- Home

- »

- Plastics, Polymers & Resins

- »

-

Starch-based Packaging Market Size, Industry Report, 2030GVR Report cover

![Starch-based Packaging Market Size, Share & Trends Report]()

Starch-based Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bags & Pouches, Films & Wraps, Bottles), By End-use (Food & Beverages, E-commerce), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-558-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Starch-based Packaging Market Summary

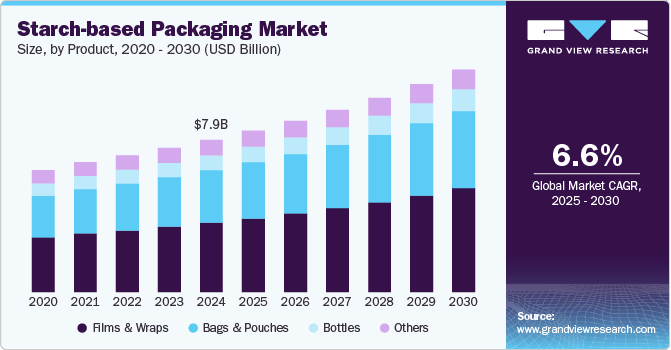

The global starch-based packaging market was estimated at USD 7.97 billion in 2024 and is projected to reach USD 11.64 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. The market is driven by increasing demand for sustainable and biodegradable alternatives to plastic. Government regulations promoting eco-friendly materials further fuel market growth. Governments worldwide are introducing stringent regulations to curb plastic pollution and promote biodegradable alternatives.

Key Market Trends & Insights

- Europe starch-based packaging industry dominated the global market with the largest revenue share of over 32.0% in 2024.

- Asia Pacific starch-based packaging industry is anticipated to grow at the fastest CAGR of 6.1% over the forecast period.

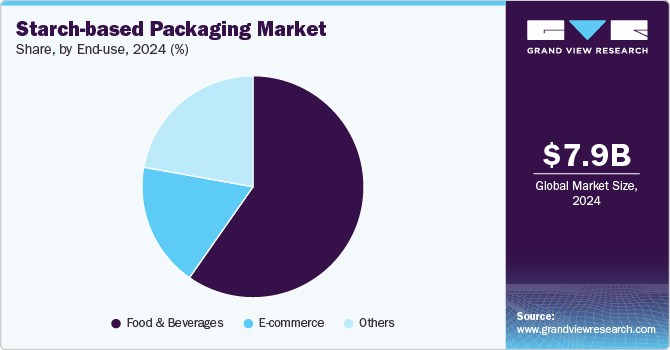

- Based on end-use, the food & beverages segment recorded the largest market share of over 59.0% in 2024 and is projected to grow at the fastest CAGR of 7.1% during the forecast period.

- In terms of product, the films & wraps segment recorded the largest market revenue share of over 45.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.97 Billion

- 2030 Projected Market Size: USD 11.64 Billion

- CAGR (2025-2030): 6.6%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, the European Union’s Single-Use Plastics Directive encourages the adoption of sustainable packaging materials such as starch-based films and containers. Similarly, in countries such as India and Canada, bans or restrictions on single-use plastics have created strong tailwinds for bio-based alternatives. Starch, being abundant, renewable, and biodegradable, is seen as a practical substitute for petroleum-based plastics, especially in short-lifecycle applications such as food packaging and disposable items.

Another major driver is growing consumer demand for sustainable and eco-friendly products. Modern consumers, particularly Millennials and Gen Z, are increasingly choosing products with minimal environmental impact, influencing brand preferences and purchasing behaviors. This trend is especially strong in the food and beverage industry, where companies are adopting starch-based trays, wrappers, and films to enhance their environmental credentials. Retailers and foodservice providers are also exploring starch-based options to enhance brand image and meet evolving consumer expectations.

Moreover, advancements in material science and packaging technologies are enabling starch-based materials to overcome traditional limitations such as poor water resistance and mechanical strength. Researchers and companies are developing starch blends, often with other biopolymers such as PLA or PHA, to improve functionality while maintaining biodegradability. For example, Novamont S.p.A. and BASF have introduced starch-based polymers that combine flexibility, printability, and compostability, expanding their use across diverse packaging formats, from films to rigid containers. These innovations are crucial in positioning starch-based packaging as not just an eco-friendly option, but a commercially viable and scalable one for mass-market adoption.

