- Home

- »

- Electronic Devices

- »

-

Restaurant Point Of Sale Terminal Market Size Report, 2030GVR Report cover

![Restaurant Point of Sale Terminal Market Size, Share & Trends Report]()

Restaurant Point of Sale Terminal Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Product (Fixed, Mobile), By Deployment, By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-487-1

- Number of Report Pages: 153

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Restaurant Point Of Sale Terminal Market Summary

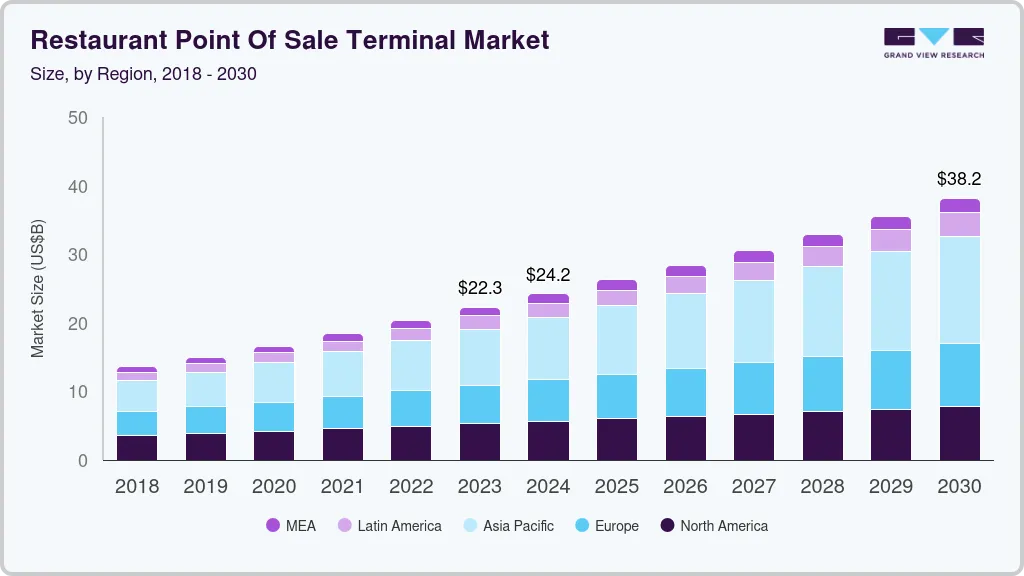

The global restaurant point of sale terminal market size was estimated at USD 22,263.9 million in 2023 and is projected to reach USD 38,159.5 million by 2030, growing at a CAGR of 8% from 2024 to 2030. Due to temporary closures and a decline in dine-in customers, the COVID-19 pandemic influenced the restaurant industry's business.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, fixed accounted for a revenue of USD 17,444.8 million in 2023.

- Mobile is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 22,263.9 Million

- 2030 Projected Market Size: USD 38,159.5 Million

- CAGR (2024-2030): 8%

- Asia Pacific: Largest market in 2023

While adopting POS for contactless payments, the development of digital ordering channels enabled businesses to escape the harsh realities of the pandemic.The effective administration facility of modern Point-of-Sale (POS) terminals, as opposed to manual systems or traditional cash registers, supports the rising demand for them. Functions of the POS system include sales analysis, inventory management, customer feedback, and personnel management analysis, which are propelling the market's expansion.

The effective administration facility of modern Point-of-Sale (POS) terminals, as opposed to manual systems or traditional cash registers, supports the rising demand for them. Functions of the POS system include sales analysis, inventory management, customer feedback, and personnel management analysis are propelling the market's expansion.

To maintain business operations, the restaurant POS terminal functions include billing, recording sales data, payroll management, and inventory control. Restaurant owners can manage sales tax reporting and measure their monthly and annual revenues by tracking daily sales and inventory data which is recorded in the POS system. Therefore, installing fixed or portable POS systems can lessen the amount of time spent on repetitive, manual operations like registering sales and creating tax reports. To produce regular updates and prepare sales reports, the Client Relationship Management (CRM) software integration in the POS system also automatically retrieves customer information. Thus, the additional benefit of putting in a POS system to extract data on client preferences and sales patterns is anticipated to boost market growth.

