- Home

- »

- Medical Devices

- »

-

Tracheostomy Tubes Market Size And Share Report, 2030GVR Report cover

![Tracheostomy Tubes Market Size, Share & Trends Report]()

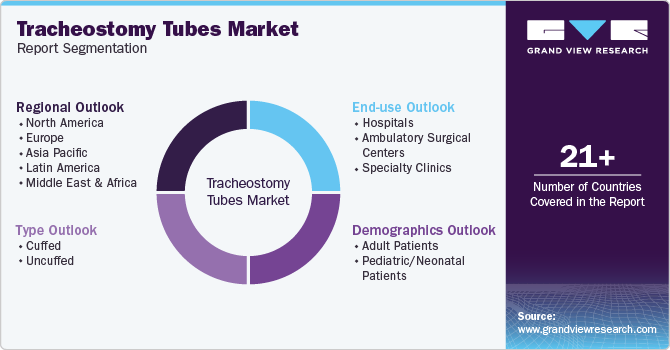

Tracheostomy Tubes Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Cuffed, Uncuffed), By Demographics (Adult Patients, Pediatric/Neonatal Patients), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-322-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tracheostomy Tubes Market Size & Trends

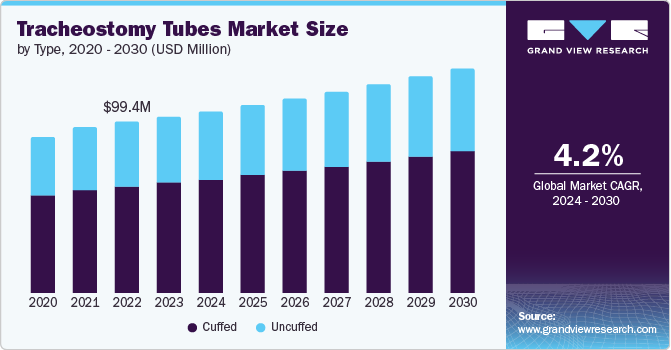

The global tracheostomy tubes market size was estimated at USD 103.1 million in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. Increasing prevalence of respiratory diseases and conditions requiring prolonged mechanical ventilation, such as chronic obstructive pulmonary disease (COPD) and sleep apnea, significantly boost demand. Technological advancements in tracheostomy tube design, improving patient comfort and ease of use, further stimulate market growth. Additionally, the aging global population and rising incidence of chronic illnesses necessitate more tracheostomies. Enhanced healthcare infrastructure in emerging economies and growing awareness about advanced medical treatments also contribute to market expansion.

The rising frequency of tobacco smoking and poor air quality, particularly in middle-income nations, are key factors contributing to a rise in COPD prevalence, resulting in an increased demand for tracheostomy tubes. For instance, according to WHO data published in November 2023, smoking is a leading cause of COPD, a common lung disease affecting 392 million people globally and causing over 3 million deaths annually. In high-income countries, smoking accounts for over 70% of COPD cases, while in low- and middle-income countries, it accounts for 30-40%, with household air pollution as another major risk factor. Three-quarters of COPD patients live in low- and middle-income countries. Some of the expressions that support our findings are,

“As well as being a major cause of long-term disability, COPD is the third commonest cause of death worldwide. COPD due to smoking remains a major problem globally and there is a growing epidemic of smokers in low- and middle-income countries as tobacco companies actively seek new customers. Around 80% of the world's 1.3 billion tobacco users now live in LMIC. This will undoubtedly lead to an enormous increase in the global burden of COPD in the coming decades. We must act now to reduce smoking rates, to ensure people with COPD are diagnosed as early as possible and to ensure all patients around the world receive effective therapy.”

- Prof. David MG Halpin, Consultant Physician & Professor of Respiratory Medicine, Member of GOLD Board of Directors and the Forum of International Respiratory Societies.

“The scale of morbidity and mortality relating to COPD is a huge concern. We must prioritize smoking cessation, as well as inhalers and pulmonary rehabilitation. Sadly, inequities in access to diagnosis and treatment persist. We need to accelerate efforts to integrate COPD care into primary care in low- and middle-income countries where three quarters of people with COPD live.”

- Dr Bente Mikkelsen, WHO Director of Noncommunicable Diseases.

