- Home

- »

- Next Generation Technologies

- »

-

Smart Agriculture Market Size, Share, Industry Report, 2033GVR Report cover

![Smart Agriculture Market Size, Share & Trends Report]()

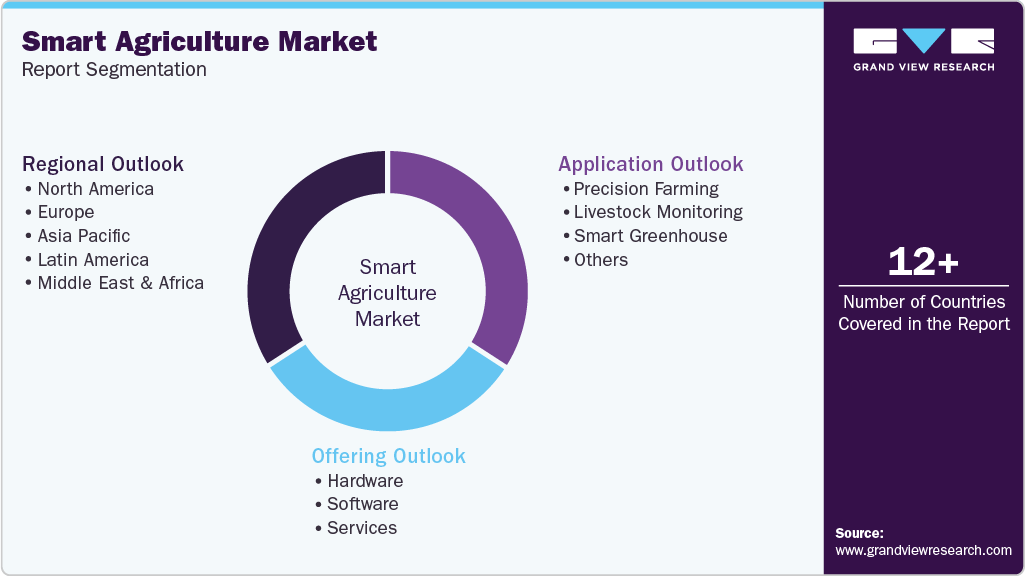

Smart Agriculture Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Application (Precision Farming, Livestock Monitoring, Smart Greenhouse), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-009-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Agriculture Market Summary