To boost product demand, restaurants must enhance their business processes. As a result, restaurant owners have applied point-of-sale systems to run further effectively by cutting down on billing time, keeping track of order completion times, and avoiding order errors at peak period. All country's major cities serve as the centers for dining establishments, coffee shops, breweries, nightclubs, and pubs, where people frequently gather with friends, family, and coworkers for socializing or business meetings, respectively. Thus, to provide a pleasant eating experience, restaurant workers must maintain efficient order and billing facilities. During peak times, a POS system works to control the back-end setup for a seamless front-end operation. A growth in the number of dine-in restaurants, nightclubs among others will promote to the market growth over the next few years. The impact of COVID-19 will result in a short-term obstacle; however, the market will soon hit recovery with large-scale vaccination programs.

The restaurant POS terminal market growth plummeted due to the COVID-19 pandemic that forced people to stay at home and avoid outside activities. Although the online ordering system helped many restaurants to keep the operation on track, the revenue loss led to the declined sale of new POS systems. As the countries such as China, Japan, South Korea, the U.S., Russia, the U.K., Germany, and other countries are recovering from the pandemic and have fully operated restaurants, the POS vendors are adding new features to help restaurants adapt to the challenge of dining. In 2022, the restaurant sector is expected to revive and boost the demand for mobile POS terminals across various types of restaurants.

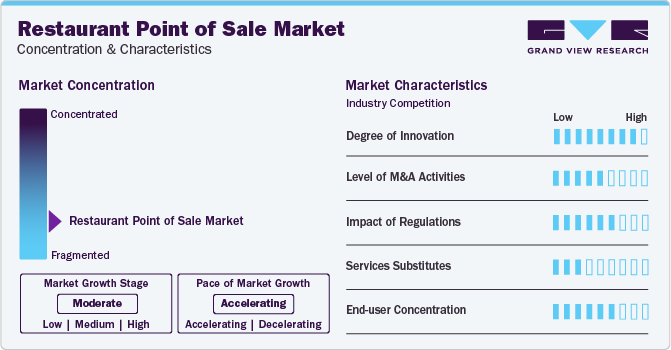

Market Concentration & Characteristics

The growth of the restaurant point-of-sale terminal market is moderate, and the growth’s pace is accelerating. For small businesses, mPOS platforms open an inexpensive channel for accepting alternate forms of payment. For large enterprises, it offers value-added features beyond the traditional POS hardware. The growth across the industry has encouraged restaurant of various sizes for leveraging these new systems and strategies for optimizing their current models along with delivering seamless customer experience.

The restaurant point-of-sale terminal market is also characterized by a high level of merger and acquisition (M&A) activity by the key players. The market players aim to develop Point-of-sale system with more advanced and automated features and provide quick interactions between restaurant operators, customers, and food service distributors.

The market is also subject to numerous rules and regulations such as, Central Consumer Protection Authority, Health Insurance Portability and Accountability Act, and General Data Protection Regulation. Companies is entitled by complying with these rules regardless of its industry.

Various international regulatory bodies have drafted regulations to protect consumer data from unauthorized users and prevent any potential misuse of it. Market players must abide by various regulations and acts, such as General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), related to personal data protection. Providers of payment processing software integrated into restaurant operating systems are obligated to adhere to the Payment Card Industry Data Security Standard (PCI DSS), which governs the structure and procedures for ensuring the security of card payment data

There is hardly any substitute to the restaurant point-of-sale systems. Restaurant operators are increasingly providing extended value added services and new acceptance capabilities, while improving in-store mobility levels by using POS systems. However, POS terminals are being preferred by high-volume restaurant operators in order to keep track of the front-end checkout.

