- Home

- »

- Advanced Interior Materials

- »

-

Powder Metallurgy Market Size, Share, Industry Report, 2033GVR Report cover

![Powder Metallurgy Market Size, Share & Trends Report]()

Powder Metallurgy Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Titanium, Steel), By Process (Hot Isostatic Pressing, Metal Injection Molding), By Application (Automotive, Oil & Gas), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-660-8

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Powder Metallurgy Market Summary

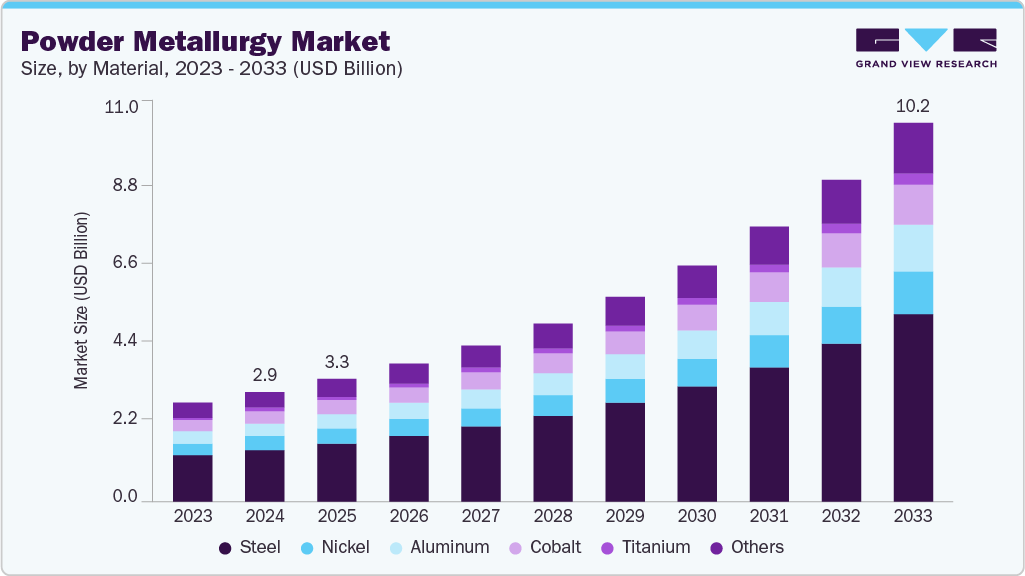

The global powder metallurgy market size was estimated at USD 2.96 billion in 2024, and is projected to reach USD 10.19 billion by 2033, growing at a CAGR of 15.1% from 2025 to 2033. The industry is witnessing robust growth, largely driven by the rising demand from the automotive sector, which remains its largest end-use industry.

Key Market Trends & Insights

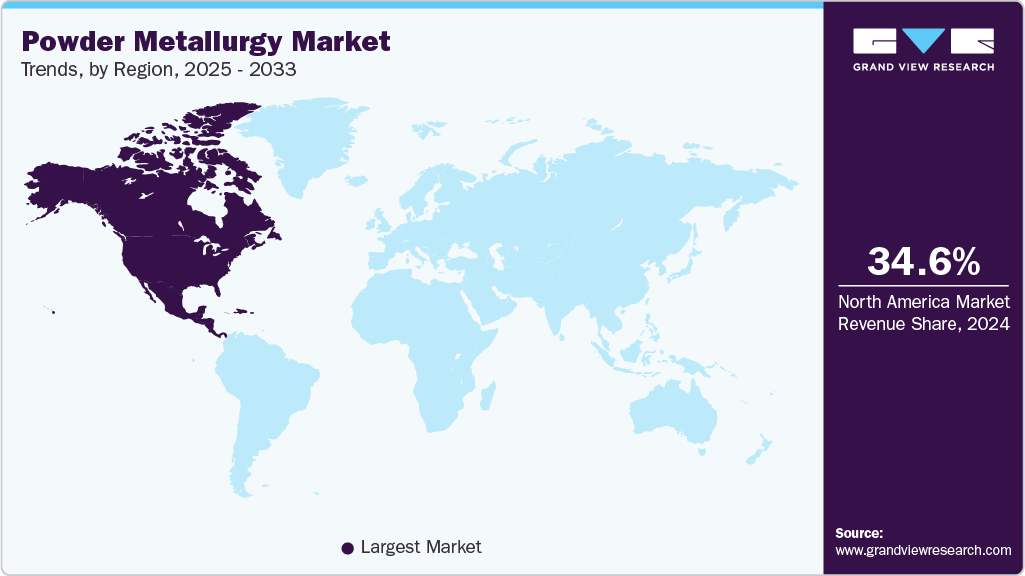

- North America dominated the powder metallurgy market with the largest market revenue share of 34.6%.

