- Home

- »

- Next Generation Technologies

- »

-

Smart Irrigation Market Size & Share, Industry Report, 2033GVR Report cover

![Smart Irrigation Market Size, Share & Trends Report]()

Smart Irrigation Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Controllers, Sensors), By Technology (IoT, AI/ML), By System (Weather-Based, System-Based), By End Use (Agricultural, Non-Agricultural), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-762-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Irrigation Market Summary

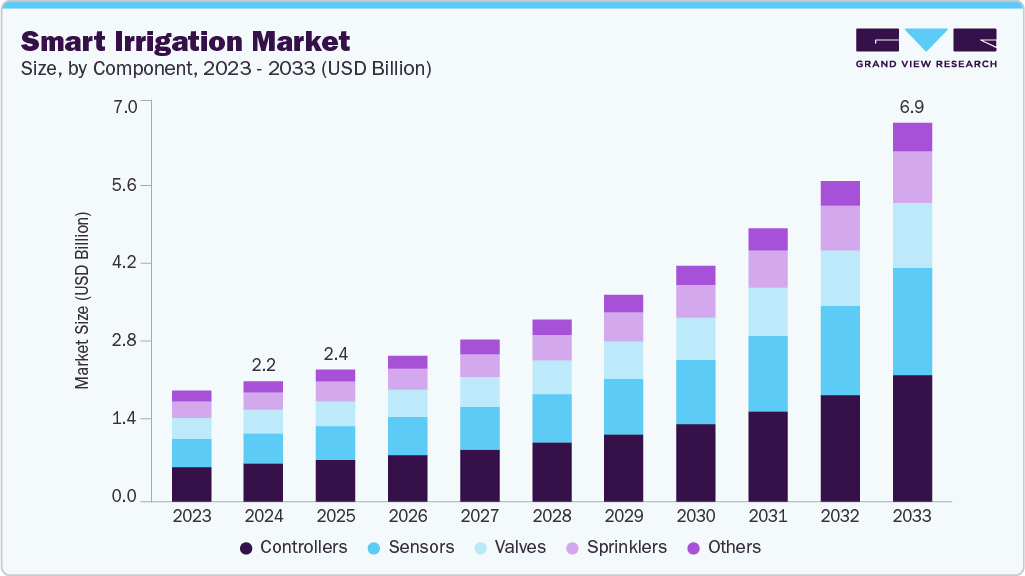

The global smart irrigation market size was estimated at USD 2.18 billion in 2024 and is projected to reach USD 6.88 billion by 2033, growing at a CAGR of 14.1% from 2025 to 2033. The increasing need for efficient water management in agriculture and landscaping is driving the market growth.

