- Home

- »

- Alcohol & Tobacco

- »

-

South Korea Hangover Cure Products Market Size ReportGVR Report cover

![South Korea Hangover Cure Products Market Size, Share & Trends Report]()

South Korea Hangover Cure Products Market Size, Share & Trends Analysis Report By Product (Solution/Drinks, Powder), By Product Consumption Pattern (Before Drinking, After Drinking), By Distribution Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-060-5

- Number of Report Pages: 81

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

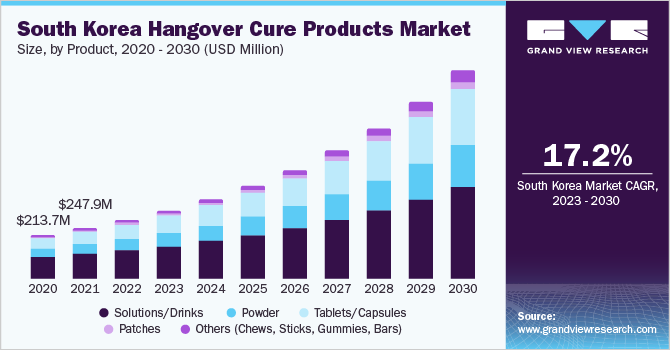

The South Korea hangover cure products market size was valued at USD 288.11 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.2% from 2023 to 2030. The increasing consumption of alcoholic drinks in the country is a major factor driving the growth of the market for hangover cure products during the forecast period. Alcohol consumption is steadily increasing in several countries in the region, including South Korea, China, and India. This can be attributed to the growing popularity of wine and beer among young consumers.

According to an article published in the National Library of Medicine, in December 2020, nearly 70.5% of men and 51.2% of women aged 19 years and older consumed alcohol in the year 2019 in South Korea. The study also revealed that approximately 20% of the total drinkers are binge or excessive drinkers and are responsible for 66% of all alcohol consumption in South Korea. Excessive drinkers are considered one of the key consumers of hangover cure products.

Alcohol consumption can result in several conditions, such as dehydration, inflammation, sleep disturbance, hormonal imbalance, and direct toxin effects. According to an article published in the National Library of Medicine, in August 2019, approximately 7.6% of deaths in men and 4.0% in women were attributed to alcohol among Korean adults. With rising awareness toward harmful side effects of alcohol consumption, such as dehydration and inflammation, South Koreans are focusing on adopting alcohol detox products, including hangover cure and rehydration products, to avoid the deteriorating side effects of excess alcohol consumption.

Consumers in South Korea are becoming increasingly aware of the benefits associated with the consumption of hangover cure products, which help improve metabolism, reduce nausea caused due to excessive alcohol consumption, and hydrate the body. This, in turn, is rolling out opportunities for the key market players to launch new products and increase their product visibility.

For instance, in December 2019, Yuhan Corporation, a pharmaceuticals company in South Korea, launched a potion using dendropanax tree extracts mixed with honey to overcome hangovers due to alcohol consumption. Such launches are expected to prove beneficial for the market.

Over the past few years, consumers over the world have become more enthusiastic about functional foods and drinks. Therefore, ingredients that boost energy, mental clarity, and mood and reduce stress are expected to appeal to consumers in the coming years. This trend in functional foods and drinks is likely to create opportunities for the hangover cure product manufacturers.

Product Insights

Solutions/ drinks dominate the market with a share of 48.1% in 2022. Hangover cure solutions are gaining impetus owing to the robust demand from health-conscious consumers for premium hydration products to combat hangovers. Market players such as Dawn 808 (Yeomyeong), Samyang Corporation (Sang kwae hwan), and HK inno.N Corporation have introduced hangover solutions in various flavors. Increased penetration and high product visibility among young consumers and working adults are the main factors driving demand for hangover cure solutions.

The others segment is expected to register the fastest growth of 22.3% during the forecast period. In South Korea, hangover remedies, including pre-and post-drinking beverages, chewing gums, and pills, are available at every convenience store, hypermarket/supermarket, and pharmacy. Launch of new and innovative hangover cure products, including ice creams, bars, gummies, jellies, chews, and sticks, are gaining popularity among South Koreans, which is expected to increase product visibility among consumers in South Korea in the coming years.

Product Consumption Pattern Insights

Before drinking hangover cure product consumption is the leading segment and holds almost 52.5% of the market in 2022. Owing to the country’s intense drinking culture, many Koreans are consuming hangover cure drinks and tablets a couple of hours before drinking to help them metabolize the alcohol and to prevent a hangover the morning after. Such a trend is driving the segment growth.

The after drinking segment is expected to register a faster growth of 18.1% from 2022-2030. Increasing adoption of hangover cure products among a number of millennials and working adults post drinking excessive alcohol is expected to boost the growth of the segment in the forecast period. Consumers have started opting for hangover cure products that are aimed at hydrating the body and easing stomach upsets after excessive alcohol consumption.

