- Home

- »

- Drilling & Extraction Equipments

- »

-

Proppants Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Proppants Market Size, Share & Trends Report]()

Proppants Market (2024 - 2030) Size, Share & Trends Analysis Report, By Type (Frac Sand, Resin-Coated, Ceramic), By Application (Shale Gas, Tight Gas, Coal Bed Methane), By Region, And Segment Forecasts

- Report ID: 978-1-68038-322-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Proppants Market Size & Trends

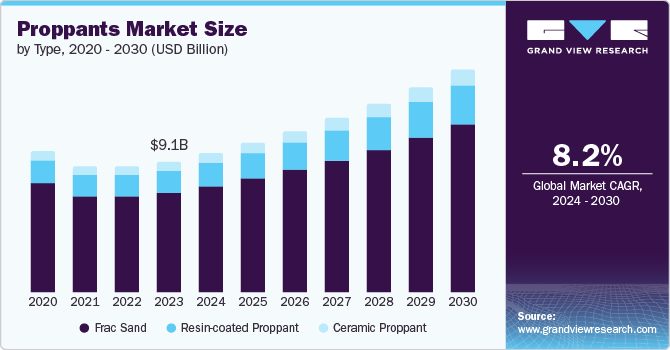

The global proppants market size was valued at USD 9.12 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. Advancements in fracturing technology and drilling techniques, along with the rise in proppants consumption per well, innovation in proppants technologies, and an increasing demand for liquefied natural gas to enhance energy security, are contributing factors. In addition, the growing demand for oil and natural gas worldwide is expected to boost market demand.

The major drivers propelling the growth of proppants are the progressions in fracturing technology, increasing proppants consumption per well, innovation in proppants technologies, and the worldwide growing natural gas demand. Proppants play a vital role in hydraulic fracturing by preserving crack permeability in shale rock, enabling the flow of hydrocarbons essential for oil and gas extraction. They come in diverse forms, sizes, densities, and properties, influencing fracture permeability.

Currently, the market offers two primary types: natural (frac sand) and man-made/engineered proppants, such as ceramic and resin-coated variations. Although the majority of proppants are typically composed of silica or ceramics, there is a growing interest in advanced proppants, such as ultra-lightweight, for their ability to minimize proppant settling and their compatibility with low-viscosity fluids for transportation. Moreover, multifunctional proppants have the potential to serve additional purposes, such as identifying hydraulic fracture geometry or acting as carriers for the gradual release of downhole chemical additives, in addition to their primary role of sustaining conductive hydraulic fractures. Their resistance to crushing and conductivity make proppants highly sought after in the oil and gas sector.

Type Insights

Frac sand dominated the market in terms of revenue share of 77.0% in 2023. It is pivotal in hydraulic fracturing, facilitating high volumes of oil and natural gas production, contributing to reliable energy, and reducing dependency on external energy sources. Fine mesh raw frac sand is a proppant for extracting oil and natural gas, enhancing their flow. In terms of cost efficiency, this sand outperforms resin-coated and ceramics. In the oil and natural gas extraction segment, it is vital to maintain underground fractures, which benefits the extraction of hydrocarbons from shale rock formations. The increasing application of fine mesh raw frac sand as a proppant symbolizes a growing trend in the market worldwide.

The ceramic proppants are expected to witness a significant growth rate with a CAGR of 9.6% over the forecast period. Ceramic proppant, a granular material, is specifically designed to support open fractures in oil and gas wells. Usually, augmentation of durable ceramic materials such as fused alumina, bauxite, or silicon carbide, ceramic proppants are significantly stronger and endure better than traditional sand proppants, making them suitable for use in high-pressure and high-temperature environments.

