- Home

- »

- Next Generation Technologies

- »

-

Smart Learning Market Size & Share, Industry Report, 2030GVR Report cover

![Smart Learning Market Size, Share & Trends Report]()

Smart Learning Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Solution), By Application (Asynchronous Learning, Synchronous Learning), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-597-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Learning Market Summary

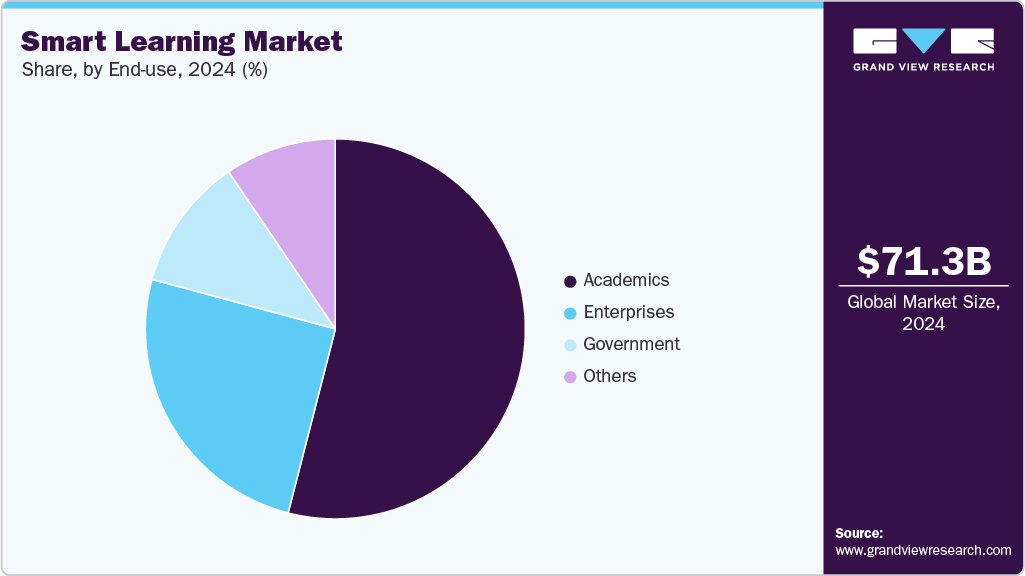

The global smart learning market size was estimated at USD 71.25 billion in 2024 and is projected to reach USD 177.43 billion by 2030, growing at a CAGR of 16.6% from 2025 to 2030. AI-driven hyper-personalization in education is becoming a major growth factor for the smart learning market.

Key Market Trends & Insights

- North America dominated the market and accounted for 38.4% share in 2024.

- The U.S. dominates the North American smart learning market, with significant spending from both government and private sectors.

- In terms of Offering, the hardware segment dominates the smart learning market is anticipated to hold 41.0% in 2024.

- By application, the asynchronous learning segment accounted for the largest market revenue share in 2024.

- By end use, the academic sector segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 71.25 Billion

- 2030 Projected Market Size: USD 177.43 Billion

- CAGR (2025-2030): 16.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advanced artificial intelligence (AI) technologies enable real-time adaptation to individual student needs. This creates customized learning paths that improve student engagement and outcomes. Multilingual and inclusive features break barriers for learners in underserved areas. Such innovations make education more accessible and effective worldwide. AI-powered personalization is transforming how education is delivered and expanding smart learning adoption. For instance, in December 2024, Infinity Learn, an EdTech company in India, collaborated with Google Cloud India to use advanced AI technologies such as Gemini and Vertex AI to deliver hyper-personalized learning experiences, especially for K-12 students in Tier 2 and 3 cities preparing for major exams. This collaboration provides AI-powered real-time guidance, tailored study plans, and multilingual support to help learners excel and bridge education gaps across India.