Key Market Trends & Insights

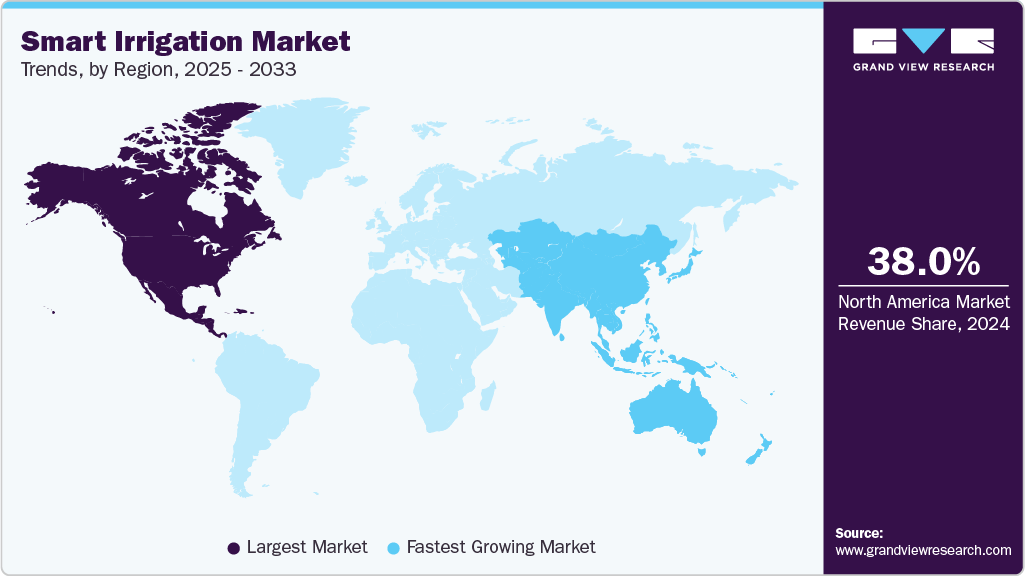

- North America held 38.0% revenue share of the global smart irrigation industry in 2024.

- In the U.S., the growing adoption of Internet of Things (IoT) and Artificial Intelligence (AI) in agriculture is driving the smart irrigation industry growth.

- By component, the controllers segment held the largest revenue share of 31.5% in 2024.

- By technology, the IoT segment held the largest revenue share in 2024.

- By system, the sensor-based segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.18 Billion

- 2033 Projected Market Size: USD 6.88 Billion

- CAGR (2025-2033): 14.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing penetration of smartphones and mobile connectivity in rural and agricultural regions is propelling the market growth. As mobile infrastructure expands and internet access improves, farmers and landowners are more easily able to integrate and manage smart irrigation solutions through mobile apps and cloud platforms. These tools provide real-time data insights, alerts, and controls that enable users to adjust watering schedules based on current conditions, significantly reducing both over-irrigation and under-watering. This convenience and accessibility are particularly valuable in regions where physical monitoring of fields may be difficult due to distance or scale.Urbanization and the growth of smart cities are further stimulating demand for advanced irrigation technologies. As cities expand and green infrastructure becomes a planning priority, there is an increasing need for intelligent systems that can maintain urban green spaces efficiently. Smart irrigation enables municipalities and private contractors to manage public parks, sports complexes, and commercial landscapes with optimized water use, helping reduce operational costs and environmental impact. This trend is especially prominent in regions facing regulatory pressure to conserve water and reduce waste as part of climate adaptation strategies.

The technological advancements in sensors, wireless communication, and automation are making smart irrigation systems more reliable, scalable, and cost-effective. Innovations such as low-power wide-area networks (LPWAN), machine learning-based irrigation models, and integration with weather forecasting APIs are enhancing the precision and intelligence of these systems. This evolving ecosystem of digital agriculture is not only improving the ROI for farmers but also attracting new market entrants and solution providers, thereby expanding product availability and accelerating overall market growth.

The increasing integration of smart irrigation with broader precision agriculture platforms drives the smart irrigation industry growth. Farmers are increasingly adopting holistic digital solutions that combine smart irrigation with drone imagery, GPS-guided machinery, and AI-based crop analytics. This integration allows for a more data-driven approach to farm management, improving overall productivity and resource efficiency. Smart irrigation serves as a key component of this ecosystem by enabling automated water management that is informed by real-time field data and predictive models, thereby enhancing decision-making across the entire cultivation process.

Furthermore, the expansion of commercial landscaping and golf course development, particularly in water-stressed regions, is boosting demand for smart irrigation. Facility managers and landscape professionals are under growing pressure to reduce water usage while maintaining high aesthetic and functional standards. Smart irrigation helps meet these dual objectives by enabling zone-specific watering and automated adjustments based on evapotranspiration rates and local weather data.

Component Insights

The controllers segment dominated the market with a revenue share of 31.5% in 2024, driven by increasing demand for automated irrigation systems that enhance precision and reduce water wastage. Smart irrigation controllers allow users to manage watering schedules based on real-time weather data, soil moisture levels, and plant requirements. As concerns around water scarcity continue to rise, especially in arid and semi-arid regions, these intelligent controllers are becoming essential tools for both agricultural and non-agricultural users to ensure optimal water usage without compromising plant health or crop yields.

