- Home

- »

- Next Generation Technologies

- »

-

Revenue Operations Market Size, Industry Report, 2033GVR Report cover

![Revenue Operations Market Size, Share & Trends Report]()

Revenue Operations Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Deployment Mode (Cloud, On-Premises), By Enterprise Size (Large Enterprises, SMEs), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-795-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Revenue Operations Market Summary

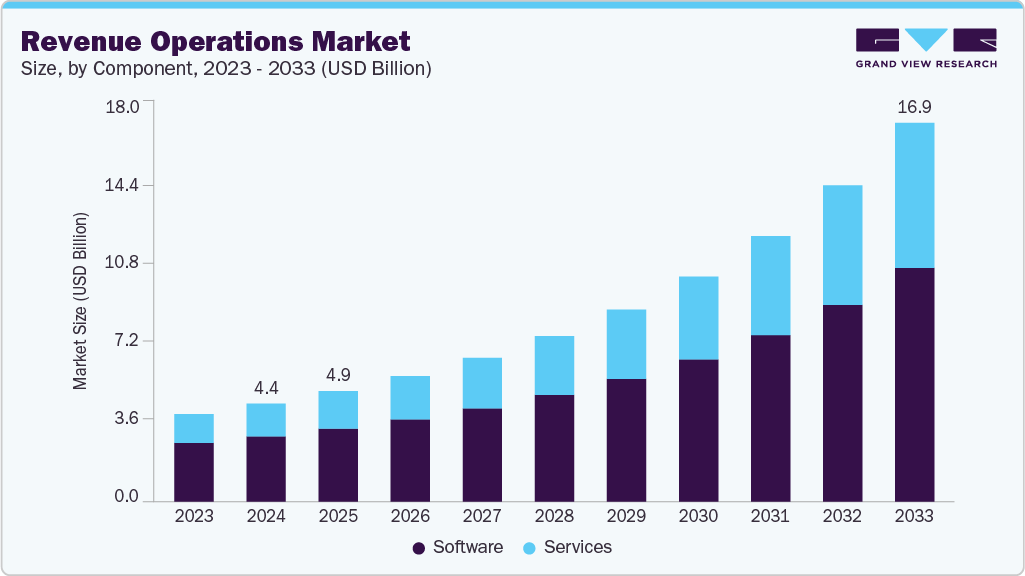

The global revenue operations market size was estimated at USD 4.39 billion in 2024 and is projected to reach USD 16.98 billion by 2033, growing at a CAGR of 16.6% from 2025 to 2033. The market is primarily driven by the growing need for unified revenue management, data-driven decision-making, and improved collaboration across sales, marketing, and customer success teams.

Key Market Trends & Insights

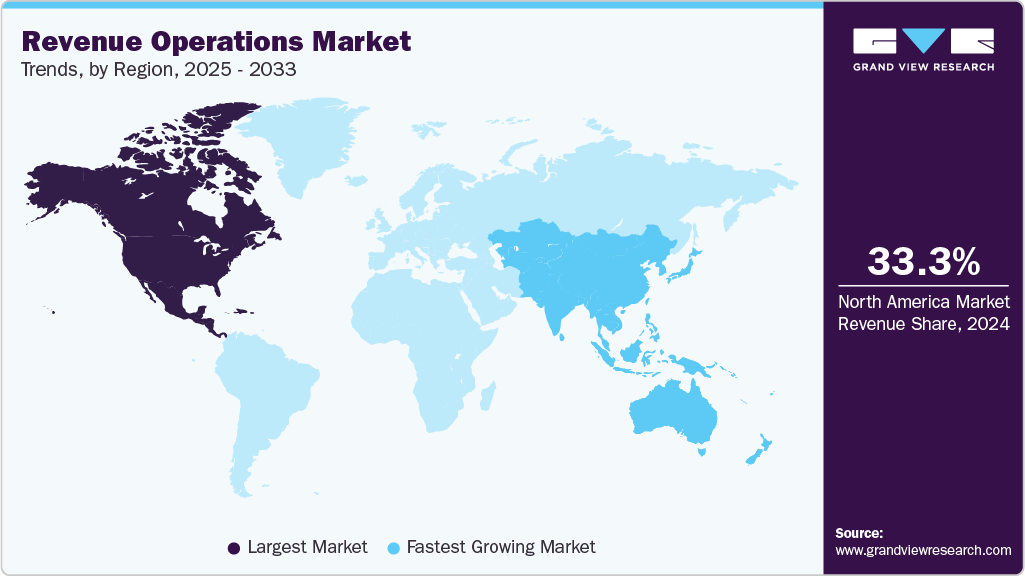

- North America dominated the global revenue operations (RevOps) industry with the largest revenue share of 33.3% in 2024.

