- Home

- »

- Consumer F&B

- »

-

Sorghum Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Sorghum Market Size, Share & Trends Report]()

Sorghum Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Grain Sorghum, Forage Sorghum, Biomass Sorghum, Sweet Sorghum), By End-use (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-325-4

- Number of Report Pages: 106

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sorghum Market Summary

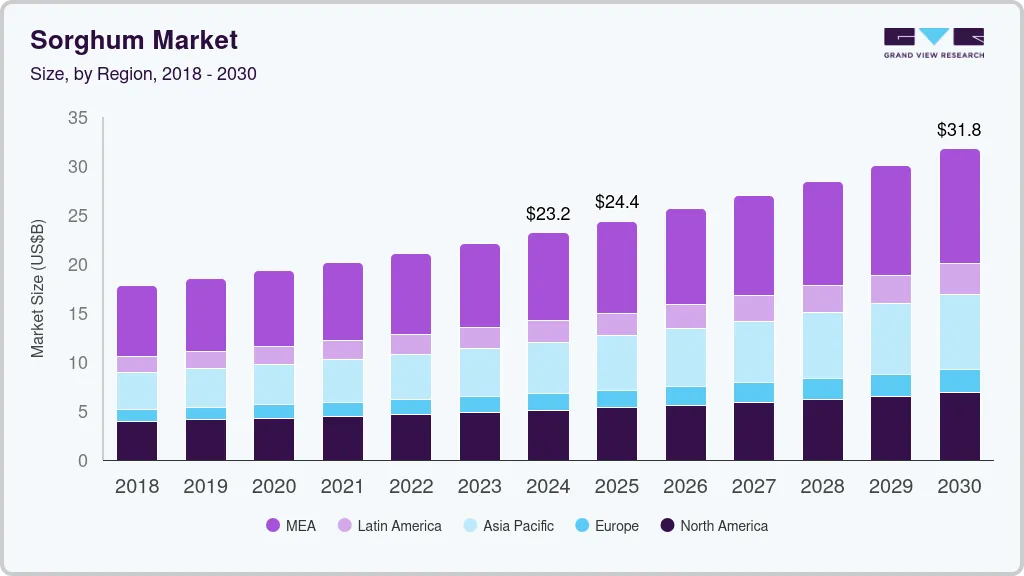

The global sorghum market size was estimated at USD 23.19 billion in 2024 and is projected to reach USD 31.77 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The market is growing due to its versatile applications, including being a staple food in regions such as Africa and Asia, a valuable nutritional component in livestock feed, and a source for biofuel production.

Key Market Trends & Insights

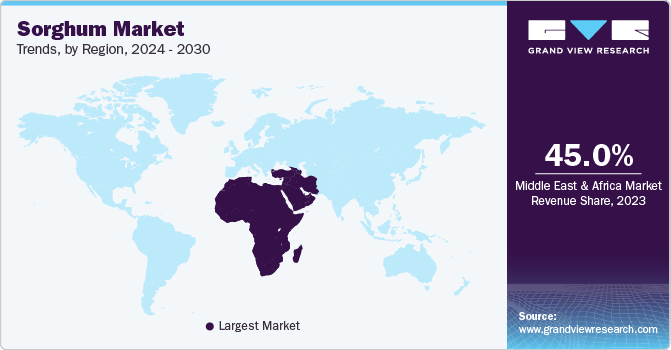

- Middle East & Africa dominated the market with a revenue share of 45.0% in 2023.

- By type, the grain sorghum segment dominated the market with a revenue share of 35.9% in 2023.

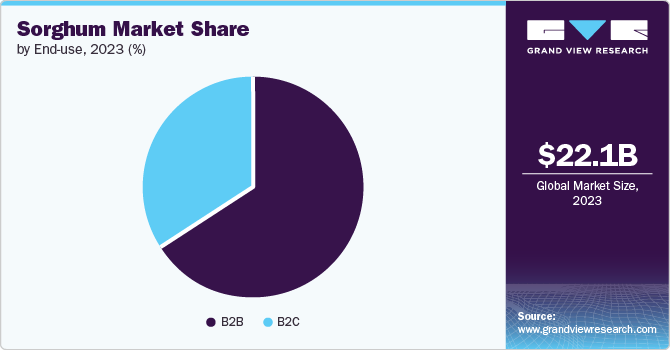

- By end-use, the B2B segment accounted for the revenue share of 65.8% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 23.19 Billion

