- Home

- »

- Biotechnology

- »

-

Tissue Clearing Market Size, Share & Growth Report, 2030GVR Report cover

![Tissue Clearing Market Size, Share & Trends Report]()

Tissue Clearing Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Kits & Reagents, Services), By Tissue Type (Soft Tissue, Hard Tissue), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-113-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

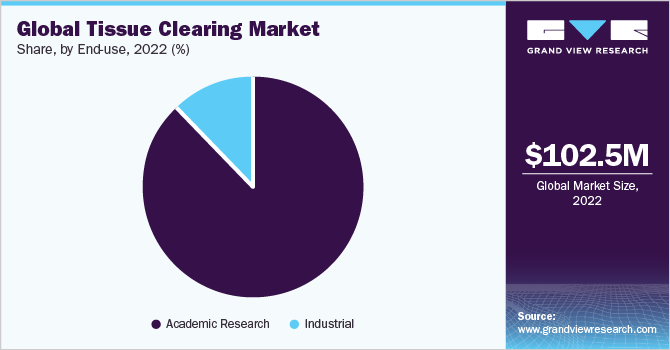

The global tissue clearing market size was valued at USD 102.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.24% from 2023 to 2030. The growing demand for R&D initiatives for various drug development activities in the fields of neuroscience & cancer, growing 3D histology adoption, and emerging advancements in clearing reagents, imaging systems, & analysis software are driving the growth of the tissue clearing market. In addition, the growing demand for reagents for rapid and efficient clearing of tissues with minimal changes in tissue morphology is anticipated to boost the market.

The tissue clearing market experienced significant disruptions due to the COVID-19 pandemic, as research institutions faced closures or limited operations, supply chains were strained, funding priorities shifted towards pandemic-related efforts, collaborative research was hindered by travel restrictions, and technology adoption was challenged by remote work. For instance, a prominent neurobiology laboratory working on a breakthrough tissue-clearing technique had to halt its experiments for several months due to lockdowns. Thus, the COVID-19 pandemic negatively impacted the market in 2020. However, with reduction in restrictions and increased focus on research and development activities in 2021, the market witnessed a rapid recovery in demand for tissue clearing products in the year.

Furthermore, tissue clearing techniques empower researchers to identify and validate drug targets, understand mechanisms of action, assess drug toxicity, optimize dosing regimens, and develop personalized therapies. These techniques are particularly transformative in neurological disorders and cancer research, where understanding intricate tissue structures is essential. Collaborative efforts between academia and industry are driving the adoption of tissue clearing, propelling advancements in drug discovery and development, ultimately leading to more effective and targeted treatments for a wide range of diseases. For instance, according to an article published in the Cell Journal in August 2023, a team of scientists unveiled that skull’s bone marrow is found to protect individuals against neurological diseases. Thus, due to the pivotal role played by tissue clearing in revolutionizing drug development R&D, the market is expected to witness lucrative growth in the near future.

In addition, imaging systems coupled with innovative tissue-clearing techniques, are enabling researchers to visualize intricate three-dimensional structures within biological tissues, unraveling previously hidden details and spatial relationships. With applications spanning neuroscience, developmental biology, and disease research, these imaging systems are fostering breakthroughs in understanding complex biological processes and interactions, propelling scientific discovery, and pushing the boundaries of biomedical knowledge. For instance, according to an article published in March 2022 , the introduction of HYBRiD (hydrogel-based reinforcement of three-dimensional imaging solvent-cleared organs), is a novel approach that combines elements from both polymer-based and organic clearing procedures. The progress in solvent- and polymer-based brain-clearing methods has significantly enhanced our capacity to observe the three-dimensional structure of the mammalian neurological system. Hence, the increasing adoption of imaging systems combined with tissue-clearing procedures is anticipated to propel the growth of the market.

