- Home

- »

- Next Generation Technologies

- »

-

Smart Air Conditioning Market Size, Industry Report, 2030GVR Report cover

![Smart Air Conditioning Market Size, Share & Trends Report]()

Smart Air Conditioning Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Temperature Control, Humidity Control, Ventilation Control, Integrated Control), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-510-2

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Air Conditioning Market Size & Trends

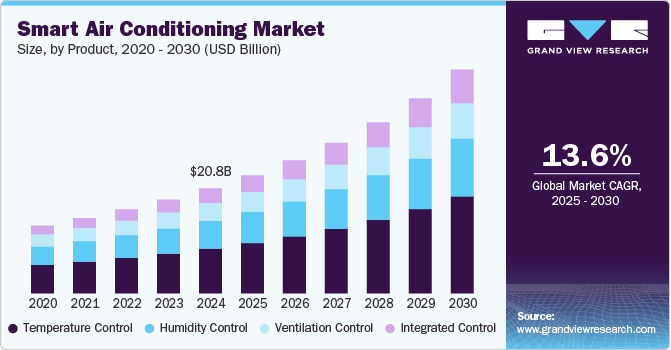

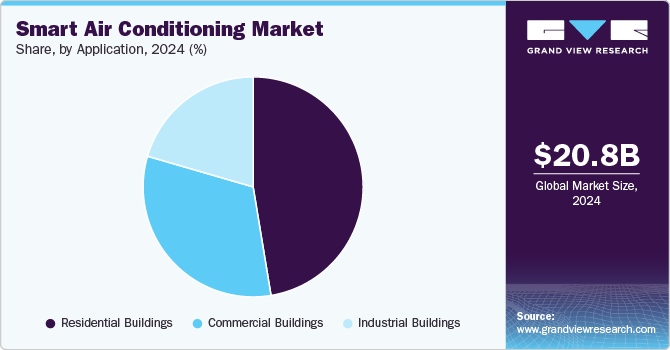

The global smart air conditioning market size was estimated at USD 20.75 billion in 2024 and is expected to witness a CAGR of 13.6% from 2025 to 2030. The smart air conditioning industry is growing quickly as demand for energy-efficient and connected cooling solutions increases. Features such as remote control, automation, and integration with smart home systems are attracting residential, commercial, and industrial customers. The need for energy savings and improved air quality is boosting the market's growth further. Consumers are increasingly looking for sustainable and cost-effective ways to cool their spaces. As a result, smart air conditioning systems are becoming a popular choice for those seeking enhanced comfort and efficiency.

The increased integration of Wi-Fi, mobile apps, and voice control systems allows users to remotely manage their air conditioning units, enhancing convenience and efficiency. Companies are adopting these smart features to meet the growing demand for seamless control and energy optimization. These technologies allow for remote control and monitoring of air conditioning units, enhancing user convenience and driving energy efficiency. For instance, in August 2024, LG Electronics launched its residential split system air conditioners in New Zealand, featuring Smart Inverter Compressor technology, smart connectivity via the LG ThinQ app, and energy-saving features such as Active Energy Control. This launch aims to provide efficient and convenient cooling solutions.

Consumers are becoming increasingly aware of the benefits that smart air conditioners offer, such as enhanced comfort and convenience. These units allow for more precise temperature control, which leads to a more comfortable living environment. With features such as remote control via mobile apps and voice assistants, users can easily adjust settings from anywhere, adding to their overall convenience. Smart air conditioners also come with energy-saving features that help reduce electricity consumption, leading to lower energy costs. As energy efficiency becomes a top priority for many households, these systems are seen as a more sustainable option. This growing awareness of both cost savings and environmental impact is driving the market for smart air conditioners.

Cloud adoption boosts the smart air conditioning industry by enabling remote control and monitoring through connected devices, offering users greater convenience. It also allows data analytics, optimizing performance and energy efficiency by analyzing system data in real-time. Cloud-based platforms integrate air conditioning units with other smart systems, facilitating automated control and improving energy management across buildings. Moreover, cloud connectivity ensures real-time software updates, remote diagnostics, and predictive maintenance, reducing manual interventions and maintenance costs. The scalability of cloud technology enables businesses to expand their smart air conditioning systems without complicated setups easily. Finally, subscription-based cloud models lower upfront costs and provide flexibility for system upgrades, making smart air conditioning more accessible and cost-efficient.

