- Home

- »

- Clothing, Footwear & Accessories

- »

-

Socks Market Size, Share And Growth, Industry Report 2033GVR Report cover

![Socks Market Size, Share & Trends Report]()

Socks Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Athletic, Lifestyle), By Socks Length (Over-the-calf, Mid-calf, Ankle), By Material (Cotton, Polyester, Polyamide, Wool, Elastane), By End Use (Men, Women, Kids), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-347-8

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Socks Market Summary

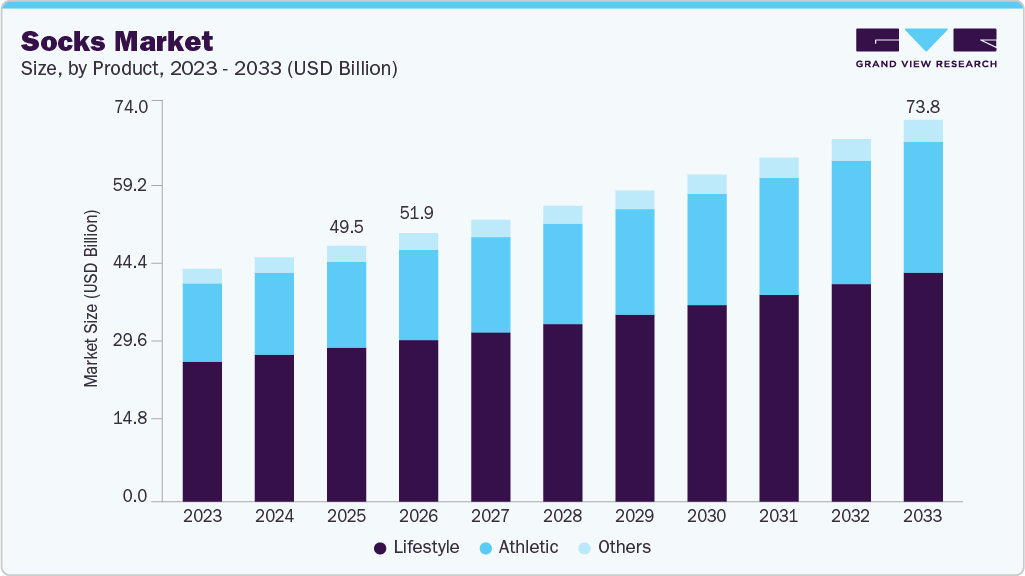

The global socks market size was estimated at USD 49.48 billion in 2025 and is projected to reach USD 73.83 billion by 2033, growing at a CAGR of 5.2% from 2026 to 2033. The socks industry is being driven by changing consumer lifestyles and evolving fashion sensibilities.

