- Home

- »

- Network Security

- »

-

Privacy Enhancing Technologies Market Size Report, 2030GVR Report cover

![Privacy Enhancing Technologies Market Size, Share & Trends Report]()

Privacy Enhancing Technologies Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Service), By Type (Cryptographic Technique, Anonymization Technique), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-457-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Privacy Enhancing Technologies Market Summary

The global privacy enhancing technologies market size was estimated at USD 3,120.9 million in 2024 and is projected to reach USD 12,094.4 million by 2030, growing at a CAGR of 25.3% from 2025 to 2030. The growth can be attributed to the increasing demand for data protection and compliance with stringent regulations that ensure secure data usage while maintaining privacy.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, the U.S. is expected to grow significantly from 2024 to 2030.

- In terms of segment, software accounted for a revenue of USD 3,120.9 million in 2024.

- Software is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,120.9 Million

- 2030 Projected Market Size: USD 12,094.4 Million

- CAGR (2025-2030): 25.3%

- North America: Largest market in 2024

Additionally, the rise of digital transformation, along with growing concerns over cybersecurity threats and data breaches, has heightened the need for advanced privacy-preserving techniques such as homomorphic encryption and differential privacy to protect sensitive information without compromising functionality.

The market is also driven by the expanding use of big data and artificial intelligence (AI) in industries such as finance, healthcare, and marketing. As these sectors rely heavily on large-scale data analytics to deliver personalized services and improve decision-making, there is an increasing need to process sensitive data without compromising privacy. PET solutions, such as secure multi-party computation and federated learning, are emerging as essential tools for enabling companies to perform advanced data analytics while adhering to privacy regulations and minimizing the risk of data breaches.

Moreover, the growing adoption of cloud computing and the rise of the Internet of Things (IoT) are contributing significantly to the demand for PET solutions. With vast amounts of data being generated and stored on cloud platforms and IoT devices, concerns over data ownership, confidentiality, and unauthorized access have become more prominent. Privacy-enhancing technologies like encryption, anonymization, and tokenization are crucial in ensuring that data remains secure and private across distributed networks, enabling organizations to leverage the benefits of cloud and IoT while addressing privacy challenges. The 2024 IBM Cost of a Data Breach Report shows that the global average data breach cost has reached USD 4.88 million, representing a 10% increase from the previous year. This significant rise underscores the increasing financial challenges businesses face from cyberattacks. Factors such as the growing complexity of threats, understaffed security teams, and the widespread use of AI by cybercriminals contribute to this surge in costs.

In addition, increasing consumer awareness about data privacy is exerting pressure on companies to prioritize privacy measures in their digital services and products. Consumers are becoming more selective about how their personal information is shared and managed, prompting businesses to invest in PET solutions that can enhance trust, foster customer loyalty, and offer a competitive edge in privacy-conscious markets. This heightened focus on privacy protection is influencing market trends and driving growth in the PET sector.

Component Insights

The software segment accounted for the largest market share of 59.1% in 2023. The exponential growth in data volume and the variety of data sources, from IoT devices to social media, creates complex privacy challenges. Software solutions are essential for managing and protecting this diverse data effectively, addressing the growing need for advanced privacy controls.

The service segment is anticipated to grow at the fastest CAGR over the forecast period. Consumers are growing more expectant of companies handling their personal data responsibly. Organizations are investing in privacy-enhancing services to build trust, enhance their reputation, and meet consumer expectations for data protection. The rise of new business models, such as data-as-a-service and platform-based business models, is increasing the need for privacy solutions that can accommodate these innovative approaches while safeguarding user data.

Type Insights

The cryptographic technique segment had the largest market share, 45.5%, in 2023. The growth of e-commerce and online financial transactions requires secure methods for handling payment information and personal data. Cryptographic techniques such as Secure Sockets Layer (SSL) and Transport Layer Security (TLS) are essential for ensuring secure communications and transactions between consumers and businesses.