- 2030 Projected Market Size: USD 31.77 Billion

- CAGR (2025-2030): 5.5%

- Middle East & Africa: Largest market in 2023

Its resilience in drought-prone areas and its gluten-free, nutritious qualities cater to both environmental sustainability and health-conscious consumer preferences. Global trade opportunities, ongoing research, and governmental support further contribute to the market's expansion. As the world population increases and the demand for food rises, sorghum's adaptability positions it as a significant player in the evolving agricultural sector.Sorghum's appeal in the health and nutrition sector lies in its gluten-free nature and rich nutritional composition. Gluten-free diets have gained popularity, particularly among individuals with gluten sensitivity or celiac disease. Sorghum serves as a viable alternative, providing a safe option for those seeking to avoid gluten-containing grains like wheat, barley, and rye. Additionally, sorghum is a good source of essential nutrients such as vitamins, minerals, and dietary fiber, contributing to a well-rounded diet. As consumers become increasingly health-conscious and prioritize dietary choices that align with their wellness goals, the demand for sorghum-based products is likely to rise, reflecting the broader trend toward healthier and more diverse food options in the market.

The versatility of sorghum is evident in its multifaceted uses, serving as a staple food in regions like Africa and Asia, where it is integrated into diverse culinary traditions, featuring porridges, flatbreads, and beverages. Simultaneously, sorghum plays a pivotal role in addressing nutritional requirements for livestock, owing to its valuable contributions to animal feed. As the global demand for meat and dairy products continues to rise, so does the demand for sorghum as a vital component in meeting the nutritional needs of both human populations and livestock, emphasizing its significance across various agricultural contexts.

Moreover, many countries’ government policies and support initiatives for sorghum cultivation have also contributed to the growth of the market. Through research, subsidies, and promotional campaigns, governments are advocating for sorghum due to its nutritional benefits and low environmental impact. The food industry's innovation in developing a wide array of sorghum-based products, from breakfast cereals to baking ingredients, has made these grains more accessible and appealing to a broad consumer base.

For instance, in September 2022, The National Sorghum Producers (NSP) launched a five-year project, funded by a USD 65 million grant from the U.S. Department of Agriculture, to quantify the climate impact of incorporating sorghum and other practices into rotations. The project aims to improve the environmental sustainability of the sorghum industry and create market opportunities for commodities produced using climate-smart practices. The focus will be on quantifying and monetizing the impact of these practices in ecosystem services markets, particularly in low carbon fuel markets. The project will initially target the California Low Carbon Fuel Standard and will involve payments to producers who adopt sorghum and other practices. The project will cover a large portion of the sorghum industry, encompassing over 20,000 sorghum farmers across six states. It will also focus on supporting irrigated agriculture and improving the carbon footprint of U.S. agriculture.

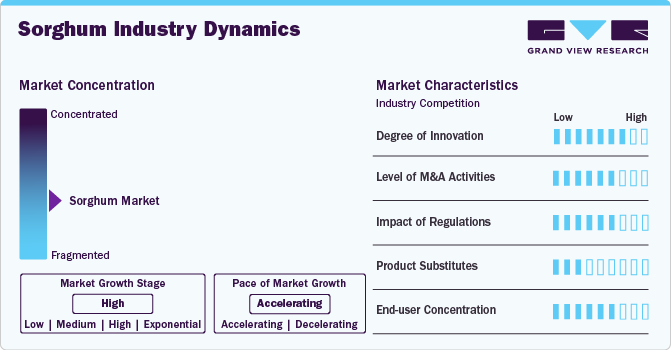

Market Concentration & Characteristics

The degree of innovation in the sorghum market is shaped by ongoing research and development initiatives, which focus on the enhancement of sorghum varieties in terms of yield, resistance to pests, and improved nutritional profiles. Technological advancements, including precision farming and mechanization, play a pivotal role in boosting efficiency throughout the sorghum cultivation and processing stages.