Key Market Trends & Insights

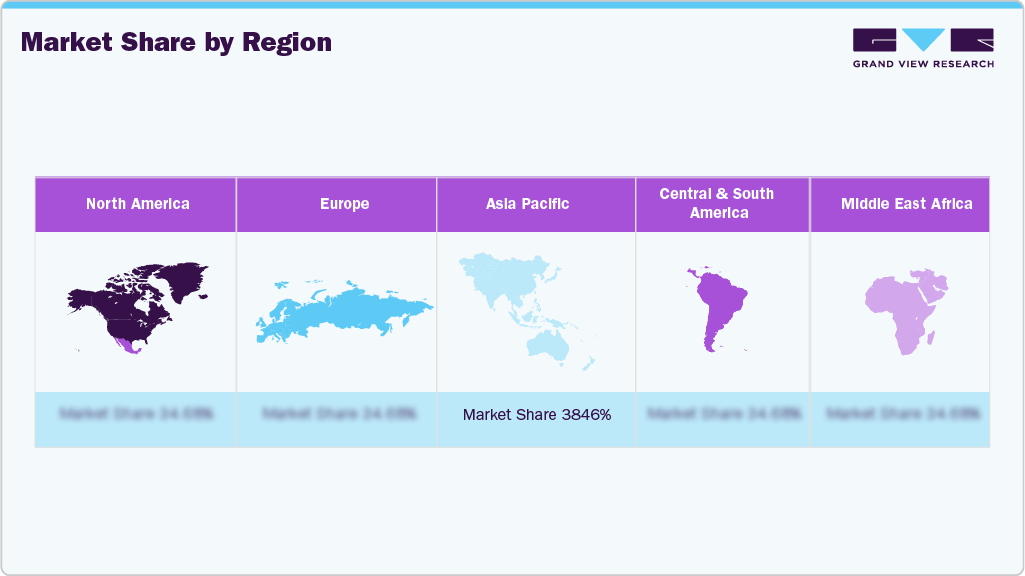

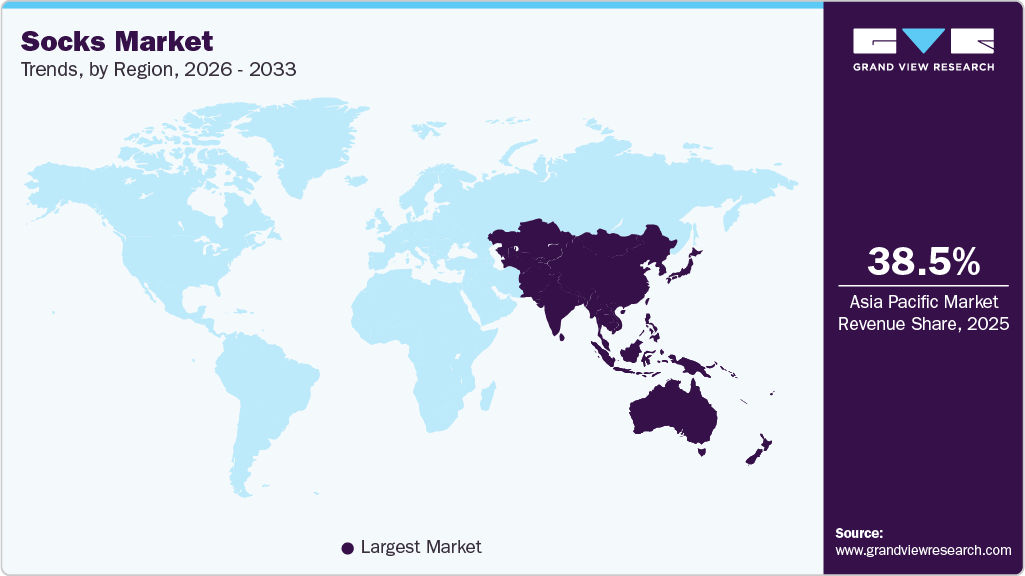

- Asia Pacific dominated the global socks market with the largest market revenue share of 38.46% in 2025.

- By product, the lifestyle socks segment led the market with the largest revenue share of 60.16% in 2025.

- By socks length, the mid-calf socks segment accounted for the largest market revenue share in 2025.

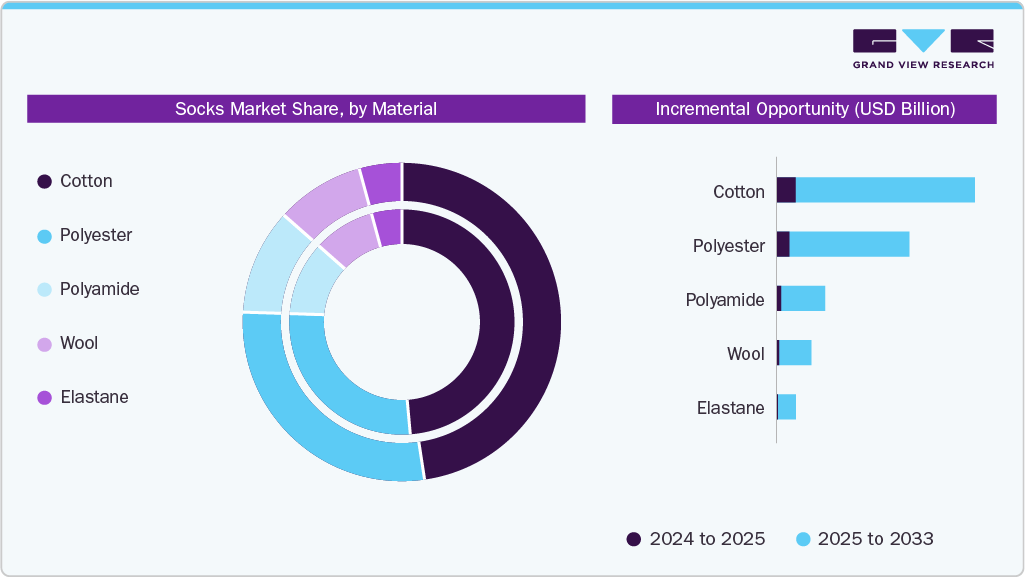

- By material, the cotton socks segment accounted for the largest market revenue share in 2025..

