- Home

- »

- Renewable Energy

- »

-

Silicon Photomultiplier Market Size & Share Report, 2030GVR Report cover

![Silicon Photomultiplier Market Size, Share & Trends Report]()

Silicon Photomultiplier Market Size, Share & Trends Analysis Report By Offering (Near Ultraviolet Silicon Photomultiplier, RGB Silicon Photomultiplier), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-366-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Silicon Photomultiplier Market Size & Trends

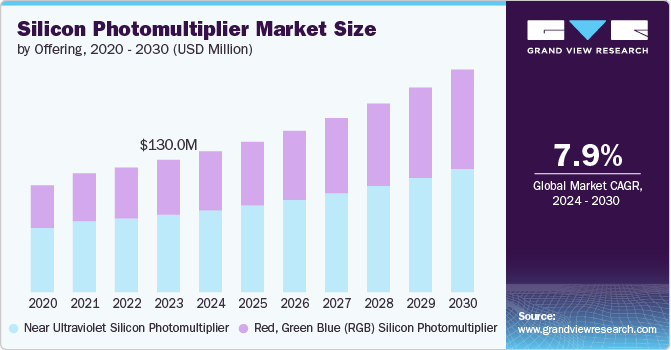

The global silicon photomultiplier market was estimated at USD 130.04 million in 2023 and is expected to grow at a CAGR of 7.9% from 2024 to 2030. This market growth is driven by the increasing demand for advanced imaging technologies in various applications, including medical imaging, automotive safety systems, and industrial automation. In the medical field, silicon photomultipliers are crucial in improving the accuracy and efficiency of diagnostic tools such as PET scanners, which are essential for early disease detection and monitoring.

The automotive industry also leverages these devices in advanced driver-assistance systems (ADAS) to enhance vehicle safety and autonomy. Moreover, the industrial sector benefits from silicon photomultipliers in areas like quality control and machine vision, where precise and reliable imaging is paramount. The rising adoption of silicon photomultipliers can be attributed to their superior performance characteristics, such as high sensitivity, low noise, and excellent timing resolution compared to traditional photomultiplier tubes. These advantages make them ideal for applications requiring high accuracy and reliability.

Additionally, the ongoing advancements in semiconductor technology are expected to further boost the market by reducing production costs and improving device performance. As industries continue to embrace these advanced imaging solutions, the silicon photomultiplier market is poised for substantial growth, reflecting a broader trend towards enhanced imaging capabilities across various sectors.

Drivers, Opportunities & Restraints

The global silicon photomultiplier market is propelled by growing demand for advanced imaging technologies in medical applications, such as positron emission tomography (PET) and computed tomography (CT) scans, which is a major driver. Silicon photomultipliers offer superior sensitivity and timing resolution, which are critical for accurate medical diagnostics and imaging. Additionally, the automotive industry’s increasing focus on safety and autonomous driving technologies is boosting the demand for these devices in advanced driver-assistance systems (ADAS) and LIDAR applications. The industrial sector also contributes to market growth by utilizing silicon photomultipliers in machine vision and quality control systems, where precision and reliability are essential.

Opportunities in the silicon photomultiplier market are abundant due to continuous advancements in semiconductor technology. These advancements are expected to enhance the performance and reduce the cost of silicon photomultipliers, making them more accessible and appealing to a broader range of applications. Emerging fields such as quantum computing and high-energy physics research also present significant opportunities for market expansion. Additionally, the growing trend of miniaturization in electronic devices opens new avenues for integrating silicon photomultipliers into compact, high-performance systems. As industries continue to innovate and develop new applications, the market for silicon photomultipliers is likely to see substantial growth.