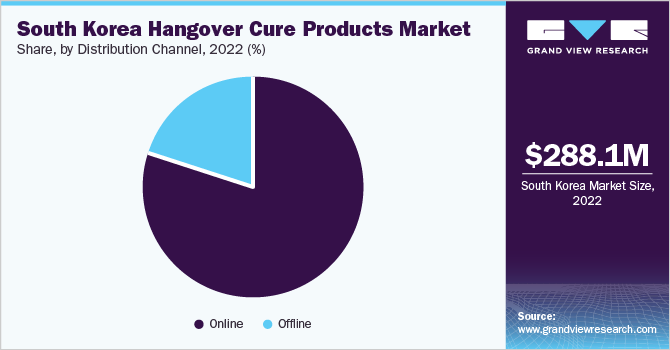

Distribution Channel Insights

The easy availability, growing access, and convenience of buying hangover cure products from offline stores are the factors propelling the segment’s growth and held 80% share of the market in 2022. These products are easily purchased at nearby convenience stores, pharmacies, supermarkets, or shopping malls. In South Korea, a convenience store chain also launched ‘Gyeondyo-bar’, which translates to “hang in there,” According to the company, it is the first ice cream bar marketed specifically to combat the after-effects of alcohol consumption.

Online sales channel is the fastest growing channel with a CAGR of 19.8%. In recent years, there has been a shift in the way South Koreans shop for various products, including hangover cure products. An increasing number of consumers have been buying these products online, especially since the start of the COVID-19 pandemic, backed by the factors such as ease of accessibility while maintaining social distancing, time-saving, and additional discounts. This, in turn, has strengthened the sales of hangover cure products via online segment.

Key Companies & Market Share Insights

The South Korea hangover cure products market is characterized by the presence of some large multinational and regional companies. Leading manufacturers hold a significant market share in South Korea. Companies have been implementing various expansion strategies such as mergers & acquisitions, marketing partnerships, capacity expansions, and strengthening of online presence to gain a competitive advantage over others in the market.

-

For instance, in June 2022, Bayer AG announced its partnership with T-Pain, a producer and musician, to launch its new innovative product Alka-Seltzer Hangover Relief. This product claims to offer quick relief from mental fatigue, body aches, and headaches the morning after. The artist also produced a new version of his jingle “Plop Plop, Fizz Fizz” to introduce the brand to a new set of younger consumers.

Some of the key players operating in the South Korea hangover cure products market include:

-

HK inno.N Corp.

-

GLAMI.COM

-

Dong-A Socio Holdings

-

Samyang Holdings Corporation

-

Bayer AG

-

HANDOK

-

Abbott

-

Flyby

-

Revival

-

Vit2go Online Shop

-

Zolv

South Korea Hangover Cure Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 335.71 million

Revenue forecast in 2030

USD 1,026.94 million

Growth rate

CAGR of 17.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, product consumption pattern, distribution channel

Country scope

South Korea

Key companies profiled

HK inno.N Corp.; GLAMI.COM; Dong-A Socio Holdings; Samyang Holdings Corporation; Bayer AG; HANDOK; Abbott; Flyby; Revival; Vit2go Online Shop; Zolv

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

South Korea Hangover Cure Products Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the South Korea hangover cure products market based on the product, product consumption pattern, and distribution channel:

-

Product Outlook (USD Million, 2017 - 2030)

-

Solutions/Drinks

-

Powder

-

Tablets/Capsules

-

Patches

-

Others (Chews, Sticks, Gummies, Bars)

-

-

Product Consumption Pattern Outlook (USD Million, 2017 - 2030)

-

Before Drinking

-

After Drinking

-

-

Distribution Channel Outlook (USD Million, 2017 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The South Korea hangover cure products market size was estimated at USD 288.1 million in 2022 and is expected to reach USD 335.7 million in 2023.

b. The South Korea hangover cure products market is expected to grow at a compound annual growth rate of 17.2% from 2023 to 2030 to reach USD 1,026 million by 2030.

b. Solutions/ drinks segment dominated the South Korea hangover cure products market with a share of 48.1% in 2022. This is attributable to the robust demand from health-conscious consumers for premium hydration products to combat hangovers. Market players such as Dawn 808 (Yeomyeong), Samyang Corporation (Sang kwae hwan), and HK inno.N Corporation have introduced hangover solutions in various flavors

b. Some key players operating in the South Korea hangover cure products market include HK inno.N Corp., GLAMI.COM, Dong-A Socio Holdings, Samyang Holdings Corporation, Bayer AG, HANDOK, Abott, Flyby, Revival, Vit2go Online Shop, Zolv

b. Key factors that are driving the market growth include the increasing consumption of alcoholic drinks in the country. Alcohol consumption is steadily increasing in several countries in the region, including South Korea, China, and India

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."