- Home

- »

- Next Generation Technologies

- »

-

Power Electronics Software Market, Industry Report, 2033GVR Report cover

![Power Electronics Software Market Size, Share & Trends Report]()

Power Electronics Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology, By Type (Control Software, Design Software, Analysis Software, Simulation Software), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-634-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Electronics Software Market Summary

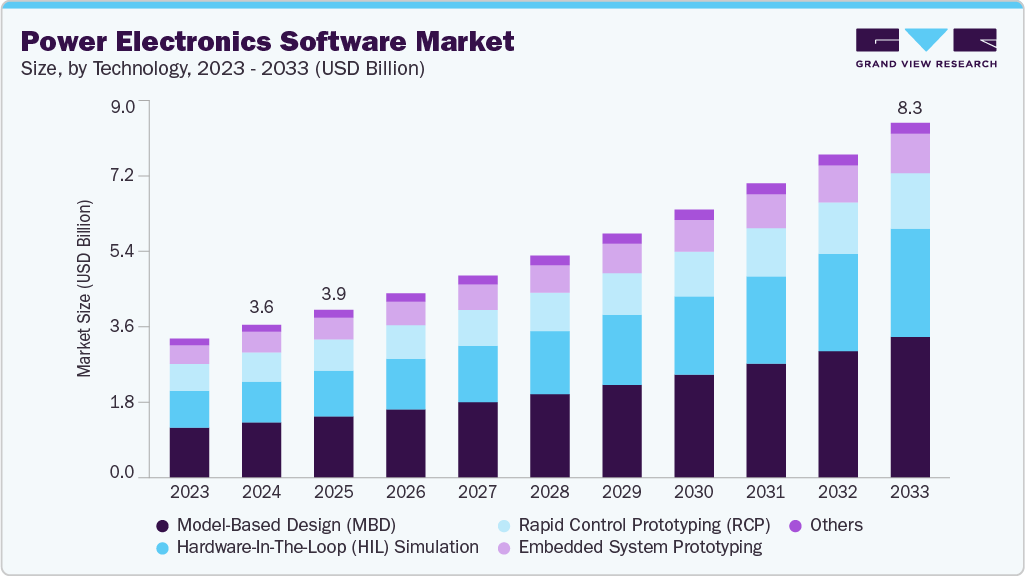

The global power electronics software market size was estimated at USD 3.56 billion in 2024 and is projected to reach USD 8.27 billion by 2033, growing at a CAGR of 9.8% from 2025 to 2033. This growth is driven by the growing demand for efficient power management in electric vehicles, renewable energy systems, and industrial automation, supported by advancements in simulation, control, and embedded design tools.

