- Home

- »

- Research

- »

-

Synthetic Fuels Market Size & Trends, Industry Report, 2033GVR Report cover

![Synthetic Fuels Market Size, Share & Trends Report]()

Synthetic Fuels Market (2025 - 2033) Size, Share & Trends Analysis Report By Feedstock (Natural Gas, Coal), By Fuel (Synthetic Diesel, Synthetic Gasoline, Synthetic Jet Fuel), By Region, And Segment Forecasts

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Fuels Market Summary

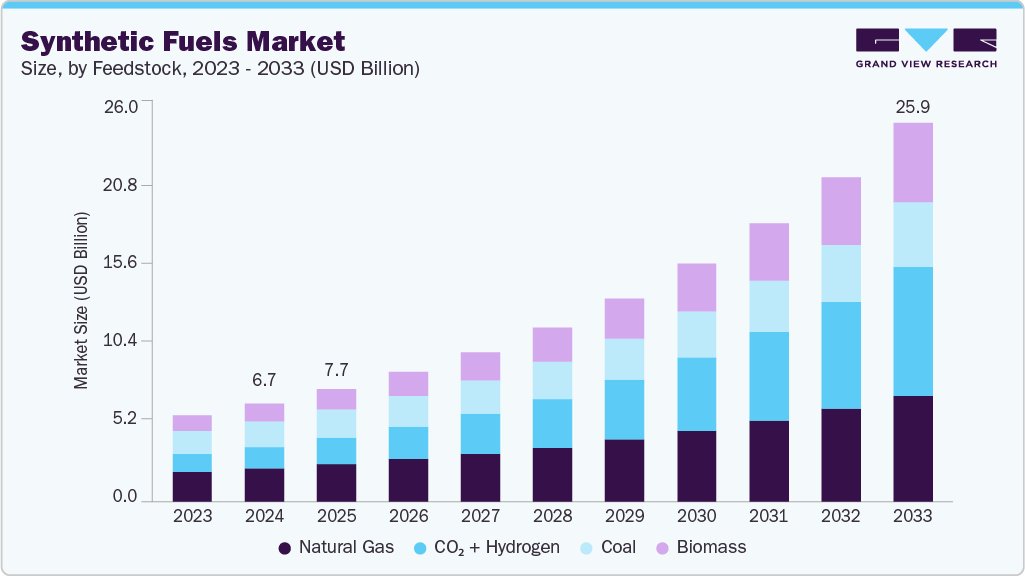

The global synthetic fuels market size was estimated at approximately USD 6.70 billion in 2024 and is projected to reach USD 25.85 billion by 2033, growing at a CAGR of 16.3% from 2025 to 2033. Growth is being propelled by the accelerating global transition toward low-carbon energy systems, increasing demand for sustainable aviation and marine fuels, and ongoing decarbonization efforts across the transport and industrial sectors.

Key Market Trends & Insights

- Europe synthetic fuels industry held the largest share of 38% of the global market in 2024.

- The synthetic fuels industry in the U.S. is expected to grow significantly over the forecast period.

- By feedstock, natural gas segment held the largest market share of 34% in 2024.