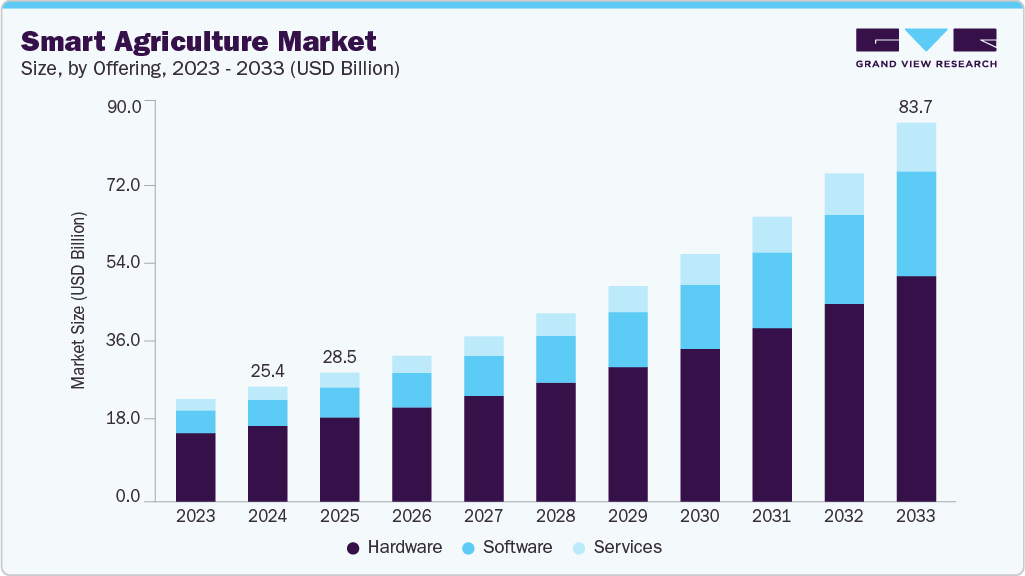

The global smart agriculture market size was estimated at USD 25.36 billion in 2024 and is projected to reach USD 83.72 billion by 2033, growing at a CAGR of 14.6% from 2025 to 2033. Increasing automation of commercial greenhouses and growing implementation of the controlled environment agriculture (CEA) are the key factors driving demand during the forecast period.

Key Market Trends & Insights

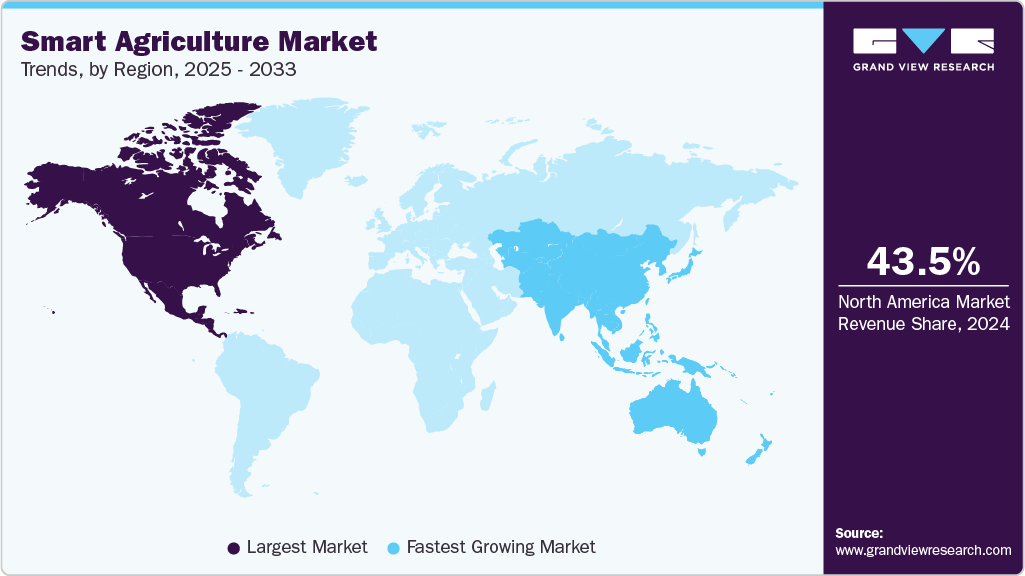

- North America dominated the global smart agriculture market with the largest revenue share of 43.5% in 2024.

- The smart agriculture industry in the U.S. accounted for the largest market revenue share in North America in 2024.

- By offering, the hardware segment led the market with the largest revenue share of 66.1% in 2024.

