- Home

- »

- Advanced Interior Materials

- »

-

Rental Air Compressor Market Size, Industry Report, 2033GVR Report cover

![Rental Air Compressor Market Size, Share & Trends Report]()

Rental Air Compressor Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Reciprocating, Rotary/Screw), By Product (Stationary, Portable), By Lubrication (Oil Free, Oil Filled), By Rental Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-647-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rental Air Compressor Market Summary

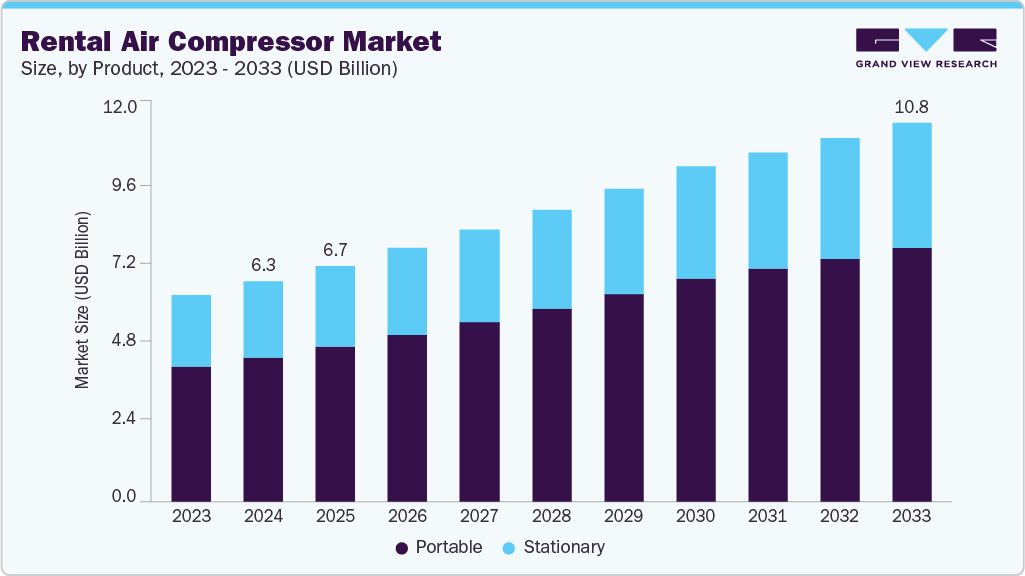

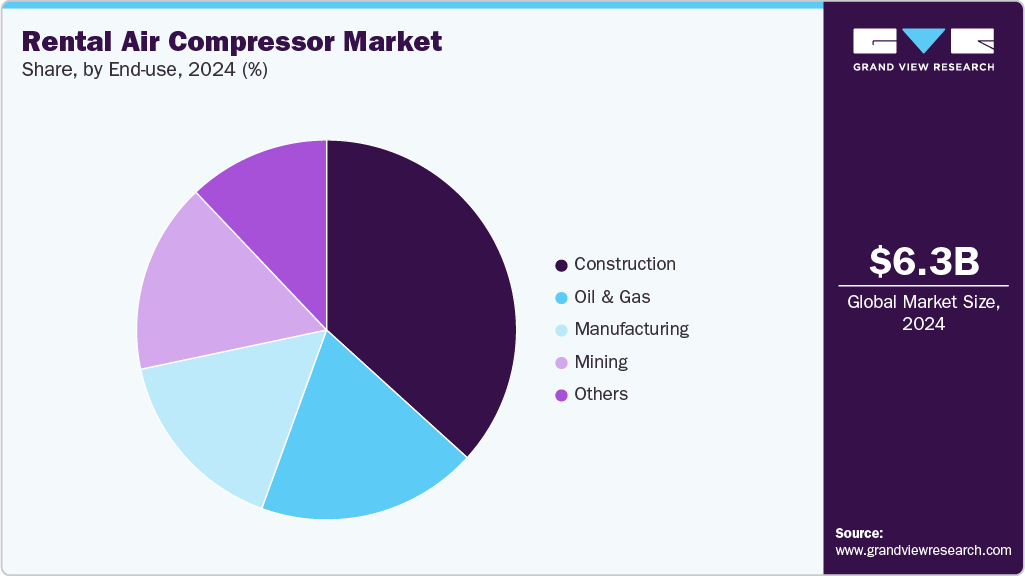

The global rental air compressor market size was estimated at USD 6,294.9 million in 2024 and is projected to reach USD 10,811.3 million by 2033, growing at a CAGR of 6.1% from 2025 to 2033. The rental air compressor market is experiencing steady growth, driven by rising demand from industries such as construction, mining, oil & gas, and manufacturing.