However, the market faces certain restraints that could hinder its expansion. One major challenge is the high initial cost of silicon photomultiplier devices compared to traditional photomultiplier tubes, which can be a barrier for widespread adoption, especially in cost-sensitive applications. Additionally, technical challenges such as temperature sensitivity and the need for precise calibration can limit the performance and reliability of these devices in some environments. The market also encounters competition from alternative technologies, such as avalanche photodiodes and traditional photomultiplier tubes, which can impact market penetration. Addressing these challenges through technological innovation and cost reduction strategies will be crucial for the sustained growth of the silicon photomultiplier market.

Offering Insights

The Red, Green Blue (RGB) silicone photomultiplier segment led the market and accounted for over 58.00% revenue share in 2023. This dominance is largely attributed to the segment's superior performance in a variety of imaging applications. RGB silicon photomultipliers are particularly valued for their high sensitivity across different wavelengths, which makes them ideal for applications requiring precise color detection and differentiation. This feature is crucial in medical imaging, where accurate color representation can significantly enhance the diagnosis and monitoring of various conditions. Furthermore, their ability to provide high-resolution images with excellent timing resolution makes them indispensable in advanced diagnostic equipment such as PET and CT scanners.

Additionally, the widespread adoption of RGB silicon photomultipliers is driven by their versatility and integration capabilities in various technological applications beyond medical imaging. In the automotive industry, for instance, RGB sensors are essential for advanced driver-assistance systems (ADAS) and LIDAR, where accurate color and depth perception enhance vehicle safety and autonomous driving capabilities. In industrial automation, these sensors improve machine vision systems, enabling more precise quality control and inspection processes. The ongoing advancements in semiconductor technology also contribute to the segment's growth by continually improving the performance and reducing the costs of RGB Silicon Photomultipliers, further solidifying their market leadership.

Application Insights

Bio photonics and medical imaging segment led the market and accounted for over 40% of revenue share in 2023. This dominance is largely due to the critical role that silicon photomultipliers play in enhancing the performance of medical diagnostic tools. Silicon photomultipliers offer high sensitivity, excellent timing resolution, and low noise characteristics, making them ideal for applications such as positron emission tomography (PET) and computed tomography (CT) scans. These attributes significantly improve the accuracy and reliability of medical imaging, enabling early detection and better monitoring of diseases. As healthcare providers increasingly prioritize precision and efficiency in diagnostics, the demand for advanced imaging technologies incorporating silicon photomultipliers continues to rise.

Moreover, the biophotonics field benefits immensely from the integration of silicon photomultipliers in various research and clinical applications. These devices are essential in fluorescence microscopy, flow cytometry, and other techniques that require precise light detection and measurement. The ability of silicon photomultipliers to detect low levels of light with high accuracy makes them invaluable for studying biological processes at the molecular and cellular levels. Additionally, ongoing advancements in biophotonics and the expanding scope of medical research further drive the demand for these sophisticated imaging solutions. The continuous development and adoption of innovative medical technologies that rely on silicon photomultipliers ensure the segment's leading position in the market.

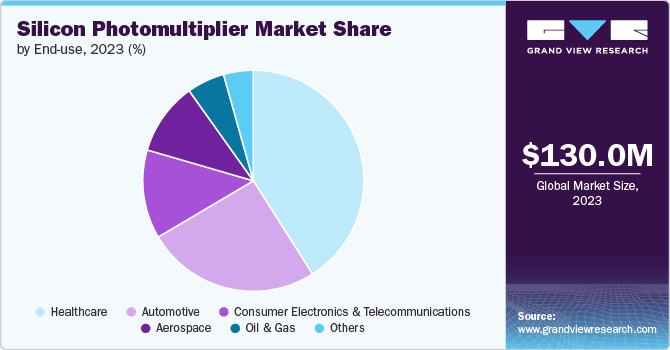

End-use Insights

The healthcare segment led the silicon photomultiplier market and accounted for more than 41.00% of revenue share in 2023. This segment's prominence can be attributed to the critical role of these devices play in advancing medical imaging and diagnostics. Silicon photomultipliers are essential components in cutting-edge medical technologies such as positron emission tomography (PET), computed tomography (CT), and single-photon emission computed tomography (SPECT). These devices offer superior sensitivity, excellent timing resolution, and low noise characteristics, which are crucial for capturing detailed images and detecting subtle abnormalities within the human body. The high sensitivity of silicon photomultipliers allows for the detection of even low levels of light emitted during medical imaging procedures, enabling healthcare professionals to achieve more accurate diagnoses and treatment planning.