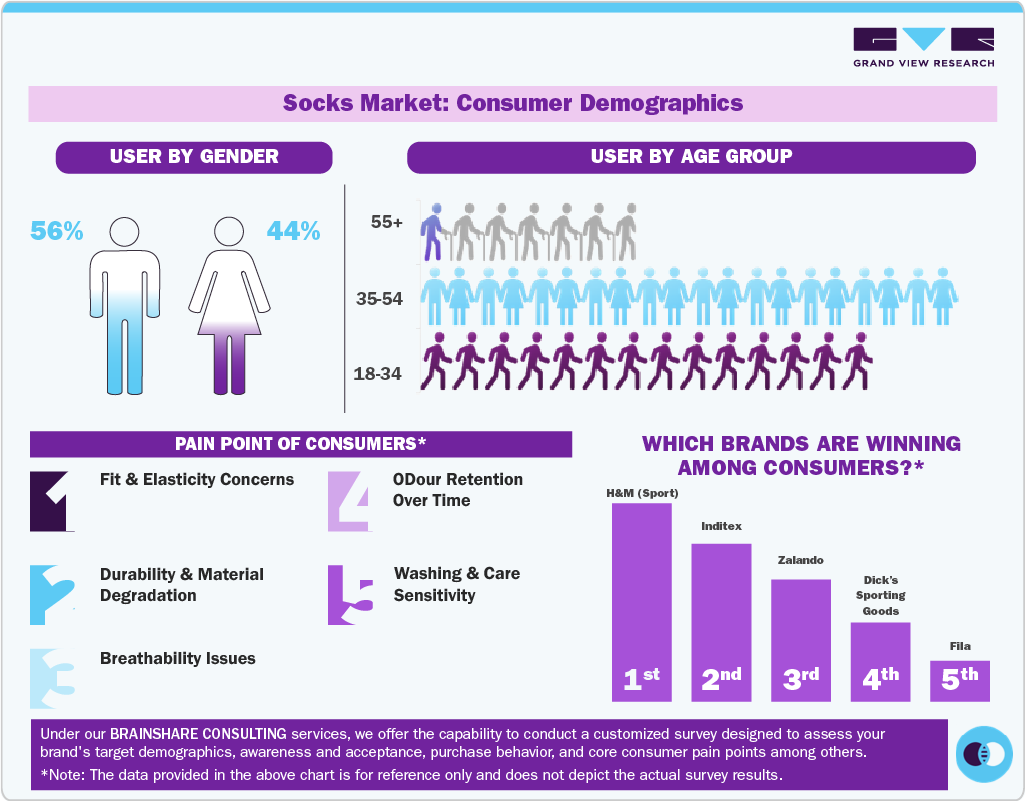

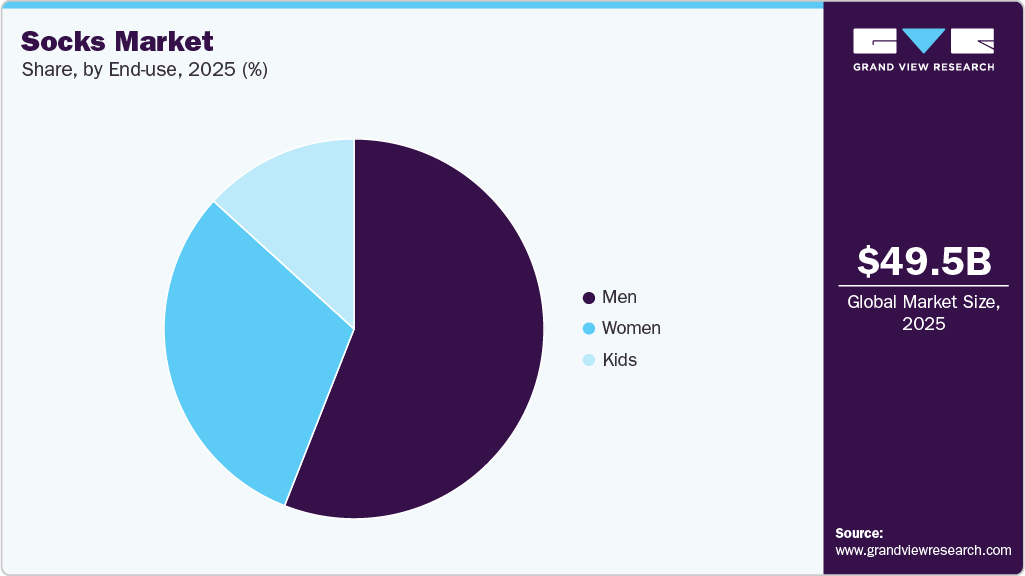

- By end use, the mens segment accounted for the largest market revenue share in 2025.