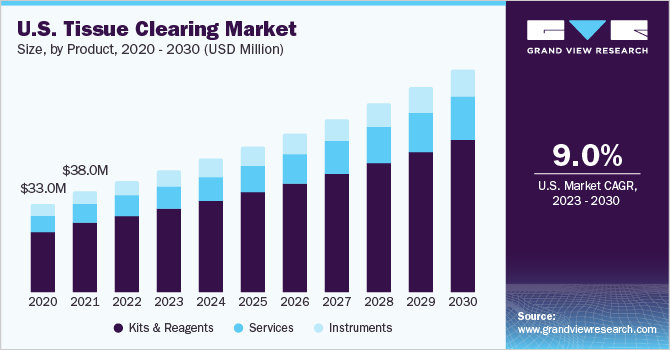

Product Insights

On the basis of product, kits & reagents accounted for the largest market share of 68.64% in 2022. Increase in strategic initiatives undertaken by various market players is a major factor anticipated to propel the segment growth in the near future. For instance, in August 2020, Corning Incorporated introduced the 3D Clear Tissue Clearing Reagent, enabling swift and non-destructive 3D imaging of tissues within cell cultures. Developed and supplied by Visikol, this solution is now purchasable through Corning. It further enriches Corning's collection of 3D cell culture offerings by providing an effective method for imaging tissues while preserving their inherent cellular structure. Launch of such reagents for tissue clearing is expected to boost their adoption in the near future for biomedical and neuroscience applications.

The services segment is expected to grow at the fastest CAGR of 10.44% from 2023 to 2030. The rise in the number of market players that provide tissue-clearing services is one of the major factors driving segment growth in the near future. LifeCanvas Technologies provides a range of services including tissue clearing, light sheet microscopy, and quantitative image analysis. Moreover, according to the press release by Carnegie Mellon University in January 2023, Zhao's Biophotonics Lab, which is a U.S. based lab, is actively engaged in the field of enhancing super-resolution imaging of biological samples. They achieve this by using expansion microscopy, a technique that involves physically expanding samples. This is done by embedding the samples in a hydrogel that can expand uniformly. As a result, the increased space between molecules enables better observation and higher resolution. Thus anticipated to boost the segment growth over the period of time.

Tissue Type Insights

On the basis of tissue type, soft tissues accounted for the larger market share of 81.71% in 2022 and is anticipated to grow at the fastest CAGR over the forecast period. Soft tissue clearing techniques enable researchers to use advanced imaging methods like confocal microscopy, light-sheet microscopy, and two-photon microscopy to examine intricate structures within tissues. This has led to breakthroughs in understanding complex biological systems. Moreover, soft tissue clearing techniques often allow researchers to image tissues without destroying or sectioning the tissue. These factors are projected to boost the segment growth.

The hard tissue segment is expected to grow at a significant growth rate over the forecast period. With increasing demand for detailed understanding of the interactions within hard tissues, particularly in fields like pharmaceuticals and biotechnology, various organizations are adopting tissue-clearing methods. This is expected to increase the potential applications of the technique in research and development processes for new drugs which is anticipated to drive the segment in the near future.

Application Insights

Neurology application held the largest market share of 36.30% in 2022. This can be attributed to the surging demand for tissue-clearing products, which is driven by rising research and development activities within the field of neuroscience. Moreover, the growing incidence of neurological disorders worldwide has amplified the need for potential treatments and management strategies, thereby fueling the requirement for tissue-clearing products for neuroscience research. These factors are anticipated to propel the growth of the segment over the forecast period.

The oncology segment is expected to grow at the fastest CAGR of 10.54% from 2023 to 2030. The rising incidence of cancer has propelled the growth of innovative treatments, consequently driving the demand for tissue clearing in oncology research. According to World Cancer Research Fund International, approximately 18.1 million cases of cancer were reported globally in 2020, with 9.3 million occurring in males and 8.8 million in females. Moreover, according to the American Cancer Society , as the second leading global cause of mortality, cancer was responsible for approximately 10 million deaths in the year 2020. Hence, the segment is anticipated to grow at a rapid rate over the forecast period.

End-use Insights

Academic research accounted for the larger market share of 87.62% in 2022. This can be attributed to the significant demand for tissue clearing products within the expanding scope of R&D activities conducted in research institutes. Moreover, the rise in public-private collaborations and investments aimed at establishing new research institutes is projected to be a prominent driving force behind the growth of this segment.

The industrial segment is expected to grow at a significant CAGR during the forecast period. The increasing recognition of tissue-clearing techniques as indispensable tools for facilitating advanced visualization and analysis of biological structures is driving segment growth. Due to a growing need for a better understanding of how tissues interact in pharmaceuticals and biotechnology, businesses are ready to use tissue-clearing techniques. Thus, this is anticipated to speed up drug research, and development, as well as bring significant advancements to the field.