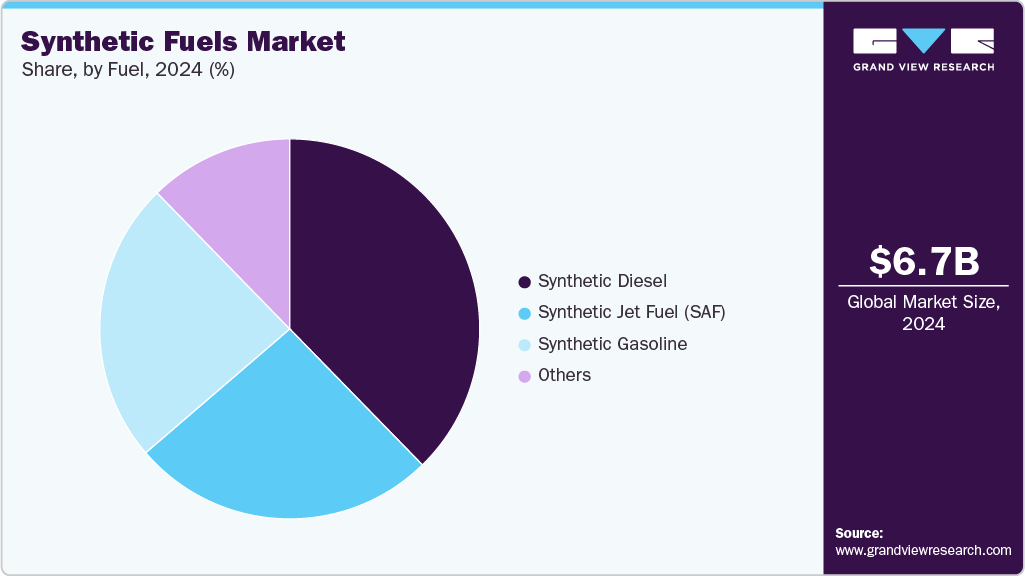

- By fuel, the synthetic diesel segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.70 Billion

- 2033 Projected Market Size: USD 25.85 Billion

- CAGR (2025-2033): 16.3%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Synthetic fuels produced from renewable hydrogen and captured CO₂ or other feedstocks offer a viable pathway to achieve carbon neutrality while leveraging existing fuel infrastructure. Rising investments in Power-to-Liquids (PtL) and Fischer-Tropsch synthesis technologies, combined with government mandates for cleaner fuels and corporate net-zero pledges, are fostering large-scale commercialization. Moreover, ongoing advancements in electrolysis efficiency, carbon capture integration, and fuel synthesis processes are driving down production costs, enabling synthetic fuels to emerge as a practical alternative to conventional fossil-based fuels in hard-to-abate sectors such as aviation, shipping, and heavy transport.

In North America, market growth is supported by robust federal clean fuel standards, expanding renewable hydrogen capacity, and the growing demand for sustainable aviation fuel (SAF). The U.S. leads regional development through Department of Energy (DOE) funded projects, state-level low-carbon fuel programs, and private-sector partnerships aimed at scaling e-fuel production. Increasing collaboration between airlines, oil majors, and technology developers, coupled with Inflation Reduction Act (IRA) tax incentives and renewable fuel credits, is accelerating investment in synthetic fuels refineries. Canada is also contributing to regional expansion, with provincial clean fuel regulations, carbon pricing mechanisms, and industrial decarbonization targets driving interest in carbon-neutral liquid fuels for both on-road and off-grid energy applications.

Europe represents another key growth hub, underpinned by the European Union’s “Fit for 55” package, ReFuelEU Aviation initiative, and strong national commitments to phase out fossil fuels. Countries such as Germany, the UK, and Norway are leading early commercialization through large-scale e-fuel pilot plants and integrated Power-to-X projects. Policy incentives supporting green hydrogen, carbon capture, and the integration of renewable energy are fostering a robust value chain for synthetic fuels. Strategic partnerships between refineries, energy companies, and technology innovators are also expanding production capacity. As the region accelerates efforts to achieve climate neutrality by 2050, synthetic fuels are increasingly being recognized as essential to decarbonizing long-haul transport and providing flexible, storable renewable energy for Europe’s evolving energy landscape.

Drivers, Opportunities & Restraints

The global synthetic fuels industry is primarily driven by the growing emphasis on achieving net-zero carbon emissions, the need to decarbonize hard-to-electrify sectors, and the rising demand for sustainable aviation and marine fuels. As countries phase out fossil-based energy and strengthen the integration of renewable energy, synthetic fuels produced from renewable hydrogen and captured CO₂, or other feedstocks, offer a viable low-carbon alternative that can leverage existing refinery, pipeline, and combustion infrastructure. Government initiatives supporting carbon capture, utilization, and storage (CCUS), as well as hydrogen development and clean fuel mandates, are providing strong policy momentum, particularly across North America, Europe, and the Asia Pacific. The growing corporate focus on carbon neutrality, coupled with increasing investment from oil & gas majors and industrial players, is accelerating the development of large-scale Power-to-Liquids (PtL) and Fischer-Tropsch synthesis facilities. Moreover, technological advancements in electrolysis efficiency, process integration, and modular reactor design are improving the economics and scalability of synthetic fuels production.

