- Home

- »

- Consumer F&B

- »

-

Soy Dessert Market Size And Share, Industry Report, 2030GVR Report cover

![Soy Dessert Market Size, Share & Trends Report]()

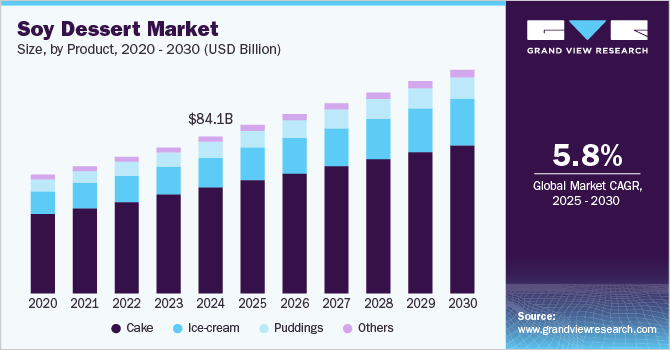

Soy Dessert Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cake, Ice-cream, Puddings), By Distribution Channel (Hypermarket, Convenience Stores, Online Retail), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-924-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soy Dessert Market Size & Trends

The global soy dessert market size was valued at USD 84.11 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. The rapidly growing health awareness among consumers worldwide, coupled with the increasing prevalence of lactose intolerance, has led to significant demand for dairy alternatives such as almonds, oats, and soy in various food items, including desserts. Additionally, soy offers various important nutritional benefits that have boosted its appeal among health-conscious individuals. The increasing availability of soy-based desserts through both retail stores and online platforms has further created notable growth opportunities for the industry.

The rise of veganism, driven by health, ethical, and environmental concerns, has boosted the demand for plant-based alternatives, including soy-based desserts. Consumers are increasingly turning to plant-based options to replace traditional dairy desserts. As per an article by WorldAnimalFoundation.org, there were around 88 million vegans globally in 2023, amounting to around 1-2% of the population. With both developed and developing economies witnessing continued propagation of this lifestyle, it is expected that the demand for dairy-free products in the food industry will increase substantially in the coming years. A significant proportion of the global population suffers from lactose intolerance, particularly in regions including Asia, Africa, and Latin America. Soy-based desserts have emerged as a viable lactose-free alternative, making them appealing to people who have difficulty digesting dairy products.

In recent years, soy desserts have significantly improved taste, texture, and variety. Soy-based ice creams, puddings, cakes, and other sweets now offer an enriching experience similar to traditional dairy desserts. This innovation is helping companies attract more mainstream consumers who may otherwise be concerned about plant-based desserts. As consumer tastes become more complex, premium soy desserts with unique flavors, for instance, matcha, salted caramel, fruit infusions, and artisanal preparations, are gaining popularity. Manufacturers are increasingly experimenting with new ingredients, textures, and flavors to cater to niche markets and higher-income consumers. The foodservice and hospitality sectors, particularly restaurants, bakeries, and cafes, have witnessed strong growth in demand for soy desserts. Many plant-based and vegan restaurants now feature these items in their menus, and traditional eateries are increasingly incorporating dairy-free options to cater to evolving dietary preferences.

Product Insights

The soy-based cakes segment accounted for the largest revenue share of 67.1% of the global soy dessert industry in 2024, owing to the extensive popularity and sales of these dessert items. They are experiencing notable growth in demand, particularly in markets with rising interest in plant-based diets, dairy-free products, and health-conscious consumption. Soy-based cakes, which use soy ingredients, including soy milk, tofu, or soy protein, as substitutes for traditional dairy or eggs, appeal to a wide range of consumers. These cakes are particularly popular among those with dietary restrictions, such as lactose intolerance or vegan preferences, as well as individuals seeking healthier dessert alternatives. Additionally, bakery companies frequently collaborate with leading chefs to launch limited-edition products that can boost consumer interest in plant-based foods.

Meanwhile, the ice-cream segment is anticipated to grow at the highest CAGR during the forecast period. The growing popularity of dairy alternatives such as soy and almond has compelled ice cream manufacturers to launch a range of soy-based products. They are often marketed as a healthier option to traditional dairy ice creams. Soy is lower in saturated fat and contains no cholesterol, making it a heart-healthy alternative to conventional products. Companies are increasingly aiming to introduce more unique offerings in their ice-cream portfolio, which is expected to present a sizeable opportunity for market expansion in the coming years.

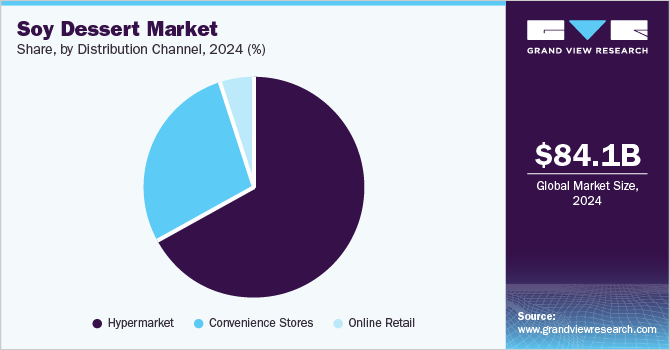

Distribution Channel Insights

The hypermarket segment accounted for the largest revenue share in the global soy dessert industry in 2024, aided by the extensive sales of soy-based desserts through these outlets. A large number of brands promote their products in stores such as Walmart, offering discount coupons and free samples that can appeal to new consumers. As there is an increasing preference for plant-based alternatives for health, ethical, and environmental reasons, hypermarkets are capitalizing on this shift by offering a broader range of soy-based products in their dessert sections. Consumers are increasingly seeking newer varieties of cakes, puddings, and pastries when purchasing, leading to their preference for hypermarkets over other distribution channels.

