- Home

- »

- Biotechnology

- »

-

Targeted DNA RNA Sequencing Market, Industry Report, 2033GVR Report cover

![Targeted DNA RNA Sequencing Market Size, Share & Trends Report]()

Targeted DNA RNA Sequencing Market (2025 - 2033) Size, Share & Trends Analysis Report By Workflow (Pre-sequencing, Sequencing, Data Analysis), By Technology, By Application, By Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-681-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Targeted DNA RNA Sequencing Market Summary

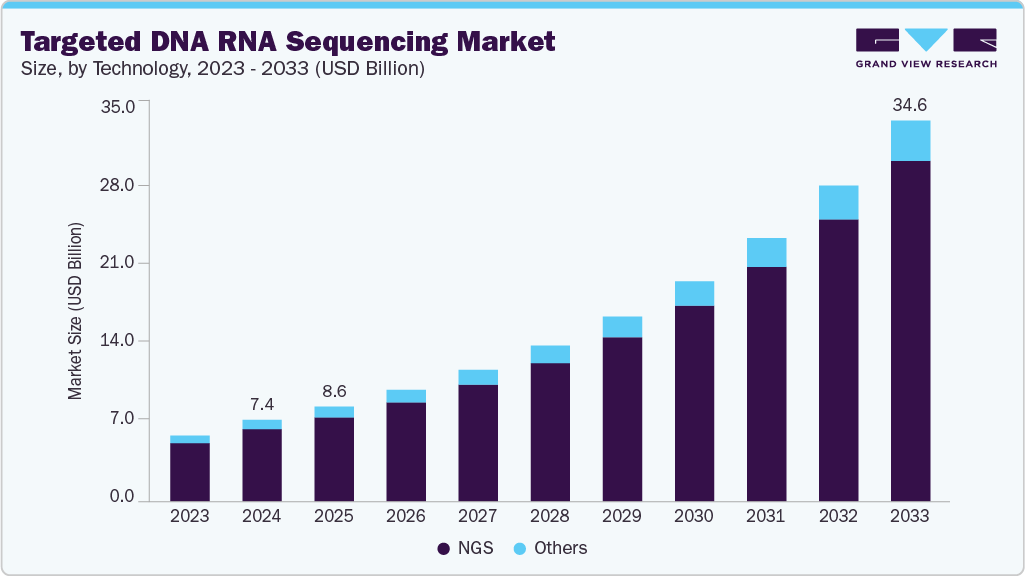

The global targeted DNA RNA sequencing market size was estimated at USD 7.40 billion in 2024 and is projected to reach USD 34.56 billion by 2033, expanding at a CAGR of 18.98% from 2025 to 2033. The market is growing rapidly due to the increasing use of precision medicine, the rising incidence of cancer and genetic diseases, and the demand for more cost-efficient and highly accurate sequencing methodologies that enable the deep analysis of specific genes or genomic regions.

Key Market Trends & Insights

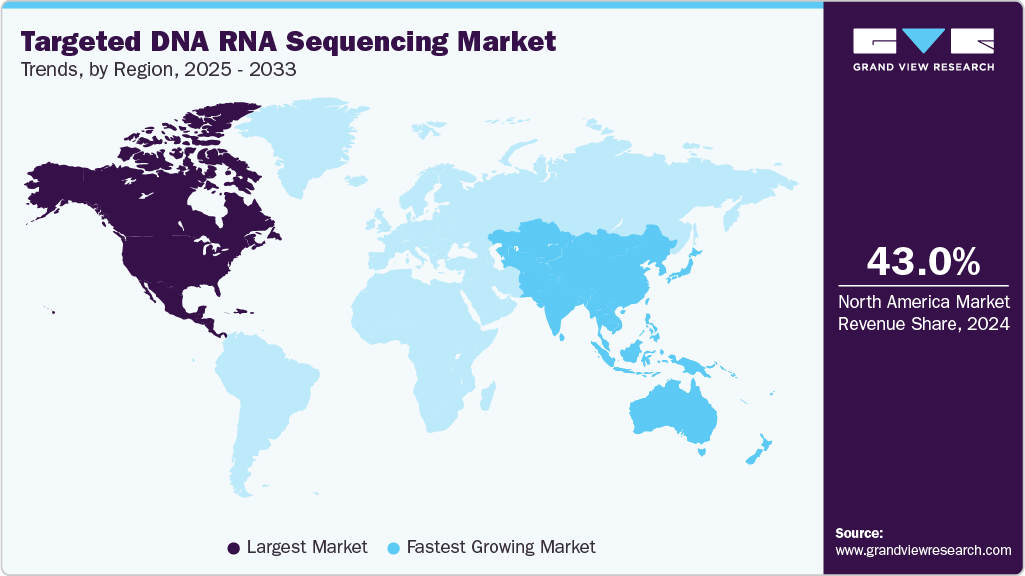

- The North America targeted DNA RNA sequencing market held the largest share of 43.03% of the global market in 2024.

