- Home

- »

- Homecare & Decor

- »

-

UAE Bathroom Linen Market Size, Industry Report, 2033GVR Report cover

![UAE Bathroom Linen Market Size, Share & Trends Report]()

UAE Bathroom Linen Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Bath Towels, Hand & Face Towels, Bathrobes), By Application (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-639-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UAE Bathroom Linen Market Size & Trends

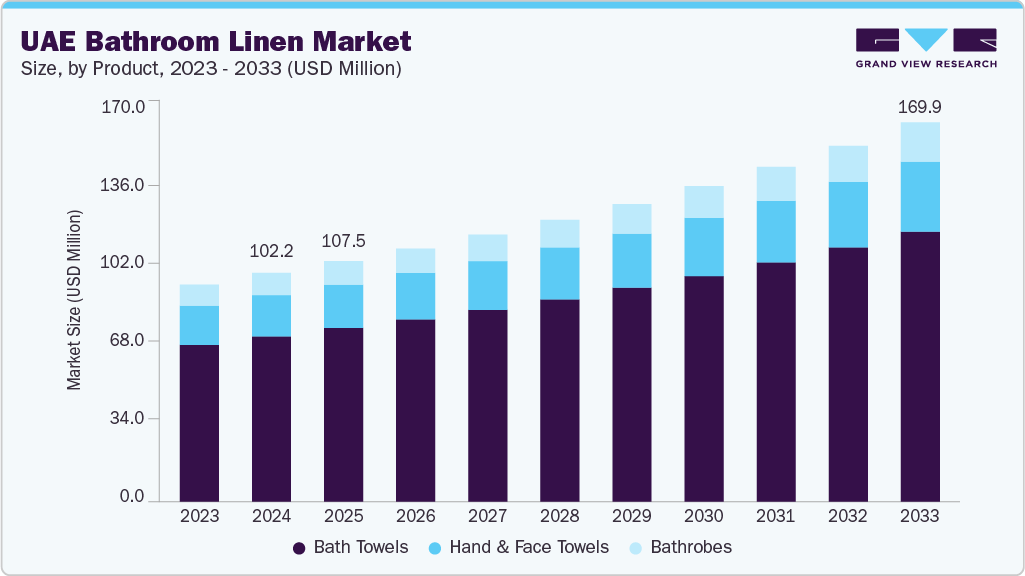

The UAE bathroom linen market size was estimated at USD 102.2 million in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2033. The market has been experiencing steady growth due to rising urbanization, increased construction activity, and the expanding hospitality and healthcare sectors. With consumers in the UAE embracing premium lifestyle choices and personalized interiors, bathroom linens have evolved beyond their utilitarian purpose to become symbols of comfort, style, and hygiene.

One of the major drivers of this market is the sustained expansion of the real estate and tourism sectors. As new residential complexes, hotels, and wellness facilities continue to be developed, there is a rising demand for high-quality bath towels, bathrobes, and related linens. Government-led infrastructure initiatives and policies that promote hospitality and healthcare investments are directly influencing procurement patterns for bathroom linens, especially in commercial segments.The hotel industry in these parts of the region offers numerous growth opportunities for players in the bathroom linen market. According to the Department of Tourism and Commerce Marketing in Dubai, there were 128,545 hotel rooms in Dubai in 2021; this included 715 hotel establishments, of which 134 were five-star hotels.

Evolving consumer preferences are also shaping the landscape of the bathroom linen industry. A growing inclination toward wellness, luxury, and sustainability is fueling demand for bath linen products made from organic cotton, bamboo fiber, and other natural materials. These materials offer advantages such as hypoallergenic properties, enhanced softness, and environmental safety, which align well with consumer values in a climate-conscious and health-aware society. Climate-specific product innovation, such as lightweight, quick-dry towels and breathable bathrobes, is seeing increased acceptance across both residential and commercial user groups.

E-commerce has emerged as a significant channel for market growth. Consumers, particularly millennials and expatriates, are leveraging online platforms to access a broader selection of designs, materials, and price points. Omni-channel strategies by retailers have improved customer convenience and loyalty, further supported by digital campaigns, influencer endorsements, and curated product collections. The market is also witnessing a surge in value-added features such as antibacterial fabrics, reversible designs, and premium packaging, which are aiding brand differentiation.

