- Home

- »

- Next Generation Technologies

- »

-

Transportation Analytics Market Size, Industry Report, 2030GVR Report cover

![Transportation Analytics Market Size, Share & Trends Report]()

Transportation Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Descriptive, Predictive, Prescriptive), By Deployment (Cloud, Hybrid, On-premise), By Application (Traffic Management, Logistics Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-241-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Transportation Analytics Market Summary

The global transportation analytics market size was estimated at USD 12.61 billion in 2024 and is projected to reach USD 43.01 billion by 2030, growing at a CAGR of 23.8% from 2025 to 2030. Factors such as the growing adoption of smart transportation initiatives and Advanced Traffic Management Systems (ATMs) undertaken worldwide are the primary drivers of market growth.

Key Market Trends & Insights

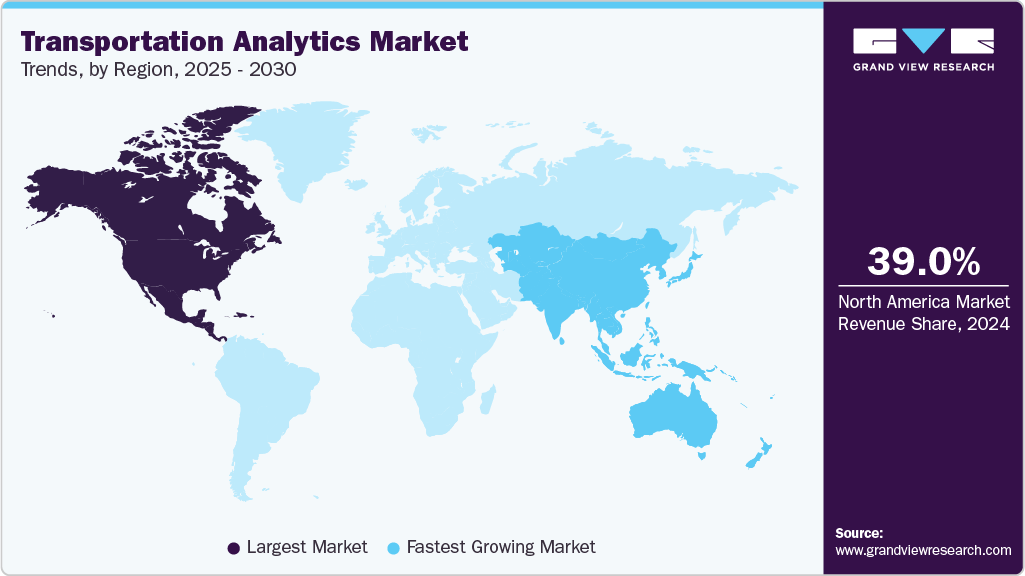

- North America transportation analytics market dominated the global market with the largest revenue share of 39.0% in 2024.

- The U.S. transportation analytics market is highly developed, underpinned by substantial federal funding and mature ITS infrastructure.

- By type, the descriptive analytics segment held the largest revenue share of 48.6% in 2024.

- By deployment, the cloud segment dominated the market in 2024.