Key Market Trends & Insights

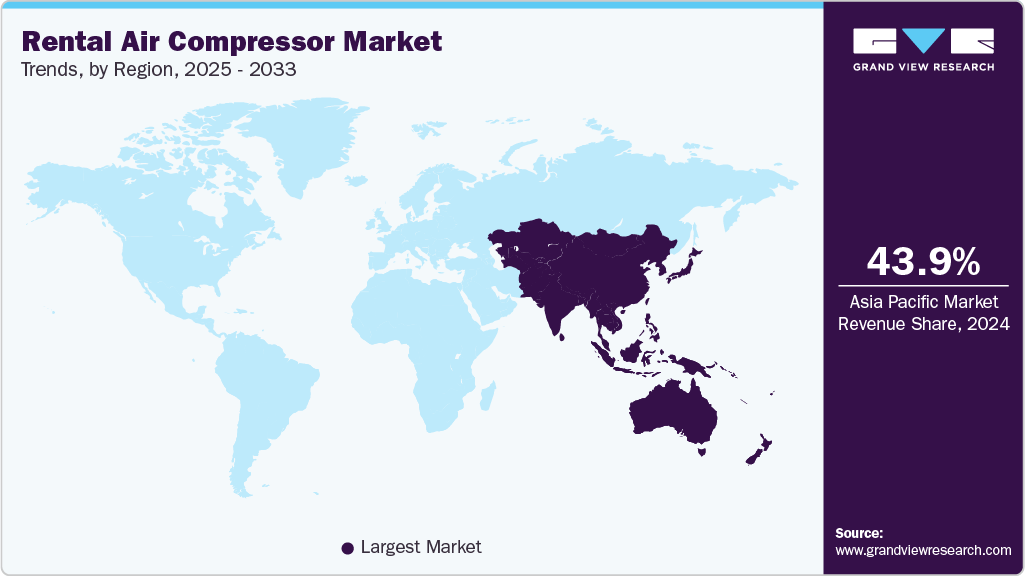

- Asia Pacific dominated the rental air compressor market with the largest revenue share of 43.9% in 2024.

- The rental air compressor market in China is expected to grow at a substantial CAGR of 7.3% from 2025 to 2033.

- By product, the portable air compressor segment dominated the market and accounted for the 65.5% revenue share in 2024.

- By technology, oil-filled compressor segment accounted for a revenue share of 56.2% in 2024.

- By end-use, the construction segment led the rental air compressor market and accounted for 37.1% revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,294.9 Million

- 2033 Projected Market Size: USD 10,811.3 Million

- CAGR (2025-2033): 6.1%

- Asia Pacific: Largest market in 2024

These sectors increasingly prefer rental solutions due to their cost-efficiency, flexibility, and reduced maintenance burden. Companies are opting for short- to medium-term rentals to meet seasonal or project-specific needs, avoiding the large upfront investment required for new equipment purchases. Another key driver is the increasing preference for energy-efficient and technologically advanced compressors.

Rental companies are offering newer models with variable speed drives and improved energy performance, aligning with sustainability goals. Furthermore, stricter environmental regulations are prompting users to upgrade temporarily through rentals instead of purchasing new units. This shift supports both operational flexibility and compliance with emission norms.

