- Home

- »

- Advanced Interior Materials

- »

-

Synthetic Graphite Market Size, Share, Industry Report 2030GVR Report cover

![Synthetic Graphite Market Size, Share & Trends Report]()

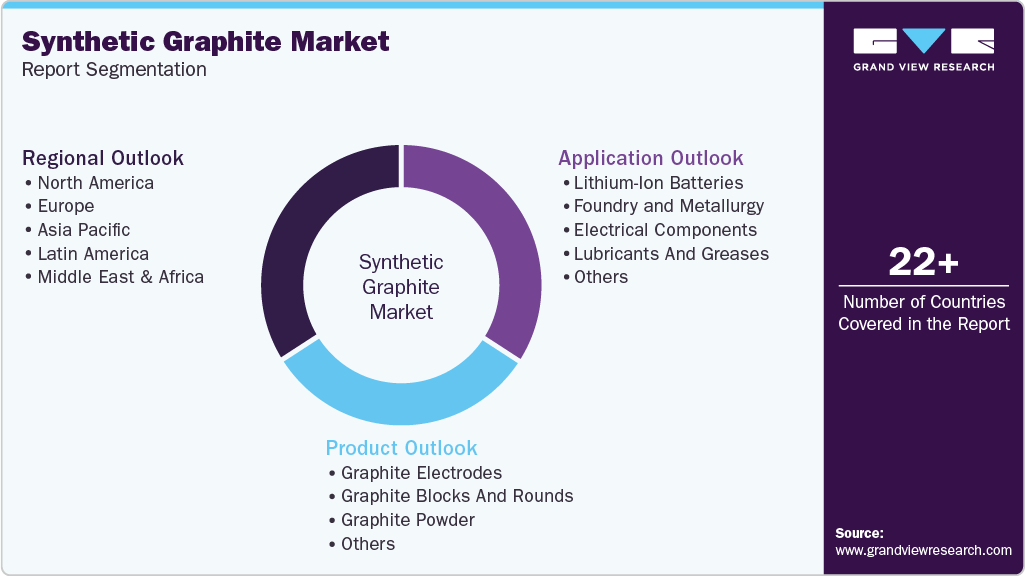

Synthetic Graphite Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Graphite Electrodes, Graphite Blocks and Rounds), By Application (Lithium-Ion Batteries), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-610-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Graphite Market Summary

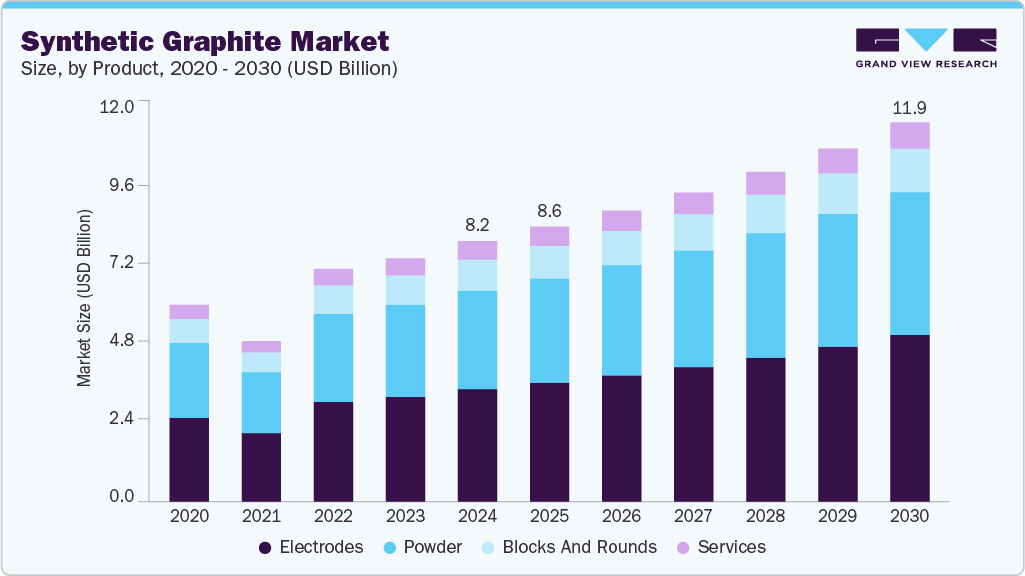

The global synthetic graphite market size was estimated at USD 8.20 billion in 2024, and is projected to reach USD 11.95 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. This market is experiencing significant growth, primarily driven by the surging demand for electric vehicles (EVs) and advancements in energy storage technologies.