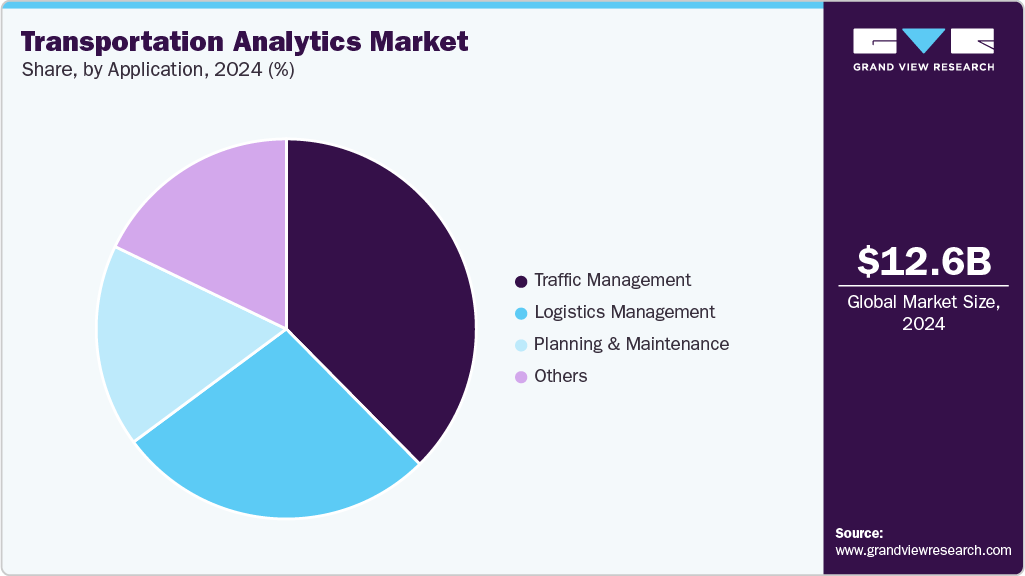

- By application, the traffic management segment dominated the market in 2024.

Market Size & Forecast

- 2024 Revenue: USD 12.61 Billion

- 2030 Projected Market Size: USD 43.01 Billion

- CAGR (2025-2030): 23.8%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

Reduction in fuel consumption, traveling time, and air pollution are some of the benefits offered by these analytics solutions. A shift toward automation of operational processes using Artificial Intelligence (AI) and Machine Learning (ML) will likely foster market growth.Transportation analytics systems, compared to Intelligent Transportation Systems (ITS), make traffic monitoring easy, reducing road accidents and harmful carbon emissions. As per the Texas Transportation Institute, U.S. drivers waste more than 3 billion gallons of fuel per year, and an average commuter spends approximately 42 hours a year stuck in traffic, which accounts for a total regional expenditure of USD 160 billion, equivalent to USD 960 per commuter. The rising population and urbanization in emerging economies will influence the demand for traffic solutions, thus driving growth in the near future.

The market expansion is driven by various government initiatives to develop smart cities, which will further contribute to the adoption of transportation analytics solutions for intelligent transport systems. An increase in the number of passenger and commercial vehicles has contributed to traffic congestion. The use of analytics in intelligent transport systems will help reduce traffic jams, divert traffic, and minimize collision risks. However, data security and privacy are some challenges that need to be addressed by analytics vendors.

Today's data collection and analytics solutions provide various functionalities, including traffic volume counts, vehicle classification counts, travel time and delay studies, and parking studies. In order to ensure better connectivity and safety of commuters, city planners are recording traffic volume and other parameters to build models to optimize public transportation and traffic movement.

The regulatory landscape for the transportation analytics market is evolving rapidly, driven by growing concerns around data privacy, infrastructure modernization, and sustainable urban mobility. Governments worldwide are introducing policies to encourage the adoption of smart transportation technologies, including mandates for real-time traffic monitoring, emissions reduction, and integration with intelligent transportation systems (ITS). Additionally, public-private partnerships and open data initiatives are being promoted to foster innovation while ensuring regulatory compliance. As a result, vendors in the transportation analytics space must align their offerings with regional policy requirements, cybersecurity standards, and interoperability protocols to successfully capture market share and support digital transformation in mobility infrastructure.

Type Insights

The descriptive analytics segment held the largest revenue share of 48.6% in 2024, owing to the increasing adoption of big data, leading to rising volumes of data generated and advancements in digital technology. Most vendors offer descriptive, predictive, and prescriptive analytics solutions as an integrated suite. However, transportation companies concerned only with optimizing their sales and operations functions and refraining from huge investments are instrumental in solely deploying descriptive analytics.

The prescriptive segment is expected to expand at the fastest CAGR over the forecast period. To have a competitive edge, transport companies and other stakeholders use advanced analytics to support them in forecasting future trends. This allows companies to make informed decisions, thus increasing their profitability, easing traffic congestion, carbon emissions, and improving road safety. Moreover, traffic information has become the central element in the emerging Advanced Traffic Management Systems (ATMS) marketplace. The commercial traffic data and information industry analysis can provide valuable insights into future ATMS types and service prospects.

Deployment Insights

The cloud segment dominated the market with the highest revenue share in 2024. The scalability and flexibility of the cloud technology, security aspects, and control over the data center are some of the major factors that will boost the utility of the cloud deployment technology in the utility of transportation analytics solutions.

