- Home

- »

- Automotive & Transportation

- »

-

U.S. Aerial Work Platform Market Size, Industry Report, 2030GVR Report cover

![U.S. Aerial Work Platform Market Size, Share & Trends Report]()

U.S. Aerial Work Platform Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Boom Lifts, Scissor Lifts, Vertical Lifts), By Propulsion Type, By Lifting Height, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-097-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Aerial Work Platform Market Trends

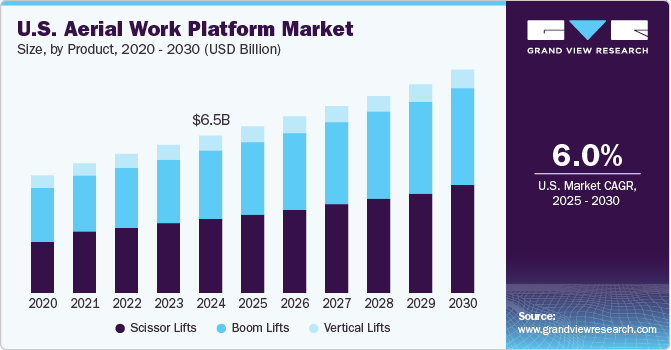

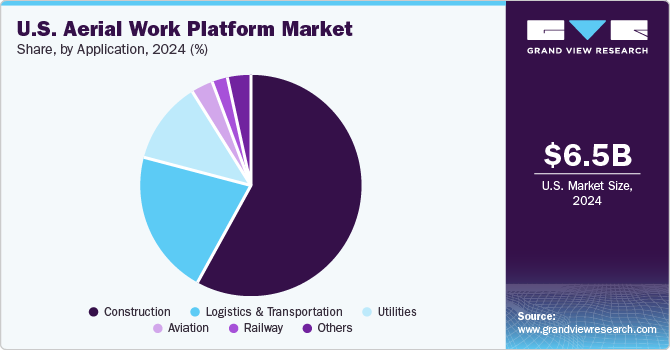

The U.S. aerial work platform market size is estimated at USD 6.50 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2030. Rapid developments in the logistics and supply chain sector, coupled with the growing focus of e-commerce businesses on constructing warehouses and large retail centers, are expected to drive the demand for aerial work platforms (AWP) in the U.S. storage and warehousing facilities play a critical role in the continuous supply of goods and equipment, particularly for e-commerce and logistics businesses.

The growing demand for new and larger warehouses leads to promising growth opportunities for warehouse automation solutions, which help increase supply chain efficiency in the face of growing service volumes. For instance, self-propelled aerial work platforms help with multi-layer stacking and storing goods. These developments bode well for the U.S. aerial work platform industry's growth.

The demand for warehouses has increased in response to the growing popularity of online shopping for most client categories in the U.S. Similarly, the demand for in-city warehouses has increased due to the growth of online delivery businesses that adhere to same-day delivery or other express delivery models. Retailers are increasing the geographic reach of their distribution centers as they keep increasing their inventory to keep up with the expansion of e-commerce operations. Moreover, the growing focus of several e-commerce businesses on diversifying their supply chains is driving the growth prospects of Third-Party Logistics (3PL) providers, further encouraging the construction of retail and warehousing facilities, and thereby driving the industry growth.

For instance, in July 2021, CRG, a real estate development firm, announced the establishment of the U.S. Logistics Fund II (USLF II), a fund that aimed to invest USD 1.5 billion in new e-commerce and distribution facilities throughout the logistics markets in the U.S. CRG is currently working on new industrial projects worth more than USD 3.8 billion for Fortune 500 clients in 21 states across the U.S.

Moreover, increasing construction and infrastructure activities fuel market growth. Construction sites often necessitate access to greater heights and primarily use rough terrain aerial work platforms, which may lead to accidents involving workers operating at such heights. AWPs offer increased safety and flexibility to workers and operators as compared to conventional solutions. AWPs offer a safer alternative to ladders or scaffoldings for performing daily tasks such as glass cleaning, painting, roof fitting, window fitting, and the repair and installation of electrical utilities.

