- Home

- »

- Biotechnology

- »

-

Recombinant Cell Culture Supplements Market Report, 2033GVR Report cover

![Recombinant Cell Culture Supplements Market Size, Share & Trends Report]()

Recombinant Cell Culture Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Products (Albumin, Insulin, Transferrin), By Type (Liquid, Powder), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-488-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Recombinant Cell Culture Supplements Market Summary

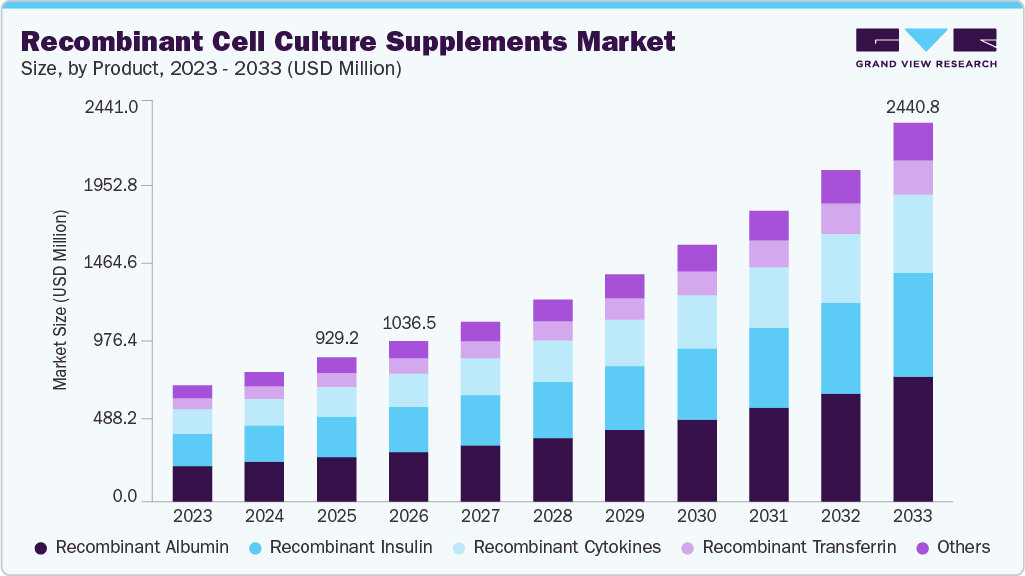

The global recombinant cell culture supplements market size was estimated at USD 929.2 million in 2025 and is projected to reach USD 2,440.8 million by 2033, growing at a CAGR of 13.01% from 2026 to 2033. The market growth can be attributed to the increasing demand for biopharmaceuticals, rising focus on animal-free supplements, advancements in recombinant technology, and increased R&D in regenerative medicine and cell therapies.

Key Market Trends & Insights

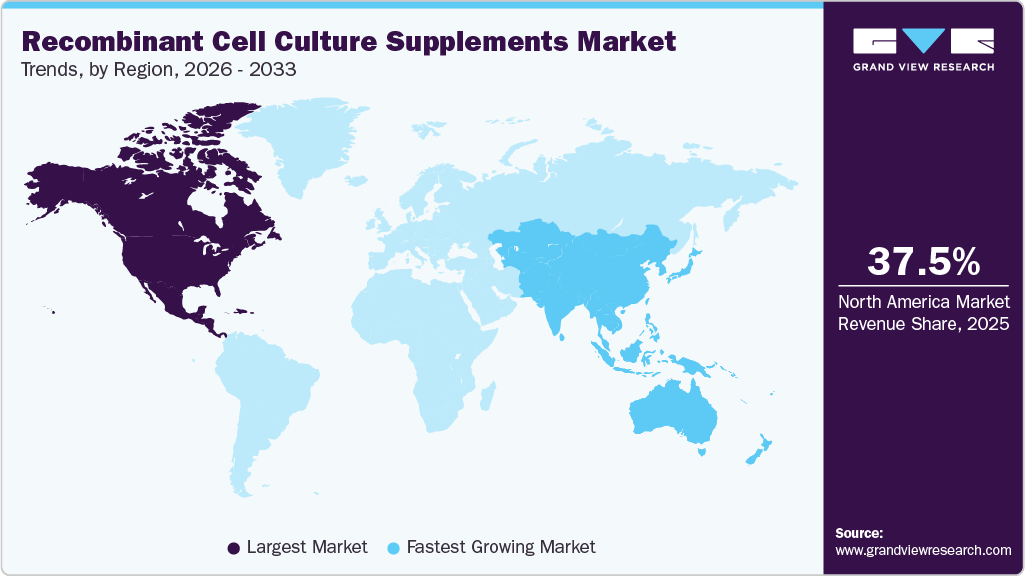

- North America recombinant cell culture supplements market has dominated the market, with a share of 37.46% in 2025.