Overall, the UAE bathroom linen industry is poised for long-term growth, supported by strong consumer demand, hospitality sector momentum, and evolving retail strategies. The future of the market lies in innovation, sustainability, and the ability of brands to cater to both functionality and aesthetics.

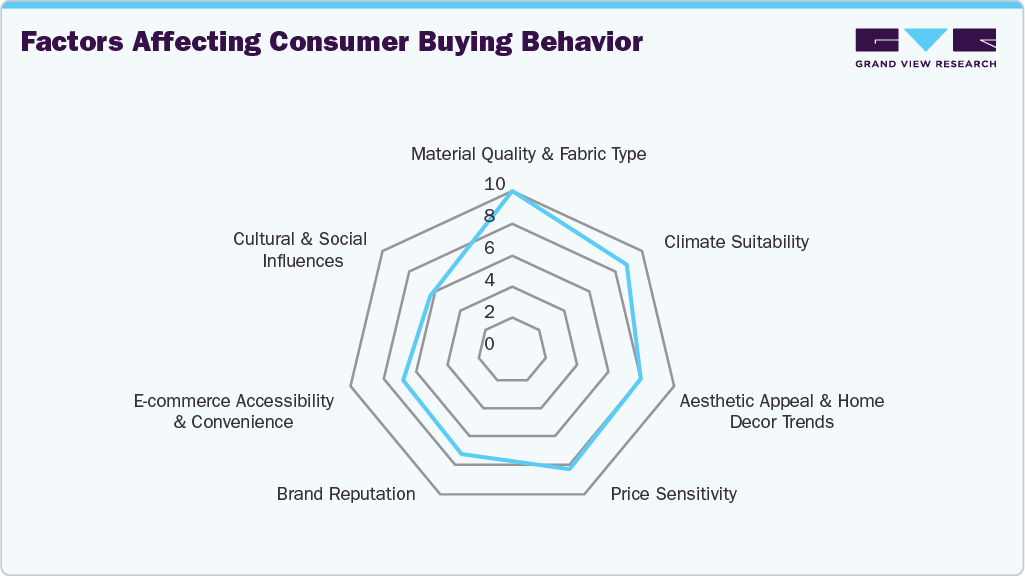

Consumer Insights

In the UAE, consumers prioritize comfort, fabric quality, and drying speed when purchasing bathroom linens. In a region characterized by high humidity and heat, breathability and quick-absorbent features are critical. Bath towels made from long-staple cotton, especially Egyptian and Turkish cotton, are preferred due to their softness and durability. Consumers are also inclined toward towels that retain their texture after multiple washes.

An important trend in the textile industry is the shift toward eco-consciousness. A significant portion of respondents, particularly families with children and younger residents, prefer products that are free from synthetic chemicals, dyes, and artificial fragrances. Hypoallergenic, organic, and OEKO-TEX-certified towels and bathrobes are gaining prominence. In addition, the demand for gender-neutral and minimalist designs is rising, reflecting broader lifestyle trends.

Price sensitivity remains moderate but varies across consumer groups. Affluent households often invest in premium branded bathrobes and towel sets, favoring boutique labels or international imports. In contrast, expatriates and middle-income families often opt for value-driven bundles and promotions. Loyalty programs, influencer recommendations, and seasonal sales are key conversion drivers. A growing number of shoppers are influenced by home décor aesthetics on social media, and they seek products that align with bathroom themes and color palettes.

Product Insights

The bath towels segment led the market with the largest revenue share of 72.30% in 2024. Bath towels dominate the UAE bathroom linen industry due to their essential use and high replacement frequency. Consumers demand highly absorbent, soft, and quick-drying materials, with organic cotton and bamboo fibers leading in preference. Retailers are offering multi-piece sets with matching hand and face towels, enhancing visual appeal. Technological innovations such as anti-bacterial and odor-resistant treatments are helping brands stand out. In hotels and spas, white and monogrammed towels remain the standard for hygiene and luxury appeal.

The bathrobes segment is projected to grow at the fastest CAGR of 6.7% from 2025 to 2033. Bathrobes are gaining popularity, especially in the wellness and hospitality segments. Lightweight, breathable robes made from terry cloth or waffle weave fabrics are favored for the UAE's warm climate. Increasing awareness of self-care and spa culture is influencing residential users as well, prompting demand for plush, spa-style bathrobes. Consumers value easy maintenance, softness, and elegant designs. Luxury hotels and resorts procure high-thread-count and embroidered robes, often customized for branding purposes, while e-commerce platforms cater to personalized and monogrammed options.