Product Insights

The films & wraps segment recorded the largest market revenue share of over 45.0% in 2024 and is projected to grow at the fastest CAGR of 7.1% during the forecast period. Starch-based films and wraps are thin, flexible packaging materials used primarily for food wrapping, produce packaging, and industrial applications. These films often include starch blended with other biodegradable polymers like PLA (polylactic acid) to improve mechanical strength and water resistance. They offer excellent breathability and barrier properties for certain types of fresh produce. Retailers and food producers are adopting starch-based films to comply with environmental regulations and cater to eco-conscious consumers.

Starch-based bags and pouches are widely used in the packaging of food items, retail products, and personal care goods. These products are known for being biodegradable and compostable, offering an eco-friendly alternative to petroleum-based plastic bags.

Starch-based bottles are an emerging category in biodegradable packaging, primarily used for personal care products, limited food & beverage uses, and specialty cleaning products. These bottles are created using modified starch compounds or starch blends to offer structural rigidity and resistance to environmental conditions.

End-use Insights

The food & beverages segment recorded the largest market share of over 59.0% in 2024 and is projected to grow at the fastest CAGR of 7.1% during the forecast period. This segment represents one of the largest consumers of starch-based packaging, leveraging it for applications such as food trays, disposable cutlery, wraps, pouches, and containers. This eco-friendly packaging helps in preserving food quality while offering compostable and biodegradable alternatives to traditional plastic packaging. It is widely used across the bakery, dairy, ready-to-eat meals, and fresh produce sectors, where both shelf-life and sustainability are critical.

In the e-commerce sector, starch-based packaging is gaining traction for use in void-fill materials, mailers, biodegradable foam peanuts, and protective cushioning. As online shopping continues to surge, especially in sectors such as fashion, electronics, and personal care, the need for secure, yet eco-friendly packaging options has grown. Brands are adopting sustainable alternatives to align with customer expectations and enhance their green image.

Regional Insights

The region’s growth in the starch-based packaging industry is primarily due to increased environmental awareness, stringent regulatory frameworks, and a growing shift toward sustainable packaging alternatives. Government regulations, such as the U.S. Environmental Protection Agency's (EPA) initiatives to reduce plastic waste and Canada’s Single-Use Plastics Prohibition Regulations (SUPPR), have significantly bolstered the demand for biodegradable materials, including starch-based packaging. These regulations are encouraging industries across the supply chain, from food service to retail, to adopt eco-friendly packaging solutions, thus solidifying North America’s position in this market.

U.S. Starch-based Packaging Market Trends

U.S. starch-based packaging industry growth can be attributed to its convergence of consumer demand for sustainable alternatives and robust agricultural infrastructure. The regulatory landscape has further accelerated market growth, with cities such as Seattle, San Francisco, and New York implementing bans on traditional single-use plastics. These policies have created immediate market opportunities for starch-based alternatives.

Europe Starch-based Packaging Market Trends

Europe starch-based packaging industry dominated the global market with the largest revenue share of over 32.0% in 2024. This dominance can be attributed to its stringent environmental regulations and ambitious sustainability targets. The European Union's Single-Use Plastics Directive and Circular Economy Action Plan have created a regulatory framework that actively discourages conventional plastic packaging while incentivizing bio-based alternatives. Countries such as Germany, France, and Italy have implemented plastic taxes and bans that have accelerated the transition to starch-based solutions across various industries.

Germany’s starch-based packaging industry growth can be attributed to its strong environmental policies, robust industrial innovation, and changing consumer preferences. The German government's implementation of stringent regulations on single-use plastics and packaging are positively influencing the starch-based packaging market in the country. The country's well-established agricultural sector provides abundant raw materials for starch production, particularly from potatoes, corn, and wheat. Companies such as BASF have capitalized on this availability by developing advanced starch-based polymers.

Asia Pacific Starch-based Packaging Market Trends

Asia Pacific starch-based packaging industry is anticipated to grow at the fastest CAGR of 6.1% over the forecast period. This region possesses abundant agricultural resources, particularly cassava, corn, and rice, that provide cost-effective raw materials for starch extraction. Countries such as Thailand, Vietnam, and Indonesia are major cassava producers, while China and India cultivate vast amounts of corn and rice, creating a natural advantage in producing starch-based packaging materials at competitive prices. In addition, the rapid growth of e-commerce platforms such as Alibaba, JD.com, and Flipkart has increased the need for sustainable packaging solutions to satisfy environmentally conscious consumers.

