- Home

- »

- Pharmaceuticals

- »

-

Protein Expression Market Size And Share Report, 2030GVR Report cover

![Protein Expression Market Size, Share & Trends Report]()

Protein Expression Market Size, Share & Trends Analysis Report By Expression System (Prokaryotic, Mammalian Cell), By Product (Reagents, Competent Cells), By Application (Therapeutic, Industrial), By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-473-4

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Protein Expression Market Size & Trends

The global protein expression market size was valued at USD 3.18 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.36% from 2023 to 2030. The increasing importance of protein-based therapeutics in modern medicine coupled with the growing investment by biopharmaceutical companies in R&D is anticipation to become a major growth determinant of the protein expression market. The COVID-19 pandemic has emerged as an urgent situation across the globe. Hence, it is required to assess the differentially expressed genes in the patients with COVID-19 to gain insights into the disease pathogenesis and the genetic factors.

Similarly, a study conducted by researchers from Adamas University, Hallym University-Chuncheon Sacred Heart Hospital, Fakir Mohan University, and Qatar University (QU) Health, developed a protein-protein interaction (PPI) pattern and cluster analysis of the PPI network to identify potential biomarkers for COVID-19 patients.

The global protein expression market is surging as the outcome of rising demand for personalized therapeutics and the rapidly growing R&D activities that support protein expression. The discovery of protein therapeutic is driven via protein engineering, along with the artificial construction of recombinant proteins. The advancement in technology is creating favorable opportunities for enhancing patient care by developing personalized medical therapies.

Strategic initiatives between companies and academic institutions to develop innovative technologies are anticipated to support the upward market momentum. For instance, the researchers from the Novartis Institutes for Biomedical Research and the University of California, Berkeley collaborated to develop and commercialize a platform for protein stabilization to surge the innovation in therapeutics for genetic disorders and cancer. In July 2022, the researchers launched Vicinitas Therapeutics with USD 65 million in series A funding. Similarly, numerous players are employing strategic initiatives to expand their presence in the market. In August 2022, BioIVT announced the acquisition of Cypex, as the acquired company’s product range of proteins complements BioIVT’s solutions for drug research and development. Furthermore, Cypex’s offerings are developed through patented technology that allows the expression of human drug-metabolizing enzymes in bacteria, without the need for a major modification to the proteins.

Acceleration in product launches coupled with the development of strong pipelines by operating players is projected to increase the usage of protein expression by the players. For instance, in May 2022, Biocon Biologics Ltd. and Viatris Inc. announced to launch of Abevmy (bevacizumab) in Canada. The product is the fourth biosimilar in Canada that is offered by Viatris for cancer. In February 2021, Viatris Canada introduced Hulio biosimilar for chronic inflammatory conditions. Hence, the increasing frequency of product development that evolves through expressing the target protein is a significant factor for the market growth.

The stringent regulations on the production of biologics products and lengthy time frame for license, approval, and clearance of the product are anticipated to restrain the growth of the market to a certain extend. However, significant changes were made by the U.S-FDA in section 506C of the FD&C Act, to address the interruption and discontinuances of biologics products in the market. Such as the manufacturer is required to inform FDA about the discontinuance of a product at least 6 months before the initiative.

Expression System Insights

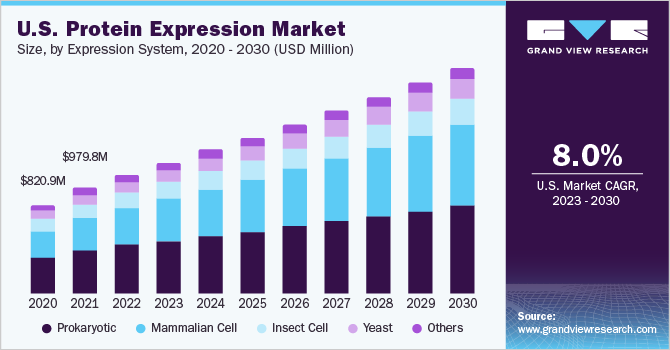

The prokaryotic expression systems segment held the highest share of 41.02% of the market in 2022. Since it is relatively easier to handle and fulfill major purposes in research. The segment is anticipated to sustain a similar position in the forecasted period, owing to favorable characteristics, such as the large scale of recombinant protein production in a short time and at a lower cost.

