-

Quantum-Resistant Encryption Solutions

-

Quantum-Safe VPN, Email, Messaging

-

Quantum-Safe Blockchain Solutions

-

Quantum-Safe Hardware

-

-

Services Outlook (Revenue, USD Million, 2017 - 2030)

-

Design, Implementation, and Consulting

-

Migration Services

-

Quantum Risk Assessment

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

Government and Defense

-

IT & ITES

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global post-quantum cryptography market size was estimated at USD 1.15 billion in 2024 and is expected to reach USD 1.58 billion in 2025.

b. The global post-quantum cryptography market is expected to grow at a compound annual growth rate of 37.6% from 2025 to 2030 to reach USD 7.82 billion by 2030.

b. North America dominated the post-quantum cryptography market with a share of over 37% in 2024, due to significant investments in cybersecurity, advanced quantum technology infrastructure, strong government initiatives, stringent data privacy regulations, and the presence of major technology companies driving early adoption and innovation.

b. Some key players operating in the post-quantum cryptography market include NXP Semiconductor, Thales, IDEMIA, Palo Alto Networks, DigiCert, Kloch Technologies, LLC, PQ Solutions Limited, PQShield Ltd, Entrust Corporation, IBM Corporation.

b. Key factors driving the post-quantum cryptography market's growth include increasing cybersecurity threats from advancing quantum computing, rising demand for quantum-resistant encryption across sectors like government and finance, ongoing government initiatives and standardization efforts, and continuous technological innovations in cryptographic algorithms and quantum key distribution.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.