Product Insights

The Temperature Control segment led the market and accounted for 42.5% of the global revenue in 2024. Temperature control has been the dominant feature in the smart air conditioning industry, as it directly affects user comfort and is the primary function of traditional air conditioning units. Consumers have long prioritized the ability to precisely control room temperatures to ensure a comfortable environment. Smart air conditioners have taken this further by offering more granular control, such as scheduling temperature adjustments and setting different temperatures for different rooms. This focus on temperature control is driven by the desire for energy efficiency and personalized comfort. As a result, temperature control remains a key selling point for many smart air conditioning systems.

Integrated control is a growing trend in the market, where users can manage not only temperature but also other aspects like humidity, air quality, and energy consumption from a single interface. This level of control allows for a more customized and efficient living environment, as the system can optimize various factors simultaneously for maximum comfort and energy savings. The increasing adoption of smart home technologies is further boosting this trend, as integrated systems can seamlessly connect with other devices, such as air purifiers, smart thermostats, and home automation systems. Consumers are becoming more interested in systems that offer a comprehensive approach to indoor climate management. As demand for smarter, more connected living spaces rises, integrated control is expected to become a significant feature of future air conditioning solutions.

Application Insights

The Residential Buildings segment led the market. With the rise of smart home technology, there is an increasing demand for HVAC systems that seamlessly integrate with home automation platforms. Companies are emphasizing the importance of connectivity by offering systems that can be controlled remotely through mobile apps or voice assistants, enhancing both convenience and user experience. This integration provides more personalized control over home climate and helps optimize energy usage, aligning with the growing consumer focus on efficiency. For instance, in May 2024, Samsung Electronics and Lennox International Inc., a U.S.-based provider of climate control solutions, formed a joint venture, Samsung Lennox HVAC North America, to offer ductless HVAC systems in the U.S. and Canada. This partnership aims to strengthen the residential and homebuilder business in North America by providing innovative ductless HVAC solutions.

The commercial buildings segment in the smart air conditioning industry is growing rapidly as businesses seek more energy-efficient and cost-effective cooling solutions. Smart AC systems in commercial spaces allow for centralized control, enabling facility managers to monitor and adjust temperatures across multiple zones. These systems also integrate with building automation platforms, providing real-time data for optimized energy usage and maintenance schedules. With the growing demand for sustainability, many businesses are adopting smart air conditioning to meet energy efficiency goals and comply with environmental regulations. Moreover, the ability to control HVAC remotely via mobile apps or cloud platforms offers greater convenience and flexibility for managing air conditioning in large commercial buildings.

Regional Insights

North America accounted to hold significant share in the market and accounted for a 35.9% share in 2024. The market in North America is growing rapidly due to increased consumer demand for energy-efficient and environmentally friendly solutions. The adoption of smart thermostats and HVAC systems integrated with IoT technology is becoming more common in both residential and commercial buildings. Rising awareness of climate change and stricter energy regulations are prompting businesses and homeowners to seek smarter cooling solutions. The increasing prevalence of smart home ecosystems is also driving demand for air conditioners that can be easily integrated with other devices.

U.S. Smart Air Conditioning Market Trends

In the U.S., the smart air conditioning industry is heavily influenced by the growing adoption of energy-efficient systems, driven by both consumer preferences and government incentives. The rise in smart home technology, including voice-controlled systems such as Amazon Alexa and Google Assistant, has significantly impacted the HVAC industry. The demand for remote control and real-time monitoring of energy usage is growing, as consumers aim to reduce electricity costs.

Europe Smart Air Conditioning Market Trends

In Europe, the smart air conditioning industry is expanding due to stringent environmental regulations and the EU’s focus on achieving carbon neutrality. The increasing demand for energy-efficient air conditioning systems is spurred by rising energy prices and the need to meet sustainability targets. Integration with renewable energy sources, such as solar panels, is becoming more common, with consumers seeking to reduce their reliance on traditional power grids.

Asia Pacific Smart Air Conditioning Market Trends

The smart air conditioning market in Asia-Pacific is experiencing rapid growth, driven by the region’s booming urbanization and expanding middle class. As countries such as China and India experience hot climates and growing populations, the demand for air conditioning systems is on the rise. Smart air conditioners with energy-saving features and IoT connectivity are gaining popularity as consumers seek cost-effective cooling solutions. The adoption of smart home technology in countries such as Japan and South Korea is further driving demand, with users looking for seamless integration between air conditioning and other home automation devices.

