- Home

- »

- Communication Services

- »

-

Satellite Data Services Market Size, Industry Report, 2030GVR Report cover

![Satellite Data Services Market Size, Share & Trends Report]()

Satellite Data Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Image Data Service, Data Analytics Service), By Application, By Deployment, By End-use (Commercial, Government & Military), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-211-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite Data Services Market Summary

The global satellite data services market size was estimated at USD 12,115.2 million in 2024 and is projected to reach USD 29,587.9 million by 2030, growing at a CAGR of 16.3% from 2025 to 2030. There is a rising need for high-resolution satellite imagery across various industries, including agriculture, defense, and environmental monitoring.

Key Market Trends & Insights

- North America satellite data services market dominated the global market, with a share of over 36% in 2024.

- The satellite data services market in Asia Pacific is expected to grow at the highest CAGR of over 19% from 2025 to 2030.

- Based on end-use, the commercial segment accounted for the largest market share in 2024.

- Based on application, the defense & security segment dominated the market with a market share of over 25% in 2024.

- Based on services, the image data service segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12,115.2 Million

- 2030 Projected Market Size: USD 29,587.9 Million

- CAGR (2025-2030): 16.3%

- North America: Largest market in 2024

This demand is driven by the necessity for accurate data to inform decisions related to climate change, resource management, and security operations, as highlighted by the deployment of advanced satellites like the Space-Based Infrared System for military applications.

The government initiatives and investments in space exploration and satellite technology have bolstered the market. Many countries focus on developing satellite programs to strengthen their capabilities in gathering and utilizing data for national security, infrastructure development, and resource management. This governmental support enhances technological advancements and encourages private-sector participation, expanding the satellite data services industry.

In addition, increasing global focus on sustainability and climate change further drives demand. Satellite data plays a vital role in helping monitor environmental changes, tracking natural disasters, and supporting climate-related research. As organizations and governments strive to meet sustainability goals, the demand for satellite data services has surged, providing insights essential for planning and implementing effective environmental policies.

Furthermore, the growing integration of satellite data with other emerging technologies, such as the Internet of Things (IoT) and big data analytics, fosters the development of new applications and services. This convergence allows for more sophisticated data analysis and enhanced decision-making capabilities, appealing to a broader range of industries. As these technologies continue to evolve, the market is expected to witness further growth driven by innovative solutions and applications, thereby boosting the satellite data services industry expansion.

Moreover, the rise of smart cities creates a substantial market for real-time satellite data. Urban planners and policymakers use satellite data to monitor urban growth, traffic patterns, and infrastructure development. By harnessing real-time insights, they can address urban challenges more effectively, improving residents' quality of life. As the demand for real-time data continues to grow across various sectors, the satellite data services industry is expected to experience further expansion.

End-use Insights

The commercial segment accounted for the largest market share in 2024, as businesses increasingly recognize the value of satellite data for competitive advantage. Industries such as retail, logistics, and telecommunications utilize satellite imagery for market analysis, supply chain optimization, and site selection. Moreover, the rise of e-commerce and global supply chains has heightened the demand for satellite data to track assets and optimize routes. Innovations in data analytics and machine learning are further enhancing the ability of companies to extract actionable insights from satellite data, driving growth in this segment.

Service providers is expected to witness a significant CAGR from 2025 to 2030. Key service providers in this segment include Lockheed Martin, Northrop Grumman, and Boeing, which offer advanced defense systems and AI-integrated solutions. Satellite providers like Maxar Technologies and ICEYE supply intelligence imagery that supports surveillance and disaster management needs. L3Harris and Thales focus on secure communications, while AWS and Microsoft Azure provide critical cloud storage and computing capabilities. These providers align with the government’s need for robust, adaptive technology tailored for global defense and emergency response.

Application Insights

The defense & security segment dominated the market with a market share of over 25% in 2024, propelled by rising geopolitical tensions and the increasing need for national security. Governments invest heavily in satellite surveillance, reconnaissance, and intelligence-gathering capabilities to enhance situational awareness and response strategies. Integrating advanced technologies such as artificial intelligence and machine learning in analyzing satellite data further augments defense agencies' capabilities. Furthermore, the shift towards cyber defense and the need to monitor critical infrastructure are expanding the role of satellite data in security applications.

