- Home

- »

- Next Generation Technologies

- »

-

Solar Power Meter Market Size, Share, Industry Report 2030GVR Report cover

![Solar Power Meter Market Size, Share & Trends Report]()

Solar Power Meter Market (2025 - 2030) Size, Share & Trends Analysis Report By Integration Type, By Product, By Measurement, By Technology (Digital, Analog), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-610-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar Power Meter Market Summary

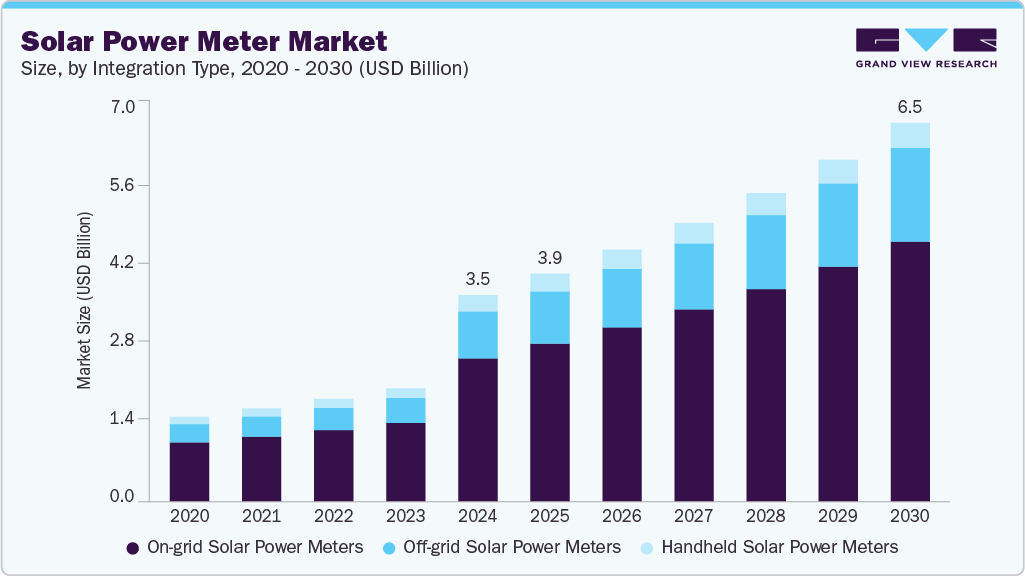

The global solar power meter market size was estimated at USD 3.52 billion in 2024 and is projected to reach USD 6.46 billion by 2030, growing at a CAGR of 10.7% from 2025 to 2030. This growth is driven by the rising adoption of solar energy systems worldwide, supported by government incentives and increasing environmental awareness.

Key Market Trends & Insights

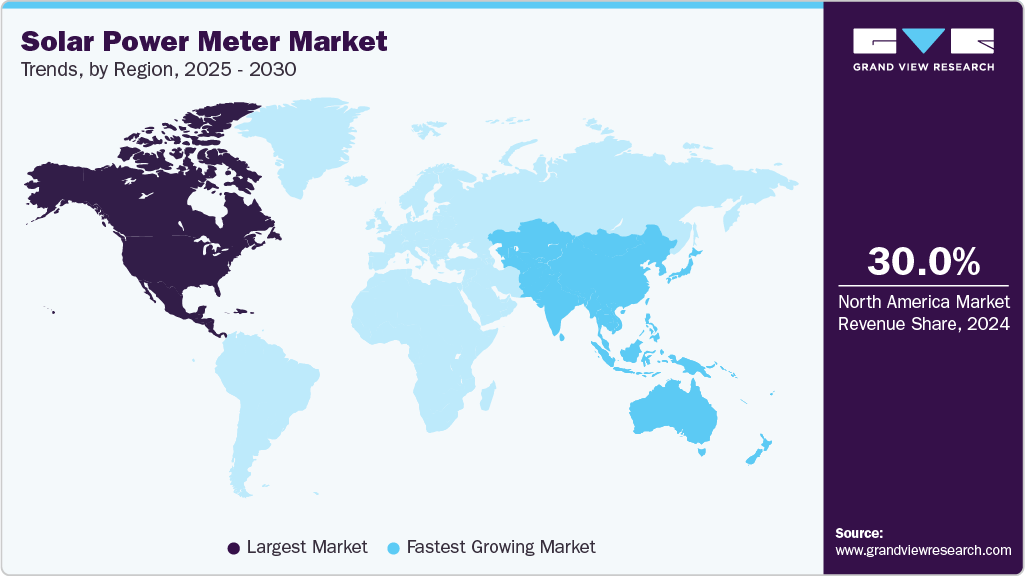

- North America dominated the solar power meter industry with a revenue share of over 30% in 2024.

