- Home

- »

- Organic Chemicals

- »

-

South America Specialty Pulp And Paper Chemicals Market, Industry Report, 2030GVR Report cover

![South America Specialty Pulp And Paper Chemicals Market Size, Share & Trends Report]()

South America Specialty Pulp And Paper Chemicals Market Size, Share & Trends Analysis Report, By Product (Functional, Bleaching), By Application (Packaging, Labeling), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-214-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The South America specialty pulp and paper chemicals market size was estimated at USD 1.04 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 1.9% from 2024 to 2030. The wide usage of specialty paper in packaging, printing, and labelling is driving the demand for functional and bleaching chemicals utilized in their manufacturing. The growing demand for flexible packaging is expected to positively impact the market growth. Also, the advancements on processing technologies in the food sector in South America is estimated to further augment packaged foods market, which in turn will escalate the demand for flexible packaging.

One of the major driving factors for the market is rising use of paper in packaging industry. South America population becoming aware about environment friendly substances and the region is limiting its usage of plastic by using plastic alternatives for sustainability. Industries in the region have begun to implement methods to reduce the usage of single-use plastics. Using specialty paper as a substitute for single-use plastics in packaging industry is anticipated to drive the market growth during the forecast period.

The raw material, byproduct, and the main chemical itself are known to have an adverse impact on the environment. Bleaching agent is a type of specialty chemical which contains chlorinated compounds. The chlorinated compounds cause water pollution as well as air pollution. Chlorine is carried out with air, and it reacts with other compounds, which have an adverse effect on health causing irritation to the eyes and nose. In addition, excessive inhalation can cause severe problems such as emphysema and damage to pulmonary blood vessels. Due to these factors, the industry is expected to face minor setbacks until the issues are resolved.

However, the rising demand for product in personal hygiene, household, and packaging are boosting the market growth. The increasing popularity of coating as protective material to reduce ink absorption and add smoothness in specialty paper is expected to increase the usage of functional chemicals during the forecast years.

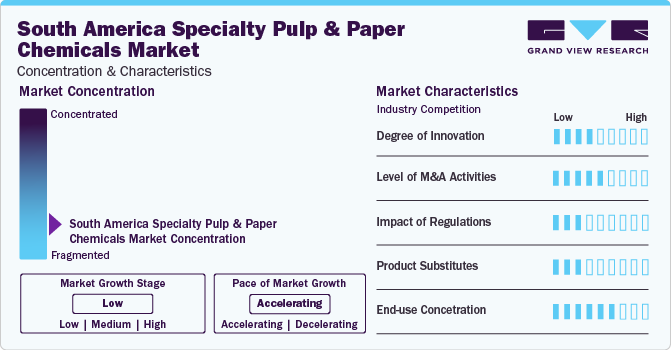

Market Concentration & Characteristics

Stringent regulations aimed at restricting the usage of bisphenol A in packaging and labelling of food & beverages are expected to reduce the access of chemical feedstock to paper manufacturers. These regulations have been put in place due to the association of bisphenoal A with estrogenicity. This is expected to hinder the market growth in the near future.

Alkenyl succinic anhydride is utilized as a key ingredient in the specialty pulp & paper chemicals industry. Researchers have found maleated sunflower oil, high oleic - MSOHO, exhibits similar chemical properties as ASA. Since MSOHO is ecofriendly, it is efficiently replacing ASA in the chemicals industry. Thus, the threat of external substitute is low to moderate.

Wide usage of specialty chemicals in manufacturing of paper products for improving the functional properties of finished goods is anticipated to limit the scope of conventional substitutes. Furthermore, gains in demand for specialty paper, because of the growth in its application in retail, manufacturing, and logistics sectors, is expected to further shrink the entry of substitute chemicals in South America market. Therefore, the threat of substitute chemicals is expected to be low during the forecast period.

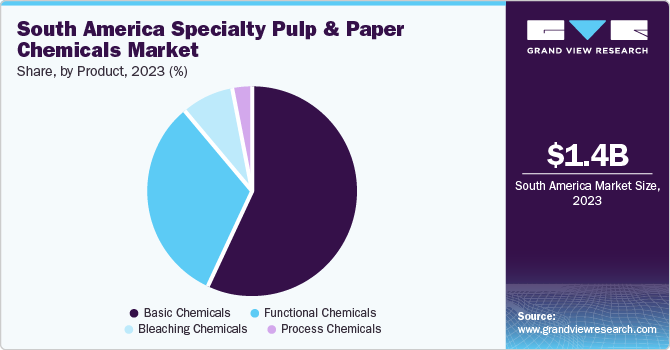

Product Insights

The functional chemicals segment dominated the market with a revenue share of 56.9% in 2023. High demands for colored, coated and finished paper is expected to fuel the growth of functional chemicals during the forecast period. Furthermore, in the post-pandemic era the demand for graphic, printing and writing paper has increased significantly thus increasing the demand for functional chemicals in South America over the forecast period.

Functional chemicals constitute of latex, starch, dye, binding agents, and other miscellaneous coating agents. These chemicals add special characteristics such as gloss, ink retention, and strength to the end-product. Various new product developments such as eco-friendly dyes, enzymes, and eco-friendly technologies such as sprinkling are also expected to boost the market growth.

Application Insights

The packaging segment dominated the market with a revenue share of 45.7% in 2023. The chemicals are used in the manufacturing of several packaging papers which are used in industries such as retail food, food service, consumer packaging and more. Wide application of the product in food packaging product portfolio including carryout boxes and corrugated clamshell, paper tubes, plates and cups is another factor augmenting the overall market demand over the next few years.