- The Asia Pacific recombinant cell culture supplements market is anticipated to grow at the fastest rate over the forecast period.

- Based on products, the recombinant albumin segment accounted for the largest revenue share of 31.02% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period.

- Based on type, the powder segment accounted for the largest revenue share in 2025.

- Based on application, the biopharmaceutical production segment dominated the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 929.2 Million

- 2033 Projected Market Size: USD 2,440.8 Million

- CAGR (2026-2033): 13.01%

- North America: Largest market in 2025

- Asia Pacific: Fastest-growing market

Advancements in recombinant cell culture supplements

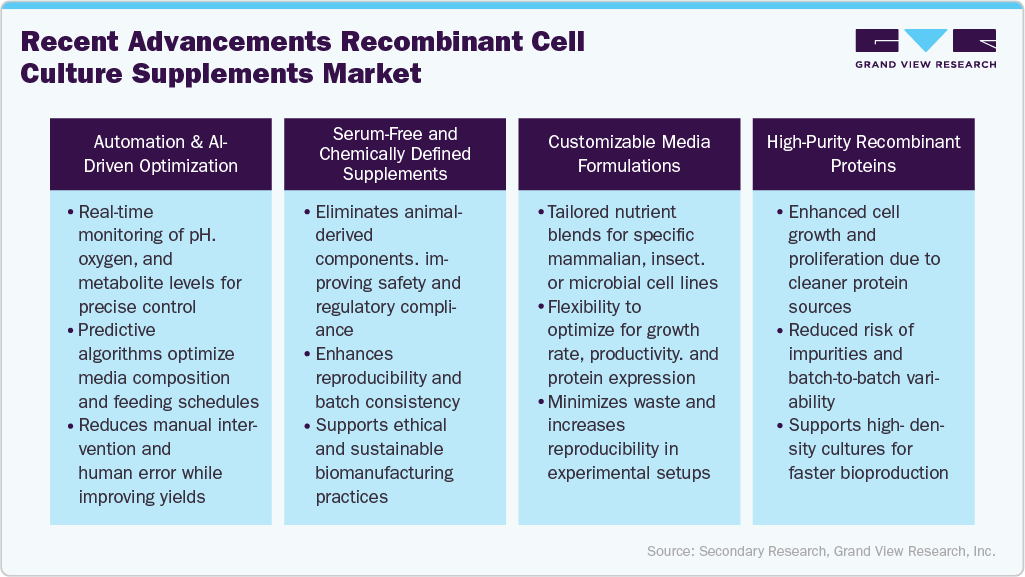

The recombinant cell culture supplement technologies that were developed through innovations in protein engineering and purification reached the highest levels of purity, consistency, and biological activity. The high-performance supplements not only control cell growth and productivity but also lead to higher yields of biopharmaceuticals. Recombinant supplements are a safer alternative to animal-derived components regarding variability and contamination, thereby increasing process robustness, scalability, and reproducibility in R&D and commercial production.

The evolution of recombinant cell culture supplements, largely propelled by breakthroughs in protein engineering, expression systems, and purification technologies, has led to the remarkable enhancement of their purity, consistency, and biological activity. The use of such supplements of superior quality gives rise to better handling and monitoring of the cell growth and their respective productivity, thereby aiding the biopharmaceutical manufacturer to achieve higher yields. In contrast to animal-derived materials, recombinant supplements minimize the potential for inconsistencies, and thus, the occurrence of contamination is also reduced. This leads to the improvement of the process and the increase in scales and reproduction of both R&D and commercial production activities through the phases of quality control and assurance.

