- Home

- »

- Plastics, Polymers & Resins

- »

-

Specialty Fuel Additives Market Size, Industry Report, 2030GVR Report cover

![Specialty Fuel Additives Market Size, Share & Trends Report]()

Specialty Fuel Additives Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Deposit Control, Cetane Improvers, Antioxidants), By Application (Gasoline, Diesel, Aviation Turbine Fuel), By Region And Segment Forecasts

- Report ID: 978-1-68038-007-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Fuel Additives Market Summary

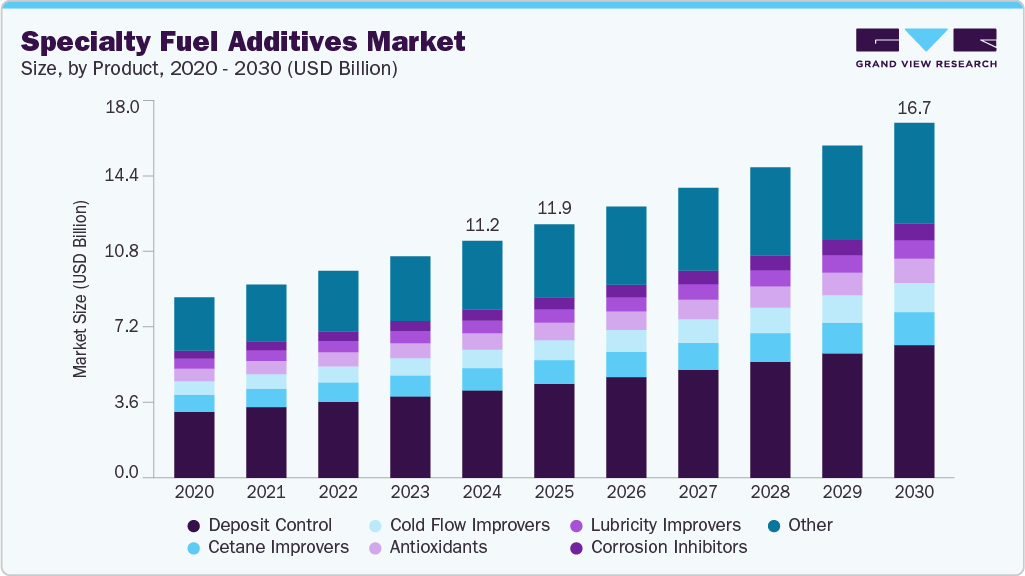

The global specialty fuel additives market size was valued at USD 11.17 billion in 2024 and is projected to reach USD 16.75 billion by 2030, growing at a CAGR of 7.0% from 2025 to 2030.The growing demand for low-emission and efficient energy sources in manufacturing, automobiles, and aviation, along with stringent environmental regulations, is projected to boost market growth.

Key Market Trends & Insights

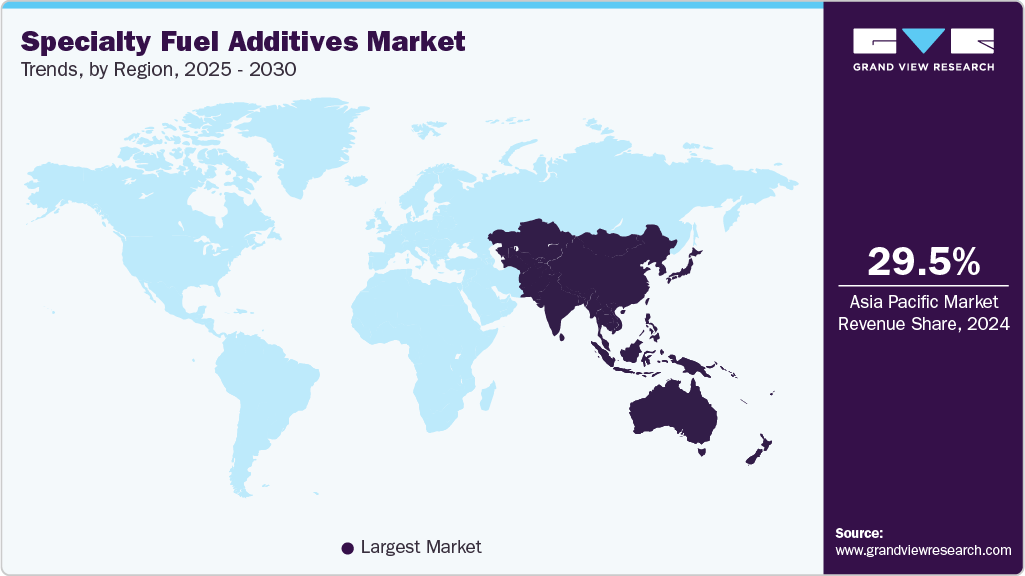

- Asia Pacific specialty fuel additives dominated the market with the largest share of 29.5% in 2024.