The environmental & climate monitoring segment is expected to witness the highest CAGR of over 19% from 2025 to 2030, owing to heightened awareness of climate change and environmental degradation. Satellite data provides critical insights into land use, deforestation, water quality, and air pollution, facilitating better environmental management and policymaking. Governments, NGOs, and research organizations increasingly rely on satellite imagery to monitor compliance with environmental regulations and assess the impact of climate-related initiatives. This focus on sustainability and conservation efforts drives the demand for accurate and timely satellite data.

Services Insights

The image data service segment accounted for the largest market share in 2024, fueled by the growing demand for high-resolution satellite imagery across industries such as agriculture, defense, and urban planning, as it enables more detailed data analysis. Enhanced imaging helps monitor changes in vegetation, infrastructure development, and military activities with precision. High-resolution data services also support environmental studies by providing in-depth visuals on terrain and natural resources. Companies invest in higher-quality optics and sensors to improve image clarity and usability. This trend reflects the increasing need for highly detailed, actionable satellite images.

Data analytics service is expected to witness the highest CAGR from 2025 to 2030 due to the increasing demand for actionable insights across industries such as agriculture, defense, environmental monitoring, and urban planning. Advances in AI, machine learning, and big data processing have enhanced the ability to extract meaningful patterns from vast amounts of satellite imagery and geospatial data. Businesses and governments increasingly rely on satellite-based analytics for real-time decision-making, predictive modeling, and risk assessment.

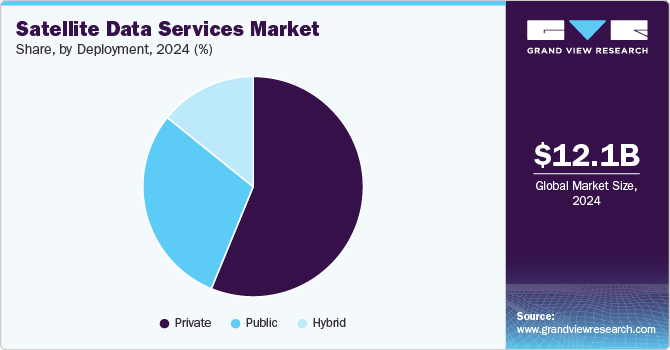

Deployment Insights

The private segment accounted for the largest market share in 2024 due to the increasing involvement of commercial satellite operators and the growing demand for high-resolution Earth observation, geospatial analytics, and real-time satellite imagery. Advancements in small satellite constellations, lower launch costs, and improvements in data processing capabilities have enabled private companies to offer cost-effective and scalable satellite data solutions. The rise of cloud-based analytics, AI-driven data processing, and government partnerships with private firms for satellite-based services have further strengthened the dominance of the private segment in the market.

The public segment is expected to witness the highest CAGR from 2025 to 2030 due to substantial government investments in space programs, Earth observation missions, and national security initiatives. Public agencies, including NASA, ESA, and national defense organizations, continue to drive demand for satellite data for applications such as climate monitoring, disaster response, border surveillance, and infrastructure planning. Moreover, governments increasingly leverage satellite data for policy-making, environmental protection, and agricultural management. The expansion of open data initiatives and collaborations between public agencies and private satellite operators have further strengthened the public segment, ensuring widespread accessibility and utilization of satellite-derived insights.

Regional Insights

North America satellite data services market dominated the global market, with a share of over 36% in 2024. AI and machine learning are revolutionizing satellite data processing, making data analysis faster and more accurate across North America. This integration allows for automation in satellite image analysis, reducing the need for human intervention and minimizing errors, which is crucial for applications like agriculture, forestry, and security. Adopting AI algorithms also enhances real-time decision-making, with faster insights into crop health, soil conditions, and even national security threats.

