- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Polyolefin Market Size, Share, Industry Report 2030GVR Report cover

![Recycled Polyolefin Market Size, Share & Trends Report]()

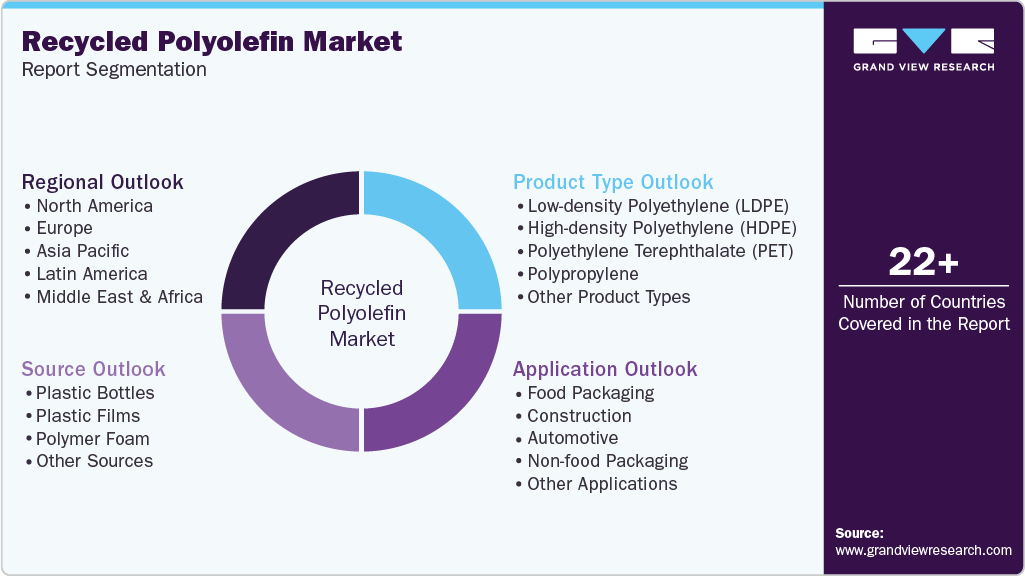

Recycled Polyolefin Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (LDPE, HDPE, PET, PP), By Source (Plastic Bottles, Plastic Films, Polymer Foam), By Application (Food Packaging, Construction, Non-food Packaging), By Region And Segment Forecasts

- Report ID: GVR-4-68040-601-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Polyolefin Market Summary

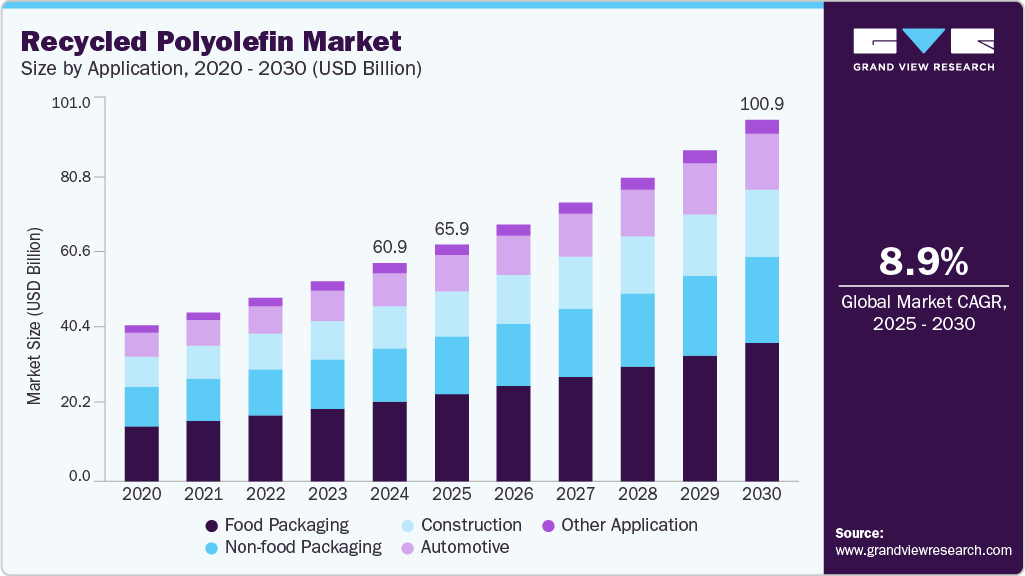

The global recycled polyolefin market size was estimated at USD 60.87 billion in 2024, and is projected to reach USD 100.94 billion by 2030, growing at a CAGR of 8.9% from 2025 to 2030. Growing consumer demand for sustainable and eco-friendly products is pushing brands across various industries to incorporate more recycled materials, particularly polyolefins, into their packaging solutions.

