- Home

- »

- Smart Textiles

- »

-

Textile Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Textile Market Size, Share & Trends Report]()

Textile Market Size, Share & Trends Analysis Report By Raw Material (Wool, Chemical, Silk), By Product (Natural Fibers, Polyester), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-736-0

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Textile Market Size & Trends

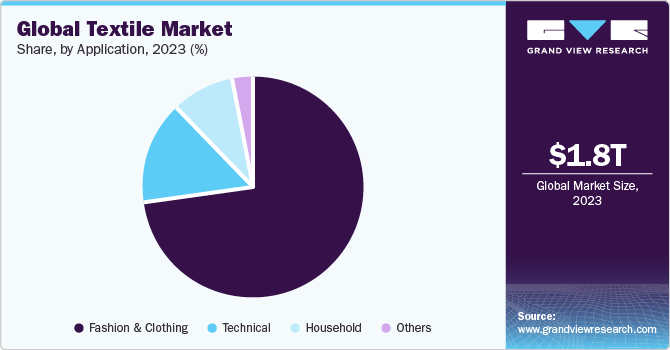

The global textile market size was valued at USD 1,837.27 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.4% in revenue from 2024 to 2030. The ever-increasing apparel demand from the fashion industry and the meteoric growth of e-commerce platforms are expected to drive market growth over the forecast period. The textile industry works on three major principles: designing, producing, and distributing different flexible materials such as yarn and clothing. Many processes, such as knitting, crocheting, weaving, and others, are primarily used to manufacture a wide range of finished and semi-finished goods in bedding, clothing, apparel, medical, and other accessories.

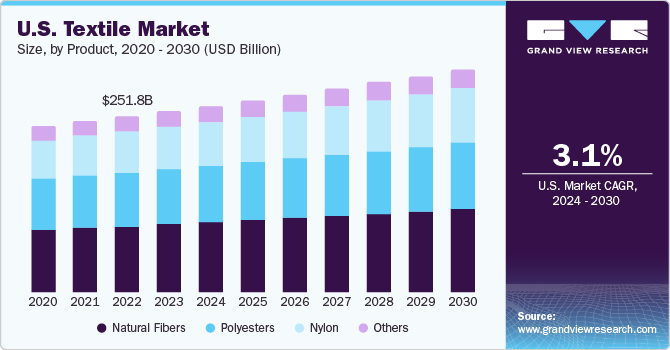

The U.S. is anticipated to be the largest market for textiles in the North American region. It is one of the largest producers, raw cotton exporters, and top raw textile importers. Fashion is the largest application segment in the region, owing to the fast-changing fashionable trends and ease of adoption due to the rapidly emerging online fast fashion companies.

There has been an increasing trend in the use of smart textiles in the market that use optical fibers, metals, and various conductive polymers to interact with the environment. These helps detect and react to various physical stimuli such as mechanical, thermal, or chemical & electric sources. This is expected to propel the growth of the technical application segment in the textiles market during the forecast period.

The rapidly growing consumer preference towards sustainable products is forcing major textile companies to focus on restructuring their business and investing in manufacturing practices that target sustainable products. For instance, DuPont’s plant-based faux fur for performance fashion apparel and Eastman’s usage of discarded carpets in new materials is expected to open several major industry avenues over the forecast period.

Fashion is gaining increasingly higher importance in consumers’ lifestyles. This can be attributed to the constant exposure to advertisements that results in impulsive buying. In addition, social media is another major factor adding to the rising demand for fashionable wear. Companies such as H&M and Zara are utilizing social media platforms to reach potential customers and gain higher market shares.

The recent coronavirus pandemic has acted as a restraint to the global market growth for textiles. Global trade restrictions due to a disrupted supply chain and the decline in textile product consumption amid the imposed lockdowns further negatively impacted the market progress. However, the industry is expected to recover strongly during the forecast period, aided by government support and increasing public awareness regarding effective precautionary measures.

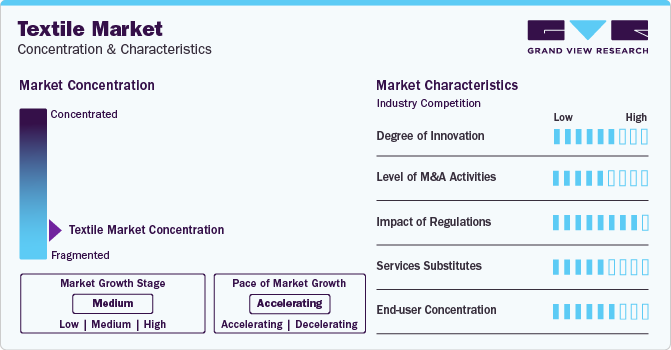

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating.The market is fragmented due to several small- and medium-sized manufacturers, especially in countries such as China and India. Moreover, the easy availability of low-cost labor, coupled with strengthening government support to establish the business units of various major players in these countries, is expected to bring healthy growth to the market.

The textile industry utilizes a number of technologies to manufacture textile products for their use in applications including household, technical, fashion, and others. The major technologies incorporated by the textile manufacturers include spun bond, melt-blown, air-laid, needle punch, wet-laid, and others.

Expanding application scope of textiles in the formulation of products related to oil & gas, automotive, and aerospace industries is expected to remain a favorable factor for the market. Furthermore, technological advancement, in terms of the development of textile products based on spider silk and aramid fiber, is expected to reduce the importance of substitutes. However, high ease of incorporation of metal and plastics in manufacturing industrial products, including automotive vehicles and machines, is expected to remain a considerable threat of substitution to the global textile market.

Raw-material Insights

The cotton segment led the market and accounted for over 38% of the overall revenue share in 2023. Cotton is the world’s most important natural fiber, attributed to its superior properties, such as high strength, absorption, and color retention. China, India, and the U.S. primarily produce cotton and cotton-based products worldwide.

The expansion of the textile industry, on account of the rising demand for garments and apparel in these countries, is likely to augment the demand for cotton, which is expected to drive segment growth over the forecast period. According to a report published by the Textile Exchange, more than 95% of all industry-grade cotton is grown in Brazil, India, China, Pakistan, the U.S., Australia, Cameroon, and Côte d’Ivoire.

Chemical-based textile plays an essential role in the textile manufacturing industry. Though chemicals are hazardous to human health and the environment, they are extensively used as mercerizing agents, neutralizers, leveling agents, binders, thickeners, and stain-removers in the textile industry.

Wool-based textiles segment is expected to grow at a significant rate over the forecast period. Wool, primarily composed of hydrogen, carbon, sulfur, and nitrogen, is extensively used to manufacture insulation products such as winter wear, blankets, carpeting, upholstery, etc. In addition, the same raw material-based products are used to absorb odor and noise in heavy machinery, thereby contributing to the growth of the technical application segment.

