- Home

- »

- Next Generation Technologies

- »

-

U.S. 5G in Aviation Market Size, Share, Industry Report 2030GVR Report cover

![U.S. 5G In Aviation Market Size, Share & Trends Report]()

U.S. 5G In Aviation Market (2025 - 2030) Size, Share & Trends Analysis Report By Communication Infrastructure, By Technology, By Connectivity Type (Air-to-Ground Communication, Ground-to-Ground Communication), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-604-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. 5G In Aviation Market Size & Trends

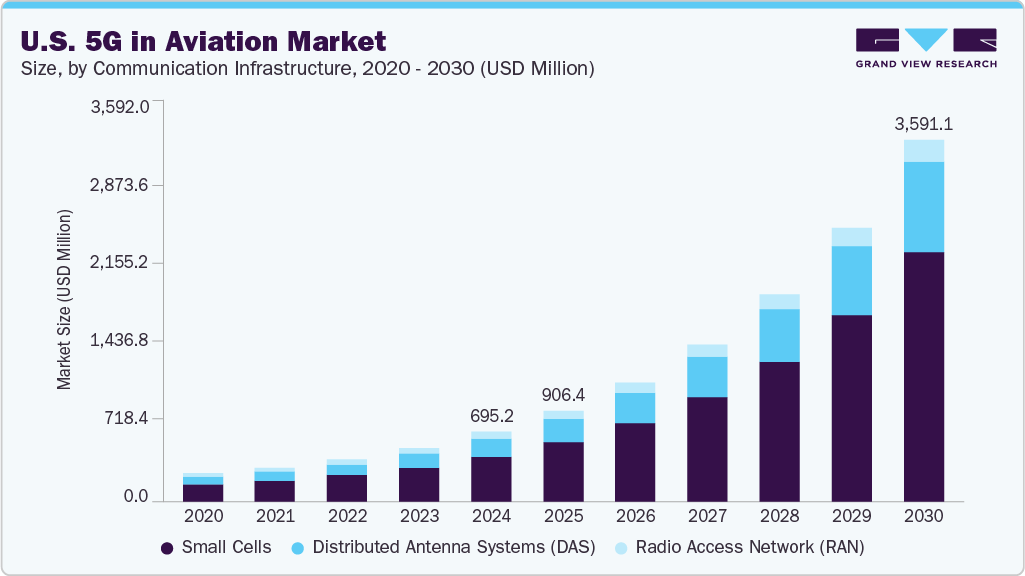

The U.S. 5G in aviation market size was estimated at USD 695.2 million in 2024 and is projected to grow at a CAGR of 31.7% from 2025 to 2030. The market growth is primarily influenced by factors such as the growing emphasis on airspace modernization under Federal Aviation Administration (FAA) initiatives, increased demand for high-speed inflight connectivity on business jets, and the rising need for rapid network restoration in disaster-affected areas.

Government agencies and private aviation operators are increasingly deploying 5G systems to support secure communications and enhance operational efficiency. Also, the U.S. is witnessing significant interest in non-terrestrial 5G platforms, including low Earth orbit satellite integration and airborne relays for emergency and defense applications. However, stringent FAA airworthiness and spectrum certification processes continue to pose regulatory hurdles. The expanding need for resilient and secure communications by U.S. defense, homeland security, and emergency services presents a substantial growth opportunity for the market.

The Federal Aviation Administration’s (FAA) modernization efforts are being accelerated by the urgent need to replace aging and unsustainable air traffic control (ATC) systems. According to a 2024 report by the U.S. Government Accountability Office (GAO), 51 of the FAA’s 138 operational systems were deemed unsustainable, with many over 30 years old and lacking spare parts or modern functionality. Following a national airspace shutdown in 2023 caused by a system outage, the FAA identified 17 critical systems as especially at risk. While some modernization projects are underway, many are not expected to be completed for 10–13 years. To mitigate near-term risks and improve efficiency, the FAA is pushing forward with initiatives such as NextGen, which encourages the use of high-speed, low-latency 5G networks. These systems support airport surface operations, cockpit-to-ground communication, and real-time data exchange, positioning 5G as a key enabler in securing U.S. airspace safety and resilience in the short to medium term.

As the U.S. continues to be the largest business aviation market globally, there is a growing expectation from passengers for high-speed inflight connectivity, especially among corporate and VIP travelers. Business jets are increasingly being equipped with 5G-enabled air-to-ground communication platforms to meet this demand. In August 2024, Gogo Business Aviation partnered with Skyservice to develop 5G Supplemental Type Certificates (STCs) for six business jet models. Supported by Gogo’s expanding 5G infrastructure, including nine sites in Canada, this initiative underlines the industry's push toward delivering seamless, low-latency broadband access at cruising altitudes across North America.