Key Market Trends & Insights

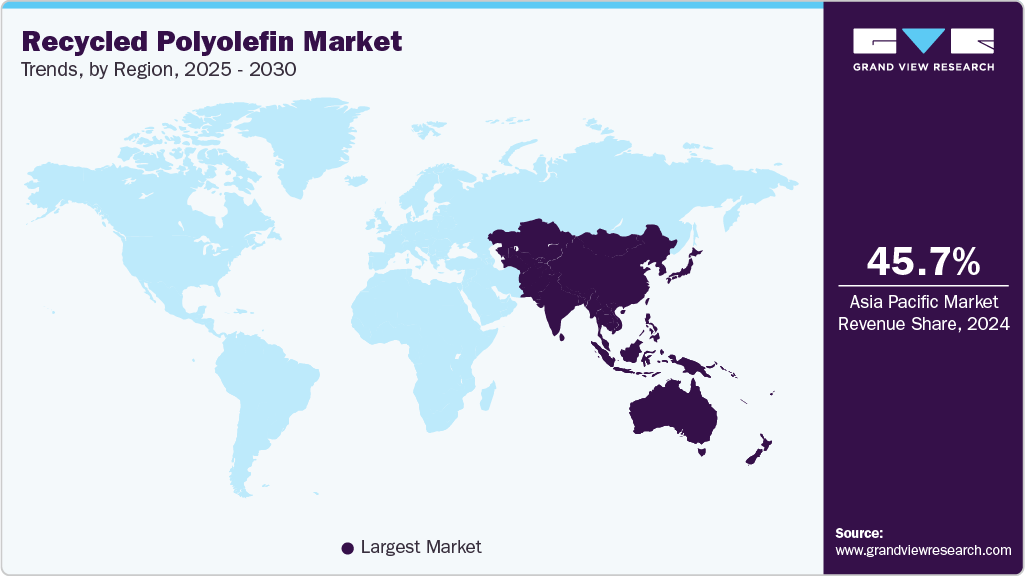

- Asia Pacific recycled polyolefin market dominated the global market and accounted for the largest revenue share of 45.74% in 2024.

- The U.S. market is uniquely driven by a convergence of state-level mandates and private-sector innovation.

- Low-density polyethylene (LDPE) dominated the recycled polyolefin market across the product type segmentation and accounted for a revenue share of 34.28% in 2024.