- The U.S. solar power meter industry is expected to grow significantly in 2024.

- By integration type, the on-grid solar power meters segment led the market in 2024, accounting for over 68% of global revenue.

- By product, the net meter segment accounted for the largest market revenue share in 2024.

- By measurement, the current measurement segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.52 Billion

- 2030 Projected Market Size: USD 6.46 Billion

- CAGR (2025-2030): 10.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Solar power meters play a vital role in monitoring and optimizing solar panel performance, which is essential for maximizing energy efficiency. Technological advancements in sensor accuracy and wireless connectivity further boost product demand across residential, commercial, and industrial sectors.The growing focus on energy conservation and the integration of smart grid infrastructure are also contributing to market expansion. Moreover, market growth is supported by expanding solar power capacity globally, especially in emerging economies where rural electrification and off-grid solar projects gain momentum. Increasing investments in smart grid infrastructure and integrating Distributed Energy Resources (DERs) require advanced metering solutions capable of bidirectional energy flow measurement and remote monitoring.

The evolution of digital and IoT-enabled solar power meters facilitates improved energy management, predictive maintenance, and data analytics, which are becoming essential for utilities and consumers. In addition, stricter regulatory frameworks and net metering policies across various regions encourage the adoption of solar power meters.

Furthermore, technological advancements in metering devices, such as digital meters with real-time data capabilities, enhance system efficiency and reliability, reinforcing the market’s present scale. For instance, in April 2025, EcoFlow launched its Stream series, a second-generation balcony solar solution that replaces the previous PowerStream line. The new series features enhanced battery integration with AI-powered coordination, enabling distributed batteries throughout a home to operate networked, plug-and-play.

In addition, sustained industrialization and urbanization in developing regions create significant solar power meter deployment opportunities in new solar installations. The rising focus on carbon emission reduction and energy efficiency drives demand for precise and reliable metering technologies. Moreover, the growing awareness among end-users about energy conservation and cost savings through optimized solar energy use supports market expansion.

Integration Type Insights

The on-grid solar power meters segment led the market in 2024, accounting for over 68% of global revenue due to the extensive deployment of grid-connected solar systems worldwide. These meters are essential for accurately measuring the electricity fed into and drawn from the utility grid, enabling effective net metering and billing. Government policies and incentives promoting renewable energy integration into existing power grids have accelerated the adoption of on-grid solar systems, mainly in developed markets. Furthermore, the increasing penetration of Distributed Energy Resources (DERs) necessitates precise metering solutions to balance energy flows, making on-grid meters indispensable for utilities and consumers.

The off-grid solar power meters segment is predicted to experience the fastest growth in the forecast years, driven by expanding solar electrification projects in remote and rural regions where grid access is limited or unreliable. These meters facilitate efficient monitoring of standalone solar systems, ensuring optimal battery management and energy usage in off-grid applications such as telecom towers, agricultural irrigation, and rural households. International development programs and government initiatives focusing on rural electrification are key factors propelling the demand for off-grid solar meters, especially in emerging economies across Asia, Africa, and Latin America.

Product Insights

The net meter segment accounted for the largest market revenue share in 2024, providing an important function in grid-tied solar installations by measuring the net energy consumed or exported by the user. This capability supports net metering policies that allow consumers to offset their electricity bills through energy credits for surplus solar power supplied to the grid. The widespread implementation of such policies in various regions has driven the adoption of net meters. In addition, utilities rely on net meters to manage grid stability and ensure fair compensation, reinforcing their position as the preferred metering solution for solar PV systems.

The dual meter segment is expected to grow at the highest CAGR over the forecast period due to its ability to provide detailed, granular data on energy flows. This separation enables consumers and energy managers to analyze consumption patterns, optimize solar usage, and identify inefficiencies. The increasing emphasis on energy management and transparency, coupled with advances in smart metering technologies, supports the growth of dual meter installations in residential and commercial sectors. Their application extends to microgrids and hybrid energy systems, where precise monitoring is important.

Measurement Insights

The current measurement segment accounted for the largest market revenue share in 2024. It accurately monitors the flow of electrical current, which is fundamental for assessing solar system performance and detecting faults. Their widespread use across residential, commercial, and utility-scale solar installations emphasizes their importance in ensuring system reliability and efficiency. Technological enhancements such as improved sensor accuracy and integration with digital monitoring platforms have further increased their adoption, enabling real-time data collection and predictive maintenance.