Key Market Trends & Insights

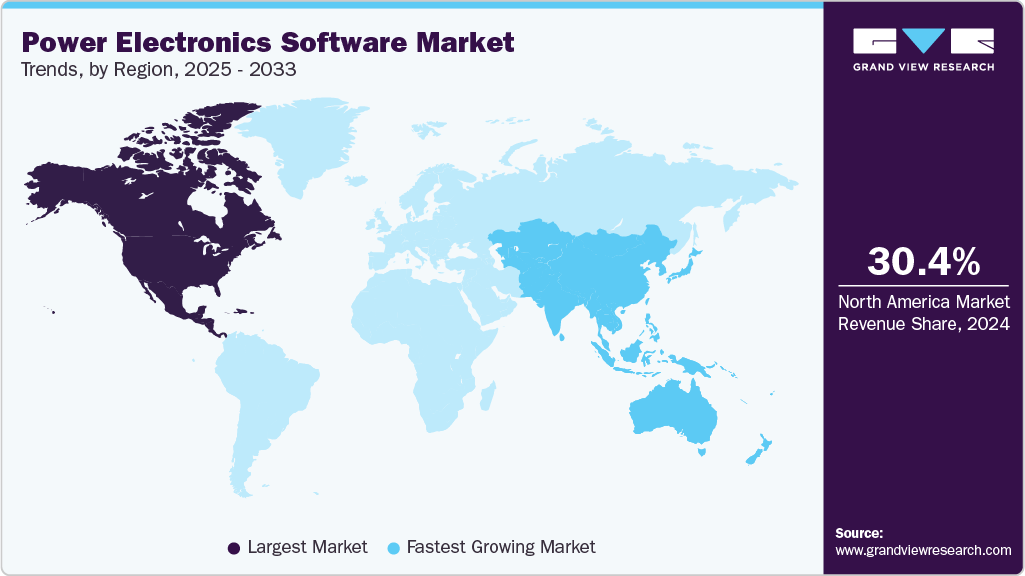

- North America dominated the global power electronics software market with the largest revenue share of 30.4% in 2024.

- The power electronics software market in the U.S. led the North America market and held the largest revenue share in 2024.

- By technology, Model-Based Design (MBD) led the market, holding the largest revenue share of 36.3% in 2024.

- By application, the industrial segment led the market, holding the largest revenue share in 2024.

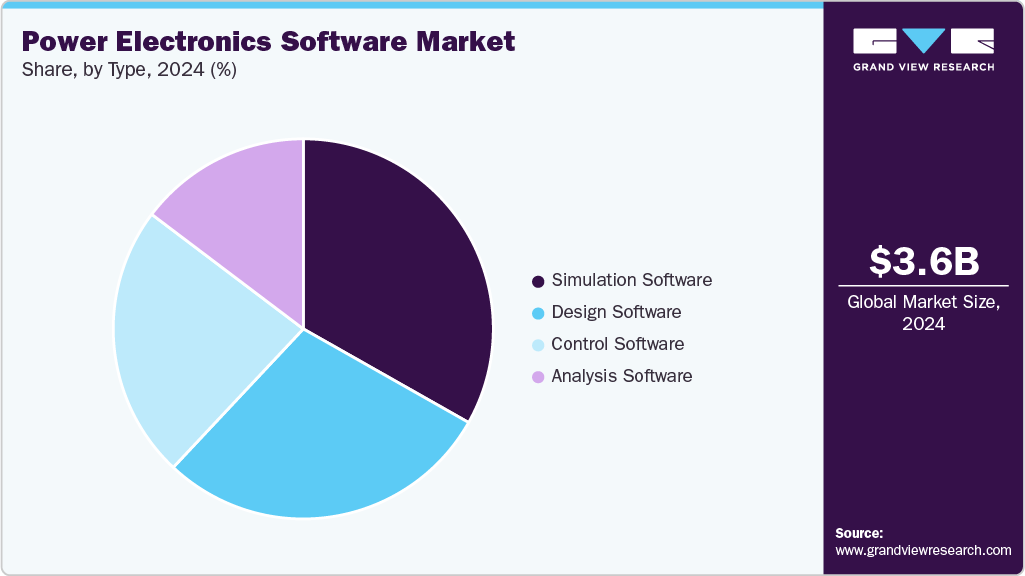

- By type, the design software segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.56 Billion

- 2033 Projected Market Size: USD 8.27 Billion

- CAGR (2025-2033): 9.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

The increasing complexity and integration of power electronic systems across diverse industries shape the current landscape of the power electronics software market. Increasing demands for accurate design, simulation, and validation tools drive the adoption of advanced software platforms that allow engineers to optimize efficiency, reliability, and performance. The rise of embedded control systems, along with the need for hardware-in-the-loop testing and real-time simulation, fosters widespread use of these software solutions in sectors such as automotive, industrial automation, aerospace, and renewable energy.In addition, the accelerating transition toward electrification and sustainable energy solutions promotes market growth. The expansion of electric vehicles and renewable energy infrastructures requires software capable of managing complex power management, battery optimization, and converter control. Stringent regulatory standards on energy efficiency and emissions compel manufacturers to deploy more advanced power electronics systems, which depend heavily on comprehensive software tools for compliance and performance enhancement.