Moreover, the continuous advancements in silicon photomultiplier technology have enabled significant improvements in medical imaging modalities, enhancing both the precision and efficiency of diagnostic procedures. By providing clearer and more detailed images, silicon photomultipliers contribute directly to improved patient outcomes by facilitating the early detection of diseases and monitoring treatment responses. The versatility of these devices extends beyond traditional imaging techniques, with applications expanding into fluorescence imaging and molecular imaging, which are critical for studying biological processes at the cellular and molecular levels.

This capability not only supports clinical diagnostics but also drives research in areas such as cancer biology, neurology, and cardiology, where precise imaging is paramount. Furthermore, the healthcare sector's adoption of silicon photomultipliers is bolstered by increasing investments in medical research and infrastructure globally. Healthcare providers and research institutions are continually seeking innovative technologies that can enhance diagnostic accuracy while improving patient care. As the demand for more sophisticated imaging solutions grows, driven by aging populations and rising healthcare expenditures, silicon photomultipliers are poised to play an increasingly pivotal role in shaping the future of medical imaging and healthcare delivery across the globe.

Regional Insights

North America silicon photomultiplier market accounted for over 33.00% revenue share in 2023. The market is experiencing robust growth, driven primarily by advancements in healthcare technology and the automotive sector. The region's strong focus on innovation and the presence of leading technology companies contribute to the widespread adoption of these devices. Additionally, the increasing investment in research and development, particularly in medical imaging and biophotonics, further propels market expansion. The United States and Canada are key players in this growth, with a significant number of startups and established companies continuously pushing the boundaries of silicon photomultiplier applications.

U.S. Silicon Photomultiplier Market Trends

The silicon photomultiplier market in the U.S. dominated in North America and accounted for a share of over 79.00% in 2023,due to its advanced healthcare infrastructure and significant investments in medical technology. The adoption of silicon photomultipliers in PET and CT scanners is growing, driven by the need for precise and early disease detection. Additionally, the U.S. automotive industry, with its strong emphasis on ADAS and autonomous vehicles, further boosts the demand for these sensors. The presence of major technology firms and research institutions also plays a crucial role in fostering innovation and market growth.

Silicon Photomultiplier Market in Canada is expected to grow at significant CAGR of 9.38% from 2024 to 2030. In Canada, the silicon photomultiplier market is bolstered by the country's strong focus on healthcare and medical research. Canadian universities and research institutions are increasingly utilizing these devices in biophotonics and advanced imaging applications. Additionally, Canada's automotive sector is gradually adopting silicon photomultipliers for safety and autonomous driving technologies, aligning with the global trend towards vehicle automation. The supportive government policies and funding for innovation further enhance the market prospects in the country.

Asia Pacific Silicon Photomultiplier Market Trends

The Asia Pacific region silicon photomultiplier market is witnessing significant growth from 2024 to 2030, driven by the rapid advancements in technology and increasing investments in healthcare and automotive sectors. Countries like China and India are at the forefront of this growth, with their expanding industrial base and rising demand for advanced imaging and sensing technologies. The region's focus on innovation and the presence of a large number of electronics manufacturers contribute to the widespread adoption of silicon photomultipliers. Additionally, the growing trend of urbanization and the increasing emphasis on smart infrastructure further drive market expansion.