- By distribution channel, the e-commerce segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 49.48 Billion

- 2033 Projected Market Size: USD 73.83 Billion

- CAGR (2026-2033): 5.2%

- Asia Pacific: Largest market in 2025

Today’s buyers are looking beyond basic functionality, seeking socks that deliver comfort, style, and performance in equal measure. The shift toward premium, skin-friendly fabrics and ergonomic designs reflects a growing awareness of quality and personal well-being.For instance, in January 2025, BONJOUR introduced eco-friendly Bamboo Socks offering breathability and odor resistance. The company also launched a campaign, “7 Days No Smell,” to promote the range of benefits. Consumers are increasingly viewing socks as part of their self-care routine, something that keeps them comfortable and confident, whether they’re at work, traveling, or relaxing at home.

As consumers become more conscious about their clothing choices, the demand for socks made from soft, breathable, and skin-friendly fabrics has surged. Natural materials, including cotton, bamboo, and Merino wool, have gained popularity due to their moisture-wicking properties, softness, and ability to regulate temperature. These fabrics offer enhanced comfort by keeping feet dry and cool, reducing irritation, and preventing odors. As people spend more time on their feet, either working, commuting, or engaging in physical activities, socks designed with comfort in mind are no longer just a basic necessity but an essential part of daily wear.

Consumers are now more likely to prioritize socks that offer a high degree of comfort throughout the day, recognizing that poor fabric choices can lead to blisters, chafing, or discomfort. The growing preference for soft and breathable materials aligns with a broader trend among consumers to prioritize clothing that prioritizes comfort. This trend has led manufacturers to innovate in the area of fabric blends, creating socks that cater to varying needs, such as extra softness, breathability, and long-lasting comfort. For instance, in November 2023, Damensch Apparel Pvt. Ltd., based in India, introduced Aloe-soft socks to enhance comfort. These aloe vera-infused socks are crafted to mitigate fatigue and feature ribbed structures that promote better circulation in the feet & legs.

Furthermore, the rising trend of athleisure has significantly impacted the socks industry, especially with the growing popularity of gym culture, running, and home workouts. As fitness enthusiasts prioritize both style and performance, socks are now seen as an integral part of athletic gear. The demand for high-performance socks has skyrocketed, driven by a desire for products that provide enhanced support, moisture-wicking properties, and breathability. According to the survey by Sporting Goods Intelligence published in January 2025, about 73% athletes believe a good pair of socks can significantly improve their performance. For instance, runners and gym-goers favor compression socks or those with arch support to improve circulation and reduce muscle fatigue during intense workouts.

According to the BioMed Central Ltd studies published in March 2021, about 88% of the compression garment users, including socks, were athletes, out of which 85% users were runners. Athleisure is no longer confined to yoga studios and fitness centers; it has become a lifestyle that has permeated everyday fashion. Socks designed for active wear are increasingly made from advanced materials, such as spandex, nylon blends, and high-tech fibers, that offer superior stretch, durability, moisture-wicking capabilities, and comfort. The performance socks segment has expanded, with products that include extra padding in high-impact areas, ergonomic designs, and ventilation zones to keep feet cool and dry, whether users are running a marathon or cycling indoors.

Consumer Insights

Sock purchases are driven by highly specific wear conditions such as foot sweat levels, friction intensity, temperature exposure, and time spent standing or walking, making socks a core performance layer rather than a basic apparel add-on. In sectors such as healthcare, warehousing, hospitality, manufacturing, endurance sports, and outdoor recreation, socks are worn continuously for 8-12 hours, which elevates the importance of blister prevention, moisture evacuation, and targeted cushioning. For lifestyle consumers, socks also act as an easy entry point into functional apparel, leading to frequent replacement cycles and multiple-pair ownership across athletic, work, casual, and travel use cases.

Fit precision is the strongest determinant of repeat purchase in the socks industry, often outweighing brand affinity. Consumers closely evaluate heel-lock construction, arch compression bands, toe-box shape, and cuff elasticity, as poor execution results in slippage, bunching, pressure marks, or circulation discomfort. Demand is rising for anatomically engineered socks with left-right specific shaping, seamless or hand-linked toes, zonal cushioning, and graduated compression to support prolonged movement and reduce foot fatigue.

Material selection plays a decisive role because socks operate in high-friction, high-moisture microclimates. Merino wool blends are preferred for odor control and temperature regulation, while polyester and nylon blends dominate performance categories due to abrasion resistance, fast drying, and shape retention. Cotton blends remain relevant for everyday wear but are increasingly enhanced with elastane or moisture-management finishes. In warm climates and high-activity scenarios, breathability and antimicrobial treatments significantly influence purchase, while colder conditions prioritise thermal insulation without bulk. Sustainability is gaining traction, particularly in lifestyle and premium segments, where buyers assess recycled yarn content, dye processes, and durability for products with high turnover.