The sensors segment is projected to be the fastest-growing segment from 2025 to 2033. Technological advancements in wireless communication and sensor miniaturization are also expanding the possibilities of sensor deployment in the smart irrigation industry. Modern sensors are more compact, energy-efficient, and capable of connecting via Wi-Fi, Bluetooth, or LoRaWAN networks. These features reduce the need for extensive infrastructure and make installation and maintenance easier, even in remote or rugged terrain. As a result, more growers and land managers, regardless of size or location, can access the benefits of sensor-based smart irrigation, driving broader adoption across both developed and developing markets.

Technology Insights

The IoT segment dominated the market in 2024. The integration of IoT with cloud computing and artificial intelligence (AI) is amplifying its impact on smart irrigation. IoT systems can feed continuous streams of data into cloud platforms, where AI algorithms analyze patterns and make predictive recommendations for irrigation schedules. This predictive capability helps optimize water usage by delivering the right amount of water at the right time, minimizing wastage and preventing issues such as root rot or drought stress. Additionally, these integrated systems can automate responses based on sensor data, creating fully autonomous irrigation systems that adapt to changing environmental conditions without human intervention.

The GIS/GPS segment is projected to be the fastest-growing segment from 2025 to 2033. GIS/GPS ability to support Variable Rate Irrigation (VRI) technology is accelerating the adoption of GIS and GPS in the smart irrigation industry. VRI systems use field data derived from GIS mapping and real-time GPS positioning to apply different amounts of water to specific zones within a field, depending on their requirements. This zonal irrigation approach ensures that each part of a farm receives exactly the amount of water it needs, reducing overwatering or under-watering and helping to conserve water while optimizing plant growth. The efficiency gains from this precision irrigation are particularly appealing in regions experiencing water scarcity or where water management is heavily regulated.

System Insights

The sensor-based segment dominated the market with a revenue share of over 28.0% in 2024. The increasing convergence of cloud computing, edge processing, and big data analytics in industrial operations further necessitates comprehensive infrastructure protection. While these technologies enable smarter and more decentralized operations, they also create new vulnerabilities due to distributed attack vectors. Protecting data as it moves between cloud platforms, edge devices, and on-premise systems becomes critical. Infrastructure protection solutions are thus expanding to include secure gateways, encrypted communication protocols, and identity-based access controls that ensure only authorized users and devices can interact with industrial networks. As the industrial landscape continues to evolve, the infrastructure protection segment will remain at the forefront of cybersecurity strategy, offering the resilience and assurance needed to thrive in an increasingly digital and interconnected world.

The weather-based segment is projected to be the fastest-growing segment from 2025 to 2033. The rapid advancement in digital technologies, including the integration of AI, IoT, and cloud computing, further strengthens the weather-based segment. Smart controllers and sensors are capable of accessing hyperlocal weather data through connected networks, enabling real-time decision-making. This is especially useful in regions prone to irregular weather patterns, where predictive weather modeling can play a crucial role in preventing crop stress.

