- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermoformed Plastic Market Size And Share Report, 2030GVR Report cover

![Thermoformed Plastics Market Size, Share & Trends Report]()

Thermoformed Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Process, By Application (Healthcare, Food Packaging, Electrical & Electronics, Automotive, Construction, Consumer Goods), And Segment Forecasts

- Report ID: GVR-1-68038-474-1

- Number of Report Pages: 128

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermoformed Plastic Market Summary

The global thermoformed plastic market size was estimated at USD 14.79 billion in 2023 and is projected to reach USD 20.66 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. Globally, increasing demand in healthcare and pharmaceutical packaging sector is projected to be a key factor driving market growth over the forecast period.

Key Market Trends & Insights

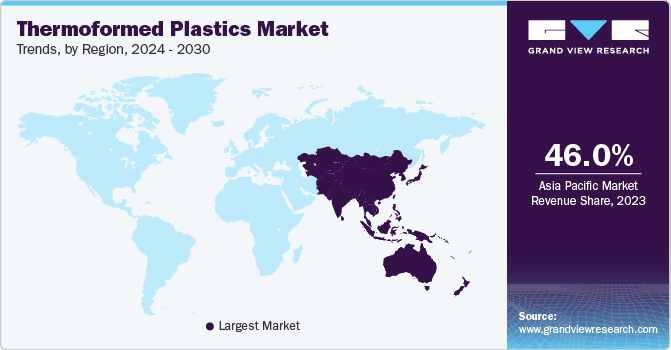

- Asia Pacific dominated the global market with a share of around 46.0% in terms of revenue in 2023.

- By product, polypropylene dominated the product segment in 2023, with a revenue share of over 21.0%.

- By process, the thin gauge thermoformed plastic segment dominated the market in 2023 with more than 35.0% revenue share.

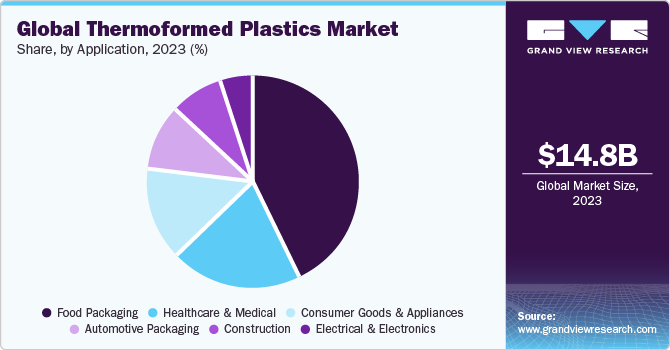

- By application, food packaging was the leading application segment in 2023 with over 42% revenue share.

Market Size & Forecast

- 2023 Market Size: USD 14.79 Billion

- 2030 Projected Market Size: USD 20.66 Billion

- CAGR (2024-2030): 4.9%

- Asia Pacific: Largest market in 2023

The thermoforming process involves the fabrication of plastic sheets heating them, to convert them into a bendable form that can be molded into the desired shape as per the customer’s specifications. In recent developments, thermoformed plastics are used as metal replacements using a heavy gauge process which provides applications in industries such as transportation, industrial equipment, aerospace, kiosks, and medical devices.In the medical industry, thermoformed plastics are used in the manufacturing of diagnostic systems, accessories, and medical plants. Thermoforming includes a manufacturing process of converting a two-dimensional thermo-polymer into a three-dimensional shape. In the pharmaceutical industry, thermoformed plastic is used for products such as prefilled syringes, pharmaceutical bottles, and medical electronics as well as for capsules and tablet packaging such as blister packaging.

Thermoformed plastics are widely used to produce lightweight vehicles due to their properties such as lightweight, durability, and strength. The growing automotive industry, coupled with the regulations favoring light vehicle usage, is expected to benefit the thermoformed plastics demand across the globe. However, volatile raw material costs associated with thermoformed plastics are anticipated to pose hindrances in terms of profitability.