For instance, in January 2021, Corteva Agriscience introduced a groundbreaking herbicide-tolerant trait called Inzen for sorghum growers, exclusively available in the industry-leading Pioneer brand sorghum. This trait enables a postemergence application of Zest WDG herbicide, delivering effective control against detrimental annual grasses like barnyard grass, foxtail, and panicum. The Inzen technology will enhance sorghum production by providing growers with a valuable tool for managing weed pressures and optimizing yields.

Furthermore, the market demonstrates innovation through the development of value-added products, responding to evolving consumer preferences and market demands. Several market players such as ADM, Cargill, Incorporated, Seedway LLC are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regulations related to import/export restrictions, tariffs, and non-tariff barriers can limit the global trade of sorghum. This can hinder the growth of the sorghum market and limit access to sorghum products in regions where they are not locally produced. Inconsistencies in regulations or standards across regions or countries can create confusion and challenges for sorghum producers and traders. Harmonizing standards can facilitate trade and market growth.

Potential substitutes for sorghum vary based on the application. In food consumption, rice and quinoa can replace sorghum, while corn and barley are common alternatives in livestock feed. For biofuel production, corn and sugarcane are often used. Sorghum and buckwheat serve as gluten-free alternatives, and amaranth or farro can replace sorghum in various recipes. The choice of a substitute depends on the specific context, nutritional requirements, and regional preferences, highlighting the versatility of options available across different applications.

Type Insights

Grain sorghum dominated the market with a revenue share of 35.9% in 2023. Grain sorghum, characterized by its larger, edible seeds, is widely consumed in many regions, particularly in Africa and Asia, where it serves as a crucial dietary staple. Its versatility in culinary applications, including the production of porridges, flatbreads, and beverages, contributes to its prevalence in food consumption.

Moreover, grain sorghum holds significance in the livestock industry due to its nutritional content, making it a preferred ingredient in animal feed formulations. As the demand for meat and dairy products rises globally, the use of grain sorghum in livestock feed has increased proportionally, further solidifying its dominance in the type segment of the sorghum market. The dual utility of grain sorghum in both human and animal nutrition makes it a key driver of market demand, overshadowing other sorghum types in terms of overall market share.

Sweet sorghum is anticipated to register a CAGR of 5.4% over the forecast period. Its high sugar content makes it suitable for the production of sweeteners, syrups, and other food products. Additionally, it can be used in the production of alcoholic beverages and as a feedstock for bioplastics. Sweet sorghum is recognized for its potential in biofuel production, particularly ethanol. As the global emphasis on renewable and sustainable energy sources grows, the demand for biofuels derived from sweet sorghum is expected to increase, driving its market growth.

End-use Insights

B2B end use accounted for the revenue share of 65.8% in 2023. The segment exerts dominance in the sorghum market, encompassing food and beverage production, animal feed, ethanol manufacturing, and diverse industrial applications. Sorghum's versatile utility is evident as a crucial ingredient in food products such as cereals and snacks, a valuable component in livestock feed, and a significant feedstock for ethanol production, aligning with the global shift towards renewable energy sources. Its multifaceted applications extend to various industrial processes, including starch production and adhesives. The prevalence of sorghum across these sectors underscores its role as a commodity with broad-reaching appeal, driven by factors such as changing dietary preferences, population growth, and sustainability initiatives, solidifying its prominence in the B2B marketplace within the end use segment.

B2B suppliers typically offer a consistent and reliable source of sorghum. Businesses can establish long-term relationships with suppliers, ensuring a steady and dependable supply of sorghum for their operations.

B2C end use is anticipated to register a CAGR of 6.2% over the forecast period. B2C channels, such as grocery stores, online retailers, and farmers' markets, offer convenience to individual consumers. Shoppers can easily find sorghum products at local stores or order them online, making the purchasing process straightforward.

B2C channels allow consumers to buy sorghum in smaller quantities that are suitable for individual or family consumption. This is especially appealing to households that do not require large bulk purchases.

Regional Insights

The sorghum market in North America is expected to grow at a CAGR of 5.4% from 2024 to 2030. This market is buoyed by its adaptability to diverse climatic conditions and its role in sustainable farming practices. The crop's use as a livestock feed and its growing importance in biofuel production are major market drivers. The rising consumer demand for gluten-free and health-conscious food products is also fueling market growth.

