- Home

- »

- Next Generation Technologies

- »

-

Power Electronic Testing Market Size, Industry Report, 2033GVR Report cover

![Power Electronic Testing Market Size, Share & Trends Report]()

Power Electronic Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Provision Type (Test Instruments & Equipment, Professional Testing Services), By Device Type (Multi-Device Modules), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-628-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Electronic Testing Market Summary

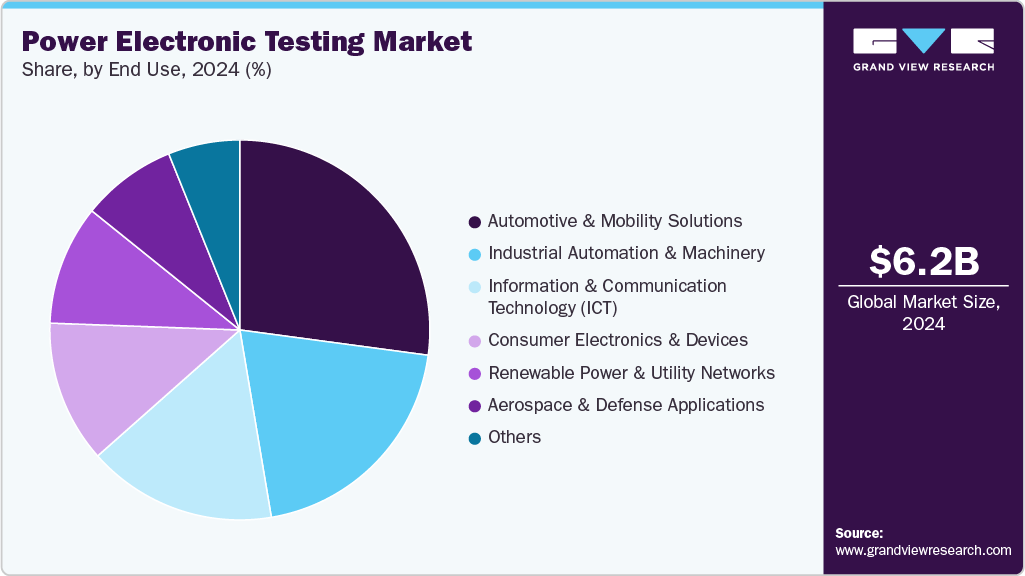

The global power electronic testing market size was estimated at USD 6,163.1 million in 2024 and is projected to reach USD 12,886.9 million by 2033, growing at a CAGR of 8.6% from 2025 to 2033. The market for power electronic testing is expanding steadily due to the increasing adoption of electric vehicles across major economies.

Key Market Trends & Insights

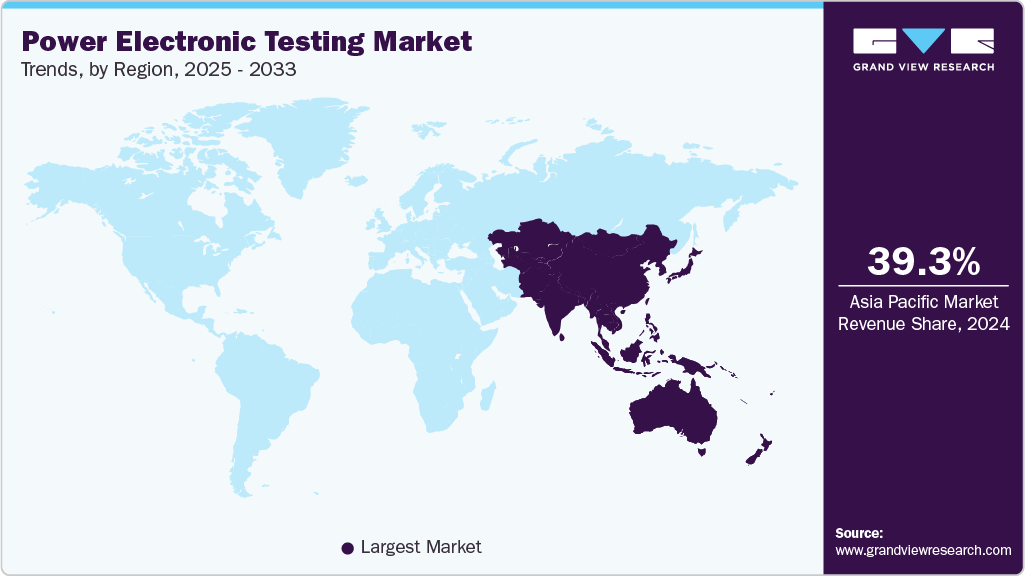

- Asia Pacific Power Electronic Testing dominated the global market with the largest revenue share of 39.3% in 2024.

