- Home

- »

- Consumer F&B

- »

-

UK Ready To Drink Cocktails Market, Industry Report, 2030GVR Report cover

![UK Ready To Drink Cocktails Market Size, Share & Trends Report]()

UK Ready To Drink Cocktails Market Size, Share & Trends Analysis Report By Alcohol Base (Wine-based, Spirit-based), By Distribution Channel (Online, Liquor Stores), By Packaging (Cans, Bottles), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-217-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

UK Ready To Drink Cocktails Market Trends

The UK ready to drink cocktails market size was estimated at USD 58.1 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 16.2% from 2024 to 2030. The rising health-consciousness and wellness trends along with the growing influence of the American culture have made the consumers in the U.K. shift to ready to drink (RTD) cocktails. The growing availability of popular brands, such as Jack Daniel’s, Bacardi, and Funkin, in the U.K. is also driving the consumption of RTD cocktails in the country. Moreover, the rising demand for low-calorie alcoholic drinks is anticipated to provide new growth opportunities to the manufacturers in the upcoming years. UK ready to drink cocktails market accounted for the share of 24.3% of the global ready to drink cocktails market in 2023.

The increasing interest in maintaining one’s health and wellness and shifting focus toward low calories drinks are driving the demand for RTD cocktails in UK. Consumers are trying to reduce their alcohol consumption, which, in turn, could offer new growth opportunities for the RTD cocktails market in the UK. Furthermore, the rising prevalence of obesity in Europe, which affected 10% to 30% of adults in 2018 according to the World Health Organization (WHO), is also influencing consumers to adopt RTD cocktails. Moreover, the growth of RTD cocktails has accelerated after the outbreak of the coronavirus pandemic due to lockdown, resulting in the shutting down of bars and restaurants and restriction on movement.

The increasing prevalence of responsible drinking and the growing preference for organic ingredients in alcoholic drinks drive the demand for RTD cocktails. Moreover, the closure of restaurants & bars during the outbreak of COVID-19 has changed the way in which European drink. Nowadays, they prefer to drink at home mindfully and prefer small pack sizes of 350 ml as opposed to traditional bottles of 750 ml, which further drives the demand for RTD cocktails in the country.

Market Concentration & Characteristics

The UK ready to drink cocktails industry is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Manufacturers have been adopting efficient production processes and technologies in order to maximize their profitability. Furthermore, by strengthening the relationships between commercial actors and technical support agencies, companies can increase their profitability. In addition, innovation in RTD cocktails by using real fruit juices with no artificial sweeteners is also driving the market demand.

Companies have undertaken several business strategies, such as partnerships, collaborations, product expansion, online marketing, and product differentiation, to sustain in the competitive market. Companies are majorly focusing on product innovation and partnerships to capture maximum market share. Key manufacturers of the market are Diageo; Brown-Forman; Pernod Ricard; Bacardi Ltd.; Asahi Group Holdings, Ltd.; Halewood Wines & Spirits; Shanghai Bacchus Liquor Co., Ltd.; Suntory Holdings Ltd.; Manchester Drinks; and Simple Skiff Beverages, LLC, among others.

End-user concentration is a significant factor in the UK ready to drink cocktails. The adoption of RTD cocktails is high among millennials and Gen Z due to changing lifestyles, responsible drinking trends, growing health-consciousness, and the convenience of these products. Furthermore, affinity toward sophisticated drinks and the overall trend of cocktail consumption is encouraging consumers to adopt RTD cocktails. Consumers perceive wine as a healthier choice than spirits and malts, which drives its demand. Moreover, wine-based cocktails usually contain juices of fruits such as grapefruit, orange, lemon, mango, and berries. Malt-based product segment is expected to grow at a substantial rate over the forecast period. These cocktails are much sweeter and don’t have a well-defined taste, which has resulted in their reduced consumption.

Alcohol Base Insights

The malt-based ready to drink cocktails accounted for a revenue share of 54.3% from 2024 to 2030. Malt-based products contain barley as their primary ingredient, which is malted before it is processed. This malt base is then mixed with other artificial or natural flavors to create a taste profile that is different from regular beers and similar to cocktails sold at bars. The market for ready to drink (RTD) cocktails has undergone a resurgence owing to lifestyle-led changes, diverse new product development initiatives, and innovative product packaging.

