- Home

- »

- Consumer F&B

- »

-

Sugar Market Size, Share, Trends And Growth Report, 2030GVR Report cover

![Sugar Market Size, Share & Trends Report]()

Sugar Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (White Sugar, Brown Sugar), By Form (Granulated Sugar, Powdered Sugar), By End-use, By Source, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-228-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sugar Market Summary

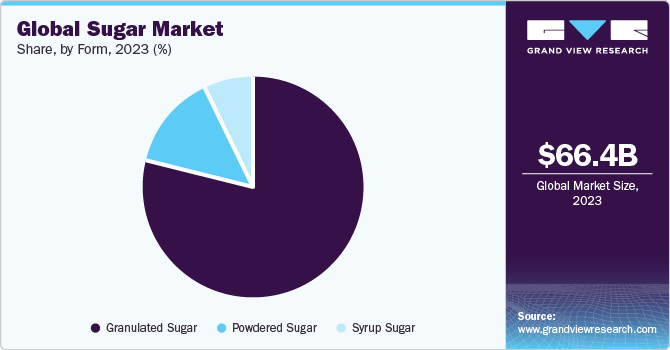

The global sugar market size was estimated at USD 66.39 billion in 2023 and is projected to reach USD 102.32 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030. The increasing global population leads to a higher demand for sugar as it is a key ingredient in many food and beverage products. Changes in consumer preferences towards sweetened goods and beverages also play a significant role in driving the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the market with the revenue share of around 42.1% in 2023.

- The sugar market in China is expected to grow at the fastest CAGR of 7.2% from 2024 to 2030.

- Based on source, the sugarcane segment held the market with the largest revenue share of 77.9% in 2023.

- Based on end-use, the food & beverages segment led the market with the largest revenue share of 45.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 66.39 billion

- 2030 Projected Market Size: USD 102.32 billion

- CAGR (2024-2030): 6.5%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

Moreover, the food industry heavily relies on sugar for various products like confectionery, baked goods, and processed foods, further boosting demand. Economic development in emerging markets results in higher disposable incomes, leading to increased consumption of sugar-based products. In addition, the use of sugar in biofuel production, government policies, subsidies, and health and wellness trends advocating for reduced sugar consumption all contribute to shaping the market growth.

Societal shifts in dietary habits, especially prevalent in emerging economies, contribute to the rising consumption of sugar. As incomes rise and lifestyles become more fast-paced, people increasingly turn to processed foods, sugary snacks, and beverages for convenience. This inclination towards convenience foods, often laden with sugars, fuels the demand for sugar within these markets. The continual expansion of the food and beverage industry, encompassing segmentation such as confectionery, bakery, and beverages, serves as a major catalyst for the market. Sugar remains a fundamental ingredient in countless food and beverage products, ranging from soft drinks to pastries. The industry's growth inevitably translates into heightened demand for sugar to meet production needs.

The utilization of sugar crops, such as sugarcane, and sugar beets, for biofuel production further bolsters the demand for sugar. In regions where biofuel mandates or incentives exist, there's increased cultivation of sugar crops for this specific purpose, creating additional demand pressure on the global market.

Processed foods, which are a mainstay in modern diets due to their convenience and longer shelf life, often contain added sugars for various purposes. One of the primary reasons for adding sugar to processed foods is flavor enhancement. Sugar has a unique ability to enhance the taste profile of food products, making them more palatable and appealing to consumers. From sweetening beverages to balancing the flavors in savory snacks, sugar plays a crucial role in creating desirable taste experiences. Moreover, sugar serves as a preservative in many processed foods, helping to extend their shelf life by inhibiting microbial growth and preventing spoilage. This is particularly important for packaged and pre-prepared foods that need to maintain their quality over extended periods, especially in distribution and retail settings.