- Powder metallurgy market in the U.S. is expected to grow at a substantial CAGR of 15.0% from 2025 to 2033.

- By material, titanium segment is anticipated to register the fastest CAGR of 16.4% from 2025 to 2033.

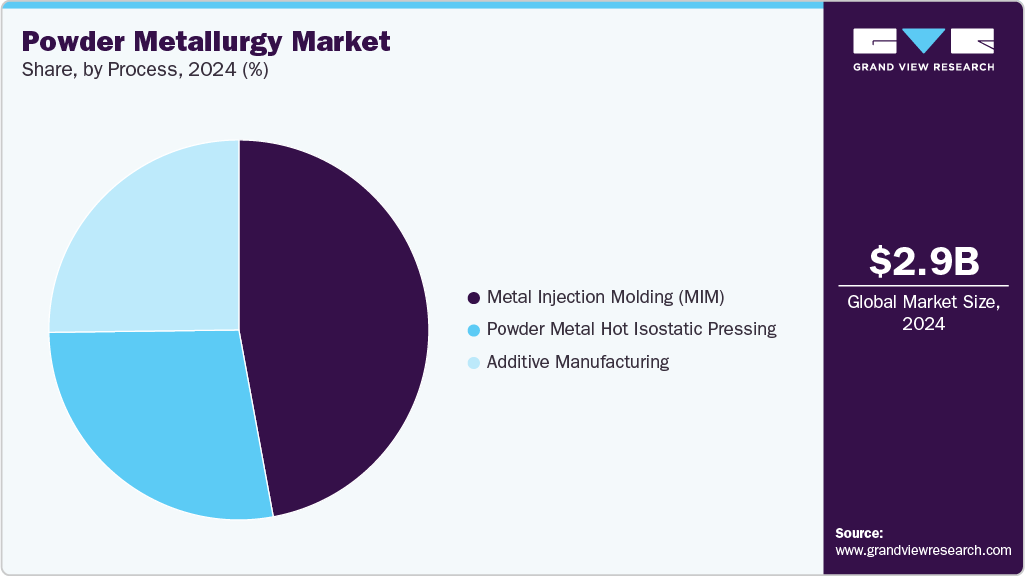

- By process, metal injection molding segment accounted for the largest market revenue share of over 47.0% in 2024.

- By application, medical & dental segment is anticipated to register the fastest CAGR of 15.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 2.96 Billion

- 2033 Projected Market Size: USD 10.19 Billion

- CAGR (2025-2033): 15.1%

- North America: Largest market in 2024

According to the International Organization of Motor Vehicle Manufacturers (OICA), global motor vehicle production reached approximately 92.5 million units in 2024, reflecting a strong rebound from previous years affected by supply chain disruptions. Powder metallurgy plays a critical role in this sector because it produces high-precision components like gears, bushings, and structural parts with minimal material wastage. The ongoing shift toward lightweighting and electric vehicle (EV) production further strengthens this trend, as powder metallurgy enables the design of complex, durable, and lightweight components essential for EV efficiency.The aerospace and medical industries are expanding their adoption of AM due to its ability to produce custom, complex parts with reduced lead times and waste. For instance, aerospace companies such as Boeing and Airbus have incorporated metal 3D-printed components into aircraft engines and structural parts to reduce weight and improve performance. Similarly, powder-based AM is used in the medical sector to manufacture orthopedic implants and dental devices tailored to individual patients. These trends are expected to significantly expand the demand for metal powders such as titanium, cobalt-chrome, and stainless steel.