- The RevOps industry in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, software led the market, holding the largest revenue share of 66.0% in 2024.

- By deployment mode, the cloud segment held the dominant position in the market in 2024.

- By enterprise size, the large enterprises segment held the dominant position in the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.39 Billion

- 2033 Projected Market Size: USD 16.98 Billion

- CAGR (2025-2033): 16.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, increasing adoption of automation, AI-driven analytics, and cloud-based CRM platforms further accelerate market growth by enhancing operational efficiency and forecasting accuracy. The RevOps industry is primarily driven by the growing need for organizations to align sales, marketing, and customer success functions to improve revenue efficiency. As businesses increasingly adopt data-driven decision-making, RevOps solutions enable unified visibility into revenue processes, helping enterprises reduce operational silos and improve forecasting accuracy. The shift toward integrated go-to-market strategies has further accelerated the adoption of RevOps platforms.The rapid adoption of automation, artificial intelligence (AI), and advanced analytics tools is fueling the expansion of the market. These technologies enhance productivity, streamline workflow automation, and provide actionable insights across departments. The growing reliance on cloud-based solutions and CRM integrations allows enterprises to centralize revenue data and optimize performance metrics.

In addition, the increasing focus on customer retention and lifetime value optimization is supporting market growth. Organizations are investing in RevOps platforms to monitor end-to-end customer journeys and strengthen post-sales engagement. Rising demand from small and medium enterprises (SMEs), coupled with expanding digital transformation initiatives across industries, continues to create new growth opportunities for RevOps vendors.

Component Insights

The software segment dominated the market with a share of over 66.0% in 2024, driven by the increasing need for unified platforms that integrate sales, marketing, and customer success data to optimize revenue performance. Organizations are adopting RevOps software to automate forecasting, enhance pipeline visibility, and improve collaboration across departments. The integration of artificial intelligence (AI) and predictive analytics within these platforms enables real-time insights and data-driven decision-making. In addition, the growing adoption of cloud-based solutions, CRM integrations, and workflow automation tools is fueling demand. As businesses prioritize revenue efficiency and scalability, RevOps software is becoming an essential enabler of strategic growth and operational alignment across enterprises.

The services segment is expected to register the fastest CAGR over the forecast period, driven by the rising demand for expert consulting, integration, and training to effectively implement and optimize RevOps platforms. As organizations increasingly seek to align sales, marketing, and customer success functions, the need for specialized service providers to manage complex data integration and workflow automation is expanding. In addition, enterprises are leveraging RevOps consulting services to customize revenue strategies, enhance forecasting accuracy, and improve customer retention. The growing adoption of cloud-based solutions, coupled with a shortage of in-house RevOps expertise, is further accelerating demand for implementation, support, and managed services across industries.

Deployment Mode Insights

The cloud segment dominated the market in 2024. The cloud deployment segment is driven by the increasing demand for scalable, cost-efficient, and easily accessible solutions that support remote and hybrid work environments. Cloud-based RevOps platforms enable real-time data synchronization across sales, marketing, and customer success functions, enhancing collaboration and decision-making. Organizations are rapidly shifting from on-premise to cloud infrastructure to benefit from faster implementation, reduced IT overhead, and continuous software updates. In addition, the integration of AI, analytics, and automation tools in cloud-based RevOps platforms provides advanced forecasting capabilities and performance insights, further fueling adoption among enterprises seeking agility and revenue optimization.

