- Home

- »

- Renewable Energy

- »

-

UK Renewable Energy Market Size, Industry Report, 2030GVR Report cover

![UK Renewable Energy Market Size, Share & Trends Report]()

UK Renewable Energy Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hydropower, Wind Power, Solar Power, Bioenergy), By Application (Industrial, Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-210-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Renewable Energy Market Size & Trends

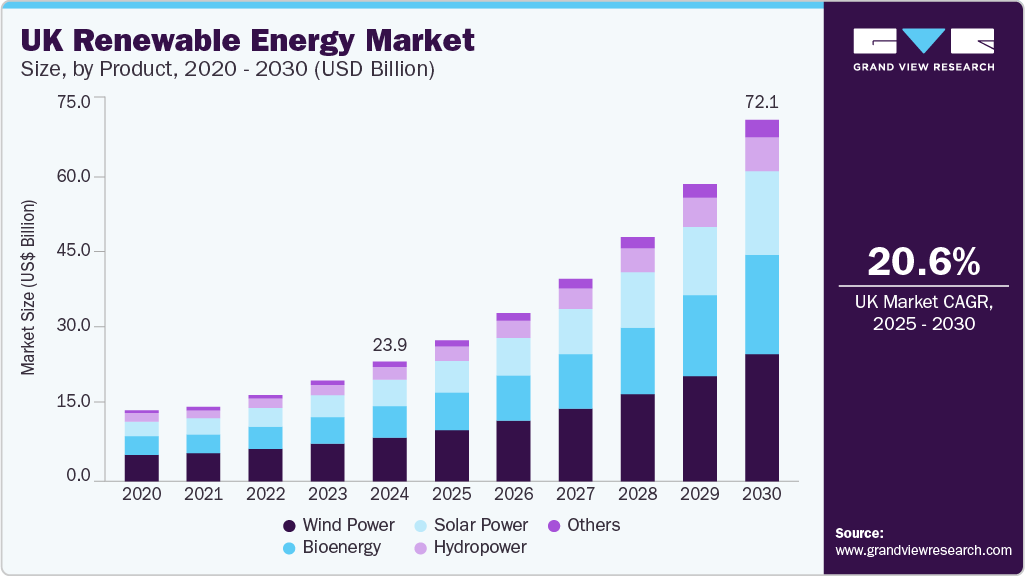

The UK renewable energy market size was estimated at USD 23.86 billion in 2024 and is expected to grow at a CAGR of 20.6% from 2025 to 2030. The growing demand for renewable energy is attributed to the high living standards of consumers and rapid economic growth. The shift towards low-carbon fuels and the presence of stringent environmental regulations in the UK have greatly boosted the growth of the renewable energy industry in the country.

Another growth factor responsible for the rising demand for renewable energy in the country is the economic benefits and opportunities provided by solar energy projects in the UK. With PV modules becoming cheap, the installation rates have gone up in the country, and the upgradation of old power plants is expected to drive the market. Notable solar companies present in the country include First4Solar and Maxeon Solar Technologies, Ltd. The use of solar panels in the country is increasingly attributed to the strategic geographical location of the country, as it is exposed to the maximum amount of sunlight throughout the year.

Increasing construction of hydropower plants in the country is also expected to foster the demand for renewable energy in the UK hydropower market during the forecast period. Increasing construction of micro and an increase in spending on mini hydro power plants will fuel the demand for the overall hydropower market in the country in the near future.

The high initial investment to produce renewable energy restrained the growth of the global renewable energy market. A similar trend is expected to be seen in the UK market for renewable energy. The cost of renewable energy production comprises land, materials, equipment, and labor. Financial assistance is required for the development and expansion of biogas plants. The process of procuring and converting raw materials is costly and time-consuming. Regulation and financial assistance are required for sorting, collecting, processing, supplying, and distributing the feedstock; the construction & operation of the plant; and the sale & distribution of renewable energy. Plant output needs to be sufficient and consistent to cover installation and operating costs.

