- Home

- »

- Plastics, Polymers & Resins

- »

-

Smart Textile Polymers Market Size, Industry Report, 2033GVR Report cover

![Smart Textile Polymers Market Size, Share & Trends Report]()

Smart Textile Polymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Conductive Polymers & Dispersions, Shape-Memory Polymers), By End-use (Healthcare & Medical, Sports & Fitness, Military & Defense), By Region And Segment Forecasts

- Report ID: GVR-4-68040-799-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Textile Polymers Market Summary

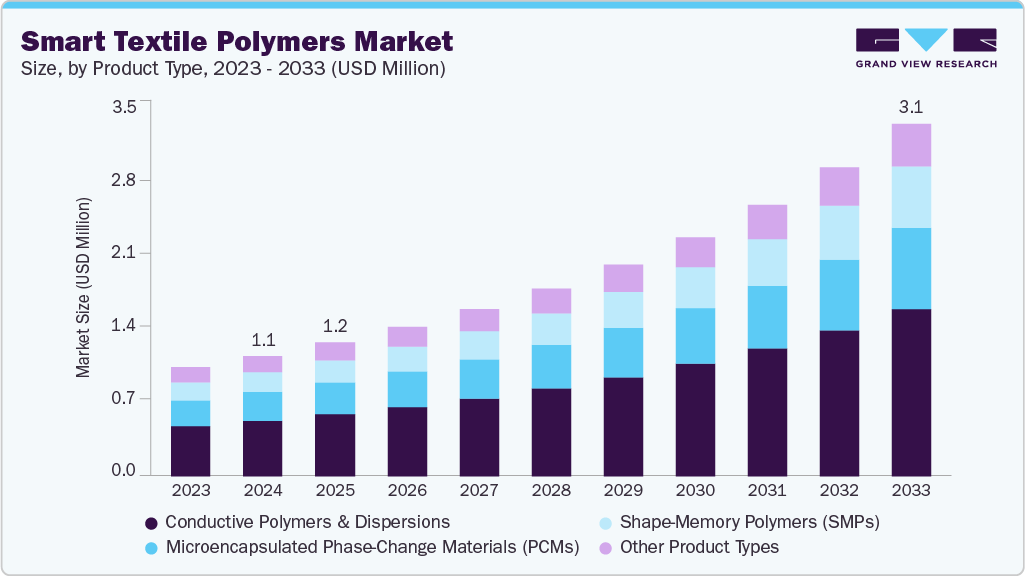

The global smart textile polymers market size was estimated at USD 1.1 million in 2024 and is projected to reach USD 3.1 million by 2033, growing at a CAGR of 12.9% from 2025 to 2033. Advancements in flexible electronics and nanomaterial integration are improving the performance and reliability of smart textile polymers, making them more suitable for real-world use.