Application Insights

The commercial segment led the market with the largest revenue share of 58.30% in 2024.The commercial segment contributes significantly to bathroom linen demand, led by the hospitality, healthcare, and spa sectors. Hotels, resorts, wellness centers, and hospitals require bulk procurement of bath towels and robes, focusing on hygiene, comfort, and durability. The need for frequent replacement due to rigorous laundering cycles drives volume purchases. Many commercial buyers prioritize cost-efficiency, ease of maintenance, and compliance with hygiene standards. Moreover, the UAE’s growth as a tourism and medical tourism hub ensures consistent demand from new developments and refurbishment projects, with institutions seeking vendors that offer customization, high GSM (grams per square meter), and fast replenishment cycles.

The residential segment is projected to grow at the fastest CAGR of 6.2% from 2025 to 2033.Residential demand for bathroom linen in the UAE is being driven by rising home ownership, lifestyle upgrades, and increasing consumer interest in coordinated and premium home décor. Families, especially in urban areas, are opting for towel sets and bathrobes that match their interior color schemes and themes. Products that balance aesthetics, comfort, and sustainability are seeing higher traction. In addition, the influence of online platforms and social media has amplified interest in luxurious and eco-friendly home textiles. As hybrid lifestyles continue, consumers are investing more in home wellness products, including plush towels and robes for daily use and leisure.

Key UAE Bathroom Linen Company Insights

The UAE bathroom linen industry is moderately fragmented and is characterized by the presence of a large number of international and local players. Key players in the UAE bathroom linen industry are employing various strategies to strengthen their market positions and capture a larger share of the home textile industry. Leading brands like Pan Emirates, Home Centre, IKEA, Danube Home, Marina Home Interiors focus on premium product offerings, targeting affluent consumers who prioritize quality and durability.

To stay competitive, many international brands are also emphasizing eco-friendly manufacturing processes and materials, aligning with growing consumer demand for sustainable options. In addition, local players in the country are intensifying competition by offering cost-effective alternatives to global brands.

Key UAE Bathroom Linen Companies:

- Home Centre

- Pan Emirates Home Furnishings

- Danube Home

- IKEA

- Marina Home Interiors

- Rivoli Group

- The Ritz Linen

- Raia Home

- Dwell

- West Elm

Recent Developments

-

In July 2023, Pan Emirates Home Furnishings, a leading home furnishing and decor brand, rebranded to Pan Home and launched a new brand identity and collection. This rebranding included a refreshed brand identity, a more modern and inclusive approach, and a new collection of furniture and decor items.

-

In September, 2024, Danube Home hosted a high-profile event at its flagship showroom in Al Barsha, Dubai, marking a significant milestone in the brand's evolution. The event showcased the unveiling of Danube Home’s new brand identity, reflecting its refreshed vision and customer-centric approach to lifestyle retail. A major highlight of the evening was the launch of the brand’s new Outdoor Living collection, which featured a wide array of stylish and functional outdoor furniture and accessories designed for the UAE’s climate and lifestyle preferences.

UAE Bathroom Linen Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 107.5 million

Revenue forecast in 2033

USD 169.9 million

Growth rate

CAGR of 5.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

UAE

Key companies profiled

Home Centre; Pan Emirates Home Furnishings; Danube Home; IKEA; Marina Home Interiors; Rivoli Group; The Ritz Linen; Raia Home; Dwell; West Elm

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Bathroom Linen Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UAE bathroom linen market report based on product, and application.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Bath Towels

-

Hand and Face Towels

-

Bathrobes

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The UAE bathroom linen market was estimated at USD 102.2 million in 2024 and is expected to reach USD 107.5 million in 2025.

b. The UAE bathroom linen market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 169.9 million by 2033.

b. Based on product type, bath towels dominate the UAE bathroom linen market due to their essential use and high replacement frequency.

b. Some of the key players operating in the UAE bathroom linen market include Home Centre; Pan Emirates Home Furnishings; Danube Home; IKEA; Marina Home Interiors; Rivoli Group; The Ritz Linen; Raia Home; Dwell; and West Elm

b. Key factors driving the UAE bathroom linen market are thriving hospitality and high-end residential demand, rising disposable incomes, rapid urbanization, e‑commerce growth, consumer preference for premium materials, eco‑friendly products, and luxury décor trends

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.