The On-Premises segment is expected to register a significant CAGR over the forecast period, driven by the growing demand for enhanced data security, regulatory compliance, and greater control over enterprise systems. Many large organizations, particularly in industries such as BFSI, healthcare, and government, prefer on-premises deployment to safeguard sensitive financial and customer data. This model offers improved customization, integration flexibility with legacy systems, and reduced dependency on third-party cloud infrastructure. In addition, enterprises with established IT infrastructure view on-premises RevOps solutions as cost-effective in the long term. The segment also benefits from increasing investments in hybrid IT environments, enabling organizations to balance control, scalability, and operational efficiency.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024, driven by the growing need to manage complex, large-scale revenue processes and cross-departmental coordination. Large enterprises operate across multiple regions and business units, they require integrated RevOps platforms to unify data from sales, marketing, finance, and customer success functions. The increasing adoption of AI-driven analytics and automation tools enables large enterprises to enhance forecasting accuracy, optimize resource allocation, and improve revenue predictability. Moreover, rising investments in digital transformation and enterprise cloud solutions further support the demand for RevOps, helping organizations achieve greater transparency, scalability, and operational efficiency in revenue management.

The SMEs segment is expected to register the fastest CAGR over the forecast period driven by the growing need for streamlined revenue processes, improved sales productivity, and data transparency across business functions. Small and medium enterprises increasingly adopt RevOps platforms to unify marketing, sales, and customer success operations under a single framework, enabling better forecasting and decision-making. The rising affordability of cloud-based and subscription-based RevOps solutions has made advanced analytics and automation accessible to SMEs, reducing operational inefficiencies. Moreover, increasing competition and the pressure to scale customer acquisition and retention efforts efficiently are compelling SMEs to invest in RevOps tools to achieve sustainable revenue growth and operational agility.

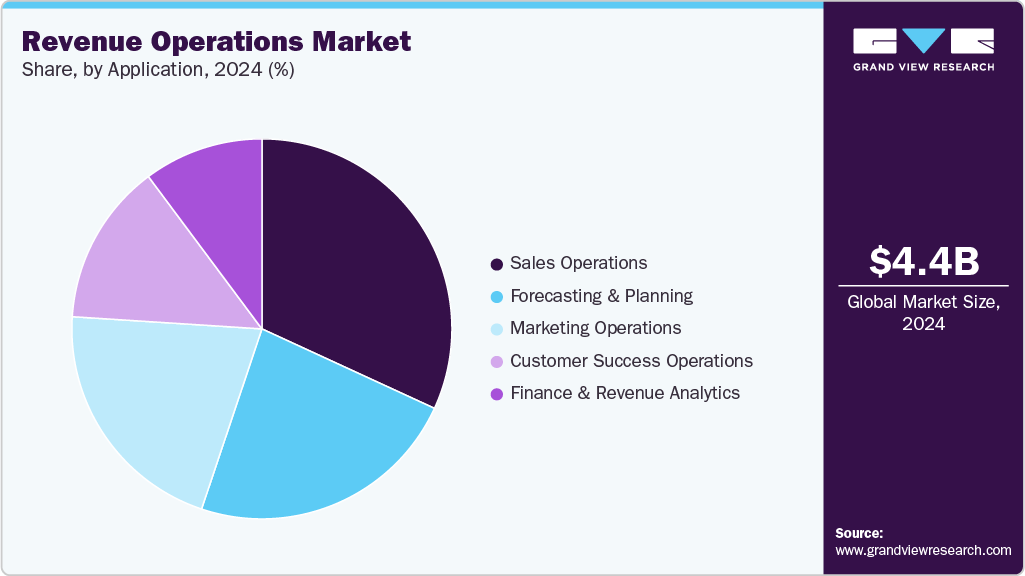

Application Insights

The sales operations segment dominated the market in 2024, propelled by the growing need for data-driven sales strategies, improved forecasting accuracy, and optimized sales performance management. Organizations are increasingly adopting RevOps platforms to automate lead management, pipeline tracking, and performance analytics, enabling sales teams to focus on high-value activities. The integration of AI and predictive analytics tools further supports real-time insights into deal progression and revenue predictability. In addition, the rising demand for cross-functional collaboration among sales, marketing, and customer success teams is boosting adoption, as companies seek to enhance conversion rates, shorten sales cycles, and achieve consistent revenue growth through centralized sales operations systems.