Some other raw materials used in the production of textiles are silk, minerals such as glass fibers and asbestos, and other synthetic materials. Silk finds extensive use in manufacturing clothing items, surgical sutures, parachutes, silk comforters, and other products having high strength and elasticity, which is expected to drive the segment growth over the forecast period.

Product Insights

The natural fibers product segment led the market in 2023 because of their extensive use in diverse applications of the fashion and apparel industry. Increasing environmental concerns, coupled with the continued consumer shift to use sustainable products, is further expected to increase the demand for natural fibers, thereby driving the growth of the overall global textiles market size over the coming years.

The surging demand for natural fibers from the apparel and fashion industries is expected to be a key driver for the growth of segment of the global textile market over the forecast period. However, these fibers are costlier than synthetic fibers, which can act as an obstacle to the growth of the natural fibers segment of the textiles market.

Polyester is expected to grow at significant rate over the forecast period. This growth can be attributed to its beneficial properties such as high strength, chemical & wrinkle resistance, and quick drying. It is used in households as cushioning & insulating material in pillows and in industries for making carpets, air filters, coated fabrics, and other products.

Nylon is widely used in apparel and home-furnishing applications owing to its high resilience, elasticity, and moisture-absorbing properties. In addition, it acts as a substitute for silk-based products such as women’s stockings, parachutes, flak vests, and others.

The other product segment includes polyethylene (PE), polypropylene (PP), aramid, and polyamide. Properties such as high resistance against acids & alkalis at high temperatures and minimum moisture retention have increased the demand for polyethylene in the market for textiles. Additionally, the use of polypropylene in the textile industry further enhances the market’s growth.

Application Insights

The fashion segment dominated the market in 2023, owing to the increasing consumer spending on clothing and apparel. In addition, high consumer requirements for crease-free suiting & shirting fabrics and quality dyed & printed fabrics across the globe are likely to drive the global market demand for textiles over the forecast period.

An increase in demand for formal & casual wear and other fashionable clothing among all age groups in the global population is a major driver for the textiles market growth. Moreover, increasing population and urbanization in emerging economies such as India, Bangladesh, Vietnam, Brazil, and others will likely propel the demand for clothing and apparel, positively contributing to market advancement.

Demand for textiles in the technical segment is expected to grow at the fastest rate over the projected period, owing to its high-performance properties and end-user applications. In addition, increasing application in construction, transportation, medical and protective clothing have boosted their use, consequently driving the textiles market.

The use of textiles in different areas of a household is one of the prominent growth drivers. This includes its utilization in bedding, upholstery, carpets, kitchen cloths, towels, and others. In addition, the high consumption of natural fibers, such as linen and cotton, along with synthetic fibers used for household textiles, further propels the segment’s growth.

Regional Insights

The Asia Pacific region dominated the market with a revenue share of more than 53% in 2023, owing to the increasing sales volume of clothing and apparel goods. The increasing population is expected to result in further substantial growth of the region. In addition, the presence of many customers on e-commerce platforms buying clothing and related accessories in developing economies is further driving the growth of the overall textiles market.

Increased penetration of organized retail, favorable demographics, rising income levels, and favorable government policies are expected to drive the demand for textiles, especially in countries such as India, Bangladesh, Pakistan, and others. For instance, in India, 100 percent foreign direct investment (FDI) is allowed in textiles, which is expected to propel regional market growth over the forecast period.

North America is expected to witness fast-paced growth in the coming years due to the growing industrial manufacturing and the rising number of product launches in the sports and fashion industries. The U.S. is expected to remain a significant cotton producer in the industry, owing to rising textile product demand from various end-use sectors. The textile market is witnessing a huge product demand for industrial manufacturing and from the home textile sector owing to the increase in awareness about the uses of technical textiles.

The market textile in Europe is expected to expand at a significant rate over the forecast period. This growth can be attributed to favorable government policies and trade agreements, such as free-trade agreements and the Euro-Mediterranean Dialogue in the textile and clothing industry.

The demand for textiles in North America and Central & South America will likely witness promising growth over the projected period, owing to the rapidly rising popularity of sports & apparel and home-furnishing textile products. In addition, the consumption of textile fibers, such as synthetic and cellulose fibers, needed for filtration in industrial applications is expected to impact the market growth over the forecast period positively.

Key Companies & Market Share Insights

The market for textiles has been witnessing a rising trend through strategies such as geographical expansions and mergers & acquisitions. Companies are trying to increase their sales through various government trade agreements and partnerships with e-commerce portals such as Amazon, flip kart, eBay, and others.

-

In December 2023, RSWM announced the acquisition of Ginni Filaments, an India based producer of combed cotton & open-end yarns. This acquisition will help RSWN to enhance its productivity and product diversity to cater to its premium customers.

-

In August 2022, American Textile Company (ATC) recently opened a technology center in Pittsburgh, U.S. as part of a digital transformation which expands to its manufacturing operations.The new location encourages collaboration through an open design and balances openness with areas for employee focus.

Key Textile Companies:

- BSL Limited

- INVISTA S.R.L.

- Lu Thai Textile Co., Ltd.

- Paramount Textile Limited

- Paulo de Oliveira, S.A.

- Successori REDA S.p.A.

- Shadong Jining Ruyi Woolen Textile Co. Ltd.

- Shandong Demian Incorporated Company

- Shijiazhuang Changshan Textile Co., Ltd

- Weiqiao Textile Company Limited

- DBL Group

- B.D. Textile Mills Pvt. Ltd.

- IBENA Inc.

- Heytex Bramsche GmbH

- Bahariye AS

- Fratelli Balli S.p.A.

- İpekiş Mensucat Türk A.Ş

- Lakhmi Woollen Mills

- Wilh. Wülfing GmbH & Co. KG

- Lanificio F.lli Cerruti

- Özlem Kumaş, Ltd.

- Trabaldo Togna S.p.A.

- Yünsa Yünlü Sanayi ve Ticaret A.Ş.

- Xinhui Woollen Textile Co., Ltd.

- O'Formula Co., Ltd.

- Wuxi Xiexin Group Co., Ltd.

- The Bombay Dyeing & Mfg. Co., Ltd

- Huafu Top Dyed Melange Yarn Co., Ltd.

- Mayur Fabrics

- Solvay S.A.

