- Home

- »

- Agrochemicals & Fertilizers

- »

-

U.S. Agricultural Adjuvants Market, Industry Report, 2030GVR Report cover

![U.S. Agricultural Adjuvants Market Size, Share & Trends Report]()

U.S. Agricultural Adjuvants Market Size, Share & Trends Analysis Report By Product (Activator Adjuvant, Utility Adjuvant), By Application (Herbicides, Insecticides), By Source, By Formulation, By Crop Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-226-2

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

U.S. Agricultural Adjuvants Market Trends

The U.S. agricultural adjuvants market size was estimated at USD 589.6 million in 2023 and is expected to grow at a CAGR of 3.1% from 2024 to 2030. The increasing demand for high agricultural productivity due to the growing population is a significant driver. As the population grows, the demand for food increases, necessitating higher crop yields. Agricultural adjuvants enhance the effectiveness of pesticides, which in turn boosts crop yield.

Advancements in farming practices and technology have led to the increased use of agricultural adjuvants. Modern farming techniques often involve the use of these adjuvants to improve the efficiency of crop protection products. Also, the rise in the cost of premium active agrochemicals motivates farmers to use adjuvants that enhance the performance of agrochemicals, reducing the overall cost.

The growing awareness among farmers regarding the benefits of adjuvants, such as their ability to improve spray droplet retention on leaves and reduce pesticide runoff, is contributing to market growth. However, this growth could be hampered by factors such as the lack of awareness among small-scale farmers and stringent environmental regulations related to synthetic adjuvants. Despite these challenges, the U.S. agricultural adjuvants market shows a promising growth trajectory for the period of 2024 to 2030.

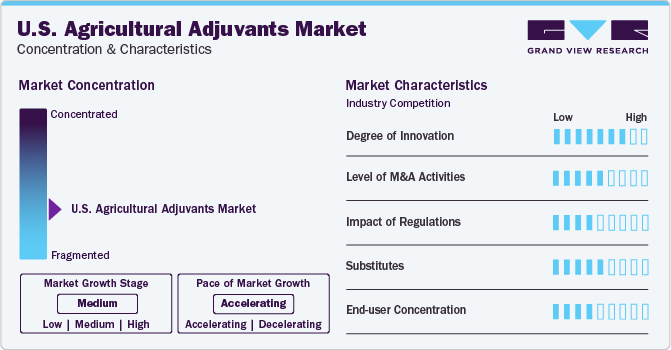

Market Concentration & Characteristics

The U.S. agricultural adjuvants market is highly competitive with local and Tier-I players focusing on factors like product quality, innovation, sustainability, and corporate reputation to enhance market share. There has been growing awareness of the environmental and health risks associated with chemically derived adjuvants. As a result, government authorities and adjuvant manufacturers have shifted their focus to renewable and sustainable products. Companies are taking steps to fulfill the customer’s need for natural adjuvants.

The market is witnessing a trend towards mergers and acquisitions, with key strategies including innovation, product launches, geographic expansion, and joint ventures. The market also shows a high degree of innovation, as adjuvant manufacturers are constantly developing new products and technologies to enhance the performance, sustainability, and compatibility of agrochemicals. For instance, In May 2023, BASF launched a new adjuvant that claims to increase the effectiveness of fungicides.

The U.S. Environmental Protection Agency (EPA) regulates adjuvant formulations. However, different regulations regarding the use of agricultural adjuvants by various authorities around the world act as a restraining factor in the growth of the market.

Product Insights

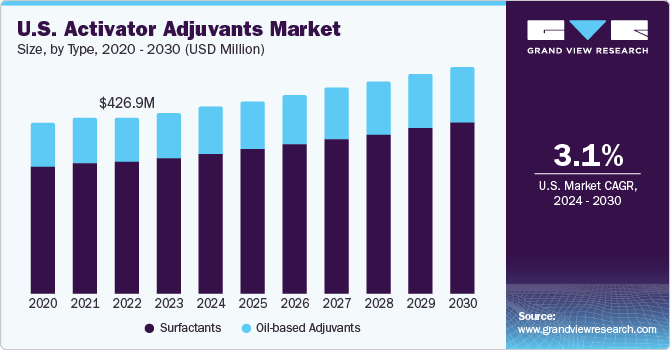

The activator adjuvantsdominated the US market in 2023 with around 72.4% revenue share. This dominance can be attributed to their ability to enhance the effectiveness of pesticides, leading to increased crop yield and quality. These adjuvants are designed to improve the spreading, wetting, penetration, or other physical characteristics of spray droplets. The market for activator adjuvants is also projected to be the fastest-growing segment with a CAGR of 3.2% from 2024 to 2030. This growth can be attributed to the increasing demand for sustainable farming practices, the need for improved pest management, and the growing food demand.

The utility adjuvants segment is also expected to witness steady growth over the forecast period. Utility adjuvants are added to pesticide formulations to enhance the consistency and foam-reducing properties of the spray solution. They also help in reducing the evaporation rate, thus improving the effectiveness of the pesticide. The growth in this segment can be attributed to the increasing need for efficient use of pesticides and the growing awareness among farmers about the benefits of utility adjuvants in improving crop yield. As the agricultural sector continues to evolve, the demand for such innovative and effective solutions is expected to rise.

Application Insights

The herbicides segment dominated the U.S. market with around 49% revenue share in 2023. Herbicides are used to control unwanted vegetation, especially in agricultural fields, and their effectiveness can be significantly enhanced with the use of adjuvants. The dominance of this segment can be attributed to the extensive use of herbicides in the agricultural sector of the U.S., which is one of the largest in the world.