The power measurement segment is expected to grow at the highest CAGR over the forecast period due to the growing demand for comprehensive energy analytics, including voltage, current, power factor, and energy consumption metrics. These meters support advanced grid management functions, such as load balancing and demand response, which are increasingly important as renewable energy penetration rises. Integrating power measurement meters with IoT and cloud-based platforms enhances their capability to deliver actionable insights, driving their adoption in smart grid and commercial solar applications.

End Use Insights

The residential segment accounted for the largest market revenue share in 2024 due to the rapid adoption of rooftop solar PV systems by homeowners seeking to reduce electricity expenses and increase energy self-sufficiency. Residential solar installations rely heavily on accurate metering for net metering, energy monitoring, and billing purposes. Factors such as declining solar panel costs, government incentives, and rising consumer environmental consciousness contribute to this segment's strong demand for solar power meters. In addition, smart home integration and energy management systems improve the functionality of advanced metering solutions in residential applications by enabling real-time monitoring, automated energy usage adjustments, and optimized consumption of solar-generated power.

The commercial segment is anticipated to grow at the highest CAGR during the forecast period as businesses increasingly invest in solar energy to lower operational costs, meet sustainability targets, and comply with regulatory requirements. Large commercial solar installations require advanced metering solutions that provide detailed energy monitoring, performance optimization, and comprehensive reporting. The rise of smart buildings and corporate sustainability initiatives drives demand for solar power meters that offer real-time data, analytics, and integration with energy management systems. In addition, commercial users benefit from demand response programs and energy trading, which depend on accurate metering.

Technology Insights

The digital segment accounted for the prominent market revenue share in 2024 due to its superior accuracy, real-time data processing, and compatibility with communication networks for remote monitoring. Its ability to support advanced functionalities such as automated data logging, fault detection, and energy analytics makes it essential for modern solar installations. The transition from analog to digital metering is accelerated by regulatory mandates and the need for smart energy management, especially in developed regions with mature solar markets.

The analog segment is anticipated to grow significantly during the forecast period. Analog meters remain significant, particularly in developing regions where cost constraints and simpler energy management requirements prevail. Their straightforward design and ease of installation make them suitable for basic solar metering applications, especially in small-scale and off-grid systems. Despite the global shift toward digital meters, analog devices remain relevant due to their affordability and reliability, supporting solar adoption in rural and emerging markets.

Regional Insights

North America dominated the solar power meter industry with a revenue share of over 30% in 2024. Favorable regulatory frameworks, widespread adoption of solar technology, and significant investments in smart grid infrastructure support this growth. The region benefits from established net metering policies, Advanced Metering Infrastructure (AMI) deployments, and a strong presence of key market players driving innovation. Consumer awareness and corporate commitments to renewable energy further accelerate the adoption of solar power meters.

U.S. Solar Power Meter Market Trends

The U.S. solar power meter industry is expected to grow significantly in 2024. The U.S. market growth is supported by expanding solar capacity across residential, commercial, and utility-scale sectors, supported by federal and state incentives such as the Investment Tax Credit (ITC). The country’s focus on grid modernization and integrating distributed energy resources necessitates advanced metering solutions to support grid stability and consumer engagement.

Europe Solar Power Meter Market Trends

The solar power meter market in Europe is expected to grow significantly over the forecast period, driven by stringent renewable energy targets, regulatory mandates for smart metering, and substantial investments in solar infrastructure. Countries such as Germany, France, and the UK lead in solar adoption and require accurate and reliable metering solutions to monitor energy generation and consumption. The region’s commitment to energy efficiency and decarbonization, combined with the rollout of smart grid technologies, supports the increasing deployment of advanced solar power meters.

Asia Pacific Solar Power Meter Market Trends

The solar power meter industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period due to rapid urbanization, increasing energy demand, and aggressive government policies promoting renewable energy adoption. Major markets such as China, India, Japan, and Australia invest heavily in solar power generation capacity and grid modernization, creating substantial demand for reliable and accurate solar power meters. Rural electrification programs and off-grid solar projects in developing countries further contribute to the rising adoption of metering solutions. The region’s expanding manufacturing capabilities and growing awareness about energy management also support rapid market growth.

Key Solar Power Meter Company Insights

Some key companies in the solar power meter industry are FLIR Systems, Fluke Corporation, Amprobe, and Jaycar Electronics.

-

FLIR Systems offers advanced solar power measurement tools for solar site surveys, installation, and maintenance of photovoltaic (PV) systems. Their product range includes devices such as the FLIR PV78 irradiance meter, which measures solar irradiance and temperature in compliance with IEC standards. The FLIR CM78-PV clamp meter is capable of handling high-voltage DC measurements up to 1,500 V. FLIR Systems integrates features such as Bluetooth connectivity via the METERLiNK app for wireless data collection and reporting, infrared thermography for fault detection, and I-V curve tracing to verify panel performance.

