- Home

- »

- Plastics, Polymers & Resins

- »

-

Silicone Elastomer Market Size, Share & Growth Report 2030GVR Report cover

![Silicone Elastomer Market Size, Share & Trends Report]()

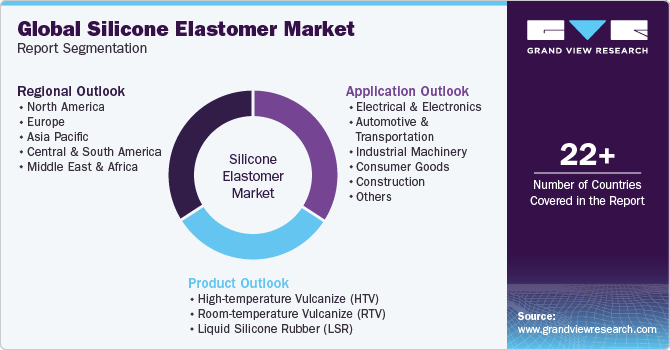

Silicone Elastomer Market Size, Share & Trends Analysis Report By Product (HTV, RTV, LSR), By Application (Electrical & Electronics, Automotive & Transportation, Industrial Machinery, Consumer Goods), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-449-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Silicone Elastomer Market Size & Trends

The global silicone elastomer market size was estimated at USD 6.34 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% from 2024 to 2030. This growth across the global silicone elastomers industry can be attributed to several critical factors such as a strong demand from end-use industries. Silicone elastomers possess superior characteristics when compared to other elastomers. Such characteristics make them imperative for industrial usage. End-use industries such as construction, automotive, and electrical & electronics are expected to witness rapid growth over the forecast period.

Emerging regions such as the Asia Pacific and Central & South America are touted to witness strong demand from end-use industries. Countries such as China, India, and Brazil are presumed to lead their respective regional markets. Growing population, rising disposable income, rapid industrialization, and urbanization in developing regions are key factors that are presumed to drive regional markets. R&D initiatives to develop superior robust products that have a wide application base across diverse industries offer ample opportunities for market development.

The silicone elastomer value chain comprises raw material producers, silicone elastomer manufacturers, distributors, and end-use industries. Raw material producers include companies that produce silicone, which has three main products, namely, silicone elastomers, silicone resins, and liquid silicone. Silicone elastomer producers produce a wide array of products with their own proprietary additives as per industry requirements. Companies are engaged in extensive R&D to develop their product portfolio and to develop newer additives with superior properties to meet growing industry demand and stringent requirements. Market space is characterized by a high level of backward integration. Companies producing silicone raw materials usually produce silicone elastomers as well.

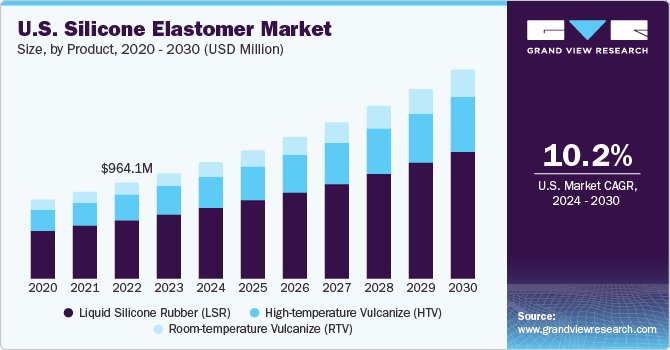

The U.S. silicone elastomer industry is expected to grow moderately during the forecast period owing to limited opportunities across the country resulting from the maturity of its manufacturing industry in general and the use of silicone elastomers. However, ongoing product innovations and technological developments are expected to promote the usage of silicone elastomers in electric vehicles (EVs) and healthcare applications. This, in turn, is anticipated to fuel market growth in the U.S. over the forecast period.

U.S. states, including New Jersey, California, Washington, and Louisiana, offer benefits such as tax credits, exemptions, and rebates for promoting the procurement of EVs. New Jersey and Washington exempt sales and use taxes for EVs, while California grants rebates on the purchase and usage of light-duty zero-emission vehicles and plug-in hybrid electric vehicles (PHEVs). These tax incentives implemented by different states of the country are anticipated to contribute to market growth for electric vehicles in the U.S. from 2023 to 2030. This, in turn, is anticipated to fuel the consumption of silicone elastomers used for cable insulation in zero-emission vehicles in the U.S. in the coming years.