In 2023, food packaging dominated the application segment of the thermoformed plastic market. The growing demand for packaged mineral water, milk, carbonated drinks, and fruit juice is projected to boost the growth. In addition, a large number of consumers are moving from unpacked to packaged food items propelling the growth. In addition, increasing retail store businesses such as convenience stores, hypermarkets, and supermarkets are projected to propel the food packaging industry, which is expected to fuel the demand for thermoformed plastics.

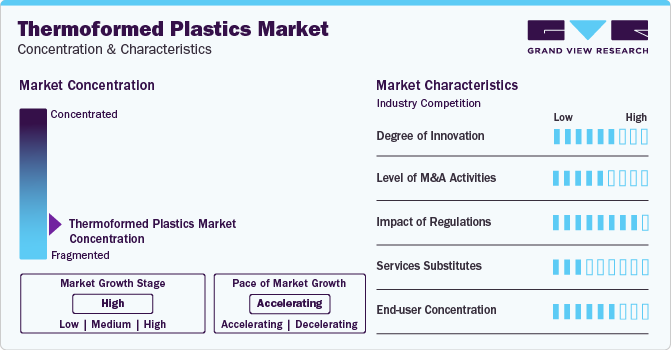

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is moderately competitive owing to the presence of a large number of players operating in the thermoformed plastics market. The competition in the market is based on the product quality offered and the technology used by the manufacturers to produce thermoformed plastics. Major players compete based on application development capability and form strategic partnerships with regional players to minimize the risk of expanding into a new marketplace.

Global thermoformed plastic manufacturers are engaged in mergers and acquisitions to increase their market share. For instance, in January 2023, Lacerta Group, a provider of thermoformed packaging services, acquired all of the assets of Portage Plastics Corp. and PPC Investments LLC. Based in Portage, Wisconsin, Portage Plastics produces thermoformed packaging products. With this acquisition, Lacerta Group aims to invest to grow capacity and establish a strong workforce in this location.

The market for thermoformed plastics is expected to witness a moderate threat of substitutes owing to the presence of various materials such as glass, aluminum, and steel. Glass is anticipated to be a major substitute to thermoformed plastics in the building & construction industry due to the absence of harmful chemicals compared to plastics. In addition, metals such as aluminum and steel also pose a threat to thermoformed plastics owing to their superior characteristics, including high resistance and enhanced strength. These aforementioned plastics are anticipated to fuel the demand for metals in various end-use industries during the forecast period.

Product Insights

Polypropylene dominated the product segment in 2023, with a revenue share of over 21.0%. This trend is expected to continue through the forecast period. Commonly used resins in thermoformed plastic production include polyethylene (PE), polystyrene (PS), and polypropylene (PP).

PP is a thermoplastic polymer and is widely used to produce food packaging products such as cups, trays, margarine tubs, sandwich packs, disposable products, beverage glasses, and microwaveable containers. A growing number of manufacturers using polypropylene for packaging products would subsequently drive the overall demand for thermoformed plastics.

Polymethyl methacrylate (PMMA) is expected to register the highest CAGR over the forecast period. This is attributed to the advantages it offers, such as light transmission, high surface hardness, and extended service life, along with certain properties such as high resistance to weathering and UV light. It is also completely recyclable and is hence environment-friendly, further driving the segment growth.

Increasing innovations, product developments, and investments in PMMA have been observed, particularly in the Middle Eastern region. For instance, Mitsubishi Rayon and SABIC announced a new joint venture for building a PMMA plant in Saudi Arabia. Key industry players that account for a major share of the overall manufacturing of PMMA include Mitsubishi Rayon Co. Ltd, Evonik Industries AG, and Altuglas International.

Process Insights

The thin gauge thermoformed plastic segment dominated the market in 2023 with more than 35.0% revenue share and is expected to remain the largest process segment through the forecast period. Thermoformed plastics are manufactured through contact, radiant, and hot air heating techniques. Increasing demand for thin gauge thermoformed plastics for products such as medical device packaging trays in the healthcare sector is anticipated to drive the segment’s growth over the forecast period.