Key Market Trends & Insights

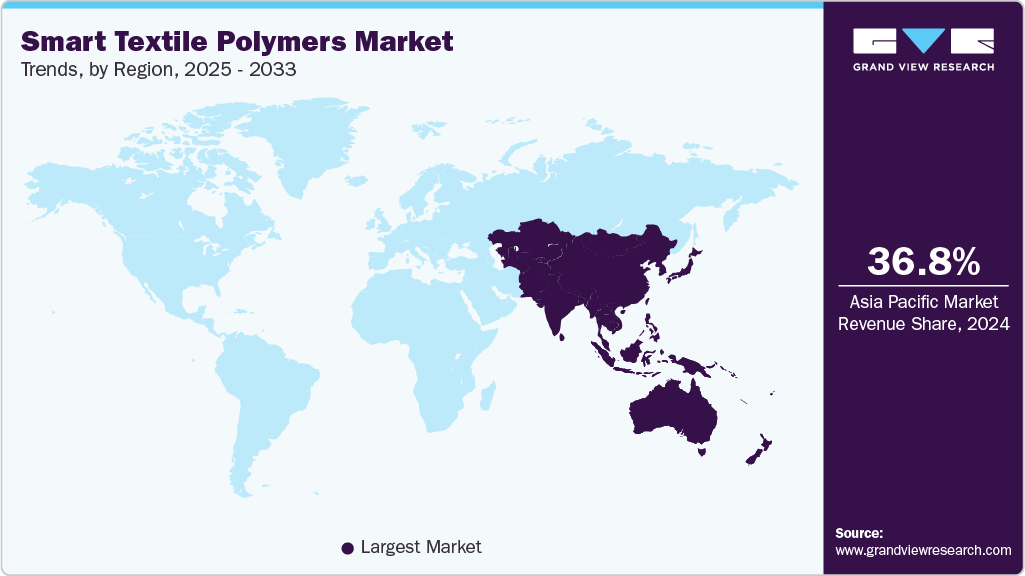

- Asia Pacific dominated the smart textile polymers market with the largest revenue share of 36.78% in 2024.

- The smart textile polymers market in China is expected to grow at a substantial CAGR of 14.3% from 2025 to 2033.

- By product type, the conductive polymers & dispersions dominated the smart textile polymers market across the product type segmentation in terms of revenue, accounting for a market share of

- 46.32% in 2024.

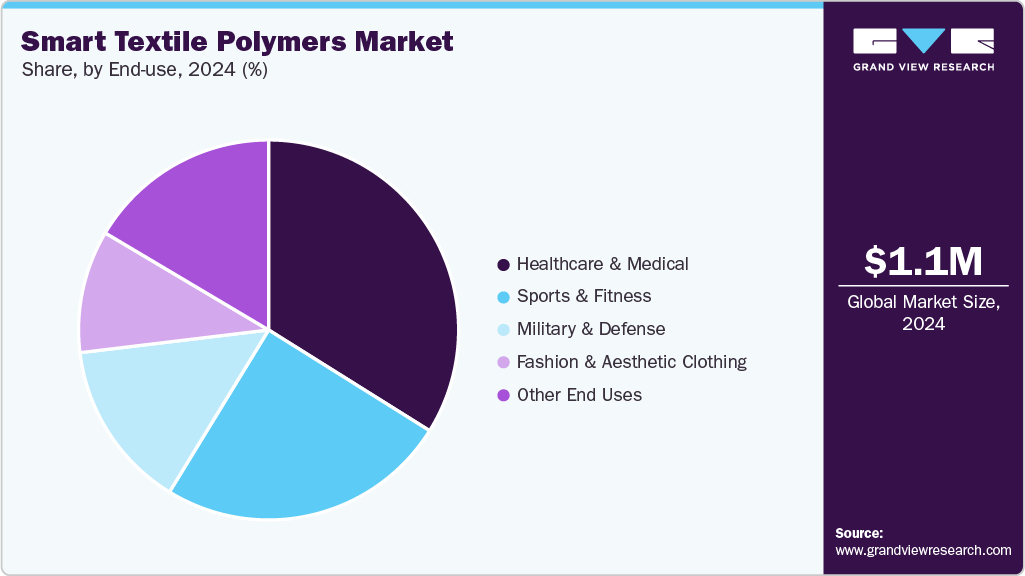

- By end-use, the healthcare & medical segment dominated the smart textile polymers market across the application segmentation in terms of revenue, accounting for a market share of 33.90% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.1 Million

- 2033 Projected Market Size: USD 3.1 Million

- CAGR (2025 - 2033): 12.9%

- Asia Pacific: Largest market in 2024

This technological progress is encouraging wider adoption across sectors like sportswear, defense, and healthcare. Investment is concentrating on polymers that combine conductivity, sensing and durability for wearable systems. Market forecasts show strong double-digit growth as system integrators adopt e-textiles for healthcare, sports and industrial safety.

Modular designs and scalable printing processes are shortening time-to-market for new polymer-enabled garments. This is driving consolidation between material suppliers and electronics integrators.

Drivers, Opportunities & Restraints

Regulatory pressure and cost benefits from remote monitoring are pushing hospitals and employers to deploy smart-fabric solutions. Polymers that enable soft, conformable sensors reduce the need for rigid hardware and improve patient comfort. Demand is highest for reliable, wash-stable conductive and dielectric polymer systems. As reimbursement and telemedicine models mature, procurement cycles at hospitals and large enterprises are accelerating adoption.