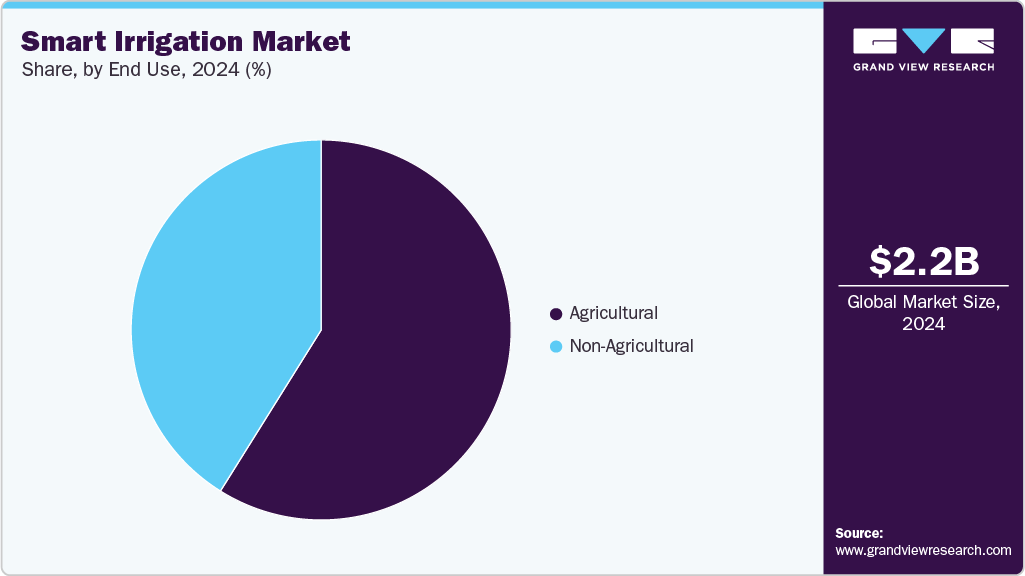

End Use Insights

The agricultural segment dominated the market in 2024. The global shift toward precision agriculture is driving the demand for the market in the agricultural segment. Farmers are increasingly looking to optimize every aspect of crop production, including water application, to improve efficiency and profitability. Smart irrigation systems fit seamlessly into precision farming strategies by enabling zone-based irrigation, reducing variability in field performance, and contributing to higher return on investment. As agriculture becomes more data-driven and technology-oriented, the agricultural segment is expected to remain a dominant force propelling the smart irrigation industry forward.

The non-agricultural segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing demand for efficient landscaping and turf management in urban areas is driving the adoption of the smart irrigation industry. Municipal governments, commercial properties, educational institutions, and sports complexes are all seeking advanced irrigation systems to maintain green spaces while reducing water consumption. These entities are under growing pressure to adopt sustainable practices amid rising water costs and environmental regulations. Smart irrigation systems provide a solution by using weather data, soil moisture sensors, and automation to optimize water use, making them particularly attractive in cities facing water restrictions or drought conditions.

Regional Insights

North America smart irrigation industry dominated the global market with a revenue share of 38.0% in 2024. The North American agricultural sector, which is characterized by large-scale and technology-intensive farming operations drives market growth. Farmers are increasingly leveraging IoT-based irrigation systems to gain precise control over water delivery, improving crop yields while reducing resource input. Integration with mobile applications and cloud-based analytics platforms allow real-time decision-making, a feature that aligns with the growing adoption of precision agriculture across the U.S. and Canada. The need to maximize productivity while minimizing environmental impact continues to push commercial farms toward data-driven irrigation solutions.

U.S. Smart Irrigation Market Trends

The U.S. smart irrigation industry is projected to grow during the forecast period. The U.S. is witnessing increasing implementation of precision farming techniques that incorporate smart irrigation. Large-scale farming operations are integrating IoT-based devices and cloud platforms that deliver actionable insights for water application based on crop system, soil conditions, and local weather patterns. These systems not only conserve water but also enhance crop yields and reduce operational costs, offering a strong value proposition for farmers facing rising input costs and labor shortages. As agribusinesses continue to prioritize sustainability and efficiency, smart irrigation is becoming a key component of modern farm infrastructure.

Asia Pacific Smart Irrigation Market Trends

The Asia Pacific smart irrigation industry is expected to be the fastest-growing segment, with a CAGR of 16.4%, over the forecast period. The expansion of smart cities across the Asia Pacific is creating demand for intelligent landscape irrigation systems in urban settings. Countries such as Japan, Singapore, and South Korea are integrating smart irrigation into public green spaces, parks, and commercial developments as part of their broader environmental sustainability efforts. These urban applications, combined with a booming agriculture sector and supportive government policies, are collectively driving the robust growth of the market in the Asia Pacific region.