Digital discovery is especially influential in the socks industry because performance benefits are difficult to assess visually. Consumers rely heavily on activity-specific labeling, wear-test reviews, and detailed feedback on thickness, compression level, and durability. Multipacks and purpose-driven assortments appeal to corporate buyers, healthcare institutions, and sports teams, while individual consumers increasingly trade up to premium socks that maintain cushioning, elasticity, and moisture control after repeated washing and extended use.

Product Insights

The lifestyle segment led the market with the largest revenue share of 60.16% in 2025. As consumers increasingly engage in walking, gym sessions, yoga, travel, work-from-home routines, and casual commuting, lifestyle socks have evolved into comfort-led, performance-inspired essentials. Contemporary lifestyle socks are engineered with soft, breathable yarn blends, seamless or flat-toe construction, targeted cushioning, and elastic arch support to ensure comfort during prolonged wear. Brands such as Nike, Adidas, Puma, Lululemon, Stance, and Uniqlo emphasise ergonomic fit, moisture management, and clean, versatile aesthetics that complement both athleisure and casual dressing.

The athletic socks segment is projected to grow at the fastest CAGR of 5.4% over the forecast period. With more people engaging in sports activities, gym workouts, and outdoor activities such as hiking and running, the demand for performance-oriented socks designed to enhance comfort, breathability, and moisture control has increased. According to the survey by Sporting Goods Intelligence published in January 2025, about 73% athletes believe a good pair of socks can significantly improve their performance.

Socks Length Insights

The Mid-calf socks segment led the market with the largest revenue share of 45.59% in 2025. Mid-calf socks are gaining traction due to their inclusion in sports and activewear collections, particularly for those involved in running, cycling, or even yoga. According to the BikeExchange Inc. data published in August 2024, mid-length socks are popular among riders as they offer good foot & ankle support and provide ankle protection in the event of a crash. In addition, the mid-calf length gives a slightly more supportive feel compared to ankle socks, especially for runners and athletes who value ankle stability. This support is key to reducing the risk of injury, especially during high-impact activities.

The ankle socks segment is projected to grow at the fastest CAGR of 5.1% over the forecast period. Demand is rising for ankle socks made with polyester-based yarns and polyester-elastane blends that provide an effective balance of stretch, breathability, and shape retention under constant movement. The emphasis on moisture-wicking performance, quick-drying properties, and resistance to abrasion is encouraging brands to adopt engineered knit structures with targeted ventilation zones and reinforced heel and toe areas, supporting both active performance and daily wear requirements.

Material Insights

The cotton socks segment led the market with the largest revenue share of 49.09% in 2025. Cotton’s ability to absorb moisture, regulate temperature, and remain comfortable in warm conditions makes it a preferred choice for socks worn over extended periods, including work, travel, and casual use. Its soft hand feel and durability support frequent washing and repeated wear without significant loss of shape or comfort, aligning well with everyday lifestyle requirements. Rising adoption is further supported by the shift toward comfort-led, versatile sock options that can transition seamlessly between home, commuting, and light activity, reinforcing cotton socks’ position as a dependable and widely accepted material segment within the market.

The polyester socks segment is projected to grow at the fastest CAGR of 5.8% over the forecast period. Consumers increasingly favour polyester-based yarns and polyester-elastane blends that deliver an effective balance of stretch, breathability, and shape retention, making them suitable for prolonged wear during high-movement activities as well as daily routines. The growing emphasis on moisture-wicking capability, quick-drying performance, and resistance to abrasion and deformation is encouraging brands to adopt engineered polyester knits with zonal ventilation and reinforced stress areas.

End Use Insights

The mens segment led the market with the largest revenue share of 55.97% in 2025. Male consumers increasingly view socks as functional necessities rather than basic apparel, driven by higher participation in fitness, walking, commuting, travel, and casual outdoor activities. Demand is closely aligned with the broader shift toward athleisure and comfort-led dressing, where socks are expected to deliver breathability, cushioning, moisture control, and consistent fit across long wear durations. Men tend to prefer designs that balance utility with clean, understated styling, enabling socks to transition easily from workouts and workdays to leisure and travel, reinforcing their dominance within the overall socks industry.

The women’s segment is projected to grow at the fastest CAGR of 5.6% over the forecast period. Growing awareness around foot health, blister prevention, and moisture management is expanding usage beyond basic utility into regular wardrobe rotation. At the same time, design innovation in women’s socks, such as seamless or flat-toe construction, targeted support zones, soft elastic cuffs, and adaptable styles, continues to improve comfort across diverse foot shapes and styling preferences, reinforcing steady growth in the segment.

