- Home

- »

- Renewable Energy

- »

-

Solar PV Glass Market Size & Trends, Industry Report, 2030GVR Report cover

![Solar PV Glass Market Size, Share & Trends Report]()

Solar PV Glass Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (AR Coated, Tempered, TCO-coated), By Technology (Crystalline Solar PV, Thin Film, Perovskite), By Application (Residential, Non-residential, Utility), By Region, And Segment Forecasts

- Report ID: 978-1-68038-865-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar PV Glass Market Summary

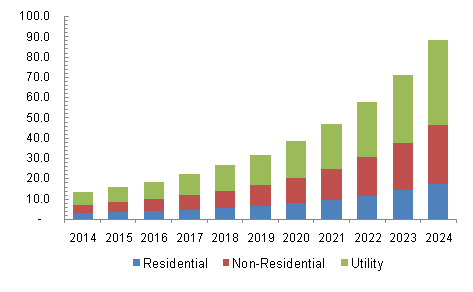

The global Solar PV Glass Market was valued at USD 10.08 billion in 2024 and is projected to reach USD 47.16 billion by 2030, growing at a CAGR of 29.5% from 2025 to 2030. Governments and international organizations set targets to reduce carbon emissions and combat climate change. Solar power is prominent in these efforts as a clean and sustainable energy source.

Key Market Trends & Insights

- Asia Pacific dominated the global market with the largest revenue share of 59.3% in 2024.

- North America is expected to witness the fastest CAGR of 30.6% over the forecast period.

- By type, the AR coated segment dominated the market in 2024 with a 46.5% revenue share.

- By technology, the perovskite module segment is anticipated to witness the fastest CAGR of 31.4% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD USD 10.08 Billion

- 2030 Projected Market Size: USD 47.16 Billion

- CAGR (2025-2030): 29.5%

- Asia Pacific: Largest market in 2024

It has led to increased investments in solar power projects worldwide, raising the demand for solar PV glass. The growth of solar installations, large-scale utility projects, and residential rooftop systems is contributing to the expansion of the market.

As countries pursue reducing their carbon footprints and attaching to international climate agreements, adopting solar energy has become a key strategy. Solar PV glass, a critical component in solar panels, is essential for converting sunlight into electricity. This rising demand for renewable energy, fueled by environmental concerns and the depletion of fossil fuels, is driving the market growth. The increasing number of solar energy projects worldwide, from large-scale solar farms to residential rooftop installations, increases the demand for advanced solar PV glass solutions.

Companies are increasingly forming strategic partnerships to enhance their technological capabilities, expand market reach, and drive innovation. These collaborations involve partnerships between manufacturers, technology firms, and solar panel producers to develop advanced, high-efficiency solar PV glass products. For instance, in February 2024, Mahindra Susten and Waaree Energies formed a strategic partnership. Mahindra Susten would get 280 MW of AHNAY Series, Bi-55 545 Wp solar modules from Waaree Energies Limited. These partnerships are crucial for accelerating the adoption of c, reducing production costs, and meeting the growing global demand for renewable energy solutions.

Type Insights

The AR coated segment dominated the market and accounted for the largest revenue share of 46.5% in 2024. AR coatings reduce sunlight reflected off the glass surface, allowing more light to enter the photovoltaic cells. The increased light absorption directly translates to higher energy output, making solar panels more effective, especially in low-light conditions. Due to its ability to significantly improve solar panels' efficiency, there is demand for AR coated glass, which optimizes energy conversion.

The tempered segment is expected to register the fastest CAGR of 30.0% over the forecast period. Tempered solar PV glass is stronger than standard annealed glass, making it more resistant to wind loads, hail, and impact damage. This strength ensures the longevity and reliability of solar panels, even in harsh environmental conditions. The safety aspect is also significant, as tempered glass breaks into small pieces rather than sharp bits, reducing the risk of injury. The demand for tempered glass in solar applications has increased due to the rising need for high-performance, durable materials that resist conditions, ensuring the longevity of solar installations.

Technology Insights

The crystalline solar PV module segment accounted for the largest revenue share of 88.8% in 2024. Crystalline solar PV modules, including monocrystalline and polycrystalline types, are highly efficient and perform effectively in converting sunlight into electricity. Monocrystalline modules offer the highest efficiency levels among commercially available solar panels, making them ideal for applications where space is limited but maximum power output is required. This high efficiency drives the adoption in the market as it allows for generating more electricity from a smaller surface area, which is essential for residential and commercial installations.