Head and neck cancers (HNC) and esophageal cancer (EC) ranked as the sixth and seventh most common cancers globally, with high prevalence in East Africa, according to the Regents of the University of California, in April 2022. Due to airway obstruction and dysphagia, tracheostomy and gastrostomy tube placements are routine at Muhimbili National Hospital (MNH) in Tanzania, with 140 tracheostomies and 130 gastrostomy tubes placed annually. Clinicians report that complications often result in unplanned readmissions and treatment delays, adversely affecting patient outcomes, highlighting the critical need for advancements and innovations in the market to improve patient care and reduce complications.

According to the National Center for Biotechnology Information (NCBI) study published in March 2024, the optimal timing for the first tracheostomy tube change in adult patients to improve clinical outcomes. A retrospective analysis of 3,957 patients revealed that changing the tube between 7 and 9 days post-tracheostomy significantly reduced all-cause mortality compared to other timings. Early changes within 6 days were associated with higher mortality and prolonged hospital and ICU stays, as well as increased pulmonary complications. These findings underscore the importance of timing in tracheostomy care, prompting calls for further prospective studies to confirm the results and refine patient management protocols.

The market is expanding due to advancements in materials used for tube construction. Commonly used materials include polyvinyl chloride (PVC), silicone, and polyurethane. PVC softens at body temperature, adapting to patient anatomy and centering the tube in the trachea, enhancing comfort and effectiveness. Silicone, being naturally soft and temperature-resistant, prevents colonization and biofilm buildup and can be sterilized for reuse. Additionally, some tracheostomy tubes come with a tracheal wedge, which aids in removing the ventilator circuit with minimal risk of tube dislodgement. These innovations improve patient outcomes and drive market growth by offering enhanced safety and functionality.

According to U.S. Food and Drug Administration (FDA) in October 2022, there is a shortage of tracheostomy tubes, emphasizing the need for reusable or alternative options. This situation drives market growth by prompting increased production and innovation in tracheostomy tubes to meet demand. The focus on reusable tubes and alternative materials encourages manufacturers to develop products that ensure patient safety and comply with regulatory standards, thereby expanding the market. Additionally, the communication's recommendations for healthcare providers and patients highlight the critical need for reliable tracheostomy supplies, further stimulating market activity.

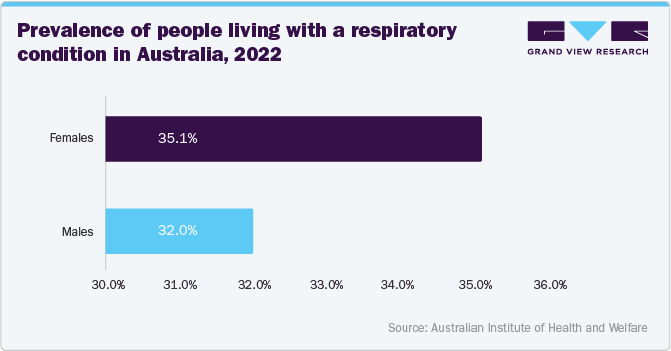

The rising incidence of chronic respiratory disorders, including cardiovascular diseases, diabetes, respiratory diseases, and cancer, is driving the growth of the tracheostomy tubes market. For instance, according to the Australian Institute of Health and Welfare in 2023, respiratory conditions accounted for 7.2% of the total disease burden (measured in disability-adjusted life years or DALYs), 8.5% of the non-fatal burden (years lived with disability or YLDs), and 5.8% of the fatal burden (years of life lost or YLLs) in Australia.

As these conditions often necessitate prolonged respiratory support, the demand for tracheostomy tubes increases. This trend prompts advancements in tube design and materials to better meet patient needs. Consequently, the market is expanding to accommodate the heightened demand for reliable, safe, and efficient tracheostomy solutions, ensuring improved patient care and outcomes.

Industry Dynamics

The tracheostomy tubes industry is characterized by a few dominant players like Medtronic, Teleflex, Inc., ConvaTec Group, and significant technological advancements. The company’s focus is on developing innovative, patient-friendly designs using materials like PVC, silicone, and polyurethane to enhance safety and comfort. Market growth is driven by increasing respiratory disorders, an aging population, and the rising demand for advanced healthcare solutions. Additionally, regulatory approvals and strategic partnerships among major players help consolidate market presence, fostering competition and continuous improvement in product offerings.