The sprit-based ready to drink cocktails is expected to grow at a CAGR of 17.3% over the forecast period. The growing demand for low content alcohol-based flavored drinks due to the rising health concerns is anticipated to drive the spirit-based segment over the forecast period. These drinks offer a wide range of variety, such as cocktails infused with ginger, rose, and lavender along with spirits, which, in turn, has increasingly made them the most preferred alcoholic beverage among consumers, and, thus, is expected to be the fastest-growing segment. Premiumization of the product with enhanced flavors, taste, quality, and package design is further expected to drive the spirit-based segment’s growth.

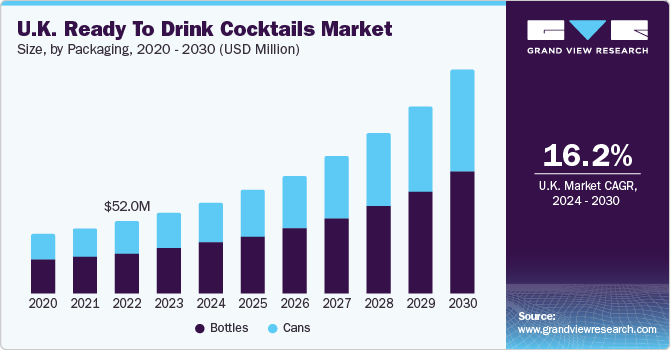

Packaging Insights

The bottle packing accounted for a revenue share of 56.3% in 2023.Initially, the ready-to-drink concept was launched in a bottle package design and became popular worldwide. Aluminum shortage in countries such as the U.S. has led to the introduction of RTD cocktails in glass bottles. For instance, High West Distillery offers barrel-finished cocktails in glass bottles. Furthermore, the rise in awareness regarding water and land pollution caused by beverages packaged in plastic bottles has led to an increased demand for RTD cocktails in glass bottles.

The RTD cans cocktails are estimated to register a CAGR of 16.9% over the forecast period owing to increasing number of consumers are switching to canned beverages as bottles are breakable. Moreover, the sleek design of cans with attractive labels and vibrant colors attracts the younger generation.Bright, eye-catching colors, simple designs, and slender cans are gaining popularity among consumers. This stylish but approachable aesthetic keeps canned RTD cocktails accessible, while also making them appear more premium than soda or beer products.

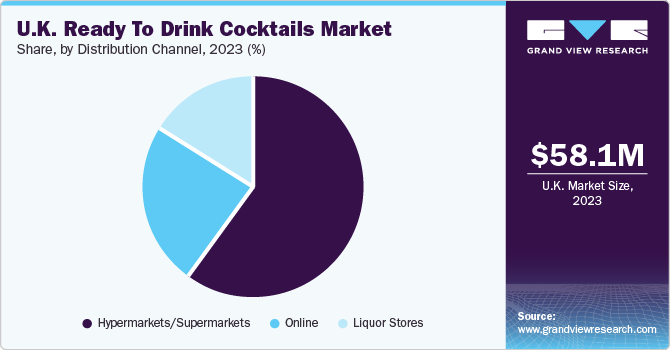

Distribution Channel Insights

Sales of RTD cocktails through hypermarket/supermarket accounted for 59.6% share in 2023. Encouraging consumers to shop at supermarkets & hypermarkets in the U.K. include high-speed services, one-stop shopping service, and extended hours of operation. Moreover, evolving store-based shopping experiences and the availability of a wide variety of brands at supermarkets and hypermarkets are fueling this segment’s growth in the U.K. Some of the most popular supermarkets & hypermarkets in the country are Tesco PLC, Sainsbury’s, Asda Stores, Morrisons, Aldi, Lidl, Waitrose, and Ocado.

Sales through online channel is anticipated to grow at a CAGR of 18.8% over the forecast period due to the changes in consumer shopping behavior. Furthermore, features of the online distribution channel such as doorstep delivery, the option to use reliable payment getaways, and the availability of coupons or discounts also influence the consumers to buy RTD cocktails online.

Key UK Ready To Drink Cocktails Company Insights

Some of the key players operating in the market include Diageo plc, Halewood Wines & Spirits, and Brown-Forman

-

Diageo plc, offers a wide range of products including beers, spirits, and other premium beverages. It also sells products under six global brands, 11 local star brands, and 12 reserve brands. According to the company, 39% of its revenue is generated by global brands, 20% by local star brands, and 21% by reserve brands. The company offers its RTD cocktail under the Smirnoff brand globally.