Restaurants across the developing countries, such as, South Africa, India are focusing on digitizing their business operations to enhance the consumer dining experience, control excess operational costs, and improve business profitability. The restaurant association in these countries are undertaking favorable initiatives to digitalize the restaurant industry, which is expected to drive the restaurant point-of-sale terminal market growth from 2023 to 2030..

Product Insights

The demand for mobile terminals is anticipated to register a CAGR of 8.3% from 2023 to 2030.. The growth is attributed to increased table turns, improved service levels, less operation cost, available accurate dish information, suggestive selling, and mobility to attend customers. The affordability of owning mobile devices like smartphones and tablets and the boost of wireless technology have contributed to the increased adoption of mPOS terminals among restaurant owners.

Additionally, the higher Return on Investment (RoI) in the long run and additional insights to improve order accuracy, revise menus based on customer preference, increase sales and profitability, and streamline order processing have compelled restaurateurs to adopt restaurant POS terminals.

The fixed product segment is sub-segmented into cash counter terminals, self-serve kiosks, and vending machines. The fixed product segment accounted for the largest market share in 2022. The market size witnessed a rise, which is primarily attributed to the implementation of point-of-sale terminals in more prominent restaurants that serve a large number of customers and have multiple outlets to manage.

The self-service kiosk segment is projected to register the highest CAGR surpassing 9.5% from 2023 to 2030. The growing demand for self-service kiosk systems to facilitate quick checkouts, while avoiding waiting in long queues for customers and the ability to manage a greater number of customers for businesses is expected to play a key role in driving industry demand.

Component Insights

The component segment is bifurcated into hardware and software. The hardware segment captured the largest market share surpassing 68% share in 2022. The hardware segment is divided into three categories: swipe card machines, touchscreen/desktop, and others.

The POS system for restaurants must be supplemented with extra hardware, for example, a touchscreen display or tablet, EFTPOS, cash drawer, and receipt printer. The introduction of OLED displays and touch screens, thermal receipt printers, and touch payment EFTPOS systems, along with many other advancements, are projected to spur market expansion.

The software segment is anticipated to register a CAGR exceeding 5.0% from 2023 to 2030. The hardware of the POS system is supported by custom restaurant point-of-sale software to facilitate the management of the business operation.

The need to meet customer expectations related to the security of their card and identity information, payment method and rewards is expected to drive the demand for POS software. Additionally, the need for software based on the type of restaurant is another factor boosting the demand for customized POS software.

Deployment Insights

The cloud segment is anticipated to exhibit a CAGR exceeding 9.2% from 2023 to 2030. Cloud-based deployment offers increased data visibility, mobility for businesses, improved data security, decreased downtime during updates and streamlined information across multiple locations. The security, economic and operational benefits of implementing POS on the cloud have become apparent for quick-service restaurateurs to upscale culinary experiences.

The on-premise segment dominated the market with a revenue share of 75.2% in 2022. On-premise deployment remains a popular choice among restaurants skeptical of data security. The legacy POS system stored information on the nearest server or local database like a computer drive which limits accessibility in the absence of the device. The on-premise deployment is still preferred as it offers full control of the system, freedom to customize, and no downtime as no internet connection is required. Also, the system is purchased on a perpetual, non-exclusive license basis for installation and use.

Application Insights

The front-end segment accounted for a market share of more than 69% in 2022. The main function of the restaurant POS terminal is to handle front-end tasks including ordering meals, billing, tracking sales, processing payments, managing orders, interacting with customers, reporting, and marketing. Additionally, it is anticipated that the requirement to monitor food usage, create sequential orders, and gather information about the most popular menu item will favor bar and restaurant point-of-sale systems growth.