There is a clear commercial opening for bio-based, biodegradable polymers that meet performance thresholds for strength and conductivity. Brands and regulators are prioritising circularity, creating premium pricing pockets for certified sustainable materials. Technical advances in polymer chemistry and enzyme-based recycling create pathways to cost parity with incumbents. Suppliers who validate lifecycle claims with robust testing will capture apparel and automotive OEM contracts.

High material costs and complex multi-step fabrication remain primary barriers to volume deployment. Many conductive and functional polymer processes are sensitive to process variation and require specialised lines. This raises unit costs and complicates supply chains for apparel manufacturers. Until throughput improves and standard test methods become widespread, adoption will be concentrated in high-value, low-volume segments.

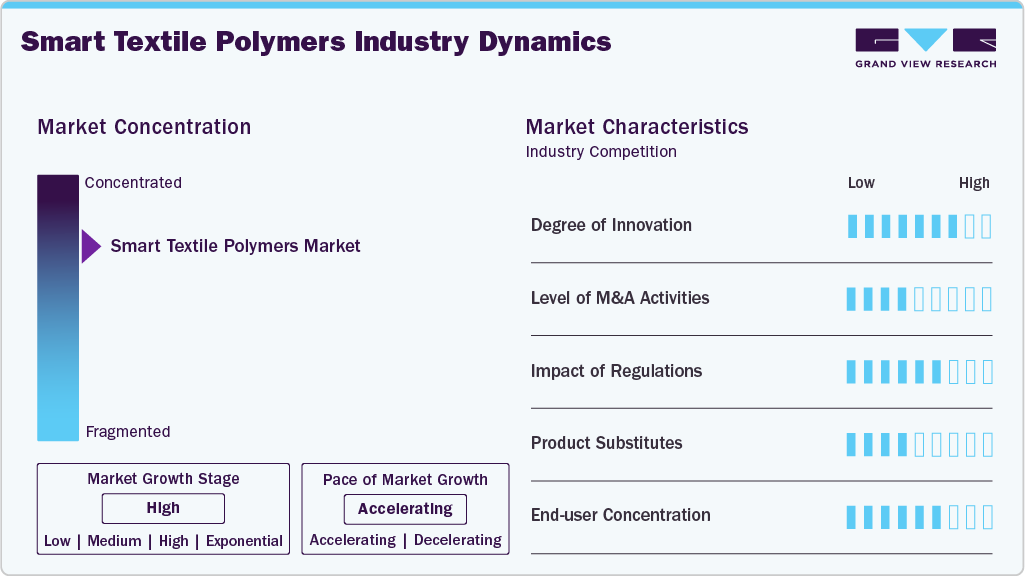

Market Concentration & Characteristics

The market growth stage of the smart textile polymers market is high, and the pace is accelerating. The market exhibits consolidation, with key players dominating the industry landscape. Major companies like Agfa, Heraeus, DuPont de Nemours Inc., Henkel AG & Co. KGaA, Outlast Technologies, BASF SE, Covestro AG, Avient, Huntsman Corporation, Solvay, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Smart textile polymers sit at the intersection of advanced materials and embedded electronics, producing rapid, application-led innovation. Recent R&D focuses on printable conductive formulations, ionic conductors and self-healing chemistries that improve durability and signal fidelity. Startup activity and strategic partnerships are accelerating scale-up of these novel chemistries into textile-compatible formats. As a result, innovation is shifting from component-level proofs of concept to system-ready polymer platforms that shorten OEM qualification cycles.

Substitution risk comes from conventional electronics, coated fabrics and retrofit sensor modules that replicate many smart-textile functions at lower technical risk. Off-the-shelf rigid sensors and stitched electronics remain attractive where cost and proven reliability matter most. Hybrid approaches, such as textile substrates combined with detachable electronic modules, are emerging as practical compromises for many customers. Full displacement of these substitutes will require further cost reduction, standardized testing and demonstrable lifecycle performance.