-

Halewood Wines & Spirits specializes in the manufacturing, sales, marketing, and distribution of wines & spirits across the globe. The company was founded in 1978 and is headquartered in Liverpool, U.K. As of December 2020, the company had an employee strength of more than 900. Halewood Wines & Spirits sells a wide range of alcoholic beverage under 23 brands in more than 50 countries. The company has eight distilleries and breweries around the world.

-

Manchester Drinks Company Ltd., Asahi Group Holdings, Ltd., Diageo plc, and The Absolut Company some of the other participants in the UK ready to drink cocktails market,

-

Manchester Drinks Company Ltd., founded in 2004and is currently headquartered in Bury, U.K., specializes in the production, sales, marketing, and distribution of alcoholic beverages and soft drinks across the globe. It has a wide range of products, which are sold through various brands including Alfie, Authentic Cocktail Co., Champs de la Fontaine, Classic Combinations, The Liquorists, Manchester Drinks, Manchester Drinks Spiced Rum Liqueur, MATTI, MyShots, Natures Seltzer, Navigator, SHOCK SHOTS, and Shuda.

-

Anheuser-Busch InBev also known as AB InBev, was incorporated in 2008 and is headquartered in Leuven, Belgium. The diverse portfolio of the company comprises over 630 beer brands, including global brands like Budweiser, Corona, and Stella Artois, multiple country brands like Beck’s, Hoegaarden, Leffe, and Michelob Ultra, and local favorites such as Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol.

Key UK Ready To Drink Cocktails Companies:

- Diageo plc

- Halewood Wines & Spirits

- Brown-Forman

- Manchester Drinks Company Ltd.

- Asahi Group Holdings, Ltd.

- Diageo plc

- The Absolut Company

- Anheuser-Busch InBev

- Pernod Ricard

- Shanghai Bacchus Liquor Co., Ltd.

Recent Developments

-

In April 2023, Absolut launched three flavors of RTD cocktails. These flavors include coffee, strawberry, and passion fruit. The new product range has only 5% ABV and was launched in the UK in May 2023.

-

In July 2022, the company collaborated with Vita Coco to launch a range of RTD cocktails spiked with coconut water and Captain Morgan White Rum

UK Ready To Drink Cocktails Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 65.5 million

Revenue forecast in 2030

USD 161.2 million

Growth rate

CAGR of 16.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Alcohol base, packaging, distribution channel

Country scope

UK

Key companies profiled

Halewood Wines & Spirits; Brown-Forman; Manchester Drinks Company Ltd.; Asahi Group Holdings, Ltd.; Diageo plc; The Absolut Company; Anheuser-Busch InBev; Pernod Ricard; Shanghai Bacchus Liquor Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

UK Ready To Drink Cocktails Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK ready to drink cocktails market report based on alcohol base, packaging, and distribution channel:

-

Alcohol Base Outlook (Revenue, USD Million, 2018 - 2030)

-

Malt-based

-

Spirit-based

-

Wine-based

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Online

-

Liquor Stores

-

Frequently Asked Questions About This Report

b. The UK ready to drink cocktail market size was estimated at USD 58.1 million in 2023 and is expected to reach USD 65.5 million in 2024.

b. The UK ready to drink cocktail market is expected to grow at a compounded growth rate of 16.2% from 2024 to 2030 to reach USD 161.2 million by 2030.

b. The malt-based ready to drink cocktails accounted for a revenue share of 54.3% from 2024 to 2030. Malt-based products contain barley as their primary ingredient, which is malted before it is processed. This malt base is then mixed with other artificial or natural flavors to create a taste profile that is different from regular beers and similar to cocktails sold at bars.

b. Some key players operating in the UK ready to drink cocktail market include Halewood Wines & Spirits; Brown-Forman; Manchester Drinks Company Ltd.; Asahi Group Holdings, Ltd.; Diageo plc; The Absolut Company; Anheuser-Busch InBev; Pernod Ricard; Shanghai Bacchus Liquor Co., Ltd.

b. Key factors that are driving the UK ready to drink cocktail market growth include the rising health-consciousness and wellness trends along with the growing influence of the American culture have made the consumers in the U.K. shift to RTD cocktails. The growing availability of popular brands, such as Jack Daniel’s, Bacardi, and Funkin, in the U.K. is also driving the consumption of RTD cocktails in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."