- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Solvent-based Plastic Recycling Market Size Report, 2030GVR Report cover

![Solvent-based Plastic Recycling Market Size, Share & Trends Report]()

Solvent-based Plastic Recycling Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Polyethylene, Polyethylene Terephthalate, Polypropylene), By Application (Automotive, Textile), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-971-8

- Number of Report Pages: 194

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

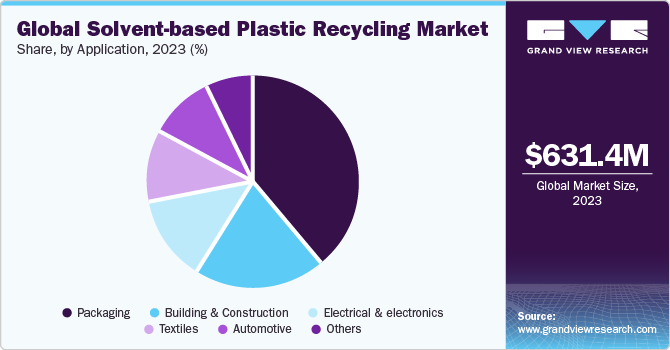

The global solvent-based plastic recycling market size was estimated at USD 631.37 million in 2023 and is expected to grow at a CAGR of 6.4% from 2024 to 2030. The consumption of plastics is growing, and with rising consumption, there is growing plastic waste because of improper plastic waste management. Solvent-based recycling of plastic waste is one of the innovative ways to solve this crisis. To remove impurities, a selective solvent dissolution process is used to recover plastics of minimum standards suitable for reuse. The pure polymer can be extracted from the solution through precipitation.

Multilayer plastic materials are being used in many applications like electrical and electronic industries, food and medical packaging, etc. They keep out moisture, light, oxygen, and prevent sterile syringes from fouling and extend the shelf life of food. Globally, about 100 million tons of multilayer plastics containing as many as twelve layers of varying polymers are produced each year according to the University of Wisconsin-Madison. As recycling multilayer plastics is difficult almost all of that plastic ends up in landfills or incinerators. Solvent-based recycling can help solve this crisis by recycling multilayer plastics.

The U.S. is the largest producer of plastic waste in the world with an average of 130 kilograms of plastic waste per person per year. According to a new study, conducted by the environmental groups The Last Beach Cleanup and Beyond Plastics, plastic waste recycling in the U.S. reduced to between 5%-6% in 2021 as countries like China and Turkey stopped importing U.S. waste exports as plastic waste generation increased significantly. According to the U.S. Environmental Protection Agency, of the 40 million tons of plastic waste generated in the U.S. in 2021, only two million tons were recycled. About 85% of plastic waste ended up in landfills, and ten percent was incinerated.

Solvent-based recycling is an innovative solution to solve the growing plastic waste crisis. Scientists from the University of Wisconsin-Madison (UW-Madison) have discovered a new process named Solvent-Targeted Recovery and Precipitation (STRAP) processing for extracting the plastics in multilayer plastics using solvents. In this process, plastics are separated into a commercial multilayer plastic consisting of polyethylene, polyethylene terephthalate, and ethylene vinyl alcohol with the help of a sequence of solvent washes.

Market Concentration & Characteristics

The market is highly consolidated, with key participants involved in R&D and technological innovations. Notable companies include Solvay, Trinseo, Sulzer Ltd., APK AG, PS LOOP B.V., among others. Several players are engaged in framework development to improve their market share.

With rising concerns over the use of plastics, an increase in demand for alternatives to conventional plastics has been observed in the market. With the pace of innovation and new product development, manufacturers are shifting their focus toward the use of solvent-based recycled plastics as these reduce the carbon footprint associated with the manufacturing process. Companies are continuously developing product lines using solvent-based recycled materials to address concerns regarding the toxic effects of plastic waste. A large number of small- and medium-scale businesses have committed to using recycled or sustainably sourced materials by a specific time.

Regulations aimed at reducing single-use plastics are likely to drive innovation in the development of alternative materials, affecting the global solvent-based plastic recycling market. Modifications and updates in the directives are done to increase and improve the process of recycling plastic waste and facilitate several incentives and plans to move toward a circular economy.

Although solvent-based recycled plastics have several advantages over conventional plastics, they cannot be used to completely replace conventional plastics, such as PS and PE, owing to the lower performance characteristics and the high price of biodegradable plastics. Some potential sustainable replacement materials for solvent-based recycled plastics include biodegradable and compostable alternatives, bio-fiber composites, and bio-polyethylene derived from sugar.