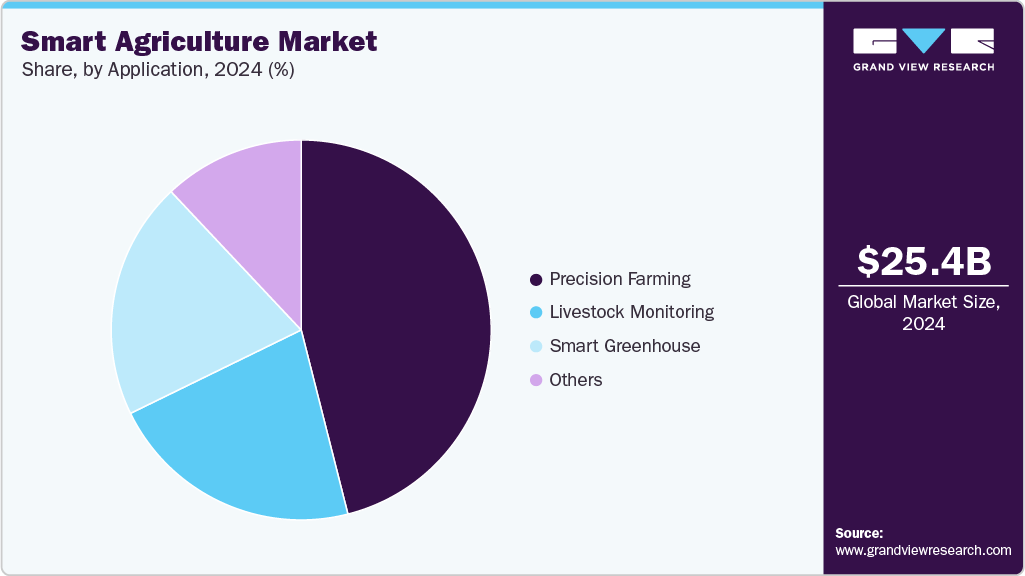

- By application, the precision farming segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.36 Billion

- 2033 Projected Market Size: USD 83.72 Billion

- CAGR (2025-2033): 14.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Smart agriculture companies are shifting their focus toward the development of equipment that is integrated with advanced sensors and cameras. Key technologies driving the market demand include livestock biometrics, such as RFID, biometrics, and GPS, to help cultivators automatically obtain information regarding livestock in real-time. Furthermore, infrastructural health sensors are used to monitor material conditions and vibrations in buildings, factories, bridges, farms, and other types of infrastructure. Coupled with an intelligent network, infrastructural health sensors help provide real-time information to the maintenance team. In addition, agricultural robots are being used to automate various farming processes, including soil maintenance, weeding, fruit picking, harvesting, planting, plowing, and irrigation, among others.To sustain profits, farmers are increasingly adopting smarter and more efficient agriculture technologies to deliver high-quality products to the smart agriculture industry in sufficient quantities. Mobile technology enables the development of innovative types and applications that are utilized throughout the entire agricultural value chain.

Machine-to-machine (M2M) applications are particularly well-suited for the agricultural sector, enabling farmers to monitor equipment, assess the environmental impact on production, precisely manage livestock and crops, and track tractors and other agricultural equipment. M2M is an integral part of IoT, which describes the coordination of multiple devices, appliances, and machines connected to the internet through multiple networks.

Offering Insights

The hardware segment led the market with the largest revenue share of 66.13% in 2024. The hardware segment has further been bifurcated into automation & control systems, HVAC systems, LED grow lights, RFID tags & readers, and sensing devices. Automation & control systems are further segmented into application control devices, milking robots, guidance systems, driverless tractors, mobile devices, remote sensing, variable rate technology, drones, and wireless modules.

The growing automation of raw material production and product manufacturing in the dairy and food industry is likely to drive the milking robots segment in the future. Automation technology has improved milk quality and animal welfare. The rising need to reduce labor costs and improve productivity is expected to positively impact the profitability of the dairy & food processing industries. Factors such as increased milk frequency, efficient management of the herd, cow health, and welfare benefits are driving the demand for milking robots.

The drones sub-segment under the automation & control system is expected to witness at the fastest growth during the forecast period. Several types of drones include hybrid and fixed-wing. Fixed-wing drones feature a rigid wing with a predetermined airfoil, which aids in flight by generating lift due to the drone’s forward airspeed. Forward thrust acquired by a propeller, an electric motor, or an internal combustion engine produces this airspeed.

Rotary blade drones comprise single-rotor and multi-rotor type drones that revolve around a fixed mast, which enables them to fly in any direction and hover in one place. Hybrid drones can stay in flight for years at a stretch as they operate on multiple sources of energy. Solar panels mounted on the wings of the hybrid drones provide fuel during the flight.