Furthermore, integrating AI, ML, and cloud computing into power electronics software fuels the market growth. These technologies enable predictive analytics, improved fault detection, and collaborative development environments that enhance design accuracy and operational resilience. The convergence of software with hardware testing platforms allows for seamless real-time validation and troubleshooting, addressing the growing complexity of modern power electronic devices. As industries emphasize automation, sustainability, and digital transformation, the demand for versatile, scalable, and intelligent software solutions is projected to drive the growth of the power electronics software industry.

Technology Insights

The Model-Based Designs (MBD) segment accounted for the largest revenue share of over 35% in 2024, driven by enabling operators to create detailed virtual representations of complex telecom networks and analytics workflows. This capability allows for precise simulation and network performance testing under diverse scenarios, reducing development cycles and operational risks. By providing a unified design, validation, and optimization platform, MBD supports proactive network management and enhances decision-making processes, which are essential in handling the increasing data volumes and dynamic traffic patterns characteristic of modern telecom environments.

The Hardware-In-The-Loop (HIL) simulation segment is expected to grow at the fastest CAGR during the forecast period, as telecom providers seek to bridge the gap between software analytics and physical network components. HIL enables real-time testing of analytics algorithms within environments that mimic actual hardware behavior, ensuring reliable performance of solutions when deployed. This method is particularly beneficial for verifying new technologies like 5G and edge computing, where seamless integration between hardware and software is vital. The capability to conduct iterative testing and refinement speeds up innovation while reducing costly errors in live networks.

Type Insights

The design software segment accounted for the prominent revenue share of the power electronics software market in 2024, driven by equipping telecom engineers with advanced tools to architect and customize analytics solutions tailored to specific network needs. These platforms facilitate the development of scalable data processing pipelines and analytics models that adapt to varying network topologies and service demands. The flexibility and precision offered by design software empower telecom operators to deploy and manage analytics applications efficiently, ensuring optimal network performance and enhanced customer experiences in an increasingly competitive landscape.

The simulation software segment is anticipated to grow at the fastest CAGR during the forecast period, as telecom operators increasingly rely on predictive modeling to predict network behavior and user patterns. By enabling virtual testing of traffic loads, fault scenarios, and service quality impacts, simulation tools help prevent outages and optimize resource allocation. The surge in 5G adoption and the proliferation of IoT devices intensify the need for simulation capabilities to handle complex, large-scale networks, thereby supporting more resilient and efficient telecom infrastructures.

Application Insights

The industrial segment accounted for the largest revenue share of the power electronics industry in 2024, due to its extensive use of analytics in managing industrial IoT networks, smart manufacturing, and automation systems. Telecom analytics facilitates real-time asset monitoring, predictive maintenance, and process optimization, which are important for minimizing downtime and maximizing operational efficiency. The scale and complexity of industrial networks require strong analytics solutions that provide actionable insights, seamlessly supporting safety, regulatory compliance, and uninterrupted productivity across manufacturing and related operations.

The automotive segment is anticipated to grow at the fastest CAGR during the forecast period as connected and autonomous vehicles increasingly depend on telecom analytics for real-time data processing, network management, and safety functions. Analytics platforms enable monitoring of vehicle-to-everything (V2X) communications, traffic flow optimization, and predictive diagnostics, essential for enhancing road safety and operational efficiency. Integrating telecom infrastructure with automotive technologies drives demand for analytics solutions capable of processing high volumes of data with minimal latency, supporting the evolution of intelligent transportation systems.

Regional Insights

North America dominated the power electronics software industry with a revenue share of over 30.4% in 2024, driven by its advanced telecom infrastructure, early adoption of emerging technologies, and concentration of key industry players. The region benefits from significant investments in 5G networks, cloud computing, and AI-driven analytics platforms that enhance network intelligence and customer service. Regulatory frameworks emphasizing data security and privacy further encourage the deployment of comprehensive analytics solutions.