Key Market Trends & Insights

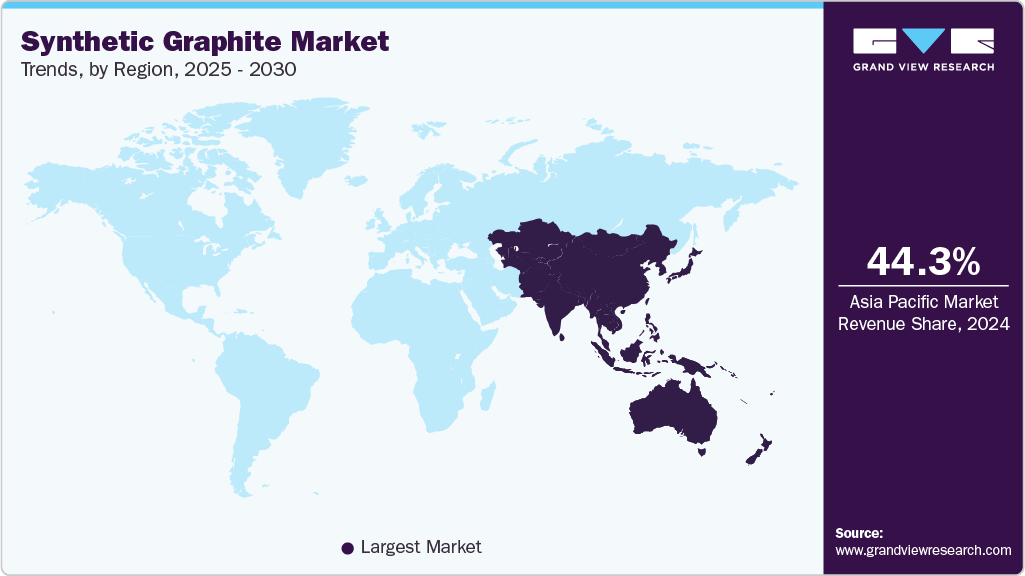

- Asia Pacific dominated the synthetic graphite market with the largest revenue share of 44.3% in 2024.

- U.S. dominated the revenue share of over 78.0% in 2024, the North America synthetic graphite market.

- By product, the electrodes segment dominated the market with a revenue share of over 43.0% in 2024.

- By application, the foundry and metallurgy segment held the largest synthetic graphite market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.20 Billion

- 2030 Projected Market Size: USD 11.95 Billion

- CAGR (2025-2030): 6.7%

- Asia Pacific: Largest market in 2024

Synthetic graphite is commonly used in electrodes for electric arc furnaces (EAFs) due to its high thermal conductivity, resistance to thermal shock, and ability to withstand extremely high temperatures. These properties are essential for smelting operations and steel recycling processes. Its uniform composition allows for precise control over furnace operations and energy efficiency.

Technological innovations in battery design further amplify this demand. The development of advanced battery chemistries and solid-state batteries necessitates materials that offer superior performance, such as high conductivity and stability, areas where synthetic graphite excels. In addition, expanding renewable energy sources like solar and wind have increased the need for efficient energy storage solutions, further propelling the demand for synthetic graphite.

Drivers, Opportunities & Restraints

The global synthetic graphite industry is primarily driven by the booming electric vehicle (EV) industry and the growing demand for lithium-ion batteries. As synthetic graphite is a crucial material for battery anodes, the shift toward sustainable transportation has significantly increased its consumption. In addition, advancements in energy storage systems and high-performance electronics are boosting demand across sectors such as renewable energy and consumer devices. These trends and technological innovations are pushing manufacturers to invest in improving production capacity and product quality.

The high cost of production, primarily due to energy-intensive manufacturing processes, poses a barrier for new entrants and small-scale producers. Environmental regulations around carbon emissions and waste management further complicate operations, especially in regions with stringent sustainability mandates. In addition, price volatility in key raw materials like petroleum coke can create uncertainty in supply chains, impacting manufacturers' cost structures and profit margins.

Recycling technologies and circular economic initiatives are gaining traction, offering potential cost reductions and enhanced sustainability. Geopolitical developments also prompt countries to diversify their supply chains and reduce reliance on Chinese imports, encouraging domestic synthetic graphite production investments. Furthermore, emerging applications in 5G networks, artificial intelligence, and other high-tech industries are expanding the scope of synthetic graphite, positioning it as a critical material in the future of advanced manufacturing and clean energy.