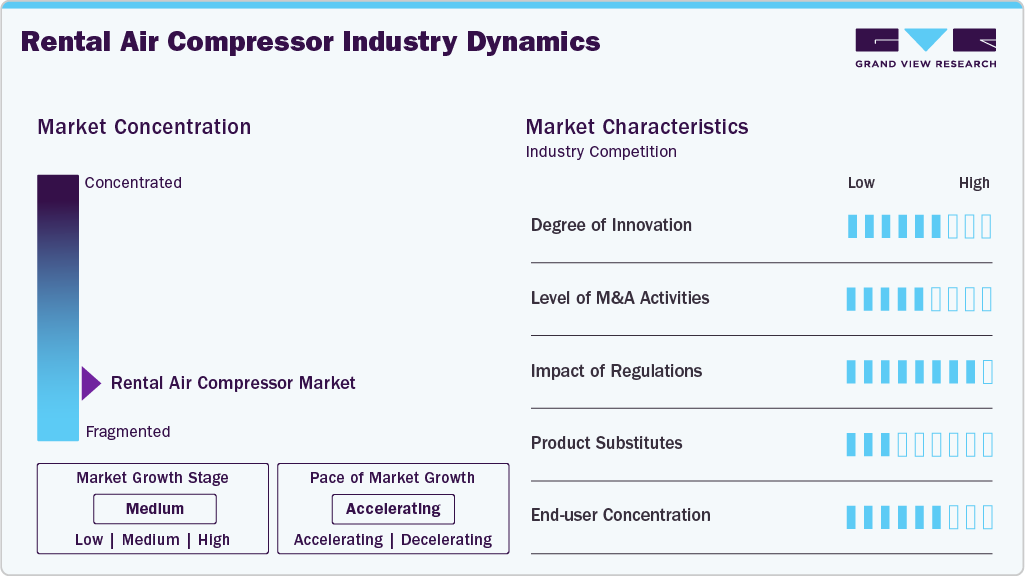

Market Concentration & Characteristics

The global rental air compressor market is fragmented, with numerous regional and international players competing across various end-use sectors. The presence of many small and medium-sized service providers contributes to a competitive landscape. While a few large companies hold significant market shares, no single player dominates the entire industry. This fragmentation fosters innovation, price competitiveness, and customized service offerings across different geographies.

The rental air compressor market shows a moderate degree of innovation, with companies focusing on energy-efficient and low-emission models. Advancements in remote monitoring and telematics are also being integrated into rental fleets. Innovation is largely driven by customer demand for reliability and operational efficiency. However, frequent product upgrades are more common among large rental firms than smaller regional players.

Mergers and acquisitions in the rental air compressor industry are moderately active, primarily aimed at expanding geographic presence and service capabilities. Larger companies often acquire smaller local firms to strengthen their regional foothold. These strategic moves help enhance fleet size, customer base, and operational infrastructure. M&A activity also supports market consolidation in regions with high competition.

Regulations concerning emissions, noise levels, and energy efficiency significantly impact the rental air compressor market. Compliance with environmental standards pushes rental firms to upgrade or replace older units with cleaner technologies. This regulatory pressure encourages the adoption of electric and hybrid compressors. In some regions, non-compliant equipment faces operational restrictions, directly influencing fleet composition.

Drivers, Opportunities & Restraints

The demand for flexible, cost-effective solutions in construction, mining, and industrial applications is a key driver of the rental air compressor market. Companies prefer renting over buying to reduce capital expenditure and maintenance costs. Rapid infrastructure development in emerging economies also fuels growth. Additionally, technological advancements in energy-efficient compressors are attracting more users to rental models.

There is growing opportunity in the adoption of eco-friendly and electric-powered rental compressors, driven by global sustainability goals. Expansion into untapped markets in Asia Pacific and Africa offers long-term growth potential. Integration of IoT and remote monitoring systems in rental fleets is also opening new service models. Moreover, rising short-term demand in disaster response and seasonal industries creates additional prospects.

High operational and maintenance costs associated with rental fleets can limit profitability for providers. Limited availability of advanced or specialized compressor types in some regions may hinder adoption. Regulatory compliance can increase costs for fleet upgrades, especially for smaller rental firms. In addition, economic slowdowns or project delays may reduce rental demand across key sectors.

Technology Insights

The rotary/screw air compressor segment dominated the market with a revenue share of 58.4% in 2024 due to their efficiency in continuous, high-demand operations. They offer quieter performance, lower energy consumption, and reduced maintenance needs compared to reciprocating types. These features make them ideal for industries like manufacturing, oil & gas, and large-scale construction. The trend toward longer rental durations and improved energy performance is accelerating their adoption.