The perovskite module segment is anticipated to witness the fastest CAGR of 31.4% over the forecast period. Perovskite materials have demonstrated the ability to achieve high-efficiency rates comparable to or exceeding those of traditional silicon-based solar cells but with lower production costs. The low-cost materials and simpler manufacturing processes associated with perovskite modules make them a suitable option for reducing the overall cost of solar energy. This combination of high efficiency and affordability drives the demand for Perovskite modules in the market.

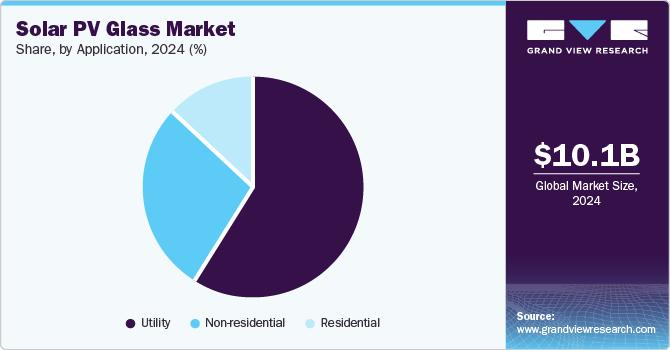

Application Insights

The utility segment accounted for the largest revenue share of 58.9% in 2024. Utility-scale solar projects benefit economically, which reduces the overall cost of solar power generation. As the size of solar installations increases, the cost per kilowatt-hour (kWh) of electricity produced decreases, making solar energy more competitive with fossil fuels. Solar PV glass is crucial as it enhances the efficiency and durability of solar panels, contributing to lower operational costs and longer lifespans. The economic advantages of large-scale solar power generation drive the adoption of Solar PV glass in utility applications.

The residential segment is anticipated to register the fastest CAGR of 31.2% from 2025 to 2030. As concerns over climate change and environmental sustainability increase, more individuals opt for solar energy to reduce their carbon footprint. Solar PV glass, an essential component in residential solar panels, allows homeowners to utilize renewable energy from the sun, decreasing reliance on fossil fuels and contributing to environmental conservation. This increasing preference for eco-friendly energy solutions significantly drives the demand for Solar PV glass in the residential sector.

Regional Insights

North America solar PV glass market is expected to witness the fastest CAGR of 30.6% over the forecast period. Solar PV glass is integrated into building fronts and windows, allowing buildings to generate electricity while reducing energy consumption. This trend, building-integrated photovoltaics, is gaining momentum as architects and developers seek to meet stricter energy efficiency standards. The rising adoption of building-integrated photovoltaics in commercial and residential buildings drives the demand for solar PV glass.

U.S. Solar PV Glass Market Trends

The solar PV glass market in the U.S. dominated the North American market and held the largest revenue share in 2024. The rising cost of conventional energy sources and the requirement for energy independence are leading U.S. consumers and businesses to invest in solar energy. Solar PV systems offer a way to reduce reliance on grid power, mitigate the impact of fluctuating energy prices, and achieve greater control over energy consumption. Solar PV glass is an essential component of these systems. As more individuals seek to lower their energy costs and enhance energy security, the demand for Solar PV glass is increasing in the U.S. market.

Europe Solar PV Glass Market Trends

The European solar PV glass market is expected to grow significantly over the forecast period. The region's growing population and expanding economies are causing a substantial increase in energy demand. Countries in the region seek to diversify their energy sources to ensure energy security and reduce dependence on fossil fuels. Solar energy, supported by solar PV glass technology advancements, is emerging as a key solution to meet these energy needs. Solar energy's ability to provide a stable and renewable power source is suitable in regions with high energy demand, making solar PV glass essential in achieving energy security.

The UK solar PV glass market is expected to witness significant growth over the forecast period. Rapid industrialization and urbanization are key factors contributing to the increased demand for energy, particularly clean and sustainable sources such as solar power in the UK. As the country continues to develop, there is a growing need for reliable energy to support industrial activities and urban infrastructure. Solar energy, powered by efficient solar PV glass, provides a viable solution to meet these energy demands while reducing environmental impact. The expansion of industrial and urban areas in the country is driving the adoption of solar PV systems, thereby increasing the market for solar PV glass.