The back-end segment registered a CAGR of over 8.4% from 2023 to 2030. Adopting a POS system is vital for managing the front end of restaurants since it offers accurate order preparation on time. By removing administrative duties from the front-end POS terminal, a back-office POS system improves operational efficiency. The need for back-end restaurant POS systems has been fueled in part by the desire to protect management's privacy and restrict employee access to important company data due to the possibility of data breaches.

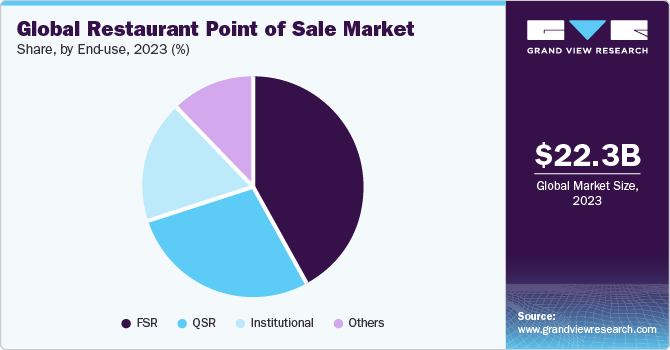

End-user Insights

The end-user segment includes Full-Service Restaurants (FSR), Quick Service Restaurants (QSR), and institutional FSR. Institutional FSR is further sub-segmented into casual dine and fine dine. The FSR segment ruled the market in 2022 accounting for over 42.1% of the global revenue share. The casual dining segment dominated as the highest revenue contributor owing to affordable and convenient eating options and rising casual dining brands such as Pizza Hut, McDonald's, Wendy’s, and Dunkin that have readily adopted POS terminals for their numerous outlets.

The Quick Service Restaurant (QSR) segment growth is expected to augment at the highest CAGR from 2023 to 2030. The QSR segment emerged as the highest revenue contributor. Moreover, the QSRs are required to attend to a larger number of customers frequently in a short duration which needs the support of POS systems to assess customer requirements, take quick orders, reduce the order turnaround time, and provide faster customer service.

Regional Insights

Asia Pacific Restaurant Point of Sale Market Trends

Asia Pacific remained the largest market for restaurant POS terminals in 2022, accounting for more than 33% of the total revenue share. It is projected to expand at the fastest CAGR from 2023 to 2030 due to the rapidly growing and evolving food service industry in countries such as India and China as a result of positive demographic conditions and increased disposable income.

China Restaurant Point of Sale Market Trends

The restaurant point of sale market in China is projected to grow at a CAGR nearly of 10% from 2023 to 2030. Various factors such as, government payment regulations, shifting customer needs, and advancement in technology are collectively contributing to the growth of the restaurant point-of-sale market in China. As the payment landscape in China is being transformed by individual items, China is keeping up with these innovations and propelling the growth of the POS terminals market.

Japan Restaurant Point of Sale Market Trends

The restaurant point of sale market in Japan is projected to grow at a CAGR nearly of 8% from 2023 to 2030. The development of advanced restaurant point of sale solutions by various companies in the country is propelling the growth of the restaurant point of sale market in Japan.

India Restaurant Point of Sale Market Trends

The restaurant point of sale market in India is projected to grow at a CAGR of 16.0% from 2023 to 2030. Various small-scale restaurants in the country have started using digital kiosks and tablet-based POS systems to display menus, place orders, increase operational efficiency, and enhance customer experience. Therefore, driving the growth of the India restaurant point of sale market.

North America Restaurant Point of Sale Market Trends

North America contributed to the more than 24.0% revenue share in 2022. The rapidly growing restaurant industry and the presence of the highest number of vendors offering restaurant POS software are driving regional growth. Additionally, the rising demand for advanced restaurant POS software in the region to ease everyday challenges related to restaurant operations and management is expected to drive the market further.

Europe Restaurant Point of Sale Market Trends

The restaurant point of sale market in Europe is growing significantly at a CAGR of 7.3% from 2023 to 2030. The market growth is attributed to the presence of various quick-service restaurants in the region that have adopted POS terminals while some of them are shifting to mobile POS terminals. This is expected to promise lucrative growth opportunities in theEurope restaurant point-of-sale terminal market from 2023 to 2030.