The reciprocating air compressor segment is expected to grow at a significant CAGR of 5.7% from 2025 to 2033. The reciprocating air compressor segment is witnessing significant growth driven by its simplicity, affordability, and suitability for intermittent use. They are widely used in construction, small-scale industrial tasks, and maintenance operations. Their robust design and ease of servicing make them a popular choice among rental companies. Additionally, their ability to deliver high-pressure output in compact sizes supports continued demand.

Product Insights

The portable air compressor segment dominated the market and accounted for the 65.5% revenue share in 2024, due to their mobility, ease of transport, and versatility across job sites. They are extensively used in construction, roadwork, and remote operations where mobility is essential. Their compact design and quick setup make them ideal for short-term and dynamic applications. Additionally, the availability of various power options enhances their appeal to rental users.

Stationary compressors are witnessing significant growth due to rising demand from industries requiring continuous and stable air supply. Sectors like manufacturing, oil & gas, and mining prefer stationary units for their durability and high output. Increasing investment in large infrastructure and industrial projects is driving this trend. Their compatibility with centralized air systems also boosts their adoption in long-term rental contracts.

Lubrication Insights

Oil-filled compressor segment accounted for a revenue share of 56.2% in 2024 due to its durability, high performance, and ability to handle heavy-duty tasks. They are preferred in construction, mining, and industrial applications where high power output is essential. Their longer operational life and cost-efficiency make them ideal for frequent rental use. Additionally, their robust design allows for extended operation under demanding conditions.

The oil-free compressor segment is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033 in terms of revenue. Oil-free compressors are the fastest-growing segment owing to rising demand in industries with strict air purity requirements, such as pharmaceuticals, food & beverage, and electronics. These compressors eliminate the risk of oil contamination, ensuring cleaner air output. Growing environmental regulations and sustainability concerns also support their adoption. Their lightweight design and lower maintenance further enhance their appeal in short-term and specialized rentals.

Rental Type Insights

The short-term rental compressor segment accounted for a revenue share of 63.4% in 2024 owing to immediate and temporary needs in sectors like construction, events, and emergency response. These rentals offer flexibility and cost-effectiveness for users who require equipment for days or weeks. Rental companies prefer short-term contracts due to quicker turnover and higher utilization rates. Additionally, seasonal demand and project-based operations further drive this segment.

The long term rentals segment is expected to grow at a significant CAGR of 6.0% from 2025 to 2033 in terms of revenue. Long term rentals are growing significantly due to increasing demand from industries with extended project timelines, such as manufacturing and oil & gas. These contracts offer stability and reduced downtime for users needing a continuous air supply over several months. Customers benefit from lower rates and fewer administrative efforts compared to multiple short-term contracts. The trend toward outsourcing equipment for operational efficiency is supporting this growth.

End-use Insights

The construction segment led the rental air compressor market and accounted for 37.1% revenue share in 2024, due to its constant need for mobile and reliable compressed air solutions. Air compressors are essential for powering tools, site preparation, and infrastructure development. The preference for renting over purchasing helps reduce capital expenditure on temporary equipment. Frequent project starts, varying durations, and remote locations make rentals the ideal choice for construction firms.

Manufacturing is the fastest-growing end-use segment, driven by increasing industrial automation and the need for uninterrupted compressed air supply. Rental compressors support operational flexibility during equipment downtime, peak production periods, or plant expansions. The shift toward lean operations and cost control is encouraging manufacturers to rent rather than buy. Additionally, rising demand in sectors like automotive, food processing, and electronics is boosting growth.

Regional Insights

North America rental air compressor market is growing at a significant CAGR of 5.2% in the global market due to its well-established industrial base and frequent demand in construction, oil & gas, and mining sectors. The presence of major rental service providers and advanced infrastructure supports widespread adoption. High labor costs and the need for efficient, short-term solutions further drive the rental trend. Moreover, technological innovations and regulatory compliance requirements are influencing fleet upgrades in the region.

The U.S. rental air compressor market leads the North American market due to its robust construction, oil & gas, and industrial sectors. High labor and equipment costs make renting a more economical option for many businesses. The presence of established rental companies with large fleets supports widespread availability and service coverage.