China Silicon Photomultiplier Market accounted for largest share of over 60.00% in 2023, and experiencing substantial growth, supported by the country's robust industrial growth and investments in healthcare technology. The Chinese government’s focus on advancing medical infrastructure and promoting the adoption of advanced diagnostic tools contributes significantly to market growth. Additionally, the booming automotive industry, with its increasing emphasis on autonomous driving and vehicle safety, drives the demand for silicon photomultipliers. The presence of numerous electronics manufacturers and the country's push for technological innovation further support market expansion.

The silicon photomultiplier market in India is expected to progress with a CAGR of 7.4% from 2024 to 2030. The Indian market is growing steadily, driven by the rising demand for advanced medical imaging technologies and the burgeoning automotive industry. The Indian healthcare sector is increasingly adopting these devices in diagnostic tools to improve the accuracy and efficiency of medical imaging. Furthermore, the country's automotive industry is beginning to embrace silicon photomultipliers for ADAS and autonomous vehicle applications. Government initiatives promoting technological innovation and the growth of the electronics manufacturing sector also contribute to the market's positive outlook.

Europe Silicon Photomultiplier Market Trends

Europe represents a mature market for silicon photomultipliers, with strong adoption across various sectors, including healthcare, automotive, and industrial applications. Countries like Germany and Italy lead the market with their advanced technological infrastructure and significant investments in research and development. The region's focus on innovation, coupled with stringent regulatory standards for safety and quality, drives the adoption of silicon photomultipliers. Additionally, the increasing trend towards automation and smart manufacturing in Europe further boosts the market.

Silicon photomultiplier market in Germany accounted for revenue share of more than 35.00% in 2023, supported by its advanced automotive industry and strong emphasis on innovation. German automakers are at the forefront of integrating silicon photomultipliers in ADAS and autonomous driving systems to enhance vehicle safety and performance. Additionally, the country’s robust healthcare infrastructure and significant investments in medical research support the adoption of these devices in diagnostic imaging. The presence of leading technology companies and a supportive regulatory environment further bolster market growth in Germany.

Italy silicon photomultiplier market is expected to grow at significant rate with CAGR of 6.8%, propelled by country's focus on healthcare advancements and automotive innovation. Italian healthcare institutions are increasingly adopting these devices in medical imaging applications to improve diagnostic accuracy and efficiency. The automotive industry in Italy is also exploring the use of silicon photomultipliers for enhancing vehicle safety and developing autonomous driving technologies. Furthermore, Italy’s commitment to research and development in photonics and electronics supports the market’s positive trajectory.

Central & South America Silicon Photomultiplier Market Trends

The silicon photomultiplier market in Central and South America is developing, with increasing adoption in the healthcare and automotive sectors. Countries in this region are investing in advanced medical technologies to improve healthcare outcomes, driving the demand for silicon photomultipliers in diagnostic imaging. The automotive industry is also beginning to integrate these devices into safety and autonomous driving systems. Despite economic challenges, government initiatives and international collaborations aimed at fostering technological innovation support market growth in this region.

Middle East & Africa Silicon Photomultiplier Market Trends

The Middle East and Africa region is gradually adopting silicon photomultipliers, with a growing focus on improving healthcare infrastructure and exploring advanced automotive technologies. Countries like the UAE and South Africa are investing in modernizing their healthcare systems, leading to increased use of advanced diagnostic tools incorporating silicon photomultipliers. Additionally, the automotive industry in the region is beginning to recognize the benefits of these devices for enhancing vehicle safety and performance. Government efforts to diversify economies and promote technological advancements further support the market's growth in the Middle East and Africa.

Key Silicon Photomultiplier Company Insights

Mergers and acquisitions are on the rise to expand geographical reach and expertise. Companies are also focusing on advancements in silicon photomultiplier technology, aiming to enhance performance characteristics such as sensitivity, timing resolution, and noise reduction. These technological improvements are crucial for meeting the evolving demands of various applications, including medical imaging, automotive safety systems, and industrial automation. Additionally, there is a significant trend towards integrating silicon photomultipliers with other advanced technologies like artificial intelligence and machine learning to develop more sophisticated and efficient imaging and sensing solutions.