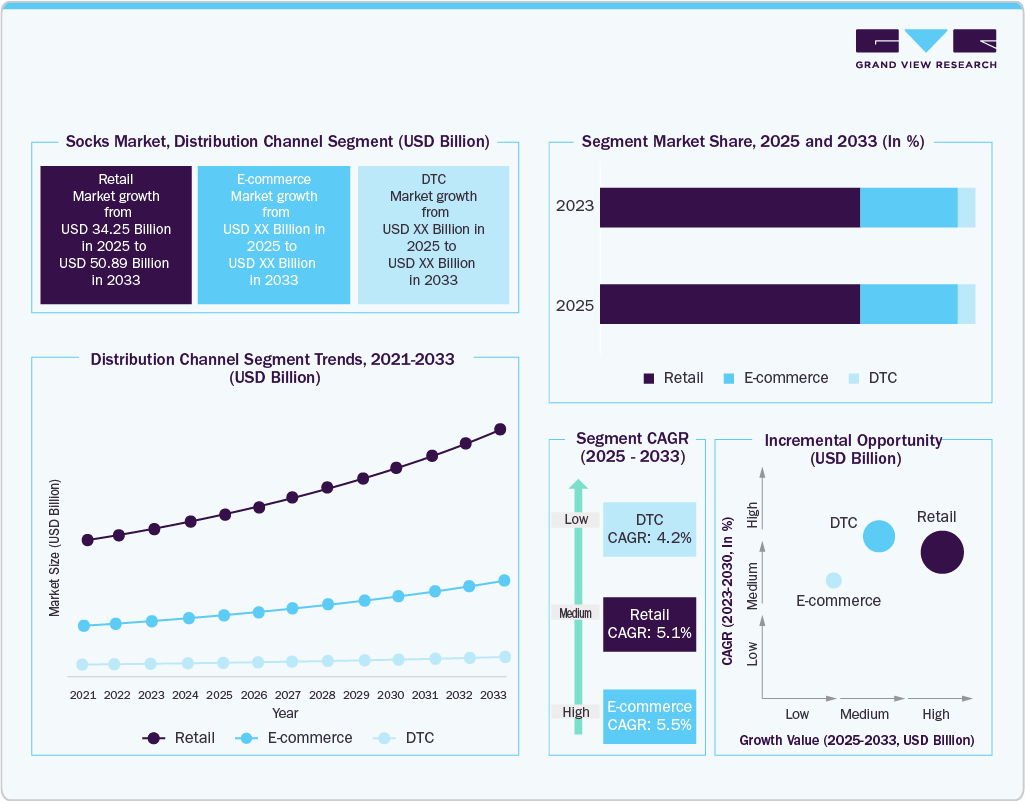

Distribution Channel Insights

The retail sales segment led the market with the largest revenue share of 69.23% in 2025. Growing awareness around foot health, blister prevention, and moisture management is expanding usage beyond basic utility into regular wardrobe rotation. At the same time, design innovation in women’s socks, such as seamless or flat-toe construction, targeted support zones, soft elastic cuffs, and adaptable styles, continues to improve comfort across diverse foot shapes and styling preferences, reinforcing steady growth in the segment.

The e-commerce sales segment is projected to grow at the fastest CAGR of 5.5% over the forecast period. E-commerce has rapidly transformed the socks industry, offering unparalleled convenience, variety, and accessibility. Online platforms, ranging from global marketplaces such as Amazon to niche sock-specific websites, enable consumers to browse a wide array of styles, sizes, and brands from the comfort of their homes. According to the DICK’S SPORTING GOODS, INC. annual report 2024, 80% of online sales were fulfilled by physical stores, serving as localized distribution points, enabling over 90% of total sales through online fulfillment and in-person sales. The ability to compare prices, read reviews, and shop at any time of day or night attracts a growing number of customers who prioritize convenience over traditional in-store shopping.

Regional Insights

The socks market in North America held a significant revenue share of 21.05% in 2025. The region’s advanced retail and e-commerce ecosystem, combined with the strong presence of global sportswear and lifestyle brands, accelerates adoption of technically engineered socks that emphasise moisture management, durability, and shape retention. Growing consumer awareness around foot health, fabric performance, and long-wear comfort continues to drive repeat purchases, reinforcing North America’s position as a mature yet innovation-led socks industry.