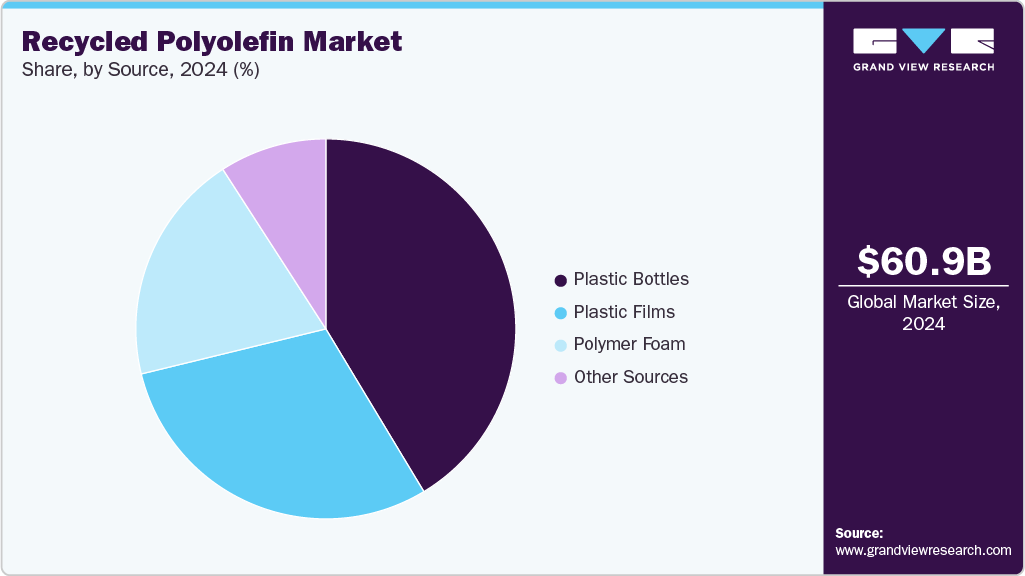

- Plastic bottles dominated the recycled polyolefin market across the source segmentation and accounted for a revenue share of 41.37% in 2024.

- Food packaging dominated the recycled polyolefin market across the source segmentation and accounted for a revenue share of 36.64% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 60.87 Billion

- 2030 Projected Market Size: USD 100.94 Billion

- CAGR (2025-2030): 8.9%

- Asia Pacific: Largest market in 2024

Recycled polyolefins, such as polypropylene and polyethylene, are gaining traction due to their versatility, durability, and lower environmental impact. This shift not only helps companies enhance their environmental image but also supports compliance with increasingly stringent green certification standards and government regulations. As sustainability becomes a key driver in consumer purchasing decisions, the market is witnessing robust growth, positioning itself as a cornerstone in the transition toward a greener, circular economy.

The global recycled polyolefin market is experiencing a marked shift toward closed-loop recycling systems, especially among high-volume end-use industries such as automotive, construction, and FMCG packaging. Companies are increasingly integrating post-consumer recycled (PCR) polyolefins into their production streams to meet ESG compliance standards and respond to investor pressure. This trend is further accelerated by purification and sorting technologies advancements, enabling higher-quality recyclates with properties nearly equivalent to virgin polymers.

Drivers, Opportunities & Restraints

One of the primary growth drivers for the recycled polyolefin market is the tightening regulatory landscape, particularly in Europe and North America, mandating minimum recycled content in plastic products. This regulatory pressure, coupled with corporate commitments toward achieving net-zero targets, is compelling manufacturers to substitute virgin polyolefins with recycled alternatives. Furthermore, the rising cost volatility of fossil-derived feedstocks has made recycled polyolefins a financially viable and strategically sustainable raw material option for multiple sectors.

An emerging opportunity lies in the untapped potential of advanced recycling methods, such as chemical depolymerization and pyrolysis, to convert mixed polyolefin waste into high-purity monomers. These technologies are still nascent but offer the promise of unlocking hard-to-recycle polyolefin streams, particularly from multilayer and contaminated sources. Early investment and collaboration in these domains can position stakeholders as leaders in a future-proof supply chain with high circularity and reduced carbon intensity.

Despite strong market momentum, the sector faces a significant restraint in the form of quality inconsistency and supply fragmentation across global recycled polyolefin feedstock. The heterogeneous nature of post-consumer waste, coupled with insufficient segregation infrastructure in developing economies, hampers the reliability of input materials. This, in turn, affects downstream processing efficiency and product performance, deterring adoption by quality-sensitive industries such as automotive and food packaging.

Market Concentration & Characteristics

The market growth stage of the recycled polyolefin market is medium, and the pace is accelerating. The market exhibits a significant level of market concentration, with key players dominating the industry landscape. Major companies like LyondellBasell, SABIC, Dow, INEOS, Borealis, GCR, Omya International AG, Pashupati Group, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

One of the primary substitutes for recycled polyolefins is biodegradable bioplastics such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), which are gaining traction in high-visibility consumer packaging. While these materials align well with zero-waste and compostable labeling strategies, they are currently limited by higher costs, lower scalability, and infrastructure gaps in industrial composting. Nonetheless, in applications where biodegradability is prioritized over durability-such as single-use foodservice items-they present a growing competitive alternative.