- China's specialty fuel additives market accounted for the largest share in the regional market in 2024

- Based on product, the deposit control segment held the largest market share of 36.9% in 2024

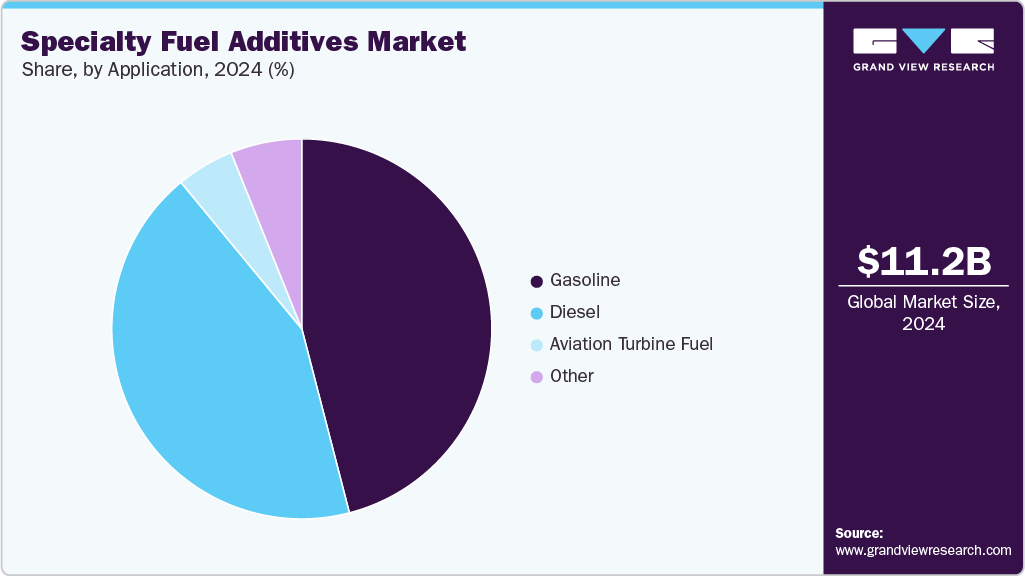

- Based on application, the gasoline segment accounted for the largest revenue share in 2024

Market Size & Forecast

- 2024 Market Size: USD 11.17 Billion

- 2030 Projected Market Size: USD 16.75 Billion

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2024

The increasing levels of toxic emissions from vehicle fuel have harmed the environment. This has led to increased use of specialty additives worldwide, which helps curb harmful gas emissions from vehicles. They help enhance the efficiency of gasoline, distillates, diesel, and other fuels. It reduces combustion and burn rates in high temperatures and avoids dreadful emissions of pollutants. The growing trend of using additives in biodiesel blends in North America and Europe to achieve efficient cold flow performance is expected to drive product demand. Continuous price inflation, driven by increasing pressure on raw materials, is anticipated to adversely impact industry growth over the coming years.

The constant focus on new product development and innovation in specialty fuel additives to reduce exhaust emissions and improve mileage is expected to drive future growth. The introduction of new engine technologies and the demand for higher efficiency are also contributing to the market's growth. The U.S., China, and India are projected to dominate the additives market.

Specialty fuel additives enhance fuel performance and protect the fuel system. In engines, the need to remove and clean harmful deposits is set to drive market growth. Removing these deposits results in better acceleration and engine power.

The global shift toward clean energy and a stronger focus on reducing carbon emissions drive the specialty fuel additives industry. Increasing demand for biofuels, natural gas, and alternative fuels requires additives that enhance fuel efficiency and minimize harmful emissions. These additives improve combustion, optimize engine performance, and ensure compliance with stringent environmental standards. The drive for sustainable energy solutions and the rising demand for cleaner fuels encourage the widespread use of specialty additives, fueling market growth and driving innovation in the coming years. For instance, in January 2022, BASF Enzymes LLC and Innospec Fuel Specialties LLC formed a strategic partnership to increase value to the client in the ethanol yield industry. BASF would distribute DCI-11 Plus ClearTrak, a concentrated corrosion inhibitor, to ethanol plants located in the U.S.