Product Insights

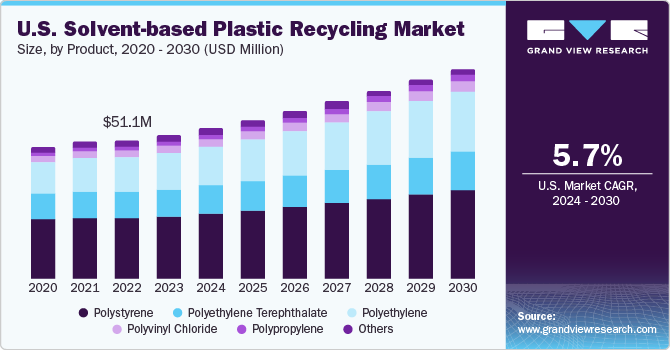

The Polystyrene (PS) segment dominated the market with the largest revenue share of 47.05% in 2023. Polystyrene (PS) is one of the most important plastics and is widely used in daily life in electronics, building materials, packaging, and food containers. According to Plastics Europe, more than 15 million tons of PS are produced per year globally but only a small fraction of this is recycled. The rate of recycling is so low since not all recyclable plastics are collected and taken to recycling facilities. Also, existing recycling technologies can only recycle certain types of PS.

The Polyethylene Terephthalate (PET) segment is expected to witness the fastest growth over the forecast period. It is the most recycled plastic globally. Solvent-based PET recycling has certain advantages over mechanical recycling. For example, Worn Again, a UK-based company has developed technology to recycle PET packaging which includes bottles based on solvent-based recycling. The major advantage of this method from mechanical recycling is the removal of dyes which affect the quality of recycled material. Dyed textiles and colored plastics are less valuable as secondary feedstock for products compared to uncolored transparent materials. In order to be economically viable, the solvent has to be recycled.

Application Insights

Packaging application segment dominated the market with the largest revenue share in 2023. Most of the plastic packaging materials manufactured today are composites made of distinct polymer layers i.e., multilayer films. Annually billions of tons of multilayer films are produced and because of inefficiencies in manufacturing result in huge post-industrial waste streams. There are no commercially practiced technologies to fully deconstruct postindustrial multilayer plastic wastes into virgin, recyclable polymers. The main plastic types found in the packaging are polyethylene terephthalate (PET), high-density polyethylene (HDPE), low-density polyethylene (LDPE), and polypropylene (PP). Together, these plastics constitute eighty-five percent of single-use plastic. The remaining two major resin types, polystyrene (PS) and polyvinyl chloride (PVC) constitute less than ten percent. Solvent-based recycling can be of use in recycling such composite plastic materials.

Electronic waste containing computer equipment and consumer electronic components is one of the fastest-growing waste streams globally. Although e-waste constitutes only two percent of U.S. total municipal waste, it contains significant amounts of toxicants including flame retardants and heavy metals. These pose a significant threat to both environment and human health given the current methods of disposal of plastic waste. Large amounts of e-waste are put into landfills or either incinerated. Heavy metals found in e-waste including cadmium, lead, and mercury pollute water sources which in turn pollutes the food chain when leached out from landfills.

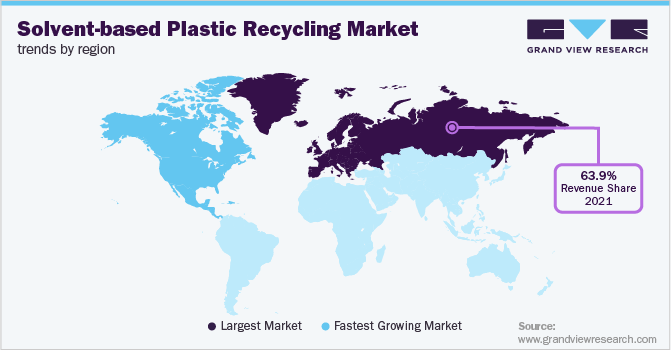

Regional Insights

North America is the second largest market for solvent-based plastic recycling and is expected to grow significantly over the forecast period, with a market share of 21.4% in 2023. The region is characterized by major companies involved in solvent-based recycling such as Proctor & Gamble and Trinseo along with the U.S. which is the largest plastic waste producer in the world. Also, the presence of major universities in this region will result in the discovery of novel methods of solvent-based plastic recycling methods.

U.S. Solvent-based Plastic Recycling Market Trends

The solvent-based plastic recycling market in the U.S. is expected to grow over the forecast period. Rising solvent-based recycled plastic demand from automotive, packaging, textile, construction, electrical & electronics, and other applications in the U.S. is expected to drive the market over the forecast period.

Asia Pacific Solvent-based Plastic Recycling Market Trends

The solvent-based plastic recycling market in Asia Pacific is expected to witness considerable growth over the forecast period. The growing popularity of green and sustainable building projects in China and India, owing to the rising environmental concerns, is propelling the adoption of solvent-based recycled plastics in the building & construction industry. Recycled plastics are widely used to manufacture roofing tiles, fences, bricks, concrete structures, structural lumber, PVC windows, and indoor insulation.

The China solvent-based plastic recycling market held a significant share in the Asia Pacific region. The rising number of sustainable infrastructure development projects and growing manufacturing industry are expected to drive the demand for solvent-based recycled plastics over the forecast period.