Building maintenance and construction sites with structures in difficult-to-reach regions benefit from using articulating boom lifts and telescopic aerial lifts, both intended for maximum reach capabilities. Several market players are introducing new products catering to this demand. For instance, in December 2024, Zoomlion Heavy Industry Science & Technology Co., Ltd. introduced the ZT82J, the tallest straight boom AWP with a height of 82.3 meters. This innovative launch establishes a new industry benchmark, building on Zoomlion's earlier successes with 68-meter and 72-meter straight booms.

Product Insights

Scissor lifts accounted for the largest share of 47.3% in 2024. Scissor lifts are affordable and offer enhanced operational efficiency due to their compact design and higher speed to perform loading tasks effectively. They are typically used for the setting and positioning work of goods and vertically positioned lifting in industries such as construction, production, warehousing, retailing, delivery, and transportation. The ergonomic design of these lifts helps improve their operational productivity while reducing the danger of workplace injuries. The design allows users to carry the load evenly and maintain stability even while moving the lift.

The boom lifts segment is expected to grow at a significant CAGR during the forecast period. Boom lifts are typically used for construction, building, gardening, and electric line repair. They help transport personnel and equipment to heights that are normally inaccessible. Boom lifts use hydraulic arms capable of maneuvering around obstacles, leading to greater flexibility. They can also reach better heights, enabling workers to effortlessly move around buildings, trees, and power lines. Manufacturers are prioritizing product development by integrating safety features such as an anti-collision system to mitigate situations that involve entrapment or colliding with other objects and ensure a safe working environment.

Propulsion Type Insights

The ICE segment held the largest market share in 2024. The increasing demand for diesel drives the growth of the ICE segment, and petrol-powered lifts are widely used for outdoor applications. ICE-based aerial work platforms are designed to operate under heavy loading applications, enabling enhanced vertical reach and load capacity. This makes them more construction-oriented compared to their electric counterparts. Moreover, engine-operated aerial work platforms are suitable for operating in remote locations. They can be deployed in a remote location owing to the wide availability of diesel or other petroleum products, thereby driving its growth in the U.S. aerial work platform industry.

The electric segment is expected to register the fastest CAGR during the forecast period. Electric aerial work platforms are expected to witness high demand owing to their high lifting capacity and zero emissions. Moreover, increasing government regulations on fossil fuel-based aerial work platforms to reduce greenhouse gas emissions contribute to segment growth. Electric aerial work platforms are used for indoor applications as they have a lower turning radius. Their compact design makes them ideal for warehouse applications with narrow aisles and confined spaces. These platforms enable technicians to access and perform tasks in hard-to-reach areas in commercial and institutional facilities.

Lifting Height Insights

The 21-50 Ft segment dominated the market in 2024. Aerial work platforms with 21-50 ft. height are ideal for interior maintenance and cleaning in industrial, warehouse, and construction settings. These platforms have a narrow lift design, enabling them to fit into small spaces. Aerial work platforms with articulating boom lifts are ideal for such operations. These platforms ensure workers have easy access to elevated areas with enhanced protection from any mishap. They are used in automated warehouses, leveraging double scissor lifts, single scissor lifts, and other lifting tables for pallet and product placement.

The less than 20 Ft segment is projected to grow at a significant CAGR over the forecast period. Aerial work platforms with less than 20 ft. height are suitable for construction, transportation, and utility operations. These lifts are designed to fit into narrow spaces such as freight elevators, attics, shelves, commercial doors, and underground spaces for roof repair, installing pipes and ducts, elevated maintenance, and lighting work. They are easily operable and carry loads up to 350 lbs. to 500 lbs., depending on the model. These platforms are generally employed to carry out one-person operations. They are suitable for warehouse operations with options such as push-around and self-propelled platforms.

