- Home

- »

- Advanced Interior Materials

- »

-

Shell And Tube Heat Exchanger Market Size Report, 2030GVR Report cover

![Shell And Tube Heat Exchanger Market Size, Share & Trends Report]()

Shell And Tube Heat Exchanger Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Hastelloy, Steel, Nickel & Nickel Alloys, Tantalum), By End Use (Power Generation, Chemical), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-674-5

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Shell And Tube Heat Exchanger Market Summary

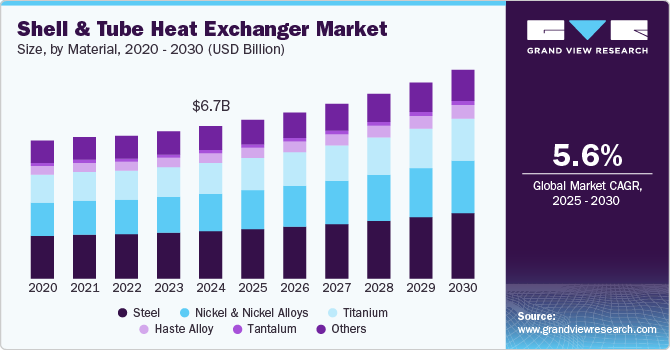

The global shell and tube heat exchanger market size was estimated at USD 6,724.4 million in 2024 and is projected to reach USD 9,203.2 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. Shell & tube heat exchangers have become increasingly popular due to rapid industrialization in the emerging countries of Asia and the Pacific and expanding investments in commercial, manufacturing, and industrial projects.

Key Market Trends & Insights

- The North America shell & tube heat exchanger market is accounted with the revenue share of 20.6% in 2024.

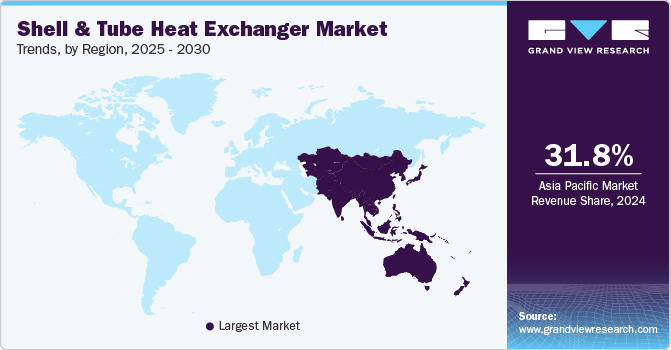

- Asia Pacific dominated the shell & tube heat exchanger market with the largest revenue share of 31.8% in 2024.

- The Europe shell & tube heat exchanger market is accounted for the revenue share of 31.6% in 2024.

- Based on material, the steel material segment led the market with the largest revenue share of 31.2% in 2024.

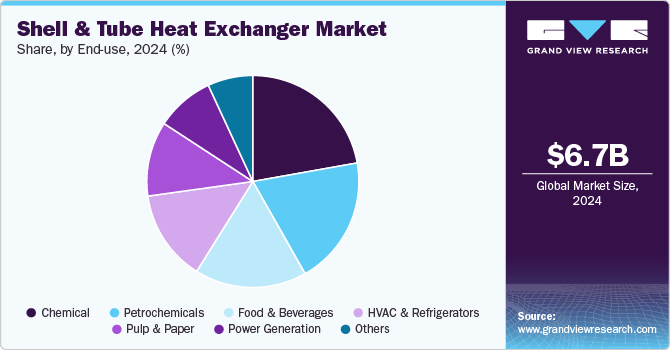

- Based on end use, the chemical segment led the market with the revenue share of 22.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,724.4 Million

- 2030 Projected Market Size: USD 9,203.2 Million

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

The expanded use of the product across a wide range of end use industries, including petrochemicals, power generation, HVAC & refrigeration, chemicals, and food & beverage, is expected to surge the market growth. Shell & tube heat exchangers are used in a wide variety of industries for pharmaceutical products for the market, refining oil, ensuring that food and dairy products are safe to eat, and helping breweries create the perfect pint of beer, among other use cases. These equipment are designed and manufactured in line with appropriate industry standards. The three combinations of shell & tube heat exchangers, namely, fixed tube sheet exchangers, U-tube exchangers, and floating header exchangers, are primarily used.