- Sinopec Yizheng Chemical Fibre Company Limited

- Li & Fung Group

- JCT Limited

Textile Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,983.92 billion

Revenue forecast in 2030

USD 3,047.23 billion

Growth Rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Million tons, Revenue in USD Billion/million and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw-material, product, application, region

Regional scope

North America, Europe, Asia Pacific, South America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Russia, Turkey, Italy, China, India, Japan, Australia, Saudi Arabia, Iran, Brazil

Key companies profiled

BSL Limited, INVISTA S.R.L., Lu Thai Textile Co., Ltd., Paramount Textile Limited, Paulo de Oliveira, S.A., Successori REDA S.p.A., Shadong Jining Ruyi Woolen Textile Co. Ltd., Shandong Demian Incorporated Company, Shijiazhuang Changshan Textile Co., Ltd, Weiqiao Textile Company Limited, DBL Group, B.D. Textile Mills Pvt. Ltd., IBENA Inc., Heytex Bramsche GmbH, Bahariye AS, Fratelli Balli S.p.A., İpekiş Mensucat Türk A.Ş, Lakhmi Woollen Mills, Wilh. Wülfing GmbH & Co. KG, Lanificio F.lli Cerruti, Özlem Kumaş, Ltd., Trabaldo Togna S.p.A., Yünsa Yünlü Sanayi ve Ticaret A.Ş., Xinhui Woollen Textile Co., Ltd., O'Formula Co., Ltd., Wuxi Xiexin Group Co., Ltd., The Bombay Dyeing & Mfg. Co., Ltd, Huafu Top Dyed Melange Yarn Co., Ltd., Mayur Fabrics, Solvay S.A., Sinopec Yizheng Chemical Fibre Company Limited, Li & Fung Group, JCT Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Textile Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global textile market report on the basis of raw-material, product, application, and region:

-

Raw-material Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

Cotton

-

Chemical

-

Wool

-

Silk

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

Natural fibers

-

Polyesters

-

Nylon

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

Household

-

Bedding

-

Kitchen

-

Upholstery

-

Towel

-

others

-

-

Technical

-

Construction

-

Transport

-

Medical

-

Protective

-

-

Fashion & Clothing

-

Apparel

-

Ties & Clothing accessories

-

Handbags

-

Others

-

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global textile market size was estimated at USD 1695.13 billion in 2022 and is expected to reach USD 1,837.27 billion in 2022.

b. The textile market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 3,047.23 billion by 2030.

b. Natural fibers led the market and accounted for over 44.1% share of the global revenue in 2022 on account of their use in the diverse application of the fashion and apparel industry

b. Some of the key players operating in the textile market include BSL Limited, INVISTA S.R.L., Lu Thai Textile Co., Ltd., Paramount Textile Limited, Paulo de Oliveira, S.A., Successori REDA S.p.A., Shadong Jining Ruyi Woolen Textile Co. Ltd., Shandong Demian Incorporated Company, Shijiazhuang Changshan Textile Co., Ltd, and Weiqiao Textile Company Limited.

b. The key factors that are driving the textile market include growing product demand for personal care & hygiene products, rising product use for production of geotextiles, and surge in demand for textile for disposable protective gears for medical applications

Table of Contents

Chapter 1. Textile Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Textile Market: Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Textile Market: Variables, Trends, and Scope