Mexico rental air compressor market is experiencing rising demand for rental air compressors, fueled by industrial expansion and ongoing construction projects. The manufacturing sector, especially automotive and electronics, is a key contributor to market growth. Renting helps businesses avoid large capital expenditures while accessing modern equipment.

Europe Rental Air Compressor Market Trends

Europe rental air compressor marketholds a substantial revenue share in the market due to strong demand in the manufacturing, automotive, and construction industries. Strict environmental regulations are pushing rental firms to upgrade their fleets with cleaner technologies. The region also benefits from a mature rental culture and a focus on energy-efficient solutions. However, growth is relatively moderate due to market saturation in Western Europe.

Rental air compressor market in Germany is growing steadily due to its strong presence in industrial and manufacturing activities. The increasing focus on automotive innovation and renewable energy projects is driving the need for temporary compressed air solutions. Ongoing construction and maintenance of infrastructure also contribute to rising rental demand. Moreover, strict environmental laws encourage the use of advanced, low-emission rental compressors.

The UK rental air compressor market is witnessing growth, driven by infrastructure upgrades and renewable energy expansion. Projects in sectors like transportation and offshore wind energy require flexible, short-term equipment solutions. The rising preference for renting over owning among contractors and industries adds to market momentum. Environmental compliance and energy efficiency standards are also prompting a shift to modern rental units.

Asia Pacific Rental Air Compressor Market Trends

Asia Pacific rental air compressor marketis the dominating region and accounted for 43.9% revenue share, driven by rapid industrialization, urbanization, and infrastructure development in countries like China, India, and Southeast Asia. Rising construction activity and government investments in large-scale projects are fueling rental demand. The market is also benefiting from growing awareness of cost-saving rental models over ownership. Additionally, expanding manufacturing hubs and energy projects are contributing to sustained growth.

China rental air compressor market is witnessing strong growth due to rapid expansion in infrastructure, industrial, and energy-related projects. Demand is rising across sectors such as construction, mining, and manufacturing, which often require short-term compressed air solutions. The government’s push for lower emissions has encouraged the adoption of efficient, low-pollution rental equipment. Additionally, the availability of both diesel and electric compressors caters to a broad range of applications across the country.

Rental air compressor market in India is expanding quickly, driven by large-scale infrastructure projects like metro networks, highways, and smart cities. Growing industrialization and the need for cost-effective equipment in sectors such as mining and construction are major contributors. The trend toward equipment rentals is further supported by rising interest in digital monitoring and energy-efficient technologies. Environmental concerns and government policies promoting cleaner alternatives are also influencing the shift to advanced rental compressors.

Middle East & Africa Rental Air Compressor Market Trends

The Middle East and Africa rental air compressor market is experiencing growing demand, primarily driven by construction, oil exploration, and infrastructure expansion. Rental air compressors are favored for their flexibility in short-duration and remote site operations. Growth is supported by large-scale government-backed projects, especially in the Gulf countries. However, the market remains fragmented, with varying adoption levels across sub-regions.

Saudi Arabia rental air compressor market is growing steadily, supported by large-scale infrastructure and urban development projects under the Vision 2030 initiative. The construction and oil & gas sectors are increasingly relying on rental equipment to maintain flexibility and reduce capital costs. Demand is also rising for energy-efficient and low-emission compressors, reflecting the country's focus on sustainability and environmental compliance. Moreover, rental providers are investing in smart, IoT-enabled compressor units to meet the evolving needs of industrial clients.

Latin America Rental Air Compressor Market Trends

The Latin America rental air compressor market is witnessing steady growth, supported by mining, oil & gas, and infrastructure development. Countries like Brazil and Mexico are key contributors due to their expanding industrial activities. Economic challenges and project delays occasionally impact demand, but rental remains a cost-effective option. Increasing interest in outsourcing equipment is expected to boost regional market participation.

Brazil air compressor market is experiencing notable growth in the market due to increased infrastructure development and construction activity across the country. Many businesses are turning to Brazil rentalsas a cost-effective solution to meet short-term equipment needs without large capital investment. The mining and oil & gas sectors are also contributing to rising demand, especially in remote or temporary operations. To meet growing needs, rental providers are expanding their compressor fleets and improving service coverage throughout key regions.