The parameters considered while designing the shell & tube heat exchangers include diameter layout, pitch, the number of tubes, type & position of baffles, and type of shell. Other technical specifications related to mechanical & thermal design include shell-side flow distribution, tube-side pressure drop, mean temperature difference, overall heat transfer coefficient, shell thickness, and flange thickness, among others. These factors play an important role in designing the product.

Drivers, Opportunities & Restraints

The market is primarily driven by the growing demand for energy-efficient solutions across various industries, including oil and gas, chemical processing, and HVAC. As industries focus on reducing energy consumption and operational costs, the efficiency and reliability of shell and tube heat exchangers make them an attractive option. In addition, stringent regulations regarding emissions and energy use are pushing companies to adopt advanced heat exchanger technologies that comply with environmental standards.

Despite their advantages, the shell and tube heat exchanger market faces several restraints, including high initial installation and maintenance costs. These systems often require significant investment in materials and fabrication, which can deter smaller companies from adopting them. Furthermore, the complexity of design and the potential for fouling can lead to increased downtime and operational challenges, making some businesses hesitant to invest in these systems.

The market presents substantial opportunities driven by advancements in materials and manufacturing technologies, which can enhance the performance and lifespan of shell and tube heat exchangers. Innovations such as the use of corrosion-resistant materials and the integration of smart monitoring systems can improve efficiency and reliability. In addition, the rising emphasis on renewable energy and sustainable practices opens new avenues for shell and tube heat exchangers in industries like solar thermal and waste heat recovery, providing a platform for growth and innovation.

Material Insights

“The demand for the nickel & nickel alloys material segment is expected to grow at a significant CAGR of 6.1% from 2025 to 2030 in terms of revenue.”

Based on material, the steel material segment led the market with the largest revenue share of 31.2% in 2024. Due to the growing demand for highly efficient plant operations and the elimination of expensive plant shutdowns, stainless steel shell & tube heat exchanger sales are expected to increase significantly. The material's low cost aids in increasing its uptake in a variety of end use sectors. It is anticipated that the characteristics of stainless steel, such as its resistance to corrosion in chemical environments and cooling waters, high-temperature resistance to scaling and oxidation, good strength in low- and high-temperature applications, and resistance to fouling caused by corrosion, will increase material penetration in heat exchangers.

The nickel and nickel alloys segment is driven by the increasing demand for materials that offer superior corrosion resistance and durability in harsh operating environments. These materials are particularly favored in industries such as petrochemical, pharmaceutical, and marine, where exposure to aggressive chemicals and extreme temperatures is common. Nickel alloys provide enhanced performance and longevity, reducing maintenance costs and downtime associated with corrosion-related failures. As industries prioritize reliability and efficiency, the shift towards nickel and nickel alloy heat exchangers is becoming a key factor in their adoption.

End Use Insights

“The demand for the petrochemicals application segment is expected to grow at a significant CAGR of 6.7% from 2025 to 2030 in terms of revenue.”

Based on end use, the chemical segment led the market with the revenue share of 22.2% in 2024. Shell & tube heat exchangers play a crucial role in the chemical industry, facilitating efficient heat transfer in various processes such as reaction, distillation, and cooling. Their design allows for high-pressure and high-temperature operations, making them ideal for handling corrosive fluids and harsh operating conditions typical in chemical manufacturing. These heat exchangers are used for heating or cooling process streams, recovering heat from exothermic reactions, and condensing vapours in distillation columns. Their versatility, robustness, and ability to accommodate large surface areas make them essential for optimizing energy efficiency and enhancing overall process performance in the chemical industy.

The petrochemicals segment is primarily driven by the increasing global demand for petrochemical products, such as plastics, fertilizers, and synthetic fibers. As the petrochemical industry expands to meet the needs of various sectors, including automotive, construction, and consumer goods, the efficiency and effectiveness of heat exchangers become critical for optimizing production processes. Shell & tube heat exchangers are preferred for their ability to handle high-pressure and high-temperature applications, making them essential for processes like refining and chemical reactions. In addition, the industry's focus on energy efficiency and sustainability further propels the need for advanced heat exchanger solutions that minimize energy consumption and improve overall process performance.

Regional Insights

“India to witness fastest market growth at 7.8% CAGR”

The North America shell & tube heat exchanger market is accounted with the revenue share of 20.6% in 2024. The North American economy is the largest and strongest globally and is witnessing significant growth owing to the industrial dynamics and commodity abundance in its countries. The region includes the U.S., Mexico, and Canada, which are significant and complex economic systems. Increasing oil & gas exploration activities in the U.S. and Canada are expected to drive the demand for shell & tube heat exchangers in the region. Surging energy demand in various industrial and commercial sectors is expected to drive power and energy sectors over the forecast period.