-

Fluke Corporation specializes in precision solar testing instruments for electricians, PV installers, and maintenance technicians. Their solar power meters and analyzers, such as the Fluke FLK-IRR1-SOL Solar Irradiance Meter and the 393 FC Solar Clamp Meter, provide accurate measurements of solar irradiance, voltage, current, and temperature essential for installation, troubleshooting, and performance verification of solar PV systems. Its products are designed for field use, with rugged construction, high safety ratings (CAT III 1500 V), and user-friendly interfaces that facilitate efficient data collection and analysis.

Key Solar Power Meter Companies:

The following are the leading companies in the solar power meter market. These companies collectively hold the largest market share and dictate industry trends.

- Amprobe

- ATP Instrumentation

- Canstar Blue Pty Ltd.

- FLIR Systems

- Fluke Corporation

- General Tools & Instruments

- Jaycar Electronics

- PCE Deutschland GmbH

- Solar Light Company, Inc.

- TES Electrical Electronic Corp.

Recent Developments

-

In April 2025, SolarEdge Technologies, a prominent player in smart energy solutions, launched its ONE Controller for the German residential solar market. The device is designed to comply with Germany’s new Section 14A EnWG regulation, which mandates grid operators' smart integration and remote controllability of high-power household energy assets to ensure grid stability. The ONE Controller enables seamless connection of residential solar and storage systems with Germany’s Smart Meter system (iMSys), facilitating regulatory compliance and advanced energy management.

-

In December 2024, Prime Minister Narendra Modi launched a scheme providing free electricity to domestic consumers using up to 300 units per month, enabling them to earn income by selling surplus solar-generated power. Under this initiative, customers installing rooftop solar projects with capacities up to three kilowatts receive subsidies from the central government. A separate net meter is required to accurately measure electricity generated, consumed, and exported to the grid. Previously, customers bore the cost of this meter; however, the Maharashtra State Electricity Distribution Company Limited (MSEDCL) has now committed to supplying solar net meters free of charge to all eligible participants.

-

In October 2024, the West Bengal Electricity Regulatory Commission (WBERC) issued draft regulations establishing a comprehensive framework for installing, operating, and managing grid rooftop solar systems. The regulations permit prosumers to install up to 500 kW capacity under net metering, net billing, and gross metering models, encouraging solar adoption across residential, commercial, and industrial sectors.

Solar Power Meter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.89 billion

Revenue forecast in 2030

USD 6.46 billion

Growth rate

CAGR of 10.7% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end use, measurement, integration type, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amprobe; ATP Instrumentation; Canstar Blue Pty Ltd.; FLIR Systems; Fluke Corporation; General Tools & Instruments; Jaycar Electronics; PCE Deutschland GmbH; Solar Light Company, Inc.; TES Electrical Electronic Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Power Meter Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global solar power meter market report based on integration type, product, measurement, technology, end use, and region:

-

Integration Type Outlook (Revenue, USD Million, 2017 - 2030)

-

On-grid Solar Power Meters

-

Off-grid Solar Power Meters

-

Handheld Solar Power Meters

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Net Meter

-

Bi-Directional Meter

-

Dual Meter

-

Others

-

-

Measurement Outlook (Revenue, USD Million, 2017 - 2030)

-

Current Measurement

-

Voltage Measurement

-

Power Measurement

-

Energy Measurement

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Digital

-

Analog

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global solar power meter market size was estimated at USD 3.52 billion in 2024 and is expected to reach USD 3.89 billion in 2025.

b. The global solar power meter market is expected to grow at a compound annual growth rate of 10.7% from 2025 to 2030 to reach USD 6.46 billion by 2030.

b. North America dominated the solar power meter market with a share of 31.2% in 2024 due to widespread solar PV adoption, supportive government policies, and strong investments in residential and commercial renewable energy infrastructure.

b. Some key players operating in the solar power meter market include Amprobe; ATP Instrumentation; Canstar Blue Pty Ltd.; FLIR Systems; Fluke Corporation; General Tools & Instruments; Jaycar Electronics; Kusam Electrical Industries; PCE Deutschland GmbH; Solar Light Company, Inc.; TES Electrical Electronic Corp.

b. Key factors that are driving the market growth include rising solar energy adoption, increasing emphasis on energy efficiency, supportive regulatory frameworks, and growing demand for accurate performance monitoring across solar power installations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.