- Home

- »

- Agrochemicals & Fertilizers

- »

-

Sodium Nitrate Market Size, Share & Growth Report, 2030GVR Report cover

![Sodium Nitrate Market Size, Share & Trends Report]()

Sodium Nitrate Market (2023 - 2030) Size, Share & Trends Analysis Report By Grade (Pharmaceutical, Industrial), By Application (Fertilizers, Explosives, Chemicals, Glass), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-368-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sodium Nitrate Market Summary

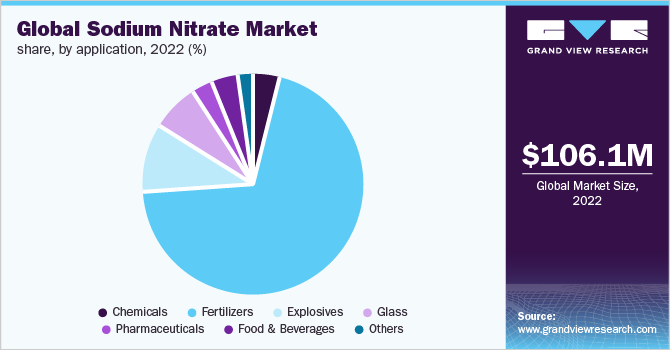

The global sodium nitrate market size was valued at USD 106.1 million in 2022 and is projected to reach USD 167.7 million by 2030, growing at a CAGR of 5.9% from 2023 to 2030. The demand for the product is anticipated to be driven by its increasing application in industrial-grade activities such as the manufacturing of fertilizers, explosives, and glass among others.

Key Market Trends & Insights

- Central & South America is the dominating region, which accounted for a revenue share of 32% in 2022.

- Asia Pacific witnessed the fastest growth of over 6.6% during the forecast period.

- Based on grade, the industrial grade segment is expected to dominate the global market with a revenue share of over 89% in 2022.

- In terms of application, fertilizer in the application segment is anticipated to dominate the global market with a revenue share of over 69% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 106.1 Million

- 2030 Projected Market Size: USD 167.7 Million

- CAGR (2023-2030): 5.9%

- Central & South America: Largest market in 2022

- Asia Pacific: Fastest growing market

Thus, the market is majorly dependent on the trend of application industries. The agricultural industry was resilient to the impact of COVID-19, despite the shutdown of industries. For instance, the Indian agriculture sector recorded a growth of 3.9% in 2020, according to the Indian finance ministry’s economic survey. The rapid increase in population is the key factor behind the growth of agricultural production across the globe. This increased yield is obtained with the help of fertilizers infused with sodium nitrate as they provide crops with all the essential nitrogen nutrients and are considered favorable for the growth of crops such as sugarcane, corn, wheat, and soybeans.

Black powder is used in black bombs and pyrotechnics. This powder requires an additional additive element to slow down its burning rate. Sodium nitrate owing to its cost-effectiveness, non-toxic, non-poisonous nature, and stability is used widely as an active additive in black powder. Thus, finding its usage in explosive industry.

The consumption and production of sodium nitrate are majorly influenced by its demand from end-use industries, majorly fertilizer and explosive manufacturing industries. However, the chemicals present in fertilizers and fertilizer additives can also adversely affect the groundwater used for drinking and other essential activities, which can lead to several diseases. For instance, the blue baby syndrome is a disease in infants caused by the consumption of nitrate contaminated water. Thus, it can act as a restraining factor in the growth of the sodium nitrate market.

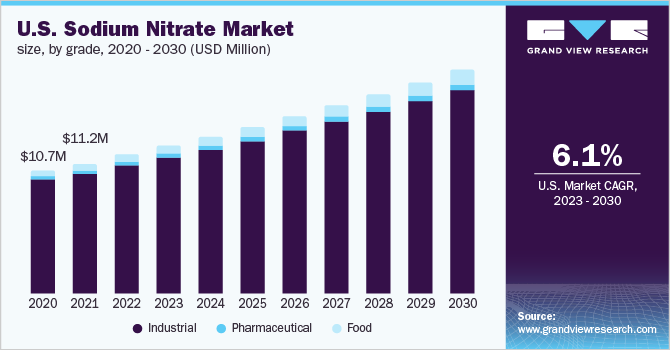

The U.S. is the largest consumer of sodium nitrate in North America with a revenue share of over 75%. This is attributed to the increasing food & beverage, fertilizer, and chemical industries in the country which make use of different grades of sodium nitrate. According to the data released by the World Bank, cereal crop production in the U.S. increased from 431.87 million metric tons in 2015 to 434.88 million metric tons in 2020, whereas, agricultural land witnessed growth from 44.2% to 44.4% of the total land area in the U.S from 2015 to 2020.

Thus, the growing demand for food crops coupled with the slow growth of arable land in the U.S. has resulted in farmers opting for sodium nitrate fertilizers for increasing their yield. In addition, the increasing food & beverage industry in the country is further accelerating the demand for food-grade sodium nitrate. It is used as a preservative, antimicrobial, and coloring agent in fish, cheese, and meats.

Grade Insights

The industrial grade segment is expected to dominate the global market with a revenue share of over 89% in 2022. The growth is attributed to the increased demand for chemicals in construction, industrial manufacturing, electronics, and other industries. With a purity level of 99%, it is used as a solvent and a key ingredient in the formulation of adhesives, construction chemicals, and degreasing agents. In addition, it is also used in the formulation of drain cleaners, explosives, heat transfer agents, and fertilizers.

The food grade is another segment followed by the industrial grade witnessing growth over the forecasted period. The growth is attributed to the growing demand for ready-to-eat food products. This food grade can help increase the shelf life of processed foods by acting as a preservative in processed meat, ham, bacon, and other food items.