The software segment is anticipated to grow at the fastest CAGR during the forecast period. The proliferation of smartphones and IoT-connected devices in rural areas has expanded the accessibility and functionality of agriculture software. With mobile apps and user-friendly interfaces, even smallholder farmers are beginning to adopt digital solutions to manage their fields, access market prices, and receive alerts on pest outbreaks or adverse weather conditions. The increasing digital literacy among farmers and the widespread penetration of internet services are important enablers for the rapid adoption of the software segment in developing regions.

Application Insights

The precision farming segment accounted for the largest market revenue share in 2024. The increasing use of drones and unmanned aerial vehicles (UAVs) in agricultural monitoring is significantly contributing to the adoption of precision farming. Drones equipped with multispectral imaging and mapping capabilities offer detailed views of crop health and field variability, enabling farmers to detect issues early and optimize interventions. As drone technology becomes more affordable and regulations around its usage become more farmer-friendly, its integration into precision farming workflows is becoming commonplace, adding a new dimension to data-driven agriculture.

The smart greenhouse segment is anticipated to grow at the fastest CAGR during the forecast period. The growing focus on urban agriculture and local food production is also driving the expansion of smart greenhouses. As urban populations expand and the distance between production and consumption centers grows, smart greenhouses are being adopted in urban and peri-urban areas to meet local food demands. These systems are well-suited for integration into urban environments due to their compact footprint and ability to produce fresh crops close to consumers, reducing transportation costs and emissions.

Regional Insights

North America dominated the global smart agriculture market with the largest revenue share of 43.5% in 2024. The region is an early adopter of technologies. Growing government initiatives and regulations to enhance the agriculture industry in the region are expected to drive the North American regional demand during the forecast period. Various agricultural organizations have come together to form the North America Climate Smart Agriculture Alliance (NACSAA), a platform for educating and equipping the cultivators for sustainable agricultural productivity. With the growing concern for water conservation, governments in North America are actively providing subsidies to promote the adoption of smart irrigation systems. For instance, the California government has provided a rebate on smart controllers.

U.S. Smart Agriculture Market Trends

The smart agriculture market in the U.S. accounted for the largest market revenue share in North America in 2024. The rising popularity of vertical farming, smart greenhouses, and indoor agriculture in urban areas of the U.S. is opening new avenues for smart agriculture technologies. These methods rely heavily on automation, IoT, and AI to control growing environments and maximize output within limited spaces, making them ideal for metropolitan regions. The integration of smart systems in these innovative agricultural models is expanding the scope of the U.S. smart agriculture industry beyond traditional farms.

Europe Smart Agriculture Market Trends

The smart agriculture market in the Europe is expected to grow at a significant CAGR during the forecast period. Europe’s highly developed digital infrastructure and widespread access to broadband internet in rural areas provide a strong foundation for the deployment of connected agricultural technologies. The availability of high-speed connectivity enables real-time monitoring of fields, machinery, and livestock, making it easier for farmers to leverage IoT, AI, and big data analytics for informed decision-making. This digital readiness supports the expansion of precision farming, smart irrigation systems, and autonomous machinery throughout the continent.

The Germany smart agriculture market is expected to account for a significant revenue share in the European market in 2024. Germany’s robust R&D ecosystem is another key driver of the smart agriculture industry. The country hosts numerous agricultural research institutions, agri-tech startups, and collaborations between academia and the private sector. Initiatives such as Smart Agriculture Made in Germany promote the development and export of innovative farming technologies, while substantial government and EU funding support experimentation and scalability of digital solutions in agriculture.

Asia Pacific Smart Agriculture Market Trends

The smart agriculture market in Asia Pacific is expected to witness at the fastest CAGR over the forecasted period. Government initiatives and policy support are also major catalysts for growth. Programs such as India's Digital Agriculture Mission, China's Smart Agriculture Development Plan, and Japan’s Society 5.0 vision are driving the integration of AI, robotics, and big data into farming practices. These policies not only encourage technology adoption but also offer subsidies, training programs, and infrastructure development to support digitized farming ecosystems.

