- Home

- »

- Plastics, Polymers & Resins

- »

-

Pressure Sensitive Adhesives Market Size Report, 2030GVR Report cover

![Pressure Sensitive Adhesives Market Size, Share & Trends Report]()

Pressure Sensitive Adhesives Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tapes, Labels, Graphic Films), By Technology, By End Use (Automotive), By Adhesive Chemistry, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-120-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pressure Sensitive Adhesives Market Summary

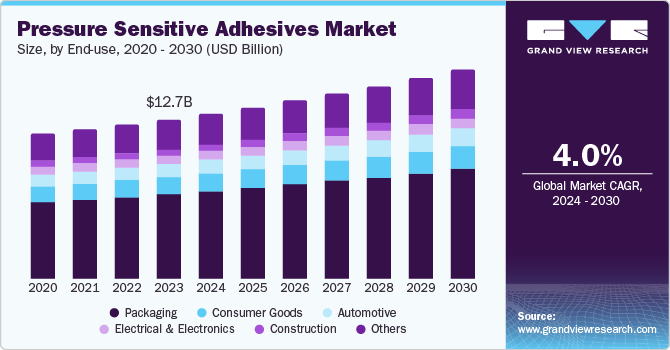

The global pressure sensitive adhesives market size was estimated at USD 12.74 billion in 2023 and is projected to reach USD 16.71 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030. The market growth is anticipated to be driven by the significant demand for pressure-sensitive tapes and labels in the packaging industry.

Key Market Trends & Insights

- The Asia Pacific pressure sensitive adhesives market dominated in 2023.

- By product, the tapes segment dominated the market in 2023.

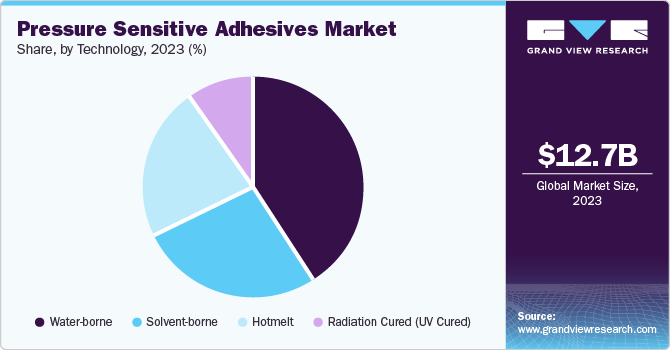

- By technology, the water-borne segment led the market in 2023.

- By adhesive chemistry, the acrylic segment led the market in 2023.

- By end use, the packaging segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.74 Billion

- 2030 Projected Market Size: USD 16.71 Billion

- CAGR (2024-2030): 4.0%

- Asia Pacific: Largest market in 2023

PSAs are easy to use and have the ability to tackle adhesion challenges in a variety of technology and coatings in packaging industry. Packaging requirements are becoming increasingly complex, especially in the food & beverages industry, due to product proliferation and rising competition. This is anticipated to open new avenues for the market as PSAs offer the flexibility to meet these complex requirements. PSAs are also used in other industries, such as automotive, wherein it finds end-uses in safety and warning labels and component identification labels in the supply chain.

About 1 square meter of label is typically used in an average car, wherein only 10%-15% of the labels are tire pressure and warning labels, which are visible to car owners. The rest of the labels, that remain unseen to the car owner, are applied on automotive parts. They are used to denote the part number and product specification, during its assembly.

One of the major drivers of the pressure sensitive adhesives market is the increasing demand for convenience packaging, especially in the food and beverage industry. PSAs are widely used in food packaging due to their ability to provide a secure and reliable seal that keeps food fresh and free from contamination.

Product Insights

Tapes dominated the market in 2023. This is attributed to extensive utilization of tapes for carton sealing in packaging sector. Moreover, they are used in various assembly end-uses, such as electronic and automotive assembly. The ease of use, eco-friendly nature, and lighter weight of the product as compared to other fastening & joining methods are anticipated to drive the demand in assembly end uses.

Demand for labels is driven by increasing utilization of food labels, clear labels, packing lists, envelopes, general purpose permanent labels, fabric labels, tire labels, removable labels, specialty labels, and durable labels. Self-adhesive labels derived from acrylic emulsions are extensively utilized in the labeling industry owing to their superior characteristics. They allow wider webs, faster speeds, and overall better uptime during converting as compared to other labels.