The smart learning market is seeing an uptick in demand for interactive and experiential learning solutions. AI-driven platforms are customizing education paths to individual learners. IoT devices in classrooms are providing real-time data and insights. Gamification and simulations are increasing student motivation and engagement. Cloud-based collaboration tools are supporting seamless remote and hybrid learning. Robust learning analytics are helping educators assess performance and refine their teaching strategies. Organizations are adopting interactive, data-driven, and collaborative technologies to transform education. For instance, in May 2025, Microsoft and the National FFA Organization expanded FarmBeats, Microsoft’s AI and IoT-powered precision agriculture platform, nationwide, equipping classrooms with smart sensor kits and an AI-driven curriculum. The program provides smart sensor kits and an AI-driven curriculum to teach precision agriculture in classrooms. It gives students hands-on experience with data science and AI, preparing them for future careers in farming and technology.

Augmented and virtual reality are transforming the smart learning environment by offering immersive, experiential methods of instruction. These tools allow learners to interact with content in three-dimensional formats, making abstract or complex subjects more tangible. Medical students, engineering trainees, and language learners benefit from simulated environments that mimic real-world scenarios. AR enhances classroom learning by overlaying digital content onto textbooks or physical surroundings, enabling real-time interactivity. Meanwhile, VR offers complete immersion, isolating learners from distractions and deepening engagement in virtual classrooms or training labs. Educational institutions and corporations are increasingly incorporating AR/VR to support blended learning models and reduce dependency on physical resources. As these technologies become more affordable and scalable, their adoption is expected to expand across both developed and emerging education systems.

Online learning has evolved from a supplementary option into a core mode of education delivery. The pandemic accelerated this transition, prompting schools, universities, and enterprises to embrace digital platforms at scale. In the corporate world, e-learning enables standardized training, faster onboarding, and continuous professional development without geographical limits. Higher education institutions are offering full degrees and certifications online, appealing to working professionals and international students. The flexibility, lower cost, and accessibility of online programs make them attractive across age groups and socioeconomic levels. Asynchronous formats, multimedia content, and AI-powered personalization further enhance learner outcomes. With ongoing investment in digital infrastructure and platform development, the trend toward online learning is expected to become permanent and increasingly sophisticated.

Offering Insights

In terms of Offering, the hardware segment dominates the smart learning market is anticipated to hold 41.0% in 2024. This dominance is driven by the widespread use of interactive displays, tablets, and other learning devices. Educational institutions are increasingly investing in advanced hardware to support digital learning environments. The segment benefits from ongoing innovations in device functionality and integration capabilities. Its continued expansion is supported by rising adoption of hybrid and remote learning models. Increased government funding for digital infrastructure in schools further boosts demand. Hardware providers are also forming strategic partnerships with content developers to offer integrated learning solutions.

The software segment in the smart learning market is experiencing steady growth. Increasing demand for personalized learning platforms and content management systems is a key factor driving this expansion. Schools and universities are adopting AI-driven tools and cloud-based solutions to enhance the learning experience. These platforms allow for real-time performance tracking and adaptive learning paths. The shift toward subscription-based models is also improving accessibility and scalability. As digital literacy improves, software adoption across both academic and corporate sectors continues to accelerate.

Application Insights

The asynchronous learning segment accounted for the largest market revenue share in 2024. Learners can engage with content anytime, making it ideal for those balancing studies with work or personal commitments. The format includes recorded lectures, digital coursework, and online assessments that do not require real-time participation. It supports self-paced progress, which is increasingly valued in both academic and corporate training settings. This model allows institutions to reach a wider and more diverse audience. As a result, asynchronous learning is becoming the preferred choice for scalable and inclusive education. Its continued adoption is driven by technological advancements in content delivery and learning management systems.

Synchronous learning involves real-time interaction between instructors and learners through live classes or virtual meetings. It supports immediate feedback and active engagement, which can enhance understanding and motivation. This approach is commonly used in classroom-based digital learning environments and live webinars. Despite its benefits, synchronous learning faces limitations in terms of scheduling and accessibility across different time zones. It often requires strong internet connectivity and coordinated timing, which can reduce its effectiveness in some settings. While still relevant, it is increasingly being supplemented by asynchronous methods for greater reach. Its use remains important in scenarios where direct interaction and collaboration are critical to the learning process.