3.1. Market Lineage

3.1.1. Global Textile Market Outlook

3.2. Industry Value Chain Analysis

3.3. Technology Overview

3.3.1. Geotextile

3.3.2. Smart textile

3.3.3. Waterproof breathable textile (WBT)

3.3.4. Antimicrobial medical textiles

3.4. Regulatory Framework

3.4.1. Standard & Compliances

3.5. Market Dynamics

3.5.1. Market Driver analysis

3.5.1.1. Improving protective clothing market

3.5.1.2. Automotive industry growth

3.5.1.3. Expansion in construction sector

3.5.1.4. Rising importance of technical textile

3.5.2. Market restraint analysis

3.5.3. Fragmented market scenario

3.6. Business Environment Analysis: Textile Market

3.6.1. Industry Analysis - Porters Model

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Industry Rivalry

3.6.2. PESTEL ANALYSIS

3.6.2.1. Political Landscape

3.6.2.2. Economic Landscape

3.6.2.3. Social Landscape

3.6.2.4. Technology Landscape

3.6.2.5. Environmental Landscape

3.6.2.6. Legal Landscape

3.7. Import & Export Scenario

3.7.1. Textile import & export trade statistics, by country, 2018-2020

3.7.1.1. U.S.

3.7.1.2. Canada

3.7.1.3. Mexico

3.7.1.4. Germany

3.7.1.5. France

3.7.1.6. U.K.

3.7.1.7. Italy

3.7.1.8. Turkey

3.7.1.9. Russia

3.7.1.10. China

3.7.1.11. Japan

3.7.1.12. India

3.7.1.13. Australia

3.7.1.14. Brazil

3.7.1.15. Saudi Arabia

3.7.1.16. Iran

3.7.2. Recent trade agreements

3.7.3. Factors prevailing in imports and exports of textile products

Chapter 4. Textile Market: Material Estimates & Trend Analysis

4.1. Textile Market: Raw Material Movement Analysis, 2023 & 2030

4.2. Global Textile Market, by Raw Material, 2018 - 2030 (USD Billion)

4.2.1. Textile market estimates & forecasts, BY Raw Material, 2018 - 2030

4.3. Cotton

4.3.1. Textile market estimates & forecasts, in cotton, 2018 - 2030 (Kilotons) (USD Billion)

4.4. Chemical

4.4.1. Textile market estimates & forecasts, in chemical, 2018 - 2030 (Kilotons) (USD Billion)

4.5. Wool

4.5.1. Textile market estimates & forecasts, in Wool, 2018 - 2030 (Kilotons) (USD Billion)

4.6. Silk

4.6.1. Textile market estimates & forecasts, in Silk, 2018 - 2030 (Kilotons) (USD Billion)

4.7. Others

4.7.1. Textile market estimates & forecasts, in others, 2018 - 2030 (Kilotons) (USD Billion)

Chapter 5. Textile Market: Product Estimates & Trend Analysis

5.1. Textile Market: Product Movement Analysis & Market Share, 2023 & 2030

5.1.1. GLOBAL Textile market estimates & forecasts, By Product, 2018 - 2030

5.2. Natural Fibers

5.2.1. Textile market estimates & forecasts, in Natural Fibers, 2018 - 2030 (Kilotons) (USD Billion)

5.3. Polyester

5.3.1. Textile market estimates & forecasts, in Polyester, 2018 - 2030 (Kilotons) (USD Billion)

5.4. Nylon

5.4.1. Textile market estimates & forecasts, in Nylon, 2018 - 2030 (Kilotons) (USD Billion)

5.5. Others

5.5.1. Textile market estimates & forecasts, in Others, 2018 - 2030 (Kilotons) (USD Billion)

Chapter 6. Textile Market: Application Estimates & Trend Analysis

6.1. Textile Market: Application Movement Analysis, 2023 & 2030

6.1.1. Textile market estimates & forecasts, by, application, 2018 - 2030

6.2. Household

6.2.1. Textile market estimates & forecasts, in Household, 2018 - 2030 (Kilotons) (USD Billion)

6.3. Bedding

6.3.1. Textile market estimates & forecasts, in Bedding, 2018 - 2030 (Kilotons) (USD Billion)

6.4. Kitchen

6.4.1. Textile market estimates & forecasts, in Kitchen, 2018 - 2030 (Kilotons) (USD Billion)

6.5. Upholstery

6.5.1. Textile market estimates & forecasts, in Upholstery, 2018 - 2030 (Kilotons) (USD Billion)

6.6. Towel

6.6.1. Textile market estimates & forecasts, in Towel, 2018 - 2030 (Kilotons) (USD Billion)

6.7. Others

6.7.1. Textile market estimates & forecasts, in Others, 2018 - 2030 (Kilotons) (USD Billion)

6.8. Technical

6.8.1. Textile market estimates & forecasts, in Technical, 2018 - 2030 (Kilotons) (USD Billion)

6.9. Construction

6.9.1. Textile market estimates & forecasts, in Construction, 2018 - 2030 (Kilotons) (USD Billion)

6.10. Transportation

6.10.1. Textile market estimates & forecasts, in Transportation, 2018 - 2030 (Kilotons) (USD Billion)

6.11. Protective

6.11.1. Textile market estimates & forecasts, in Protective, 2018 - 2030 (Kilotons) (USD Billion)

6.12. Medical

6.12.1. Textile market estimates & forecasts, in Medical, 2018 - 2030 (Kilotons) (USD Billion)

6.13. Others

6.13.1. Textile market estimates & forecasts, in Others, 2018 - 2030 (Kilotons) (USD Billion)

6.14. Fashion & Clothing

6.14.1. Textile market estimates & forecasts, in Fashion & Clothing, 2018 - 2030 (Kilotons) (USD Billion)

6.15. Apparel

6.15.1. Textile market estimates & forecasts, in Apparel, 2018 - 2030 (Kilotons) (USD Billion)

6.16. Ties & Clothing Accessories

6.16.1. Textile market estimates & forecasts, in Ties & Clothing Accessories, 2018 - 2030 (Kilotons) (USD Billion)

6.17. Handbags

6.17.1. Textile market estimates & forecasts, in Handbags, 2018 - 2030 (Kilotons) (USD Billion)

6.18. Others

6.18.1. Textile market estimates & forecasts, in Others, 2018 - 2030 (Kilotons) (USD Billion)

6.19. Others

6.19.1. Textile market estimates & forecasts, in Others, 2018 - 2030 (Kilotons) (USD Billion)

Chapter 7. Textile Market: Regional Estimates & Trend Analysis

7.1. Regional market place: Key takeaways

7.2. Regional Movement Analysis & Market Share, 2023 & 2030

7.3. North America

7.3.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.3.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.3.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.3.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.3.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.3.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.4. U.S.

7.3.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.3.4.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.3.4.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.3.4.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.4.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.4.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.4.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.3.5. Canada

7.3.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.3.5.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.3.5.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.3.5.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.5.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.5.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.5.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.3.6. Mexico

7.3.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.3.6.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.3.6.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.3.6.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.6.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.6.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.3.6.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.4. Europe

7.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.4.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.4.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.3.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.3.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.3.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.4. Germany

7.4.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.4.4.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.4.4.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.4.4.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.4.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.4.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.4.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.4.5. France

7.4.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.4.5.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.4.5.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.4.5.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.5.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.5.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.5.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.4.6. Italy

7.4.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.4.6.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.4.6.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.4.6.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.6.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.6.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.6.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.4.7. UK

7.4.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.4.7.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.4.7.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.4.7.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.7.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.7.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.7.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.4.8. Turkey

7.4.8.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.4.8.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.4.8.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.4.8.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.8.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.8.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.8.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.4.9. Russia

7.4.9.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.4.9.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.4.9.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.4.9.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.9.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.9.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.4.9.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.5. Asia Pacific

7.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.5.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.5.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.3.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.3.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.3.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.4. China

7.5.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.5.4.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.5.4.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.5.4.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.4.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.4.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.4.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.5.5. India

7.5.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.5.5.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.5.5.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.5.5.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.5.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.5.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.5.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.5.6. Japan

7.5.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.5.6.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.5.6.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.5.6.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.6.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.6.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.6.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.5.7. Australia

7.5.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.5.7.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.5.7.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.5.7.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.7.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.7.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.5.7.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.6. Central & South America

7.6.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.6.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.6.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.6.3.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.6.3.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.6.3.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.6.4. Brazil

7.6.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.6.4.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.6.4.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.6.4.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.6.4.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.6.4.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.6.4.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.7. Middle East & Africa

7.7.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.7.2. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.7.3. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.3.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.3.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.3.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.4. Saudi Arabia

7.7.4.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.7.4.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.7.4.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.7.4.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.4.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.4.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.4.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

7.7.5. Iran

7.7.5.1. Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Billion)

7.7.5.2. Market estimates and forecasts, by raw material, 2018 - 2030 (Kilotons) (USD Billion)

7.7.5.3. Market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Billion)

7.7.5.4. Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.5.4.1. Market estimates and forecasts in household, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.5.4.2. Market estimates and forecasts in technical, by sub-application, 2018 - 2030 (Kilotons) (USD Billion)