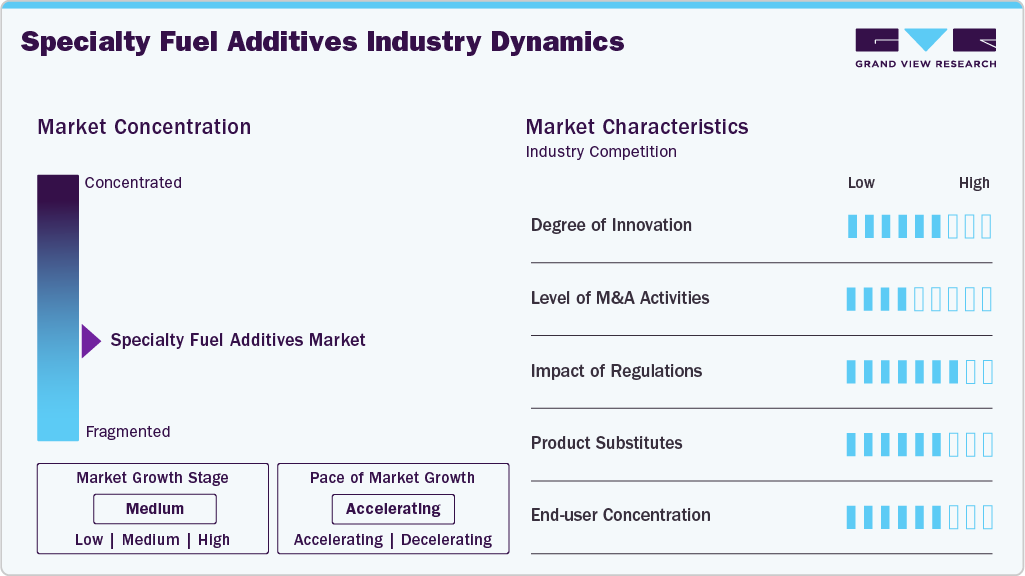

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. Leading companies continuously invest in research and development to create advanced additives that enhance fuel efficiency, reduce emissions, and improve engine performance. These innovations are driven by the need to meet stringent environmental regulations and cater to the growing demand for cleaner, more efficient fuels.

Moreover, collaborations and strategic partnerships between manufacturers and distributors help expand the market reach, ensuring wider adoption of specialty additives across various industries, thereby driving overall market growth.

The global specialty fuel additives industry is characterized by a high degree of innovation, which is driving substantial market growth. Companies constantly develop advanced formulations to enhance fuel efficiency, reduce emissions, and improve engine performance. Innovations in additives for biofuels, natural gas, and other alternative fuels are expanding market opportunities.

Product Insights

The deposit control segment held the largest market share of 36.9% in 2024, fueled by its essential function in maintaining engine cleanliness and efficiency. These additives help prevent the formation of harmful carbon deposits in fuel injectors, intake valves, and combustion chambers, which can degrade engine performance and increase emissions. With stricter emission regulations and growing consumer demand for improved fuel economy, the use of deposit control additives has risen substantially. Their proven benefits in extending engine life and improving fuel performance have made them a dominant choice in the market.

The cold flow improvers segment is anticipated to grow at the fastest CAGR of 7.7% over the forecast period, attributed to their ability to enhance fuel performance in low-temperature environments. These additives prevent wax crystallization and gelling in diesel and biodiesel, ensuring smooth engine operation during colder months.

Application Insights

The gasoline segment accounted for the largest revenue share in 2024, propelled by its vital role in improving engine performance, fuel efficiency, and reducing emissions. Gasoline additives are essential for enhancing fuel quality, preventing engine deposits, and complying with strict environmental regulations. The increasing focus on fuel efficiency and cleaner emissions in the automotive sector has driven the demand for high-performance gasoline additives. Furthermore, the widespread use of gasoline-powered vehicles globally has contributed to the continuous growth and dominance of the gasoline segment. In May 2024, Braskem introduced Octane Plus, a premium fuel additive for the high-performance automotive fuel market. It is an additive that is blended while producing gasoline to enhance the fuel’s octane rating and increase its ability to resist intense temperatures.