Thick gauge thermoforms are sturdy and rigid enclosures that are used to pack electronic equipment. Thick gauge thermoformed plastics are used in a wide range of applications including front and rear bumpers and interior trim components in the heavy trucks industry. They are also used in enclosures for treadmills and weights in fitness equipment; large decorative signs in signage; cowlings, dash components, and fenders in the agricultural sector; and cab interiors & engine covers in the construction equipment industry.

Plug-assist forming is projected to be the fastest-growing process segment over the forecast period. The rising use of plug assist forming products in food packaging is projected to boost the market growth. Packaging materials formed using this method have a uniform wall thickness with a reduced starting gauge and hence help protect the product within the packaging.

AMUT Group manufactured a thermoforming machine whose properties include servo-driven plug assist on lower and upper mold platens, good mold clamping and cutting force performance, and various heat oven configurations. This machine is designed to handle materials such as PVC, PLA, PP, EPS, PS, HIPS, OPS, CPET, RPET, APET, and PET.

Application Insights

Food packaging was the leading application segment in 2023 with over 42% revenue share. Thermoformed plastics are widely used in the food industry for the packaging of fruits, vegetables; confectionery products; meat, poultry, and fish; and prepared meals. Thermoformed plastic packaging is also suitable for use in the medical and healthcare sector as it comprises a range of materials that help enhance the appearance of the final product. Also, food packaging requires high-quality packaging materials to ensure the protection from moisture, odor, and bacteria provided by thermoplastics, their demand in the food industry is very high. Packaging products used in the healthcare and medical sector include medical devices, medical trays, procedure trays, pharmaceutical packaging, and protective packaging.

Automotive is projected to be the fastest-growing application segment over the forecast period. Thermoformed plastics are preferred for electric vehicles as they are durable and lightweight. Increasing demand for automotive panels, liners, and vehicle parts is further expected to drive the segment growth over the forecast period. The University of Delaware Center for Composite Materials (UD-CCM), in partnership with the National Center for Manufacturing Sciences (NCMS), effectively designed a product to meet structural and crash safety requirements using thermoplastic composites.

Regional Insights

Asia Pacific dominated the global market with a share of around 46.0% in terms of revenue in 2023. Rapid industrialization and advancements in the packaging industry are projected to drive the growth over the forecast period. The growing number of manufacturers and suppliers of thermoformed plastic products in this region is further expected to drive the regional market’s growth.

Asia Pacific is expected to be the fastest-growing regional market over the forecast period. Emerging economies in the region such as India and China have been experiencing strong economic growth. China is the largest producer and supplier of thermoformed plastic equipment using various types of technologies in this region. Rapid urbanization and increasing per capita disposable income are projected to drive thermoformed plastic market in China. In addition, the growth of the automotive market and the subsequent demand for lightweight components to improve the efficiency of the vehicle are anticipated to drive the regional demand for thermoformed plastics.

Key Companies & Market Share Insights

The global players face intense competition from each other and regional players who have strong distribution networks and good knowledge about suppliers and regulations. To overcome these challenges, in October 2021, Placon purchased Sonoco Products Company’s production facility in Wilson, North Carolina to increase its production capacity to meet the growing demand for sustainable packaging products.

The market competition is based on the product quality offered and the technology used for the production of thermoformed plastics by the manufacturers. Major players compete based on the application development capability and form strategic partnerships with regional players to minimize the risk of expanding into a new marketplace. Global manufacturers are investing in technology to increase their market offerings, giving them a competitive edge over the other players.

-

In April 2023, Greiner Packaging GmbH developed thin-walled plastic cups with thermoformed plastics as a processing method in cooperation with Engel and Brink BV. These cups are lightweight since they are made with r-PET material, thus contributing towards sustainable packaging.