U.S. Shell And Tube Heat Exchanger Market

The U.S. shell & tube heat exchanger market is expected to grow at a substantial CAGR of 4.7% from 2025 to 2030. The chemical industry is the largest manufacturing industry in the country and serves both domestic and export needs. Shell & tube heat exchangers are used in the manufacturing of chemicals in industrial chemical production. Moreover, in an industrial process, shell & tube heat exchangers are required for cooling, heating, and mixing a substance at a required temperature. The rapid expansion of the chemical industry in the country is expected to act as a major factor for steering the market growth.

The shell & tube heat exchanger market in Canada is expected to grow at a significant CAGR of 5.6% from 2025 to 2030. In Canada, the demand for shell and tube heat exchangers is driven by the country's robust energy sector, including oil and gas production, mining, and chemical manufacturing. As Canada continues to invest in energy efficiency and sustainable practices, industries are increasingly adopting advanced heat exchanger technologies to optimize their operations and reduce environmental impact.

The Mexico shell & tube heat exchanger market is expected to grow at the fastest CAGR of 6.0% from 2025 to 2030. Mexico's demand for shell and tube heat exchangers is fueled by its growing manufacturing sector, particularly in petrochemicals and food processing. The country is experiencing significant industrial growth, which necessitates improved thermal management solutions to enhance productivity and energy efficiency. Furthermore, investments in infrastructure and energy projects, along with increasing regulatory pressures to adopt environmentally friendly technologies, are driving the adoption of advanced heat exchangers.

Europe Shell And Tube Heat Exchanger Market Trends

The Europe shell & tube heat exchanger market is accounted for the revenue share of 31.6% in 2024. Increasing exploration & production activities in offshore areas are expected to drive the market growth over the forecast period. In addition, several upcoming oil & gas projects in the European region are expected to have a positive impact on the market in the coming years. Moreover, emissions and stringent EU directives on energy efficiency are likely to drive the demand for energy-efficient heat exchangers.

The Germany shell & tube heat exchanger market held a market share of 29.4% in Europe in 2024. Rising energy demand for space heating from commercial and residential buildings is expected to drive the power generation sector in the country in the coming years, which, in turn, is anticipated to drive the demand for shell & tube heat exchangers over the forecast period. Stringent regulations to reduce CO2 and greenhouse gas emissions are expected to drive the product demand across various end use industries.

The shell & tube heat exchanger market in the UK accounted for the market share of 10.2% in Europe in 2024. In the UK, the demand for shell and tube heat exchangers is largely driven by the need for efficient heat transfer solutions in key sectors such as oil and gas, chemical processing, and power generation. The UK’s commitment to reducing carbon emissions and enhancing energy efficiency has prompted industries to adopt advanced heat exchanger technologies that minimize energy consumption while maximizing operational reliability. In addition, ongoing investments in renewable energy projects and the upgrading of aging infrastructure are further fueling the demand for shell and tube heat exchangers as companies seek to modernize their systems and improve overall process efficiency.

Asia Pacific Shell And Tube Heat Exchanger Market Trends

Asia Pacific dominated the shell & tube heat exchanger market with the largest revenue share of 31.8% in 2024. The ongoing investments in the commercial and residential construction industry are expected to drive the demand for HVAC and refrigeration over the forecast period. Shell & tube heat exchangers play a crucial role in enhancing the overall energy efficiency of a heating or cooling system.

The shell & tube heat exchanger market in China accounted for the market share of 44.6% share in the Asia Pacific in 2024. In China, the demand for shell and tube heat exchangers is significantly driven by the rapid industrialization and urbanization occurring across the country. Key sectors such as petrochemicals, power generation, and HVAC are expanding rapidly, necessitating efficient thermal management solutions to support increased production capacities. China's focus on energy efficiency and reducing environmental impact has led to a rise in the adoption of advanced heat exchanger technologies that enhance performance while complying with stringent environmental regulations. Furthermore, government initiatives promoting clean energy and sustainable industrial practices are expected to boost the demand for shell and tube heat exchangers in various applications.