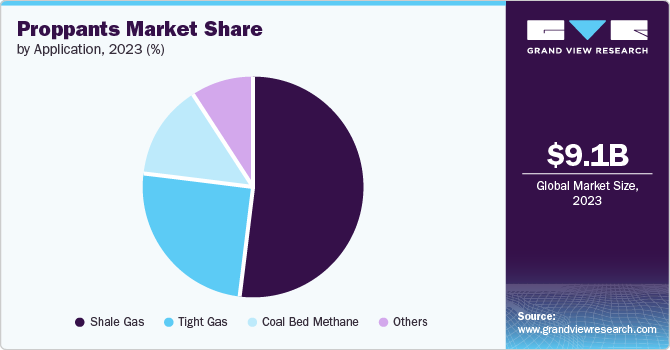

Application Insights

Shale gas dominated the market with a share of 51.6% in 2023 in the application category. The shale gas features are crucial for hydro-fracturing efficacy and the stability of induced fractures as the minerals have poor permeability that challenges the fluids to pass through them. As a result, hydraulic fracturing is essential to extract the oil and gas from these rocks; it is also related to the mineral assemblage or composition. Gas-bearing shale is a brittle rock with comparatively high contents of feldspar, quartz, and carbonate minerals and contains a relatively low level of clay minerals.

Tight gas witnessed significant growth with a CAGR of 8.5% over the forecast period. Hydraulic fracturing includes injecting fracking fluids into wells to separate the rocks in the formation. This is one of the most widespread methods for producing a tight gas. This improves permeability and makes gas flow out of the trap easier. Natural gas is present in low-permeability rocks. It is a form of natural gas that is obtained unconventionally. The development can be linked to the consumption of tight gas with multiple value-added outputs in the industrial sector. Tight gas is also used as a feedstock to manufacture fertilizer, chemicals, and various products. This has offered many possibilities for gas-rich economies in the upcoming years to drive industrial output using tight gas.

Regional Insights

The North America proppants market dominated with a significant share of 45.5%. The North America and the Gulf of Mexico continental shelf have numerous oilfields at high maturity levels. This is expected to further enhance the demand for proppants in the region. Moreover, upgraded technology and effectiveness have further permitted completion activity to alter the breakeven costs in favor of manufacturers in this region.

U.S. Proppants Market Trends

The U.S. proppants market dominated North America accounting for a share of 93.3%. The U.S. is one of the dominant countries in terms of assessing the unconventional crude oil reserves and the use of hydraulic fracturing simultaneously. Drillers are flourishing up production, particularly in Texas. The state’s Permian Basin is experiencing the activity as drillers attain as much oil and gas as possible from hydraulic fracturing operations.

Europe Proppants Market Trends

The European proppants market is determined to grow rapidly in the coming years and will experience a substantial increase. Some prominent players have acquired small companies with drilling specialization to expand in several categories by building distribution and marketing networks. Subsequently, as energy costs ascend and drilling activities rise, the market demand is met advertently. This allows the manufacturers to produce in bulk and is significant to the regional market growth.

The UK proppants market is expanding significantly because of factors driving market growth. Proppants are crucial elements used in hydraulic fracturing, consisting of evenly sized gritty granules combined with fracturing fluid to keep fractures open in the subsurface. The surging demand for proppants optimizes oil and gas production from wells using hydraulic fracturing techniques & results in the growing need for proppants in the oil and gas sector due to hydraulic fracturing.

The proppants market in Germany witnessed substantial growth, through the integration of cutting-edge drilling technologies and intricate frac designs, proppant solutions that contribute significantly to enhancing the daily yield of oil and natural gas. Nevertheless, the efficacy of the proppant in extracting hydrocarbons from reservoirs is contingent upon the performance parameters of the proppant pack.

Asia Pacific Proppants Market Trends

Asia Pacific proppants market is expected to grow with a CAGR of 9.3% over the forecast period. Asia-Pacific is expected to witness the highest growth during the forecast period due to the presence of huge reserves of shale gas and hydraulic fracturing projects in countries such as China, India, and Australia. In 2023, The Government of the People's Republic of China declared various developmental plans for shale gas reserves as a part of a Natural Gas Development plan that is expected to result in a positive outcome on market growth.