Rising focus on animal-free supplements

The increasing emphasis on supplements without animal sources is the main reason for the rise in demand for functional recombinant cell culture supplements because of the regulatory, ethical, and quality considerations. Animal-derived substances are subject to the risks of contamination and variation, while recombinant counterparts provide guaranteed composition, reproducibility, and tractability.

With serum-free and xeno-free systems being increasingly adopted in cell and gene therapy, regenerative medicine, and stem cell research, the demand for animal-free recombinant supplements is also likely to rise. Consistency in cell performance and easy regulatory approvals are the benefits of these formulations. In the course of emphasizing risk reduction and regulatory alignment, companies will find animal-free supplements ever more supportive of market growth that is not only sustained but also prolonged.

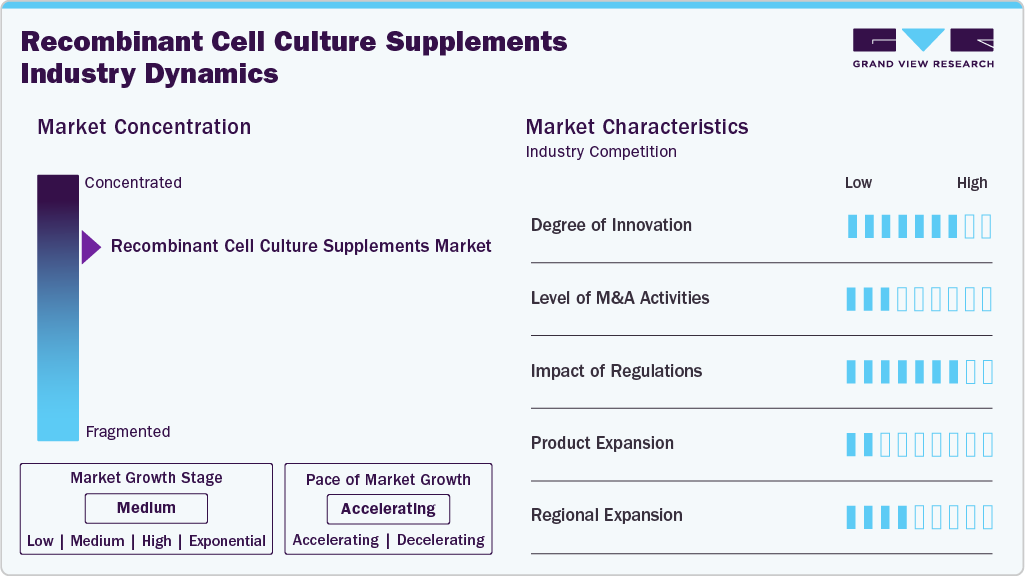

Market Concentration & Characteristics

The recombinant cell culture supplements industry's growth stage is medium, and the pace is accelerating. This growth is fueled by rising demand for biologics, advancements in cell-based therapies, and increased biopharmaceutical R&D investments.

In the industry, collaboration activities are low to moderate due to the niche nature of the market. However, as the demand for advanced bio-manufacturing solutions grows, some companies are exploring partnerships to accelerate innovation and expand their market reach. For instance, in March 2022, FUJIFILM Irvine Scientific, Inc. acquired Shenandoah Biotechnology, Inc. to expand and enhance its cell culture solutions and bioprocessing capabilities.

Regulations significantly impact the industry as regulations boost the demand for animal-free supplements due to increasing concerns over ethical sourcing, the need for consistent and reliable product quality, and stricter guidelines aimed at reducing animal-derived components in biopharmaceutical production.

The recombinant cell culture supplements industry currently exhibits moderate product expansion. This is attributed to the high specialization required for developing effective supplements, regulatory challenges, and the dominance of a few established players controlling the market. However, as the demand for biologics and personalized medicine increases, there is a gradual shift towards product diversification, with companies exploring new formulations and applications to meet evolving market needs.

The recombinant cell culture supplements industry is growing moderately in different regions. This is the result of other regions' investment levels in biotech, regulatory variances, and the increasing need for biologics and cell therapies in new markets. Nonetheless, the industry will see faster regional growth, especially in the Asia-Pacific and the Middle East, as global healthcare investments rise and more regions aim at reinforcing their biopharmaceutical sectors.