Drivers, Opportunities & Restraints

Environmental commitments, technological advancements, and supportive government policies drive the UK renewable energy industry. The country's legally binding net-zero emissions target and ongoing efforts to reduce greenhouse gas emissions significantly push the demand for clean energy. Additionally, declining costs of renewable technologies, such as wind and solar power, have made them increasingly competitive compared to traditional fossil fuels. The UK's natural resources, especially in offshore wind, provide a solid foundation for expanding renewable capacity. Furthermore, research and innovation, supported by institutions focused on renewable energy technologies, continue to enhance the efficiency and feasibility of green projects.

The UK's renewable energy sector presents substantial opportunities, particularly in offshore wind, battery storage, and green job creation. Offshore wind, in particular, is poised to become a global leader, supported by extensive coastal resources and advanced turbine technology. Battery energy storage is also gaining momentum, driven by the need to stabilize the grid amidst growing renewable input. Furthermore, as the UK transitions to a low-carbon economy, significant employment opportunities are emerging, with green jobs revitalizing regions historically dependent on fossil fuels. The government's focus on clean energy initiatives offers a promising innovation, investment, and sustainable growth landscape.

Despite positive developments, the UK renewable energy market faces several challenges. Infrastructure limitations, particularly grid congestion, have led to inefficiencies and occasional underutilization of renewable resources. Policy uncertainties, including debates over energy pricing and regulatory frameworks, sometimes hinder investment and project continuity. Additionally, inflation and supply chain disruptions increase project costs, leading to potential delays in implementation. The intermittent nature of renewable sources also poses a challenge, necessitating advancements in energy storage and grid management to ensure a consistent power supply. To maintain growth, addressing these issues requires coordinated policy, infrastructure investment, and continued technological innovation.

Product Insights

The wind power segment dominated the UK renewable energy industry with a revenue share of over 36.0% in 2024. A substantial increase in demand for renewable energy is expected to drive the growth of the wind energy market. Wind energy is cost-effective and one of the cheapest renewable energy sources, costing 1-2 cents per kWh. Wind energy is a renewable energy source used to generate electricity from kinetic energy. Wind turbines transform the energy into kinetic energy, which is further converted into electrical energy by a generator. Wind energy can be generated both onshore and offshore. Onshore wind energy is associated with onshore turbines located on land, while offshore wind turbines are located in the ocean. However, offshore wind turbines are more efficient than onshore wind turbines due to the constant wind currents. These factors, coupled with environmentally friendly technology over the use of fossil fuels, are expected to drive the demand for wind energy over the forecast period.

The solar energy power segment is expected to witness the fastest CAGR of 21.8% in 2024. Grid electricity has a lot of blackouts, even hydropower is prone to blackouts during transmission, but solar systems are much more efficient at transmission. This is the major driving factor for the segment. Furthermore, it is low in cost and provides a company green label and minimizes power outages. Hence, organizations are shifting to solar power over conventional electricity. For instance, the UK government allocated a budget of GBP 4 billion from 2022 to 2026. The grant is to aid in the installation of solar panels in residential buildings. The government also introduced a 0% VAT scheme on solar panels as a product as well as its installation.