Application Insights

Fertilizer in the application segment is anticipated to dominate the global market with a revenue share of over 69% in 2022. The growth is attributed to increasing demand for fertilizer as a result of increasing food production to fulfill the demand. According to the Food & Agriculture Organization (FAO), the demand for cereals is anticipated to reach 3 billion tons by 2050 as compared to 2.1 billion in 2009. Thus, to fulfill the growing demand, farmers are shifting towards techniques to maximize their yield with the usage of fertilizers, which in turn is expected to play a major role in driving the product demand.

Explosives is another application segment anticipated to witness growth over the forecast period followed by fertilizers. The growth is attributed to the rising demand for the product due to its ability to react with heat and accelerate the burning process. Thus, it acts as the best additive for black powder used in smoke bombs and pyrotechnics. Additionally, the slow-burning rate of the product makes it ideal for use in rocket propellant.

Pharmaceuticals is another application segment expected to witness the fastest growth of over 6.6% during the forecast period. This growth is attributed to the fact that sodium nitrate along with sodium thiosulfate is used as an antidote for treating cyanide poisoning.

Regional Insights

Central & South America is the dominating region, which accounted for a revenue share of 32% in 2022. This growth is attributed to increasing agricultural activities in the region coupled with growing demand for processed foods due to changing lifestyles of people.

Brazil, one of the largest producers of soybeans, rice, wheat, and coffee in the region is expected to account for a major revenue share in Central & South Africa in 2022. The agricultural sector in the country is expected to witness rapid growth due to the presence of suitable climatic conditions and cultivable land.

According to the international grains council, Brazil was the largest soybean producer globally. It produced around 140.5 million tons in 2021-2022, as compared to its previous year’s production of 139 million tons. In addition, it is also the largest soybean exporter internationally, with exports as high as 91.4 million tons in 2021-22.

Furthermore, as per the USDA, the production of corn increased by 8% from 2021 to 2022. In 2021, corn production was around 116 million metric tons, rising to around 126 million metric tons in 2022. Thus, the availability of farmland for crops such as corn, oilseeds, soybean, and sugarcane is anticipated to boost the growth of the agricultural sector, which in turn will drive higher demand for fertilizers.

Asia Pacific witnessed the fastest growth of over 6.6% during the forecast period. This growth is attributed to the fact that the region comprises the largest agrarian countries such as India, China, and other agriculture-based economies. The increasing population putting pressure on increasing the crop yield to fulfill the demand is anticipated to drive the demand for fertilizers which in turn will propel the demand for the product market.

Key Companies & Market Share Insights

The sodium nitrate industry is highly competitive with players focusing on differentiating themselves from others. Manufacturers are opting for different methods such as engaging with third-party distributors and selling products through their own websites to improve their profit margins. Companies such as BASF SE, are investing in R&D activities to develop innovative products to widen the product portfolio. Some prominent players in the global sodium nitrate market include:

-

Deepak Nitrate Limited

-

SQM S.A.

-

BASF SE

-

Weifang Haiye Chemistry and Industry Co

-

Acf Nitratos S.A

-

Quality Chemicals S.L

-

Shijizhuang Fengshan Chemical Co. Ltd.

-

Ural Chem JSC

Sodium Nitrate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 112.2 million

Revenue forecast in 2030

USD 167.7 million

Growth Rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; China; India; Japan; Brazil; Chile; Peru; Saudi Arabia; South Africa

Key companies profiled

Deepak Nitrite Limited; SQM S.A.; BASF SE; Weifang Haiye Chemistry And Industry Co; ACF Nitratos S.A; Quality Chemicals S.L; Shijiazhuang Fengshan Chemical Co. Ltd.; Ural Chem JSC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

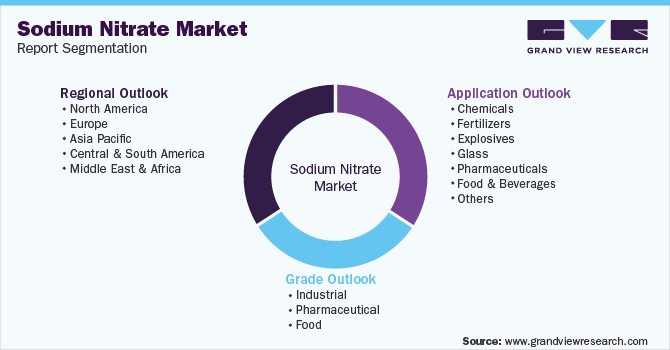

Global Sodium Nitrate Market Segmentation

This report forecasts the volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sodium nitrate market report based on grade, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Pharmaceutical

-

Food

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Chemicals

-

Fertilizers

-

Explosives

-

Glass

-

Pharmaceuticals

-

Food & Beverages

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Chile

-

Peru

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global sodium nitrate market size was estimated at USD 106.1 million in 2022 and is expected to reach USD 112.2 million in 2023

b. The global sodium nitrate market is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030 and reach USD 167.7 million by 2030

b. In terms of revenue, the fertilizers application segment dominated the market with a revenue share of 69.6% in 2022. This high share is attributable to increasing demand for fertilizers to meet increasing demand for food owing to rising global population

b. Some of the prominent players in the sodium nitrate market include Deepak, SQM S.A., BASF SE, Weifang Haiye Chemistry And Industry Co, Acf Nitratos S.A, Quality Chemicals S.L, Shijizhuang Fengshan Chemical Co. Ltd., Ural Chem JSC

b. The sodium nitrate market is anticipated to be driven by the growth of fertilizers products in the agriculture industry and their ability to provide necessary nitrogen nutrients to the crops.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.