Key Smart Air Conditioning Company Insights

Some of the key companies in the smart air conditioning industry include Electrolux Group, Carrier, Hitachi, Ltd., MITSUBISHI ELECTRIC CORPORATION and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Carrier focuses on creating air conditioning systems that are energy-efficient and environmentally friendly. Their smart air conditioners let users control and monitor settings remotely, helping save energy and improve air quality. Carrier’s systems use cloud-based platforms and apps for easy adjustments and tracking energy use. They aim to provide sustainable HVAC solutions for homes, businesses, and industries.

-

Hitachi, Ltd. develops smart air conditioning systems that use IoT and AI to improve energy efficiency and performance. Their air conditioners come with smart controls to maintain comfort while reducing environmental impact. Hitachi incorporates sensors and AI for easier management, including remote monitoring and maintenance.

Key Smart Air Conditioning Companies:

The following are the leading companies in the smart air conditioning market. These companies collectively hold the largest market share and dictate industry trends.

- DAIKIN INDUSTRIES Ltd.

- Electrolux Group

- Carrier

- Hitachi, Ltd.

- MITSUBISHI ELECTRIC CORPORATION

- Panasonic Holdings Corporation

- Voltas Ltd.

- Johnson Controls

- TOSHIBA CORPORATION

- FUJITSU GENERAL

Recent Developments

-

In February 2024, Carrier launched the Carrier Smart Thermostat, a connected control solution designed for new residential construction, offering affordable connectivity and easy installation. The thermostat features a contemporary design, integrates with smart home systems, and provides homeowners with full control through the Carrier Home App.

-

In August 2024, Carrier and Sibi, a U.S.-based software company, partnered to enhance the HVAC supply chain by integrating Sibi's technology platform. This collaboration will empower HVAC contractors with digital tools to access Carrier's energy-efficient solutions and transform supply chain management through advanced AI and data-driven insights.

-

In September 2023, DAIKIN INDUSTRIES, Ltd. launched Daikin Cloud Plus, a web-based remote monitoring and service solution that allows facility managers to manage and optimize HVAC systems, enhancing energy efficiency and comfort. The platform offers real-time control, predictive maintenance, and integration with other building systems, enabling smarter, greener, and more efficient operations across multiple sites.

Smart Air Conditioning Market Report Scope

Report Attribute

Details

Market Size value in 2025

USD 23.32 billion

Revenue forecast in 2030

USD 44.17 billion

Growth rate

CAGR of 13.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Product, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia, South Korea, Brazil, KSA, UAE, South Africa

Key companies profiled

DAIKIN INDUSTRIES Ltd.; Electrolux Group; Carrier; Hitachi, Ltd.; MITSUBISHI ELECTRIC CORPORATION; Panasonic Holdings Corporation; Voltas Ltd.; Johnson Controls; TOSHIBA CORPORATION; FUJITSU GENERAL

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Air Conditioning Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart air conditioning market in terms of product, application and region.

-

Product Outlook (Revenue, USD Billion; 2018 - 2030)

-

Temperature Control

-

Humidity Control

-

Ventilation Control

-

Integrated Control

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Residential Buildings

-

Commercial Buildings

-

Industrial Buildings

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart air conditioning market size was estimated at USD 20.75 billion in 2024 and is expected to reach USD 23.32 billion in 2025.

b. The global smart air conditioning market is expected to grow at a compound annual growth rate of 13.6% from 2025 to 2030 to reach USD 44.17 billion by 2030.

b. North America dominated the smart air conditioning market with a share of 35.9% in 2024. This is attributable to high adoption rates and increasing demand for energy-efficient cooling solutions.

b. Some key players operating in the smart air conditioning market include DAIKIN INDUSTRIES Ltd., Electrolux Group, Carrier, Hitachi, Ltd., MITSUBISHI ELECTRIC CORPORATION, Panasonic Holdings Corporation, Voltas Ltd., Johnson Controls, TOSHIBA CORPORATION, FUJITSU GENERAL

b. Key factors that are driving the market growth include rising energy efficiency demand, technological advancements, and increasing consumer preference for smart home integration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.