The China proppants market is expected to grow rapidly due to several key factors, such as the country's objective of expanding its domestic natural gas production and meeting the growing demand for enhancing regional energy security. Most of China's tight gas reserves are located in its hilly areas, leading to a substantial increase in drilling costs. China gives high priority to the burgeoning shale gas industry. With the support of national industrial policies, China's shale gas sector has made swift progress. It is now in the phase of extensive exploitation of shale gas located at depths below 3500 m.

The proppants market in India is growing slightly, with the rise in oil and gas exploration, surge in demand for mineral exploration and the development of shale gas reserves are factors supporting the growth of the proppants market in the region. The regional markets have witnessed developments in the drilling sectors owing to industrial growth and a rise in hydraulic fracking, as the rising demand for oil recovery drives the demand for proppants. The growth of proppants in this region can also be attributed to growing investments in research and development, the expansion of international players, and technological advancements.

Key Proppants Company Insights

Some key companies in the proppants market include Carbo Ceramics Inc.; U.S. Silica Holdings Inc.; Fairmount Santrol Holdings Inc.; Hi-Crush Inc.; Emerge Energy Services LP; Badger Mining Corporation; Saint-Gobain Proppants; China GengSheng Minerals, Inc.; Hexion Inc.; Momentive Specialty Chemicals Inc; in the market are focusing on development & to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Hi-Crush Inc. provides proppant and logistics services to the petroleum industry in North America. The company owns, operates, and develops sand reserves. Hi-Crush produces monocrystalline sand which is a specialized mineral used as a proppant for the well completion process to facilitate oil and natural gas recovery.

-

Fairmount Santrol Holdings Inc. produces industrial and commercial foundry resin-coated sand. The company offers pool filter sand that cleans pool water, filter gravels to remove clay, shale, and inorganic impurities. The rubber-coated sand is used as an infill material in artificial turf, and multi-colored stone for epoxy basement, driveway, and patio applications.

Key Proppants Companies:

The following are the leading companies in the proppants market. These companies collectively hold the largest market share and dictate industry trends.

- Carbo Ceramics Inc.

- U.S. Silica Holdings Inc.

- Fairmount Santrol Holdings Inc.

- Hi-Crush Inc.

- Emerge Energy Services LP

- Badger Mining Corporation

- Saint-Gobain Proppants

- China GengSheng Minerals, Inc.

- Hexion Inc.

- Momentive Specialty Chemicals Inc.

Recent Developments

-

In February 2024, Atlas Energy Solutions Inc., a company specializing in renewable energy solutions, entered into an agreement with Hi Crush Inc. to acquire the latter’s North American logistics operations and proppant production assets

Proppants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.74 billion

Revenue forecast in 2030

USD 15.62 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilo tons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Netherlands, Norway, China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Thailand, Brazil, Argentina, Venezuela, South Africa, Saudi Arabia, UAE, Qatar, Kuwait

Key companies profiled

Carbo Ceramics Inc.; U.S. Silica Holdings Inc.; Fairmount Santrol Holdings Inc.; Hi-Crush Inc.; Emerge Energy Services LP; Badger Mining Corporation; Saint-Gobain Proppants; China GengSheng Minerals, Inc.; Hexion Inc.; Momentive Specialty Chemicals Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Proppants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global proppants market report based on type, application, and region:

-

Type Outlook (Volume in Tons; Revenue USD Billion, 2018 - 2030)

-

Frac Sand

-

Resin-coated Proppant

-

Ceramic Proppant

-

- Application Outlook (Volume in Tons; Revenue USD Billion, 2018 - 2030)

-

Shale Gas

-

Tight Gas

-

Coal Bed Methane

-

Others

-

-

Regional Outlook (Volume in Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.