The availability of a wide variety of sugary products in the market fuels the market growth through multiple channels. With diverse options catering to varying tastes and preferences, consumers are more likely to indulge in sugary treats and beverages, expanding the consumer base and driving overall consumption rates. Enhanced accessibility across retail channels further encourages impulse purchases and regular consumption habits. Coupled with aggressive marketing efforts promoting sugary products as desirable and enjoyable, consumer demand remains consistently high, sustaining the need for sugar as a key ingredient in food and beverage manufacturing. As a result, the market growth is driven by the pervasive presence and popularity of sugary products in the market.

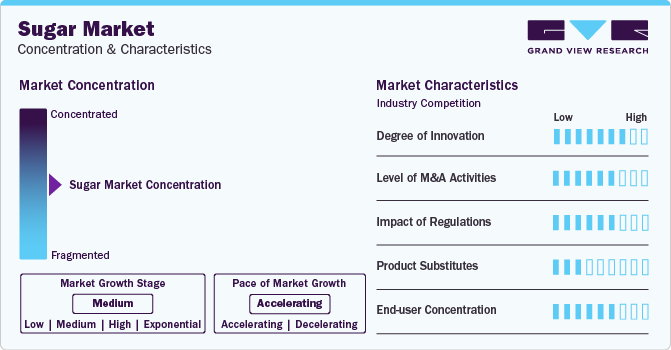

Market Concentration & Characteristics

The degree of innovation in the market varies based on several factors, including consumer preferences, regulatory environment, and technological advancements. Traditionally, the market has been relatively conservative, with limited innovation primarily focused on refining processes and improving efficiency in sugar production. However, in recent years, there has been a growing emphasis on innovation driven by changing consumer preferences and health concerns related to sugar consumption.

There has been innovation in sugar reduction technologies aimed at reducing the sugar content in food and beverage products while maintaining taste and texture. This includes techniques such as microencapsulation, which allows for the controlled release of sweetness, and flavor modulation, which enhances the perception of sweetness without increasing sugar content.

The sugar industry has experienced several merger and acquisition (M&A) activities to expand market presence, enhance product offerings, and achieve strategic growth.

Regulations play a significant role in the sugar industry, exerting influence over product safety, quality standards, and market competition. Regulatory bodies, both at national and international levels, establish stringent standards to ensure the safety and quality of sugar products. These standards encompass various aspects, including production processes, hygiene practices, labeling requirements, and permissible additives. By setting clear guidelines and specifications, regulatory bodies safeguard consumer health and promote transparency within the industry.

Product Type Insights

Based on product type, the white sugar segment led the market with the largest revenue share of 67.7% in 2023.White sugar's versatility makes it a preferred choice across various industries, including baking, confectionery, beverages, and food processing. Its neutral flavor and easy dissolvability make it suitable for a wide range of culinary forms, appealing to both consumers and manufacturers alike. Moreover, white sugar enjoys a perception of purity, as its refined appearance and absence of impurities compared to brown or liquid sugars resonate with consumers seeking a clean and uniform product. In addition, its extended shelf life enhances convenience for both retailers and consumers, minimizing the risk of spoilage and waste. White sugar's prominence as a key ingredient in industrial manufacturing further consolidates its position in the market.

The brown sugar segment is expected to grow at the fastest CAGR of 6.9% from 2024 to 2030. Its perceived health benefits, including a slightly higher mineral content and the presence of molasses, position it as a more wholesome alternative to white sugar in the eyes of health-conscious consumers. Moreover, brown sugar's distinct caramel-like flavor and moist texture make it a popular choice for enhancing the taste profile of various culinary creations, from baked goods to savory dishes. With the surge in home baking and cooking trends, consumers are increasingly turning to brown sugar for its versatility and unique flavor profile.