U.S. Socks Market Trends

The socks market in the U.S. accounted for the largest market revenue share in North America in 2025. Demand is increasing for socks that offer lightweight construction, breathable yarn blends, and a secure yet non-restrictive fit, particularly among consumers engaged in regular physical activity or extended work-from-home routines. Younger demographics, especially Gen Z, are accelerating this shift through digital-first shopping behaviour, strong alignment with athleisure and lifestyle branding, and elevated expectations around comfort, durability, and value.

Europe Socks Market Trends

The socks market in Europe is anticipated to grow at a significant CAGR during the forecast period. Consumers across key markets such as Germany, France, Italy, and the Nordics increasingly view socks as visible style elements rather than purely functional basics, driving interest in designs that offer comfort, breathability, and everyday versatility. The rise of walking culture, cycling, fitness, and urban commuting has strengthened demand for socks that combine cushioning, moisture control, and durable construction with clean, contemporary aesthetics.

The Germany socks market led the Europe market in 2025, holding the largest market share in the region’s total revenue. Consumers increasingly seek socks that support the country’s active lifestyle, shaped by widespread participation in walking, cycling, fitness training, and recreational sports. The popularity of hiking, gym workouts, and urban running culture is boosting demand for performance-oriented socks that offer moisture management, cushioning, and reliable fit over long wear periods. Shoppers in major cities such as Berlin and Munich also show a growing willingness to invest in higher-quality socks that reflect German values of craftsmanship, clean design, and functional aesthetics, reinforcing Germany’s leadership within the European market.

Asia Pacific Socks Market Trends

Asia Pacific dominated the global socks market with the largest revenue share of 38.46% in 2025 and is anticipated to grow at the fastest CAGR during the forecast period. Consumers in markets such as China, Japan, India, and South Korea are increasingly adopting socks as essential daily-wear items that combine comfort, functionality, and style. The growing influence of athleisure and casual fashion is boosting demand for versatile socks suitable for both active and non-active settings, while the region’s strong manufacturing and textile capabilities support rapid innovation in lightweight, breathable, and climate-appropriate yarn blends.

Central & South America Socks Market Trends

The socks market in Central & South America is projected to grow at a significant CAGR of 5.5% from 2026 to 2033. Consumers across key markets in the region are increasingly adopting socks as essential daily-wear items that combine comfort, functionality, and style. The expanding influence of athleisure and casual fashion is driving demand for versatile sock designs suitable for both active and non-active use, while warm climatic conditions are encouraging adoption of lightweight, breathable, and moisture-managing yarn blends.

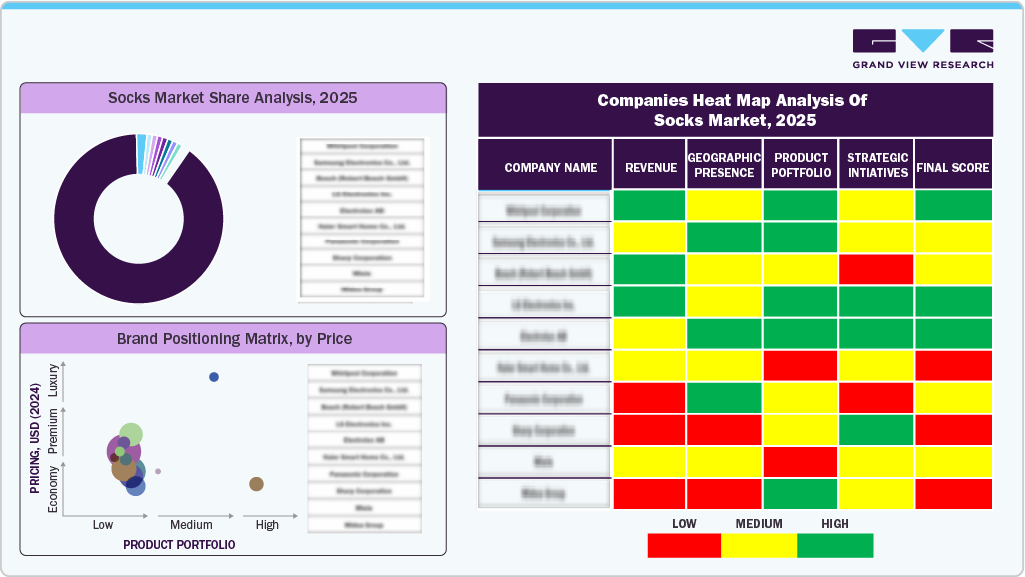

Key Socks Company Insights

Many brands in the global socks industry have identified untapped growth opportunities across specialised lifestyle, performance, and occupational segments and are actively innovating to capture them. This includes the development of advanced yarn blends, activity-specific cushioning systems, moisture-management technologies, and ergonomic constructions tailored for sports, healthcare, travel, commuting, and extended daily wear.