Product Insights

Graphite electrodes play a crucial role in several industrial processes, with their primary application being in electric arc furnaces (EAFs) used in the steel and non-ferrous metal industries. These electrodes conduct high levels of electrical current to generate the intense heat needed to melt scrap metal, making them essential in modern, energy-efficient steel production. Beyond metallurgy, graphite electrodes are also employed in producing silicon and yellow phosphorus, which serve as key components in submerged arc furnaces. The growing demand for recycled steel, driven by sustainability goals, continues to fuel the global need for high-performance graphite electrodes.

Graphite blocks and rounds are widely utilized across various industries due to their exceptional thermal stability, electrical conductivity, chemical resistance, and machinability. In the metallurgical sector, they are commonly used as components in high-temperature furnaces, including linings, heating elements, and insulation parts, thanks to their ability to withstand extreme temperatures without degrading. In the electronics industry, graphite rounds and blocks serve as molds for continuous casting and sintering processes, as well as EDM (Electrical Discharge Machining) electrodes, where precision and durability are critical.

Application Insights

Lithium-ion batteries, which commonly use synthetic graphite as the anode material, are a significant growth driver across several rapidly expanding industries. The automotive sector, particularly electric vehicles (EVs), relies heavily on these batteries due to their high energy density, long cycle life, and efficient charge-discharge capabilities. As global governments push for cleaner transportation to reduce carbon emissions, the demand for EVs and lithium-ion batteries with synthetic graphite anodes is surging.

Synthetic graphite is vital in the foundry and metallurgy industries due to its excellent high-temperature resistance, thermal conductivity, and chemical stability. In foundries, synthetic graphite is used to manufacture molds, crucibles, and cores because it can withstand extreme heat without deforming or reacting with molten metals. This ensures precision casting and improves the quality of metal products. In metallurgy, synthetic graphite serves as electrodes in electric arc furnaces (EAFs) for steelmaking, where its superior electrical conductivity and durability allow efficient melting of scrap metal.

The electronics and electrical sectors are major drivers of synthetic graphite demand, particularly as the global shift toward electric vehicles, renewable energy technologies, and advanced consumer electronics accelerates. This growth is driven by the increasing need for electrical components that are more efficient, reliable, and capable of operating under high temperatures and challenging conditions. As innovation continues and the adoption of electric technologies expands, synthetic graphite remains a crucial material supporting the ongoing growth of these industries.

Regional Insights

The North American synthetic graphite industry is experiencing significant growth, driven by strategic investments, policy initiatives, and evolving industry dynamics. Companies like Mersen and Graphite One are expanding their production capabilities to meet the growing demand for high-purity graphite products, particularly in the semiconductor and energy storage sectors. These developments indicate a dynamic and evolving synthetic graphite industry in North America, characterized by innovation, diversification, and a focus on sustainability.

U.S. Synthetic Graphite Market Trends

The U.S. synthetic graphite industry is transforming significantly, driven by strategic investments, policy support, and shifting industry dynamics. A notable development is the U.S. Department of Energy's commitment to support Australian company Novonix with a USD 755 million conditional loan for a new synthetic graphite facility in Chattanooga, Tennessee. This facility, set to be North America's first large-scale synthetic graphite plant, aims to reduce reliance on China, which currently dominates over 95% of the global graphite supply for electric vehicle (EV) batteries. The new plant is projected to supply enough graphite for 325,000 EVs annually by 2028, aligning with the U.S. strategy to develop alternative EV supply chains and comply with the Inflation Reduction Act's requirements for tax credits.

Asia Pacific Synthetic Graphite Market Trends

The Asia Pacific synthetic graphite industry is experiencing significant growth, driven by several key trends and developments in the region. Synthetic graphite accounted for the largest revenue share in 2024. It is expected to continue leading the market due to its high purity and consistent quality, making it ideal for lithium-ion batteries and electronics applications.

Europe Synthetic Graphite Market Trends

The European synthetic graphite industry is experiencing significant growth, driven by strategic investments, policy initiatives, and evolving industry dynamics. A notable development in the region is Vianode's establishment of a synthetic graphite production facility in Herøya, Norway, which commenced operations in the second half of 2024. This facility, equipped with advanced furnaces, aims to produce 2,000 tonnes of synthetic anode annually, sufficient to supply approximately 30,000 EVs annually.

Key Synthetic Graphite Company Insights

Some of the key players operating in the market include GrafTech International Ltd., SGL Carbon SE, and Showa Denko K.K.