Regulatory frameworks, particularly in the EU and North America, are increasingly mandating minimum recycled content thresholds across various plastic applications, directly accelerating the adoption of recycled polyolefins. The European Commission’s Packaging and Packaging Waste Regulation (PPWR), for instance, sets ambitious targets for recyclability and material reuse by 2030, compelling manufacturers to rethink their raw material sourcing. Such mandates are reshaping procurement strategies across packaging, automotive, and construction industries, embedding recycled polyolefins deeper into core material portfolios.

Product Type Insights

Low-density polyethylene (LDPE) dominated the recycled polyolefin market across the product type segmentation in terms of revenue, accounting for a market share of 34.28% in 2024. The growth is attributed to the surging demand for flexible packaging and e-commerce mailers, particularly in developing markets across Southeast Asia and Latin America. As online retail and doorstep delivery services expand, so does the pressure on brand owners to source eco-conscious alternatives for secondary and tertiary packaging. Recycled LDPE, with its favorable flexibility and cushioning properties, is emerging as a go-to solution for lightweight, cost-effective packaging with lower environmental impact.

The polyethylene terephthalate (PET) segment is anticipated to grow at a significant CAGR of 9.7% through the forecast period, propelled by rising global investments in bottle-to-bottle recycling technologies, spurred by commitments from major beverage giants like Coca-Cola and PepsiCo to achieve 50% rPET usage in their bottles by 2030. This has led to significant upgrades in PET collection infrastructure and purification processes, especially in the EU and U.S., transforming recycled PET from a waste byproduct into a premium-grade circular input for food-grade packaging systems.

Source Insights

Plastic bottles dominated the recycled polyolefin market across the source segmentation in terms of revenue, accounting for a market share of 41.37% in 2024. The plastic bottles segment benefits from municipal and private sector-led take-back programs and extended producer responsibility (EPR) initiatives that have streamlined collection and segregation of post-consumer bottles. This improved feedstock traceability allows manufacturers to produce high-purity recycled polyolefins suitable for non-food liquid containers, especially in sectors like personal care and household cleaning, which are under increasing regulatory and consumer pressure to reduce single-use plastics.

The plastic film segment is projected to witness a substantial CAGR of 8.6% through the forecast period. Plastic film applications are increasingly influenced by the agricultural and industrial sectors' push toward sustainability, particularly in greenhouse coverings, silage wraps, and industrial pallet wraps. Recycled polyolefins offer a cost-effective route to reducing environmental footprints in these sectors without compromising on film strength or barrier properties. This has made multilayer films with recycled cores a preferred solution among bulk users aiming for both durability and regulatory compliance.

Application Insights

Food packaging dominated the recycled polyolefin market across the source segmentation in terms of revenue, accounting for a market share of 36.64% in 2024. The growth is attributed to the rapid evolution of food-safe recycling technologies, such as decontamination protocols and EFSA/USFDA-approved processes that ensure the safety and quality of recycled materials. These innovations have opened up opportunities for recycled polyolefins to penetrate primary food contact applications, especially in dry food, bakery, and snack packaging, where barrier requirements are less stringent but environmental accountability is a purchasing factor.

The automotive segment is anticipated to grow at a significant CAGR of 9.2% through the forecast period. The automotive industry's transition toward electric mobility and lightweighting is boosting demand for recycled polyolefins in non-structural parts like interior trims, under-the-hood components, and cable insulation. OEMs are under dual pressure to meet sustainability KPIs and reduce vehicle weight for extended EV range. Recycled PP and PE compounds provide an optimal balance of performance, recyclability, and cost, aligning well with circular design principles now embedded in vehicle development roadmaps.

Regional Insights

Asia Pacific recycled polyolefin market dominated the global market and accounted for the largest revenue share of 45.74% in 2024. Industrial decarbonization policies and increasing export restrictions on plastic waste imports are key drivers. Countries like Japan and South Korea are now investing heavily in domestic recycling infrastructure to process local post-consumer waste and reduce landfill dependency. Simultaneously, Southeast Asian nations are targeting value-added recycling to attract global buyers seeking traceable and compliant recycled polyolefins.

China Recycled Polyolefin Market Trends

China recycled polyolefin market is rapidly advancing under the influence of its “dual carbon” strategy, which targets peak carbon by 2030 and neutrality by 2060. The Chinese government has also banned the import of plastic waste, spurring massive investments in internal recycling systems. State-owned enterprises and private firms are scaling up high-throughput mechanical recycling plants to meet the surging domestic demand for sustainable plastics across construction, packaging, and electronics.