- The targeted DNA RNA sequencing industry in the U.S. is expected to grow significantly over the forecast period.

- By workflow, the sequencing segment held the highest market share of 56.30% in 2024.

- Based on technology, the NGS segment held the highest market share in 2024.

- By workflow, the sequencing segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.40 Billion

- 2033 Projected Market Size: USD 34.56 Billion

- CAGR (2025-2033): 18.98%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing Demand for Precision Diagnostics and Targeted Therapies

With the rising incidences of diseases such as cancer, heart diseases, and genetic disorders, the need to diagnose and develop specific treatments drives the market growth. In targeted sequencing, it is possible to identify pathogenic variations at an earlier stage in the process, which facilitates diagnosis and improves treatment options. This is particularly sensitive if the cancer type can be treated with targeted therapy that may not cause as many side effects as chemotherapy.

Heart Disease in the United States - Key Statistics

Statistic

Detail

Leading Cause of Death

Heart disease is the leading cause of death for men, women, and most racial/ethnic groups

Death Frequency

One person dies every 34 seconds from cardiovascular disease

Total Deaths in 2023

919,032 deaths (1 in every 3 deaths)

Economic Burden (2020-2021)

$417.9 billion (healthcare services, medicines, and lost productivity)

Source: CDC Secondary Research, Grand View Research

Moreover, targeted sequencing facilitates the transition to personalized, less invasive therapies, particularly in the fields of oncology and rare disease. By identifying actionable genetic mutations, clinicians can select targeted therapies that are both more effective and have lower toxicity compared to standard chemotherapy or broad-spectrum treatments. The capacity for individualized care, minimal toxicity, and improved patient outcomes continues to drive the use of targeted sequencing in the clinical, research, and pharmaceutical sectors, making it a major contributor to healthcare innovation and market expansion.

Technological Advancements and Cost Efficiency Accelerating Adoption

Advances in next-generation sequencing platforms, enrichment chemistry, and automation make targeted sequencing faster, more accurate, and significantly less costly. Innovations such as improved capture kits, high-throughput systems, and enhanced reagents are reducing processing and turnaround times, thereby supporting applications in hospitals, research laboratories, and biotech companies.

Moreover, targeted sequencing focuses on only selected gene regions, allowing for deeper coverage and increased sensitivity in detecting rarer variants, which is superior to whole-genome sequencing. Given that targeted sequencing has lower data analysis requirements, fewer storage needs, and cost-efficient workflows, it is increasingly chosen by healthcare providers in areas such as routine diagnostics, precision medicine, and large genomic programs. This value proposition, based on efficiencies, continues to drive market expansion.