-

In December 2022, Placon Corporation launched Crystal Seal Cravings product which is an innovative thermoformed packaging solution. This is made with recycled PET material that will keep all kinds of food items safe, thus meeting the requirement of sustainability goals.

Key Thermoformed Plastic Companies:

The following are the leading companies in the thermoformed plastics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these thermoformed plastics companies are analyzed to map the supply network.

- Pactiv LLC

- Genpak LLC

- Sonoco Products Company

- CM Packaging

- Placon Corporation

- Anchor Packaging LLC

- Brentwood Industries

- Greiner Packaging GmbH

- Dongguan Ditai Plastic Products Co., Ltd

- Palram Americas Ltd.

Thermoformed Plastic Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.51 billion

Revenue forecast in 2030

USD 20.66 billion

Growth Rate

CAGR of 4.9% from 2024 to 2030

Historical data

2019 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilo tons, revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, process, application, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Saudi Arabia; UAE; South Africa; Brazil; Argentina

Key companies profiled

Pactiv LLC; Genpak LLC; Sonoco Products Company; CM Packaging; Placon Corporation; Anchor Packaging LLC; Brentwood Industries; Greiner Packaging GmbH; Dongguan Ditai Plastic Products Co., Ltd; Palram Americas Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

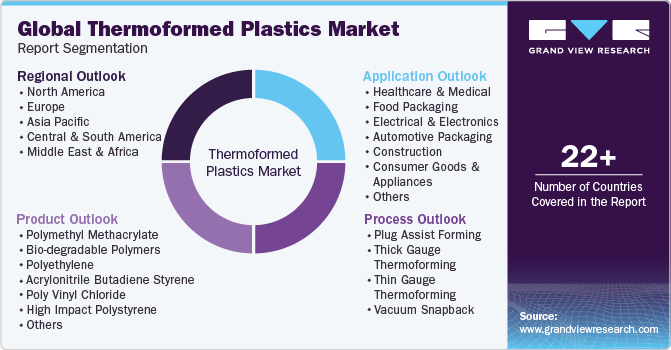

Global Thermoformed Plastic Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global thermoformed plastics market on the basis of product, process, application, and region:

-

Product Outlook (Volume, KiloTons; Revenue, USD Billion, 2019 - 2030)

-

Polymethyl Methacrylate (PMMA)

-

Bio-degradable polymers

-

Polyethylene (PE)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Poly Vinyl Chloride (PVC)

-

High Impact Polystyrene (HIPS)

-

Polystyrene (PS)

-

Polypropylene (PP)

-

-

Process Outlook (Volume, KiloTons; Revenue, USD Billion, 2019 - 2030)

-

Plug assist forming

-

Thick gauge thermoforming

-

Thin gauge thermoforming

-

Vacuum snapback

-

-

Application Outlook (Volume, KiloTons; Revenue, USD Billion, 2019 - 2030)

-

Healthcare & medical

-

Food packaging

-

Electrical & electronics

-

Automotive packaging

-

Construction

-

Consumer goods & appliances

-

Others

-

-

Regional Outlook (Volume, KiloTons; Revenue, USD Billion, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global thermoformed plastic market size was estimated at USD 14.10 billion in 2022 and is expected to reach USD 14.79 billion in 2023.

b. The global thermoformed plastics market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 20.66 billion by 2030.

b. The polypropylene segment dominated the thermoformed plastic market with a share of 21.9% in 2022. Polypropylene is a thermoplastic polymer and is widely used to produce food packaging products such as cups, tubs, trays, and others.

b. Some key players operating in the thermoformed plastic market include Pactiv LLC, D&W Fine Pack LLC, Genpak LLC, and Sonoco Plastics, Placon Corporation, Anchor Packaging, Spencer Industries, Brentwood Industries, Greiner Packaging, and Silgan Plastics.

b. Key factors that are driving the market growth include increasing demand from the healthcare and pharmaceutical sectors and growing utilization as a metal replacement using the heavy gauge process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.