Key Rental Air Compressor Company Insights

Some key players operating in the market include Atlas Copco, OTC Industrial Technologies, and United Rental Inc.

-

OTC Industrial Technologies is an industrial equipment, service, and supply company in the United States. Its product portfolio includes air compressors, pumps, bearings, motors, filtration systems, and other industrial machinery and tools. The company owns multiple companies such as OTP Industrial Solutions, Advanced Industrial Products, and others. Its air supply group of companies includes DIRECTAIR, Air Technologies, IDG COMPRESSOR, CAS Compressed Air Systems, PK Controls, and LARON Air Supply.

-

United Rentals Inc. provides a wide range of equipment, including heavy machinery, aerial work platforms, portable generators, general construction tools, and more. Their inventory of air compressors comprises stationary and portable air compressors from Atlas Copco, Hitachi Global Air Power, US LLC, Doosan Corporation, and Mi-T-M Corporation.

Key Rental Air Compressor Companies:

The following are the leading companies in the rental air compressor market. These companies collectively hold the largest market share and dictate industry trends.

- CATERLPILLAR INC.

- Atlas Copco

- OTC Industrial Technologies

- United Rental Inc

- Sunbelt Rentals

- Texas First Rentals

- Empire Tool Rentals

- Pro Rental & Sales

- Mountain Air Compressor

- MacAllister Rentals

- Coast to Coast Equipment Rentals

- Harris Equipment Rental

- H&E Equipment Services

- Loxam Group

Recent Developments

-

In October 2024, Atlas Copco has merged its North American rental businesses, Prime Service Inc. and Rental Service Corporation, into a single organization. The integration aims to improve operational efficiency and enhance service delivery across the industrial and construction sectors. The merged entity will continue to serve customers under two specialized brands while operating under a unified management structure. This strategic move strengthens Atlas Copco’s presence and competitiveness in the equipment rental market.

-

In July 2023, OTC Industrial Technologies opened a new distribution center in Cincinnati, Ohio, to improve logistics and streamline operations. The facility is designed to speed up order processing and ensure better inventory control. It also aims to enhance coordination with suppliers, offering a wider range of products and faster delivery times. This development strengthens OTC’s ability to provide efficient, customer-focused industrial distribution services.

Rental Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,722.9 million

Revenue forecast in 2033

USD 10,811.3 million

Growth rate

CAGR of 6.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, product, lubrication, rental type, end-use, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Pakistan; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

CATERLPILLAR INC.; Atlas Copco; OTC Industrial Technologies; United Rental Inc.; Sunbelt Rentals; Texas First Rentals; Empire Tool Rentals; Pro Rental & Sales; Mountain Air Compressor; MacAllister Rentals; Coast to Coast Equipment Rentals; Harris Equipment Rental; H&E Equipment Services; Loxam Group; HSS Hire

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rental Air Compressor Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global rental air compressor market report based on product, rental type, lubrication, technology, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Stationary

-

Portable

-

-

Rental Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Short Term Rental

- End Use

-

Long Term Rental

-

End Use

-

-

-

Lubrication Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil Free

-

Oil Filled

-

-

Technology Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Reciprocating

-

Rotary/Screw

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Construction

-

Mining

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rental air compressor market size was estimated at USD 6,294.9 million in 2024 and is expected to reach USD 6,722.9 million in 2025.

b. The global rental air compressor market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 10,811.3 million by 2033.

b. The portable air compressor segment dominates the market and accounted for the 65.5% share, due to their mobility, ease of transport, and versatility across job sites. They are extensively used in construction, roadwork, and remote operations where mobility is essential.

b. Some of the key players operating in the rental air compressor market include CATERLPILLAR INC.; Atlas Copco; OTC Industrial Technologies; United Rental Inc; Sunbelt Rentals; Texas First Rentals; Empire Tool Rentals; Pro Rental & Sales; Mountain Air Compressor; MacAllister Rentals; Coast to Coast Equipment Rentals; Harris Equipment Rental; H&E Equipment Services; Loxam Group; HSS Hire

b. The rental air compressor market is driven by rising demand for cost-effective, flexible equipment solutions across construction, mining, and industrial sectors. Increasing infrastructure development and preference for short-term use without high capital investment are also key contributors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.