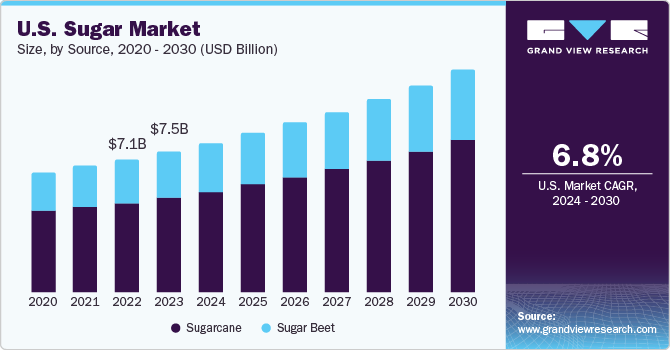

Source Insights

Based on source, the sugarcane segment held the market with the largest revenue share of 77.9% in 2023. Sugarcane boasts a higher sugar content compared to sugar beet, making it a more efficient and economical source of sugar production. This inherent advantage translates to higher yields and lower production costs, which ultimately contribute to sugarcane's dominance in the market. In addition, sugarcane cultivation is more widespread globally, with tropical regions providing ideal conditions for its growth. Its cultivation in these regions benefits from abundant sunlight, ample rainfall, and fertile soils, further enhancing its productivity and availability. Moreover, sugarcane's versatility extends beyond sugar production, with its by-products finding forms in biofuel production, animal feed, and various industries.

The sugar beet segment is projected to register the fastest CAGR of 5.3% from 2024 to 2030. Sugar beet cultivation offers advantages in temperate regions with suitable soil and climate conditions, expanding its geographic reach and potential for increased production. The adaptability of sugar beet to cooler climates makes it a viable alternative to sugarcane in regions where sugarcane cultivation may be less feasible. In addition, advancements in agricultural practices and breeding techniques have enhanced sugar beet yields and sugar content, further bolstering its attractiveness to growers and manufacturers.

End-use Insights

Based on end-use, the food & beverages segment led the market with the largest revenue share of 45.6% in 2023. Sugar serves as a fundamental ingredient in a wide range of food and beverage products, contributing sweetness, texture, and flavor enhancement. From sweetening beverages to enhance the taste of baked goods, confectionery, and dairy products, sugar plays a central role in the formulation and production of various consumer favorites. Its versatility allows for seamless integration into diverse culinary creations, making it indispensable for manufacturers across the food and beverage industry. Moreover, consumer preferences for sweetened products drive the demand for sugar in the food and beverage sector. Sugary treats, snacks, and beverages remain perennially popular among consumers worldwide, reflecting a universal craving for sweetness and indulgence. As a result, food and beverage manufacturers rely heavily on sugar to meet consumer expectations for taste, texture, and sensory experiences.

Furthermore, the sheer scale of consumption within the food and beverage industry contributes to the dominance of sugar as an end-use category. With billions of consumers worldwide consuming a wide array of food and beverage products daily, the demand for sugar remains consistently high, driving production volumes and market growth.

The pharmaceutical & personal care segment is expected to grow at the fastest CAGR of 6.2% from 2024 to 2030. There has been a growing awareness and recognition of the multifaceted benefits of sugar in pharmaceutical and personal care forms. Sugar serves as a versatile ingredient in pharmaceutical formulations, where it is used as an excipient, binder, or coating agent in the production of tablets, capsules, and syrups. Its hygroscopic properties also contribute to the stability and shelf life of certain medications.

In the personal care industry, sugar is increasingly incorporated into skincare and beauty products for its exfoliating, moisturizing, and humectant properties. Sugar scrubs, lip balms, body lotions, and hair care products utilize sugar to gently remove dead skin cells, hydrate the skin, and maintain moisture balance. Moreover, sugar-derived ingredients like glycolic acid, a natural alpha hydroxyl acid (AHA), are utilized in anti-aging and skincare treatments for their exfoliating and skin-renewing properties.

Form Insights

Based on form, the granulated sugar segment led the market with the largest revenue share of 79.2% in 2023. The granulated form offers versatility, easily blending into various mixtures and dissolving uniformly, making it an essential component in both home kitchens and industrial food production settings. In addition, granulated sugar's extended shelf life and resistance to clumping ensure its longevity and ease of storage, factors highly valued by consumers and manufacturers alike. Its affordability and accessibility further bolster its market dominance, appealing to a wide demographic of consumers across different socio-economic backgrounds.