- The power electronic testing market in the U.S. led the North America market and held the largest revenue share in 2024.

- By provision type, test instruments and equipment led the market and held the largest revenue share of 64.5% in 2024.

- By device type, the individual power provision types segment held the dominant position in the market and accounted for the largest revenue share of 45.2% in 2024.

- By end use, the automotive and mobility solutions segment is expected to grow at the fastest CAGR of 10.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 6,163.1 Million

- 2033 Projected Market Size: USD 12,886.9 Million

- CAGR (2025-2033): 8.6%

- Asia Pacific: Largest market in 2024

Rising investments in renewable energy systems are adding to the demand for advanced testing solutions. Manufacturers are focusing on efficiency, safety, and compliance, fueling further market development.The power electronics testing market is evolving with increasing complexity in device design. To address this, companies are adopting more accurate and repeatable testing methods. Automation is helping reduce testing time while improving efficiency and consistency. High-precision tools are being used to validate performance under realistic operating conditions. These developments support the broader adoption of wide bandgap semiconductors in advanced applications.

As a result, automated and precise testing is becoming the standard approach in the industry. For instance, in April 2025, Rohde & Schwarz, a German-based test and measurement technology company, collaborated with PE-Systems GmbH to enhance power electronics testing solutions. The collaboration focuses on improving double pulse and automated load jump testing using advanced instruments such as the R&S MXO 5 oscilloscope and RT-ZISO isolated probing system.

The power electronics industry is shifting toward advanced semiconductor materials. These include newer options beyond traditional silicon. Such materials are used in high-efficiency and high-performance devices. Their unique electrical and thermal characteristics require specialized validation. Testing systems must handle higher voltages, temperatures, and frequencies. This is increasing the need for more sophisticated and reliable testing solutions. Equipment must be adapted to evaluate material behavior under stress.

The goal is to ensure long-term reliability and compliance with evolving industry standards. Companies are investing in tools that simulate real-world conditions. For instance, in May 2025, EDA Industries S.P.A., an electronics company in Italy, and ChipTest Engineering formed a joint venture to establish a Burn-in and Reliability Testing Laboratory in India, targeting the growing demand for SiC and GaN technologies. This collaboration aims to strengthen India’s semiconductor ecosystem and expand both companies’ reach in domestic and global markets.

As electronics manufacturing continues to expand, power electronic testing is becoming a critical phase in the production process. It ensures that components such as converters, inverters, and power modules perform reliably under varying electrical conditions. The increasing complexity of power devices demands more accurate and thorough validation. With shrinking form factors and higher efficiency targets, even small defects can lead to major system failures.

Testing helps uncover design flaws and operational issues early, minimizing risks and reducing development delays. This has become vital for meeting the demands of industries such as automotive, industrial automation, and renewable energy. Manufacturers are now focusing on performance consistency and regulatory compliance. As circuits carry higher voltages and switch faster, precision testing capabilities are more important than ever. Systems must evaluate thermal behavior, load responses, and electromagnetic compatibility. In this environment, power electronic testing is evolving from a back-end task to a strategic investment in product quality and innovation.

Provision Type Insights

The test instruments and equipment segment dominated the power electronic testing market with a revenue share of 64.5% in 2024. This segment includes oscilloscopes, analyzers, signal generators, and specialized power testing systems. These tools are essential for evaluating voltage, current, frequency, and thermal behavior in power devices. The growing demand for high-efficiency and high-density electronics has increased reliance on advanced test hardware. Manufacturers prefer in-house testing equipment to ensure control over quality and speed up development. As designs become more complex, investment in reliable test instruments continues to grow across industries.