Opportunities in the market are expanding rapidly as energy systems transition toward renewable-based generation and sustainable mobility. The aviation and shipping industries, under mounting regulatory pressure to curb lifecycle emissions, present significant adoption potential for e-fuels and synthetic hydrocarbons. The integration of synthetic fuels plants with renewable energy and hydrogen hubs offers new revenue pathways through grid balancing, carbon recycling, and local job creation. Emerging applications in heavy-duty transport, industrial heat generation, and backup power further broaden the opportunity landscape. Partnerships among fuel producers, technology developers, and utilities are driving the commercialization of projects, while carbon pricing mechanisms and green fuel certification programs enhance market visibility and investor confidence. As synthetic fuels become a crucial component of national clean energy strategies, their role in energy storage, grid flexibility, and circular carbon utilization will continue to grow in importance.

However, the market faces several restraints, including high production costs, limited large-scale infrastructure, and the current scarcity of low-cost renewable hydrogen and captured CO₂. Early-stage commercialization challenges such as financing risk, feedstock availability, and technology standardization may hinder near-term adoption. The lack of globally harmonized certification frameworks for e-fuels, combined with inconsistent policy support across regions, creates uncertainty for investors and developers. Technical hurdles related to process energy efficiency, fuel conversion yields, and lifecycle emissions accounting also persist. Moreover, competition from other low-carbon fuel alternatives, such as biofuels, renewable natural gas, and ammonia-based fuels, may influence the pace of synthetic fuels deployment. Continued innovation in electrochemical conversion, favorable policy alignment, and cross-sector collaboration will be crucial to achieving cost parity and unlocking the full potential of synthetic fuels in the global clean energy transition.

Feedstock Insights

The natural gas-based synthetic fuels segment accounted for the largest revenue share, around 34%, in 2024, solidifying its position as the dominant feedstock category in the global market. This leadership is primarily attributed to the widespread availability of natural gas, mature gas-to-liquids (GTL) technology, and well-established production infrastructure across major regions, including North America, the Middle East, and the Asia Pacific. GTL processes enable the conversion of natural gas into high-quality synthetic diesel, jet fuel, and naphtha with low sulfur and aromatic content, offering compatibility with existing combustion engines and refining systems. The ability to deliver cleaner-burning fuels with improved performance and reduced particulate emissions continues to drive adoption in transportation and industrial sectors. Furthermore, ongoing investments in GTL plants, particularly in gas-rich nations such as Qatar, the U.S., and China, are strengthening the market outlook by leveraging stranded gas resources and monetizing surplus natural gas supplies.

The CO₂ + Hydrogen segment is expected to witness the fastest growth, registering a robust CAGR of 21.7% from 2025 to 2033, driven by global efforts to produce carbon-neutral or carbon-negative fuels through Power-to-Liquids (PtL) and carbon recycling technologies. These fuels, synthesized from captured carbon dioxide and renewable hydrogen via processes such as Fischer-Tropsch or methanol synthesis, are emerging as a cornerstone of the next-generation energy transition. Growing deployment of green hydrogen projects, rapid cost declines in electrolyzers, and expanding carbon capture, utilization, and storage (CCUS) infrastructure are making CO₂-derived synthetic fuels increasingly viable. Strong policy support, as seen in initiatives such as the EU’s ReFuelEU Aviation regulation, Japan’s GX Roadmap, and the U.S. Inflation Reduction Act (IRA) incentives, is accelerating the demonstration and commercialization of these technologies. As industries and transport sectors seek scalable pathways toward deep decarbonization, the CO₂ + Hydrogen feedstock route is poised to redefine sustainable fuel production, offering circular carbon utilization and aligning with global net-zero targets.