India shell & tube heat exchanger market accounted for the market share of 22.6% in Asia Pacific in 2024. India's demand for shell and tube heat exchangers is primarily fueled by the growth of its manufacturing and energy sectors, particularly in industries such as oil and gas, chemicals, and pharmaceuticals. As the country aims to enhance its industrial output and improve energy efficiency, there is a growing need for reliable and efficient heat transfer solutions. The push towards modernization and sustainability in industrial processes, coupled with government initiatives to promote clean energy, is driving the adoption of advanced heat exchanger technologies. In addition, the increasing investments in infrastructure development and urbanization are expected to further boost the demand for shell and tube heat exchangers across various applications in India.

Middle East & Africa Shell And Tube Heat Exchanger Market Trends

The shell & tube heat exchangers market in the Middle East & Africa (MEA) is primarily characterized by the growing HVAC and petrochemical sectors. Ongoing mega construction projects in commercial, residential, and hospitality segments are expected to drive the HVAC market over a long period. The rising population, coupled with surging energy demand in countries such as the UAE and Saudi Arabia is expected to propel the demand for energy-efficient equipment over the forecast period.

The Saudi Arabia shell & tube heat exchanger market accounted with a market share of 26.7% in the Middle East & Africa in 2024. The Kingdom of Saudi Arabia is a predominantly oil-based economy with a majority of economic activities controlled by the government in the country. However, the government is making an effort to boost the growth of non-oil industries, thereby driving the growth of the manufacturing sector. Thus, the presence of a robust oil & gas sector coupled with the growth of the manufacturing sector is anticipated to drive the demand for shell & tube heat exchangers in petrochemical & heavy machinery equipment applications over the forecast period.

Latin America Shell And Tube Heat Exchanger Market Trends

The shell & tube heat exchanger market in Latin America accounted for a market share of 7.8% in 2024. The robust presence of oil & gas reserves in Brazil, Argentina, Venezuela, and Columbia is expected to have a positive impact on the market. In addition, the high potential of tight oil & gas in the Vaca Muerta field of Argentina is expected to augment the demand for new oil & gas refineries over the forecast period. This, in turn, is expected to boost the utilization of shell & tube heat exchangers over the forecast period.

The Brazil shell & tube heat exchanger market accounted for the market share of 36.5% in Central & South America in 2024. Brazil shell & tube heat exchangers market is expected to witness significant growth owing to a considerable rise in construction activities in industrial and commercial markets. An increase in the establishment of independent power plants coupled with advancements in technology is anticipated to fuel the product demand in Brazil over the forecast period.

Key Shell And Tube Heat Exchanger Company Insights

Some of the key players operating in the global market include Alfa Laval, API Heat Transfer, and Xylem.

-

Alfa Laval was incorporated in 1883 and is headquartered in Lund, Sweden. The company’s business line is segmented based on three major technologies, namely heat transfer, separation, and fluid handling. Products offered under the heat transfer technology segment include numerous types of shell and tube heat exchangers that are designed for different temperatures and pressure levels. The segment accounted for around 44% of the total group sales in 2018. The separation technology segment offers products such as separators, decanter centrifuges, strainers, filters, and membranes. The fluid handling technology segment provides various products, including valves, pumps, tank cleaning equipment, and installation material

-

API Heat Transfer was incorporated in 1947 and is headquartered in Buffalo, New York, U.S. The company’s business line is focused on manufacturing and supplying heat transfer equipment. It markets its products under five brands, namely AirTech, Basco, Covrad, Schmidt, and TTP. Furthermore, the company operates through four heat transfer groups, namely air-cooled, Shell & Tube, Plate & Thermal Systems, and Fluid Power & Distributed Products, which provide optimal heat transfer solutions for required applications. Major products offered by the company include gasketed plate, brazed plate, welded plate, plate & shell, shell & tube heat exchangers, air coolers, radiators, evaporation systems, dealcoholization systems, and pasteurization systems

Kelvion Holding GmbH and HRS Heat Exchangers are some of the emerging players in the global market.

-

Kelvion Holding GmbH was established in 1920 as Gesellschaft für Entstaubungs-Anlagen (GEA). GEA Heat Exchangers was acquired by the Triton fund in 2014 and was renamed as Kelvion, post-acquisition in November 2015. Kelvion Holding GmBH had around 4,700 employees as of December 2019 and the company operates as a standalone company and is managed under Galapagos Holding S.A. The company’s business line is focused on manufacturing and supply of heat exchangers to HVAC, chemical, oil & gas, power generation, and food & beverage industries. Heat exchangers offered by the company are broadly categorized as compact fin heat exchangers, shell & tube heat exchangers, plate heat exchangers, and single tube heat exchangers. Other products in the company’s product portfolio include transformer cooling systems and cooling towers

-

HRS Heat Exchangers was established in 1981 and is headquartered in Watford, England. The company is engaged in designing and manufacturing effective and innovative heat transfer products such as heat exchangers. HRS Group markets its products to clients in the food, bioenergy, HVAC, chemical, pharmaceutical, and waste-to-energy

Key Shell And Tube Heat Exchanger Companies:

The following are the leading companies in the shell and tube heat exchanger market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Laval

- HRS Heat Exchangers

- Kelvion Holding GmbH

- API Heat Transfer

- Brask, Inc.