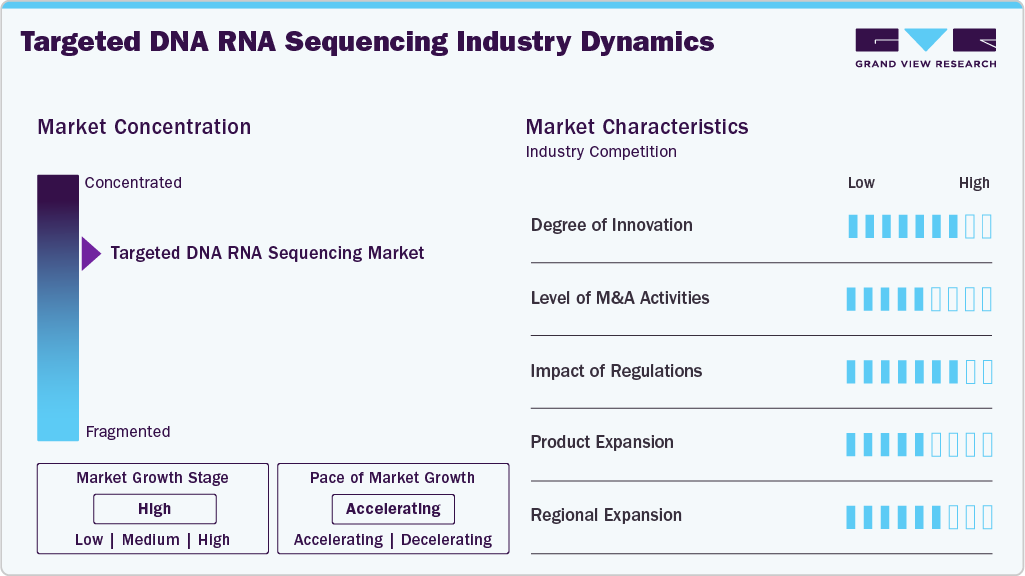

Market Concentration & Characteristics

The targeted DNA RNA sequencing industry is characterized by high innovation, driven by ongoing advancements in NGS platforms, target-enrichment techniques, and AI-based data processing. Novel ultra-sensitive panels, automated workflows, and liquid biopsy-based frameworks all improve accuracy, timeliness, and provide potential early-stage disease detection. For instance, in April 2024, QIAGEN expanded its cancer research portfolio in the U.S., introducing dPCR PanCancer Kits, a QIAseq Targeted RNA-seq T-cell receptor panel, and urine liquid biopsy stabilization technology at the AACR.

The targeted DNA RNA sequencing industry experiences a moderate to high level of M&A activity, as major sequencing and biotech firms acquire smaller innovators to expand their technology capabilities, strengthen clinical applications, and scale their global presence.

Regulations play a crucial role in the targeted sequencing industry for DNA RNA, as they ensure accuracy, quality, and safety for patients, particularly as testing transitions to clinical use. While regulations and approvals can increase costs and lengthen timelines, regulatory oversight and data privacy regulations (such as HIPAA and GDPR) help build trust, provide a foundation for secure data collection, and ultimately expedite the adoption of targeted sequencing in precision medicine and clinical diagnostics.

The targeted DNA RNA sequencing industry is experiencing rapid product expansion as companies introduce broader and more sensitive gene panels, kits designed for streamlined workflows, and tools for oncology, rare diseases, and liquid biopsy applications. Companies are also working to develop integrated sequencing and analysis platforms for enhanced accuracy and ease of use, thereby further promoting clinical and research applications.

Companies are expanding their presence in rapidly developing regions such as the Asia-Pacific, the Middle East, and Latin America, thereby boosting regional growth in the targeted DNA RNA sequencing industry. Emerging markets are adopting targeted sequencing technologies due to investments in genomics infrastructure, national precision medicine initiatives, and expanding access to healthcare.

Technology Insights

The next-generation sequencing (NGS) segment dominated the market in 2024, driven by the offering of NGS technology with several advantages over older methods, including the ability to sequence a significantly larger number of targets simultaneously and at a substantially lower cost. These factors underscore the importance of NGS, which is the most widely used workflow in targeted sequencing among all researchers and healthcare service providers in the market.

The other segment is projected to grow at a substantial rate over the forecast period. This segment extends to other fields beyond drug discovery, human health, and plant & animal sciences, as highlighted below. The emergence of research branches such as pharmacogenomics, which examines the impact of genes on the effectiveness of drugs, and metagenomics, which focuses on determining the genomes of microbes in an environment, underscores the importance of these fields. This has unveiled new opportunities for targeted sequencing in tools, thus stimulating segment growth.

Workflow Insights

The sequencing segment dominated the market in 2024, accounting for a 56.30% share. This dominance majorly highlights its role in every stage of the process. The sequencing segment defines the specific order of nucleotides in the targeted DNA or RNA, which forms the basis for all other analyses contributing to market growth.

The data analysis segment is expected to grow at the fastest rate. The growing use of AI-powered analytics and cloud-based systems makes efficient data processing and actionable reporting increasingly vital, as the role of targeted sequencing continues to expand in research and clinical settings.

Application Insights

In 2024, the segment of human biomedical research represented the largest revenue market share, which was 68.60%. The segment’s dominance can be attributed to the growing use of targeted sequencing by academic and clinical researchers in cancer genomics, rare disease research, and biomarker discovery, as well as the increasing amount of funding for precision medicine projects and big genomic initiatives.