The Sugar Syrups segment is projected to register the fastest CAGR of 5.6% from 2024 to 2030. Sugar syrup's ability to serve as a sweetening agent, flavor enhancer, and the texturizing agent makes it indispensable in the formulation of a diverse array of food and beverage products, catering to evolving consumer preferences for taste, texture, and sensory experiences.Furthermore, the increasing demand for convenience foods and ready-to-drink beverages has propelled the adoption of sugar syrup as a key ingredient in product formulations, driving its rapid market growth. As consumers seek convenient and indulgent food and beverage options, sugar syrup emerges as a versatile and essential component.

Regional Insights

The sugar market in North America is expected to grow at the fastest CAGR of 6.5% from 2024 to 2030. The trend towards convenience foods and snacking fuels demand for sugar-based products such as packaged snacks, sweetened beverages, and confectionery items. Consumers' busy lifestyles and on-the-go eating habits contribute to the popularity of these products.

U.S. Sugar Market Trends

The sugar market in the U.S. is expected to grow at the fastest CAGR of 6.8% from 2024 to 2030, owing to its widespread use as a sweetening agent in various food and beverage products. Sugar is a staple ingredient in the food industry, used in the production of baked goods, confectionery, beverages, sauces, and other processed foods, contributing to its continuous demand.

Asia Pacific Sugar Market Trends

Asia Pacific dominated the market with the revenue share of around 42.1% in 2023. Asia Pacific is home to some of the world's largest sugar-producing countries, including India, China, Thailand, and Indonesia. The region's favorable agro-climatic conditions and extensive arable land make it conducive to sugarcane cultivation, which forms the backbone of the sugar industry. Moreover, the region's large and growing population, coupled with rising disposable incomes and changing dietary patterns, drives robust demand for sugar as a staple ingredient in various food and beverage products. The preference for sweetened beverages, confectionery, bakery items, and processed foods further fuels the consumption of sugar across Asia Pacific markets.

In addition, rapid urbanization, industrialization, and economic development in countries like China and India have led to increased urban consumption and demand for convenience foods, where sugar plays a crucial role as a primary sweetener and preservative. Furthermore, Asia Pacific's expanding pharmaceutical and personal care industries contribute to the demand for sugar-based ingredients in medications, cosmetics, and personal care products.

The sugar market in China is expected to grow at the fastest CAGR of 7.2% from 2024 to 2030. The sheer size and increasing affluence of China’s population drive substantial demand for sugar and sugar-based products. With a population exceeding 1.4 billion and rising disposable incomes, more consumers have the purchasing power to buy sugary snacks, confectionery, and beverages.

Europe Sugar Market Trends

The sugar market in Europe is expected to grow at the fastest CAGR of 6.1% from 2024 to 2030. This growth is driven by evolving consumer preferences, innovation in sugar-based products, favorable regulatory environments, and advancements in processing technologies. Despite concerns about health and sustainability, sugar remains a fundamental ingredient in European diets and culinary traditions. Additionally, government policies supporting domestic sugar production and sustainable agriculture contribute to market stability.

The Germany sugar market is anticipated to grow at the fastest CAGR of 6.3% from 2024 to 2030. The German food and beverage industry, known for its quality and diversity, heavily relies on sugar as a primary ingredient in many products. From chocolates, and candies to baked goods and soft drinks, sugar is integral to the formulation of numerous consumer goods, thereby sustaining demand.