Product Insights

The recombinant albumin accounted for the largest revenue share of 31.02% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period. Segment growth is attributed to widespread use in cell culture processes, enhancing cell growth and productivity, increased production of biopharmaceuticals, and investment in cell culture innovations. These factors are expected to propel the market's growth over the forecast period.

The recombinant cytokines market is anticipated to grow rapidly during the forecast period, with the main reason being the growing need for targeted treatments, particularly in cancers and autoimmune diseases. The use of recombinant cytokines in biopharmaceutical production and research has been made possible due to their properties of being able to stimulate cells and manage the immune system. In addition, the demand for R&D investments and the development of personalized medicine have also been increasing, which will eventually lead to the growth of the segment during the forecast period.

Type Insights

The powder segment accounted for the largest revenue share in 2025, owing to the longer shelf life, ease of storage and transport, and cost-effectiveness, making it highly preferable for large-scale production, which drives the segment's growth over the forecast period. Furthermore, the rising adoption of powdered supplements in biopharmaceutical and vaccine manufacturing further strengthens the position in the market, thereby boosting the demand over the forecast period.

The liquid segment is expected to have the fastest growth rate during the forecast period of 2026-2033, as it offers faster and more efficient cell culture setups. The high-throughput processes generally favor liquid formulations due to their compatibility with automated systems. In addition, the growing trend towards personalized medicine and small-batch production in biotech is driving demand for liquid supplements. Thus, it will propel the growth of the segment over the forecast period.

Application Insights

In 2025, biopharmaceutical production reigned over the market with an impressive revenue share of 60.42%, which was primarily attributed to the higher demand for biologics like monoclonal antibodies and recombinant proteins that depend on high-quality cell culture media. Moreover, the potential growth in biopharmaceutical R&D, continuous improvement in biomanufacturing technologies, and significant investments in cell-based therapies will further augment the use of recombinant supplements in the industry.

The regenerative medicine segment is projected to witness the fastest growth rate from 2026 to 2033 due to the increasing focus on cell and gene therapies, which require advanced culture media for cell expansion and differentiation. The increased occurrence of chronic diseases, combined with breakthroughs in stem cell research and tissue engineering, is the main contributor to the rising need for recombinant cell culture supplements. Therefore, driving the segment's growth throughout the forecast period.

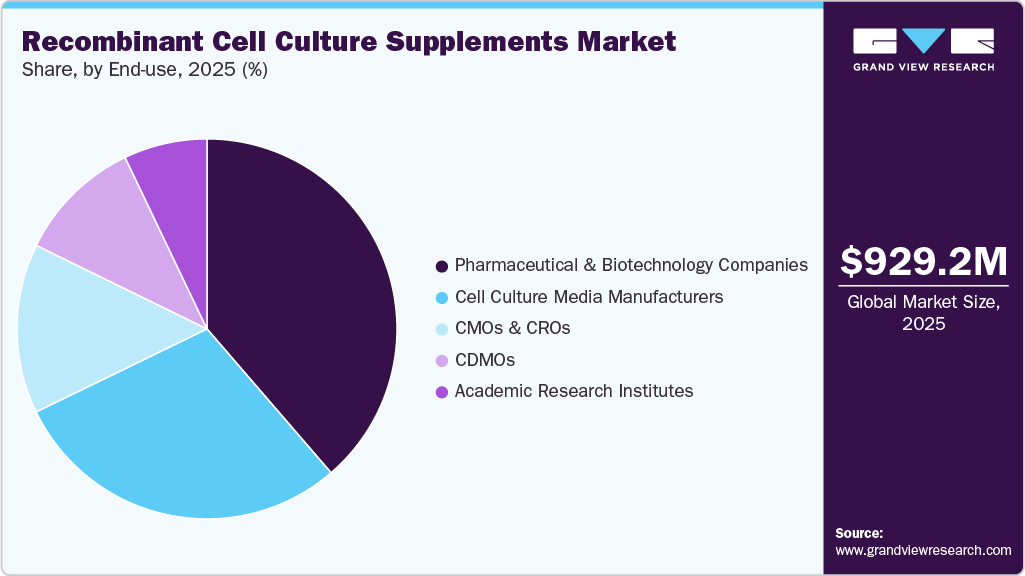

End Use Insights

The pharmaceutical & biotechnology companies segment dominated the market and accounted for the largest revenue share of 38.68% in 2025. The segment growth is attributed to the high demand for recombinant supplements in drug development, biologics production, and vaccine manufacturing. Furthermore, the increasing focus on biologics & biosimilars and expanding R&D activities in companies are further anticipated to drive market growth.