The solvent-based plastic recycling market in India is expected to grow at a significant CAGR through the forecast period.Growing middle-class population, improving standard of living, and rising disposable incomes, along with the growing concerns related to environmental health are the major factors contributing to the growth of various end-use industries including automotive, construction, and others which, in turn, is expected to generate a demand for sustainable architectural and decorative paints and coatings over the forecast period, thus propelling the demand for solvent-based plastic recycled plastics.

Europe Solvent-based Plastic Recycling Market Trends

Europe was the largest regional segment of the global solvent-based plastic recycling market share in 2023. Solvent-based plastic waste recycling in Europe is expected to grow significantly over the forecast period, because of the growing awareness regarding sustainability among consumers and increasing pressure from regulators regarding plastic pollution. European Union has set a target of recycling 50% of plastic packaging by 2025 and 55% by 2030. Governments and major companies are continuously refining targets to reduce plastic waste and promote circular economy in the plastics value chain because of which solvent-based recycling has seen a surge of interest. Solvent-based recycling is also useful to recycle low-quality plastic waste which cannot be mechanically recycled.

The solvent-based plastic recycling market in Germany held a significant market share in Europe. The rising demand for green buildings, owing to the presence of strong government regulations and rising environmental concerns, is positively influencing the growth of the construction industry. This is expected to create lucrative growth opportunities for recycling in construction and automotive applications over the coming years.

The UK solvent-based plastic recycling market is projected to grow over the forecast period. Initiatives toward product development, including driverless cars, are expected to boost investments in the automotive industry. The emerging trends to cut down vehicle emissions and develop cleaner cars are leading to the development of electric cars. All these factors are expected to have a positive impact on the growth of the automotive industry in the country, which, in turn, is anticipated to propel the demand for recycled products from 2024 to 2030.

Central & South America Solvent-based Plastic Recycling Market Trends

The solvent-based plastic recycling market in Central & South America is expected to witness significant growth over the forecast period. The presence of various plastic recycling key players in the region, including The Sherwin-Williams Company, AkzoNobel NV, and RPM International, Inc., is expected to propel the demand for solvent-based recycled products.

Middle East & Africa Solvent-based Plastic Recycling Market Trends

The solvent-based plastic recycling market in the Middle East & Africa is expected to witness significant growth through the forecast period. A shift in focus toward the non-oil private sector in the region is predicted to boost manufacturing and other end-use industries, as well as diversify the economy of the region. The efforts taken by various governments in the region to support the growth of plastic recycling in industrial sector and achieve economic goals are anticipated to contribute to the growth of the solvent-based plastic recycling market.

Key Solvent-based Plastic Recycling Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Solvent-based Plastic Recycling Companies:

The following are the leading companies in the solvent-based plastic recycling market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- Sulzer Ltd

- Trinseo

- Procter & Gamble

- APK AG

- Fraunhofer

- PolystyreneLoop

- PureCycle Technologies Inc

- Saperatec GmbH

Recent Developments

- In June 2023, Austrian plastic packaging manufacturer and plastic recycling company ALPLA Group has announced the launch of a new brand called ALPLArecycling. The company has been investing in developing its own recycling capabilities and currently has a total of 13 plants producing high-quality rPET and rHDPE. Through these efforts, ALPLA aims to recycle at least 25% post-consumer recycled content (PCR) by 2025.

Solvent-based Plastic Recycling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 664.22 million

Revenue forecast in 2030

USD 965.10 million

Growth rate

CAGR of 6.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative Units

Volume in kilotons; Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; China; India; Japan

Key companies profiled

Solvay; Sulzer Ltd; Trinseo; Procter & Gamble; APK AG; Fraunhofer; PolystyreneLoop; PureCycle Technologies Inc; Saperatec GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solvent-based Plastic Recycling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global solvent-based plastic recycling market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Polyethylene Terephthalate

-

Polypropylene

-

Polyvinyl Chloride

-

Polystyrene

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Packaging

-

Electrical & Electronics

-

Textiles

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global solvent-based plastic recycling market size was estimated at USD 631.37 million in 2023 and is expected to reach USD 664.22 million in 2024

b. The global solvent-based plastic recycling market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 965.10 million by 2030

b. The polystyrene product segment led the market with a more than 47.05% share in 2023 and is expected to maintain a healthy growth rate over the forecast period

b. Some of the major companies in the solved-based recycling market include Solvay; Sulzer Ltd; Trinseo; Procter & Gamble; APK AG; Fraunhofer; and PolystyreneLoop

b. Growing consumption of plastics has resulted in growing plastic waste, which, because of improper plastic waste management, has become a global crisis. Solvent-based recycling of plastic waste is one innovative way to solve this crisis. To remove impurities, a selective solvent dissolution process is used to recover plastics of minimum standards suitable for reuse

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.