- Home

- »

- Advanced Interior Materials

- »

-

U.S. Air Diffusers Market Size, Trends, Industry Report, 2033GVR Report cover

![U.S. Air Diffusers Market Size, Share & Trends Report]()

U.S. Air Diffusers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Ceiling Diffusers, Wall Diffusers) By Type (Electronic Diffusers, Thermal Diffusers), By End-use (Residential, Commercial), By Distribution Channel, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-649-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Air Diffusers Market Summary

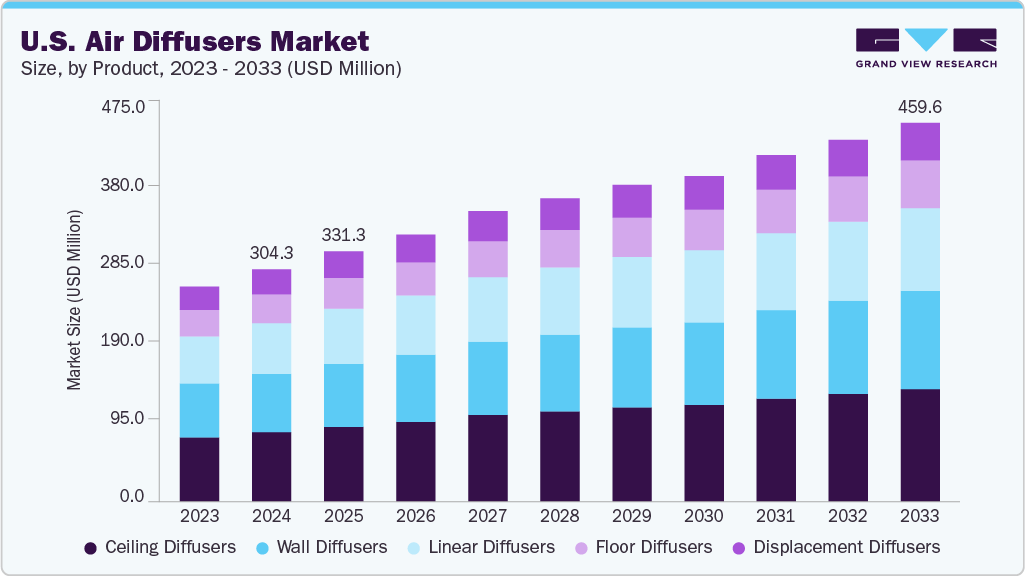

The U.S. air diffusers market size was estimated at USD 304.4 million in 2024 and is projected to reach USD 459.6 million by 2033, growing at a CAGR of 4.2% from 2025 to 2033, driven by increased focus on indoor air quality, energy efficiency, and wellness. Rising adoption of smart home technologies and sustainable building practices is boosting demand.

Key Market Trends & Insights

- The U.S. air diffusers market is expected to grow at a substantial CAGR of 4.2% from 2025 to 2033.

- By product, wall diffusers segment is expected to grow at a considerable CAGR of 4.5% from 2025 to 2033 in terms of revenue.

- By type, thermal diffusers segment is expected to grow at a considerable CAGR of 3.9% from 2025 to 2033 in terms of revenue.

- By end use, residential segment is expected to grow at a considerable CAGR of 4.9% from 2025 to 2033 in terms of revenue.

- By distribution channel, wholesale stores segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 304.4 Million

- 2033 Projected Market Size: USD 459.6 Million

- CAGR (2025-2033): 4.2%

In addition, consumer interest in aromatherapy and customizable air solutions continues to support market expansion across residential and commercial sectors. Modern air diffusers now incorporate smart controls, allowing users to adjust airflow, temperature, and humidity remotely through mobile apps or home automation systems. IoT integration enhances real-time monitoring and performance optimization, especially in commercial buildings. In addition, innovations such as low-noise operation, sensor-based air quality control, and energy-efficient materials are improving both comfort and sustainability.