The on-premise segment is expected to grow at the highest CAGR over the forecast period. The transportation industry handles sensitive logistics, operations, and customer information. Some organizations prefer to keep this data within their infrastructure to maintain greater control over security and ensure compliance with data protection regulations. On-premise deployment gives them direct control over data security measures and maintains privacy.

Application Insights

The traffic management segment dominated the market in 2024. Solutions such as video management software with integrated video analytics help address traffic congestion and accidents caused by a lack of proper traffic management. Moreover, analytics in traffic management help reduce vehicle carbon emissions, thus providing environment-friendly traffic solutions.

The logistics management segment is expected to witness the fastest CAGR over the forecast period. Transportation analytics solutions offer real-time visibility and tracking of goods in transit, providing organizations with accurate information about the location, condition, and status of shipments. This level of visibility helps logistics managers make informed decisions, address potential bottlenecks, and proactively manage exceptions or delays.

Regional Insights

North America transportation analytics market dominated the global market with the largest revenue share of 39.0% in 2024. North America is a major global trade and commerce hub, resulting in complex logistics and supply chain networks. Transportation analytics can provide valuable insights into optimizing supply chain operations, route planning, demand forecasting, and inventory management. By leveraging transportation analytics, companies can enhance efficiency, reduce delivery times, optimize resource allocation, and streamline logistics operations. The need for efficient logistics and supply chain management in North America's vibrant business environment is driving the growth of the transportation analytics market.

U.S. Transportation Analytics Market Trends

The U.S. transportation analytics market is highly developed, underpinned by substantial federal funding and mature ITS infrastructure. The Infrastructure Investment and Jobs Act allocates significant resources toward digital infrastructure upgrades, traffic flow optimization, and sustainable mobility technologies. Leading cities are leveraging data-driven platforms for congestion pricing, real-time traffic monitoring, and emissions control, creating robust demand for advanced analytics solutions across the public and private sectors.

Asia Pacific Transportation Analytics Market Trends

The Asia Pacific transportation analytics market is expected to expand at the fastest CAGR during the forecast period. The regional growth is driven by the increasing smart city and smart transportation initiatives. Countries such as Japan, China, South Korea, Australia, and Taiwan are anticipated to lead transport and traffic management initiatives. Governments across the Asia Pacific region actively promote smart city initiatives and invest in transportation infrastructure and technology. This includes deploying intelligent transportation systems (ITS), smart traffic management, and data-driven decision-making processes. Transportation analytics support these initiatives by providing data-driven insights for better planning, optimization, and managing of transportation networks.

China transportation analytics market is a leading player in adopting transportation analytics, supported by its aggressive investment in smart infrastructure and AI-driven urban mobility solutions. It has placed strong emphasis on intelligent transportation systems, with heavy backing for connected vehicle ecosystems and big data platforms for traffic forecasting. Major cities like Beijing and Shanghai are piloting cutting-edge analytics systems to reduce congestion and emissions, positioning China as a strategic hub for transportation analytics innovation.

Transportation analytics market in India is witnessing rapid growth, fueled by increasing urbanization, a surge in vehicle ownership, and government-led smart city initiatives. Programs such as the National Electric Mobility Mission and Smart Cities Mission are driving the integration of advanced traffic management solutions and real-time data analytics. Additionally, the government's push toward intelligent transport infrastructure through public-private partnerships is fostering a favorable environment for domestic and global analytics providers.

Europe Transportation Analytics Market Trends

Europe transportation analytics market remains at the forefront of the transportation analytics market, driven by stringent environmental regulations, sustainability goals, and investments in multimodal transportation systems. The European Commission’s Sustainable and Smart Mobility Strategy is catalyzing the adoption of AI, IoT, and big data for urban transport efficiency and decarbonization. With strong cross-border collaboration and funding mechanisms such as Horizon Europe, the region is accelerating digital transformation in mobility infrastructure.

The UK transportation analytics market is experiencing steady growth, supported by smart city programs, net-zero targets, and investments in digital infrastructure. Government initiatives such as the Future of Mobility Urban Strategy and Transforming Cities Fund are encouraging the adoption of predictive analytics, automated traffic control, and integrated mobility platforms. Additionally, the post-Brexit regulatory environment is prompting increased focus on localized innovation and public-private collaboration in transport data services.