Key Sugar Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers and acquisitions, global expansion, and others. Some of the initiatives include:

-

In August 2023, Sugar Refinery Sdn Bhd (CSR) launched its latest product, Better White Clear White Sugar, aiming to reinforce its position as Malaysia's premier sugar specialist. This introduction follows the success of CSR's Better Brown variant, which was introduced in 2018 to promote healthier sugar consumption and has since dominated 78% of the brown sugar segmentation in Malaysia. Better White aims to meet rising consumer expectations by offering high-quality sugar products at fair prices

-

In September 2023, British Sugar, and Sidel announced a groundbreaking partnership to introduce an innovative end-of-line solution for the first time. British Sugar, a subsidiary of Associated British Foods plc and a leading sugar producer in the Irish and British food and beverage markets, stands to benefit from this collaboration. Demonstrating a firm commitment to meeting market demands and exceeding retailer expectations, British Sugar processes approximately 8 million tonnes of sugar beet annually, resulting in up to 1.2 million tonnes of sugar production. The objective of this initiative is to replace British Sugar's outdated end-of-line system, which has been operational for over 38 years, with a cutting-edge solution. This new system will be equipped to manage high levels of complexity and automation, ensuring efficient handling of multiple SKUs

-

In August 2023, Mumbai-based UPL Sustainable Agriculture Solutions (UPL SAS) and Hyderabad's NSL Sugars signed an MoU to promote sustainable sugarcane production practices. UPL SAS aims for market penetration while NSL seeks benefits from sustainable cultivation. The partnership targets a 15% increase in sugarcane yield per acre, equivalent to 5 metric tonnes

Key Sugar Companies:

The following are the leading companies in the sugar market. These companies collectively hold the largest market share and dictate industry trends.

- Südzucker AG

- Tereos

- Cosan

- Mitr Phol Group

- Associated British Foods plc

- Nordzucker

- Texon International Group

- Biosev (Louis Dreyfus)

- Wilmar International Ltd

- Thai Roong Ruang Sugar Group

Sugar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 70.20 billion

Revenue forecast in 2030

USD 102.32 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segmentation covered

Product type, form, source, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Indonesia; Thailand; Brazil; South Africa

Key companies profiled

Südzucker AG; Tereos; Cosan; Mitr Phol Group; Associated British Foods plc; Nordzucker; Texon International Group; Biosev (Louis Dreyfus); Wilmar International Ltd; Thai Roong Ruang Sugar Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sugar Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global sugar market report based on product type, form, source, end-use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

White Sugar

-

Brown Sugar

-

Liquid Sugar

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Granulated Sugar

-

Powdered Sugar

-

Syrup Sugar

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Sugarcane

-

Sugar Beet

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Confectionary

-

Bakery Products

-

Dairy Products

-

Beverages

-

Others

-

-

Pharmaceuticals

-

Personal Care

-

Household

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

- South Africa

-

Frequently Asked Questions About This Report

b. The global sugar market size was estimated at USD 66.39 billion in 2023 and is expected to reach USD 70.20 billion in 2024.

b. The global sugar market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 102.31 billion by 2030.

b. Asia Pacific sugar market held the largest revenue share of around 42.1% in 2023 and is expected to retain its dominance during 2024-2030. Asia Pacific is home to some of the world's largest sugar-producing countries, including India, China, Thailand, and Indonesia. The region's favorable agro-climatic conditions and extensive arable land make it conducive to sugarcane cultivation, which forms the backbone of the sugar industry. Moreover, the region's large and growing population, coupled with rising disposable incomes and changing dietary patterns, drives robust demand for sugar as a staple ingredient in various food and beverage products

b. Some of the key market players in the Sugar market are Südzucker AG; Tereos; Cosan; Mitr Phol Group; Associated British Foods plc; Nordzucker; Texon International Group; Biosev (Louis Dreyfus); Wilmar International Ltd; Thai Roong Ruang Sugar Group

b. The sugar market is driven by several factors, including the increasing global population leads to a higher demand for sugar as it is a key ingredient in many food and beverage products. Changes in consumer preferences towards sweetened goods and beverages also play a significant role in driving the market. Moreover, the food industry heavily relies on sugar for various products like confectionery, baked goods, and processed foods, further boosting demand. Economic development in emerging markets results in higher disposable incomes, leading to increased consumption of sugar-based products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.