Fuel Insights

The synthetic diesel segment accounted for the largest market share, around 37.7%, in 2024, establishing itself as the leading fuel within the market. This dominance is largely driven by its compatibility with existing diesel engines, fuel distribution infrastructure, and industrial applications, allowing seamless substitution for conventional petroleum diesel without requiring major equipment modifications. Synthetic diesel, produced through gas-to-liquids (GTL), coal-to-liquids (CTL), or biomass-to-liquids (BTL) pathways, offers improved combustion efficiency and significantly lower particulate and sulfur emissions. Its growing use in commercial transport fleets, off-road machinery, and industrial power generation underscores its reliability and performance in high-energy-demand environments. In addition, government incentives promoting cleaner fuels, combined with corporate fleet decarbonization programs, have supported its adoption as an interim solution during the transition toward full electrification. Ongoing investments in Fischer-Tropsch synthesis and carbon-neutral diesel projects, particularly in Europe and North America, continue to strengthen this segment’s market position.

The synthetic jet fuel (SAF) segment is anticipated to record the fastest growth, with a CAGR of 21.4% from 2025 to 2033, fueled by the aviation industry’s accelerating efforts to achieve carbon neutrality and comply with stringent emission reduction targets. SAF derived from renewable hydrogen and captured CO₂, or from biomass and waste feedstocks via Power-to-Liquids (PtL) and Fischer-Tropsch routes, is being increasingly adopted by airlines and airports worldwide. Global initiatives such as the International Civil Aviation Organization’s (ICAO) CORSIA framework, the EU’s ReFuelEU Aviation policy, and the U.S. SAF Grand Challenge are catalyzing large-scale production and offtake agreements. Major airline partnerships and refinery conversions are further enhancing supply chain development, while falling renewable hydrogen costs are improving economic feasibility. As aviation demand rebounds and pressure mounts to decarbonize long-haul flights, SAF is poised to become a cornerstone of sustainable air travel, positioning the segment as a key growth driver in the global market over the coming decade.

Regional Insights

Europe synthetic fuels market accounted for the largest share, approximately 38%, of the global market in 2024, driven by robust policy support, rapid integration of renewable energy, and the continent’s strong decarbonization agenda. The European Union’s Fit for 55 package, ReFuelEU Aviation initiative, and Renewable Energy Directive (RED III) are key policy drivers that mandate the reduction of transport sector emissions and promote the use of sustainable fuels. Leading nations such as Germany, the United Kingdom, the Netherlands, and Spain are advancing large-scale Power-to-Liquids (PtL) and Fischer-Tropsch projects, supported by carbon pricing mechanisms, national hydrogen strategies, and green investment funding. Strong public-private partnerships are driving the commercialization of synthetic diesel and sustainable aviation fuel (SAF), while growing collaboration among refineries, utilities, and technology providers is fostering cross-sector innovation. Europe’s integrated regulatory environment and well-developed renewable infrastructure continue to position it as the global hub for low-carbon synthetic fuels production and export.

North America Synthetic Fuels Market Trends

North America synthetic fuels industry represents a major market, driven by robust federal clean energy targets, advancements in carbon capture and utilization (CCU), and strong momentum in hydrogen and e-fuel project development. The U.S. leads regional growth, supported by the Inflation Reduction Act (IRA), which provides tax credits for low-carbon hydrogen, carbon capture, and sustainable fuel production. Ongoing collaborations between energy companies, technology developers, and airlines are propelling large-scale SAF and synthetic diesel initiatives. Additionally, state-level low-carbon fuel standards (LCFS) in California, Oregon, and Washington are fostering market expansion. Canada is also emerging as a strategic participant, leveraging its abundant renewable resources and carbon pricing framework to promote the adoption of synthetic fuels across the transport and industrial sectors. The combination of policy incentives, private investment, and decarbonization commitments positions North America as one of the most advanced and commercially viable markets globally.