Key Transportation Analytics Company Insights

Some key companies in the transportation analytics market include IBM Corporation, Oracle Corporation, and Hitachi, Ltd., among others. Partnerships, strategic mergers, and acquisitions are anticipated to be the most effective way for industry players to gain quick access to emerging markets and enhance technological capabilities. Also, type differentiation and upgradation are expected to pave the way for developing companies in the market. Rapidly growing transport analytics startups such as TERAKI, Populus.ai, Sixgill, Conduent, UrbanLogiq, MOTIONTAG, IoTium, Immense Simulations, CyberOwl, Emu Analytics, and B-Line Transportation, among others, offer potential competition.

-

IBM Corporation is a prominent player in the transportation analytics market, leveraging its deep expertise in artificial intelligence, hybrid cloud, and data analytics to deliver advanced mobility solutions. Through its IBM Intelligent Transportation solutions, the company offers real-time traffic monitoring, predictive analytics, and incident management tools aimed at optimizing urban mobility and reducing congestion.

-

Oracle Corporation brings a robust suite of transportation analytics capabilities through its cloud-based solutions, focusing on operational efficiency, logistics optimization, and intelligent supply chain management. The Oracle Transportation Management (OTM) platform incorporates advanced analytics to deliver real-time visibility, performance monitoring, and data-driven route planning for complex logistics networks.

Key Transportation Analytics Companies:

The following are the leading companies in the transportation analytics market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Sisense Ltd.

- Oracle Corporation

- Cubic Corporation

- INRIX

- Cellint

- Alteryx

- Hitachi, Ltd.

- SmartDrive Systems, Inc.

- Omnitracs

Recent Developments

-

In September 2024, Hitachi Ltd. introduced ‘HMAX’ (Hyper Mobility Asset Expert), a comprehensive digital asset management platform developed by Hitachi Rail. Designed for transport operators, HMAX leverages AI-powered tools to enhance the efficiency of train operations, signaling systems, and infrastructure maintenance through a unified, intelligent solution.

-

In June 2023, AFWERX developed an Uncrewed Aircraft System Traffic Management (UTM) system at the Eglin Air Force Base in Florida in partnership with the Air Force Research Laboratory's Information Directorate. The primary objective of this implementation is to ensure the safety of drones and electric vertical takeoff and landing (eVTOL) aircraft while they take flight. By establishing a robust UTM infrastructure, the initiative directly addresses the safety concerns arising from the growing presence of unmanned aerial vehicles and eVTOL aircraft in the skies.

Transportation Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.80 billion

Revenue forecast in 2030

USD 43.01 billion

Growth rate

CAGR of 23.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

IBM Corporation; Sisense Ltd.; Oracle Corporation; Cubic Corporation; INRIX; Cellint; Alteryx; Hitachi, Ltd.; SmartDrive Systems, Inc.; Omnitracs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transportation Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global transportation analytics market report based on type, deployment, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Descriptive

-

Predictive

-

Prescriptive

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Traffic Management

-

Logistics Management

-

Planning & Maintenance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global transportation analytics market size was estimated at USD 12.61 billion in 2024 and is expected to reach USD 14.80 billion in 2025.

b. The global transportation analytics market is expected to witness a compound annual growth rate of 23.8% from 2025 to 2030 to reach USD 43.01 billion by 2030.

b. The descriptive type segment held the largest share of 48.6% in 2024, owing to the increasing adoption of big data, leading to the rising volumes of data generated and advancements in digital technology. Most vendors offer descriptive, predictive, and prescriptive analytics solutions as an integrated suite.

b. Some key players operating in the transportation analytics market include IBM Corporation, Sisense Ltd., Oracle Corporation, Cubic Corporation, INRIX, Cellint, Alteryx, Hitachi, Ltd, SmartDrive Systems, Inc., and Omnitracs, among others.

b. Factors such as the growing adoption of smart transportation initiatives and the Advanced Traffic Management Systems (ATMs) undertaken worldwide are the primary drivers of market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.