- Home

- »

- Consumer F&B

- »

-

Saccharin Market Size, Share, Trends, Industry Report, 2030GVR Report cover

![Saccharin Market Size, Share & Trends Report]()

Saccharin Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sodium Saccharin, Calcium Saccharin, Insoluble Saccharin), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-610-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Saccharin Market Summary

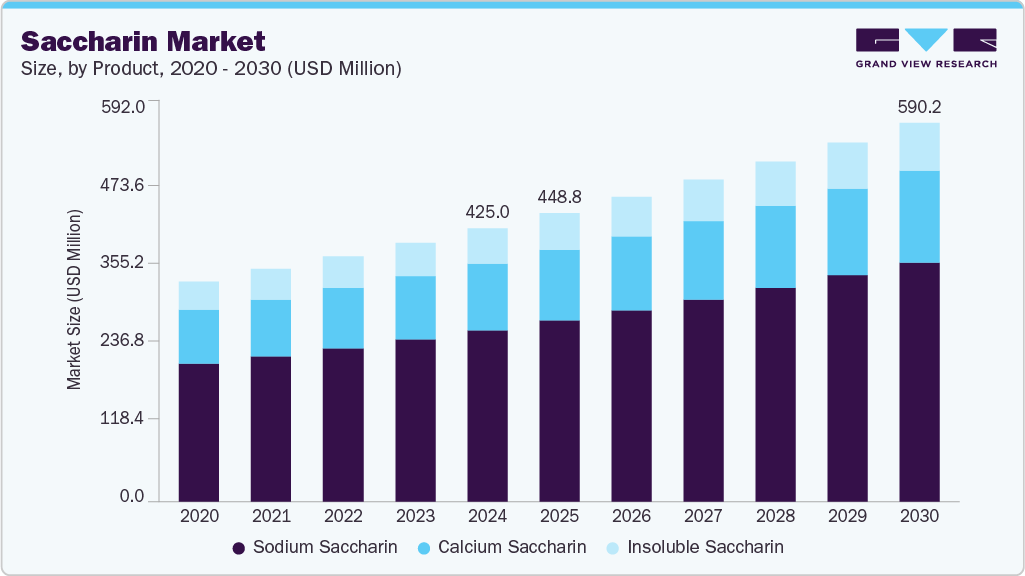

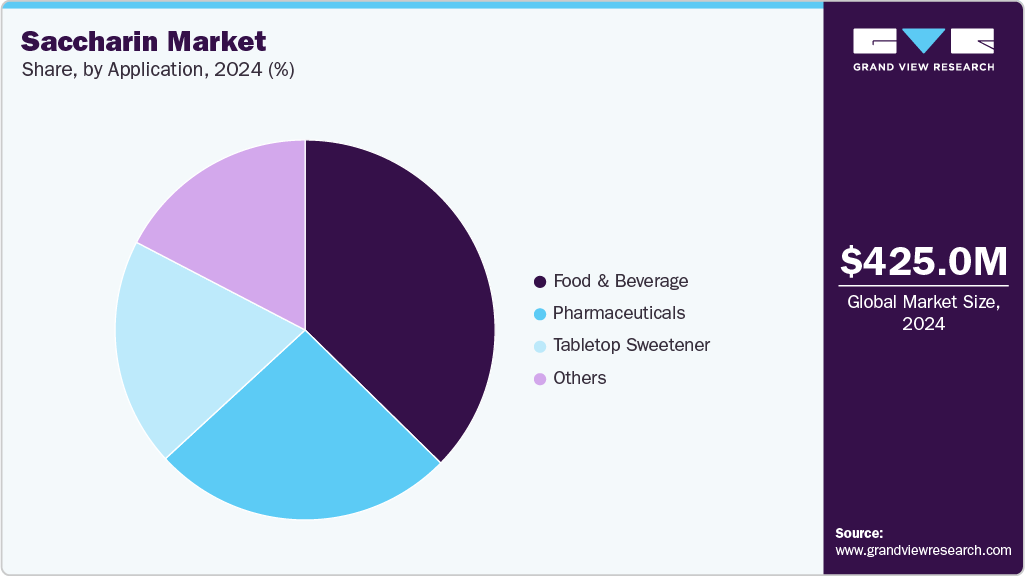

The global saccharin market size was estimated at USD 425.0 million in 2024 and is projected to reach USD 590.2 million by 2030, growing at a CAGR of 5.6% from 2025 to 2030. One of the primary drivers for this growth is the rising consumer demand for low-calorie sweeteners, propelled by increasing health consciousness and the prevalence of lifestyle-related diseases such as obesity and diabetes.