With increasing awareness toward sustainability, packaging infused with specialty paper is in high demand due to its eco-friendly properties such as compostable and recyclable, fluorochemical-free, and oil & grease resistant. Furthermore, green and light weight packaging are trending thus increasing the consumption of specialty paper to reduce packaging weight.

Country Insights

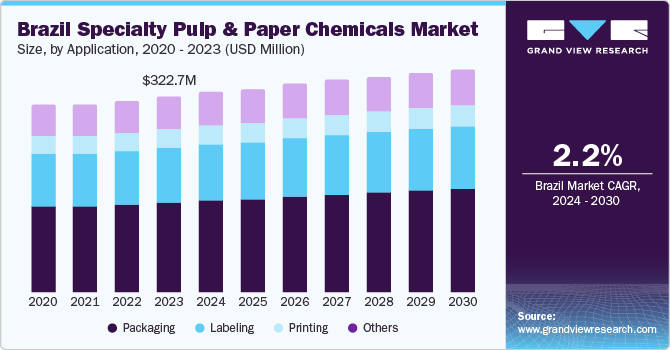

Brazil Specialty Pulp And Paper Chemicals Market Trends

Brazil dominated the market with a revenue share of USD 293 million in 2023. The country is also expected to witness fastest CAGR of 1.5 % during the forecast period. The country has an abundance of sugarcane and oilseeds along with regulatory support aimed for the production of bio-based specialty paper products. This resulted in increasing the importance of Brazil as an ideal manufacturing location for the market.

The Brazilian printing ink industry is experiencing growth due to consolidation and expansion of digital and flexographic product segments. The most widely used printing ink product in South America is lithographic. It is highly used due to its versatile printing output. These factors are likely to augment the overall printing application in the market over the forecast period.

Key South America Specialty Pulp And Paper Chemicals Company Insights

The market is highly competitive in nature. The market comprises prominent and well-established players, collectively capturing the larger portion of it in 2023. The manufacturers compete on various criteria including sales, product offering, production capacity, geographical presence and strategic initiatives.

BASF SE attained the topmost market position in 2023 followed by Ashland, Kemira, and Evonik Industries AG. These manufacturers have a firm foothold in the market with capabilities catering to the local as well as international market. These companies have a broad clientele base within the country as well as outside the country.

BASF SE and Ashland are some of the leading players in the market.

-

BASF SE: BASF SE operates through its major business segments including chemicals, performance products, functional materials & solutions, agricultural solutions, and oil & gas. The company offers innovative solutions for board and paper products under the “Pulping Chemicals” category

-

Evonik Industries AG: Evonik Industries AG provides a broad range of products, including organic acids, enzymes, and other specialty chemicals. The company provides active oxygens, additives, adhesives & sealants, plastic additives, silica, and auxiliaries for the pulp, paper, and packaging applications

Key South America Specialty Pulp And Paper Chemicals Companies:

- Klabin

- Ashland

- BASF SE

- Buckman Laboratories International, Inc.

- Kemira

- Evonik Industries AG

- MWV Rigesa

- CMPC

- MASISA

Recent Developments

-

In December 2023, Klabin, one of the leading producers of packaging and sustainable packaging paper, announced the acquisition of Arauco's forestry management in Paraná. This investment includes purchase of more than 85,000 hectares of valuable forest areas which falls majorly in the State of Paraná. With this acquisition, the company expects to become more self-sufficient for raw materials

-

In June 2023, CMPC, a Chile based packaging and tissue paper company, signed an agreement to purchase Powell Valley Millwork in the United States. With this deal the company aims to expand its business in the U.S.

-

In August 2021, Klabin empowered its growth strategy by starting first paper machine (MP27) of the Puma II Project located in Ortigueira, Paraná. The machine has a production capacity of 450,000 tons to produce Eukaliner, the world’s first kraftliner paper made 100% from eucalyptus fiber

South America Specialty Pulp And Paper Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.06 billion

Revenue forecast in 2030

USD 1.18 billion

Growth Rate

CAGR of 1.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Regional scope

South America

Country scope

Brazil; Argentina; Venezuela

Key Companies

Klabin; MWV Rigesa; CMPC; MASISA; Ashland; BASF SE; Buckman Laboratories International, Inc.; Kemira; Evonik Industries AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

South America Specialty Pulp & Paper Chemicals Market Report Segmentation

This report forecasts revenue and volume growth at the region level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the South America specialty pulp and paper chemicals market report based on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Basic Chemicals

-

Functional Chemicals

-

Bleaching Chemicals

-

Process Chemicals

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Printing

-

Packaging

-

Labeling

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Argentina

-

Venezuela

-

Frequently Asked Questions About This Report

b. The South America specialty pulp and paper chemicals market was estimated at USD 1.04 billion in 2023 and is expected to reach USD 1.06 billion in 2024

b. The South America specialty pulp and paper chemicals market is projected to grow at a CAGR of 1.9% between 2024 to 2030 and reach USD 1.18 billion by 2030

b. The functional chemicals segment dominated the market with a revenue share of 56.9% in 2023 due to high demand for colored, coated, and finished paper.

b. Key players in the South America specialty pulp and paper chemicals market are Klabin; MWV Rigesa; CMPC; MASISA; Ashland; BASF SE; Buckman Laboratories International, Inc.; Kemira; Evonik Industries AG

b. The market is driven by the wide usage of specialty paper in packaging, printing, & labeling, and the growing demand for flexible packaging

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."