U.S. Power Electronics Software Market Trends

The U.S. power electronics software industry is expected to grow significantly in 2024, driven by the nationwide rollout of 5G and the exponential growth in data traffic. Telecom operators leverage analytics to optimize network performance, enhance security, and deliver personalized services that improve customer retention. Integrating health and safety features, such as contactless access and network resilience during emergencies, further fuels demand for intelligent analytics platforms that offer scalability and flexibility across diverse commercial and public sectors.

Europe Power Electronics Software Market Trends

The power electronics software industry in Europe is expected to grow significantly over the forecast period, driven by stringent data protection regulations and substantial investments in smart city and digital infrastructure projects. The region prioritizes modernizing telecom networks to improve efficiency, security, and user experience. Collaborative initiatives among telecom providers, governments, and technology vendors accelerate the adoption of integrated analytics solutions that address both physical and cybersecurity challenges, supporting the digital transformation of public services and private enterprises alike.

Asia Pacific Power Electronics Software Market Trends

The power electronics software industry in Asia Pacific is anticipated to register the fastest CAGR over the forecast period, driven by rapid urbanization, an expanding mobile subscriber base, and government-led digital initiatives. Telecom operators in this region adopt advanced analytics to manage increasingly complex networks, support emerging technologies like IoT and AI, and enhance customer engagement. Large-scale 5G deployments and investments in cloud-based analytics platforms further accelerate market expansion, enabling real-time decision-making and operational excellence across diverse industries and geographies.

Key Power Electronics Software Company Insights

Some key companies in the power electronics software industry are The MathWorks, Inc.; Keysight Technologies; Cadence Design Systems, Inc.; and Synopsys, Inc.

-

The MathWorks, Inc. provides software tools for engineering and scientific applications, specializing in the MATLAB and Simulink platforms. MathWorks offers comprehensive simulation and modeling solutions within the power electronics software market, enabling engineers to efficiently design, simulate, and validate power electronic systems and control algorithms. Their Simscape Electrical product allows for detailed modeling of power systems, including semiconductors, motors, and converters, facilitating system-level performance testing and hardware-in-the-loop validation.

-

Keysight Technologies is a prominent player in electronic measurement solutions, providing hardware and software tools that support the design, testing, and validation of electronic systems. It offers simulation and testing platforms in the power electronics sector that enable precise characterization and analysis of power devices and systems. Their solutions help engineers evaluate power converters, semiconductors, and control systems under real-world conditions, ensuring compliance with industry standards and enhancing reliability.

Key Power Electronics Software Companies:

The following are the leading companies in the power electronics software market. These companies collectively hold the largest market share and dictate industry trends.

- The MathWorks, Inc.

- Keysight Technologies

- Cadence Design Systems, Inc.

- Synopsys, Inc.

- Altair Engineering Inc.

- NATIONAL INSTRUMENTS CORP.

- Renesas Electronics Corporation

- Infineon Technologies AG

- dSPACE GmbH

- Siemens

Recent Developments

-

In June 2025, Infineon Technologies AG partnered with Typhoon HIL to deliver a fully integrated testing and development environment for complex components of xEV powertrain systems. This partnership enables automotive engineering teams using Infineon’s AURIX TC3x and TC4x microcontrollers to access Typhoon’s ultra-high-fidelity HIL simulators, which precisely emulate onboard chargers, motor drives, battery management systems, and power electronics.

-

In March 2025, dSPACE launched its XSG Power Electronics Systems software, designed to support the simulation of high dynamic switching frequencies up to 500 kHz. This software is specifically tailored for HIL tests and includes a library of pre-built models representing power electronics circuitry, enabling users to create simulations rapidly. This advanced tool facilitates the validation and optimization of EV and HEV power electronics systems, enhancing the efficiency and reliability of components.