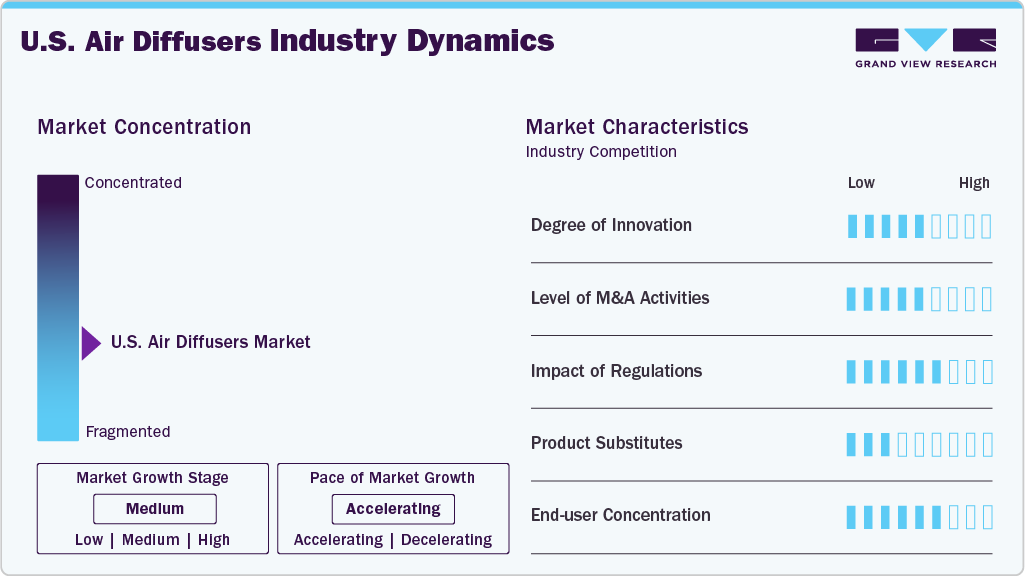

Market Concentration & Characteristics

U.S. air diffusers market is moderately fragmented, with several major players leading through advanced technology, product innovation, and extensive distribution networks. While large corporations dominate key segments, strong competition from regional and niche manufacturers adds diversity to the market. This structure allows room for differentiation through smart features, energy efficiency, and sustainable design. Innovation, customization, and regulatory compliance continue to shape competitive strategies within the U.S. market.

U.S. air diffusers market exhibits a high level of innovation, driven by growing demand for energy-efficient HVAC systems, improved indoor air quality, and wellness-oriented living. Manufacturers are integrating smart technologies such as IoT connectivity, app-based controls, noise reduction, and customizable airflow into their products. Aesthetic appeal and the use of eco-friendly materials are also gaining importance as consumers seek both performance and visual harmony in their indoor environments.

In the U.S., merger and acquisition activity remains steady, with companies aiming to expand their product portfolios, technological capabilities, and geographic presence. Major players are acquiring regional firms and startups to strengthen their market position and tap into emerging trends such as smart homes, wellness solutions, and sustainable ventilation systems.

Regulatory frameworks in the U.S. are strongly shaping the air diffusers market by mandating compliance with strict standards for energy efficiency and indoor air quality. Guidelines from organizations such as ASHRAE and programs such as LEED certification are influencing product development. As a result, manufacturers are focusing on low-emission, environmentally responsible designs that support green building initiatives and promote healthier indoor spaces across residential, commercial, and institutional settings.

Drivers, Opportunities & Restraints

A major growth driver for the U.S. air diffusers market is the increasing demand for energy-efficient HVAC systems in both residential and commercial buildings. Rising awareness of indoor air quality and the adoption of wellness-focused living and working spaces are pushing consumers and businesses to invest in advanced air diffusers that ensure comfort, health, and regulatory compliance.

An emerging opportunity in the U.S. air diffusers market lies in the integration of smart technologies. As smart homes and automated buildings become more common, demand is rising for air diffusers with app-based controls, sensors, and IoT connectivity. Manufacturers that innovate in this space can tap into growing consumer interest in personalization, energy savings, and high-tech indoor climate solutions.

A key restraint in the U.S. air diffusers market is the high upfront cost of advanced, energy-efficient systems. While they offer long-term savings, initial expenses and installation complexities can deter adoption, especially among small businesses and budget-conscious homeowners. In addition, low awareness in certain demographics may limit demand for premium or smart air diffuser technologies.

Product Insights

The ceiling diffusers segment dominated the market in 2024 by accounting for a share of 29.8% due to their extensive use in offices, commercial complexes, and residential buildings. Their ability to ensure uniform air distribution while blending seamlessly with interior designs makes them ideal for modern HVAC systems. Their compatibility with energy-efficient standards and green building practices further supports strong demand across new and existing structures.