Product Type Insights

Conductive polymers & dispersions dominated the smart textile polymers market across the product type segmentation in terms of revenue, accounting for a market share of 46.32% in 2024. Manufacturers are prioritizing dispersions that deliver consistent conductivity after textile printing and washing. This reduces integration costs for garment makers and shortens qualification cycles for OEMs. Volume growth is supported by broader adoption in flexible electronics and automotive interiors. Market forecasts and industry research show accelerating investment in scalable conductive polymer technologies.

The shape-memory polymers (SMPs) segment is anticipated to grow at a substantial CAGR of 13.5% through the forecast period. SMPs enable textiles that change shape or stiffness in response to temperature or electrical stimulus. Designers use this to add adaptive fit, passive compression and deployable features without heavy mechanical parts. Aerospace and medical device interest is pushing material development and regulatory testing. Recent market analyses indicate fast revenue growth as application engineering reduces unit cost.

End-use Insights

Healthcare & medical dominated the smart textile polymers market across the application segmentation in terms of revenue, accounting for a market share of 33.90% in 2024 and is forecasted to grow at fastest CAGR of 13.7% from 2025 to 2033. Hospitals and device makers favour polymer systems that embed biosensing capabilities into comfortable garments. Key selection criteria are signal fidelity, wash durability and validated clinical performance. Telemedicine expansion and chronic care pathways are shifting procurement toward integrated textile solutions. Market reports highlight healthcare as one of the largest and fastest growing end uses.

The sports & fitness segment is expected to expand at a substantial CAGR of 13.2% through the forecast period. Sports brands invest in polymers that enable high-resolution motion and physiological sensing while preserving stretch and breathability. Data-driven coaching and injury prevention programs increase willingness to pay for validated textile sensors. Manufacturing partnerships between material suppliers and sports OEMs are shortening product cycles. Industry forecasts show consistent CAGR for the smart sports segment.

Regional Insights

Asia Pacific held the largest share of 36.78% in terms of revenue of the smart textile polymers market in 2024 and is expected to grow at the fastest CAGR of 14.0% over the forecast period. Asia Pacific’s large textile manufacturing base and close OEM relationships accelerate commercial trials and cost down of smart polymers. Local brands in sportswear and consumer electronics move fast from pilot to production because converters and garment makers are co-located. Investment in textile automation and contract R&D shortens the path from formulation to finished product. Market entrants that offer localized technical support and supply reliability win rapidly.

China Smart Textile Polymers Market Trends

China combines aggressive industrial policy on AI-enabled manufacturing with targeted consumer subsidies for smart devices. The result is rapid deployment of smart textile lines and rising domestic demand for wearable sensors. Government programs that fund equipment upgrades and smart factories lower cost barriers for polymer-scale up. Firms that align with local ecosystems and comply with domestic standards gain fast commercial traction.

North America Smart Textile Polymers Market Trends

Demand in North America is shaped by defense contracts and industrial wearable pilots that require robust, certifiable polymer solutions. Firms are investing in scalable conductive and sensor polymers to meet ruggedization and cybersecurity requirements. Supply chain localization and partnerships with electronics integrators shorten qualification cycles. These dynamics favor suppliers that can demonstrate regulatory compliance and volume manufacturing.

The U.S. smart textile polymers market size is significantly increasing because hospitals and home-health providers are buying discrete, garment-based monitoring systems. Federal funding and venture capital are supporting startups that translate lab chemistries into washable, clinical-grade polymers. At the same time, reshoring of high-tech textile manufacturing is improving domestic scale and reducing time-to-market. Suppliers with clear clinical validation and domestic production capability capture premium contracts.

Europe Smart Textile Polymers Market Trends

European demand is increasingly driven by regulatory frameworks and brand commitments on textile waste and traceability. Extended producer responsibility and emerging circular procurement criteria push buyers toward recyclable and certified polymer systems. This creates a premium segment for validated lifecycle-compliant materials. Companies that embed recyclability and chain-of-custody data into their polymers gain preferential access to large retail and automotive tenders.