End Use Insights

The academic sector segment accounted for the largest market revenue share in 2024. This is driven by the widespread integration of digital tools in schools and universities. Institutions are adopting e-learning platforms, smart classrooms, and virtual labs to enhance learning outcomes. Government initiatives to improve digital infrastructure in education are further accelerating this trend. The pandemic significantly boosted the use of remote learning solutions across K-12 and higher education. Teachers and administrators are increasingly leveraging analytics and AI-based tools to personalize instruction. This strong foundation positions academics as the core user base in the smart learning ecosystem.

The enterprise segment is growing steadily in the smart learning market, fueled by the need for continuous employee training and skill development. Companies are investing in online learning platforms to deliver scalable, on-demand training programs. These solutions help organizations remain competitive in rapidly changing industries. Features such as gamification, mobile access, and real-time performance tracking are improving engagement and outcomes. As workforce upskilling becomes a strategic priority, demand for corporate e-learning continues to increase. Enterprises are also using smart learning tools to support compliance training, leadership development, and onboarding processes.

Regional Insights

North America dominated the market and accounted for 38.4% share in 2024. The Smart Learning market in North America is well-established due to strong digital infrastructure and high education technology adoption. Schools and businesses are widely implementing AI-driven tools, cloud platforms, and immersive learning solutions. Public and private investments continue to drive innovation and expansion across the region. The presence of major EdTech companies supports ongoing product development and deployment.

U.S. Smart Learning Market Trends

The U.S. dominates the North American smart learning market, with significant spending from both government and private sectors. K-12 and higher education institutions are rapidly integrating virtual classrooms, learning management systems, and digital content. Corporations are also using advanced e-learning platforms for employee training and development. Policy support and ongoing digital transformation efforts fuel sustained growth in this space.

Europe Smart Learning Market Trends

Europe’s Smart Learning market is growing steadily, driven by widespread digitization in education and workforce training. Countries are investing in modernizing their education systems with online platforms and adaptive learning technologies. The European Union is supporting digital education initiatives through funding and policy frameworks. Demand is particularly strong in Western Europe, where institutions prioritize innovation in teaching and learning.

Asia Pacific Smart Learning Market Trends

The Asia Pacific Smart Learning market is expanding rapidly due to rising internet penetration and increased demand for accessible education. Governments in countries such as China, India, and Japan are promoting digital learning through national initiatives. A large student population and growing emphasis on competitive skills contribute to high platform adoption. Local EdTech startups and global players are both active in capturing market share.

Key Smart Learning Company Insights

Some of the key companies in the smart learning industry include BYJU’S, Coursera, Inc., Duolingo, Inc., Edmodo, Inc., Instructure, Inc., Khan Academy, Inc. and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

BYJU’S focuses on app-based, personalized learning for K-12 students and exam preparation. It uses interactive videos and AI-driven tools to customize lessons according to each learner’s pace. The company has expanded internationally through acquisitions and collaborations. Ongoing development in technology and content supports its growth in the smart learning market.

-

Coursera, Inc. offers online courses and professional training through partnerships with universities and organizations. Its platform provides access to MOOCs, degrees, and certificates for learners worldwide. Coursera uses adaptive learning and collaborative features to improve engagement and outcomes. Collaboration with academic and corporate partners continues to support its expansion.

Key Smart Learning Companies:

The following are the leading companies in the smart learning market. These companies collectively hold the largest market share and dictate industry trends.

- BYJU’S

- Coursera, Inc.

- Duolingo, Inc.

- Edmodo, Inc.

- Instructure, Inc.

- Khan Academy, Inc.

- Knewton, Inc. (John Wiley & Sons, Inc.)

- Pearson

- SMART Technologies ULC

- Udemy, Inc.

Recent Developments

-

In February 2025, Pearson and Amazon Web Services, Inc. expanded their collaboration to enhance AI-powered personalized learning for millions globally, focusing on higher education, virtual schools, and professional assessments. This collaboration utilizes AWS’s cloud infrastructure and AI tools such as Amazon Bedrock to improve learning experiences, workforce skilling, and digital credentialing, to make education more effective, accessible, and scalable.