The U.S. has witnessed an uptick in severe weather events such as hurricanes, wildfires, and major storms. These disasters often cripple terrestrial communication networks, disrupting coordination among emergency response teams. In this context, airborne 5G platforms are gaining traction as rapid deployment solutions for restoring connectivity. Leveraging high-altitude aircraft equipped with 5G systems, agencies including FEMA and the Department of Defense (DoD) can quickly reestablish mobile networks in affected regions. These systems provide mission-critical data links for search and rescue, medical response, and logistics coordination. The relevance of this capability is increasingly recognized, leading to public-private collaborations to develop air-based 5G relays and emergency telecom frameworks.

Integrating 5G into U.S. aviation is significantly delayed due to stringent FAA airworthiness certifications and spectrum-related safety concerns, particularly regarding C-band usage near airports. In January 2022, the CEOs of major U.S. airlines, including American, Delta, and United, issued an urgent letter warning of a “catastrophic” aviation crisis if AT&T and Verizon launched 5G near major hubs. They stated that widebody aircraft could become unusable, potentially grounding tens of thousands of passengers. Emirates and other international carriers canceled U.S. flights due to safety concerns with Boeing 777 altimeters. The FAA responded by restricting low-visibility landings at dozens of airports. Though telecoms delayed 5G rollouts near airports, these events underscore how unresolved technical risks and certification hurdles continue to disrupt deployment, limit market scaling, and prolong integration timelines.

Communication Infrastructure Insights

The small cells segment accounted for the largest share of 62.3% in 2024. This dominance is driven by the growing demand for dense, high-capacity wireless infrastructure across major U.S. airports such as Hartsfield-Jackson Atlanta and Chicago O’Hare. The need for enhanced in-flight and terminal connectivity is pushing airport authorities and airlines to deploy 5G-enabled small cells capable of delivering low-latency, high-throughput data. Key players, including AT&T and Gogo Business Aviation, are investing in small cell rollouts to upgrade outdated legacy networks and meet the surging expectations for seamless broadband access throughout the travel experience.

The distributed antenna systems (DAS) segment is expected to grow at the fastest CAGR from 2025 to 2030. U.S. airports are increasingly implementing DAS to address structural interference issues and ensure uninterrupted wireless coverage inside terminals and aircraft cabins. Major initiatives, including DAS deployments at Los Angeles International Airport (LAX) and Dallas/Fort Worth International Airport (DFW), are designed to support high user density and meet FAA safety and communication compliance standards. This trend is accelerating as U.S. carriers and hub airports prioritize infrastructure modernization to enhance both operational efficiency and passenger satisfaction.

Technology Insights

The enhanced mobile broadband (eMBB) segment accounted for the largest share of the U.S. 5G in aviation industry in 2024. This growth is largely driven by the increasing demand for high-speed inflight internet on domestic and transcontinental routes operated by U.S. carriers such as Delta, United, and American Airlines. Passengers now expect uninterrupted video streaming, virtual meetings, and real-time messaging services during flights. In response, U.S.-based providers, including Panasonic Avionics Corporation, have been expanding partnerships with airlines to deploy 5G eMBB systems. For example, Gogo’s AVANCE platform supports high-bandwidth applications, offering passengers a seamless broadband experience while enabling real-time telemetry data exchange with ground systems.

The ultra-reliable low-latency communication (URLLC) segment is expected to grow at a significant CAGR during the forecast period. Companies in the country are developing URLLC solutions tailored for U.S. aviation use cases. These technologies are increasingly deployed at major U.S. airports to support latency-sensitive functions like remote ground control operations, automated aircraft guidance systems, and emergency response coordination. With the FAA emphasizing next-generation safety and air traffic systems under programs like NextGen, URLLC solutions are becoming essential to support mission-critical data transmission with sub-millisecond latency.

Connectivity Type Insights

The air-to-ground communication segment accounted for the largest share of the U.S. 5G in aviation market in 2024, driven by rising demand for uninterrupted inflight connectivity on domestic routes, enabling real-time data exchange between aircraft and U.S. ground stations. Services such as live video streaming, flight tracking, predictive maintenance updates, and enhanced flight management are becoming standard. Major players in the country are deploying nationwide 5G networks tailored for business and regional jets.