Diesel is projected to be the fastest-growing segment from 2025 to 2030, propelled by the rising demand for cleaner and more efficient fuel solutions. Adopting Ultra-Low Sulfur Diesel (ULSD) has driven the need for additives that improve fuel stability, enhance engine performance, and reduce emissions. In addition, stricter environmental regulations and the growing demand for diesel in emerging markets are further fueling this trend.

Regional Insights

The North America specialty fuel additives market is expected to witness a significant CAGR of 6.7% from 2025 to 2030 due to the rapid growth of the automotive sector and the development of biofuel-compatible additives. The increasing number of vehicles is fueling demand for additives that improve fuel performance and efficiency. Furthermore, the shift toward biofuels, owing to sustainability initiatives, necessitates the creation of additives that enhance biofuel stability and combustion.

U.S. Specialty Fuel Additives Market Trends

TheU.S. specialty fuel additives market held the largest share in 2024. Stringent environmental regulations in the U.S. push fuel producers to adopt specialty additives that minimize emissions and enhance fuel efficiency. This demand for cleaner fuels is reinforced by evolving technology in fuel systems, including more efficient engines and advanced fuel types.

Europe Specialty Fuel Additives Market Trends

The European specialty fuel additives market is anticipated to experience significant expansion during the forecast period, driven by growing awareness of climate change and the rising demand for fuel efficiency. Increasing environmental concerns are prompting consumers and businesses to seek cleaner and more sustainable fuel options.

Asia Pacific Specialty Fuel Additives Market Trends

Asia Pacific specialty fuel additives dominated the market with the largest share of 29.5% in 2024, attributed to innovations in additive chemistry and the growing demand for multi-functional additives. Advanced formulations, such as detergents, corrosion inhibitors, and friction modifiers, enhance fuel performance and engine efficiency. These innovations help meet increasingly stringent emissions standards and boost fuel economy. In January 2024, BASF introduced the next generation of Keropur gasoline additive bottle in the Taiwan automotive aftermarket. This new formulation enhances the engine cleaning effect and is a cleaner combustion process, contributing to a sustainable mobility system.

China's specialty fuel additivesmarket accounted for the largest share in the regional market in 2024, owing to the shift toward alternative fuels and the integration of nanotechnology. The growing demand for biofuels and synthetic fuels drives the need for additives that enhance combustion efficiency and maintain fuel stability.

Key Specialty Fuel Additives Company Insights

Some of the key companies in the specialty fuel additives industry include NewMarket Corporation, BASF, Baker Hughes Company, Dow, and Chevron Oronite Company LLC.

-

Baker Hughes Company offers integrated oilfield services, technologies, and solutions for the energy and industrial sectors. Its portfolio includes drilling services, artificial lift systems, specialty chemicals, and digital tools for optimizing production and emissions management.

-

Dow provides various materials science solutions, including specialty chemicals, plastics, and performance materials. Its offerings support industries, including packaging, infrastructure, transportation, and consumer goods, with a strong focus on sustainability and innovation.

Key Specialty Fuel Additives Companies:

The following are the leading companies in the specialty fuel additives market. These companies collectively hold the largest market share and dictate industry trends.

- NewMarket Corporation

- Innospec

- BASF

- Infineum International Limited

- Albemarle Corporation

- Baker Hughes Company

- Dow

- Chevron Oronite Company LLC

- The Lubrizol Corporation

- TotalEnergies

- Dorf Ketal

- Clariant

- Eurenco

- NALCO Champion

- Evonik Industries AG

Recent Developments

- In August 2023, Infineum entered into a strategic partnership with World Fuel Services, naming them the global distributor for its Marine Fuel Additives product line.

Specialty Fuel Additives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.96 billion

Revenue forecast in 2030

USD 16.75 billion

Growth Rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

June 2025

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

NewMarket Corporation; Innospec; BASF; Infineum International Limited; Albemarle Corporation; Baker Hughes Company; Dow; Chevron Oronite Company LLC; The Lubrizol Corporation; TotalEnergies; Dorf Ketal; Clariant; Eurenco; NALCO Champion; and Evonik Industries AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Fuel Additives Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global specialty fuel additives market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Deposit Control

-

Cetane Improvers

-

Antioxidants

-

Lubricity Improvers

-

Cold flow Improvers

-

Corrosion Inhibitors

-

Other

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Diesel

-

Aviation Turbine Fuel

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.