The tracheostomy tubes industry showcases significant innovation driven by advancements in materials and design. Modern tubes utilize polyvinyl chloride (PVC), silicone, and polyurethane to enhance patient comfort, safety, and functionality. Innovations like anti-microbial coatings, adjustable flanges, and better biofilm resistance address clinical needs and reduce complications. For instance, the Bivona Adult TTS Tracheostomy Tubes by ICU Medical features a unique silicone design that combines flexibility and durability. The TTS (Tight-to-Shaft) cuff technology allows for a secure seal when inflated and a low profile when deflated, enhancing patient comfort and reducing the risk of tracheal trauma.

Regulations play a crucial role in the tracheostomy tubes industry by ensuring product safety, efficacy, and quality. Regulatory bodies, such as the FDA and EMA, set stringent standards for material use, design, and manufacturing processes. Compliance with these regulations is mandatory for market approval and helps maintain high safety standards, thereby boosting consumer confidence. Additionally, regulatory guidelines promote continuous innovation as manufacturers strive to meet evolving requirements, driving advancements in tracheostomy tube technology. For instance, in April 2024, Smiths Medical's urgent field safety notice for certain Portex tracheotomy tubes highlights the industry's commitment to patient safety and regulatory compliance. This proactive measure ensures high standards and continuous improvement, reinforcing trust in tracheostomy products. Regulatory vigilance fosters innovation and reliability, ultimately benefiting patient care and industry growth.

Mergers and acquisitions in the tracheostomy tubes industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in September 2021, Atos Medical announced the acquisition of Tracoe Medical, expanding its portfolio in airway management solutions. This strategic move enhances Atos Medical's position in the tracheostomy tube market, combining expertise to offer advanced products and services for patients requiring respiratory support worldwide.

In the tracheostomy tube industry, product substitutes include non-invasive ventilation devices and alternative airway management methods like laryngeal masks and endotracheal tubes. Non-invasive ventilation options such as CPAP (Continuous Positive Airway Pressure) and BiPAP (Bilevel Positive Airway Pressure) devices provide respiratory support without the need for a tracheostomy tube. Laryngeal masks offer a less invasive airway management solution for short-term use, while endotracheal tubes are used in emergency intubations and surgeries. These substitutes cater to different patient needs and clinical scenarios, offering alternatives to tracheostomy tubes based on the severity of respiratory conditions and treatment goals.

Companies are targeting various regions due to the rising prevalence of chronic respiratory conditions, increasing healthcare investments, and improving medical infrastructure. The regional diversification not only boosts global market presence for companies but also enhances access to advanced tracheostomy care in underserved areas, promoting overall healthcare improvements.

Type Insights

The cuffed segment accounted for the largest market share of 62.7% in 2023 showing the fastest CAGR over the forecast period due to their ability to provide a secure seal, minimizing the risk of aspiration and optimizing ventilation in patients. These tubes feature an inflatable cuff that seals around the trachea, preventing leakage and facilitating mechanical ventilation. This design is particularly beneficial in critically ill patients requiring precise control over respiratory parameters. As healthcare facilities prioritize patient safety and comfort, cuffed tracheostomy tubes continue to be preferred for their effectiveness in managing airway complications and improving outcomes in various clinical settings globally.

According to Pinpoint Scotland Ltd data published in June 2022, the umbrella furling-deflation technique simplifies cuffed tracheostomy tube insertion by ensuring smoother passage through the trachea. This method reduces procedural difficulty and potential complications, enhancing clinician confidence and patient comfort. Such innovations contribute to improved procedural outcomes, encouraging wider adoption of cuffed tracheostomy tubes and stimulating market growth through increased usage and preference.

Demographics Insights

The adult patients segment accounted for the largest market share of 71.8% in 2023 and shows the fastest CAGR over the forecast period driven by the prevalence of conditions requiring long-term airway management, such as respiratory failure, neurological disorders, and trauma. Tracheostomy tubes for adults prioritize features like comfort, ease of maintenance, and compatibility with ventilatory support systems. Manufacturers focus on innovations like adjustable flanges and materials that minimize irritation and facilitate secretion management. With aging populations and increasing chronic disease burdens globally, the demand for tracheostomy tubes tailored to adult patients continues to grow, reinforcing their dominant position in the market.

The pediatric/neonatal patients segment is also driving due to the unique needs of younger patients requiring airway management. These tubes are designed with smaller sizes, softer materials, and specialized features to accommodate delicate airways and growth. They play a crucial role in managing congenital conditions, severe respiratory illnesses, and post-surgical care in infants and children.