The ground-to-ground communication segment is expected to register a notable CAGR from 2025 to 2030, fueled by the modernization of airport infrastructure across major hubs such as John F. Kennedy International Airport (JFK), Los Angeles International Airport (LAX), and Hartsfield–Jackson Atlanta International Airport (ATL). Key applications include airside vehicle coordination, baggage routing systems, gate allocation, and airport security protocols. U.S. companies such as Cisco Systems and Honeywell International are spearheading the development of integrated, low-latency 5G ground networks that enhance real-time coordination among airport stakeholders, streamline passenger handling, and boost safety and efficiency within airside and landside operations.

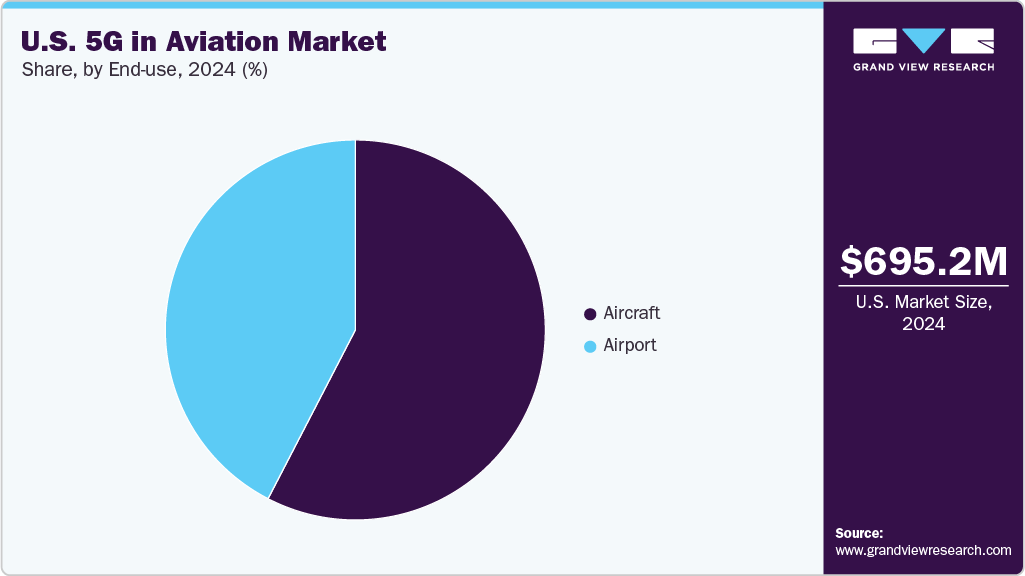

End-use Insights

The aircraft segment accounted for the largest share of the U.S. 5G in aviation industry in 2024, driven by growing demand for seamless in-flight connectivity and real-time communication systems to enhance passenger experience and flight operations. Major U.S. airlines, including Delta Air Lines, United Airlines, and American Airlines, are investing in 5G-enabled solutions through partnerships with providers such as Gogo Business Aviation and Viasat to offer high-speed internet access and advanced onboard services. Additionally, the integration of IoT-based systems for predictive maintenance and aircraft health monitoring is boosting the need for high-throughput, low-latency 5G connectivity.

The airport segment is expected to register a notable CAGR from 2025 to 2030, supported by ongoing investments in smart airport infrastructure across major U.S. hubs. For instance, in May 2023, Dallas Fort Worth International Airport (DFW) partnered with AT&T to deploy around USD 10 million private 5G network and upgrade its Wi-Fi infrastructure. The initiative includes the installation of 200 new access points and upgrades to 800 existing ones, improving connectivity for passengers while also enabling internal 5G use for IoT-based operational digitization. This development highlights how U.S. airports are leveraging next-generation wireless technologies to enhance passenger experience, optimize ground operations, and support scalable, future-ready infrastructure.

Key U.S. 5G In Aviation Company Insights

Some of the key companies in the U.S. 5G in Aviation industry include Gogo Business Aviation LLC; Ericsson Inc.; Honeywell International Inc.; Collins Aerospace; and Cisco Systems, Inc. The key participants focus on adopting strategies such as service differentiation, inclusion of customization and personalization in service offerings, and improved customer assistance to address growing competition.

-

Founded in 1991 and headquartered in Chicago, Illinois, Gogo Business Aviation LLC is a prominent provider of in-flight broadband connectivity and wireless solutions for business aviation. The company offers high-speed internet, voice, and entertainment services tailored for private jets and corporate aircraft. Gogo leverages advanced air-to-ground and satellite technology to enable seamless communication and real-time data transfer at cruising altitudes.