The wall diffuser segment is expected to grow at a considerable CAGR of 4.5% from 2025 to 2030 in terms of revenue. The wall diffusers segment is experiencing rapid growth in the U.S., particularly driven by trends in compact housing, modular construction, and building renovations. Their straightforward installation in spaces with limited ceiling access makes them a practical choice. Increasingly used in residential, hospitality, and small commercial applications, wall diffusers offer efficient airflow and aesthetic flexibility suited to modern indoor environments.

Type Insights

The thermal diffusers segment dominated the market in 2024 due to their energy-efficient performance, making them ideal for commercial buildings, offices, and industrial facilities. These diffusers respond naturally to temperature variations, providing consistent airflow without the need for complex controls.

The electronic diffusers segment is expected to grow at a considerable CAGR of 4.5% from 2025 to 2030 in terms of revenue. The electronic diffusers segment is growing rapidly due to growing demand for smart, automated air distribution. These diffusers offer precise control of airflow, temperature, and indoor air quality through advanced sensors and programmable settings. The rise of smart homes and buildings, along with the emphasis on personalized comfort and energy savings, is accelerating their adoption in residential and commercial spaces alike.

Distribution Channel Insights

The retail stores segment dominated the market in 2024 by accounting for a share of 45.6%as consumers continue to prefer in-person shopping. The ability to see, touch, and compare products encourages purchases. With expanding home improvement chains and boutique wellness outlets, retail channels will thrive by offering personalized guidance, immediate availability, and curated selections of stylish and smart diffuser models.

The wholesale stores segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2030 in terms of revenue. The wholesale stores segment is driven by increased adoption of volume procurement by contractors, builders, and property managers. These channels offer cost-effective bulk purchasing, streamlined logistics, and consistent supply for large HVAC installation and renovation projects. Expansion in commercial construction and institutional upgrades will further boost demand through wholesale distribution networks.

Application Insights

The new installation segment dominated the market in 2024 driven by large-scale construction of commercial spaces, residential developments, and infrastructure projects. Builders prioritize the integration of modern, energy-efficient diffusers from the outset to meet environmental regulations, improve indoor air quality, and optimize HVAC performance making new installations the dominant application across growing urban and suburban areas.

The replacement segment is expected to grow at a considerable CAGR of 4.1% from 2025 to 2030 in terms of revenue. The replacement segment is growing rapidly as aging HVAC systems are upgraded to meet evolving energy efficiency and indoor air quality standards. Retrofitting older buildings, combined with stricter ventilation codes and rising consumer awareness, is fueling demand for advanced air diffusers.

End-use Insights

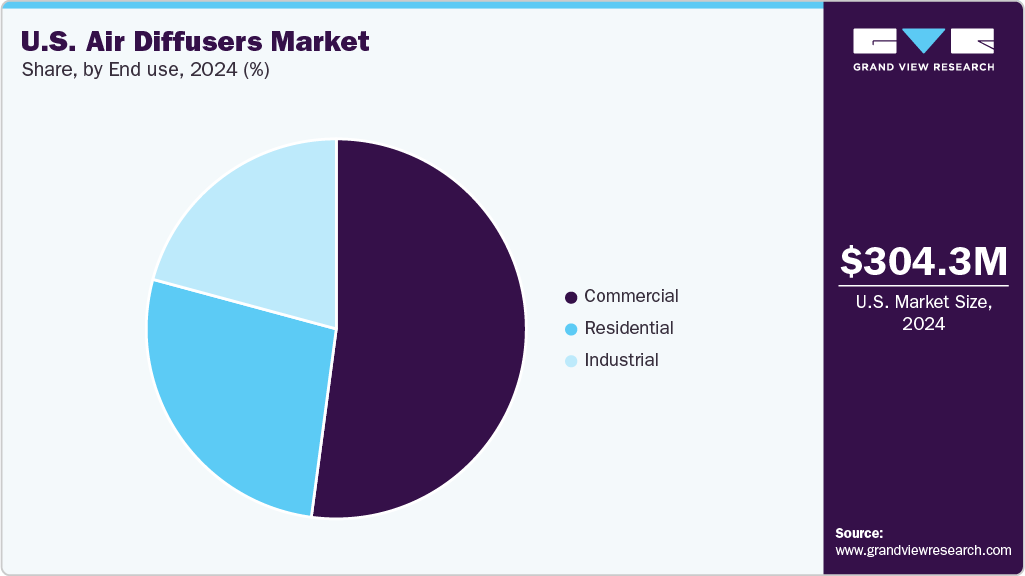

The commercial segment dominated the market in 2024 by accounting for a share of 52.1% driven by strong demand from offices, malls, healthcare facilities, airports, and hotels where efficient, large-scale air distribution is essential. Commercial buildings emphasize indoor air quality, energy efficiency, and compliance with ventilation regulations, leading to significant investment in advanced diffusers to enhance comfort, safety, and sustainability in high-traffic environments