The China smart agriculture market held a significant market revenue share in Asia Pacific in 2024. The country’s expanding e-commerce and agri-food export sectors are pushing the need for enhanced traceability and quality control. Smart agriculture technologies enable the monitoring and documentation of every stage of the crop lifecycle, from seed to shelf. This traceability is becoming a key value differentiator in domestic and global markets, especially in the context of food safety regulations and consumer demand for transparency.

Key Smart Agriculture Company Insights

Some of the key players operating in the market include Trimble, Inc., AGCO Corporation, and Deere & Company, among others, which are among the leading participants in the smart agriculture industry.

-

AGCO Corporation is a U.S.-based agriculture equipment manufacturer. The company develops and sells a range of products and solutions, including tractors, combines, foragers, hay tools, self-propelled sprayers, smart farming technologies, seeding equipment, and tillage equipment.

-

Deere & Company is engaged in the manufacturing & construction of agricultural and forestry machinery, drivetrains, and diesel engines for heavy equipment, and lawn care machinery. In addition, the Company manufactures and supplies other heavy-duty manufacturing equipment. The company serves diverse industries, including agriculture, forestry, construction, landscaping & grounds care, engines & drivetrain, government and military, and sports turf.

Prospera Technologies and Agrible, Inc. are some of the emerging market participants in the smart agriculture industry.

-

Prospera Technologies is a global service provider of agriculture technology for managing and optimizing irrigation and crop health. The company provides AI-based sensors and cameras that aid farmers in crop monitoring.

-

Agrible is a U.S.-based agriculture solution provider. The company helps customers in more than 30 countries optimize water use, crop protection, fertilization, fieldwork, research trials, food supply chains, and sustainability initiatives.

Key Smart Agriculture Companies:

The following are the leading companies in the smart agriculture market. These companies collectively hold the largest Market share and dictate industry trends.

- Ag Leader Technology

- AGCO Corporation

- AgJunction, Inc.

- AgEagle Aerial Systems Inc.

- Autonomous Solutions, Inc.

- Argus Control Systems Ltd

- BouMatic Robotic B.V.

- CropMetrics

- CLAAS KGaA mbH

- CropZilla

- Deere & Company

- DICKEY-john

- DroneDeploy

- DeLaval Inc

- Farmers Edge Inc

- Grownetics, Inc.

- Granular, Inc.

- Gamaya

- GEA Group Aktiengesellschaft

- Raven Industries

- Trimble Inc.

- Topcon Positioning System

Recent Developments

-

In April 2025, Farmers Edge Inc. partnered with Taurus Ag Marketing Inc. to expand access to high-quality soil testing solutions across Canada. Taurus will improve the availability of advanced lab services, delivering industry-leading turnaround times and tailored insights to support data-driven decisions for growers, agronomists, and agri-businesses.

-

In July 2023, Deere & Company announced the acquisition of Smart Apply, Inc. The company planned to leverage Smart Apply’s precision spraying to assist growers in addressing the challenges associated with input costs, labor, regulatory requirements, and environmental goals.

-

In May 2023, AgEagle Aerial Systems Inc. announced that it had entered into a 2-year supply agreement with Wingtra AG. This agreement is intended to secure the supply of RedEdge-P sensor kits for incorporation with WingtraOne VTOL drones. This is particularly beneficial for those seeking to derive tangible benefits from unparalleled, high precision, and plant-level detail in commercial agriculture, environmental research, forestry, and water management applications.

-

In April 2023, AGCO Corporation announced a strategic collaboration with Hexagon for the expansion of AGCO’s factory-fit and aftermarket guidance offerings. The new guidance system was planned to be commercialized as Fuse Guide on Valtra and Massey Ferguson tractors.