-

GrafTech is a global leader in the manufacturing of synthetic graphite products. The company specializes in graphite electrodes, advanced graphite materials, and specialty graphite products used primarily in steel production, energy, aerospace, and chemical industries. GrafTech's graphite electrodes are critical in electric arc furnaces (EAF) and are essential for steel recycling and production.

-

SGL Carbon is among the largest synthetic graphite producers and other carbon-based materials globally. With a comprehensive portfolio that includes synthetic graphite, carbon fibers, and composites, SGL Carbon serves a variety of sectors such as lithium-ion batteries, automotive, industrial, and aerospace.

-

Showa Denko is a diversified chemical company and a major player in synthetic graphite electrode production, supplying steelmakers and other heavy industries. Their synthetic graphite products are used in electric arc furnaces for steelmaking and non-ferrous metal processing.

Key Synthetic Graphite Companies:

The following are the leading companies in the synthetic graphite market. These companies collectively hold the largest market share and dictate industry trends.

- GrafTech International Ltd.

- HEG Limited

- Imerys Graphite & Carbon

- Mersen S.A.

- Nippon Carbon Co., Ltd.

- SGL Carbon SE

- Showa Denko K.K.

- Superior Graphite

- Tokai Carbon Co., Ltd.

- Toyo Tanso Co., Ltd.

Recent Developments

-

In December 2024, the U.S. Department of Energy offered Novonix a conditional commitment for a direct loan of up to USD 754.8 million to partially finance a new synthetic graphite manufacturing facility in Chattanooga, Tennessee. The proposed facility is expected to produce approximately 31,500 tonnes of synthetic graphite annually, supporting the production of lithium-ion batteries for approximately 325,000 electric vehicles annually. This initiative is part of the U.S. strategy to reduce reliance on China's global graphite supply chain dominance.

-

In October 2024, HEG Limited acquired an 8.23% stake in GrafTech International for approximately INR 250 crore (approximately USD 30 million). This strategic investment aligns with HEG's focus on enhancing its global graphite electrode market presence. GrafTech's high-capacity facilities and low-cost manufacturing capabilities complement HEG's 100,000-tonne production capacity in Madhya Pradesh, India.

-

In November 2024, Graphjet Technology commenced operations at its first commercial-scale green graphite facility in Subang District, Malaysia. Utilizing palm kernel shells, a byproduct of palm oil production, the facility has a production capacity of up to 3,000 metric tons of battery-grade graphite per year, sufficient to power approximately 40,000 electric vehicles annually. This innovative approach positions Graphjet as a sustainable and cost-effective supplier in the EV and semiconductor markets.

-

In February 2024, Toyo Tanso Co., Ltd. announced a capital investment of approximately USD 37 million to expand its production capacity for SiC (silicon carbide) and TaC (tantalum carbide)-coated graphite products at its Technology Centre in Kanonji City, Kagawa Prefecture, Japan. This expansion aims to triple the production of SiC-coated graphite and increase TaC-coated graphite production sixfold by 2025, addressing the growing demand in semiconductor and power electronics applications.

Synthetic Graphite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.65 billion

Revenue forecast in 2030

USD 11.95 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; China; India; Japan; Brazil

Key companies profiled

GrafTech International Ltd.; HEG Limited; Imerys Graphite & Carbon; Mersen S.A.; Nippon Carbon Co. Ltd.; SGL Carbon SE; Showa Denko K.K.; Superior Graphite; Tokai Carbon Co., Ltd.; Toyo Tanso Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Graphite Market Report Segmentation

This report forecasts revenue growth at the global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global synthetic graphite market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Graphite Electrodes

-

Graphite Blocks and Rounds

-

Graphite Powder

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lithium-Ion Batteries

-

Foundry and Metallurgy

-

Electrical Components

-

Lubricants and Greases

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global synthetic graphite market size was estimated at USD 8.20 billion in 2024 and is expected to reach USD 8.66 billion in 2025.

b. The global synthetic graphite market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 11.95 billion by 2030.

b. By product, the electrodes segment dominated the market with a revenue share of over 43.0% in 2024.

b. Some of the key vendors in the global synthetic graphite market are GrafTech International Ltd., HEG Limited, Imerys Graphite & Carbon, Mersen S.A., Nippon Carbon Co., Ltd., SGL Carbon SE, Showa Denko K.K., Superior Graphite, Tokai Carbon Co., Ltd., Toyo Tanso Co., Ltd.

b. The global synthetic graphite market is primarily driven by the booming electric vehicle (EV) industry and the growing demand for lithium-ion batteries. Additionally, advancements in energy storage systems and high-performance electronics are boosting demand across sectors such as renewable energy and consumer devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.