The drug discovery segment is expected to grow at the fastest CAGR during the forecast period. This is attributed to pharmaceutical companies that target sequencing to determine genetic factors related to specific diseases. Moreover, it accelerates drug development by focusing on targets and ensures the development of more effective medicines with fewer side effects. With the increasing focus on personalized medicine, targeted sequencing has become an invaluable tool for drug development tailored to individual patient needs, further propelling its growth.

Type Insights

The DNA-based targeted sequencing segment accounted for the largest share of the market in 2024. This is due to DNA analysis offering a more stable target compared to RNA, which degrades faster. By targeting specific genes associated with diseases, researchers can develop personalized therapies. Furthermore, DNA sequencing is a more advanced technology than RNA, providing a faster and more cost-effective workflow.

The RNA-based targeted sequencing segment is projected to grow at a substantial rate over the forecast period. The newer methods aimed at stabilizing RNA are helping to overcome the fundamental problem of RNA instability, making RNA a less risky target. Moreover, RNA sequencing provides a dynamic view of gene expression analysis in cellular processes and mechanisms, driving the development of disease treatments and market growth.

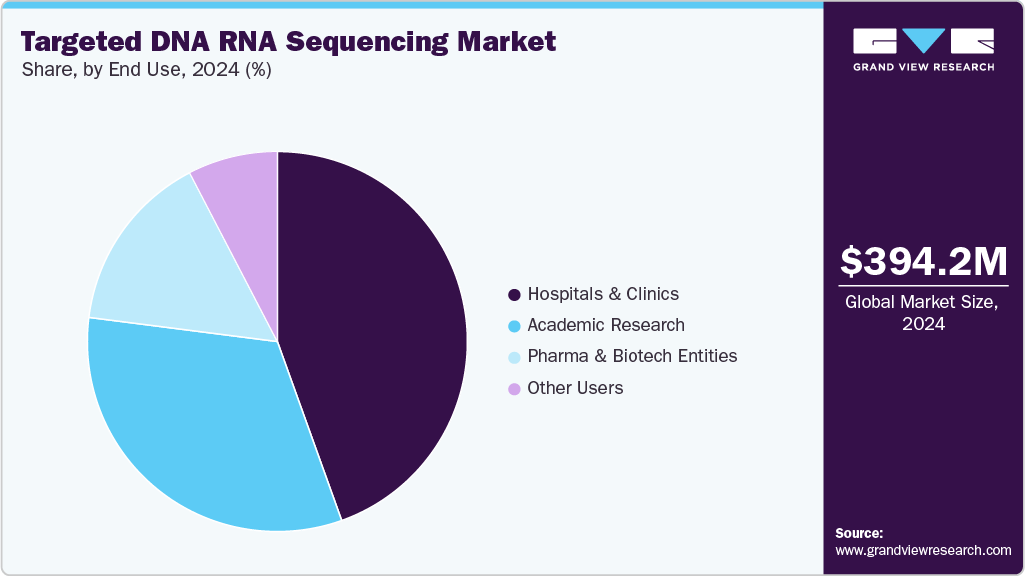

End Use Insights

In 2024, the hospitals & clinics segment held the highest revenue share of the market at 44.50%, reflecting the growing adoption of targeted sequencing technologies in clinical diagnostics, oncology care, and personalized treatment programs within healthcare facilities.

The pharma and biotech entities segment is projected to grow at a significant CAGR over the forecast period. They are more effective because targeted sequencing helps to identify each key component specifically related to diseases. Secondly, it shortens drug development timelines as researchers avoid irrelevant pathways, hence allowing patients to access new drugs in the shortest time possible.

Regional Insights

North America dominated the DNA RNA sequencing market, accounting for the largest revenue share of 43.03% in 2024. This is largely due to the presence of many well-funded research institutions and pharmaceutical organizations in that region, which have expressed keen interest in utilizing this technology for drug discovery and development.

U.S Targeted DNA RNA Sequencing Market Trends

The targeted DNA RNA sequencing market in the U.S. dominated North America in 2024, primarily due to a significant surge in government funding for research and policies, supplemented by a robust pipeline of biotech and pharmaceutical companies, as well as research universities. In addition, investments and expertise will support the further development and deployment of targeted sequencing in new areas.