The anonymization technique segment is anticipated to grow at the fastest CAGR over the forecast period. The rapid growth of data analytics and artificial intelligence (AI) technologies necessitates anonymization to ensure that data used for training models or conducting analyses does not reveal personal identities. As AI and machine learning applications become more prevalent, the demand for robust anonymization methods to safeguard privacy in these contexts increases.

Application Insights

The compliance management segment had the largest market share, 40.0%, in 2023. The growing prevalence of cyberattacks and data breaches has heightened the need for advanced compliance solutions. Organizations are investing in PETs to protect sensitive information from unauthorized access and mitigate the risks associated with cybersecurity threats, thereby enhancing their overall security posture.

The reporting & analytics segment is anticipated to grow at the fastest CAGR over the forecast period. Data collaborative platforms that facilitate secure sharing and analysis of data between multiple parties are gaining traction. PET solutions that enable privacy-preserving analytics in these collaborative environments are becoming increasingly important.

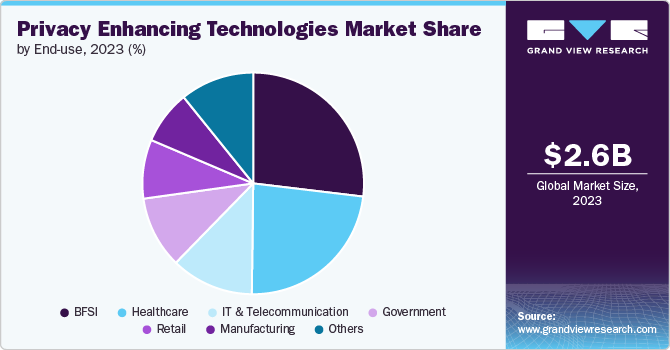

End-use Insights

The BFSI segment accounted for the largest market share of 27% in 2023. Financial institutions handle vast amounts of sensitive personal and financial data, making them prime targets for cyberattacks and data breaches. As a result, there is a heightened emphasis on protecting this information to maintain customer trust and meet stringent regulatory requirements. Privacy Enhancing Technologies, such as data anonymization, encryption, and secure multi-party computation, are becoming essential tools for these organizations to safeguard sensitive data while still enabling valuable data analysis and business operations.

The manufacturing segment is anticipated to grow at the fastest CAGR over the forecast period due to the rise of smart manufacturing and Industry 4.0 initiatives, which involve the integration of advanced technologies such as IoT, AI, and big data analytics into production processes. These technologies generate and process vast amounts of data, which raises concerns about data privacy and security. PETs address these concerns by providing mechanisms to secure data while enabling its use for insights and decision-making.

Regional Insights

North America privacy enhancing technologies market held a share of 39.8% in 2023. The rise of AI and machine learning across sectors such as healthcare, finance, and marketing in North America has accelerated the need for privacy-preserving data analytics. Technologies such as differential privacy and secure multi-party computation are being increasingly adopted to enable organizations to leverage large datasets while safeguarding individual privacy. The growing consumer awareness of data privacy and increasing concerns over cybersecurity threats are also pushing businesses to invest in more advanced privacy-enhancing technologies to maintain a competitive edge and ensure transparency in their data practices.

U.S. Privacy Enhancing Technologies Market Trends

The privacy enhancing technologies market in the U.S. is expected to grow significantly from 2024 to 2030. The enforcement of the California Consumer Privacy Act (CCPA) and other state-level privacy regulations has increased the need for businesses to comply with stringent data protection standards, prompting the adoption of PET solutions such as data anonymization, encryption, and differential privacy. These technologies help organizations mitigate legal risks while ensuring secure and privacy-compliant data handling.

Europe Privacy Enhancing Technologies Market Trends

The privacy enhancing technologies market in Europe is expected to grow significantly at a CAGR of 24.7% from 2024 to 2030. Europe's emphasis on digital sovereignty and data localization is influencing PET trends. Governments and businesses are increasingly focused on controlling and protecting data within their borders, driving demand for secure data processing solutions that respect privacy rights. The rise of cloud computing and IoT in Europe has further fueled PET adoption, as organizations seek to protect the growing volume of data generated across these networks. Privacy-enhancing technologies like tokenization, encryption, and privacy-preserving computation are essential in ensuring data security while supporting innovation.