Manufacturers prioritize safety, ease of insertion, and compatibility with pediatric ventilatory systems. With advancements in pediatric healthcare and increasing cases of congenital anomalies, pediatric and neonatal tracheostomy tubes are pivotal in enhancing care outcomes, driving their dominance in the market. For instance, according to the Stevens Institute of Technology in April 2019, Steven’s students developed a safer pediatric tracheostomy tube securing system, minimizing accidental dislodgement and enhancing patient comfort. Their innovation improves stability and reduces the need for frequent tube adjustments, benefiting the care of young patients requiring long-term airway management, and thereby advancing safety standards in pediatric tracheostomy procedures.

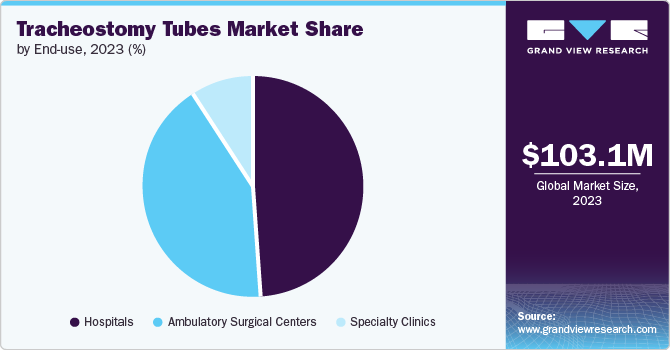

End-use Insights

The hospitals segment accounted for the largest revenue share of 49.4% in 2023 showing the fastest CAGR over the forecast period. Hospitals are the primary end users dominate the market due to their role as major centers for acute and chronic medical care. Hospitals require a steady supply of tracheostomy tubes to manage patients with respiratory complications from various conditions such as trauma, critical illness, and surgeries.

They prioritize tubes that ensure patient safety, ease of use for healthcare professionals, and compatibility with hospital equipment like ventilators. With hospitals continually expanding their capacity and improving patient care standards, they represent the largest consumer base driving the demand and market growth for tracheostomy tubes globally.

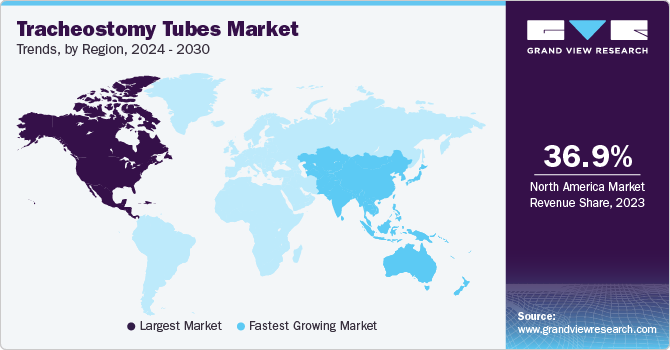

Regional Insights

North America tracheostomy tubes market dominated the overall global market and accounted for the 36.94% revenue share in 2023. Due to rapid advancements in technology and therapies for throat cancer, the increasing presence of major industry players, and well-established healthcare infrastructure, the North American market is poised for growth. Factors such as higher healthcare spending per capita, a substantial population affected by respiratory diseases, supportive government initiatives, and rising research collaborations are expected to further drive market expansion in the region.

U.S. Tracheostomy Tubes Market Trends

The tracheostomy tubes market of the U.S. held a significant share of North America's market in 2023, as chronic conditions are becoming more prevalent, especially among the geriatric population. According to the CDC, over 9 million people were diagnosed with severe bronchitis in 2017 alone, highlighting the widespread prevalence of respiratory diseases requiring advanced airway management. This demand drives innovation and investment in tracheostomy tube technologies tailored to American healthcare standards, emphasizing safety, efficacy, and patient comfort. With a strong healthcare infrastructure and continuous advancements in medical therapies, the U.S. market for tracheostomy tubes is poised for growth to meet the evolving needs of respiratory care.