7.7.5.4.3. Market estimates and forecasts in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons) (USD Billion

Chapter 8. Competitive Landscape

8.1. Competitive Environment

8.2. Strategy Framework

8.3. Vendor Landscape

8.4. Public Companies

8.4.1. Company Market position analysis

8.4.2. SWOT ANALYSIS

8.5. Private Companies

Chapter 9. Company Profiles

9.1. BSL Limited

9.1.1. Company overview

9.1.2. Financial performance

9.1.3. Product benchmarking

9.1.4. Strategic initiatives

9.2. INVISTA S.R.L.

9.2.1. Company overview

9.2.2. Financial performance

9.2.3. Product benchmarking

9.2.4. Strategic initiatives

9.3. Lu Thai Textile Co., Ltd.

9.3.1. Company overview

9.3.2. Financial performance

9.3.3. Product benchmarking

9.3.4. Strategic initiatives

9.4. Paramount Textile Limited

9.4.1. Company overview

9.4.2. Financial performance

9.4.3. Product benchmarking

9.4.4. Strategic initiatives

9.5. Paulo de Oliveira, S.A.

9.5.1. Company overview

9.5.2. Financial performance

9.5.3. Product benchmarking

9.5.4. Strategic initiatives

9.6. Successori REDA S.p.A.

9.6.1. Company overview

9.6.2. Financial performance

9.6.3. Product benchmarking

9.6.4. Strategic initiatives

9.7. Shadong Jining Ruyi Woolen Textile Co. Ltd.

9.7.1. Company overview

9.7.2. Financial performance

9.7.3. Product benchmarking

9.7.4. Strategic initiatives

9.8. Sinopec Yizheng Chemical Fibre Company Limited

9.8.1. Company overview

9.8.2. Financial performance

9.8.3. Product benchmarking

9.8.4. Strategic initiatives

9.9. China textiles Ltd.

9.9.1. Company overview

9.9.2. Financial performance

9.9.3. Product benchmarking

9.9.4. Strategic initiatives

9.10. Rhodia SA

9.10.1. Company overview

9.10.2. Financial performance

9.10.3. Product benchmarking

9.10.4. Strategic initiatives

9.11. Li & Fung Group

9.11.1. Company overview

9.11.2. Financial performance

9.11.3. Product benchmarking

9.11.4. Strategic initiatives

9.12. Modern Woollens Ltd.

9.12.1. Company overview

9.12.2. Financial performance

9.12.3. Product benchmarking

9.12.4. Strategic initiatives

9.13. Mayur Suitings

9.13.1. Company overview

9.13.2. Financial performance

9.13.3. Product benchmarking

9.13.4. Strategic initiatives

9.14. JCT Limited

9.14.1. Company overview

9.14.2. Financial performance

9.14.3. Product benchmarking

9.14.4. Strategic initiatives

9.15. Shijiazhuang Changshan Textile Co Ltd

9.15.1. Company overview

9.15.2. Financial performance

9.15.3. Product benchmarking

9.15.4. Strategic initiatives

9.16. Weiqiao Textile Co Ltd

9.16.1. Company overview

9.16.2. Financial performance

9.16.3. Product benchmarking

9.16.4. Strategic initiatives

9.17. Huafu Top Dyed Melange Yarn Co., Ltd.

9.17.1. Company overview

9.17.2. Financial performance

9.17.3. Product benchmarking

9.17.4. Strategic initiatives

9.18. DBL Group

9.18.1. Company overview

9.18.2. Financial performance

9.18.3. Product benchmarking

9.18.4. Strategic initiatives

9.19. B.D. Textile Mills Pvt. Ltd.

9.19.1. Company overview

9.19.2. Financial performance

9.19.3. Product benchmarking

9.19.4. Strategic initiatives

9.20. IBENA Inc.

9.20.1. Company overview

9.20.2. Financial performance

9.20.3. Product benchmarking

9.20.4. Strategic initiatives

9.21. Heytex Bramsche GmbH

9.21.1. Company overview

9.21.2. Financial performance

9.21.3. Product benchmarking

9.21.4. Strategic initiatives

9.22. Bahariye AS

9.22.1. Company overview

9.22.2. Financial performance

9.22.3. Product benchmarking

9.22.4. Strategic initiatives

9.23. Fratelli Balli SpA

9.23.1. Company overview

9.23.2. Financial performance

9.23.3. Product benchmarking

9.23.4. Strategic initiatives

9.24. İpekiş Mensucat Türk A.Ş.