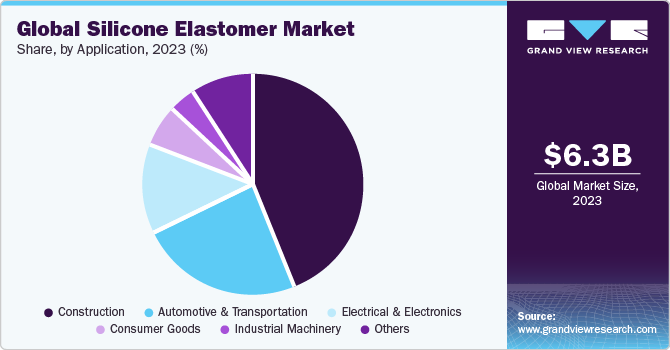

Application Insights

The construction segment led the market with a revenue share of 43.0% in 2023. Silicone elastomers follow silicone fluids in terms of leading market share for silicone in the global market. A wide range of applications across industries such as electronics & electrical, automotive & transportation, industrial machinery, consumer goods, construction and others is anticipated to boost the overall market. A wide application base can be attributed to inherent qualities such as inertness, high permeability, easy processing, and low toxicity. These qualities make silicone elastomers a leading choice for multiple applications across several industries.

The construction segment is set to continue its dominance during the forecast period. The growing global population is touted to put ample pressure on healthcare industry. Along with a rise in population, the growing aged population in developed countries is expected to be further beneficial for the overall market. Silicone elastomers are used in the industry in manufacturing catheters, medical cables, tubing, anesthetic masks, seals & gaskets, valves, respiratory care applications, medical textile coatings, and medical instruments & equipment. Such wide usage is expected to have a positive influence on the overall market demand.

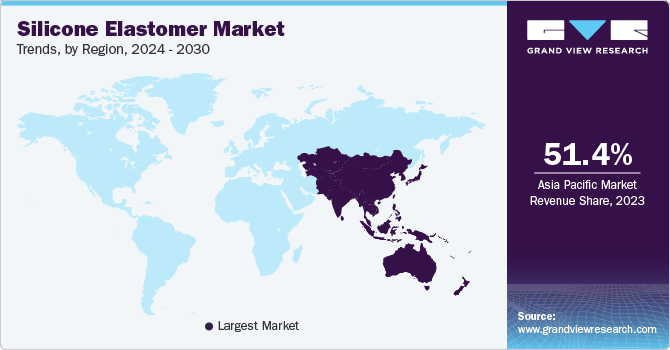

Regional Insights

Asia Pacific emerged as a dominating region with a revenue share of over 51.36% in 2023. Market shares of developed regions such as North America and Europe are anticipated to decrease owing to end-use industry saturation. Developing markets such as Asia Pacific, and Middle East & Africa are projected to experience brisk growth in areas such as automotive, construction, healthcare, consumer goods and electrical & electronics. Robust demand from these end-use industries is projected to fuel regional silicone elastomers sector.

Several key factors such as strong demand from end-use industries owing to rapid industrialization & urbanization and increasing disposable income giving rise to higher consumer goods & automotive demand are slated to play a key role in shaping regional as well as global silicone elastomers industry. Government initiatives encouraging infrastructure development, especially in developing markets, are slated to further complement regional markets.

Market Dynamics

Superior attributes of silicone elastomers, increasing utilization across the medical industry, and rising demand from the electrical & electronics industry are preponderance for the silicone elastomers industry. Silicone elastomers have superior properties compared to other elastomers. These properties make it desirable for various end-use industries.

With novel applications coming to the fore, requirements from end-use industries have become difficult to meet. End-use industries require properties such as extended lifetime and efficient performance over a wide range of temperatures, low toxicity, low flammability, low smoke density, inertness to chemicals & solvents, oil & fuel resistance, and high productivity. These requirements are fulfilled by silicone elastomers.

Silicone elastomers have widespread applications in the medical & healthcare industries. Starting from medical equipment to drug delivery systems, silicone elastomers have gained acceptance in the medical & healthcare industry fairly rapidly. Such acceptance can be attributed to favorable properties such as inertness, high permeability, easy processing, and low toxicity. With the growing population, there has been tremendous pressure on the medical industry to cater to the healthcare demand.