Asia Pacific Privacy Enhancing Technologies Market Trends

The privacy enhancing technologies market in Asia Pacific is expected to grow significantly at a CAGR of 27.8% from 2024 to 2030. The rapid digital transformation in the Asia Pacific, particularly in sectors such as financial services, healthcare, and e-commerce, is accelerating the demand for privacy-preserving technologies. As these industries increasingly rely on data analytics, AI, and machine learning to enhance services, PET solutions such as federated learning and secure multi-party computation are being adopted to allow data-driven innovation without compromising user privacy. This is especially important in countries such as China and India, where large-scale data collection from users necessitates advanced privacy protections.

Key Privacy Enhancing Technologies Company Insights

Key players operating in the privacy enhancing technologies market include Microsoft Corporation, IBM Corporation, Google LLC, Cisco Systems, Inc., and Fortinet, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Check Point Software Technologies Ltd. introduced CloudGuard WAF-as-a-Service (WAFaaS), an AI-driven web application firewall designed to provide automated protection for web applications. This fully managed solution helps organizations safeguard against cyber threats, unauthorized access, and data breaches. With a focus on prevention, ease of use, and scalability, the service offers a cost-efficient and straightforward way to secure cloud applications and APIs effectively.

-

Between January and July 2024, Gen Digital Inc. introduced several key updates. In January, version 23.12 implemented Port Scan and ARP Spoofing detection in the Firewall, enhancing network security. March’s version 24.2 brought Web Shield optimizations for faster browsing and email syncing issues. May's version 24.4 addressed a problem with Site Blocking on managed devices and improved Firewall rule updates. In July, version 24.6 renamed Password Protection to Browser Shield, adding cookie theft protection while resolving issues related to Mail Shield’s email scanning and other minor fixes.

Key Privacy Enhancing Technologies Companies:

The following are the leading companies in the privacy enhancing technologies market. These companies collectively hold the largest market share and dictate industry trends.

- CipherTrust

- IBM

- Microsoft

- Oracle

- SAP

- SAS Institute

- Socure

- Thales eSecurity

- TrustArc

- Veracod

Privacy Enhancing Technologies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.12 billion

Revenue forecast in 2030

USD 12.09 billion

Growth rate

CAGR of 25.3% from 2024 to 2030

Base Year

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

CipherTrust; IBM; Microsoft; Oracle; SAP; SAS Institute; Socure; Thales eSecurity; TrustArc; Veracod

Customization scope

With purchase, you can customize your report free of charge (equivalent to up to 8 analysts' working days). You can add or alter the country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Privacy Enhancing Technologies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global privacy enhancing technologies market report based on component, type, application, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Service

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cryptographic Technique

-

Anonymization Technique

-

Pseudonymization Techniques

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Compliance Management

-

Risk Management

-

Reporting & Analytics

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

IT and Telecommunication

-

Government

-

Retail

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global privacy enhancing technologies market size was estimated at USD 2.60 billion in 2023 and is expected to reach USD 3.12 billion in 2024.

b. The global privacy enhancing technologies market is expected to grow at a compound annual growth rate of 25.3% from 2024 to 2030 to reach USD 12.09 billion by 2030.

b. The privacy enhancing technologies market in North America held the share of 39.8% in 2023. The rise of AI and machine learning across sectors such as healthcare, finance, and marketing in North America has accelerated the need for privacy-preserving data analytics.

b. Some key players operating in the privacy enhancing technologies market include CipherTrust, IBM, Microsoft, Oracle, SAP, SAS Institute, Socure, Thales eSecurity, TrustArc, and Veracod

b. The growth can be attributed to the increasing demand for data protection and compliance with stringent regulations such as GDPR and CCPA, pushing organizations to adopt PET solutions that ensure secure data usage while maintaining privacy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.