U.K. Restaurant Point of Sale Market Trends

The restaurant point of sale market in U.K. is growing significantly at a CAGR nearly of 7% from 2023 to 2030. Government bodies across the U.K. are increasingly promoting to use restaurant point-of-sale system. Thus, retailers across the country are seen to be using EPOS system to identify between good solds at different rates of VAT. Therefore, driving the growth of the U.K. restaurant point of sale market.

Germany Restaurant Point of Sale Market Trends

The restaurant point of sale market in Germany is growing significantly at a CAGR of 7% from 2023 to 2030. There has been increasing focus on order quality and supply chain management procedures across the retail sector in the country. Therefore, utilizing the appropriate supply chain methods reduces costs while simultaneously enhancing restaurant quality and service.

France Restaurant Point of Sale Market Trends

The restaurant point of sale market in Franceis growing significantly from 2023 to 2030. The need for POS terminals is rising as a result of the rise in supermarkets, speciality shops, and hypermarkets. Moreover, the growing preference for smartphone payments across the country is one of the major factors driving the growth of the restaurant POS terminals in the country.

Middle East & Africa Restaurant Point of Sale Market Trends

Middle East & Africa restaurant point of sale market is anticipated to witness significant growth from 2023 to 2030 at a CAGR of 7.4%. In MEA, there is a notable surge in the need for restaurant point of Sale systems, which are being linked with widely used digital wallets such as, Apple Pay, Samsung Pay, and Google Pay. Customers can use this interface to make purchases with their mobile devices, while restaurant operators can offer loyalty programs and prizes to customers who use their digital wallets. Therefore, driving the growth of the Middle East & Africa restaurant point of sale market.

Saudi Arabia Restaurant Point of Sale Market Trends

Saudi Arabia restaurant point of sale market is anticipated to witness significant growth from 2023 to 2030. The increasing use of the POS system in the retail sector has been driven by the growing need for various POS systems with a robust and centralized system among large merchants, supermarkets, and department stores. Moreover, restaurant POS implementation has expanded due to the increased use of customer behaviour brought about by its consumer mapping application. Therefore, driving the growth of the Saudi Arabia restaurant point of sale market.

Key Restaurant POS Terminal Company Insights

Some of the key players operating in the market include NCR Corporation, and Oracle Corporation.

-

NCR Corporation provides mobile and electronic payment solutions to the hospitality and retail sectors. The company specializes in offering POS software applications, store and restaurant management applications, and back-office inventory management solutions to the restaurant and hotel chains. The company delivers a range of hardware solutions, including self-checkout kiosks, barcode scanners, order and payment kiosks, printers, and peripherals to restaurants, retailers, sports venues, and entertainment and foodservice companies.

-

Oracle Corporation is engaged in delivering Point-of-Sale (POS) solutions to retail and hospitality industries globally. The company provides a range of solutions to businesses, including inventory management, reporting and analysis, loss prevention, gift and loyalty, and table reservations. Oracle Corporation offers Simphony First Edition, a hospitality management platform service that helps in managing back-office systems and financial analysis of the business.

Toast, Inc., and Revel Systems are some of the emerging market participants in the restaurant point-of-sale terminal market.

-

Toast, Inc. is a provider of various end-to-end platforms built for restaurants of all sizes. The platforms help increase revenue, improve operations, and delight guests. The company provides a single platform of software as a service (SaaS) products and financial technology solutions. These offerings provide restaurants all the necessary things they need to run their business across operations, point-of-sale, digital ordering and delivery, marketing and loyalty, and team management.

-

Revel Systems is an iPad-based point-of-sale system provider. It offers the most mature, cloud-native POS platform. The company’s portfolio includes products and solutions in POS, delivery management, open API, employee, kitchen management, enterprise management, cash building, online ordering, self-service kiosk, and payments. The company offers POS solutions for business types such as Quick-Service POS System, Restaurant POS System, Retail POS System, Pizza POS System, and Coffee shop POS System.