Key Market Trends & Insights

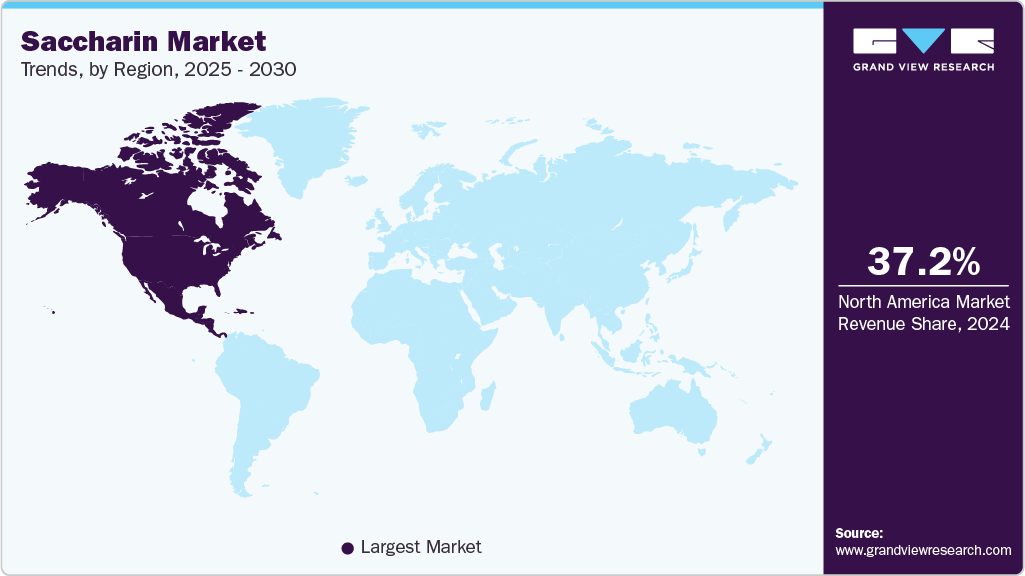

- The North America saccharin market dominated the global industry with a share of 37.16% in 2024.

- The saccharin market in the U.S. is expected to grow at a CAGR of 5.5% over the forecast period.

- By product, the sodium saccharin market is expected to exceed USD 375 million by 2030.

- By application, the food and beverage segment was the largest consumer and is expected to grow at a CAGR of 5.8% over the forecast period.

- By distribution channel, Offline channels segment accounting for over 70% of sales in 2024.

Market Size & Forecast

- 2024 Market Size: USD 425.0 Million

- 2030 Projected Market Size: USD 590.2 Million

- CAGR (2025-2030): 5.6%

- North America: Largest market in 2024

As more individuals become aware of the adverse effects of excessive sugar consumption, they are seeking healthier alternatives, making saccharin, an artificial sweetener with zero calories, a popular choice. The food and beverage industry remains the largest consumer of saccharin, utilizing it extensively in products such as soft drinks, baked goods, confectionery, jams, and sugar-free snacks. The growth of this industry, fueled by global population increases and changing dietary habits, has significantly contributed to the expansion of the saccharin market. Saccharin’s stability under heat and acidic conditions, coupled with its ability to provide intense sweetness at a low cost, makes it an attractive ingredient for manufacturers looking to create sugar-free or reduced-sugar products without sacrificing taste.Beyond food and beverages, saccharin’s role in the pharmaceutical and personal care industries is also expanding. In pharmaceuticals, saccharin is used to mask the bitter taste of oral medications, syrups, and chewable tablets, enhancing patient compliance. Its inclusion in personal care products such as toothpaste, mouthwash, and cosmetics further broadens its application base. The animal feed industry is another emerging area, where saccharin is added to improve the palatability of feed and mask unpleasant flavors in veterinary medications.

Technological advancements and ongoing research and development efforts are playing a crucial role in driving the market growth. Manufacturers are investing in new formulations that enhance solubility, improve taste profiles, and increase the versatility of saccharin across different product categories. These innovations not only address consumer expectations for better-tasting sugar substitutes but also help manufacturers stay competitive in a rapidly evolving market.