Insecticides were the second-largest segment in the U.S. agricultural adjuvants market in 2023. However, this segment is expected to be the fastest-growing from 2024 to 2030, with a CAGR of 3.7%. The growth in this segment can be attributed to the increasing threat of crop diseases and pests, which has led to a rise in the use of insecticides. Adjuvants enhance the effectiveness of insecticides, making them a crucial component of pest management strategies.

Crop Type Insights

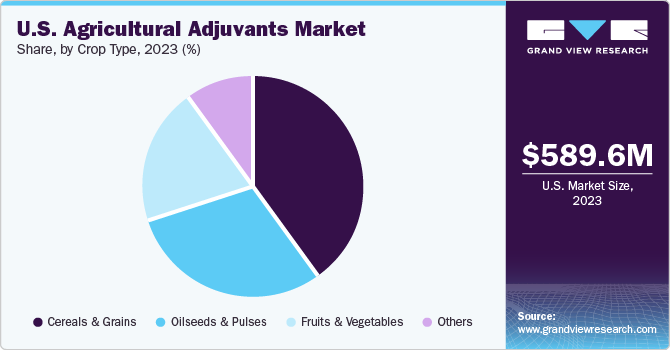

The cereal & grains dominated the U.S. agricultural adjuvants market with a significant revenue share of around 39% in 2023. This can be attributed to the extensive cultivation of cereal and grain crops in the U.S., including corn, wheat, and rice. The use of adjuvants in these crops helps in improving the effectiveness of pesticides, leading to increased crop yield and quality.

The oilseeds & pulses segment also forms a significant part of the U.S. agricultural adjuvants market. Oilseeds and pulses such as soybeans, sunflower, and lentils are majorly grown in the U.S. The use of adjuvants in these crops helps in the efficient use of pesticides and improves overall crop production.

The fruits & vegetables segment is expected to be the fastest-growing from 2024 to 2030, with a CAGR of 3.6%. The growth in this segment can be attributed to the increasing demand for fruits and vegetables and the need for effective pest management strategies in these crops. Adjuvants play a crucial role in enhancing the effectiveness of pesticides used in fruit and vegetable cultivation, thus contributing to the growth of this segment.

The other agricultural adjuvants are also expected to witness growth over the forecast period, driven by the diverse needs of the agricultural sector and the versatile roles that adjuvants can play in enhancing the effectiveness of various pesticides.

Key U.S. Agricultural Adjuvants Company Insights

The US agricultural adjuvants market, with the presence of healthy competition among many local and global companies, has a moderate level of market concentration. The industry is witnessing significant innovation as many major players keep innovating and introducing better products. Some of the major players in the US agricultural adjuvants market are BASF SE, Dow Inc., and Nufarm Limited.

-

BASF SE is a global leader in agricultural solutions, offering a wide range of products to enhance crop productivity and sustainability. Their portfolio includes plant growth regulators and health-enhancing products.

-

Dow Inc. is an American chemical corporation that provides adjuvants under the brand name of Dow AgroSciences. Dow offers products that enhance pesticide coverage and adhesion.

-

Nufarm Limited specializes in crop protection products, including adjuvants such as Amigo, Bonza gold, and Contact Xcel.

Key U.S. Agricultural Adjuvants Companies:

- BASF SE

- Dow Inc.

- Nufarm Limited

- Helena Agri Enterprises

- Huntsman Corporation

- Corda International Plc.

- Evonik Industries AG

- Stepan

- Wilbur-Ellis Company LLC

Recent Developments

-

In November 2023, Nufarm launched a new herbicide technology that claims to help farmers fight the challenging weeds in cereals.

-

In April 2022, Clariant AG launched DropForward, an approach towards providing precision application with adjuvants and co formulants.

-

In May 2022, BASF announced the expansion of its research & development network for agricultural division in Argentina by opening a new R&D site in the central region of the country.

U.S. Agricultural Adjuvants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 606.7 million

Revenue forecast in 2030

USD 729.3 million

Growth rate

CAGR of 3.1% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, crop type

Key companies profiled

BASF SE, Dow Inc., Nufarm Limited, Helena Agri Enterprises, Huntsman Corporation, Corda International Plc., Evonik Industries AG, Stepan Company, Wilbur-Ellis Company LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Agricultural Adjuvants Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. agricultural adjuvants market report based on product, application, and crop type:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Activator Adjuvants

-

Surfactants

-

Oil-based Adjuvants

-

-

Utility Adjuvants

-

Compatibility Agents

-

Drift Control Agents

-

Buffering Agents

-

Water Conditioning Agents

-

Others

-

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Herbicides

-

Insecticides

-

Fungicides

-

Others

-

-

Crop Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. agricultural adjuvants market size was estimated at USD 589.6 million in 2023

b. The U.S. agricultural adjuvants market is expected to grow at a CAGR) of 3.1% from 2024 to 2030 to reach USD 729.3 million by 2030.

b. The activator adjuvants dominated the US market in 2023 with around 72.4% revenue share. This dominance can be attributed to their ability to enhance the effectiveness of pesticides, leading to increased crop yield and quality.

b. Key Players of the U.S. Agricultural Adjuvants Market • BASF SE • Dow Inc. • Nufarm Limited • Helena Agri Enterprises • Huntsman Corporation • Corda International Plc. • Evonik Industries AG

b. The increasing demand for high agricultural productivity due to the growing population is a significant driver. As the population grows, the demand for food increases, necessitating higher crop yields. Agricultural adjuvants enhance the effectiveness of pesticides, which in turn boosts crop yield.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."