Sustainability and material efficiency are increasingly becoming focal points for global industries, adding another layer of momentum to the powder metallurgy market. Powder metallurgy inherently generates less scrap compared to traditional machining methods, aligning well with the circular economy goals embraced by major manufacturing economies. For example, in industrial and consumer product manufacturing, components made through powder metallurgy have demonstrated material utilization rates of up to 9598%, contributing to cost savings and environmental benefits. This high efficiency is particularly valued in regions with strict environmental regulations, such as the European Union and parts of North America, driving the adoption of powder metallurgy solutions.

In addition, technological advancements in powder production and processing are enabling wider adoption across industries. Innovations such as plasma atomization, gas atomization, and laser sintering have improved powder quality, consistency, and performance. These developments allow for tighter tolerances and better mechanical properties in finished parts. The increased availability of high-performance powders such as nickel-based superalloys, tungsten, and aluminum alloys supports their use in demanding applications across defense, oil & gas, and heavy machinery. For instance, Caterpillar and General Electric have integrated powder metallurgy parts in engines and turbines for performance enhancement and operational efficiency.

Lastly, government investments and R&D initiatives are vital in shaping the powder metallurgy landscape. Countries like the U.S. (through the Department of Energy), Germany (via Fraunhofer Institutes), and China (via the Made in China 2025 policy) are significantly funding research in advanced materials and manufacturing techniques. These initiatives aim to enhance domestic technological capabilities and reduce reliance on imported parts. Additionally, several industry-academia collaborations, such as those under the EU’s Horizon Europe program, focus on developing next-generation powder materials and processes. Such support is expected to accelerate innovation, reduce production costs, and encourage the wider adoption of powder metallurgy across traditional and emerging industries.

Drivers, Opportunities & Restraints

The market is being driven by the growing demand for lightweight and high-strength components, especially in the automotive and aerospace sectors. With increasing regulatory pressure to reduce vehicle emissions and enhance fuel efficiency, manufacturers are shifting toward powder metallurgy to produce intricate parts with minimal material wastage. Additionally, advancements in additive manufacturing and metal injection molding (MIM) are further propelling market adoption, enabling mass production of complex geometries with high precision.

Emerging applications in EVs, renewable energy systems, and medical implants present significant growth opportunities for the powder metallurgy industry. The rapid electrification of transportation drives demand for magnetic materials and heat-resistant components, which powder metallurgy processes can effectively deliver. Furthermore, the increasing adoption of 3D printing using metal powders across industrial and consumer sectors is expected to open new avenues for customization and cost efficiency.

Despite its advantages, the powder metallurgy market faces challenges such as high initial equipment costs and limited material options compared to traditional manufacturing. Small-scale manufacturers may find it difficult to invest in advanced sintering technologies or source high-purity powders at competitive prices. Moreover, the mechanical properties of components produced via powder metallurgy may not always match those formed through conventional casting or forging, limiting their adoption in highly demanding structural applications.

Material Insights

Steel is considered one of the cheapest materials in additive manufacturing, which can also be utilized in a mixture with other metals, such as bronze, titanium, and aluminum. The low cost and easy availability of steel are expected to increase its utilization in the printing of large products, including machines, car frames, and transport equipment over the coming years. Other applications of steel include spare parts and fully functional components.

Titanium is anticipated to register the fastest CAGR over the forecast period. Powder metallurgy enables efficient and cost-effective production of titanium components that are otherwise expensive and difficult to machine using traditional methods. In aerospace, titanium powders are widely used to manufacture structural parts and engine components that require excellent strength-to-weight ratios and heat resistance.

Application Insights

Powder metallurgy techniques, including metal injection molding and additive manufacturing, are increasingly being adopted to produce intricate parts such as turbine blades, structural brackets, and engine components using materials like titanium, nickel-based alloys, and stainless steel. These parts must withstand extreme temperatures, high stress, and corrosive environments, making powder metallurgy an ideal choice for achieving performance and weight reduction goals. The defense sector is also leveraging powder metallurgy to produce complex and high-precision components in weapons systems, drones, and protective gear. Manufacturing near-net-shape components with minimal material waste and reduced machining makes powder metallurgy cost-effective and sustainable.