North America Recycled Polyolefin Market Trends

In North America, the recycled polyolefin market is being propelled by a robust push from institutional investors and ESG-focused funds demanding measurable sustainability outcomes from manufacturing and packaging firms. Companies across sectors are integrating post-consumer recycled content to align with SEC climate disclosures and ESG scoring systems. This investor-driven compliance trend is turning recycled polyolefins from a cost center into a strategic differentiator across procurement and branding.

The U.S. market is uniquely driven by a convergence of state-level mandates and private-sector innovation. California’s SB 343 and minimum recycled content laws are compelling packaging manufacturers to integrate recycled polyolefins at scale. At the same time, industry players such as Dow and ExxonMobil are advancing mechanical and chemical recycling capacities, enhancing domestic supply of high-grade recyclates and reducing reliance on virgin imports.

Europe Recycled Polyolefin Market Trends

Europe remains a frontrunner in the recycled polyolefin market due to the continent's aggressive circular economy policies under the EU Green Deal and the Circular Plastics Alliance. Member states are adopting harmonized standards for recycled content and Extended Producer Responsibility (EPR), pushing demand upstream. Additionally, a well-established waste management ecosystem supports material traceability and high-quality input streams, reinforcing recycling viability across sectors.

Key Recycled Polyolefin Market Company Insights

The Recycled Polyolefin Market is highly competitive, with several key players dominating the landscape. Major companies include LyondellBasell, SABIC, Dow, INEOS, Borealis, GCR, Omya International AG, Pashupati Group. The recycled polyolefin market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Recycled Polyolefin Companies:

The following are the leading companies in the recycled polyolefin market. These companies collectively hold the largest market share and dictate industry trends.

- LyondellBasell

- SABIC

- Dow

- INEOS

- Borealis

- GCR

- Pashupati Group

- Omya International AG

Recent Developments

-

In January 2025, Chandigarh-based startup PolyCycl launched its patented Generation VI chemical recycling technology in Bengaluru to tackle India’s growing plastic waste problem. The technology converts hard-to-recycle plastics, including single-use grocery bags and food-contaminated packaging, into food-grade polymers, renewable chemicals, and sustainable fuels.

-

In June 2024, Borealis announced it would invest in a new semi-commercial compounding line in Beringen, Belgium, to produce high-quality recycled polyolefins (rPO) using its Borcycle M technology.

Recycled Polyolefin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 65.99 billion

Revenue forecast in 2030

USD 100.94 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

LyondellBasell; SABIC; Dow; INEOS; Borealis; GCR; Omya International AG; Pashupati Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Polyolefin Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recycled polyolefin market report based on product type, source, application, and region:

-

Product Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Low-density Polyethylene (LDPE)

-

High-density Polyethylene (HDPE)

-

Polyethylene Terephthalate (PET)

-

Polypropylene

-

Other Product Types

-

-

Source Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Plastic Bottles

-

Plastic Films

-

Polymer Foam

-

Other Sources

-

-

Application Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Food Packaging

-

Construction

-

Automotive

-

Non-food Packaging

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recycled polyolefin market size was estimated at USD 60.87 billion in 2024 and is expected to reach USD 65.99 billion in 2025.

b. The global recycled polyolefin market is expected to grow at a compound annual growth rate of 8.87% from 2025 to 2030 to reach USD 100.94 billion by 2030.

b. Food packaging dominated the recycled polyolefin market across the source segmentation in terms of revenue, accounting for a market share of 36.64% in 2024, drive by the rapid evolution of food-safe recycling technologies such as decontamination protocols and EFSA/USFDA-approved processes that ensure the safety and quality of recycled materials.

b. Some key players operating in the recycled polyolefin market include LyondellBasell, SABIC, Dow, INEOS, Borealis, GCR, Omya International AG, and Pashupati Group.

b. Growing consumer demand for sustainable and eco-friendly products is pushing brands to use more recycled materials like polyolefins in their packaging. This shift is helping companies improve their environmental image and meet green certification standards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.