Regulatory support and favorable government initiatives have further bolstered the growth of the saccharin industry. For instance, actions such as the removal of saccharin from hazardous waste lists and the imposition of duties to protect domestic manufacturers have created a more conducive environment for saccharin production and use. Additionally, the approval of saccharin as a food additive by regulatory bodies in various countries has facilitated its widespread adoption.

Broader macroeconomic trends, including rising disposable incomes, urbanization, and the proliferation of online retail platforms have made saccharin more accessible to consumers worldwide. Aggressive marketing strategies and increasing product availability have further accelerated market penetration, particularly in emerging economies such as China and India, where rapid urbanization and shifting lifestyles are driving demand for convenient, healthier food options. These factors are expected to sustain and accelerate the global market growth.

One significant challenge facing the saccharin market is the volatility of raw material prices. Saccharin production heavily depends on key raw materials, such as anthranilic acid and phthalic anhydride, which experience considerable price fluctuations due to factors like global supply and demand dynamics, geopolitical tensions, currency variations, and changes in feedstock prices. This volatility directly affects production costs, squeezes profit margins, and undermines the competitiveness of manufacturers, particularly in a market characterized by intense price competition and narrow margins. Sudden surges in raw material costs can disrupt production schedules and inventory management, while sharp drops may lead to excess inventory and financial losses, complicating manufacturers' ability to plan and maintain stable operations.

Product Insights

The sodium saccharin market is expected to exceed USD 375 million by 2030. Sodium saccharin is the most widely used form due to its high water solubility and intense sweetness, which is approximately 300-500 times that of regular sugar. Its versatility makes it ideal for various applications, including soft drinks, baked goods, candies, jams, and various sugar-free snacks. Additionally, sodium saccharin is extensively used in oral care products such as toothpaste and mouthwash to mask bitterness and enhance flavor. The pharmaceutical industry also relies on sodium saccharin to improve the palatability of medicines, syrups, and chewable tablets. The growth of sodium saccharin is driven by its cost-effectiveness, stability under various conditions, and the increasing consumer demand for low-calorie and sugar-free products.

Calcium saccharin, another water-soluble variant, is favored in applications where low sodium content is essential. This makes it particularly suitable for products targeted at health-conscious consumers, especially those with hypertension or cardiovascular concerns who need to limit their sodium intake. The demand for calcium saccharin increases as awareness about the health risks associated with high sodium consumption grows. It is used in the food and pharmaceutical industries, where offering low-sodium alternatives is becoming a key differentiator for manufacturers catering to specific dietary needs.

Insoluble saccharin, in contrast, does not dissolve in water and is less commonly used in mainstream food and beverage products. However, it plays a significant role in specific industrial processes and is an intermediate in synthesizing other saccharin salts. While its market size is smaller than that of sodium and calcium saccharin, acid saccharin’s growth is supported by specialized demand in chemical and manufacturing industries.

Distribution Channel Insights

Offline channels, which include traditional retail outlets, supermarkets, specialty stores, direct sales, and wholesale distributors, continue to dominate the market, accounting for over 70% of saccharin sales in 2024. The primary reason for the sustained growth of offline channels is the widespread availability of saccharin products in brick-and-mortar stores, which provides consumers with immediate access and the ability to inspect products before purchase. This is especially significant in emerging economies, where in-store shopping is preferred due to established consumer habits and trust in physical retail environments. Additionally, offline channels benefit from established supply chains and relationships with institutional buyers in the food and beverage, pharmaceutical, and personal care industries.

Saccharin sales through online channels are expected to grow at a CAGR of 6% from 2025 to 2030. Online distribution channels, encompassing both B2B e-commerce platforms and B2C portals, are rapidly gaining traction in the saccharin market. The growth of online channels is fueled by the increasing penetration of smartphones and internet access, making it easier for consumers and businesses to purchase saccharin products from anywhere. The convenience of online shopping, access to a broader product selection, and the availability of detailed product information and customer reviews have empowered consumers to make informed purchasing decisions. The COVID-19 pandemic further accelerated this trend, as more consumers turned to digital platforms for safe, contactless shopping experiences. Moreover, online channels enable manufacturers to reach a broader customer base without the geographic limitations of traditional retail, supporting market expansion into new regions and demographics.