-

In February 2023, Topcon Agriculture unveiled the launch of Transplanting Control, an exceptional guidance control solution for specialty farmers. This turnkey solution was designed to boost efficiency, reduce labor, and increase production. Further, it delivers GNSS-driven guidance, autosteering & control, thereby proving advantageous for the growers of perennial trees, vegetables, and fruits.

-

In January 2023, ASI Logistics, in collaboration with SICK, Inc., announced the successful implementation of autonomous yard truck operations. In this collaboration, ASI Logistics leveraged its groundbreaking Vehicle Automation Kit (VAK) along with the industry-leading LiDAR systems of SICK.

Smart Agriculture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.51 billion

Revenue forecast in 2033

USD 83.72 billion

Growth rate

CAGR of 14.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; Netherlands; Russia; China; India; Japan; Australia; Singapore; Brazil; Turkey

Key companies profiled

Ag Leader Technology; AGCO Corporation; AgJunction, Inc.; AgEagle Aerial Systems Inc.; Autonomous Solutions, Inc.; Argus Control Systems Ltd; BouMatic Robotic B.V.; CropMetrics; CLAAS KGaA mbH; CropZilla; Deere & Company; DICKEY-john; DroneDeploy; DeLaval Inc; Farmers Edge Inc.; Grownetics, Inc.; Granular, Inc.; Gamaya; GEA Group Aktiengesellschaft; Raven Industries; Trimble Inc.; Topcon Positioning System

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Agriculture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart agriculture market report based on offering, application, and region.

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Automation & Control Systems

-

Drones

-

Application Control Devices

-

Guidance System

-

GPS

-

GIS

-

-

Remote Sensing

-

Handheld

-

Satellite Sensing

-

-

Driverless Tractors

-

Mobile Devices

-

VRT

-

Map-based

-

Sensor-based

-

-

Wireless Modules

-

Bluetooth Technology

-

Wi-Fi Technology

-

Zigbee Technology

-

RF Technology

-

-

Milking Robots

-

-

Sensing Devices

-

Soil Sensor

-

Nutrient Sensor

-

Moisture Sensor

-

Temperature Sensor

-

-

Water Sensors

-

Climate Sensors

-

Others

-

-

HVAC System

-

LED Grow Light

-

RFID Tags & Readers

-

-

Software

-

Web-based

-

Cloud-based

-

-

Services

-

System Integration & Consulting

-

Maintenance & Support

-

Managed Types

-

Data Types

-

Analytics Types

-

Farm Operation Types

-

-

Assisted Professional Types

-

Supply Chain Management Types

-

Climate Information Types

-

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Precision Farming

-

Yield Monitoring

-

On-Farm

-

Off-Farm

-

-

Field Mapping

-

Crop Scouting

-

Weather Tracking & Forecasting

-

Irrigation Management

-

Inventory Management

-

Farm Labor Management

-

-

Livestock Monitoring

-

Milk Harvesting

-

Breeding Management

-

Feeding Management

-

Animal Comfort Management

-

Others

-

-

Smart Greenhouse

-

Water & Fertilizer Management

-

HVAC Management

-

Yield Monitoring

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global smart agriculture market size was estimated at USD 25.36 billion in 2024 and is expected to reach USD 28.51 billion in 2025.

b. The global smart agriculture market is expected to grow at a compound annual growth rate of 14.6% from 2025 to 2033 to reach USD 83.72 billion by 2033.

b. North America accounted for the largest revenue share of over 43.5% in 2024. The region is an early adopter of technologies. Growing government initiatives and regulations to enhance the agriculture industry in the region are expected to drive the North American regional demand during the forecast period.

b. Some key players operating in the smart agriculture market include Argus Control Systems Ltd. (Canada), Agribotix LLC (U.S.), Autonomous Solutions, Inc. (U.S.), CNH Industrial (UK), CLAAS (Germany), and CropZilla Software, Inc. (U.S.).

b. Key factors that are driving the smart agriculture market growth include increasing automation of commercial greenhouses and growing adoption of the Controlled Environment Agriculture (CEA) in the indoor farming sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.