U.S. Synthetic Fuels Market Trends

The U.S. synthetic fuels industry is experiencing rapid growth, driven by robust regulatory frameworks, corporate sustainability initiatives, and the expansion of domestic hydrogen and carbon capture projects. Federal incentives under the IRA, including production and investment tax credits, are spurring investment in Power-to-Liquids and e-fuel plants across key states such as Texas, California, and Louisiana. The Department of Energy (DOE) and the Federal Aviation Administration (FAA) are promoting the commercialization of sustainable aviation fuel (SAF) through the SAF Grand Challenge and public-private partnerships with major airlines and refineries. Growing collaborations between oil majors, renewable developers, and technology firms are facilitating large-scale projects that repurpose existing infrastructure for carbon-neutral fuel production. As the U.S. moves toward its 2050 net-zero target, synthetic fuels are emerging as a critical pillar of energy security and industrial decarbonization.

Asia Pacific Synthetic Fuels Market Trends

The Asia Pacific synthetic fuels industry is projected to grow at the fastest pace globally, with a CAGR of 19.5% from 2025 to 2033. Growth is driven by rising energy demand, expanding renewable capacity, and increasing national commitments to carbon neutrality. Countries such as Japan, China, South Korea, and Australia are at the forefront of hydrogen production, carbon capture, and Power-to-X (PtX) projects. Japan and South Korea are promoting synthetic aviation fuels and hydrogen-based mobility, while China and Australia are developing large-scale e-fuel export hubs targeting global demand. Favorable government policies, clean energy financing, and bilateral trade agreements are accelerating regional commercialization. Additionally, integrating synthetic fuels facilities with renewable power plants enhances energy self-sufficiency and industrial competitiveness. With abundant renewable resources and emerging green hydrogen corridors, the Asia Pacific is poised to become a central hub for production and export in the global synthetic fuels ecosystem.

Latin America Synthetic Fuels Market Trends

The Latin American synthetic fuels industry is gaining momentum as regional governments prioritize the integration of renewable energy, decarbonization, and energy diversification. Countries such as Brazil, Chile, and Argentina are leveraging their vast solar and wind resources to develop green hydrogen and synthetic fuels export projects. Chile, in particular, has emerged as a pioneer in the Power-to-Liquids segment, with several pilot plants under construction supported by international consortia and development agencies. Growing interest in reducing fossil fuel dependence, coupled with strong foreign investment and supportive government roadmaps, is driving the adoption of technology. The region’s focus on sustainable aviation fuel (SAF) and synthetic methanol for industrial applications further reinforces its long-term growth potential.

Middle East & Africa Synthetic Fuels Market Trends

The Middle East & Africa synthetic fuels industry is in the early stages of development. Still, it holds immense potential, driven by large-scale renewable energy investments, abundant feedstock availability, and the emergence of green hydrogen economies. Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the United Arab Emirates, are spearheading e-fuel projects to diversify their energy portfolios and support global demand for exports. Mega-projects, such as NEOM in Saudi Arabia, are integrating renewable hydrogen and carbon capture to produce synthetic fuels. In Africa, nations such as South Africa, Namibia, and Morocco are leveraging renewable resources to establish Power-to-X and synthetic fuels pilot programs. Supportive government policies, green finance initiatives, and international partnerships are expected to accelerate the commercialization of these technologies. As regional infrastructure and hydrogen economies mature, the Middle East & Africa are likely to emerge as strategic suppliers of carbon-neutral fuels for global markets.

Key Synthetic Fuels Company Insights

Some of the key players operating in the global synthetic fuels industry include Shell Plc and Sasol Limited, among others.

-

Shell Plc is a leading multinational energy company headquartered in the United Kingdom, actively investing in the development and commercialization of synthetic fuels to support its energy transition strategy. The company is leveraging its expertise in Fischer-Tropsch (FT) synthesis and carbon capture technologies to produce artificial diesel, gasoline, and sustainable aviation fuels (SAF) from renewable hydrogen and captured CO₂. Shell’s involvement in large-scale synthetic fuels projects, such as partnerships in Europe and the Middle East, aims to accelerate the production of low-carbon liquid fuels that can be directly used in existing combustion engines. The company’s recent initiatives include expanding its Power-to-Liquids (PtL) operations and advancing pilot plants that demonstrate scalability and economic viability, positioning Shell as a frontrunner in the global shift toward carbon-neutral fuels.