Medical & dental is anticipated to register the fastest CAGR over the forecast period. The medical industry increasingly relies on powder metallurgy to meet the need for miniaturized, precise, and cost-effective surgical and diagnostic tools. Additive manufacturing is transformative by enabling rapid prototyping, customization, and small-batch production of implants and instruments tailored to individual patients. Regulatory approvals for 3D-printed medical devices and the growing adoption of minimally invasive surgical techniques also contribute to the segment’s growth.

End Use Insights

OEMs benefit from powder metallurgy’s ability to produce near-net-shape parts with minimal waste, reduced machining, and shorter production cycles, key factors for maintaining profitability and competitiveness in high-volume production environments. This is especially relevant in the automotive sector, where OEMs use powder metallurgy for manufacturing gears, camshaft components, and structural parts that meet stringent performance and durability standards. As OEMs continue to push for lightweighting, fuel efficiency, and precision engineering, powder metallurgy offers a compelling solution to meet evolving design and material requirements.

AM operators is anticipated to grow significantly over the forecast period. AM operators are vital in bridging the gap between concept and production, offering speed, design freedom, and material efficiency. The growing number of service bureaus and contract manufacturers adopting laser-based powder bed fusion, binder jetting, and electron beam melting further reinforces this trend. In addition, AM operators are driving innovation in powder handling, recycling, and process optimization, which enhances the cost-effectiveness and sustainability of additive manufacturing. They are also increasingly involved in R&D partnerships to develop new alloys and printing techniques tailored to specific industrial applications.

Process Insights

MIM is particularly advantageous for producing small, complex-shaped components with tight tolerances and excellent surface finish, making it ideal for medical, electronics, automotive, and consumer goods applications. As miniaturization becomes a key trend, especially in electronics and medical devices, MIM offers a scalable and cost-effective solution for high-volume production of precision metal parts such as connectors, gears, surgical instruments, and watch components.

Additive manufacturing is anticipated to register the fastest CAGR over the forecast period. Additive manufacturing (AM), also known as 3D printing, is a rapidly growing segment within the powder metallurgy market. Its ability to produce complex geometries, reduce material waste, and enable rapid prototyping drives it. The technology is particularly valuable in aerospace, medical, automotive, and defense industries, where customization, lightweight structures, and performance optimization are critical. Powder-based AM techniques like Selective Laser Melting (SLM) and Electron Beam Melting (EBM) allow for precise layer-by-layer construction of parts using metals such as titanium, stainless steel, and aluminum.

Regional Insights

North America powder metallurgy market is witnessing steady growth, driven by strong demand from key industries such as automotive, aerospace, medical, and defense. The region’s well-established automotive manufacturing base, particularly in the U.S. and Mexico, continues to adopt powder metallurgy to produce high-performance engine and transmission components that require precision, durability, and cost efficiency. In aerospace, the demand for lightweight and high-strength materials has led to increased use of advanced powder metallurgy processes like additive manufacturing and hot isostatic pressing (HIP) to produce turbine parts and structural components. The presence of major OEMs and tier-one suppliers, combined with ongoing investment in R&D and production technology, supports the growing use of powder metallurgy across industrial sectors.

U.S. Powder Metallurgy Market Trends

The powder metallurgy market in the U.S. is growing as manufacturers are increasingly adopting powder metallurgy techniques to meet demands for lightweight, high-precision, and durable components while maintaining cost efficiency. The automotive sector, particularly in the Midwest, relies heavily on powder metallurgy to mass produce gears, bearings, and structural parts to improve fuel efficiency and reduce emissions.

Asia Pacific Powder Metallurgy Market Trends

The powder metallurgy market in Asia Pacific is driven by rapid industrialization, expanding automotive production, and increasing adoption of advanced manufacturing technologies. Countries like China, Japan, South Korea, and India are at the forefront of automotive and electronics manufacturing, where powder metallurgy is widely used to produce complex, high-strength, and wear-resistant components at scale. The cost advantages of local manufacturing, the availability of skilled labor, and growing domestic demand make the Asia Pacific a favorable environment for powder metallurgy adoption. Additionally, the push for fuel efficiency and emission control in vehicles encourages automakers to adopt lightweight materials and precision components, further supporting powder metallurgy techniques such as metal injection molding and sintering.