Europe Targeted DNA RNA Sequencing Market Trends

The targeted DNA RNA sequencing market in Europe was identified as a lucrative region in 2024. This growth is fueled by governmental support for genomics research and more attention paid to personalized medicine programs. Based on these factors, market players and researchers have a conducive environment in which to increase the use of targeted sequencing technologies in Europe.

The UK targeted DNA RNA sequencing market is expected to grow rapidly in the coming years due to a solid academic foundation in genomics in the UK, and some research facilities are already applying genomics in medical research. Secondly, government-related schemes, such as the 100,000 Genomes Project and the development of genomic infrastructure, are promoting the adoption of targeted sequencing in the UK healthcare system.

The targeted DNA RNA sequencing market in Germany is poised for strong growth, driven by increasing adoption of genomic diagnostics, rising demand for personalized cancer treatments, and expanding investment in precision medicine and research infrastructure across the country.

Asia Pacific Targeted DNA RNA Sequencing Market Trends

The targeted DNA RNA sequencing market in the Asia Pacific is anticipated to witness the fastest growth with a CAGR of 19.06%. This surge is driven by the increase in disposable income and rising government expenditure in the field of genomics. These factors have created increased demand in the healthcare sector and unlocked new opportunities for sequencing technologies in diagnostics and personalized medicine within the regional market.

China targeted DNA RNA sequencing market held a substantial market share in 2024, driven by a steady rise in population, resulting in massive demand for superior medical services. Moreover, the government policies drive the local industries to develop and increase access to targeted sequencing systems for research and diagnostics.

The targeted DNA RNA sequencing market in Japan is expected to grow considerably, driven by strong government support for genomics, expanding precision medicine programs, and rising demand for advanced cancer diagnostics across healthcare and research settings.

MEA Targeted DNA RNA Sequencing Market Trends

The targeted DNA RNA sequencing market in the Middle East and Africa is projected to grow significantly over the forecast period, driven by the growing prevalence of cancer, government-led genomics programs, and strengthened partnerships with global biotech and diagnostic companies, which are further driving demand for targeted sequencing solutions across hospitals, research centers, and clinical laboratories in the region.

Kuwait targeted DNA RNA sequencing marketis still in its early stages of development, driven by growing interest in precision medicine and investments in modern healthcare and genomic capabilities. As hospitals and research centers expand their use of molecular diagnostics, and government efforts support biotechnology and cancer care, adoption is expected to increase gradually.

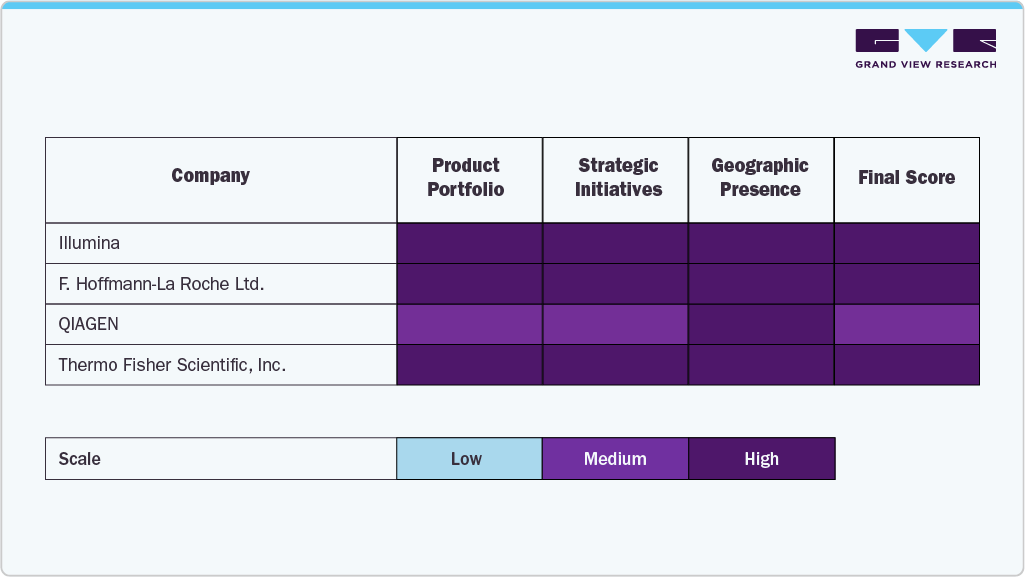

Key Targeted DNA RNA Sequencing Company Insights

The targeted DNA RNA sequencing industry comprises several major, established companies that utilize advanced sequencing technology and have established customer bases through their product portfolios and alliances in both clinical and research settings. Illumina, F. Hoffmann-La Roche Ltd., QIAGEN, Thermo Fisher Scientific, Inc., and Bio-Rad Laboratories, Inc. are leading companies in the market, with established platforms for sequencing, reagents, and assays, as well as comprehensive global distribution.