Furthermore, the trend leans towards offering full-service solutions encompassing construction, maintenance, and even financing, catering to the diverse needs of industries such as healthcare, automotive, and industrial manufacturing. This comprehensive approach enables companies to provide end-to-end solutions that address the entire lifecycle of silicon photomultiplier applications, from initial setup and deployment to ongoing maintenance and upgrades. By offering such holistic services, companies can better meet the specific requirements of their clients, enhance customer satisfaction, and foster long-term partnerships across various sectors.

Key Silicon Photomultiplier Companies:

The following are the leading companies in the silicon photomultiplier market. These companies collectively hold the largest market share and dictate industry trends.

- AdvanSiD

- Berkeley Nucleonics Corporation

- Broadcom Inc.

- Cremat Inc

- Dynasil Corporation

- Excelitas Technologies Corp.

- First Sensor AG (TE Connectivity)

- Hamamatsu Photonics K.K.

- John Caunt Scientific ltd.

- PicoQuant

Recent Developments

-

In May 2024, onsemi launched a high-gain, single photon-sensitive sensor named ARRAYRDM-0112A20-QFN Silicon Photomultiplier which is specifically designed for automotive NIR-enhanced LiDAR applications.

-

In November 2023, LabLogic Systems Ltd. launched two new cableless detectors in their portfolio named Flow-RAM 2 and Scan-RAM 2 with improved sensitivity, including Silicon Photomultipliers, or SiPMs, with Peltier cooling for nuclear medicine applications.

-

In August 2023, NASA Goddard Space Flight Center (GSFC) and The U.S. Naval Research Laboratory (NRL) announced to launch a ComPair instrument to measure and detect gamma-ray emissions from astrophysical objects.

Silicon Photomultiplier Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 138.43 million

Revenue forecast in 2030

USD 218.83 million

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; China; India; Japan; South Korea; Australia; Germany; Russia; UK; Italy; Qatar; Saudi Arabia; South Africa; Brazil; Argentina, Kuwait

Key companies profiled

AdvanSiD; Berkeley Nucleonics Corporation; Broadcom Inc.; Cremat Inc, Dynasil Corporation; Excelitas Technologies Corp.; First Sensor AG (TE Connectivity); Hamamatsu Photonics K.K.; John Caunt Scientific ltd.; PicoQuant, Semiconductor Components Industries LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicon Photomultiplier Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global silicon photomultiplier market based on the offering, application, end-use, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Near Ultraviolet Silicon Photomultiplier

-

Red, Green Blue Silicon Photomultiplier

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

LiDAR And 3D Ranging

-

Bio Photonics and Medical Imaging

-

High Energy Physics

-

Radiation Detection & Monitoring

-

Flow Cytometry

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Automotive

-

Consumer Electronics & Telecommunications

-

Aerospace

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

Norway

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Qatar

-

Saudi Arabia

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global silicon photomultiplier market size was estimated at USD 130.04 million in 2023 and is expected to reach USD 138.43 million in 2024.

b. The global silicon photomultiplier market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 218.83 million by 2030.

b. Based on the application, Bio photonics and medical imaging segment led the market and accounted for over 40.00% revenue share in 2023. This dominance is largely attributed to the critical role that silicon photomultipliers play in enhancing the performance of medical diagnostic tools.

b. Some of the key players operating in this industry include AdvanSiD, Berkeley Nucleonics Corporation, Broadcom Inc., Cremat Inc, Dynasil Corporation, Excelitas Technologies Corp., First Sensor AG (TE Connectivity), Hamamatsu Photonics K.K., John Caunt Scientific ltd., PicoQuant, Semiconductor Components Industries LLC, among others.

b. Key factors driving the market growth include increasing demand for advanced medical imaging technologies and the growing adoption of these devices in automotive safety systems and industrial applications. Continuous technological advancements and the rising focus on precision and efficiency in diagnostics and automation also contribute significantly to market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."