-

Sasol Limited, a South Africa-based integrated energy and chemical company, is among the pioneers in synthetic fuels production, with decades of experience in coal-to-liquid (CTL) and gas-to-liquid (GTL) technologies. The company operates one of the world’s largest GTL facilities, producing high-quality synthetic diesel and other liquid hydrocarbons with low sulfur and aromatic content. In recent years, Sasol has been actively transitioning toward sustainable feedstocks, investing in biomass- and hydrogen-based synthetic fuels projects to align with global decarbonization goals. The company’s collaboration with international partners to develop green hydrogen and sustainable aviation fuel (SAF) production capacity further underscores its commitment to cleaner, more efficient fuel pathways. Sasol’s ongoing technological innovations and global project portfolio continue to reinforce its leadership in the market.

Key Synthetic Fuels Companies:

The following are the leading companies in the global synthetic fuels market. These companies collectively hold the largest market share and dictate industry trends.

- Shell Plc

- ExxonMobil Corporation

- Sasol Limited

- Chevron Corporation

- Airbus SE

- TotalEnergies SE

- Neste Oyj

- Johnson Matthey Plc

- Repsol S.A.

- Synhelion SA

Recent Developments

- In February 2025, Shell Plc announced the launch of its first commercial-scale Power-to-Liquids (PtL) synthetic fuels plant in Hamburg, Germany, signaling a major step toward large-scale production of carbon-neutral fuels. The facility utilizes renewable electricity to generate green hydrogen, which is then combined with captured CO₂ to produce synthetic diesel and sustainable aviation fuel (SAF) through advanced Fischer-Tropsch synthesis. Developed in collaboration with several European aviation and transport partners, the project aims to produce over 100,000 tonnes of e-fuels annually by 2026.

Synthetic Fuels Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the total investment and operational spending involved in producing, processing, and distributing synthetic fuels from feedstocks such as natural gas, coal, biomass, and CO₂ + hydrogen.

Market size value in 2025

USD 7.70 billion

Revenue forecast in 2033

USD 25.85 billion

Growth rate

CAGR of 16.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Feedstock, fuel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Shell Plc; ExxonMobil Corporation; Sasol Limited; Chevron Corporation; Airbus SE; TotalEnergies SE; Neste Oyj; Johnson Matthey Plc; Repsol S.A.; Synhelion SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Fuels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global synthetic fuels market report based on feedstock, fuel, and region.

-

Feedstock Outlook (Revenue, USD Million, 2021 - 2033)

-

Coal

-

Natural Gas

-

Biomass

-

CO₂ + Hydrogen

-

-

Fuel Outlook (Revenue, USD Million, 2021 - 2033)

-

Synthetic Diesel

-

Synthetic Gasoline

-

Synthetic Jet Fuel (SAF)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global synthetic fuels market size was estimated at USD 6.70 billion in 2024 and is expected to reach USD 7.70 billion in 2025.

b. The global synthetic fuels market is expected to grow at a compound annual growth rate of 16.3% from 2025 to 2033 to reach USD 25.85 billion by 2033.

b. Based on the feedstock segment, natural gas held the largest revenue share of more than 34% in 2024.

b. Some of the key players operating in the global synthetic fuels market include Shell Plc, ExxonMobil Corporation, Sasol Limited, Chevron Corporation, Airbus SE, TotalEnergies SE, Neste Oyj, Johnson Matthey Plc, Repsol S.A., and Synhelion SA.

b. The synthetic fuels market is primarily driven by the growing demand for low-carbon energy alternatives, increasing adoption of sustainable transportation solutions, and rising investments in technologies that convert renewable energy and captured carbon into cleaner liquid fuels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.