Application Insights

The food and beverage industry was the largest consumer of saccharin and is expected to grow at a CAGR of 5.8% over the forecast period. In the food and beverage industry, saccharin is extensively used as a non-nutritive sweetener to provide sweetness without the added calories of sugar. Its high-intensity sweetness and stability under heat and acidic conditions make it ideal for a wide range of products, including soft drinks, diet sodas, baked goods, jams, yogurts, ice creams, sauces, and condiments. The primary reason for the growth of saccharin use in this sector is the increasing consumer demand for healthier, low-calorie, and sugar-free food options. Manufacturers are leveraging saccharin to reduce sugar content in their offerings, catering to the needs of calorie-conscious consumers and those managing conditions like obesity and diabetes. Additionally, regulatory pressures to lower sugar content in processed foods and beverages have further accelerated its adoption.

In the pharmaceutical industry, saccharin plays a crucial role as a sweetening agent in various drug formulations, including chewable tablets, liquid medications, and oral syrups. Its ability to mask the bitter or unpleasant taste of active pharmaceutical ingredients significantly enhances the palatability of medicines, which is particularly important for pediatric and geriatric patients. The growth in this application is driven by the need for patient-friendly formulations that improve compliance, especially among children and individuals sensitive to taste. Furthermore, saccharin’s non-nutritive nature makes it suitable for diabetic-friendly medications, and ongoing research and development in drug delivery systems continue to expand its use in innovative pharmaceutical products.

Tabletop sweeteners represent another significant application of saccharin, where it is marketed as a convenient, zero-calorie sugar substitute for direct use by consumers. The growth of this segment is fueled by rising health awareness and the increasing prevalence of conditions like diabetes, which drive consumers to seek alternatives to traditional sugar. Tabletop saccharin sweeteners are popular among individuals looking to manage their weight or blood sugar levels, and their convenience and versatility have broadened their appeal in both home and foodservice settings. The expansion of online retail platforms and greater product availability have also contributed to the steady rise in demand for saccharin-based tabletop sweeteners.

Regional Insights

The North America saccharin market dominated the global industry with a share of 37.16% and was valued at USD 158 million in 2024. The growth is primarily fueled by rising consumer awareness of health issues such as obesity and diabetes, which has led to a significant shift toward low-calorie and sugar-free products. The region’s robust food processing industry has embraced saccharin as a cost-effective and stable sweetener for various applications, including diet soft drinks, sugar-free candies, and pharmaceuticals. Regulatory support from agencies like the U.S. Food and Drug Administration (FDA), which has approved saccharin for numerous uses, further bolsters market confidence and encourages broader adoption by manufacturers. Major food and beverage companies have reformulated their products to meet consumer demand for healthier alternatives, increasing saccharin’s penetration in the market.

U.S. Saccharin Market Trends

In the U.S. saccharin industry, the demand is expected to reach USD 175 million by 2030, growing at a CAGR of 5.5% over the forecast period. In the U.S. specifically, the market is experiencing growth due to the increasing prevalence of diabetes and hyperglycemia and heightened efforts to reduce sugar consumption among the population. According to recent surveys, a substantial portion of Americans actively seek to reduce or eliminate sugar from their diets, with younger generations such as Gen Z and millennials showing a powerful preference for low- or no-calorie sweeteners. This trend is supported by greater product availability and awareness, making saccharin an attractive option for both consumers and manufacturers seeking to offer healthier choices.

Asia Pacific Saccharin Market Trends

Asia Pacific saccharin industry is expected to grow at a CAGR of 6% from 2025 to 2030. Rapid urbanization, rising disposable incomes, and a growing population have led to increased demand for processed and convenience foods, many of which utilize saccharin as a sugar substitute. Additionally, heightened health awareness and the rising incidence of diabetes and obesity are prompting consumers to seek out low-calorie sweeteners. Countries like China and India are at the forefront of this expansion, with manufacturers capitalizing on the cost-effectiveness and versatility of saccharin in food, beverage, pharmaceutical, and personal care products. The region’s dynamic market environment, with ongoing investments and product innovation, is expected to sustain strong growth in the years ahead.