U.S. Satellite Data Services Market Trends

The satellite data services market in U.S. is expected to grow at a CAGR of over 15% from 2025 to 2030. Due to the urgency of addressing climate change, the U.S. increasingly relies on satellite data for environmental monitoring and climate analysis. Satellite imagery is essential for tracking wildfires, deforestation, and pollution levels, providing real-time data that aid in immediate response efforts. Federal agencies, research organizations, and private companies use this data to monitor coastline changes, predict extreme weather events, and guide environmental policies.

Europe Satellite Data Services Market Trends

The satellite data services market in Europe is expected to grow at a CAGR of over 14% from 2025 to 2030. European countries use satellite data to monitor maritime borders, track illegal fishing, and combat piracy, especially in the Mediterranean and the Baltic regions. Satellite imagery aids in tracking vessel movements, enforcing territorial waters, and preventing smuggling activities. Collaborations between national defense agencies and EU bodies support satellite-based maritime surveillance, enhancing the safety of shipping routes and coastal areas.

The UK satellite data services market is expected to grow significantly in the coming years. The financial and insurance industries in the UK are turning to satellite data for risk assessment, asset management, and fraud prevention. Satellite imagery provides real-time monitoring of insured assets like properties, vehicles, and farmland, enhancing accuracy in claim validation and reducing fraudulent claims. Financial institutions also use satellite data to evaluate climate-related risks and investment opportunities, particularly in sectors like renewable energy and real estate.

The satellite data services market in Germany is fueled by rising demand for high-resolution satellite imagery, driven by sectors such as agriculture, urban planning, and environmental monitoring. High-resolution data helps clients gain detailed insights, allowing them to make more precise, data-driven decisions for specific locations. German providers are investing in advanced imaging technologies to meet this demand, including multi-spectral and high-frequency data capture.

Asia Pacific Satellite Data Services Market Trends

The satellite data services market in Asia Pacific is expected to grow at the highest CAGR of over 19% from 2025 to 2030. There is a surge in investment across the Asia Pacific region in earth observation programs that utilize satellite imagery for environmental monitoring and management. Countries prioritize satellite services to support conservation efforts and ensure compliance with environmental regulations. This trend emphasizes the role of satellite imagery in promoting sustainable practices and informing policy decisions related to environmental protection. As awareness of environmental issues grows, the demand for earth observation data is set to expand.

Japan satellite data services market is gaining traction owing to the growing adoption of hybrid cloud solutions. This approach combines both public and private cloud infrastructures, allowing organizations to optimize data storage and processing capabilities while maintaining security. By leveraging hybrid models, companies can efficiently manage large volumes of satellite data, ensuring scalability and flexibility in operations.

The satellite data services market in China is rapidly expanding. China increasingly integrates advanced technologies such as artificial intelligence (AI) and cloud computing into its satellite data services. These technologies enhance data analysis capabilities, enabling users to derive actionable insights from vast amounts of satellite data. For instance, AI-powered platforms can process imagery more efficiently and accurately, mitigating issues like cloud cover that traditionally hindered data quality.

Key Satellite Data Services Company Insights

Some key players operating in the market include Airbus SE and Maxar Technologies, Inc.

-

Maxar Technologies, Inc. is a premier provider of space-based solutions with expertise in satellite technology, Earth intelligence, and geospatial services. The company utilizes advanced satellite imagery and data analytics to deliver critical insights for sectors such as defense, intelligence, and environmental monitoring. With its high-resolution satellites, Maxar gathers data that informs strategic decision-making in areas like climate change, national security, and infrastructure management.

-

Airbus SE is known for innovative solutions in commercial aviation, helicopters, defense, and space sectors. The company operates through multiple segments: Commercial Aircraft, Helicopters, and Defense and Space, providing diverse products from passenger jets to satellite and defense systems. Airbus excels in satellite data services, supporting various industries with Earth observation, navigation, and communication solutions. In satellite data services, Airbus offers high-resolution imagery and geospatial intelligence, enabling advanced analytics for defense, environmental monitoring, and resource management applications worldwide.

Earth-i Ltd and Ursa Space Systems Inc. are some of the emerging market participants.