Electrical & electronics is a major end-use industry for silicone elastomers. Rapid growth in silicone elastomer demand can be attributed to the expanding electrical & electronics industry, as well as the growth of other industries such as automotive and construction. Silicone elastomers are used for a variety of applications in the electrical & electronics industry, including electrical & composite insulators, potting, silicone cables, automotive electronics, telecommunication applications, and energy-system applications, on account of their favorable properties such as heat resistance, nonreactivity, inhibited microbial growth, low viscosity, flame resistance, solvent resistance, heat transfer properties, long-lasting durability, and stress relieving.

Product Insights

The LSR product segment led the market and accounted for more than 61.0% revenue share in 2023. Major silicone elastomer products include high-temperature vulcanize (HTV), room-temperature vulcanize (RTV) and liquid silicone rubber (LSR). HTV emerged as the leading product and accounted for more than half of the overall market in recent past. Growing demand in major end-use industries, especially in developing regions, is expected to be a key driving factor for silicone elastomers industry growth over the next few years.

Silicone can be manifested in various other forms such as adhesives, sealants, coatings, oils, lubricants, and resins. These materials can be tailored to specific performance requirements. Silicone HTV elastomers can withstand prolonged exposures to higher temperatures. Major LSR application includes injection molding. Injection molding application is prevalent across multiple end-use industries such as automotives, medical equipment, toys, packaging, musical instruments, house wares, consumer goods, storage containers, and furniture.

Physical properties such as resilience, heat resistivity, flexibility, water repellents, insulation, and high tear strength over other elastomers are anticipated to boost the global demand. Growing population, rising disposable income, rapid industrialization and urbanization in developing regions are key factors that are presumed to drive regional markets.

Key Companies & Market Share Insights

The industry displays oligopolistic and consolidated nature and is characterized by mergers & acquisitions, production expansion, new product launches, and other strategic initiatives. Industry participants are taking such ardent steps to improve their product portfolio and gain a competitive advantage in rapidly growing regional markets. In April 2023, DuPont announced the introduction of their new low-cyclosiloxane silicone elastomer and silicone blends in line with the rising consumer demands for products addressing range of troubling skin conditions.

Key Silicone Elastomer Companies:

- China National BlueStar (Group) Co., Ltd.

- Dow Corning Corporation

- KCC Corporation

- Mesgo S.P.A.

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Reiss Manufacturing Inc.

- Wacker Chemie AG

- Zhejiang Xinan Chemical Industrial Group Co., Ltd.

- Stockwell Elastomerics

- Specialty Silicone Products, Inc.

Silicone Elastomer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.99 billion

Revenue forecast in 2030

USD 12.58 billion

Growth rate

CAGR of 10.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, Region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; Italy; France; China; Japan; South Korea; India; Brazil;

Key companies profiled

China National BlueStar (Group) Co., Ltd.; Dow Corning Corporation; KCC Corporation;

Mesgo S.P.A.; Momentive Performance Materials Inc.; Shin-Etsu Chemical Co., Ltd.; Reiss Manufacturing Inc.; Wacker Chemie AG; Zhejiang Xinan Chemical Industrial Group Co., Ltd.; Stockwell Elastomerics; Specialty Silicone Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicone Elastomer Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global silicone elastomer market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High-temperature Vulcanize (HTV)

-

Room-temperature Vulcanize (RTV)

-

Liquid Silicone Rubber (LSR)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electrical & Electronics

-

Automotive & Transportation

-

Industrial Machinery

-

Consumer Goods

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global silicone elastomer market size was estimated at USD 6.34 billion in 2023 and is expected to reach USD 6.99 billion in 2024.

b. The global silicone elastomer market is expected to grow at a compound annual growth rate of 10.3% from 2024 to 2030 to reach USD 12.58 billion by 2030.

b. Asia-Pacific dominated the silicone elastomer market with a share of more than 43.70% in 2023. Construction spending in Malaysia, Indonesia, Vietnam, South Korea, China, and India is expected to influence regional demand.

b. Some key players operating in the silicone elastomer market include Wacker Chemie AG, Dow Corning Corporation, KCC Corporation, Momentive Performance Materials Inc., Reiss Manufacturing, and Shin-Etsu Chemical Co.; Ltd.

b. Key factors that are driving the silicone elastomers market growth include technological advancements in product offerings based on favorable chemical and mechanical properties.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."