9.24.1. Company overview

9.24.2. Financial performance

9.24.3. Product benchmarking

9.24.4. Strategic initiatives

9.25. Lakhmi Woollen Mills

9.25.1. Company overview

9.25.2. Financial performance

9.25.3. Product benchmarking

9.25.4. Strategic initiatives

9.26. Wilh. Wülfing GmbH & Co. KG

9.26.1. Company overview

9.26.2. Financial performance

9.26.3. Product benchmarking

9.26.4. Strategic initiatives

9.27. Lanificio F.lli Cerruti

9.27.1. Company overview

9.27.2. Financial performance

9.27.3. Product benchmarking

9.27.4. Strategic initiatives

9.28. O'Formula Co., Ltd

9.28.1. Company overview

9.28.2. Financial performance

9.28.3. Product benchmarking

9.28.4. Strategic initiatives

9.29. Trabaldo Togna SpA

9.29.1. Company overview

9.29.2. Financial performance

9.29.3. Product benchmarking

9.29.4. Strategic initiatives

9.30. Xinhui Woollen Textile Co., Ltd

9.30.1. Company overview

9.30.2. Financial performance

9.30.3. Product benchmarking

9.30.4. Strategic initiatives

9.31. Yünsa Yünlü Sanayi ve Ticaret A.Ş.

9.31.1. Company overview

9.31.2. Financial performance

9.31.3. Product benchmarking

9.31.4. Strategic initiatives

9.32. Özlem Kumaş, Ltd

9.32.1. Company overview

9.32.2. Financial performance

9.32.3. Product benchmarking

9.32.4. Strategic initiatives

9.33. Wuxi Xiexin Group Co., Ltd

9.33.1. Company overview

9.33.2. Financial performance

9.33.3. Product benchmarking

9.33.4. Strategic initiatives

9.34. The Bombay Dyeing & Mfg. Co., Ltd

9.34.1. Company overview

9.34.2. Financial performance

9.34.3. Product benchmarking

9.34.4. Strategic initiatives

9.35. Grasim Industries Limited

9.35.1. Company overview

9.35.2. Financial performance

9.35.3. Product benchmarking

9.35.4. Strategic initiatives

9.36. FabIndia Overseas Ltd.

9.36.1. Company overview

9.36.2. Financial performance

9.36.3. Product benchmarking

9.36.4. Strategic initiatives

9.37. Honeywell International Inc.

9.37.1. Company overview

9.37.2. Financial performance

9.37.3. Product benchmarking

9.37.4. Strategic initiatives

List of Tables

1. Textiles - Market driver analysis

2. U.S. construction industry, by segment, 2018 - 2023(USD Billion)

3. Comparison of regular textiles and technical textiles

4. Textiles - Market restraint analysis

5. U.S. textiles imports and exports, 2018 - 2023 (USD Billion)

6. Canada textiles imports and exports, 2018 - 2023 (USD Billion)

7. Mexico textiles imports and exports, 2018 - 2023 (USD Billion)

8. Germany textiles imports and exports, 2018 - 2023 (USD Billion)

9. France textiles imports and exports, 2018 - 2023 (USD Billion)

10. U.K. textiles imports and exports, 2018 - 2023 (USD Billion)

11. Italy textiles imports and exports, 2018 - 2023 (USD Billion)

12. Turkey textiles imports and exports, 2018 - 2023 (USD Billion)

13. Russia textiles imports and exports, 2018 - 2023 (USD Billion)

14. China textiles imports and exports, 2018 - 2023 (USD Billion)

15. Japan textiles imports and exports, 2018 - 2023 (USD Billion)

16. India textiles imports and exports, 2018 - 2023 (USD Billion)

17. Australia textiles imports and exports, 2018 - 2023 (USD Billion)

18. Brazil textiles imports and exports, 2018 - 2023 (USD Billion)

19. Saudi Arabia textiles imports and exports, 2018 - 2023 (USD Billion)

20. Iran textiles imports and exports, 2018 - 2023 (USD Billion)

21. Global cotton-based textile market volume and revenue, 2018 - 2030 (Kilotons) (USD Billion)

22. Global chemical-based textile market volume and revenue, 2018 - 2030 (Kilotons) (USD Billion)

23. Global wool-based textile market volume and revenue, 2018 - 2030 (Kilotons) (USD Billion)

24. Global silk-based textile market volume and revenue, 2018 - 2030 (Kilotons) (USD Billion)

25. Global textile market volume and revenue from other raw materials, 2018 - 2030 (Kilotons) (USD Billion)

26. Global natural-fiber textile market volume and revenue, 2018 - 2030 (Kilotons) (USD Billion)

27. Global polyester textile market volume and revenue, 2018 - 2030 (Kilotons) (USD Billion)

28. Global nylon textile market volume and revenue, 2018 - 2030 (Kilotons) (USD Billion)

29. Global textile market volume and revenue from other products, 2018 - 2030 (Kilotons) (USD Billion)

30. Global market for textiles in household, 2018 - 2030 (Kilotons) (USD Billion)

31. Global market for textiles in household for bedding, 2018 - 2030 (Kilotons) (USD Billion)

32. Global market for textiles in household for kitchen, 2018 - 2030 (Kilotons) (USD Billion)

33. Global market for textiles in household for upholstery, 2018 - 2030 (Kilotons) (USD Billion)

34. Global market for textiles in household for towels, 2018 - 2030 (Kilotons) (USD Billion)

35. Global market for textiles in household for other sub-applications, 2018 - 2030 (Kilotons) (USD Billion)

36. Global market for textiles in technical, 2018 - 2030 (Kilotons) (USD Billion)

37. Global market for textiles in technical for construction, 2018 - 2030 (Kilotons) (USD Billion)

38. Global market for textiles in technical for transportation, 2018 - 2030 (Kilotons) (USD Billion)

39. Global market for textiles in technical for protective, 2018 - 2030 (Kilotons) (USD Billion)

40. Global market for textiles in technical for medical, 2018 - 2030 (Kilotons) (USD Billion)

41. Global market for textiles in other technical applications, 2018 - 2030 (Kilotons) (USD Billion)

42. Global market for textiles in fashion & clothing, 2018 - 2030 (Kilotons) (USD Billion)

43. Global market for textiles in fashion & clothing for apparel, 2018 - 2030 (Kilotons) (USD Billion)

44. Global market for textiles in fashion & clothing for ties & clothing accessories, 2018 - 2030 (Kilotons) (USD Billion)