-

In February 2025, Ingram Micro, a U.S.-based information technology company, partnered with Udemy to offer extensive upskilling opportunities across India, providing businesses access to nearly 30,000 courses in technical, business, and leadership skills. This partnership aims to equip organizations with the tools needed to stay competitive and future-ready in the evolving digital landscape.

-

In January 2025, Banco Santander, a financial services company in Spain, partnered with Coursera, Inc. to offer 10,000 scholarships providing free access to over 13,000 courses, including professional certifications from companies such as IBM Corporation, Microsoft, and Google LLC, across 13 countries. This partnership aims to boost employability and career growth by delivering high-quality, accessible education to a diverse global audience.

Smart Learning Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 82.24 billion

Revenue forecast in 2030

USD 177.43 billion

Growth rate

CAGR of 16.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Offering, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

BYJU’S; Coursera, Inc.; Duolingo, Inc.; Edmodo, Inc.; Instructure, Inc.; Khan Academy, Inc.; Knewton, Inc. (John Wiley & Sons, Inc.); Pearson plc; SMART Technologies ULC; Udemy, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Learning Market Report Segmentation

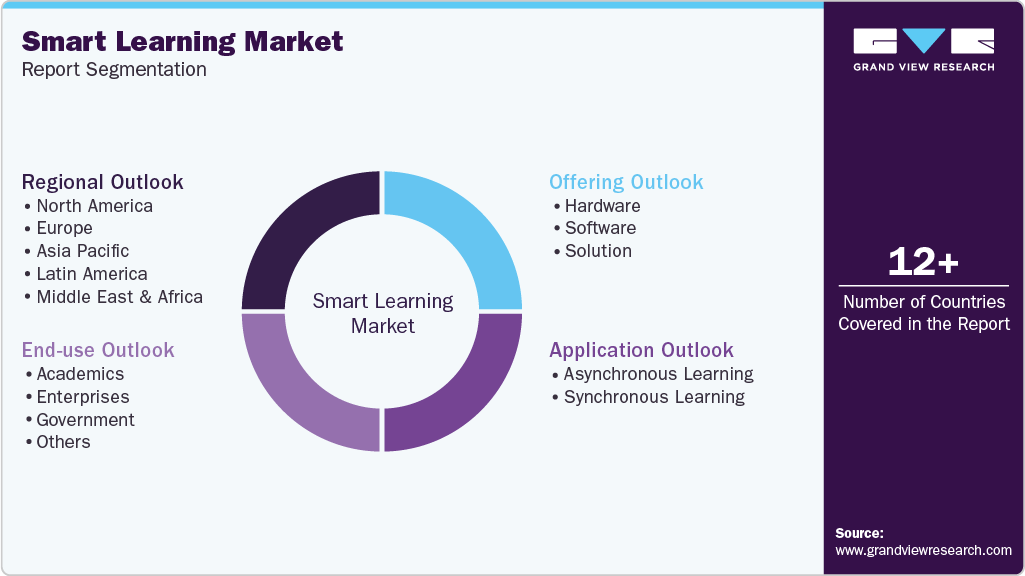

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart learning market report based on offering, application, end use, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Solution

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Asynchronous Learning

-

Synchronous Learning

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academics

-

Enterprises

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart learning market size was estimated at USD 71.25 billion in 2024 and is expected to reach USD 82.24 billion in 2025.

b. The global smart learning market is expected to grow at a compound annual growth rate of 16.6% from 2025 to 2030 to reach USD 177.43 billion by 2030.

b. North America dominated the smart learning market with a share of 38.4% in 2024. This is attributable to strong technological infrastructure, high digital adoption in education, and significant investments in e-learning solutions across the region.

b. Some key players operating in the smart learning market include BYJU’S, Coursera, Inc., Duolingo, Inc., Edmodo, Inc., Instructure, Inc., Khan Academy, Inc., Knewton, Inc. (John Wiley & Sons, Inc.), Pearson plc, SMART Technologies ULC, and Udemy, Inc.

b. Key factors that are driving the market growth include increasing demand for personalized learning, rising adoption of digital technologies in education, growing investments in EdTech, expansion of remote and hybrid learning models, and government initiatives supporting digital education.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.