China’s starch-based packaging industry growth can be attributed to its country's massive agricultural output, particularly in corn, tapioca, and rice production, providing abundant raw materials for starch extraction at competitive costs. This agricultural advantage is coupled with China's well-developed manufacturing infrastructure and significant government support through policies promoting sustainable packaging solutions.

Key Starch-based Packaging Company Insights

Competition among players centers on technological innovation to improve product properties such as moisture resistance and shelf life, cost optimization to narrow the price gap with petroleum-based packaging and expanding production capacity to achieve economies of scale. Competitive dynamics are further shaped by regional variations in agricultural feedstock availability, regulatory incentives promoting biodegradable materials, and downstream partnerships with major food and beverage companies that provide both distribution channels and brand credibility.

-

In January 2025, Storopack Hans Reichenecker GmbH introduced RENATURE Wrap, an innovative sustainable packaging solution made primarily from starch, offering an environmentally friendly alternative to traditional bubble wrap and polyethylene foam. This protective packaging is completely biodegradable, certified by TÜV Austria for home composting and utilizes starch sourced mainly from yellow peas, a by-product of crop rotation, ensuring no impact on food production. RENATURE Wrap is dust-free, easy to handle, and designed for versatile use, including wrapping, cushioning, and surface protection of sensitive goods during transport.

-

In July 2020, Oimo, a Spanish startup, developed a sustainable, starch-based, water-soluble packaging material made from algae extracts, natural sugars, and vegetable oils that is biodegradable both on land and in marine environments and non-toxic to marine life. This innovative bioplastic mimics the properties of traditional plastics but without environmental harm, making it suitable for disposable packaging in the food sector, beverage can holders, and cosmetics packaging.

Key Starch-based Packaging Companies:

The following are the leading companies in the starch-based packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Bluecraft Agro

- Storopack Hans Reichenecker GmbH

- Cargill

- Biogreen Bags

- Amtrex Nature Care Pvt. Ltd.

- Easy Green Eco Packaging Co., Ltd.

- PakFactory Inc.

- Ecolastic

- Packman Packaging

- PaperFoam

- Oimo

- Bharat Compostables

- LeKAC Sourcing Limited

- Unique Packaging Solutions Ltd

Starch-based Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.44 billion

Revenue forecast in 2030

USD 11.64 billion

Growth Rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico;U.K.; Germany; France; Italy; Spain;China; India; Japan; Australia; South Korea;Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Bluecraft Agro; Storopack Hans Reichenecker GmbH; Cargill; Biogreen Bags; Amtrex Nature Care Pvt. Ltd.; Easy Green Eco Packaging Co., Ltd.; PakFactory Inc.; Ecolastic; Packman Packaging; PaperFoam; Oimo; Bharat Compostables; LeKAC Sourcing Limited; Unique Packaging Solutions Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Starch-based Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global starch-based packaging market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bags & Pouches

-

Films & Wraps

-

Bottles

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global starch-based packaging market was estimated at around USD 7.97 billion in the year 2024 and is expected to reach around USD 8.44 billion in 2025.

b. The global starch-based packaging market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach around USD 11.64 billion by 2030.

b. The food & beverages sector dominated the starch-based packaging market in 2024 with a 59.0% value share due to rising demand for sustainable packaging, strict plastic bans, and the need for biodegradable solutions in perishable goods.

b. The key players in the starch-based packaging market include Bluecraft Agro; Storopack Hans Reichenecker GmbH; Cargill; Biogreen Bags; Amtrex Nature Care Pvt. Ltd.; Easy Green Eco Packaging Co., Ltd.; PakFactory Inc.; Ecolastic; Packman Packaging; PaperFoam; Oimo; Bharat Compostables; LeKAC Sourcing Limited; and Unique Packaging Solutions Ltd.

b. The starch-based packaging market is driven by increasing demand for sustainable and biodegradable materials due to environmental concerns and stringent plastic bans, along with advancements in biopolymer technology enhancing performance and cost competitiveness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.