The marketing operations segment is expected to register the fastest CAGR over the forecast period, driven by the rising need for data integration, campaign performance optimization, and alignment between marketing and sales teams. Organizations are increasingly adopting RevOps platforms to automate marketing workflows, measure ROI more effectively, and ensure consistent lead management across channels. The growing use of AI and predictive analytics enables real-time insights into customer behavior, improving targeting and personalization. In addition, the expansion of digital marketing channels and the demand for unified dashboards to track marketing attribution are propelling market growth. Cloud-based solutions and CRM integrations further enhance collaboration and efficiency across marketing functions.

End Use Insights

The IT & Telecom segment dominated the market in 2024, propelled by the growing need to streamline complex revenue streams, subscription models, and multi-channel customer engagement processes. As telecom operators and IT service providers adopt digital transformation and cloud-based platforms, RevOps solutions enable better coordination among sales, marketing, and customer success teams. The increasing adoption of AI-driven analytics and automation tools helps improve sales forecasting accuracy and operational efficiency. In addition, rising competition and the demand for enhanced customer retention strategies are prompting IT and telecom enterprises to invest in RevOps platforms to gain real-time revenue insights and optimize end-to-end revenue performance.

The BFSI segment is expected to register the fastest CAGR over the forecast period, propelled by the growing need for operational efficiency, regulatory compliance, and enhanced customer engagement. Financial institutions are increasingly adopting RevOps solutions to unify sales, marketing, and customer success operations, enabling data-driven decision-making and improved revenue forecasting. The sector’s emphasis on personalized customer experiences and digital transformation initiatives further accelerates the adoption of RevOps platforms. Moreover, the integration of AI, automation, and analytics helps BFSI organizations streamline lead management, optimize client onboarding, and enhance cross-selling and upselling strategies, driving revenue growth and business agility.

Regional Insights

North America RevOps industry dominated globally with a revenue share of over 33.3% in 2024, driven by the strong presence of technologically advanced enterprises and early adoption of data-driven revenue management solutions. Companies across sectors such as IT & telecom, BFSI, and healthcare are increasingly leveraging RevOps platforms to align sales, marketing, and customer success operations for improved revenue visibility and forecasting accuracy. Moreover, the region’s growing focus on customer retention, performance optimization, and integrated go-to-market strategies, supported by robust digital infrastructure, continues to drive the adoption of RevOps solutions across large enterprises and SMEs.

U.S. Revenue Operations Market Trends

The U.S. RevOps industry is expected to grow significantly in 2024, driven by the growing demand for integrated revenue management solutions that align sales, marketing, and customer success teams. The increasing adoption of automation, analytics, and AI-powered tools among U.S. enterprises is enhancing operational visibility and improving the accuracy of revenue forecasting. The strong presence of numerous CRM and analytics providers, coupled with a mature digital infrastructure, supports widespread deployment of RevOps platforms. Moreover, the rising focus on customer retention, data-driven decision-making, and cross-functional collaboration is propelling market expansion. Continuous investments in cloud-based technologies and advanced sales intelligence tools further accelerate the growth of the U.S. market.

Europe Revenue Operations Market Trends

The RevOps industry in Europe is expected to grow significantly over the forecast period driven by the region’s increasing focus on digital transformation and data integration across business functions. European enterprises are adopting RevOps platforms to unify sales, marketing, and customer success operations, enabling greater transparency and efficiency in revenue generation. The growing adoption of cloud-based CRM and automation tools, along with compliance-focused data management under GDPR, is further supporting market growth. In addition, the rise of subscription-based business models, coupled with the need for improved forecasting and customer lifecycle management, is encouraging organizations across various industries, such as IT, BFSI, and healthcare, to invest in advanced RevOps solutions for sustainable revenue optimization.

Asia Pacific Revenue Operations Market Trends

The RevOps industry in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific market is driven by rapid digital transformation, expanding cloud adoption, and the growing need for integrated revenue management across enterprises. Businesses in the region are increasingly leveraging RevOps platforms to unify sales, marketing, and customer success operations, ensuring better alignment and data transparency. The rising adoption of CRM and analytics solutions, in numerous sectors such as, IT & telecom, BFSI, and e-commerce, is further boosting market growth. In addition, the increasing presence of SaaS startups, focus on automation, and investments in AI-driven tools for revenue forecasting and customer engagement are key factors propelling the market in the region.

Key Revenue Operations Company Insights

Some key companies in the market are Salesforce, Inc., and Clari.