Application Insights

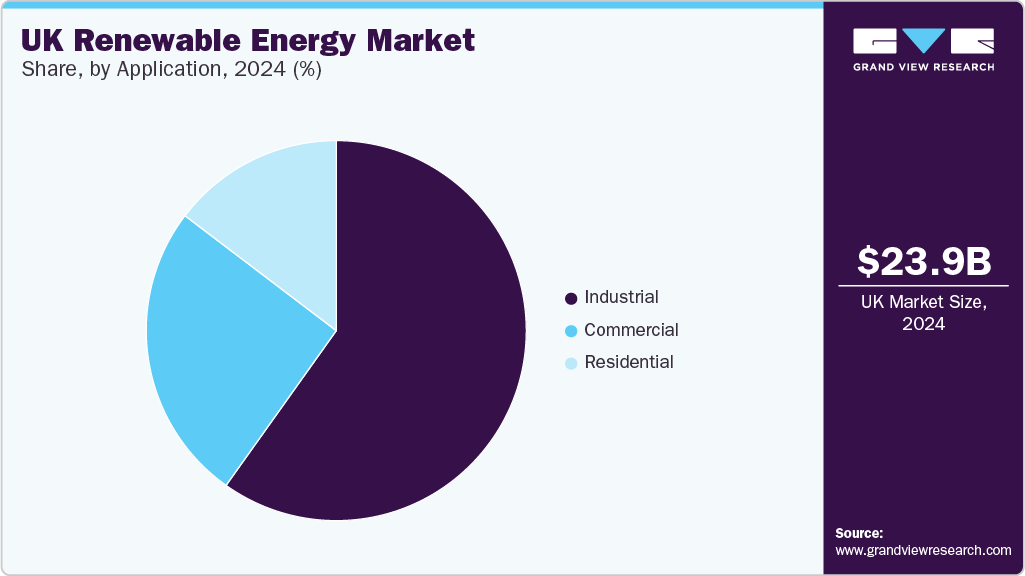

The industrial segment dominated the UK renewable energy industry with a revenue share of over 59% in 2024. Increasing demand for clean electricity is expected to increase the number of utility projects and drive the growth of the photovoltaic module market across the industrial sector. Furthermore, the long-term adoption of renewable energy sources in industrial applications is expected to make up approximately 21% of the energy consumption in the manufacturing sector as feedstock by 2050.

The residential segment is anticipated to witness the fastest CAGR during the forecast period. The rapid growth of solar energy in the residential segment is attributed to numerous benefits such as lower carbon footprints, lower electricity bills, and higher home values. With the help of solar systems, consumers are eligible for tax credits introduced by governments. The launch of solar PV panels in residential applications is expected to increase product demand over the forecast period. For instance, Solaria introduced a black solar panel for residential applications with a power output of 430 W. The new panel is dubbed PowerXT 430R-PL and has a power conversion efficiency of 20.40% along with a size of 1,076×1,957x35mm and a weight of 21.3 kg.

Key UK Renewable Energy Company Insights

The market is extremely competitive, with key participants involved in collaboration and expansion to increase their renewable energy production capacity. The players are continuously involved in adopting various organic and inorganic strategies to expand their global footprint and energy production capacities. The most adapted strategy is collaboration and partnership to minimize competition and focus on the expansion of the market.

Key UK Renewable Energy Companies:

- ABB

- Acconia

- Enel Spa

- General Electric

- Invenergy

- Schneider Electric

- Siemens Gamesa Renewable Energy

- Suzlon Energy Ltd.

UK Renewable Energy Market Report Scope

Report Attribute

Details

Market size volume in 2025

USD 28.28 billion

Volume forecast in 2030

USD 72.14 billion

Growth rate

CAGR of 20.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in TWh; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

UK

Key companies profiled

ABB; Acconia; Enel Spa; General Electric; Invenergy; Schneider Electric; Siemens Gamesa Renewable Energy; Suzlon Energy Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Renewable Energy Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the UK renewable energy market report based on product and application:

-

Product Outlook (Volume, TWh; Revenue, USD Million, 2018 - 2030)

-

Hydropower

-

Wind Power

-

Solar Power

-

Bioenergy

-

Others

-

-

Application Outlook (Volume, TWh; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The UK renewable energy market was valued at USD 23.86 billion in the year 2024 and is expected to reach USD 28.28 billion in 2025.

b. The UK renewable energy market is expected to grow at a compound annual growth rate of 20.5% from 2025 to 2030 to reach USD 72.14 billion by 2030.

b. Wind Power segment emerged as a dominating segment in the market with over a share of 38.50% in 2024 due to inclination towards purchasing of renewable energy from the government.

b. The key market player in the UK renewable energy market includes ABB; Acconia; Enel Spa; General Electric; Invenergy; Schneider Electric; Siemens Gamesa Renewable Energy; and Suzlon Energy Ltd.

b. The key factors that are driving the UK renewable energy market include, shift towards low-carbon fuels and the presence of stringent environmental regulations in UK.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.