The online retail segment is expected to grow at the fastest CAGR during the forecast period. The rapid proliferation of smartphones and the Internet globally and the rising demand for plant-based alternatives to traditional desserts have resulted in the growing usage of online channels among consumers. Additionally, these platforms provide a cost-effective way to promote and sell products for smaller brands as well as chefs and baking enthusiasts operating from their homes. The availability of same-day or next-day delivery options and discounts further drive traffic to online channels, enabling segment expansion.

Regional Insights

North America accounted for the largest revenue share of 27.3% in 2024 in the global soy dessert industry. The rapid expansion of the vegan population and the presence of a substantial lactose-intolerant demographic have led to the establishment of a competitive market in this region. Major fast-food establishments, as well as smaller food outlets in the U.S. and Canada, have increased the presence of soy-based products in their menus to address the growing popularity of this ingredient. Moreover, regional authorities are constantly focusing on ensuring that manufacturers use high-quality ingredients and follow best practices to produce their goods. In October 2024, Soy Canada announced a partnership with the Canadian Grain Commission, enabling the latter to deliver the Canadian Soy Quality Program. The initiative is expected to enable international buyers to understand the quality of the country’s food-grade soybeans.

U.S. Soy Dessert Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, aided by the rising demand for dairy alternatives in products such as pastries and ice-creams. Consumers are increasingly becoming aware of the various health benefits of soy, which is being further propagated by celebrities and sports athletes promoting different brands. According to a report by the National Institutes of Health’s National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), around 36% of the U.S. population suffers from lactose malabsorption. This has led to increased sales of alternative products made from almonds, soy, and oats, leading to market expansion.

Europe Soy Dessert Market Trends

Europe accounted for a substantial revenue share in the global market in 2024, aided by a significant shift toward plant-based diets, with countries such as Germany, the UK, and the Netherlands leading in vegan and vegetarian food adoption. The rise of veganism, driven by health, ethical, and environmental concerns, has boosted the demand for plant-based alternatives, including soy-based desserts. Moreover, soybeans have a lower environmental footprint compared to dairy production, which suits Europe’s strong focus on sustainability and climate change initiatives. The European Plant-based Foods Association (ENSA) aims to promote plant-based products to ensure healthier and more sustainable diets by driving awareness among policymakers.

Asia Pacific Soy Dessert Market Trends

The Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The region has a long history of using soy as an ingredient in food items, and the market for soy-based desserts is influenced by local dietary habits, health trends, and growing consumer interest in plant-based alternatives. Tofu-based desserts such as tofu pudding (douhua) are popular in China, Taiwan, and Hong Kong. Miso and soy paste desserts witness significant sales in Japan, Korea, and other parts of East Asia. As competition has grown among soy dessert manufacturers, traditional products have been modernized to cater to evolving consumer tastes, including the introduction of premium soy desserts and new flavors.

China accounted for a leading revenue share in the Asia Pacific market for soy desserts in 2024. The country is the largest producer of soy in the region and a top five producer globally, as per data from the U.S. Department of Agriculture. Soy has been an essential ingredient in Chinese cooking for centuries, both in savory dishes and traditional Chinese desserts. The ‘Douhua’ is a soft and silky tofu dessert often served with sweet syrup or other toppings that are very popular across the country, particularly in southern regions. Soy is seen as a healthier alternative to dairy products due to its lower saturated fat content and lack of cholesterol. As more consumers in China adopt healthier eating habits, plant-based desserts such as soy-based options are becoming more popular, aiding industry advancement.

Key Soy Dessert Company Insights

Some major companies involved in the global soy dessert industry include Danone S.A., Hain Celestial, and AFC Soy Foods, among others.

-

Danone S.A. is a global producer and manufacturer of dairy and nutritional products operating through four segments - fresh dairy and plant-based products, early life products, medical nutrition products, and bottled water. The plant-based products and beverages portfolio was developed after the acquisition of WhiteWave in 2017. This line includes natural or flavored beverages prepared from soy, coconuts, almonds, rice, and oats, among other ingredients, along with plant-based alternatives to cooking products such as yogurt and cream. The company stated that in 2023, it had utilized 53,000 tons of soybeans to manufacture its Silk and Alpro soy-based products.

-

AFC Soy Foods is a U.S.-based company specializing in producing and distributing high-quality soy-based products, focusing on leveraging the nutritional benefits of soy to create plant-based food products. Tofu is a core product of the company, offering various types such as silken, firm, and extra firm tofu, which are used in a variety of culinary applications ranging from cooking to baking. Other major products include soy pudding snacks that include three flavors - original, almond, and coconut; and soy pudding variants that are available in the same flavors.

Key Soy Dessert Companies:

The following are the leading companies in the soy dessert market. These companies collectively hold the largest market share and dictate industry trends.

- THE HERSHEY COMPANY

- Danone S.A.

- The Hain Celestial Group, Inc.

- AFC American Food Company

- ADM

- NOW Foods

- Kerry Group plc

- Gluten Intolerance Group

Soy Dessert Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 90.16 billion

Revenue forecast in 2030

USD 119.32 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, UAE

Key companies profiled

THE HERSHEY COMPANY; Danone S.A.; The Hain Celestial Group, Inc.; AFC American Food Company; ADM; NOW Foods; Kerry Group plc; Gluten Intolerance Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soy Dessert Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soy dessert market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cake

-

Ice-cream

-

Puddings

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket

-

Convenience Stores

-

Online Retail

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.