Asia Pacific Solar PV Glass Market Trends

Asia Pacific solar PV glass market dominated the global market and accounted for the largest revenue share of 59.3% in 2024. The region benefits from favorable climate conditions and abundant solar resources. The high solar irradiance in these areas makes them ideal for solar energy generation, driving the deployment of solar panels and Solar PV glass. The geographic advantage of high sunlight exposure supports the growth of solar energy installations, contributing to the expansion of the Solar PV glass market.

The solar PV glass market in China led the Asia Pacific market with the largest revenue share in 2024. China dominance in solar PV glass manufacturing has created strong international trade opportunities. The country's ability to produce high-quality, cost-competitive solar PV glass has led to its position as a leading supplier in the global market. According to the IEA , in 2021, China's solar PV exports were over USD 30 billion. The strong export demand further boosts the country's solar PV glass industry, encouraging continued investment and production growth.

Key Solar PV Glass Company Insights

Key players in the solar PV glass market include First Solar., Saint-Gobain S.A, Xinyi Solar Holdings Limited, Nippon Sheet Glass Co., Ltd, Yingli Solar, and others. These companies employ strategies such as expanding production capacity, investing in research and development for advanced and efficient products, pursuing strategic partnerships and acquisitions, integrating supply chains, and focusing on sustainability and cost competitiveness to strengthen market position and meet rising global demand.

-

First Solar specializes in designing, manufacturing, and selling advanced solar panels and photovoltaic (PV) solutions. The company’s product offerings include its Series 6 and Series 7 modules, designed for utility-scale solar power plants.

-

Nippon Sheet Glass Co., Ltd has expertise in glass and glazing technology and serves diverse markets, including the architectural, automotive, and technical glass sectors. Its product offerings include advanced solar PV glass solutions designed to enhance the efficiency and durability of solar panels.

Key Solar PV Glass Companies:

The following are the leading companies in the solar PV glass market. These companies collectively hold the largest market share and dictate industry trends.

- First Solar Inc.

- Xinyi Solar Holding Ltd.

- Nippon Sheet Glass Co. Ltd.

- Yingli Green Energy Holding Company Ltd.

- Sun Power Corporation

- ReneSola Ltd.

- Hanwha Q CELLS Co.

- Saint-Gobain S.A

- Guardian Industries

- Borosil Glass Works Limited

Recent Developments

-

In November 2024, Onyx Solar introduced innovative walkable solar PV glass tiles for decks, patios, and sidewalks. Each tile, made from 8 mm-thick anti-slip safety solar PV glass, supports up to 400 kg/m² and a capacity of 75 W.

-

In August 2024, Ankara Solar Energy introduced a brand of walkable PV flooring for commercial and residential projects. It is now available in Europe and the U.S. markets with its 30 and 120-W square panels, which have anti-slip glass surfaces and are sold with a supportive pedestal system.

-

In April 2024, Bluebird Solar launched the n-type TOPCon dual-glass bifacial PV module at the RenewX 2024 event in Hyderabad. The new module includes a power output of 600 Wp and an energy conversion efficiency of 23.25%. It features a 16-busbar design, which minimizes resistive losses and enhances overall power generation. The module offers a 12-year warranty and a 30-year performance guarantee.

-

In January 2024, Trina Solar unveiled its latest Vertex S+ n-type dual-glass modules, enhancing durability and performance in commercial and industrial solar projects.

Solar PV Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.93 billion

Revenue forecast in 2030

USD 47.16 billion

Growth rate

CAGR of 29.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in million square meter, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East & Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, India, Japan, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

First Solar; Xinyi Solar Holdings Limited; Nippon Sheet Glass Co., Ltd; Yingli Solar; SunPower Corporation; RENESOLA; Hanwha Group; Saint-Gobain S.A; Guardian Industries; Borosil Glass Works Limited

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar PV Glass Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global solar PV glass market report based on type, technology, application, and region.

-

Type Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

AR Coated

-

Tempered

-

TCO-coated

-

-

Technology Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Crystalline Solar PV Module

-

Thin Film Module

-

Perovskite Module

-

-

Application Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

Utility

-

-

Regional Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.