Mammalian cell expression system, on the other hand, is projected to grow CAGR of 10.88% during the forecasted period. As various pharmaceutical companies have employed mammalian expression systems to develop and produce protein transiently or complete formed cell lines. This takes place where particular expression constructs combine into the genome host. However, the employment of systems depends on the purpose and approach. For instance, for antigen production, structural studies, and activity studies, wherein post-translational is not a requirement, the prokaryotic is considered to be ideal. However, companies prefer mammalian cells for vaccines, therapeutics, and proteins productions.

Product Insights

Reagents dominate the market with the largest share of 43.85% of the market in 2022. The market consists of mature players such as Agilent Technologies, Inc. and Thermo Fisher Scientific. The companies offer a wide range of transfection reagents to fulfill the particular needs of transfection and idealized the conditions of cell culture.

On the other hand, the service segment is anticipated to have substantial growth with 11.33% CAGR between 2023 and 2030. The growth is attributed to the increasing outsourcing by pharmaceutical and biotech companies to antibody production companies for protein production and expression, in order to support their personalized assay development and discovery of therapeutic antibodies.

Application Insights

The therapeutic segment dominated of protein expression market by contributing 51.72% of the overall market value in 2022 and is anticipated to maintain a similar trend during the forecasted period with the highest growth rate of 10.28%. Since protein therapeutic poses numerous advantages over other medications. They are relatively more customized to the target, resulting in a more effective and low probability of side effects. Additionally, it can act as a replacement treatment during the shortage of a functional protein in the body owing to gene deficiency.

The most important driver of this application is the increasing participation of companies in developing protein-based therapeutics. Since the approval time is comparatively shorter and has better patent protection regulation. Both these factors increase the profitability of the pharma and biotech companies and encourage further investment in R&D.

End-use Insights

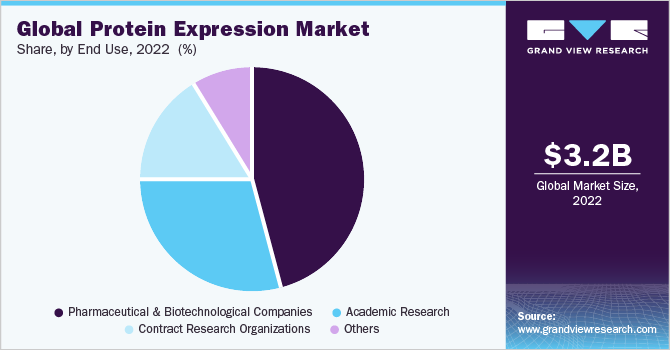

The pharmaceutical and biotechnological companies segment apprehended the highest revenue share of 45.78% of the market in 2022. The widespread use of cultured cells for the development of therapeutics and personalized medicines is driving the market. The segment is also driven by the increasing innovative use of proteins in the pharmaceutical industry. For creating a superior value in therapeutic and protein stability, the companies use existing proteins with genetic variants coupled with completely new protein designs.

Furthermore, contract research organizations segment is considered to be an emerging segment with the fastest growth rate of 11.17% during the forecast period. The range of specialized services provided by the organizations to the pharma and biopharma companies at considerable pricing, and offering a competitive advantage over their competitors is anticipated to drive the growth of this segment. For instance, Charles River Laboratories offers services ranging from construct design to automated protein purification.