The residential segment is expected to grow at a significant CAGR of 4.9% from 2025 to 2030 in terms of revenue. The residential segment is growing rapidly driven by rising demand for improved indoor air quality, energy efficiency, and personalized comfort. Increasing adoption of smart home systems and wellness-focused living is encouraging homeowners to invest in modern diffusers. Growth in housing development and renovations further supports wider usage of stylish, efficient air distribution solutions.

Key U.S. Air Diffusers Company Insights

Some of the key players operating in the market include Greenheck Fan Corporation, TROX GmbH, Systemair AB, Titus HVAC.

-

TROX GmbH specializes in manufacturing air diffusers, air-handling units, fire and smoke dampers, filters, and acoustic systems for commercial, industrial, and healthcare applications. Known for its focus on innovation, TROX invests heavily in research and development to deliver energy-efficient, high-performance solutions that enhance indoor air quality and support sustainable building practices worldwide.

-

Greenheck Fan Corporation is a prominent manufacturer of air movement, control, and distribution products. Its offerings include fans, blowers, dampers, louvers, grilles, registers, and diffusers designed for commercial and industrial buildings. Greenheck is recognized for durable, energy-efficient solutions that improve ventilation and air quality. The company emphasizes innovation and reliability, serving applications ranging from office buildings to critical environments such as hospitals and cleanrooms.

Key U.S. Air Diffusers Companies:

- TROX GmbH

- Systemair AB

- Titus HVAC

- Aldes Group

- Luwa Air Engineering AG

- Rentschler REVEN

- Alfa Mega Inc.

- Halton Group

- Price Industries

- Greenheck Fan Corporation

Recent Developments

-

In April 2024, Greenheck Group announced its expansion in Knoxville, Tennessee campus with a USD 300 million investment. The project, featuring manufacturing, warehousing, office, and R&D facilities, is being built in multiple phases and is expected to begin operations by summer 2026.

-

In April 2024, TROX expanded its wall diffuser portfolio with the launch of CHM and CHS models, offering flexible solutions for spaces with or without suspended ceilings. These new diffusers are designed to deliver optimized air distribution, improved aesthetics, and easier integration into various room types. Their innovative design supports enhanced indoor air quality while meeting modern architectural and ventilation requirements.

U.S. Air Diffusers Market Report Scope

Report Attribute

Details

Market size in 2025

USD 331.3 million

Revenue forecast in 2033

USD 459.6 million

Growth rate

CAGR of 4.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use, distribution channel, application

Key companies profiled

TROX GmbH; Systemair AB; Titus HVAC; Aldes Group; Luwa Air Engineering AG; Rentschler REVEN; Alfa Mega Inc.; Halton Group; Price Industries; Greenheck Fan Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Air Diffusers Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. air diffusers market Report on the basis of on product, type, end-use, distribution channel, and application.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Ceiling Diffusers

-

Wall Diffusers

-

Floor Diffusers

-

Linear Diffusers

-

Displacement Diffusers

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronic diffusers

-

Thermal diffusers

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Retail Stores

-

Wholesale Stores

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

New Installation

-

Replacement

-

Frequently Asked Questions About This Report

b. The U.S. air diffusers market size was estimated at USD 304.4 million in 2024 and is expected to reach USD 331.3 million in 2025.

b. The U.S. air diffusers market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2033, reaching USD 459.6 million by 2033.

b. The ceiling diffusers segment accounted for a share of 29.8% in 2024 driven by their extensive use in commercial buildings, offices, and residential complexes. These diffusers are favored for their ability to distribute air uniformly while complementing modern interior designs.

b. Some of the key players operating in the U.S. air diffusers market include TROX GmbH, Systemair AB, Titus HVAC, Aldes Group, Luwa Air Engineering AG, Rentschler REVEN, Alfa Mega Inc., Halton Group, Price Industries, Greenheck Fan Corporation.

b. U.S. air diffusers market is driven by growing demand for energy-efficient HVAC systems, rising awareness of indoor air quality, and increased adoption of smart home technologies. Trends in wellness-focused living, green building practices, and ongoing construction and renovation activities also contribute to the market’s steady expansion across residential and commercial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.