Europe Powder Metallurgy Market Trends

The powder metallurgy market in Europe is growing as countries are investing heavily in R&D for advanced materials and 3D printing technologies, with support from EU-wide initiatives like Horizon Europe and national programs to boost advanced manufacturing. The medical and dental sectors are also expanding the use of powder metallurgy for customized implants and surgical tools made from titanium and stainless steel. Furthermore, Europe's focus on circular economy principles, resource efficiency, and low-carbon technologies aligns well with the sustainable advantages of powder metallurgy, positioning the region as a leader in innovation and responsible manufacturing practices.

Latin America Powder Metallurgy Market

The powder metallurgy market in Latin America is growing steadily, supported by increased demand for precision components in automotive, industrial machinery, and aerospace sectors. For instance, several Tier-1 automotive suppliers in the region are incorporating powder metallurgy to produce transmission gears, connecting rods, and engine parts that offer strength, durability, and reduced material waste.

Middle East & Africa Powder Metallurgy Market

The powder metallurgy market in the Middle East & Africa is witnessing emerging growth, primarily driven by increasing industrial diversification efforts and investment in automotive, aerospace, oil & gas, and medical devices. Countries in the Gulf region are actively promoting local manufacturing through industrial development programs and special economic zones, which are encouraging the adoption of cost-effective and material-efficient processes like powder metallurgy.

Key Powder Metallurgy Company Insights

Key players operating in the powder metallurgy market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Powder Metallurgy Companies:

The following are the leading companies in the powder metallurgy market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Technology & Materials Co., Ltd. (AT&M)

- CRS Holdings Inc.

- GKN PLC

- Höganäs AB

- JSC POLEMA

- Liberty House Group

- Molyworks Materials Corporation

- Rio Tinto Metal Powders

- Rusal

- Sandvik AB

Recent Development

-

In June 2024, AMETEK Specialty Metal Products (SMP) announced the launch of its innovative High Green Strength Stainless Steel Powders, designed specifically for powder metallurgy applications in the automotive and industrial sectors. These new powders deliver a significant performance boost, consistently providing a 50% or greater improvement in green strength for 300 and 400-series stainless steel grades compared to powders mixed with standard EBS wax.

Powder Metallurgy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.31 billion

Revenue forecast in 2033

USD 10.19 billion

Growth rate

CAGR of 15.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 2023

Forecast period

2025 - 2033

Quantitative units

Volume in tons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, process, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Germany; France; UK; China; Japan; Brazil

Key companies profiled

Molyworks Materials Corp.; Advanced Technology & Materials Co.; Ltd. (AT&M); JSC POLEMA; Sandvik AB; Hoganas AB; GKN PLC; Rio Tinto Metal Powders; Rusal; CRS Holdings, Inc.; Liberty House Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Powder Metallurgy Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global powder metallurgy market report on the basis of material, process, application, end use, and region:

-

Material Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Titanium

-

Nickel

-

Steel

-

Aluminum

-

Cobalt

-

Others

-

-

Process Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Additive Manufacturing

-

Hot Isostatic Pressing

-

Metal Injection Molding

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Aerospace & Defense

-

Automotive

-

Medical & Dental

-

Oil & Gas

-

Industrial

-

-

End Use Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

OEMs

-

AM Operators

-

- Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

- Brazil

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global powder metallurgy market size was estimated at USD 2.96 billion in 2024 and is expected to reach USD 3.31 billion in 2025.

b. The global powder metallurgy market is expected to grow at a compound annual growth rate of 15.1% from 2025 to 2033 to reach USD 10.19 billion by 2033.

b. The steel segment dominated the powder metallurgy market with a volume share of 47.3% in 2024, being the cheapest form of metal for additive manufacturing.

b. Some of the key players operating in the powder metallurgy market include Molyworks Materials Corporation, Advanced Technology & Materials Co., Ltd. (AT&M), JSC POLEMA, Sandvik AB, GKN PLC, Rio Tinto Metal Powders, Rusal, CRS Holdings Inc., and Liberty House Group.

b. The key factor driving the powder metallurgy market is an increase in demand from the aerospace & defense sector owing to the strong capabilities to reduce the weight of aerospace parts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.