The CDMOs segment is expected to witness the fastest growth rate from 2026 to 2033. This is attributed to the growing trend of outsourcing biopharmaceutical production to reduce costs and improve scalability. Moreover, CDMOs are investing in advanced technologies and capacity expansion to meet the needs of personalized medicine and cell and gene therapies, further driving the adoption of recombinant cell culture supplements.

Regional Insights

North America recombinant cell culture supplements market has dominated the market, with a share of 37.46% in 2025. The presence of major pharmaceutical companies and advanced healthcare infrastructure further impelled the market growth over the forecast period.

U.S. Recombinant Cell Culture Supplements Market Trends

The recombinant cell culture supplements market in the U.S. is expected to grow over the forecast period. The rising use of cell and gene therapies, combined with strong financial support from both government and private sectors, has driven the need for recombinant cell culture supplements.

Europe Recombinant Cell Culture Supplements Market Trends

The recombinant cell culture supplements market in Europe is experiencing significant expansion, driven by multiple structural and strategic factors that extend beyond broad regional trends to specific national dynamics in markets such as Germany, the UK, and Spain.

The UK recombinant cell culture supplements market is expected to grow over the forecast period. The rising prevalence of chronic diseases and the need for innovative treatment options contribute to the adoption of recombinant cell culture supplements in drug discovery and production, propelling the growth.

The recombinant cell culture supplements market in Germany is expected to grow over the forecast period. This is attributed to the strong infrastructure for biopharmaceutical manufacturing and increasing investments in cell-based therapies and biologics.

Asia Pacific Recombinant Cell Culture Supplements Market Trends

The recombinant cell culture supplements market in the Asia Pacific is anticipated to grow at the fastest rate of 13.84% over the forecast period. This growth is primarily attributed to the rapid expansion of the biopharmaceutical and biotechnology industries in countries like China, India, and Japan. Increased investments in healthcare infrastructure, growing demand for biologics and vaccines, and rising adoption of advanced therapies such as cell and gene therapies drive the market.

China recombinant cell culture supplements market is expected to grow over the forecast period. The improving manufacturing capabilities and the shift towards animal-free and cost-effective production methods further fuel the demand for recombinant cell culture supplements.

The recombinant cell culture supplements market in Japan is expected to grow over the forecast period. Advancements in biopharmaceuticals, regenerative medicine, and government support for biotech innovation drive the market.

MEA Recombinant Cell Culture Supplements Market Trends

The recombinant cell culture supplements market in the MEA is expected to experience substantial growth over the forecast period. An expanding interest in regenerative medicine drives this growth, the rising prevalence of chronic diseases requiring biologics, and increased collaborations with global biotech companies.

Kuwait recombinant cell culture supplements market is expected to grow over the forecast period. The reason for this is the increase in investments in the healthcare sector and the growing emphasis on the enhancement of biotech and pharmaceutical competencies.