Companies including Oxford Nanopore Technologies, PierianDx, Genomatix GmbH, DNASTAR, Inc., and PerkinElmer, Inc. are expanding their market presence by delivering specialized sequencing solutions, advanced computational analysis tools, and cloud-based genomic interpretation platforms.

As strategic partnerships, acquisitions, and trends toward greater accuracy in sequencing and computational analysis proliferate the competitive landscape, companies that can effectively combine advanced sequencing capabilities with user-friendly clinical insights and scalable opportunities will not only be able to provide sustained value but will also shape the next wave of the rapid growth of this industry.

Key Targeted DNA RNA Sequencing Companies:

The following are the leading companies in the targeted DNA RNA sequencing market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

Recent Developments

-

In February 2025, Roche in Switzerland launched its SBX sequencing technology, delivering ultra-rapid, scalable next-generation sequencing to accelerate genomic research, enhance clinical applications, and strengthen its competitive position in precision medicine markets.

-

In June 2024, Bio-Rad launched a new ddSEQ Single-Cell 3' RNA-Seq Kit to support single-cell gene expression research. This kit enables researchers to affordably and rapidly analyze gene expression at single-cell resolution. It is anticipated that this technology will aid in the research of oncology, immunology, and other related fields.

Targeted DNA RNA Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.60 billion

Revenue forecast in 2033

USD 34.56 billion

Growth rate

CAGR of 18.98% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, workflow, application, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Illumina; F. Hoffman-La Roche Ltd.; QIAGEN; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Oxford Nanopore Technologies; PierianDx; Genomatix GmbH; DNASTAR, Inc.; Perkin Elmer, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Targeted DNA RNA Sequencing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global targeted DNA RNA sequencing market based on technology, workflow, application, type, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

NGS

-

Method

-

Exome Sequencing

-

Enrichment Sequencing

-

Amplicon Sequencing

-

Others

-

-

Application

-

Cancer Gene Sequencing

-

Inherited Disease Screening

-

Drug Development

-

Forensic Genomics

-

16S ribosomal RNA (rRNA) sequencing

-

-

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-sequencing

-

Sequencing

-

Data Analysis

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Human Biomedical Research

-

Plant & Animal Sciences

-

Drug Discovery

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

DNA Based Targeted Sequencing

-

RNA Based Targeted Sequencing

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic Research

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global targeted DNA RNA sequencing market size was estimated at USD 7.40 billion in 2024 and is expected to reach USD 8.60 billion in 2025.

b. The global targeted DNA RNA sequencing market is expected to grow at a compound annual growth rate of 18.98% from 2025 to 2033 to reach USD 34.56 billion by 2033.

b. North America dominated the targeted DNA RNA sequencing market with a share of 43.03% in 2024. This is attributable to the presence of a large number of genome centers with installed sequencers.

b. Some key players operating in the targeted DNA RNA sequencing market include Illumina, Inc.; F. Hoffmann-La Roche Ltd; Agilent Technologies; GATC Biotech Ag; Oxford Nanopore Technologies; Thermo Fisher Scientific, Inc.; DNASTAR Inc.; QIAGEN; BGI; Perkin Elmer, Inc.; Pacific Biosciences of California, Inc.; Bio-Rad Laboratories, Inc.; Integrated DNA Technologies, Inc.; RainDance Technologies, Inc.; PierianDx; Genomatix GmbH; and Macrogen, Inc.

b. Key factors that are driving the market growth include cost-saving advantages pertaining to the adoption of targeted sequencing approach as well as plummeting sequencing cost, advantages associated with targeted gene panels and amplicon sequencing, technological advancements in sequencing technology and related ancillary protocols, and rising number of targeted sequencing-based research projects and consequent popularity growth of genomic medicine

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.