-

Founded in 1876 and headquartered in Stockholm, Sweden, Ericsson Inc. is a subsidiary of Ericsson AB, a global player in telecommunications and networking solutions. The company specializes in the design and deployment of 5G infrastructure, including radio access networks, core networks, and cloud-based services. Ericsson provides end-to-end solutions for the aviation industry to enable ultra-reliable, low-latency communications and enhanced connectivity for aircraft and airports.

Key U.S. 5G In Aviation Companies:

- Gogo Business Aviation LLC

- Honeywell International Inc.

- Collins Aerospace

- Cisco Systems, Inc.

- Ericsson Inc.

- Nokia of America Corporation (Nokia Corporation)

- Panasonic Avionics Corporation

- AT&T Inc.

- OneWeb

- Thales USA Inc.

Recent Developments

-

In April 2025, Nokia extended its strategic partnership with T-Mobile US to expand 5G network capacity and coverage nationwide. The deal includes deployment of AirScale RAN solutions and AI-powered automation tools, enhancing the reliability and performance of the U.S. 5G infrastructure that supports connected aviation operations.

-

In October 2024, Nokia and NTT DATA deployed a Private 5G network in Brownsville, Texas, under their global partnership. The secure, carrier-grade system supports public safety, operational scalability, and future smart city use cases, aligning with airport and aviation sector connectivity advancements.

-

In August 2024, Gogo Business Aviation LLC partnered with Skyservice Business Aviation to develop 5G Supplemental Type Certificates (STCs) for six aircraft models. With FAA validations underway, this initiative enhances U.S. inflight connectivity and supports AVANCE system upgrades ahead of the planned LTE transition in 2026.

-

In January 2024, Boingo Wireless launched a next-generation 5G network and expanded Wi-Fi 6 coverage at John Wayne Airport. The integrated system enhances traveler connectivity and supports critical airport operations, ensuring secure, high-speed wireless service across terminals, checkpoints, parking, and rideshare areas.

-

In January 2022, AT&T and Verizon launched 5G services in the U.S. with limited disruption to flights after scaling back deployment near airports. The FAA approved most commercial aircraft for low-visibility landings, easing concerns over 5G interference with radio altimeters.

U.S. 5G In Aviation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 906.4 million

Revenue forecast in 2030

USD 3,591.1 million

Growth rate

CAGR of 31.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Communication infrastructure, technology, connectivity type, end-use

Key companies profiled

Gogo Business Aviation LLC; Honeywell International Inc.; Collins Aerospace; Cisco Systems, Inc.; Ericsson Inc.; Nokia of America Corporation; Panasonic Avionics Corporation; AT&T Inc.; OneWeb; Thales USA Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. 5G In Aviation Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. 5G in aviation market report based on communication infrastructure, technology, connectivity type, and end-use:

-

Communication Infrastructure Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Cells

-

Distributed Antenna Systems (DAS)

-

Radio Access Network (RAN)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Enhanced Mobile Broadband (eMBB)

-

Ultra-Reliable Low-Latency Communication (URLLC)

-

Massive Machine-Type Communication (mMTC)

-

-

Connectivity Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Air-to-Ground Communication

-

Ground-to-Ground Communication

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aircraft

-

Airport

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include growing emphasis on airspace modernization under Federal Aviation Administration (FAA) initiatives, increased demand for high-speed inflight connectivity on business jets, and the rising need for rapid network restoration in disaster-affected areas. Government agencies and private aviation operators are increasingly deploying 5G systems to support secure communications and enhance operational efficiency.

b. The global U.S. 5G in aviation market size was estimated at USD 695.2 million in 2024 and is expected to reach USD 3,591.1 million in 2030.

b. The global U.S. 5G in aviation market is expected to grow at a compound annual growth rate of 31.6% from 2025 to 2030 to reach USD 3,591.1 million by 2030.

b. The small cells segment accounted for the largest share of 62.3% in 2024. This dominance is driven by the growing demand for dense, high-capacity wireless infrastructure across major U.S. airports such as Hartsfield-Jackson Atlanta and Chicago O’Hare. The need for enhanced in-flight and terminal connectivity is pushing airport authorities and airlines to deploy 5G-enabled small cells capable of delivering low-latency, high-throughput data.

b. Some key players operating in the U.S. 5G in aviation market include Gogo Business Aviation LLC, Honeywell International Inc., Collins Aerospace, Cisco Systems, Inc., Ericsson Inc., Nokia of America Corporation, Panasonic Avionics Corporation, AT&T Inc., OneWeb, Thales USA Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.