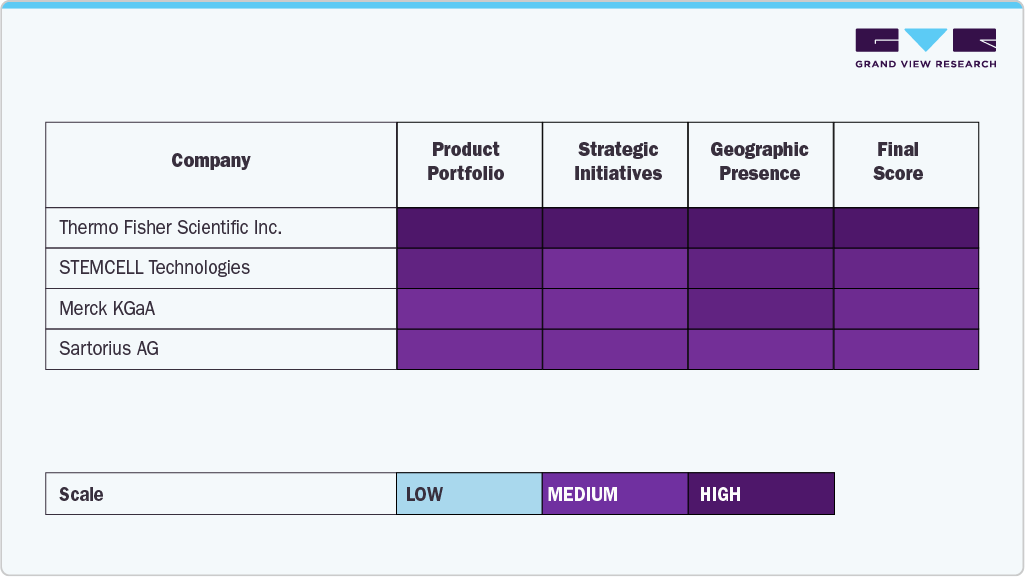

Key Recombinant Cell Culture Supplements Company Insights

The companies that are operating in the market are using product approval as one of the strategies to gain market reach for their products and make them more accessible in different areas. Besides, they are also expanding as a strategy to support their production/research activities.

Moreover, the acquisition of smaller market players is one of the key strategies by which several market players are fortifying their positions. This tactic not only allows the firms to augment their skills but also to diversify their product lines and strengthen their competencies.

Key Recombinant Cell Culture Supplements Companies:

The following are the leading companies in the recombinant cell culture supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- STEMCELL Technologies

- Merck KGaA

- Sartorius AG

- Lonza

- Miltenyi Biotec

- Capricorn Scientific

- InVitria

- Biotechne

- Sino Biological, Inc.

- Novo Nordisk Pharmatech A/S

Recent Developments

-

In November 2025, Evonik partnered with InVitria to distribute animal-free recombinant human serum albumin (rHSA) in the global biopharmaceutical market, enhancing protein consistency, safety, and scalability for drug development.

-

In April 2022, Lonza, along with Luzhu Biotech, developed a recombinant Herpes Zoster vaccine and a bispecific antibody using Lonza’s GS Xceed Gene Expression System, highlighting the growing demand for advanced recombinant cell culture supplements in the biopharma industry.

Recombinant Cell Culture Supplements Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,036.5 million

Revenue forecast in 2033

USD 2,440.8 million

Growth rate

CAGR of 13.01% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; STEMCELL Technologies; Merck KGaA; Sartorius AG; Lonza; Miltenyi Biotec; Capricorn Scientific; InVitria; Biotechne; Sino Biological, Inc.; Novo Nordisk Pharmatech A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recombinant Cell Culture Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global recombinant cell culture supplements market report based on products, type, application, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Recombinant Albumin

-

Recombinant Insulin

-

Recombinant Transferrin

-

Recombinant Cytokines

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Liquid

-

Powder

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

-

Regenerative Medicine

-

Other Applications

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Cell Culture Media Manufacturers

-

CMOs & CROs

-

CDMOs

-

Academic Research Institutes

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global recombinant cell culture supplements market size was estimated at USD 929.2 million in 2025 and is expected to reach USD 1.04 billion in 2025.

b. The global recombinant cell culture supplements market is expected to grow at a compound annual growth rate of 13.01% from 2026 to 2033 to reach USD 2,440.8 million by 2033.

b. The recombinant albumin accounted for the largest revenue share of 31.02% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period. Segment growth is attributed to widespread use in cell culture processes, enhancing cell growth and productivity, increased production of biopharmaceuticals, and investment in cell culture innovations.

b. Some key players operating in the recombinant cell culture supplement market include Thermo Fisher Scientific Inc.; STEMCELL Technologies; Merck KGaA; Sartorius AG; Lonza; Miltenyi Biotec; Capricorn Scientific; InVitria; Biotechne; Sino Biological, Inc.; Novo Nordisk Pharmatech A/S

b. Key factors that are driving the recombinant cell culture supplements market are growing demand for biopharmaceuticals, rising focus on animal-free supplements, advancements in recombinant technology, and increased R&D in regenerative medicine & cell therapies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.