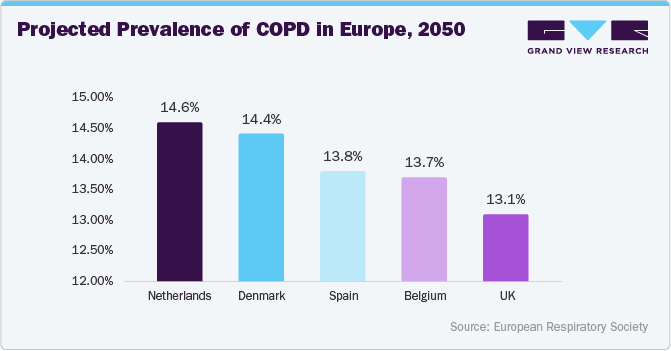

Europe Tracheostomy Tubes Market Trends

The Europe tracheostomy tubes market is witnessing growth, driven by rising COPD prevalence. According to the European Respiratory Society, COPD is projected to increase by 35.2% in patients and 39.6% in prevalence by 2050, from an estimated 36.6 million in 2020 to 49.5 million. This demographic shift underscores the increasing demand for advanced respiratory care solutions, including tracheostomy tubes, to manage chronic respiratory conditions effectively. Market expansion is expected to be fueled by innovations in airway management technologies and healthcare infrastructure improvements across Europe to cater to the growing needs of COPD patients. The projections highlight the countries expected to be most affected.

The tracheostomy tubes market of UK is witnessing significant growth due to the increasing prevalence of cardiovascular diseases. As these conditions rise, so does the demand for advanced airway management solutions like tracheostomy tubes to support patients requiring respiratory assistance during treatment and recovery. The table below summarizes the number of people dying from cardiovascular diseases (CVD) in 2022, the number of those under 75 years old affected, and the estimated population living with CVD,

Heart Foundation

Nation

No. of People Dying from CVD (2022)

No. of People Under 75 Years Old Dying from CVD (2022)

Estimated Number of People Living with CVD (latest estimate)

England

142,690

39,164

6.4 million

Scotland

18,077

5,354

700,000

Wales

9,570

2,739

340,000

Northern Ireland

4,079

1,131

225,000

UK total

174,884

48,694

7.6 million

France tracheostomy tubes market is witnessing growth, benefits from a comprehensive healthcare system and advanced medical technology adoption. With an aging population and increasing chronic respiratory conditions, including COPD and neurological disorders, there is growing demand for tracheostomy tubes. French healthcare policies emphasizing patient-centered care and technological advancements support market expansion.

The tracheostomy tubes market of Germany is experiencing notable growth as the German manufacturers have established a strong reputation for producing high-quality medical devices. The country’s rigorous quality control standards and adherence to safety regulations further enhance this reputation. As a result, healthcare providers trust German-made medical devices leading to increased sales and market dominance. For instance, SILVER tracheostomy tubes are hand-made in Germany from high-grade sterling silver (925) of medical quality. The use of this premium material ensures the durability, biocompatibility, and non-reactivity of the tracheostomy tubes. This results in a reduced risk of infection, inflammation, and other complications for patients. Consequently, healthcare professionals prefer these tubes over other alternatives, driving the demand for SILVER tracheostomy tubes in the German market.

Asia Pacific Tracheostomy Tubes Market Trends

Asia Pacific tracheostomy tubes market is witnessing significant growth driven by rising healthcare investments, an expanding elderly population, and an increasing prevalence of chronic respiratory diseases. Countries like China, India, and Japan are key contributors, with growing adoption of advanced medical technologies and improving healthcare infrastructure. Demand for tracheostomy tubes is rising due to higher incidences of stroke, COPD, and trauma cases requiring long-term airway management. Moreover, supportive government initiatives and efforts to enhance healthcare accessibility are further fueling market expansion, making the Asia Pacific region a focal point for innovation and investment in tracheostomy tube technologies.

The tracheostomy tubes market of Japan is projected to grow rapidly as there is significant growth in tracheostomy decannulation rates in Japan. For instance, a study was conducted by Nature in November 2022, which investigated tracheostomy decannulation rates among adult patients over a two-year period in Japan. The research aimed to explore factors associated with prolonged tracheostomy using a health insurance claims database, which included 3,758,210 people. The primary outcome of the study was the time to decannulation. Among the 917 patients who underwent tracheostomy, 752 met the eligibility criteria. The mean time to decannulation was 30.9 days.

China tracheostomy tubes market is expected to grow in the Asia Pacific in 2023, due to the increasing demand for respiratory care devices. For instance, ISO13485 and CE-certified tracheostomy tube manufacturers play a crucial role in driving this market by ensuring high-quality products, adhering to strict regulations, and promoting innovation. This article discusses how these manufacturers drive the market in China. ISO13485 and CE certification are essential requirements for medical device manufacturers, ensuring they meet international standards for quality management systems. Compliance with these standards helps Chinese manufacturers establish credibility, both locally and internationally. As a result, healthcare providers are more likely to trust and adopt their products, driving the market in China.