Key Smart Textile Polymers Company Insights

The Smart Textile Polymers Market is highly competitive, with several key players dominating the landscape. Major companies include Agfa, Heraeus, DuPont de Nemours Inc., Henkel AG & Co. KGaA, Outlast Technologies, BASF SE, Covestro AG, Avient, Huntsman Corporation, and Solvay. The smart textile polymers market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Smart Textile Polymers Companies:

The following are the leading companies in the smart textile polymers market. These companies collectively hold the largest Market share and dictate industry trends.

- Agfa

- Heraeus

- DuPont de Nemours Inc.

- Henkel AG & Co. KGaA

- Outlast Technologies

- BASF SE

- Covestro AG

- Avient

- Huntsman Corporation

- Solvay

Recent Developments

-

In April 2025, AFFOA selected Nuream and Z-Polymers for its Product Accelerator for Functional Fabrics (PAFF) 2.0. The award gives both firms technical and pilot-scale support to speed commercialization of polymer-enabled fabrics and pilot production with U.S. textile partners.

-

In April 2025, Nottingham Trent University and Trelleborg launched a knowledge-transfer partnership to advance smart medical textiles. The collaboration focuses on R&D and development of polymer-based smart mattress and patient-monitoring systems for clinical use.

Smart Textile Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.2 million

Revenue forecast in 2033

USD 3.1 million

Growth rate

CAGR of 12.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Global Transparent Plastic Market Report Segmentation

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Agfa; Heraeus; DuPont de Nemours Inc.; Henkel AG & Co. KGaA; Outlast Technologies; BASF SE; Covestro AG; Avient; Huntsman Corporation; Solvay

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

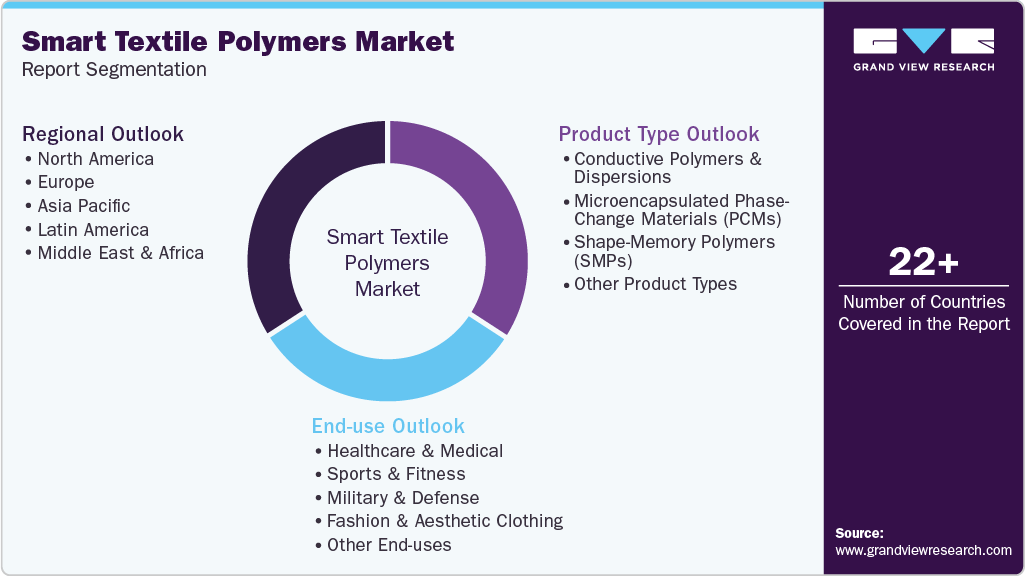

Global Smart Textile Polymers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the smart textile polymers market report on the basis of product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, Volume, Tons, 2021 - 2033)

-

Conductive Polymers & Dispersions

-

Microencapsulated Phase-Change Materials (PCMs)

-

Shape-Memory Polymers (SMPs)

-

Other Product Types

-

-

End-use Outlook (Revenue, USD Million, Volume, Tons, 2021 - 2033)

-

Healthcare & Medical

-

Sports & Fitness

-

Military & Defense

-

Fashion & Aesthetic Clothing

-

Other End-uses

-

-

Regional Outlook (Revenue, USD Million, Volume, Tons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.