Key Restaurant Point of Sale Terminal Companies:

The following are the leading companies in the restaurant point of sale terminal market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these restaurant point of sale terminal companies are analyzed to map the supply network.

- Aireus Inc.

- Dinerware, Inc.

- EposNow

- LimeTray

- NCR Corporation

- Oracle Corporation

- ParTech, Inc

- PAX Technology Limited

- Posera

- Posist

- POSsible POS

- Revel Systems

- ShopKeep (acquired by LightSpeed)

- Snack POS

- Squirrel Systems

- Toast, Inc.

- TouchBistro

- Upserve, Inc.

- Verifone Systems Inc.

Recent Developments

-

In January 2024, ParTech, Inc., restaurant POS provider, launched the PAR Wave - an All-In-One touch panel designed for hardware component for the hospitality industry. PAR's Wave combines performance, security, functionality, and new design to meet the demands of the restaurant industry.

-

In August 2023, Snack POS, restaurant point of sale system provider, partnered with PAX, provider of secure electronic payment terminal solutions to launch Europay, MasterCard, and Visa (EMV) enabled terminals to restaurants, securing payment and convenience for both customers and businesses.

-

In May 2023, Toast, Inc., restaurant POS provider, partnered with Deliverect, a provider of solutions that help simplify online orders from food delivery businesses into the POS systems of restaurants. Through this partnership, Deliverect aimed to use the Toast Partner Ecosystem to enable restaurants to manage online orders from their Toast POS systems with enhanced flexibility and ease.

Restaurant Point Of Sale Terminal Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.26 billion

Revenue forecast in 2030

USD 38.16 billion

Growth rate

CAGR of 8.0% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, deployment, application, end-user, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S., Canada, U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, Mexico, UAE, Saudi Arabia, South Africa

Key companies profiled

Aireus Inc., Dinerware, Inc., EposNow, LimeTray, NCR Corporation, Oracle Corporation, ParTech, Inc, PAX Technology Limited, Posera, Posist, POSsible POS, Revel Systems, ShopKeep (acquired by LightSpeed), Snack POS, Squirrel Systems, Toast, Inc., TouchBistro, Upserve, Inc., Verifone Systems Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Restaurant Point Of Sale Terminal Market Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the restaurant point of sale terminal market report on the basis of component, product, deployment, application, end-user, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed

-

Self-serve Kiosks

-

Cash Counters Terminal

-

Vending Machine

-

-

Mobile

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Swipe Card Machine

-

TouchScreen/Desktop

-

Others

-

-

Software

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Front-End

-

Back-End

-

-

End-User Outlook (Revenue, USD Billion, 2018 - 2030)

-

FSR

-

Fine Dine

-

Casual Dine

-

-

QSR

-

Institutional

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global restaurant point of sale terminal market size was estimated at USD 20,308.2 million in 2022 and is expected to reach USD 22,263.9 million in 2023.

b. The global rrestaurant point of sale terminal market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 38,159.5 million by 2030.

b. The Asia Pacific dominated the restaurant POS terminals market with a share of 30% in 2020. This is attributable to rapidly expanding and evolving foodservice industries as a result of favorable demographic conditions and increasing disposable income levels.

b. Some key players operating in the restaurant point of sale terminal market include Ingenico Group; PAX Technology Limited; Verifone Systems Inc.; NCR Corporation; Revel Systems; Aireus Inc.; Aireus Inc.; Dinerware, Inc.; Posist, and Harbortouch Payments, LLC.

b. Key factors that are driving the market growth include inventory management, employee management, sales analysis, and customer feedback analysis capability of restaurant PoS terminals.

b. The hardware segment dominated the global restaurant POS terminal market share with more than 65.0% share in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.