Brands are expanding size ranges, introducing gender-inclusive fits, and offering purpose-driven designs that address varied foot shapes, activity levels, and comfort needs, while refining branding and distribution strategies to align with regional climate conditions, usage patterns, and purchasing behaviour. By targeting emerging lifestyle segments and evolving expectations around comfort, durability, and functional design, sock brands are strengthening differentiation, broadening market reach, and enhancing their global competitiveness.

Key Socks Companies:

The following are the leading companies in the socks market. These companies collectively hold the largest market share and dictate industry trends.

- H&M (sport)

- Inditex

- Zalando

- Dick's Sporting Goods

- Fila

- Intersport

- Lidl

- Columbia Sportswear

- Lululemon

- Hoka

- Deckers

- Skechers

- Brooks (Brooks Sports, Inc)

- Gymshark

- Under Armour

- JD Sports

- Li Ning

- Asics

- Salomon

- Anta Group

- VF Corp

- On Running

- Superdry

- Patagonia

- Kari Traa

- Foot Locker

Recent Developments

-

In August 2025,Gildan, the owner of Gold Toe socks, acquired Hanesbrands for USD 2.2 billion in equity, plus debt, giving Hanes shareholders a mix of Gildan shares and cash, and approximately 19.9% ownership in the combined company. The acquisition brings major consumer brands such as Hanes and Maidenform under Gildan’s portfolio. The deal is aimed at expanding Gildan’s scale, operational efficiency, and presence in the global apparel market.

-

In July 2025, Nester Hosiery, LLC, a U.S. manufacturer of socks and related footwear accessories, acquired most of the assets of Fox River Mills, a long-established sock maker. Following the acquisition, Fox River Mills’ manufacturing facility in Osage was closed, and its production equipment was moved to Nester’s headquarters in North Carolina.

Socks Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 51.90 billion

Revenue forecast in 2033

USD 73.83 billion

Growth rate

CAGR of 5.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, socks length, material, end use, distribution channel, regional

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Poland; Czech Republic; Croatia; Hungary; China; India; Japan; Australia & New Zealand; South Korea; Indonesia; Thailand; Malaysia; Vietnam; Brazil; South America, Bahrain, Kuwait; Oman; Qatar; Saudi Arabia; UAE

Key companies profiled

H&M (sport); Inditex; Zalando; Dick's Sporting Goods; Fila; Intersport; Lidl; Columbia Sportswear; Lululemon; Hoka; Deckers; Skechers; Brooks (Brooks Sports, Inc); Gymshark; Under Armour; JD Sports; Li Ning; Asics; Salomon; Anta Group; VF Corp; On Running; Superdry; Patagonia; Kari Traa; Foot Locker

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Socks Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global socks market report based on the product, socks length, material, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Athletic

-

Lifestyle

-

Others

-

-

Socks Length Outlook (Revenue, USD Billion, 2021 - 2033)

-

Over-the-calf

-

Mid-calf

-

Ankle

-

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cotton

-

Polyester

-

Polyamide

-

Wool

-

Elastane

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retail

-

E-commerce

-

DTC

-

-

Region Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Poland

-

Czech Republic

-

Croatia

-

Hungary

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

Indonesia

-

Thailand

-

Malaysia

-

Vietnam

-

-

Central & South America

-

Brazil

-

South America

-

-

Middle East & Africa

-

Kuwait

-

Oman

-

Bahrain

-

Qatar

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global socks market size was estimated at USD 49.48 billion in 2025 and is expected to reach USD 51.90 billion in 2026.

b. The global socks market is expected to grow at a compound annual growth rate of 5.2% from 2026 to 2033 to reach USD 73.83 billion by 2033.

b. Asia Pacific dominated the socks market with a share of 38.46% in 2025. This is attributable to Population growth, rising disposable income and urbanization in developing counties including China, Bangladesh, Pakistan, and India.

b. Some key players operating in the socks market include H&M (sport); Inditex; Zalando; Dick's Sporting Goods; Fila; Intersport; Lidl; Columbia Sportswear; Lululemon; Hoka; Deckers; Skechers; Brooks (Brooks Sports, Inc); Gymshark; Under Armour; JD Sports; Li Ning; Asics; Salomon; Anta Group; VF Corp; On Running; Superdry; Patagonia; Kari Traa; Foot Locker

b. Key factors that are driving the socks market growth include the rising importance of maintaining formal attire among white-collar professionals and increasing spending on health and fitness among adults worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.