Regional Insights

North America held the largest share of 44.47% of the global market in 2022. The dominant market share is primarily due to the robust U.S. biotechnology and biopharmaceutical industry, driving the demand for tissue clearing solutions for research and diagnostics. Growth in R&D efforts and growing public-private investments in neuroscience and cancer also strengthen demand, contributing to market growth. Continuous advancements in tissue clearing and imaging, coupled with affordable adoption of innovative systems solidify the U.S. as the world's most lucrative market.

The Asia Pacific market is anticipated to grow at fastest CAGR of 11.50% from 2023 to 2030. This trend is mainly due to rapid growth in emerging economies' biopharmaceutical sectors, like China and India. Robust government backing for biotechnology in these nations also fuels market expansion. Continuous R&D investments in tissue research, neuroscience, and cancer further boost demand for tissue clearing products. For instance, in August 2023, NSW Government Australia announced an investment of USD 2 million which would support Motor Neurone Disease (MND) research within New South Wales. Approximately eight out of every 100,000 individuals in Australia are believed to be impacted by MND. Hence, such initiatives are anticipated to increase the adoption of tissue clearing solutions in the Asia Pacific region.

Key Companies & Market Share Insights

Market leaders are involved in extensive R&D for manufacturing cost-efficient and technologically advanced products. Several strategies, such as mergers & acquisitions, undertaken by these organizations to expand their market presence are anticipated to create significant growth opportunities over the forecast period. For instance, in August 2023 , MatTek and Visikol announced their official commercial integration under the MatTek name. The combined efforts of these two companies would result in the marketplace's most extensive array of advanced cell culture models and services, contributing significantly to the evolution of micro-physiological systems. Such strategic initiatives by organizations are anticipated to propel the growth of the market over a period of time. Some of the key players operating in the global tissue clearing market include:

-

Logos Biosystems

-

Visikol, Inc.

-

LifeCanvas Technologies

-

Miltenyi Biotec

-

Bio-Techne

-

Abcam plc

-

ClearLight Biotechnologies, Inc.

-

FUJIFILM Corporation

-

Thermo Fisher Scientific, Inc.

-

Corning Incorporated

Tissue Clearing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 111.3 million

Revenue forecast in 2030

USD 206.6 million

Growth rate

CAGR of 9.24% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, tissue type, application, end-use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Norway, Sweden, Denmark, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Logos Biosystems; Visikol Inc.; LifeCanvas Technologies; Miltenyi Biotec; Bio-Techne; Abcam plc; ClearLight Biotechnologies, Inc.; FUJIFILM Corporation; Thermo Fisher Scientific, Inc.; Corning Incorporated.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tissue Clearing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tissue clearing market based on product, tissue type, application, end-use, and region:

-

Product Outlook (USD Million; 2018 - 2030)

-

Instruments

-

Kits & Reagents

-

Services

-

-

Tissue Type Outlook (USD Million; 2018 - 2030)

-

Soft Tissue

-

Hard Tissue

-

-

Application Outlook (USD Million; 2018 - 2030)

-

Neurology

-

Oncology

-

Cardiology

-

Others

-

-

End-use Outlook (USD Million; 2018 - 2030)

-

Academic Research

-

Industrial

-

-

Regional Outlook (USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tissue clearing market size was estimated at USD 102.5 million in 2022 and is expected to reach USD 111.3 million in 2023

b. The global tissue clearing market is expected to grow at a compound annual growth rate of 9.24% from 2023 to 2030 to reach USD 206.6 million by 2030.

b. North America dominated the tissue clearing market with the highest share of 44.47% in 2022. This is attributable to increasing R&D activities in the bio-pharmaceutical sector and the presence of major players in the region.

b. Some key players operating in the tissue clearing market include Logos Biosystems; Visikol, Inc.; LifeCanvas Technologies; Miltenyi Biotec; Bio-Techne; Abcam plc; ClearLight Biotechnologies, Inc.; FUJIFILM Corporation; Thermo Fisher Scientific, Inc.; Corning Incorporated

b. Key factors driving the tissue clearing market growth include the growing demand for R&D initiatives for various drug development activities in the fields of neuroscience & cancer, growing 3D histology adoption, and emerging advancements in clearing reagents, imaging systems, and analysis software.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.