U.S. Sorghum Market Trends

The sorghum market in U.S. held a market share of 77.1% of the North America market in 2023. The sorghum market is driven by its versatility and adaptability to different climatic conditions, making it a valuable crop in regions facing water scarcity. Sorghum's use as a cost-effective feedstock in the livestock industry and its growing application in biofuel production are significant growth factors.

Europe Sorghum Market Trends

The sorghum market in Europe is projected to grow at a CAGR of 5.7% from 2024 to 2030. The European sorghum market is driven by the region's focus on sustainable agriculture and climate resilience. Sorghum's ability to thrive in warmer, drier conditions aligns with the EU's agricultural sustainability goals. Its applications in animal feed, biofuel production, and the food industry, particularly gluten-free products, are significant market drivers. European policies promoting renewable energy and reducing carbon footprints support the growth of sorghum cultivation.

The sorghum market in Germany is projected to grow at a CAGR of 5.5% from 2024 to 2030. Germany's sorghum market is influenced by the crop's growing recognition as a sustainable and eco-friendly alternative to traditional cereals. Its resilience to drought and low water requirements make it an attractive option amidst growing concerns about climate change and water conservation. Sorghum's use in bioenergy production and as a feed ingredient in the livestock sector are key market drivers.

Middle East & Africa Sorghum Market Trends

Middle East & Africa dominated the market with a revenue share of 45.0% in 2023. Sorghum is well-suited to the arid and semi-arid climates prevalent in many parts of the Middle East and Africa. Its ability to thrive in conditions with limited water availability makes it a preferred crop in these regions. Sorghum has deep cultural and culinary roots in many Middle Eastern and African societies. It is incorporated into traditional dishes, such as various porridges, flatbreads, and beverages, making it an integral part of the local diet. Sorghum plays a significant role in the economies of many countries in the Middle East and Africa. It contributes to food security, employment, and income generation for farmers, especially in rural areas.

Several research initiatives are focused on enhancing sorghum varieties, improving yields, and developing resilient strains capable of withstanding diverse climatic conditions. For instance, in April 2023, two prominent agricultural research institutes in Belgium, in collaboration with the International Crops Research Institute for the Semi-Arid Tropics (ICRISAT), initiated a climate adaptation project named 'StratAdapt-Mali' in Mali. This endeavor focuses on safeguarding sorghum yields, a pivotal crop for both sustenance and income in the region. The initiative encompasses comprehensive training and the application of advanced crop and climate modeling technologies, empowering rural farming communities and stakeholders to proactively strategize for extreme weather conditions. Utilizing the web-based tool CLIMTAG, developed by the Flemish Institute for Technological Research, the project aims to generate personalized agro-climate indicators for precise impact assessment and adaptive planning in the agricultural sector.

Asia Pacific Sorghum Market Trends

The market for sorghum in the Asia Pacific region is anticipated to register a CAGR of 6.1% over the forecast period. Changing dietary preferences, with an increasing focus on healthier and gluten-free alternatives, is driving demand for sorghum-based products. The region's substantial and growing population, coupled with the need for diverse grains, contributes to heightened cultivation and consumption of sorghum. Additionally, the expanding livestock industry, rising meat consumption, and sorghum's nutritional value are fostering its use as a key component in animal feed formulations. The emphasis on renewable energy sources in the Asia Pacific region is boosting demand for sorghum as a feedstock for biofuel production, aligning with sustainability goals.

India sorghum market is accounted for the largest share in Asia Pacific in 2023. The India sorghum market is primarily driven by its traditional use as a staple food in rural areas, where it is valued for its nutritional benefits and resilience to harsh climatic conditions. Increasing awareness of sorghum's health benefits, including its gluten-free properties and high fiber content, is spurring its demand in urban areas.

Central & South America Sorghum Market Trends

The CSA sorghum market is driven by the crop's adaptability to varying climatic conditions and its importance as a staple food and feed crop. In regions facing challenges like drought and poor soil quality, sorghum's resilience makes it a preferred choice for farmers. The growing livestock sector in countries like Brazil and Argentina boosts the demand for sorghum as animal feed.