The professional testing services segment is predicted to foresee significant growth at the fastest CAGR over the forecast period, due to the increasing complexity of power devices and systems. As manufacturers face growing demands for reliability, safety, and compliance, they are increasingly relying on third-party specialists to conduct comprehensive testing. These services offer access to advanced facilities and expertise, allowing companies to validate designs without the need for costly internal setups. Regulatory requirements and evolving industry standards are also encouraging firms to engage certified testing providers. This approach supports faster time-to-market while ensuring product quality and adherence to technical specifications.

Device Type Insights

Individual Power Components dominate the power electronic testing market in 2024, due to their widespread deployment in power conversion, regulation, and distribution applications across sectors. These components, such as rectifiers, diodes, and transistors, are typically tested in isolation, allowing for focused analysis of their electrical characteristics under specific load conditions.

As power densities increase and energy efficiency regulations become more stringent, the need for precise and repeatable testing of these individual components has intensified. Their modular nature simplifies test configuration, fault localization, and performance evaluation, making them a preferred category in many end-use sectors. Continued innovation in semiconductor materials and packaging has also driven the demand for advanced testing equipment tailored to these discrete devices.

Multi-Device Modules are experiencing significant growth in the power electronic testing market, driven by the trend toward greater system integration and efficiency in high-performance applications. These modules combine multiple functions such as rectification, inversion, and amplification into compact packages, increasing testing complexity due to interdependent component behavior.

Their adoption in applications like electric vehicles, renewable energy systems, and industrial automation is expanding rapidly, prompting the need for holistic testing strategies that address both individual and interactive performance metrics. Testing tools must be capable of simulating real-world electrical and thermal stress conditions to validate long-term reliability and compliance.

End Use Insights

Automotive and mobility solutions dominated the power electronic testing market in 2024. The rapid shift toward electric vehicles significantly increased the need for advanced power electronic testing. Key systems such as inverters, onboard chargers, and battery management modules require strict validation under real-world conditions. Manufacturers are using power electronic test instruments to ensure safety, efficiency, and compliance with global automotive standards. Growing adoption of wide-bandgap semiconductors such as SiC and GaN further amplifies the demand for specialized testing. As a result, the automotive sector accounted for the largest share of the market, driven by increasing electrification across passenger and commercial vehicle platforms.

Renewable power and utility network is projected to grow at a significant CAGR over the forecast period. As utilities integrate more solar, wind, and battery storage systems, testing becomes essential to ensure grid stability and efficiency. Power converters, smart inverters, and energy management systems are being validated for performance, interoperability, and regulatory compliance. Grid modernization and the rise of distributed energy resources drive demand for advanced power electronics. Testing services for this sector focus on high-voltage reliability, thermal performance, and electromagnetic compatibility. Utility companies are increasingly investing in robust testing frameworks to support the energy transition.

Regional Insights

Asia Pacific power electronic testing market dominated the market and accounted for 39.3% revenue share in 2024. The region benefits from a strong manufacturing base, particularly in countries such as China, Japan, and South Korea. High adoption of electric vehicles and renewable energy systems is driving demand for advanced testing solutions. Government incentives and investments in EV infrastructure and clean energy projects support sustained growth. The presence of major electronics and automotive manufacturers contributes to high testing volumes.

Europe Power Electronic Testing Market Trends

The Europe power electronic testing market is expanding due to strong EV adoption and strict emissions regulations across the region. Governments are supporting renewable energy projects, which is increasing the need for testing in solar, wind, and energy storage systems. Smart grid development and the integration of distributed energy resources are driving demand for advanced grid-tied testing solutions. Sectors such as aerospace, defense, and telecom are contributing to market growth through requirements for high-reliability and EMC testing.

North America Power Electronic Testing Market Trends

The North America power electronic testing market is expanding due to increasing electrification in transportation and industrial applications. Electric vehicles, advanced driver-assistance systems, and automation are driving demand for high-precision testing of power modules and components. Government-backed investments in renewable energy and grid modernization are increasing the need for testing in solar inverters, battery systems, and power converters. Regulatory frameworks and safety standards across the energy and automotive sectors are prompting companies to adopt advanced testing protocols.