The smart irrigation industry in China is projected to grow during the forecast period. China's rapid expansion of its 5G and NB-IoT infrastructure is facilitating the deployment of connected irrigation solutions in remote and rural areas. The growing penetration of rural broadband and smart devices is enabling the seamless integration of various smart agriculture tools, including irrigation controllers, moisture sensors, and data analytics platforms. These network advancements are reducing technological barriers for adoption, allowing even small-scale farmers to benefit from automated, data-driven irrigation systems. As connectivity improves and cloud-based services become more affordable and accessible, the ecosystem for smart irrigation is expected to grow even more robust.

Europe Smart Irrigation Market Trends

The smart irrigation industry in Europe is expected to grow during the forecast period. The growing demand for high-value crops, such as vineyards, orchards, and greenhouse vegetables in Europe, is propelling the demand for the market. These crops require precise irrigation management to maintain quality, consistency, and profitability. The need for uniform crop growth and minimal resource wastage has led large agribusinesses and cooperatives to implement data-driven irrigation systems that can be remotely managed and adjusted in real-time. The availability of tailored solutions for specific crop systems and farm sizes further strengthens the appeal of smart irrigation across diverse agricultural segments in the region.

The smart irrigation industry in the UK is projected to grow during the forecast period. The UK’s horticulture and greenhouse industries, particularly in regions like Kent and East Anglia, are actively investing in smart irrigation due to the sensitivity of high-value crops to over- or under-watering. Controlled environments benefit greatly from precision irrigation, and growers are increasingly adopting drip systems, fertigation tools, and climate-responsive controllers to ensure optimal growing conditions. The integration of weather-based automation and advanced telemetry in these operations reflects a growing reliance on technology to maintain consistency and quality in production.

Key Smart Irrigation Company Insights:

Some of the key companies operating in the market include Netafim and Hunter Industries.

-

Netafim is a modern drip irrigation technology company. Netafim offers cutting-edge digital farming tools, including GrowSphere OS and NetBeat. GrowSphere, the smart irrigation operating system, enables real-time automation, remote control, tracing, and data analytics from a unified dashboard. NetBeat, powered by advanced algorithms and Dynamic Crop Models, delivers daily crop-specific irrigation and fertigation recommendations, effectively acting as a virtual agronomic advisor. These platforms enhance decision-making and operational efficiency across farm scales and geographies.

-

Hunter Industries is a global manufacturer of innovative irrigation solutions. Hunter Industries' flagship smart irrigation solutions, such as the Hydrawise cloud-based platform, allow users to manage watering schedules remotely through mobile apps or web interfaces. These systems are equipped with weather forecasting, flow monitoring, and real-time alerts, helping property owners and landscape managers reduce water waste and respond to environmental conditions dynamically.

GroGuru, and HydroPoint are some of the emerging market participants in the market.

-

GroGuru develops precision irrigation management systems for commercial agriculture. The company specializes in cloud‑based, data‑driven irrigation solutions that help farmers optimize water use and maximize crop yields while promoting sustainability. GroGuru’s offering includes a Continuous Root Zone Monitoring (CRM) platform, which leverages the patented Wireless Underground System (WUGS). This setup allows soil sensors to be buried permanently below till depth, even in annual field crops like corn, soybeans, cotton, and sorghum.

-

HydroPoint is a smart irrigation company. HydroPoint’s flagship offering, WeatherTRAK, delivers smart irrigation by leveraging real‑time weather data and predictive analytics to adjust watering schedules dynamically. This cloud‑based system interprets local evapotranspiration rates, rainfall, and onsite climate measurements to optimize irrigation timing and quantities, dramatically reducing water waste and enhancing landscape health.