Graphic films are expected to register the fastest CAGR during the forecast period. Pressure sensitive adhesives are used in graphic films across numerous applications including branding graphics, road traffic signage, advertising graphics, large format weather-resistant graphics, home décor, outdoor advertising, point-of-purchase promotions, and vehicle graphics. Branding and advertising graphics are gaining more emphasis in corporate strategies of multinational companies as brand logos and advertising play a crucial role in influencing consumer demand.

Technology Insights

Water-borne dominated the market in 2023. This is attributed to its environmentally friendly nature and its significant adoption in the manufacturing of tapes and labels. Water-based PSAs are extensively used on paper and are preferred over other technologies for food & beverage labels. Moreover, they are used in the production of general-purpose permanent labels, removable labels, and pharmaceutical labels.

Solvent-based technology is generally acrylic or rubber-based polymer formulations dissolved in solvent. Major advantages of solvent-based technology include a wide range of adhesion with quick curing, high bond strength, and high heat and chemical resistance. Solvent-based segment is driven by the utilization of this technology in durable, demanding, and long-term applications.

The demand for hot melt technology is expected to grow in the coming years owing to lower costs as compared to other technologies. Hot melt PSAs allow the converters to use higher coat weight. Also, the flexibility offered by hot melts to bond on both smooth and rough surfaces is a significant factor in facilitating the faster growth of this segment.

Radiation Cured (UV Cured) are expected to register the fastest CAGR during the forecast period. The technology is designed to meet a variety of end use requirements including the tapes and labels in different end-use industries, such as food packaging, automotive, and Electronics. They have similar advantages as that of solvent-based acrylic including resistance to cleaners and solvents. Moreover, they do not require special ovens to dry and have no appreciable VOC emissions.

Adhesive Chemistry Insights

Acrylic dominated the market in 2023 owing to their oxidation and UV resistance. They are generally used on paper and polar surfaces like glass, steel, aluminum, polycarbonate, zinc, tin, and Polyvinyl Chloride (PVC). Rubber-based products are typically based on hot melt and solvent-based systems. The adoption of rubber-based products in tapes is driven by their ability to provide quick adhesion on rough and smooth surfaces alike.

As opposed to acrylic, rubber-based products are extensively utilized on non-polar, low-energy surfaces. Moreover, they offer a more economical choice for tapes manufacturers. Silicone is expected to register the fastest CAGR during the forecast period. Silicone formulations are characterized by longer durability and extreme weather resistance in comparison to acrylics and rubber.

End Use Insights

Packaging dominated the market in 2023. Tapes find various applications in packaging industry ranging from containers, boxes, and envelopes to bank bags and pouches. Self-adhesive labels are extensively utilized for packaged food & beverages, beauty products, warehouse boxes, jars, pharmaceutical and packaging among others. The user-friendly nature and instant bonding speed offered by tapes and self-adhesive labels are the major factors driving the product demand in the packaging industry.

PSAs are also used in building & construction industry for applications such as automotive, roofing linings, vapor barriers, masking, and interior design. Companies are undertaking numerous strategies to identify and explore the opportunities for specialty tapes in the construction industry. For instance, The Pressure Sensitive Tape Council (PSTC) conducted an event pertaining to the use of PSAs in the building & construction industry in May 2019 in Baltimore.

Automotive is projected to grow at the fastest CAGR over the forecast period. In the automotive industry, pressure sensitive adhesives provide a cost-effective solution to car manufacturers for improving the speed and efficiency of assembly operations. Furthermore, they improve productivity in complex assembly operations. PSAs contribute to ensuring the light weight of cars, thereby improving crash performance and providing an ideal counterbalance. Furthermore, eco-friendly and efficient electric cars are expected to replace combustion engines and redefine the requirements for vehicle manufacturing.

Regional Insights

Asia Pacific pressure sensitive adhesives market dominated the market in 2023. The growing economies in the region, especially in China and India, have higher demand for consumer products, resulting in a rise in the need for packaging and labeling options. The strong growth of the automotive industry and the increasing emphasis on electric vehicles and lightweight parts drive the utilization of PSAs in assembly and bonding processes. Moreover, the fast urbanization and infrastructure growth in the construction sector are opening possibilities for PSA-based insulation, roofing, and flooring products.

The India pressure sensitive adhesives market held a substantial share in 2023 driven by the growth of the automotive sector, combined with government efforts to support electric vehicles and component production, which is fueling the utilization of PSAs in assembly and bonding procedures. Moreover, the fast urbanization and infrastructure growth in the construction industry are opening chances for PSA-based products in roofing, insulation, and flooring. Also, the expanding electronics and electrical manufacturing field is boosting the PSA market due to the need for effective bonding solutions for components.