45. Global market for textiles in fashion & clothing for handbags, 2018 - 2030 (Kilotons) (USD Billion)

46. Global market for textiles in fashion & clothing for other sub-applications, 2018 - 2030 (Kilotons) (USD Billion)

47. Global market for textiles in other applications, 2018 - 2030 (Kilotons) (USD Billion)

48. North America textile market, 2018 - 2030 (Kilotons) (USD Billion)

49. North America textile market volume, by raw material, 2018 - 2030 (Kilotons)

50. North America textile market revenue, by raw material, 2018 - 2030 (USD Billion)

51. North America textile market volume, by product, 2018 - 2030 (Kilotons)

52. North America textile market revenue, by product, 2018 - 2030 (USD Billion)

53. North America textile market volume, by application, 2018 - 2030 (Kilotons)

54. North America textile market revenue, by application, 2018 - 2030 (USD Billion)

55. North America textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

56. North America textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

57. North America textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

58. North America textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

59. North America textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

60. North America textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

61. U.S. textile market, 2018 - 2030 (Kilotons) (USD Billion)

62. U.S. textile market volume, by raw material, 2018 - 2030 (Kilotons)

63. U.S. textile market revenue, by raw material, 2018 - 2030 (USD Billion)

64. U.S. textile market volume, by product, 2018 - 2030 (Kilotons)

65. U.S. textile market revenue, by product, 2018 - 2030 (USD Billion)

66. U.S. textile market volume, by application, 2018 - 2030 (Kilotons)

67. U.S. textile market revenue, by application, 2018 - 2030 (USD Billion)

68. U.S. textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

69. U.S. textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

70. U.S. textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

71. U.S. textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

72. U.S. textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

73. U.S. textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

74. Canada textile market, 2018 - 2030 (Kilotons) (USD Billion)

75. Canada textile market volume, by raw material, 2018 - 2030 (Kilotons)

76. Canada textile market revenue, by raw material, 2018 - 2030 (USD Billion)

77. Canada textile market volume, by product, 2018 - 2030 (Kilotons)

78. Canada textile market revenue, by product, 2018 - 2030 (USD Billion)

79. Canada textile market volume, by application, 2018 - 2030 (Kilotons)

80. Canada textile market revenue, by application, 2018 - 2030 (USD Billion)

81. Canada textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

82. Canada textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

83. Canada textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

84. Canada textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

85. Canada textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

86. Canada textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

87. Mexico textile market, 2018 - 2030 (Kilotons) (USD Billion)

88. Mexico textile market volume, by raw material, 2018 - 2030 (Kilotons)

89. Mexico textile market revenue, by raw material, 2018 - 2030 (USD Billion)

90. Mexico textile market volume, by product, 2018 - 2030 (Kilotons)

91. Mexico textile market revenue, by product, 2018 - 2030 (USD Billion)

92. Mexico textile market volume, by application, 2018 - 2030 (Kilotons)

93. Mexico textile market revenue, by application, 2018 - 2030 (USD Billion)

94. Mexico textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

95. Mexico textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

96. Mexico textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

97. Mexico textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

98. Mexico textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

99. Mexico textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

100. Europe textile market, 2018 - 2030 (Kilotons) (USD Billion)

101. Europe textile market volume, by raw material, 2018 - 2030 (Kilotons)

102. Europe textile market revenue, by raw material, 2018 - 2030 (USD Billion)

103. Europe textile market volume, by product, 2018 - 2030 (Kilotons)

104. Europe textile market revenue, by product, 2018 - 2030 (USD Billion)

105. Europe textile market volume, by application, 2018 - 2030 (Kilotons)

106. Europe textile market revenue, by application, 2018 - 2030 (USD Billion)

107. Europe textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

108. Europe textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

109. Europe textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

110. Europe textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

111. Europe textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

112. Europe textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

113. Russia textile market, 2018 - 2030 (Kilotons) (USD Billion)

114. Russia textile market volume, by raw material, 2018 - 2030 (Kilotons)

115. Russia textile market revenue, by raw material, 2018 - 2030 (USD Billion)

116. Russia textile market volume, by product, 2018 - 2030 (Kilotons)

117. Russia textile market revenue, by product, 2018 - 2030 (USD Billion)

118. Russia textile market volume, by application, 2018 - 2030 (Kilotons)

119. Russia textile market revenue, by application, 2018 - 2030 (USD Billion)

120. Russia textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

121. Russia textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

122. Russia textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

123. Russia textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

124. Russia textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

125. Russia textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

126. Germany textile market, 2018 - 2030 (Kilotons) (USD Billion)

127. Germany textile market volume, by raw material, 2018 - 2030 (Kilotons)

128. Germany textile market revenue, by raw material, 2018 - 2030 (USD Billion)

129. Germany textile market volume, by product, 2018 - 2030 (Kilotons)

130. Germany textile market revenue, by product, 2018 - 2030 (USD Billion)

131. Germany textile market volume, by application, 2018 - 2030 (Kilotons)

132. Germany textile market revenue, by application, 2018 - 2030 (USD Billion)

133. Germany textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

134. Germany textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

135. Germany textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

136. Germany textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

137. Germany textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

138. Germany textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

139. France textile market, 2018 - 2030 (Kilotons) (USD Billion)

140. France textile market volume, by raw material, 2018 - 2030 (Kilotons)

141. France textile market revenue, by raw material, 2018 - 2030 (USD Billion)

142. France textile market volume, by product, 2018 - 2030 (Kilotons)

143. France textile market revenue, by product, 2018 - 2030 (USD Billion)

144. France textile market volume, by application, 2018 - 2030 (Kilotons)

145. France textile market revenue, by application, 2018 - 2030 (USD Billion)

146. France textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

147. France textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

148. France textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

149. France textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

150. France textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

151. France textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

152. Turkey textile market, 2018 - 2030 (Kilotons) (USD Billion)

153. Turkey textile market volume, by raw material, 2018 - 2030 (Kilotons)

154. Turkey textile market revenue, by raw material, 2018 - 2030 (USD Billion)

155. Turkey textile market volume, by product, 2018 - 2030 (Kilotons)

156. Turkey textile market revenue, by product, 2018 - 2030 (USD Billion)

157. Turkey textile market volume, by application, 2018 - 2030 (Kilotons)

158. Turkey textile market revenue, by application, 2018 - 2030 (USD Billion)

159. Turkey textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

160. Turkey textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

161. Turkey textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

162. Turkey textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

163. Turkey textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

164. Turkey textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

165. Italy textile market, 2018 - 2030 (Kilotons) (USD Billion)

166. Italy textile market volume, by raw material, 2018 - 2030 (Kilotons)

167. Italy textile market revenue, by raw material, 2018 - 2030 (USD Billion)

168. Italy textile market volume, by product, 2018 - 2030 (Kilotons)

169. Italy textile market revenue, by product, 2018 - 2030 (USD Billion)

170. Italy textile market volume, by application, 2018 - 2030 (Kilotons)

171. Italy textile market revenue, by application, 2018 - 2030 (USD Billion)

172. Italy textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

173. Italy textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

174. Italy textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

175. Italy textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

176. Italy textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

177. Italy textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

178. U.K. textile market, 2018 - 2030 (Kilotons) (USD Billion)

179. U.K. textile market volume, by raw material, 2018 - 2030 (Kilotons)

180. U.K. textile market revenue, by raw material, 2018 - 2030 (USD Billion)

181. U.K. textile market volume, by product, 2018 - 2030 (Kilotons)

182. U.K. textile market revenue, by product, 2018 - 2030 (USD Billion)

183. U.K. textile market volume, by application, 2018 - 2030 (Kilotons)

184. U.K. textile market revenue, by application, 2018 - 2030 (USD Billion)

185. U.K. textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

186. U.K. textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

187. U.K. textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

188. U.K. textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

189. U.K. textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

190. U.K. textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

191. Asia Pacific textile market, 2018 - 2030 (Kilotons) (USD Billion)

192. Asia Pacific textile market volume, by raw material, 2018 - 2030 (Kilotons)

193. Asia Pacific textile market revenue, by raw material, 2018 - 2030 (USD Billion)

194. Asia Pacific textile market volume, by product, 2018 - 2030 (Kilotons)

195. Asia Pacific textile market revenue, by product, 2018 - 2030 (USD Billion)

196. Asia Pacific textile market volume, by application, 2018 - 2030 (Kilotons)

197. Asia Pacific textile market revenue, by application, 2018 - 2030 (USD Billion)