-

In February 2025, Dynolt Technologies, a startup specializing in power electronics, secured USD 1.7 million in a funding round led by Transition VC. The investment supports the company’s efforts to advance its innovative power electronics solutions, which aim to improve energy efficiency and performance across applications such as electric vehicles, renewable energy systems, and industrial automation.

Power Electronics Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.91 billion

Revenue forecast in 2033

USD 8.27 billion

Growth rate

CAGR of 9.8% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

The MathWorks, Inc.; Keysight Technologies; Cadence Design Systems, Inc.; Synopsys, Inc.; Altair Engineering Inc.; NATIONAL INSTRUMENTS CORP.; Renesas Electronics Corporation; Infineon Technologies AG; dSPACE GmbH; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Electronics Software Market Report Segmentation

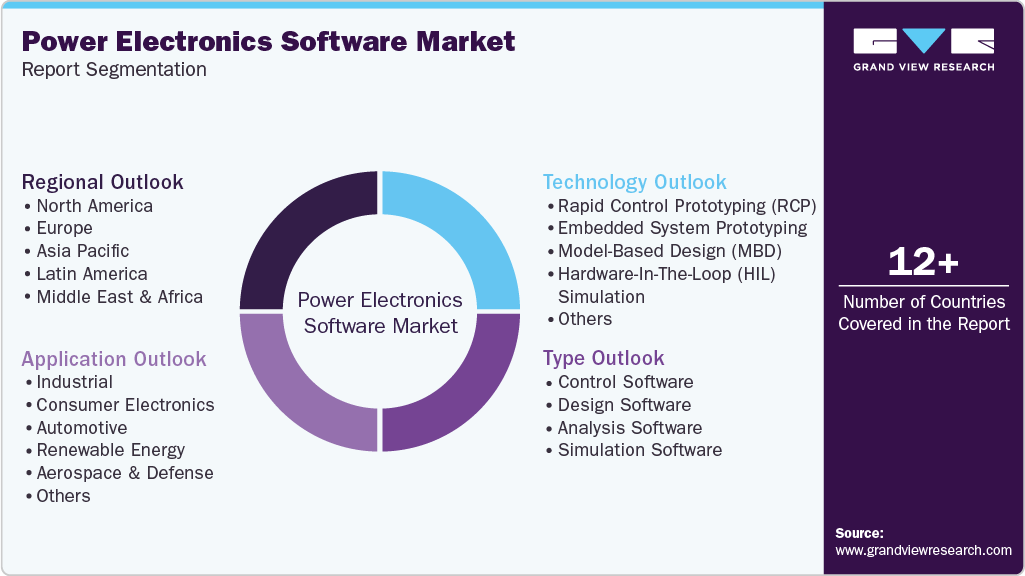

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global power electronics software market report based on technology, type, application, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Rapid Control Prototyping (RCP)

-

Embedded System Prototyping

-

Model-Based Design (MBD)

-

Hardware-In-The-Loop (HIL) Simulation

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Control Software

-

Design Software

-

Analysis Software

-

Simulation Software

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Consumer Electronics

-

Automotive

-

Renewable Energy

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global power electronics software market size was estimated at USD 3.56 billion in 2024 and is expected to reach USD 3.91 billion in 2025.

b. The global power electronics software market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2033 to reach USD 8.27 billion by 2033.

b. North America dominated the power electronics software market with a share of 30.4% in 2024. This can be attributed to the presence of prominent industry players, strong R&D investments, and high adoption of electric vehicles and renewable energy systems.

b. Some key players in the power electronics software include The MathWorks, Inc.; Keysight Technologies; Cadence Design Systems, Inc.; Synopsys, Inc.; Altair Engineering Inc.; National INSTRUMENTS CORP.; Renesas Electronics Corporation; Infineon Technologies AG; dSPACE GmbH; Siemens

b. Key factors that are driving the market growth include the rising adoption of electric vehicles, increasing demand for energy-efficient systems, and growing reliance on simulation and design tools to optimize power electronic components.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.