North America Pressure Sensitive Adhesives Market Trends

North America's pressure sensitive adhesives are anticipated to witness significant growth in the market. The growth of the construction sector, especially in housing and commercial areas, necessitates a wide range of adhesive options for insulation, roofing, and flooring. In addition, the growing need for PSAs in wound care, drug delivery systems, and medical tapes is fueled by the healthcare sector's dependence on disposable medical devices and the increasing number of elderly individuals.

U.S. Pressure Sensitive Adhesives Market Trends

The U.S. pressure sensitive adhesives market dominated North America in 2023. Several main factors drive the U.S. pressure sensitive adhesives (PSA) market. The growing e-commerce sector plays a key role, as PSAs are vital for packaging and mailing items. Furthermore, the increasing emphasis on vehicle electrification is driving the use of PSA in the automotive industry, as there is a demand for lightweight and efficient components.

Europe Pressure Sensitive Adhesives Market Trends

Europe's pressure sensitive adhesives market was identified lucrative in 2023 due to the focus on creating innovative and personalized products. The region is a center for research and development in adhesive technologies, resulting in the creation of advanced PSAs designed for specific applications. Moreover, the growing emphasis on sustainability has influenced the need for eco-friendly PSAs created from renewable materials and with minimal environmental impact. Moreover, the increasing demand for DIY and home improvement projects is opening possibilities for consumer-grade PSA products.

Key Pressure Sensitive Adhesives Company Insights

Some of the key companies in the pressure sensitive adhesives market include Henkel Corporation, Bostik, Momentive Performance Materials, and others. Organizations are concentrating on expanding their customer base to achieve a competitive advantage in the market. Hence, major stakeholders are implementing various strategic actions, including mergers, acquisitions, and collaborations with other leading firms.

-

Bostik, a subsidiary of Arkema, offers a range of hot melt, waterborne, UV, and specialty acrylic PSAs for various uses such as tapes, labels, and specialty films. Bostik also offers environmentally friendly PSAs, meeting the increasing need for eco-conscious products in the market.

Key Pressure Sensitive Adhesives Companies:

The following are the leading companies in the pressure sensitive adhesives market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel Corporation

- Bostik

- Momentive Performance Materials

- 3M

- Avery Dennison Corp.

- AdCal Inc

- tesa Tapes

- Nitto Denko Corporation

- Ashland

- H.B. Fuller Company

- Arkema

- Dow

- Eastman Chemical Company

- Sika AG

Recent Developments

-

In April 2024, Henkel's Aquence PS 3017 , adhesive solution, received certification from the cyclos-HTP Institute (CHI). This certification confirms the packaging component recyclability.

-

In April 2024, Bostik, a subsidiary of Arkema specializing in adhesive solutions, invested in UV acrylic HMPSA capabilities, thereby expanding UV acrylic hot melt pressure sensitive adhesive in the North American facilities and offer high performance offerings in the market.

-

In November 2023, Engineered Polymer Solutions (EPS) launched EPS 2133, a new resin for Pressure-Sensitive Adhesives (PSAs).

Pressure Sensitive Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.21 billion

Revenue forecast in 2030

USD 16.71 billion

Growth Rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, adhesive chemistry, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, Brazil, Argentina, Colombia, South Arabia, South Africa

Key companies profiled

Henkel Corporation; Bostik; Momentive Performance Materials;3M; Avery Dennison Corp.; AdCal Inc; tesa Tapes; Nitto Denko Corporation; Ashland; .B. Fuller Company; Arkema; Dow; Eastman Chemical Company; Sika AG;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pressure Sensitive Adhesives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pressure sensitive adhesives market report based on product, technology, adhesive chemistry, end use, and region

-

Product Outlook (Revenue, USD Billion, Kilo Tons, 2018 - 2030)

-

Tapes

-

Labels

-

Graphic Films

-

Others

-

-

Technology Outlook (Revenue, USD Billion, Kilo Tons, 2018 - 2030)

-

Water-borne

-

Solvent-borne

-

Hotmelt

-

Radiation Cured (UV Cured)

-

-

Adhesive Chemistry Outlook (Revenue, USD Billion, Kilo Tons, 2018 - 2030)

-

Acrylic

-

Rubber

-

Silicone

-

Others

-

-

End Use Outlook (Revenue, USD Billion, Kilo Tons, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Consumer Goods

-

Packaging

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Billion, Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.