198. Asia Pacific textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

199. Asia Pacific textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

200. Asia Pacific textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

201. Asia Pacific textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

202. Asia Pacific textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

203. Asia Pacific textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

204. China textile market, 2018 - 2030 (Kilotons) (USD Billion)

205. China textile market volume, by raw material, 2018 - 2030 (Kilotons)

206. China textile market revenue, by raw material, 2018 - 2030 (USD Billion)

207. China textile market volume, by product, 2018 - 2030 (Kilotons)

208. China textile market revenue, by product, 2018 - 2030 (USD Billion)

209. China textile market volume, by application, 2018 - 2030 (Kilotons)

210. China textile market revenue, by application, 2018 - 2030 (USD Billion)

211. China textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

212. China textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

213. China textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

214. China textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

215. China textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

216. China textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

217. India textile market, 2018 - 2030 (Kilotons) (USD Billion)

218. India textile market volume, by raw material, 2018 - 2030 (Kilotons)

219. India textile market revenue, by raw material, 2018 - 2030 (USD Billion)

220. India textile market volume, by product, 2018 - 2030 (Kilotons)

221. India textile market revenue, by product, 2018 - 2030 (USD Billion)

222. India textile market volume, by application, 2018 - 2030 (Kilotons)

223. India textile market revenue, by application, 2018 - 2030 (USD Billion)

224. India textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

225. India textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

226. India textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

227. India textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

228. India textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

229. India textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

230. Japan textile market, 2018 - 2030 (Kilotons) (USD Billion)

231. Japan textile market volume, by raw material, 2018 - 2030 (Kilotons)

232. Japan textile market revenue, by raw material, 2018 - 2030 (USD Billion)

233. Japan textile market volume, by product, 2018 - 2030 (Kilotons)

234. Japan textile market revenue, by product, 2018 - 2030 (USD Billion)

235. Japan textile market volume, by application, 2018 - 2030 (Kilotons)

236. Japan textile market revenue, by application, 2018 - 2030 (USD Billion)

237. Japan textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

238. Japan textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

239. Japan textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

240. Japan textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

241. Japan textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

242. Japan textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

243. Australia textile market, 2018 - 2030 (Kilotons) (USD Billion)

244. Australia textile market volume, by raw material, 2018 - 2030 (Kilotons)

245. Australia textile market revenue, by raw material, 2018 - 2030 (USD Billion)

246. Australia textile market volume, by product, 2018 - 2030 (Kilotons)

247. Australia textile market revenue, by product, 2018 - 2030 (USD Billion)

248. Australia textile market volume, by application, 2018 - 2030 (Kilotons)

249. Australia textile market revenue, by application, 2018 - 2030 (USD Billion)

250. Australia textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

251. Australia textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

252. Australia textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

253. Australia textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

254. Australia textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

255. Australia textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

256. Central & South America textile market, 2018 - 2030 (Kilotons) (USD Billion)

257. Central & South America textile market volume, by raw material, 2018 - 2030 (Kilotons)

258. Central & South America textile market revenue, by raw material, 2018 - 2030 (USD Billion)

259. Central & South America textile market volume, by product, 2018 - 2030 (Kilotons)

260. Central & South America textile market revenue, by product, 2018 - 2030 (USD Billion)

261. Central & South America textile market volume, by application, 2018 - 2030 (Kilotons)

262. Central & South America textile market revenue, by application, 2018 - 2030 (USD Billion)

263. Central & South America textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

264. Central & South America textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

265. Central & South America textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

266. Central & South America textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

267. Central & South America textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

268. Central & South America textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

269. Brazil textile market, 2018 - 2030 (Kilotons) (USD Billion)

270. Brazil textile market volume, by raw material, 2018 - 2030 (Kilotons)

271. Brazil textile market revenue, by raw material, 2018 - 2030 (USD Billion)

272. Brazil textile market volume, by product, 2018 - 2030 (Kilotons)

273. Brazil textile market revenue, by product, 2018 - 2030 (USD Billion)

274. Brazil textile market volume, by application, 2018 - 2030 (Kilotons)

275. Brazil textile market revenue, by application, 2018 - 2030 (USD Billion)

276. Brazil textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

277. Brazil textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

278. Brazil textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

279. Brazil textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

280. Brazil textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

281. Brazil textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

282. Middle East & Africa textile market, 2018 - 2030 (Kilotons) (USD Billion)

283. Middle East & Africa textile market volume, by raw material, 2018 - 2030 (Kilotons)

284. Middle East & Africa textile market revenue, by raw material, 2018 - 2030 (USD Billion)

285. Middle East & Africa textile market volume, by product, 2018 - 2030 (Kilotons)

286. Middle East & Africa textile market revenue, by product, 2018 - 2030 (USD Billion)

287. Middle East & Africa textile market volume, by application, 2018 - 2030 (Kilotons)

288. Middle East & Africa textile market revenue, by application, 2018 - 2030 (USD Billion)

289. Middle East & Africa textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

290. Middle East & Africa textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

291. Middle East & Africa textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

292. Middle East & Africa textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

293. Middle East & Africa textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

294. Middle East & Africa textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

295. Saudi Arabia textile market, 2018 - 2030 (Kilotons) (USD Billion)

296. Saudi Arabia textile market volume, by raw material, 2018 - 2030 (Kilotons)

297. Saudi Arabia textile market revenue, by raw material, 2018 - 2030 (USD Billion)

298. Saudi Arabia textile market volume, by product, 2018 - 2030 (Kilotons)

299. Saudi Arabia textile market revenue, by product, 2018 - 2030 (USD Billion)

300. Saudi Arabia textile market volume, by application, 2018 - 2030 (Kilotons)

301. Saudi Arabia textile market revenue, by application, 2018 - 2030 (USD Billion)

302. Saudi Arabia textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

303. Saudi Arabia textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

304. Saudi Arabia textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

305. Saudi Arabia textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

306. Saudi Arabia textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

307. Saudi Arabia textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

308. Iran textile market, 2018 - 2030 (Kilotons) (USD Billion)

309. Iran textile market volume, by raw material, 2018 - 2030 (Kilotons)

310. Iran textile market revenue, by raw material, 2018 - 2030 (USD Billion)

311. Iran textile market volume, by product, 2018 - 2030 (Kilotons)

312. Iran textile market revenue, by product, 2018 - 2030 (USD Billion)

313. Iran textile market volume, by application, 2018 - 2030 (Kilotons)

314. Iran textile market revenue, by application, 2018 - 2030 (USD Billion)

315. Iran textile market volume in household, by sub-application, 2018 - 2030 (Kilotons)

316. Iran textile market revenue in household, by sub-application, 2018 - 2030 (USD Billion)

317. Iran textile market volume in technical, by sub-application, 2018 - 2030 (Kilotons)

318. Iran textile market revenue in technical, by sub-application, 2018 - 2030 (USD Billion)

319. Iran textile market volume in fashion & clothing, by sub-application, 2018 - 2030 (Kilotons)

320. Iran textile market revenue in fashion & clothing, by sub-application, 2018 - 2030 (USD Billion)

321. Company ranking analysis

322. Global textile market vendor landscape

List of Figures

1. Textile Market Segmentation

2. Penetration and growth prospect mapping (Kilotons) (USD Billion)

3. Value Chain Analysis

4. Market Dynamics

5. Market Drivers

6. Market Restraints

7. Global personal protective equipment market, 2018 - 2030 (USD Billion)

8. Global automobile production, 2016 - 2019 (Billion Units)

9. Construction industry growth in Asia Pacific, 2016 - 2027

10. U.S. construction industry, 2016 - 2019 (USD Billion)

11. Textile Market - Porter’s Five Forces Model

12. PESTEL Analysis

13. Textile market: Raw material movement analysis

14. Textile market: Product movement analysis

15. Textile market: Application movement analysis

16. Textile Market Regional Overview

17. North America Textile Market Regional Overview

18. Europe Textile Market Regional Overview

19. Asia Pacific Textile Market Regional Overview

20. CSA Textile Market Regional Overview

21. MEA Textile Market Regional Overview

22. Competitive environment

23. Strategy FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Textile Market Raw-material Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

- Cotton

- Chemical

- Wool

- Silk

- Others

- Textile Market Product Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

- Natural fibers

- Polyesters

- Nylon

- Others

- Textile Market Application Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

- Household

- Bedding

- Kitchen

- Upholstery

- Towel

- others

- Technical

- Construction

- Transport

- Medical

- protective

- Fashion & Clothing

- Apparel

- Ties & Clothing accessories

- Handbags

- Others

- Others

- Household