U.S. Power Electronic Testing Market Trends

The U.S. power electronic testing market is growing steadily due to the increasing deployment of electric vehicles, renewable energy systems, and industrial automation. Companies are investing in advanced testing solutions to ensure compliance with safety, efficiency, and performance standards. The shift toward wide-bandgap semiconductors in EVs and power grids has created new requirements for precision testing.

Key Power Electronic Testing Company Insights

Some key companies in the power electronic testing industry include Bureau Veritas, Chroma ATE Inc., Intertek Group plc, Keysight Technologies, National Instruments Corporation, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Keysight Technologies has expanded its power electronic testing portfolio by integrating advanced GaN and SiC device testing capabilities. The company offers precision power analyzers and oscilloscopes designed for high-speed switching applications. Keysight focuses on enabling faster design cycles through simulation-integrated test platforms. It has introduced AI-driven analytics to enhance test efficiency and accuracy.

-

Rohde & Schwarz has strengthened its offerings in power electronic testing by enhancing its oscilloscope bandwidth and resolution for wide bandgap devices. The company emphasizes real-time analysis of power integrity and switching characteristics. Rohde & Schwarz supports EMC and compliance testing through modular solutions. Its R&SRT-ZHD probes and power analyzers are optimized for high-voltage and high-frequency applications.

Key Power Electronic Testing Companies:

The following are the leading companies in the power electronic testing market. These companies collectively hold the largest market share and dictate industry trends.

- AMETEK Programmable Power Inc.

- Bureau Veritas

- Chroma ATE Inc.

- Intertek Group plc

- Keysight Technologies

- National Instruments Corporation

- Rohde & Schwarz

- SGS SA

- TEKTRONIX, INC.

Recent Developments

-

In March 2025, Keysight Technologies launched an enhanced double-pulse test portfolio enabling accurate and easy measurement of Wide-Bandgap (WBG) power semiconductor bare chips, crucial for efficient power electronics. This new solution allows dynamic characterization of bare chips without soldering, minimizing parasitics and expediting development for applications like electric vehicles and data centers.

-

In May 2024, Intertek Group plc and Korea Testing & Research Institute formed a Master Services Agreement to streamline global market entry for electrical and electronic product manufacturers. This partnership enables mutual recognition of test reports for certifications in South Korea and Europe, improving efficiency and reducing costs.

Power Electronic Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,655.3 million

Revenue forecast in 2033

USD 12,886.9 million

Growth rate

CAGR of 8.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Provision type, device type, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia, South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

AMETEK Programmable Power Inc.; Bureau Veritas; Chroma ATE Inc.; Intertek Group plc; Keysight Technologies; National Instruments Corporation; Rohde & Schwarz; SGS SA; TEKTRONIX, INC.; TUV Rheinland

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Electronic Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global power electronic testing market report based on provision type, device type, end use, and region.

-

Provision Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Test Instruments and Equipment

-

Professional Testing Services

-

-

Device Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Individual Power Provision Types

-

Multi-Device Modules

-

Power Management ICs

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial Automation and Machinery

-

Automotive and Mobility Solutions

-

Information & Communication Technology (ICT)

-

Consumer Electronics and Devices

-

Renewable Power and Utility Networks

-

Aerospace and Defense Applications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global power electronic testing market size was estimated at USD 6,163.1 million in 2024 and is expected to reach USD 6,655.3 million in 2025.

b. The global power electronic testing market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2033 to reach USD 12,886.9 million by 2033.

b. Asia Pacific dominated the power electronic testing market with a share of 39.3% in 2024. This is attributable to the region’s strong electronics manufacturing base, growing energy infrastructure, and rising demand for high-performance power systems.

b. Some key players operating in the power electronic testing market include AMETEK Programmable Power Inc., Bureau Veritas, Chroma ATE Inc., Intertek Group plc, Keysight Technologies, National Instruments Corporation, Rohde & Schwarz, SGS SA, TEKTRONIX, INC., and TUV Rheinland.

b. Key factors driving the market growth include the rise in electric vehicle adoption, expansion of renewable energy systems, increasing deployment of 5G and smart grids, growth in industrial automation, and the adoption of wide-bandgap semiconductors requiring advanced testing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.