- Koch Heat Transfer Company

- Xylem Inc.

- WCR, Inc.

- Southern Heat Exchanger Corporation

- Manning and Lewis

- Elanco, Inc.

- Mersen

- Thermex

- Tinita Engineering Pvt. Ltd

- Barriquand Technologies Thermiques

Recent Developments

-

In September 2024, Alfa Laval launched three new heat exchangers at Chillventa 2024, specifically designed for propane (R290), CO2 (R744), and ammonia (R717) systems. Renowned for its engineering solutions in heat transfer, separation, and fluid handling across various sectors, including HVAC&R, power generation, and wastewater treatment, Alfa Laval is introducing these products for residential, commercial, and industrial applications. The new offerings include the SE series, AC900, and a semi-welded plate heat exchanger

Shell And Tube Heat Exchanger Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,999.0 million

Revenue forecast in 2030

USD 9,203.2 million

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; India; Japan; South Korea; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Alfa Laval; HRS Heat Exchangers; Kelvion Holding GmbH; API Heat Transfer; Brask, Inc.; Koch Heat Transfer Company; Xylem Inc.; WCR, Inc.; Southern Heat Exchanger Corporation; Manning and Lewis; Elanco, Inc.; Mersen; Thermex; Tinita Engineering Pvt. Ltd; Barriquand Technologies Thermiques

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

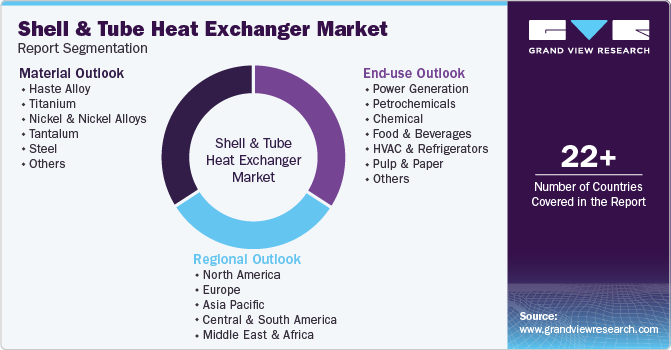

Global Shell And Tube Heat Exchanger Market Report Segmentation:

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shell and tube heat exchanger market report based on material, end use and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Haste Alloy

-

Titanium

-

Nickel & Nickel Alloys

-

Tantalum

-

Steel

-

Stainless Steel

-

Duplex Steel

-

Carbon Steel

-

Super Duplex Steel

-

Others

-

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Petrochemicals

-

Chemical

-

Food & Beverages

-

HVAC & Refrigerators

-

Pulp & Paper

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shell and tube heat exchanger market size was estimated at USD 6,724.4 million in 2024 and is expected to reach USD 6,999.0 million in 2025.

b. The global shell and tube heat exchanger market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 9,203.2 million by 2030.

b. The chemical end-use segment led the market and accounted for 22.2% of the global revenue share in 2024. Shell & tube heat exchangers play a crucial role in the chemical industry, facilitating efficient heat transfer in various processes such as reaction, distillation, and cooling. Their design allows for high-pressure and high-temperature operations, making them ideal for handling corrosive fluids and harsh operating conditions typical in chemical manufacturing.

b. Some of the key players operating in the shell and tube heat exchanger market include Alfa Laval; HRS Heat Exchangers; Kelvion Holding GmbH; API Heat Transfer; Brask, Inc.; Koch Heat Transfer Company; Xylem Inc.; WCR, Inc.; Southern Heat Exchanger Corporation; Manning and Lewis; Elanco, Inc.; Mersen; Thermex; Tinita Engineering Pvt. Ltd; Barriquand Technologies Thermiques, among others.

b. Shell & tube heat exchangers have become increasingly popular due to rapid industrialization in the emerging countries of Asia and the Pacific and expanding investments in commercial, manufacturing, and industrial projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.