Regional Insights

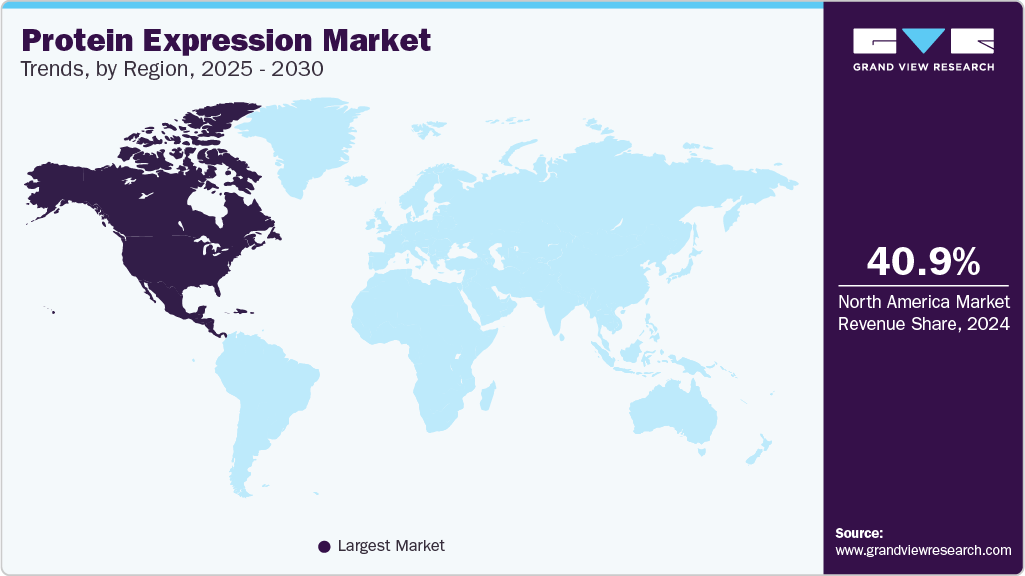

North America predominated the regional market with a share of 39.83 % in 2022. This major proportion of share can be attributed to the presence of key players in the region with increasing fund flow in R&D, coupled with strong pipelines of biosimilars. It has been observed that collaboration between companies and academic institutions is one of the key strategies employed in the North American region.

The Asia Pacific is anticipated to be the fastest-growing region with CAGR of 11.28% during the forecast period. The fast growth is due to the extensive developments by India and China in the adoption of protein expression in various applications. Additionally, the emerging focus on proteomics and genomics research, coupled with increasing initiatives by academic institutions for innovative development in protein therapeutic have impacted the Asia Pacific market with lucrative growth opportunities throughout the forecast period.

Key Companies & Market Share Insights

Numerous players as well as government organizations in this market are employing several strategies such as vertical collaboration, product discovery, and development, establishing a strong product portfolio through mergers and acquisitions, and geographical expansion, to expand their global footprints. For instance, in July 2022, Beijing Luzhu Biotechnology and Maxvax Biotechnology are fundraising for their respective R&D programs for developing a vaccine. Maxvax raised approximately USD 74 million via Series B funding to support multiple clinical trials of its vaccine pipeline. The company owns various platforms, such as recombinant protein expression and an mRNA that are employed across the globe.

In May 2023, WHO and the Republic of Korea signed a Memorandum of Understanding (MOU) with the aim of establishing a worldwide training hub in biomanufacturing. This global training facility will benefit all low and middle-income countries by providing expertise in the production of biologicals, including vaccines, insulin, monoclonal antibodies, and cancer treatments. These initiatives are anticipated to further stimulate market growth in the coming years. Some of the key players in the global protein expression market include:

-

Agilent Technologies, Inc.

-

Bio-Rad Laboratories

-

Thermo Fisher Scientific, Inc.

-

Merck Millipore

-

New England BioLabs, Inc.

-

Promega Corporation

-

QIAGEN

-

Takara Bio, Inc.

-

Oxford Expression Technologies

-

Lucigen Corporation

Protein Expression Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.55 billion

Revenue forecast in 2030

USD 6.64 billion

Growth rate

CAGR of 9.36% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Expression system, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Agilent Technologies, Inc., Bio-Rad Laboratories, Thermo Fisher Scientific, Inc., Merck Millipore, New England BioLabs, Inc., Promega Corporation, QIAGEN, Takara Bio, Inc., Oxford Expression Technologies, Lucigen Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Protein Expression Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global protein expression market report on the basis of expression system, products, application, end-use, and region:

-

Expression System Outlook (Revenue, USD Million, 2018 - 2030)

-

Prokaryotic

-

Mammalian Cell

-

Insect Cell

-

Yeast

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents

-

Competent Cells

-

Expression Vectors

-

Services

-

Instruments

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic

-

Industrial

-

Research

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnological Companies

-

Academic Research

-

Contract research organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North Americ

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwai

-

-

Frequently Asked Questions About This Report

b. The global protein expression market size was estimated at USD 3.18 billion in 2022 and is expected to reach USD 3.55 billion in 2023.

b. The global protein expression market is expected to grow at a compound annual growth rate of 9.36% from 2023 to 2030 to reach USD 6.64 billion by 2030.

b. Prokaryotic expression systems dominated the protein expression market with a share of 41.02% in 2022. This is attributable to its large application, high production capacity, and inexpensive production.

b. Some key players operating in the protein expression market include Agilent Technologies, Inc., Bio-Rad Laboratories, Thermo Fisher Scientific, Inc., Merck Millipore, New England BioLabs, Inc., Promega Corporation, QIAGEN, Takara Bio, Inc., Oxford Expression Technologies, and Lucigen Corporation.

b. Key factors driving the protein expression market growth include the increasing importance of protein-based therapeutics in modern medicine coupled with the growing investment by biopharmaceutical companies in R&D.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."