Key Sorghum Company Insights

Seedway LLC, ADM, Cargill Inc., are some of the dominant players operating in sorghum market.

-

Cargill, Incorporated, has a vast geographical presence and operates in nearly every corner of the world. They have a significant presence in various countries across Europe, the Americas, Asia, and Africa.

-

ADM has a global presence with significant operations in various regions including North America, Europe, Asia Pacific, and Middle East and Africa.

Welter Seed & Honey Co, Advanta Seeds, Nu Life Market are some of the emerging players functioning in sorghum market.

-

Advanta Seeds offers a range of grains and pulses, including Grain sorghum, corn, sunflower, canola, rice, various vegetables (tomato, okra, eggplant, etc.). The company operates in over 20 countries across Asia, Africa, Latin America, and Europe

Key Sorghum Companies:

The following are the leading companies in the sorghum market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated

- ADM

- Seedway, LLC.

- Ernst Conservation Seeds

- The Scoular Company

- American Seed Co.

- Ardent Mills

- Advanta Seeds

- Nu Life Market

- Welter Seed & Honey Co.

Recent Developments

-

In October 2022, Faranaya inaugurated a processing facility at its Garu complex in northern Ghana. This achievement marks the fulfillment of the company's longstanding aspiration to engage in value addition for sorghum. Since its establishment in 2010, Faranaya has been dedicated to aggregating sorghum from local farmers, supporting them in boosting productivity through access to inputs, credit, and extension services. The recovery of costs at harvest not only aids in developing loyalty but, more crucially, fosters a trusting relationship with smallholder farmers. The launch of the processing facility signifies Faranaya's commitment to advancing the sorghum value chain in the region.

-

In May 2022, Chinese seed company LongPing High-Tech has expanded its product offerings in Brazil by launching a new sorghum seed, marking a shift from its primary focus on corn seeds. By diversifying its portfolio and entering the sorghum and soy seed markets, LongPing High-Tech aims to intensify competition with established rivals in Brazil, including Corteva and Bayer, which may lead to increased options for Brazilian farmers and advancements in seed technology in the region.

Sorghum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.36 billion

Revenue forecast in 2030

USD 31.77 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy Spain, China; India; Japan; Australia & New Zealand; Brazil; Argentina; South Africa.

Key companies profiled

Cargill, Incorporated; ADM; Seedway LLC.; Ernst Conservation Seeds; The Scoular Company; American Seed Co.; Ardent Mills; Advanta Seeds; Nu Life Market; Welter Seed & Honey Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Sorghum Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sorghum market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Forage Sorghum

-

Grain Sorghum

-

Biomass Sorghum

-

Sweet Sorghum

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

B2B

-

Food & Beverages

-

Animal Feed

-

Ethanol Production

-

Others

-

-

B2C

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sorghum market size was estimated at USD 22.11 billion in 2023 and is expected to reach USD 23.19 billion in 2024.

b. The global sorghum market is expected to grow at a compounded growth rate of 5.4% from 2024 to 2030 to reach USD 31.77 billion by 2030.

b. Grain sorghum accounted for largest market share of 35.9% in 2023. Grain sorghum, characterized by its larger, edible seeds, is widely consumed in many regions, particularly in Africa and Asia, where it serves as a crucial dietary staple. Its versatility in culinary applications, including the production of porridges, flatbreads, and beverages, contributes to its prevalence in food consumption

b. Some key players operating in sorghum market include Cargill, Incorporated; ADM; Seedway, LLC.; Ernst Conservation Seeds; The Scoular Company; American Seed Co.; Ardent Mills; Advanta Seeds; Nu Life Market; Welter Seed & Honey Co..

b. The sorghum market is experiencing growth driven by its versatile applications, including being a staple food in regions like Africa and Asia, a valuable nutritional component in livestock feed, and a source for biofuel production. Its resilience in drought-prone areas and its gluten-free, nutritious qualities cater to both environmental sustainability and health-conscious consumer preferences. Global trade opportunities, ongoing research, and governmental support further contribute to the market's expansion. As the world population increases and the demand for food rises, sorghum's adaptability positions it as a significant player in the evolving agricultural sector

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.