The tracheostomy tubes market of India is experiencing significant growth driven by the country's high burden of respiratory diseases intensified by severe air pollution. With nearly 100 million people affected by respiratory conditions and approximately 1 million annual deaths attributed to asthma and COPD, according to Broadcast Limited in 2023, there is escalating demand for advanced airway management solutions like tracheostomy tubes. This trend is enhanced by increasing healthcare awareness, expanding healthcare infrastructure, and efforts to mitigate the impact of environmental factors, positioning India as a key market for innovations in respiratory care technologies including tracheostomy tubes.

Latin America Tracheostomy Tubes Trends

Latin American tracheostomy tubes market is fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for tracheostomy tubes as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

The tracheostomy tubes market of Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Tracheostomy Tubes Company Insights

The market is highly competitive, with key players such as Smith’s Group plc, Medtronic; and ConvaTec Group holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Tracheostomy Tubes Companies:

The following are the leading companies in the tracheostomy tubes market. These companies collectively hold the largest market share and dictate industry trends.

- Pulmodyne, Inc.

- Smith’s Group plc

- Medtronic

- TRACOE Medical GmbH

- Teleflex, Inc.

- TuoRen (India)

- ConvaTec Group

- Boston Medical

- Fisher & Paykel Healthcare Ltd.

- Angiplast

- ICU Medical

Recent Developments

-

In June 2023, the Fischell Institute's innovations showcased at Children's National Hospital's 2023 Innovation Day include advancements relevant to the tracheostomy tubes market. These developments likely feature new technologies or techniques that could improve patient outcomes and care practices, potentially influencing future innovations in airway management and respiratory care.

-

In January 2022, ICU Medical completed the acquisition of Smiths Medical, expanding its portfolio of medical devices and strengthening its market position. This strategic move enhances ICU Medical's capabilities in infusion therapy, vascular access, and vital care, positioning the company for growth and innovation in the global healthcare market.

-

In April 2022, The Global Cancer Program is pleased to announce that Muhimbili University of Health and Allied Sciences (MUHAS), in collaboration with Dr. Selekwa Msiba, has been awarded by The Coalition for Implementation Research in Global Oncology (CIRGO). The award supports the development and evaluation of interventions to enhance tracheostomy and gastrostomy tube care for cancer patients in Tanzania.

-

In January 2020, Smiths Medical has introduced the Portex tracheostomy tubes and kits, enhancing their respiratory care offerings. These products are designed for secure and effective airway management during tracheostomy procedures. The launch aims to improve patient care and provide clinicians with reliable, high-quality tools for managing airway needs in various medical settings.

Tracheostomy Tubes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 107.1 million

Revenue forecast in 2030

USD 136.7 million

Growth rate

CAGR of 4.2% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, demographics, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Pulmodyne, Inc.; Smiths Group plc; Medtronic; TRACOE Medical GmbH; Teleflex, Inc.; TuoRen (India); ConvaTec Group; Boston Medical; Fisher & Paykel Healthcare Ltd.; Angiplast; ICU Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tracheostomy Tubes Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tracheostomy tubes market report based on type, demographics, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cuffed

-

Uncuffed

-

-

Demographics Outlook (Revenue, USD Million, 20c18 - 2030)

-

Adult Patients

-

Pediatric/Neonatal Patients

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tracheostomy tubes market size was estimated at USD 103.1 million in 2023 and is expected to reach USD 107.1 million in 2024.

b. The global tracheostomy tubes market is expected to grow at a compound annual growth rate of 4.15% from 2024 to 2030 to reach USD 136.7 million by 2030.

b. North America dominated the tracheostomy tubes market with a share of 36.% in 2023. This is attributable to the rapid development of innovative technologies and increasing prevalence of COPD

b. Some of the key market players operating in the tracheostomy tubes market are Pulmodyne Inc., Smiths Group plc, Medtronic, TRACOE Medical GmbH, Teleflex Incorporated, Cook Group, ConvaTec Group, Boston Medical, Fisher & Paykel Healthcare Ltd., Angiplast, Andreas Fahl Medizintechnik–Vertrieb GmbH, Biçakcilar A.S, Sterimed, Henan Tuoren Medical Device Co., Ltd., among others

b. Rising prevalence of chronic respiratory diseases, aging population, and technological advancements are driving the market growth. In addition, growing awareness of tracheostomy procedures, increased demand for home care and favorable reimbursement policies are increasing the demand for tracheostomy tubes

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.