-

Salesforce, Inc. is a key player in the market. It offers comprehensive RevOps capabilities through its Sales Cloud, Revenue Intelligence, and Data Cloud platforms. Salesforce, Inc. dominates due to its vast enterprise customer base, integrated CRM ecosystem, and strong AI-driven forecasting and analytics tools.

-

Clari leads the market by specializing in revenue forecasting, pipeline management, and go-to-market execution. Clari is widely recognized for pioneering the “Revenue Operations” category, leveraging AI to deliver real-time revenue intelligence and operational visibility across sales, marketing, and customer success functions.

Key Revenue Operations Companies:

The following are the leading companies in the revenue operations market. These companies collectively hold the largest market share and dictate industry trends.

- Clari

- Gong.io Ltd.

- Aviso

- HubSpot, Inc.

- Salesforce, Inc.

- People.ai Inc

- KANINI Software Solutions

- Kantify

- Revecue

- RevOS GmbH

Recent Developments

-

In September 2025, HG Insights, a market intelligence and technology insights company, acquired MadKudu Inc., a predictive analytics and AI company, and launched its “Revenue Growth Agentic Ecosystem”. HG Insights announced this acquisition and ecosystem launch to deliver AI-driven, agentic workflows for B2B sales and RevOps. The initiative combines MadKudu Inc.’s predictive lead-scoring and AI analytics with HG Insights’ market intelligence platform, empowering enterprises to optimize go-to-market strategies, enhance revenue forecasting, and drive data-driven decision-making across RevOps functions.

-

In July 2025, 2X LLC, a B2B marketing and RevOps services company, acquired OutboundFunnel, a subscription-based GTM services provider, to expand its rev-ops and AI-powered go-to-market technology services in the market. The acquisition enables 2X LLC to integrate Outbound Funnel’s advanced sales engagement and automation tools, enhancing data-driven decision-making, pipeline management, and revenue optimization capabilities to deliver more efficient RevOps and GTM solutions globally.

-

In June 2025, Fullcast, a RevOps platform provider, acquired Commissionly, a sales commission management platform provider, to create a more comprehensive revenue operations offering. The acquisition enhances Fullcast’s end-to-end RevOps capabilities by integrating Commissionly’s robust sales commission automation and performance management tools, enabling organizations to streamline incentive planning, improve sales productivity, and drive revenue accountability through a unified platform.

Revenue Operations Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.95 billion

Revenue forecast in 2033

USD 16.98 billion

Growth rate

CAGR of 16.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, enterprise size, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Clari; Gong.io Ltd.; Aviso; HubSpot, Inc.; Salesforce, Inc.; People.ai Inc; KANINI Software Solutions; Kantify; Revecue; RevOS GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Revenue Operations Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global revenue operations market report based on component, deployment mode, enterprise size, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-Premises

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Sales Operations

-

Marketing Operations

-

Customer Success Operations

-

Finance & Revenue Analytics

-

Forecasting & Planning

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Healthcare & Life Sciences

-

Retail & E-commerce

-

Manufacturing

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global revenue operations market size was estimated at USD 4.39 billion in 2024 and is expected to reach USD 4.95 billion in 2025.

b. The global revenue operations market is expected to grow at a compound annual growth rate of 16.6% from 2025 to 2033 to reach USD 16.98 billion by 2033.

b. North America dominated the RevOps market with a share of 33.3% in 2024. This is attributable to the strong presence of technologically advanced enterprises and early adoption of data-driven revenue management solutions. Companies across sectors such as IT & telecom, BFSI, and healthcare are increasingly leveraging RevOps platforms to align sales, marketing, and customer success operations for improved revenue visibility and forecasting accuracy.

b. Some key players operating in the RevOps market include Clari; Gong.io Ltd.; Aviso; HubSpot, Inc.; Salesforce, Inc.; People.ai Inc; KANINI Software Solutions; Kantify; Revecue; and RevOS GmbH.

b. Key factors that are driving the revenue operations market growth include the growing need for unified revenue management, data-driven decision-making, and improved collaboration across sales, marketing, and customer success teams. Additionally, increasing adoption of automation, AI-driven analytics, and cloud-based CRM platforms further accelerates market growth by enhancing operational efficiency and forecasting accuracy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.