Key Saccharin Company Insights

The competitive landscape of the saccharin market is characterized by a mix of established multinational corporations, regional leaders, and specialized manufacturers, all vying for market share in a steadily growing industry. Globally, the market is anchored by legacy players such as BASF SA, Merck KGaA, and PMC Specialties Group, alongside prominent Asian suppliers like A.H.A International Co., Ltd., Ace Ingredients Co., Ltd., and Kaifeng Xinghua Fine Chemical Ltd. These companies leverage advantages in scale, integrated R&D, and regional supply chains to serve diverse end-user industries, from food and beverage to pharmaceuticals and personal care.

Key Saccharin Companies:

The following are the leading companies in the saccharin market. These companies collectively hold the largest market share and dictate industry trends.

- Henan Kaifeng Pingmei Shenma Xinghua Fine Chemical Co., Ltd.

- Salvi Chemical Industries Ltd.

- Vishnu Chemicals Ltd.

- JMC Corporation

- Shanghai Fortune Techgroup Co. Ltd.

- Tianjin Changjie Chemical Co. Ltd.

- Kyung-In Synthetic Corporation

- Sigma-Aldrich Corp (Merck KGaA)

- Cumberland Packing Corp

- PMC Specialties Group

- Productos Aditivos SA

- Mubychem Group

- Shree Vardayini Chemical Industries Pvt Ltd.

- Foodchem

- Anhui Suntran Chemical

Saccharin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 448.8 million

Revenue forecast in 2030

USD 590.2 million

Growth rate

CAGR of 5.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Henan Kaifeng Pingmei Shenma Xinghua Fine Chemical Co., Ltd.; Salvi Chemical Industries Ltd.; Vishnu Chemicals Ltd.; JMC Corporation; Shanghai Fortune Techgroup Co. Ltd.; Tianjin Changjie Chemical Co. Ltd.; Kyung-In Synthetic Corporation; Sigma-Aldrich Corp (Merck KGaA); Cumberland Packing Corp; PMC Specialties Group; Productos Aditivos SA; Mubychem Group; Shree Vardayini Chemical Industries Pvt Ltd.; Foodchem; Anhui Suntran Chemical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Saccharin Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. Grand View Research has segmented the global saccharin market report by product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sodium Saccharin

-

Calcium Saccharin

-

Liquid Saccharin

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Pharmaceuticals

-

Pharmaceuticals

-

Tabletop Sweetener

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The sodium saccharin market is expected to exceed USD 375 million by 2030. Sodium saccharin is the most widely used form due to its high water solubility and intense sweetness, which is approximately 300–500 times that of regular sugar. Its versatility makes it ideal for various applications, including soft drinks, baked goods, candies, jams, and various sugar-free snacks. Additionally, sodium saccharin is extensively used in oral care products such as toothpaste and mouthwash to mask bitterness and enhance flavor. The pharmaceutical industry also relies on sodium saccharin to improve the palatability of medicines, syrups, and chewable tablets. The growth of sodium saccharin is driven by its cost-effectiveness, stability under various conditions, and the increasing consumer demand for low-calorie and sugar-free products.

b. Some of the key players operating in the market include Henan Kaifeng Pingmei Shenma Xinghua Fine Chemical Co., Ltd.; Salvi Chemical Industries Ltd.; Vishnu Chemicals Ltd.; JMC Corporation; Shanghai Fortune Techgroup Co. Ltd.; Tianjin Changjie Chemical Co. Ltd.; Kyung-In Synthetic Corporation; Sigma-Aldrich Corp (Merck KGaA); Cumberland Packing Corp; PMC Specialties Group; Productos Aditivos SA; Mubychem Group; Shree Vardayini Chemical Industries Pvt Ltd.; Foodchem; Anhui Suntran Chemical

b. One of the primary drivers is the rising consumer demand for low-calorie sweeteners, propelled by increasing health consciousness and the prevalence of lifestyle-related diseases such as obesity and diabetes. As more individuals become aware of the adverse effects of excessive sugar consumption, they are seeking healthier alternatives, making saccharin—an artificial sweetener with zero calories—a popular choice.

b. The global saccharin market was valued at USD 425 million in 2024 and is expected to reach USD 448.8 million in 2025.

b. The global saccharin market is expected to grow at a CAGR of 5.6% from 2025 to 2030 to reach USD 590.2 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.