Application Insights

The construction segment dominated the market in 2024. The growing commercial and residential construction industry in the U.S. is expected to propel the demand for aerial work platforms. The U.S. aerial work platform industry growth is expected to be driven by government initiatives to refurbish commercial and public infrastructure and the increasing public and private construction projects in New York, California, Florida, and Texas. Construction sites require access around high-rise commercial and residential buildings and commonly use rough terrain and heavy-duty aerial work platforms. This increases the probability of injuries and accidents. Aerial work platforms offer workers and operators more flexibility and safety compared to conventional methods such as ladders and hanging ropes.

The utilities segment is projected to grow at a significant CAGR over the forecast period. Aerial work platforms play a pivotal role in the repair and maintenance of electric power lines and service towers. Government institutions such as electricity boards, municipal corporations, and other bodies require aerial work platforms to regularly maintain and repair electricity transmission lines and streetlights. Increasing government expenditure in the U.S. to develop and maintain such infrastructure is expected to create considerable demand for aerial work platforms over the forecast period.

Key U.S. Aerial Work Platform Company Insights

Some key companies in the market include Terex Corporation, JLG Industries, Haulotte Group, Skyjack, and others. Organizations focus on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

JLG Industries, one of the subsidiaries of Oshkosh Corporation, designs and manufactures access equipment and also provides training and support services. It offers a full line of aerial work platforms, stock pickers, tele handlers, trailers, mast booms, and equipment accessories. These products are offered to various application industries, including agriculture & landscaping, aviation & aerospace, commercial & retail, demolition, energy, entertainment, general construction, heavy construction, industrial, institutional, mining, and warehouse & distribution.

-

Haulotte Group designs, manufactures, and markets products to elevate mobile work platforms and telehandlers. The company offers seven people-lifting equipment product ranges, three telehandler product ranges, customized financing services, and services to optimize equipment lifecycles. The company operates its business through three segments: design and assembly, distribution, and rental. Haulotte Group offers its products to rental companies, industrial end-users, and special equipment military solutions.

Key U.S. Aerial Work Platform Companies:

- Terex Corporation

- JLG Industries

- Haulotte Group

- Skyjack

- Snorkel Lifts

- Manitou.com

- Palfinger AG

- Niftylift (UK) Limited

- TEUPEN

- Ruthmann Reachmaster N. A., LP

Recent Developments

-

In February 2025, JLG Industries, one of Oshkosh Corporation's businesses, launched a newly designed aviation package for its electric-drive scissor lifts, JLG ES2646. The package is intended for aircraft manufacturing and maintenance requirements and includes cutting-edge sensor technology, enhanced safety capabilities, contact-free maintenance capacity, and more.

-

In September 2024, Skyjack launched newly designed micro XStep, equipped with compatibility with its latest SJ3213 micro and the SJ3219 micro scissors. The micro XStep, new addition to ACCESSORYZERS line, aims to enable operators to maximize productivity by gaining desired work height in tight space.

U.S. Aerial Work Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.85 billion

Revenue forecast in 2030

USD 9.18 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in units, revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, propulsion type, lifting height, application

Key companies profiled

Terex Corporation; JLG Industries; Haulotte Group; Skyjack; Snorkel Lifts; Manitou.com; Palfinger AG; Niftylift (UK) Limited; TEUPEN; Ruthmann Reachmaster N. A., LP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aerial Work Platform Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. aerial work platform market report based on product, propulsion type, lifting height, and application:

-

Product Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Boom Lifts

-

Scissor Lifts

-

Vertical Lifts

-

-

Propulsion Type Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

ICE

-

Electric

-

-

Lifting Height Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Less than 20 Ft

-

21-50 Ft

-

More than 51 Ft

-

-

Application Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Utilities

-

Logistics & Transportation

-

Aviation

-

Railway

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.