-

Earth-i Ltd is a prominent provider of geospatial data analytics, leveraging Earth observation technology and AI to deliver critical insights for business and government decision-making. The company operates through segments like consultancy, data sales, and customized information services that reduce cost and complexity barriers, making advanced geospatial intelligence accessible even for non-specialists.

-

Ursa Space Systems Inc. offers advanced geospatial data and analytics, leveraging radar satellite technology to provide aerial and space-based insights across industries. Operating primarily in energy, finance, and government sectors, Ursa Space delivers alternative data products that enhance decision-making accuracy and transparency. Its product offerings supply global economic and market insights, supporting clients in making informed, data-driven choices.

Key Satellite Data Services Companies:

The following are the leading companies in the satellite data services market. These companies collectively hold the largest market share and dictate industry trends.

- Maxar Technologies Holdings Inc. (Maxar)

- Planet Labs PBC.

- Airbus SE

- ICEYE

- L3Harris Technologies, Inc.

- Earth-i Ltd

- Geocento Limited

- NV5 Global, Inc.

- Satellite Imaging Corporation

- Satpalda

- Telstra

- Ursa Space Systems Inc.

- Geospatial Intelligence Pty Ltd

Recent Developments

-

In September 2024, ICEYE US announced its selection by NASA for a five-year contract to supply synthetic aperture radar (SAR) data through NASA’s Commercial Smallsat Data Acquisition Program. The initiative, which has utilized commercial data since 2020, aims to enhance NASA’s Earth Science Division in achieving its research and application goals.

-

In September 2024, Planet Labs signed a three-year agreement with the German Space Agency at the German Aerospace Center, enabling Planet to provide Earth observation data and products to support German researchers. The agreement grants access to PlanetScope's advanced monitoring tools, including PlanetScope’s and RapidEye's extensive imagery archives, supporting R&D activities across Germany.

-

In June 2024, Ursa Space Systems partnered with NEC Corporation to offer satellite image analysis services through one of the largest "virtual constellations" of SAR and optical satellites worldwide. By combining NEC’s SAR-based monitoring with Ursa’s global image analysis platform, the partnership initially targets Japanese enterprises with plans for global expansion. This collaboration aims to strengthen efforts in disaster prevention, infrastructure management, and environmental monitoring, addressing complex global challenges.

Satellite Data Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.91 billion

Revenue forecast in 2030

USD 29.59 billion

Growth rate

CAGR of 16.3% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deployment, service, end-use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Maxar Technologies Holdings Inc. (Maxar); Planet Labs PBC; Airbus SE; ICEYE; L3Harris Technologies, Inc.; Earth-i Ltd; Geocento Limited; NV5 Global, Inc.; Satellite Imaging Corporation; Satpalda; Telstra; Ursa Space Systems Inc.; Geospatial Intelligence Pty Ltd

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Satellite Data Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global satellite data services market report based on application, deployment, service, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Defense & Security

-

Energy & Utilities

-

Agriculture & Forestry

-

Environmental & Climate Monitoring

-

Engineering & Infrastructure Development

-

Marine

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

Hybrid

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Image Data Service

-

Data Analytics Service

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Government and Military

-

Service Providers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global satellite data services market size was estimated at USD 12.12 billion in 2024 and is expected to reach USD 13.91 billion in 2025.

b. The global satellite data services market is expected to grow at a compound annual growth rate of 16.3% from 2025 to 2030 to reach USD 29.59 billion by 2030.

b. The defense & security segment dominated the market with a market share of 25.4% in 2024. This is attributable to the rising geopolitical tensions and the increasing need for national security.

b. Some of the key players in the global satellite data services market include Maxar Technologies Holdings Inc. (Maxar), Planet Labs PBC, Airbus SE, ICEYE, L3Harris Technologies, Inc., Earth-i Ltd, Geocento Limited, NV5 Global, Inc., Satellite Imaging Corporation, Satpalda, Telstra, Ursa Space Systems Inc., and Geospatial Intelligence Pty Ltd

b. Key factors that are driving the market growth include technological proliferation in satellite data services industry, miniaturization of sensors and satellites, and incrementing demand for small sized satellites.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.