Key Smart Irrigation Companies:

The following are the leading companies in the smart irrigation market. These companies collectively hold the largest market share and dictate industry trends.

- Netafim

- Hunter Industries

- The Toro Company

- Rain Bird Corporation

- HydroPoint

- GroGuru

- WiseConn Engineering

- Smart Rain Systems, LLC

- Galcon

- Telit Cinterion

- Smart Irrigation Company

- SitelogIQ

- IAP Solutions

- Weihai Jingxun Changtong Electronic Component Co., Ltd

- Atlas Meters and Measuring Instruments Inc.

Recent Developments

-

In April 2025, Rain Bird Corporation acquired OtO Inc., enhancing its ability to meet a wider array of homeowner needs. OtO’s innovative smart irrigation solutions align seamlessly with Rain Bird’s mission to encourage the intelligent use of water. This groundbreaking technology expands Rain Bird’s product portfolio by catering to homeowners seeking automated irrigation without the complexity of installing an underground system.

-

In October 2024, Netafim partnered with Phytech Ltd. to enhance in-field irrigation management by integrating Phytech’s real-time monitoring technology with Orbia Netafim’s GrowSphere, an all-in-one irrigation operating system. Through this collaboration, the companies aim to offer mutual customers improved visibility and data-driven insights for more efficient and accurate irrigation decisions. The partnership will also leverage Netafim’s extensive distribution and service network to deliver real-time feedback and optimized irrigation recommendations directly to farmers.

-

In April 2024, GroGuru launched the first fully integrated wireless soil sensor probe designed for root zone monitoring in annual field crops. This advanced probe incorporates GroGuru’s patented Wireless Underground System (WUGS) and features six sensors positioned at different soil depths to measure moisture and temperature levels. The new integrated design extends the battery life from five to ten years and simplifies the installation process. This innovation is the result of several months of joint development, during which GroGuru carried out extensive laboratory and field testing to validate the technology.

Smart Irrigation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.39 billion

Revenue forecast in 2033

USD 6.88 billion

Growth Rate

CAGR of 14.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, technology, system, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Netafim; Hunter Industries; The Toro Company; Rain Bird Corporation; HydroPoint; GroGuru; WiseConn Engineering; Smart Rain Systems, LLC; Galcon; Telit Cinterion; Smart Irrigation Company; SitelogIQ; IAP Solutions; Weihai Jingxun Changtong Electronic Component Co., Ltd; Atlas Meters And Measuring Instruments Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Irrigation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the smart irrigation market report based on component, technology, system, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Controllers

-

Sensors

-

Valves

-

Sprinklers

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

IoT

-

AI/ML

-

GIS/GPS

-

-

System Outlook (Revenue, USD Million, 2021 - 2033)

-

Weather-Based

-

Sensor-Based

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Agricultural

-

Greenhouses

-

Open Fields

-

Non-Agricultural

-

-

Residential

-

Sports Grounds

-

Golf Courses

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart irrigation market size was estimated at USD 2.18 billion in 2024 and is expected to reach USD 2.39 billion in 2025.

b. The global smart irrigation market is expected to grow at a compound annual growth rate of 14.1% from 2025 to 2033 to reach USD 6.88 billion by 2033.

b. The controllers segment dominated the smart irrigation market with a market share of 31.5% in 2024, driven by increasing demand for automated irrigation systems that enhance precision and reduce water wastage.

b. Some key players operating in the market include Netafim, Hunter Industries, The Toro Company, Rain Bird Corporation, HydroPoint, GroGuru, WiseConn Engineering, Smart Rain Systems, LLC, Galcon, Telit Cinterion, Smart Irrigation Company, SitelogIQ, IAP Solutions, Weihai Jingxun Changtong Electronic Component Co., Ltd, Atlas Meters and Measuring Instruments Inc.

b. Factors such as the increasing need for efficient water management in agriculture and landscaping and the growing adoption of IoT and AI in agriculture are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.